Recently, the bidding results for a “universe’s first standard” of 500,000 pieces were released, sparking heated discussions in the industry. The wireless communication module, as the core component for terminal access to the Internet of Things (IoT), is rarely mentioned in the industry. Today, we have consolidated three reports to discuss various aspects of this sector.

Industry Chain Analysis

The wireless communication module is a key link connecting the perception layer and network layer of the IoT, belonging to the lower-level hardware segment, which possesses irreplaceability; there is a one-to-one correspondence between wireless communication modules and IoT terminals.

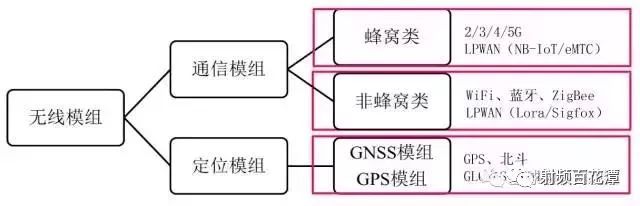

Classification of Wireless Modules

Wireless modules are categorized into “communication modules” and “positioning modules” based on their functions. Relatively speaking, communication modules have a wider range of applications, as not all IoT terminals require positioning functionality.

Note: Since short-range wireless communication chips were introduced earlier, this article focuses primarily on cellular modules (2G/3G/4G/NB-IOT).

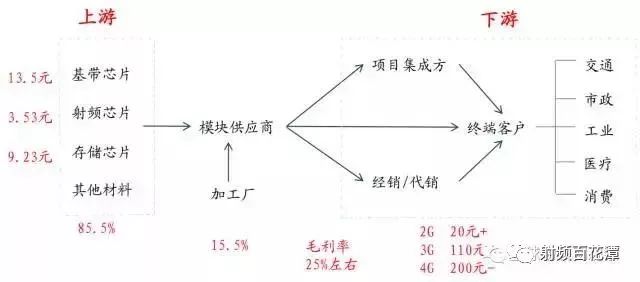

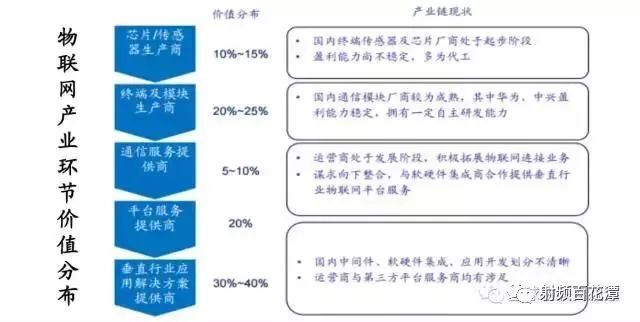

From the perspective of the industrial chain, the upstream of wireless communication modules consists of production materials such as baseband chips, which are highly standardized. The downstream consists of various segmented application fields, which are extremely dispersed and often flow into various fields through intermediary distribution channels. The business model of module companies generally involves procuring upstream materials, handling product design and sales, while outsourcing production to third-party processing plants.

In the upstream, baseband chips (communication chips) are the core, accounting for about 50% of material costs. The upstream has high technical barriers, with a highly concentrated industry and strong supplier bargaining power. Major suppliers include Qualcomm, Intel, MediaTek, RDA, Huawei, ZTE, etc.

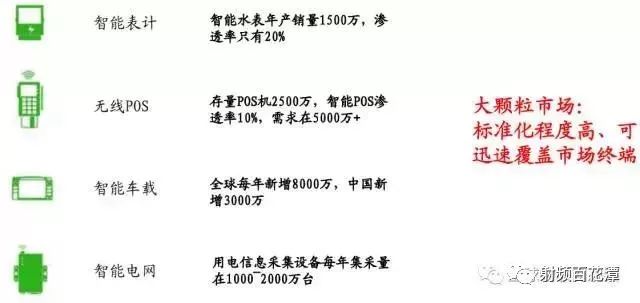

Due to the extensive applications of IoT, the downstream of the industry is very dispersed. The market is divided into large particle markets and small particle markets based on application market size. The large particle market (see below) has a high volume of IoT modules, high standardization, and fierce competition, making it suitable for generating significant revenue and establishing a brand, while requiring relatively fewer R&D personnel but strong market development capabilities.

The small particle market (such as industrial IoT, asset tracking, environmental monitoring, etc.) has a low volume of IoT modules, high customization, and high profit margins, but requires significant R&D investment from suppliers.

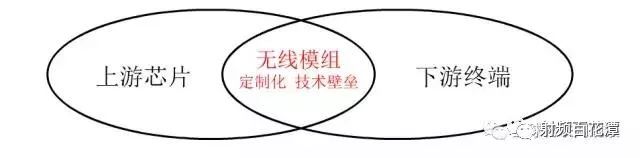

The IoT modules themselves are situated between standardized upstream chips and the decentralized vertical fields downstream, needing to meet specific requirements from different customers and application scenarios. Their hardware structure design and customized software development become the value-added segments, which is also where the value of the industrial chain lies.

Value of the Industrial Chain:

1. Hardware integration and design, integrating various communication standards to meet environmental requirements in different application scenarios, with stability and timeliness as the core;

2. Customized embedded software development, programming Linux/Android systems to meet different downstream application needs, with mature application experience and solution capabilities as the core.

The wireless communication module market currently has a low concentration, with the industry’s top tier occupying about 30% of the global market share. As downstream applications rise and the total market scale expands, a number of quality module suppliers focusing on specific vertical application fields will begin to emerge.

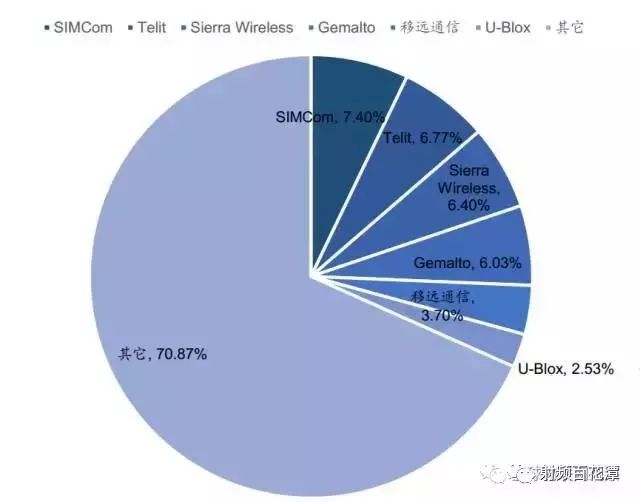

Global Module Supplier Market Share in 2015

Data source: Guosen Securities Economic Research Institute

Overall, the industry is currently in a competitive landscape led by the top tier, while the domestic second tier is gradually strengthening. Global leading companies include Italy’s Telit, Canada’s Sierra Wireless, Switzerland’s u-blox, and Netherlands’ Gemalto.

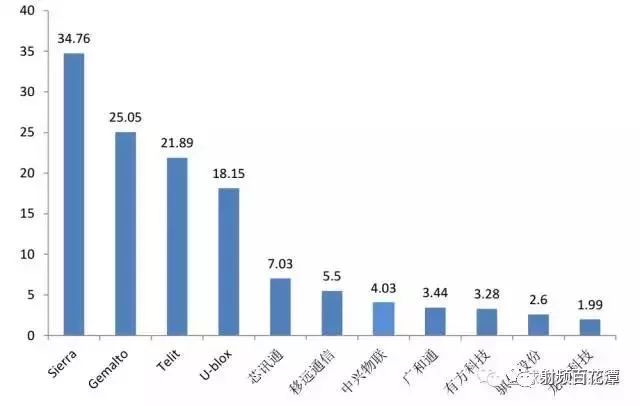

2016 Revenue Overview of Industry Companies (Billion Yuan)

“Market-Related” Companies

In the past year, domestic top-tier wireless communication module suppliers have successively entered the A-share market through either IPOs or acquisitions. The following are the main “market-related” companies. (Note: rankings are not in order)

1. Simcom

Headquarters: Shanghai

Introduction: Simcom is a subsidiary of the Hong Kong-listed company Simcom Technology, with a significant market share in smart POS, smart metering, and healthcare industries. As Simcom’s wireless communication module business is a relatively traditional manufacturing business, it does not align with Simcom Technology’s current strategic direction of transitioning towards high-margin service industries.

In January this year, Simcom Technology planned to sell its wireless communication module assets (wholly-owned subsidiaries Shanghai Simcom and Simcom Wireless) to Swiss u-blox for $52.5 million. However, due to disruptions from Shanghai Immersive Communication, the acquisition did not reach consensus, and Simcom Technology ultimately announced that Simcom would be sold to Immersive Communication and a company owned by internal directors’ sons, while another asset, Simcom Electronics, would also be bundled for sale.

According to Immersive Communication’s latest announcement, the Shenzhen Stock Exchange is still reviewing this transaction plan.

Website: www.simcomm2m.com

2. Queclink

Headquarters: Shanghai

Introduction: Queclink was established in 2009, primarily focusing on positioning modules, and went public in January 2017. Queclink’s wireless communication module shipments reached the global top position in 2015. If this acquisition succeeds, Queclink will become the largest IoT wireless communication company globally, solidifying its monopoly position in the field of IoT communication terminals.

Website: www.queclink.com

3. Quectel

Headquarters: Shanghai

Introduction: Quectel was founded in 2010 and has grown rapidly, achieving significant success in the domestic smart POS market, overseas automotive OEM market, and telecom operator market. It has a leading position in the NB-IOT module field and was one of Huawei’s early partners for NB-IOT chip production. Quectel was previously listed on the New Third Board and is currently planning to go public on the A-share market, having submitted relevant materials to the Shanghai regulatory bureau.

Interestingly, the founders of Immersive Communication, Liao Ronghua, and Quectel, Qian Penghe, both came from Simcom. Immersive Communication and Quectel were originally one company (Immersive Communication), which later became independent due to differentiated business development directions.

Website: www.quectel.com

4. Gosuncn

Headquarters: Guangzhou

Introduction: Gosuncn is a provider of IoT applications and services for smart cities. In 2016, it acquired ZTE’s wireless communication module subsidiary, ZTE IoT, which focuses on the enterprise market and has strong experience in automotive networking and satellite communication applications.

Website: www.gosuncn.com

5. Fibocom

Headquarters: Shenzhen

Introduction: Fibocom, established in 1999, is an old-established company. It initially worked as an OEM for Motorola, but after Telit acquired Motorola’s mobile communications division in 2008, all contracts with Fibocom were voided. It then transformed to develop its own brand and successfully entered high-margin electronic consumer markets such as laptops and tablets after receiving investment from Intel. In April of this year, Fibocom successfully went public.

Website: www.fibocom.com

6. Cheerzing

Headquarters: Xiamen

Introduction: Cheerzing was established in 2012 and obtained production qualifications for live broadcast satellite set-top box positioning modules recognized by the State Administration of Radio, Film and Television in 2013. Its products have been adopted by nearly thirty companies including Haier, Hisense, Changhong, TCL, and Konka, capturing a significant share of the domestic set-top box positioning terminal market.

Website: www.cheerzing.com

7. Sunsea

Headquarters: Shenzhen

Introduction: Sunsea is the largest supplier of physical connection devices for communication networks in China. In September, Sunsea acquired Longshang Technology, a leader in 4G wireless communication modules, and combined it with its previous investment in Aila IoT to realize a layout of IoT cloud platform + modules. While providing cloud platforms for traditional enterprises, it can also directly package modules for integrated sales of products.

Website: www.sunseagroup.com

Future Trends

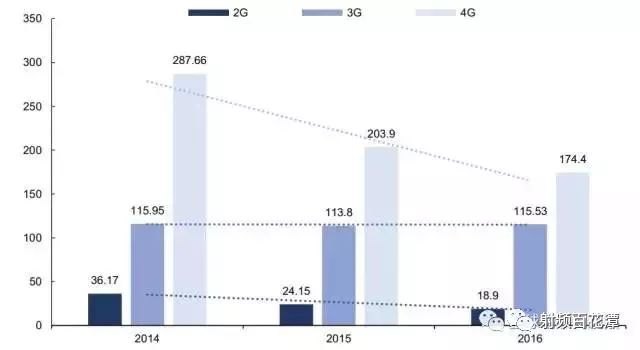

To achieve networking or positioning functions, IoT terminals require wireless modules. Typically, for every additional terminal, 1-2 wireless modules need to be added, indicating a vast market. Of course, this is the future direction. In the short term, the prices of 4G modules are rapidly declining, and the shipment volume is expected to see significant growth.

Price Trends of Fibocom’s 2G/3G/4G Modules

Currently, domestic wireless communication module suppliers are focusing more on the module business itself. However, the standardized nature of the module business leads to high price transparency and limited premium space. International leading companies have begun exploring new development directions for module businesses, which is worth learning from for later entrants.

Canada’s Sierra Wireless, established in 1993, was the world’s first supplier of cellular communication modules, with full product line capabilities including 2G, 3G, 4G, LPWA modules, Bluetooth, WiFi, GNSS, etc. Its module business has become the undisputed industry leader.

To improve overall business profitability and open up growth space for the company, Sierra Wireless has developed a one-stop service solution for “end + cloud + applications” through self-research + mergers and acquisitions.

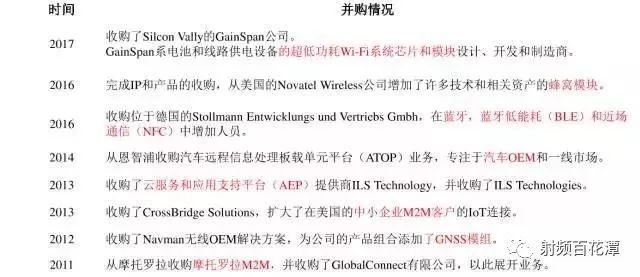

Sierra Recent M&A Events Overview

Based on its hardware business (modules), the company launched the AirVantage Cloud platform, and in 2014, it introduced the Linux-based open-source embedded platform LegatoTM. In 2015, it further introduced the open-source hardware design project MangOH. Based on these two service platforms and the AirVantage cloud platform, the company can provide complete IoT platform service capabilities.

Along with communication modules, Sierra Wireless has launched a series of smart routers and gateways, as well as management tools and applications, providing cellular connection services based on specific customer requirements. All cellular gateways can be remotely monitored, managed, and controlled via the AirVantage Cloud platform.

In specific vertical application fields, the company entered the automotive networking market in 2016 by acquiring GenX, completing the full business extension of the “end + cloud + applications” solution.

Sierra’s Business Layout

How is the transformation going? From Sierra Wireless’s financial reports, the introduction of the IoT platform has steadily improved its gross profit margin. The company believes that platform business will continue to occupy an important position in the future, with an expected contribution of about 70% to revenue by 2021.

From the industrial chain to manufacturers to future trends, with this understanding, I believe you now have a comprehensive understanding of the wireless communication module industry.

Note: The relevant data for this article comes from

1.07-20 Guosen Communication – “IoT Discussion Part 2: Communication Modules in Shared Bicycles”

2.08-29 CITIC Construction Investment – “IoT In-Depth Report Series Part 5: Wireless Modules Enable Everything to Connect and Position”

3.09-22 Guosen Securities – “Research and Thoughts on the Wireless Communication Module Industry”

(Editor: IoT Vision; Source: Global IoT Observation)

Focusing on RF microwave/high-frequency high-speed technology, the largest technical exchange and information sharing platform in this field. Founded by senior RF experts, director of the RF laboratory at Xingsen Technology, and editor-in-chief of “ADS2008/2011 RF Circuit Design and Simulation Examples” and “HFSS RF Simulation Design Example Collection” Xu Xingfu. This account has 70,000 followers and over 13,000 people in groups (2,000+ PhDs). The WeChat group includes many unit general managers, chief engineers, directors, R&D directors, professors, Thousand Talents Program, Changjiang Scholars, chief scientists, IEEE Fellows, gathering global Chinese RF elites.

1. Only RF groups 1-24 do not re-add

2. Add group owner for verification invitation to join

3. Must indicate unit position direction

Follow the largest RF public account in China