Author: Zhao Xiaofei

IoT Think Tank Original

Reprint please indicate the source and origin

Introduction

If eMTC is to be commercially launched, the industry should abandon the view that “module prices are the bottleneck for industrial development” and hope that eMTC does not follow the old path of NB-IoT. Instead, it should seek to provide value to vertical industries and reasonable returns for industry chain manufacturers, rather than simply lowering prices.。

Recently, the official website of the Ministry of Industry and Information Technology released a request for public comments on the “Notice on Enhancing the Frequency Usage of Machine Communication (eMTC) Systems (Draft for Comments)”, clearly proposing requirements for the RF technology of eMTC base stations, base station settings, and interference coordination management. In the current context of IoT development, the release of this draft is interpreted as a key action in paving the way for eMTC commercialization. However, despite strong efforts to promote the development of NB-IoT, it has not reached the expected level of “bringing huge opportunities and space to the IoT market”, and the progress of eMTC commercialization seems to have not attracted much attention in the industry. Whether it is an opportunity or a distraction may be a question for many.

The further improvement of IoT infrastructure indeed presents opportunities for the industry

At the end of 2018, the Central Economic Work Conference proposed: “We must play a key role in investment, accelerate the pace of 5G commercialization, and strengthen the construction of new infrastructure such as artificial intelligence, industrial Internet, and Internet of Things.” The eMTC network is a very typical IoT infrastructure, and it is still an infrastructure that has not yet started construction. From the perspective of macro-control, it will have a certain leverage effect on the entire industry. The eMTC network has already had nearly two years of practice overseas, and it can be said that the groundwork for infrastructure has been laid in the domestic market.

(1) Global eMTC Deployment and Application Status

As early as the beginning of 2017, during the Mobile World Congress, nine major global operators simultaneously announced the commercial launch of eMTC networks. Prior to this, global mainstream operators showed even greater enthusiasm for NB-IoT, and the deployment of these nine operators rapidly increased the strength of eMTC. According to GSMA data, by the end of 2018, there were already 23 eMTC networks officially commercialized globally, providing IoT infrastructure support for the countries and regions where these operators are located.

|

Operator |

Region |

|

AIS |

Thailand |

|

AT&T |

North America |

|

AT&T |

Mexico |

|

Bell |

Canada |

|

Dialog Ataxia |

Sri Lanka |

|

Etisalat |

UAE |

|

KDDI Corporation |

Japan |

|

KPN |

Netherlands |

|

NTT Docomo |

Japan |

|

Orange |

Belgium |

|

Orange |

France |

|

SingTel |

Singapore |

|

Spark |

New Zealand |

|

Swisscom |

Switzerland |

|

Telenor |

Norway |

|

Telstra |

Australia |

|

Turkcell |

Turkey |

|

Verizon |

North America |

|

Vodafone |

Singapore |

|

Vodafone |

Netherlands |

|

SoftBank |

Japan |

|

Asia Pacific Telecom |

Taiwan, China |

|

Chunghwa Telecom |

Taiwan, China |

Global eMTC network situation (Source: GSMA, compiled by IoT Think Tank)

In GSMA’s latest publication “LTE-M Commercial Use Cases”, typical applications of AT&T in the United States and Telstra in Australia were specifically studied. Among them, AT&T demonstrated its smart home appliance application case launched in the United States, using the eMTC network to replace the original WiFi solution, providing users with a simpler networking solution. Additionally, the AWS IoT 1-Click device launched in collaboration with Amazon accelerates the development of one-click intelligence in some scenarios. Australia’s Telstra has launched asset management and logistics tracking solutions for solar devices using the eMTC network.

However, overall, the number of connections realized by overseas operators’ eMTC networks is not large, and there are many application projects but they have not been scaled up. GSMA estimates that the number of connections for AT&T and Telstra’s eMTC networks is less than one million.

(2) Are domestic operators ready?

In the past two years, leaders from China Telecom and China Unicom have frequently mentioned plans for trial commercialization and commercial use of eMTC in public documents. China Telecom even mentioned in its 2017 performance report that it would officially commercialize the eMTC network in 2018. However, as of now, major operators have not officially commercialized.

Theoretically, the three major operators have the conditions for eMTC commercialization.

On the one hand, as a narrowband cellular IoT network technology based on LTE, it can be quickly implemented through a soft upgrade of the existing LTE network, with minimal changes on the base station side, and the core network can be shared. Therefore, the commercialization of the eMTC network can be realized quickly. In contrast, the NB-IoT network required the update of some equipment, making its deployment slower. Currently, the three major operators have established a nationwide LTE network, and the deep coverage of major locations has also been completed, laying the foundation for a soft upgrade of the existing network to eMTC. Previously, China Mobile lacked the FDD license, which hindered its first-mover advantage in NB-IoT/eMTC deployment. However, with its acquisition of the FDD license and nationwide deployment of FDD-based infrastructure, it now has the foundation for rapid upgrades.

On the other hand, operators have been promoting testing and trial commercialization of the eMTC network, advancing cooperation within the industry chain. For example, China Telecom began outdoor testing of eMTC in mid-2017, conducting comparative tests of eMTC in different scenarios and frequency bands to understand the impact of resource allocation on user experience. The outdoor tests utilized software upgrades on the existing 4G network, allowing eMTC to share wireless resources with LTE, verifying the impact of the eMTC network on the 4G network, testing eMTC handover functions and performance, and collecting and analyzing key parameters and frequency strategy configurations for eMTC commercialization preparation.

Of course, the readiness of operators does not mean that the entire industry chain is ready. This infrastructure can be built in a short time, but the overall industrial development it drives may not be visible in the short term.

The upstream eMTC industry chain has begun to take shape

In terms of the industry chain, similar to the development of NB-IoT in previous years, it first needs the support of a large number of chip and module manufacturers. In recent years, the upstream industry chain represented by chips and modules has begun to take shape and accumulated a lot of experience.

(1) Multi-mode chips dominate, but single-mode barriers are not high

Due to the concentration of more resources on NB-IoT by domestic and foreign cellular IoT manufacturers, especially in China, the current eMTC chip suppliers are primarily foreign companies, with only RDA launching corresponding products domestically, but not yet achieving mass production. Moreover, most of the chips launched by these manufacturers are multi-mode, including NB-IoT/eMTC dual-mode and NB-IoT/eMTC/2G tri-mode. Qualcomm is a staunch advocate of eMTC and multi-mode chips, with its MDM9206 initially released and the MDM9205 launched by the end of 2018, both adhering to the multi-mode of NB-IoT/eMTC/2G. Major eMTC chip manufacturers and their products include:

|

Manufacturer |

Model |

Standard |

|

RDA |

RDA8910 RDA8911 |

NB-IoT/eMTC/2G |

|

Qualcomm |

MDM9206 MDM9205 |

NB-IoT/eMTC/2G |

|

Altair |

ALT1210 ALT1250 |

eMTC NB-IoT/eMTC |

|

Sequans |

SQN3330 |

NB-IoT/eMTC |

|

Nordic |

nRF91 |

NB-IoT/eMTC |

|

GCT |

GDM7243i |

NB-IoT/eMTC/2G/Sigfox |

|

Riot |

RM1000 |

NB-IoT/eMTC |

eMTC chip manufacturers and models (Source: Internet, compiled by IoT Think Tank)

At the early stage of market development, launching products in multi-mode form undoubtedly reduces uncertainty and risk. However, as eMTC commercial network and applications increase, there will certainly be a future need for lower-cost single-mode chips. Several friends in the industry have indicated that due to the close relationship between eMTC and 4G, the speed of launching eMTC single-mode chips based on LTE chips is very fast. In addition to traditional LTE chip manufacturers, there are also many small teams capable of designing LTE chips, which may join the ranks of eMTC single-mode chips in the future.

(2) Modules Already Have Ready Groups

Domestically, module manufacturers already have experience in developing eMTC products. In 2017, the IoT Think Tank collaborated with Qualcomm to organize several module matchmaking meetings based on MDM9206, and more than ten mainstream domestic module manufacturers launched corresponding products, including Quectel, Fibocom, Longshang, XunTong, Hightel, Youfang, Yuge, Qijun, and Kuanyi.

However, since there is currently no eMTC network in China, domestic module manufacturers cannot achieve eMTC connections on existing networks. Most of their modules are used in NB-IoT or 2G scenarios, and with the rapid decline in the price of NB-IoT modules over the past year, these multi-mode modules based on NB-IoT/eMTC/2G have not found a market.

Overseas manufacturers have commercial eMTC networks, so the real demand for eMTC modules is more worthy of attention. Taking AT&T as an example, this operator regularly publishes certified eMTC chips and module products. When its eMTC network was commercialized in 2017, the minimum price for certified eMTC modules was about $7.5. According to publicly available information, the eMTC modules certified by AT&T include:

|

Module Manufacturer |

Module Model |

Chip Manufacturer |

Chip Model |

|

Gemalto |

EMS31-US |

Sequans |

SQN3330 |

|

Quectel |

BG96 |

Qualcomm |

MDM9206 |

|

ZTE |

TPM10 |

Sequans |

SQN3330 |

|

XunTong |

SIM7000A |

Qualcomm |

MDM9206 |

|

Sierra |

HL7748 |

Altair |

ALT1210 |

|

Sierra |

WP7700 |

Qualcomm |

MDM9206 |

|

Sierra |

WP7702 |

Qualcomm |

MDM9206 |

|

Telit |

ME866A1-NA |

Altair |

ALT1210 |

|

Telit |

ME910C1-NA |

Qualcomm |

MDM9206 |

|

Telit |

ME910C1-WW |

Qualcomm |

MDM9206 |

|

U-Blox |

SARA-R410M |

Qualcomm |

MDM9206 |

|

U-Blox |

SARA-R410M-02B |

Qualcomm |

MDM9206 |

|

U-Blox |

SARA-R410M-52B |

Qualcomm |

MDM9206 |

|

QiQi Technology |

IMA2A |

Altair |

ALT1250 |

|

QiQi Technology |

IMA3 |

Altair |

ALT1210 |

|

QiQi Technology |

IMS2 |

Sequans |

SQN3330 |

AT&T certified eMTC module information (Source: AT&T, compiled by IoT Think Tank)

It can be seen that among the AT&T certified modules, those using Qualcomm chips account for the vast majority. With the increase in eMTC network deployment, the cost of chips and modules will significantly decrease, and the number of participating manufacturers will also increase. Of course, after the chips and modules are ready, the corresponding terminals and application links also need to develop quickly. Currently, these links are not mature enough compared to NB-IoT.

Examining Opportunities and Distractions from the Intersection of eMTC and NB-IoT

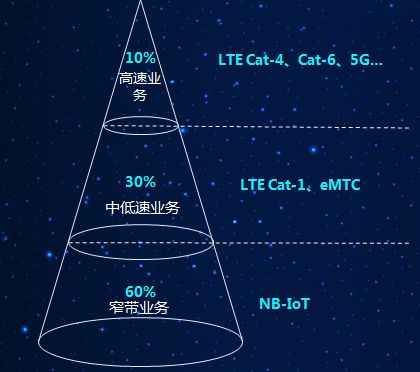

From the overseas market perspective, at least 13 operators have deployed both NB-IoT and eMTC networks in the same country or region. Theoretically, the two mainly face different scenarios of rate and reliability; there may be some overlap in certain scenarios, but more often they complement each other, covering most of the medium to low-speed IoT scenarios together. However, in the actual promotion, there will be various interests at play within the industry chain.

(1) Overlap and Complementarity Between Functions

After the 3GPP R13 protocol was frozen on June 3, 2016, NB-IoT became a hot topic. Regarding the differences between NB-IoT and eMTC from the application scenario perspective, the focus is more on three points: eMTC has a peak rate of 1Mbps, higher than NB-IoT’s 250Kbps; eMTC supports cell handover, providing better mobility, while NB-IoT does not; eMTC supports voice, while NB-IoT does not. Notably, since NB-IoT only supports cell reselection and lacks mobility during service, it is considered limited in many scenarios.

However, in the 3GPP R14 core protocol frozen in August 2017, NB-IoT received multiple functional enhancements. According to an article published by Lu Qiang from China Telecom Jiangsu Company, titled “Interpretation of the Seven Major Changes in NB-IoT R14 Version”, these enhancements include the ability for NB-IoT to support cell handover in service status and location functions. These enhancements have expanded the application scenarios for NB-IoT and increased the overlap with the scenarios covered by eMTC.

I have communicated with friends from several companies engaged in wearable devices, tracking, positioning, and asset management. Previously, they had some demand for eMTC in their service scenarios, but with the enhancement of mobility and positioning for NB-IoT, the demand for eMTC in these scenarios has become less pronounced. Currently, eMTC’s typical advantages lie in supporting voice and medium-speed bandwidth, making it irreplaceable in scenarios requiring certain bandwidth data, images, and emergency calls.

(2) Thoughts on eMTC Following the Commercial Promotion of NB-IoT

More than two years ago, the industry had high hopes for NB-IoT, expecting it to take on the responsibility of “big connectivity” in the IoT space in a short time. However, after more than two years of commercial promotion, the results of millions of connections have fallen short of expectations. It is well known that NB-IoT is expected to carry over 60% of cellular IoT connections, and the failure of these IoT applications to materialize as expected is not due to a lack of effort from upstream suppliers, but rather involves the maturity of the entire industrial ecosystem, especially the insufficient scale of demand from downstream application providers. Faced with the same issue, if the network carrying the majority of connections does not develop as expected in a few years of commercialization, then the development of an eMTC network after its commercialization may also fall short of expectations. The challenges of industrial ecosystem maturity and insufficient demand encountered by operators during the promotion of NB-IoT may be reasons for the lack of enthusiasm for eMTC commercialization in China.

Expectations for eMTC Commercialization

Although eMTC has not yet been commercialized, the recent public announcement of the spectrum management system for eMTC by regulatory agencies can be seen as a positive signal. Coupled with macro policies supporting IoT infrastructure, the possibility of accelerating eMTC commercialization is high. From the development path of NB-IoT over the past few years, I believe eMTC commercialization needs to learn from some previous lessons.

First, if eMTC is to be commercially launched, the industry should abandon the view that “module prices are the bottleneck for industrial development”. This viewpoint was very prevalent during the development of NB-IoT, resulting in the rapid drop of NB-IoT module prices below the previously expected “$5” to below 20 RMB after multiple concentrated tenders and fierce competition among manufacturers in 2018. This rapid price decline not only debunked the notion that “module prices are the bottleneck for industrial development” but also led to an abnormal bloodbath for the chip and module industry chain. It is hoped that the future development of eMTC will not repeat the old path of NB-IoT, but will seek to provide value to vertical industries and reasonable returns for industry chain manufacturers, rather than simply lowering prices.

Second, eMTC exists to address the needs between narrowband and broadband, with certain overlaps with both 4G and NB-IoT. This raises the question of whether its existence is significant. Therefore, during the commercialization process, it is even more important to identify suitable application scenarios in downstream industries, demonstrating its irreplaceability. For example, the current rapid growth in connections based on 2G includes many scenarios where NB-IoT cannot perform well, which may be where eMTC can play a role. Similarly, smart wireless POS machines, which have high costs and power consumption when using 4G, may find eMTC to be a better solution. Application orientation is a long-term process that needs to follow the development laws of each industry, requiring closer cooperation between upstream manufacturers and downstream users, rather than relying on subsidies and special actions to achieve rapid progress.

Currently, the 4G network is mature, and NB-IoT has gathered a lot of resources. Adhering to a value-oriented approach and the applicability of application scenarios, eMTC should be able to bring opportunities to the IoT market rather than being seen as a distraction.

Scan the QR code or click the end of the article to download the MindSphere white paper

Previous Hot Articles (Click on the article title to read directly):

-

“How Difficult Is It to Make Smart Locks for Shared Bicycles?”

-

“Cognitive Computing, Blockchain IoT, IoT Security… Those Who Understand Will Control the Future”

-

“[Heavy Release] 2017-2018 China IoT Industry Panorama Report – IoT Has Started to Deeply Transform the Industry”

-

“[Heavyweight] IoT Industry Panorama Report, the First Domestic IoT Industry Two-Dimensional Perspective Panorama”

-

“A Cartoon Explains: Besides WiFi and Bluetooth, What Can the Recently Hot NB-IoT Do?”

-

“A Cartoon Explains: Behind NB-IoT, What Is the LoRa Everyone Is Talking About?”