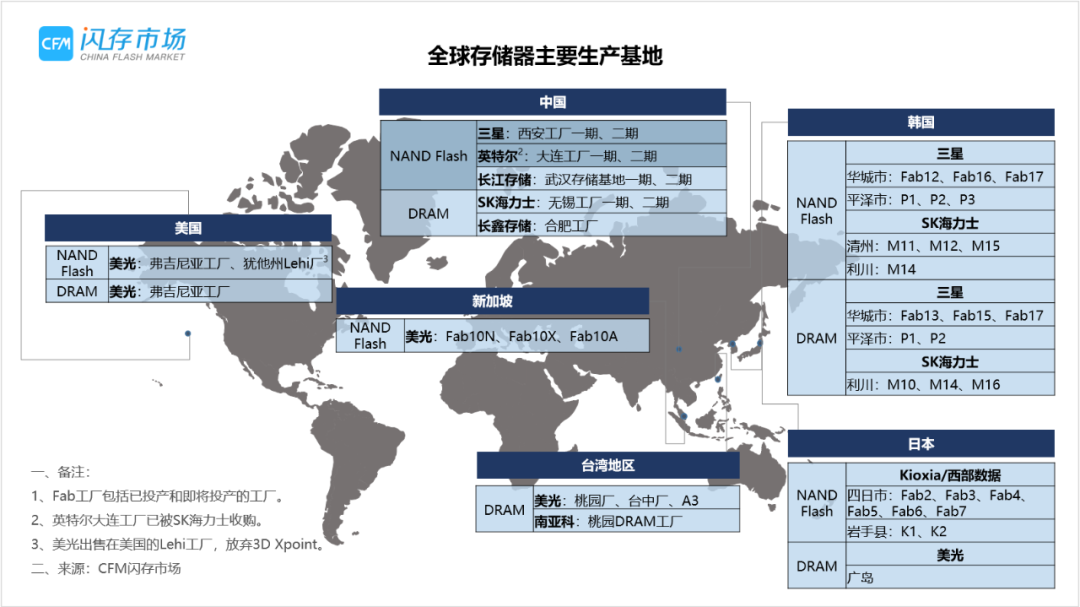

According to media reports, Samsung Electronics has completed the expansion of its Xi’an Phase II factory, which is expected to fully commence operations across all production lines by mid-year.

It is reported that the monthly production capacity of Samsung’s Xi’an Phase II factory is approximately 130,000 wafers, combined with the first phase’s monthly capacity of about 120,000 wafers, totaling approximately half of Samsung’s total NAND production capacity in 2020.

The Samsung memory chip project was established in Xi’an High-tech Zone in 2012, with the first phase completed and put into production in May 2014, involving a total investment of $10.8 billion, which established Samsung’s memory chip project and packaging testing project; the second phase has a total investment of $15 billion, primarily for manufacturing flash memory chips, divided into two stages, with the first stage having a total investment of $7 billion and the second stage $8 billion.

The first phase production line of the second phase held its offline ceremony in March last year, achieving mass production in August, while the second phase production line officially started on December 25, 2019, with equipment installation beginning in March this year.

In addition to the Xi’an factory, Samsung has also announced the commencement of construction for the P3 factory in Pyeongtaek, planning to start equipment procurement in the second half of 2021. Semiconductor equipment generally takes about 3 to 6 months from ordering to delivery, and currently, there is a supply tightness in the equipment industry, which is expected to delay delivery times compared to previous periods. The P3 factory is expected to introduce production equipment by March 2022.

Alongside Samsung, Kioxia and Western Digital are also investing heavily in new factories, with their Fab7 and K2 factories having begun construction in the spring of 2021, with the first phase of construction expected to be completed in the first half of next year. Fab7 will support the production of the sixth-generation 162-layer 3D NAND technology, known as BiCS6.

In the current shortage situation, the global market is facing a “chip crisis,” and industry insiders generally expect that the chip shortage may continue until 2022. Additionally, new application demands driven by automotive, 5G, and AI will continue to increase. Therefore, the mass production at Samsung’s Xi’an factory is expected to significantly increase the supply of NAND Flash, alleviating the market shortage while also addressing the continuously growing market demand.

Latest Recommended Reading:

-

Japanese media: Kioxia plans to IPO as early as September this year; wafer foundry prices are expected to continue rising in early 2022.

-

The channel market is struggling, and SSDs are unlikely to escape the downward trend; memory modules may have already “hit bottom”?

-

Major smartphone manufacturers disclose the battle situation for 618!

-

Chip shortages persist, and another semiconductor giant has issued a price increase notice.