What is the SIMD 228 proposal? This article will clarify it for you. If we compare Solana to a company, then SOL stakers are the “employees” of this company, maintaining network security by staking SOL in exchange for “salary” (staking rewards) issued by the system. The SIMD 228 proposal essentially announces: The salary distribution mechanism will be adjusted, and future salaries will fluctuate and gradually decrease. This is a significant matter, and today we will discuss what exactly has changed with SIMD 228 and what it means for Solana and its holders.

SIMD 228 Proposal: Changes to SOL’s Inflation Mechanism

Currently, the inflation mechanism for SOL is that a certain number of SOL is added each year to reward stakers. This inflation rate was originally 8% but has now been reduced to 4.8% and is planned to eventually decrease to 1.5%-2%. This means that the issuance of SOL will decrease year by year.

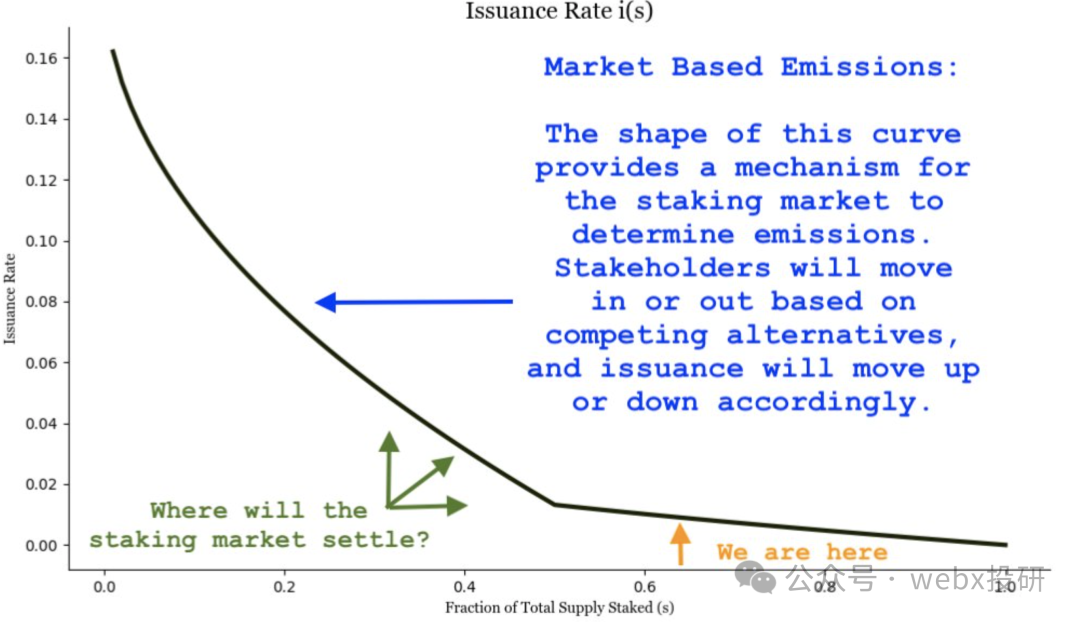

The core adjustment of the SIMD 228 proposal is: The inflation rate will no longer be fixed but will fluctuate based on the staking rate. The goal is to stabilize the SOL staking rate at 50%. In the short term, SOL staking rewards will decrease (possibly fluctuating between 1%-4.5%). In the long term, the issuance rate of SOL will be lower, reducing inflation.

Currently, the staking rate of SOL is as high as 70%, which means that if the proposal passes, many SOL stakers will see their rewards decrease, potentially leading some to unstake and sell SOL on the market.

Why the Change?

You can think of Solana as a country, where its “monetary policy” determines the supply of SOL and market liquidity. Currently, the staking rate of SOL is too high, with many SOL locked up, reducing liquidity. If inflation is adjusted and SOL staking rewards decrease, some SOL will flow into the market, activating transactions and ecological vitality on the Solana chain.

People in different positions have different views on this matter.

1. VC (Venture Capital Firms): Support VCs hold a large amount of SOL and are more concerned about the long-term value of SOL rather than staking rewards. They believe that reducing inflation and releasing liquidity will make SOL more valuable and promote the development of ecosystems like DeFi. Additionally, the current MEV (Miner Extractable Value) income on the Solana chain is high, and adjusting the staking mechanism will not immediately affect network security.

2. Solana Foundation and Stakers: Oppose Stakers’ rewards will be affected, especially those institutions and users who rely on staking income. The Solana Foundation hopes to steadily promote institutional adoption rather than suddenly change the rules before institutions like ETFs enter, increasing market uncertainty. A decrease in the staking rate may affect network security and weaken decentralization.

What Impact Will This Have on SOL Prices?

Short-term: Stakers may reduce their staking, leading to increased selling pressure on SOL in the short term. Some SOL may flow into high-yield areas like DeFi, potentially driving a new round of capital movement on-chain (such as meme coin trends).

Long-term: Reduced issuance and lower inflation will slow the overall supply growth of SOL. If the demand for SOL continues to grow steadily, this could be beneficial for SOL’s long-term price.

Institutional Adoption: Institutions prefer stable and predictable market rules, and a sudden adjustment to the inflation mechanism may cause concerns for institutional investors like ETFs, impacting adoption in the short term.

Voting Time

Voting will start on March 6 and will be completed within 1-2 weeks. Voting rights are determined by validators based on the proportion of SOL they have staked. Currently, VCs support the proposal, while the Solana Foundation and stakers oppose it, and the final result is still uncertain.

Conclusion

The SIMD 228 proposal is essentially a “monetary policy adjustment” for Solana, which will have profound effects on the circulation and value of SOL. Currently, it may bring short-term selling pressure but long-term reduced inflation, and the flow of funds within the Solana ecosystem may also change as a result.

For ordinary holders, this means:

- Short-term SOL may experience more volatility.

- The on-chain DeFi ecosystem may become more active.

- Long-term inflation pressure on SOL will decrease.

Regardless of whether this adjustment passes, it reflects the game within the Solana ecosystem: Should we prioritize short-term activity or long-term stability? This proposal may be a precursor to the future direction of Solana’s development.