Current Progress🔥

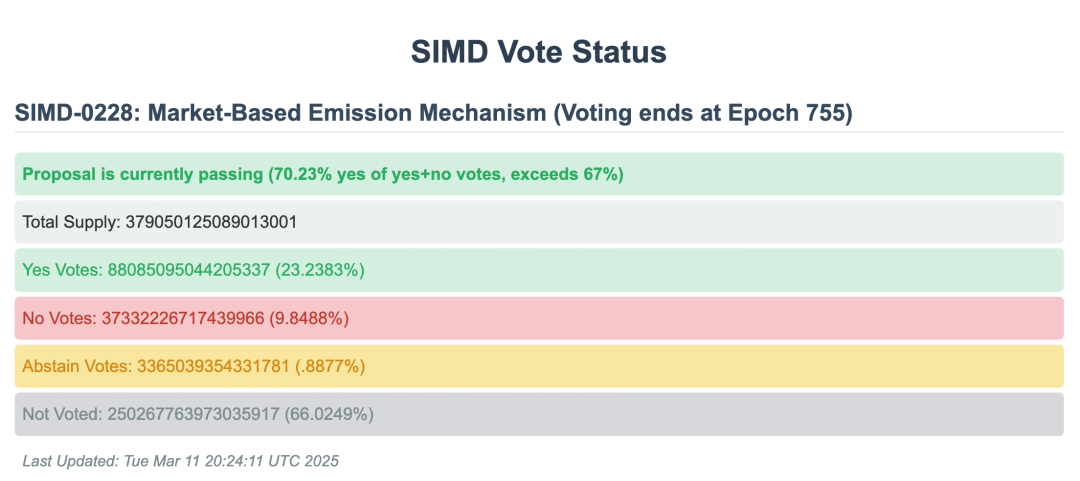

The Solana proposal SIMD-228 has received 70% approval votes, and the voting is expected to conclude in 52 hours (Epoch 755).

Core Mechanism

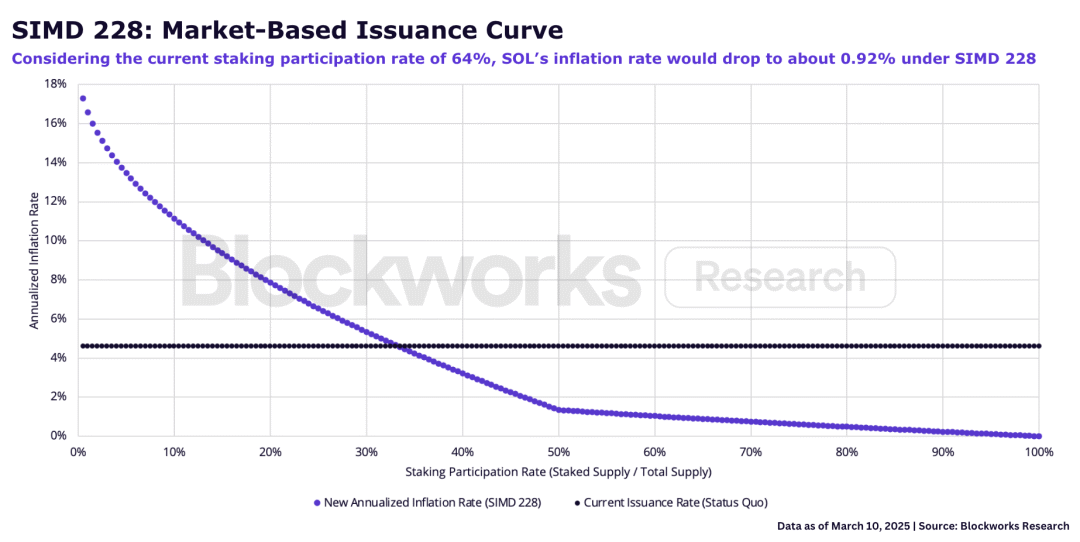

👉 Introduction of a dynamic adjustment mechanism for the SOL issuance curve based on staking rates.

-

At the current staking rate of 64%, the annual inflation rate of SOL will gradually decrease to 0.92%.

-

When the staking rate falls below 50%, the issuance will be more aggressive than the current mechanism.

-

At a staking rate of 33.3%, the new issuance will exceed the current standard.

Three Major Supporting Arguments

✅ Security Cost Optimization Theory Solana has transformed from a grassroots chain into a value network. The current fixed issuance model is like a “leaky bucket” (as @MaxResnick1 metaphorically describes), where excessive SOL release leads to unnecessary selling pressure. The proposal will dynamically adjust based on actual economic value (REV), achieving “maximum security at the lowest cost”.

✅ Real Yield Awakening Theory @y2kappa points out that the current high staking yields are an illusion created by inflation, with institutions harvesting retail investors through custodial services (like Coinbase/Binance nodes). The proposal will promote the market to distinguish between nominal yields (based on money printing) and real yields (based on transaction fees), fostering ecological maturity.

✅ Market Economic Superiority Theory Even if the proposal is not perfect, the dynamic adjustment mechanism is still superior to a rigid fixed issuance, allowing the market to determine the optimal inflation rate.

Three Major Opposing Voices

❗ Institutional Conflict of Interest Theory Custodial institutions and ETP issuers (like @calilyliu) rely on high nominal yields to earn commissions, and the proposal will impact their business models. Just like banks prefer to promote high-commission financial products rather than the real yields for customers.

❗ ETF Layout Risk Theory This is a golden period for institutional entry (Solana ETF is expected to be approved within the year), and modifying the economic model at this time may cause confusion in inflation expectations, weakening asset attractiveness.

❗ Node Survival Crisis Theory @David_Grid warns that small validation nodes may be eliminated due to declining yields, with calculations showing that profitable nodes may decrease by 3.4% at a 70% staking rate (according to @0xIchigo data).

Potential Impact

-

If passed, there will be a transition period of 50 epochs (approximately 100 days).

-

DeFi interest rates may fluctuate, but in the long run, it will promote ecological health.

-

Validation nodes will face reshuffling, concentrating towards professional institutions.

Deep Summary Insights: This is not just an adjustment of economic parameters, but also a rite of passage for Solana’s transformation from a grassroots experiment to mainstream financial infrastructure.

As @TusharJain_ said: “True crypto economy should not rely on money printing to sustain prosperity.”