Skip to content

LED (Light Emitting Diode) is a type of semiconductor solid-state light-emitting device. It uses solid semiconductor chips as the light-emitting material, where excess energy is released as photons through the recombination of carriers in the semiconductor, emitting red, yellow, blue, green, cyan, orange, purple, and white light directly.

The core part of the light-emitting diode is a chip composed of P-type and N-type semiconductors, with a transition layer called the PN junction between them. In certain semiconductor materials, when injected minority carriers recombine with majority carriers at the PN junction, excess energy is released in the form of light, thus converting electrical energy directly into light energy. When a reverse voltage is applied to the PN junction, minority carriers are difficult to inject, hence it does not emit light.

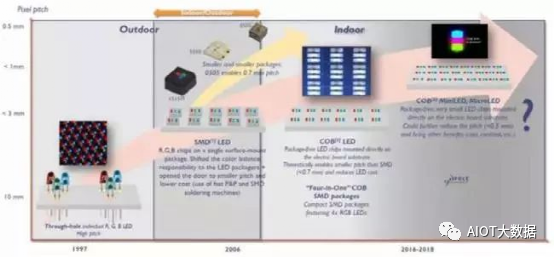

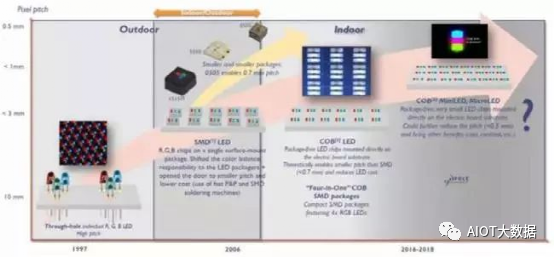

As the name suggests, “Mini” means “miniature” in Chinese. If small-pitch LED displays focus on the “small” between pixel pitches, then Mini LED naturally reaches an even smaller level, qualifying it as mini. Tracing back, the term Mini LED originated from Epistar, which has revealed information about the mass production process of Mini LED.

The concept of Mini LED was first proposed by Epistar, and it is gradually being accepted by manufacturers in mainland China, although AIOT big data suggests that the definitions of Mini LED differ slightly between the two parties.

Specifically, the term “Mini LED” in the industry refers to different concepts compared to “Mini LED display.” Taiwanese manufacturers refer to Mini LED purely in terms of the spacing between crystal particles, while mainland LED display companies emphasize differences in packaging forms. One refers to a type of new packaging form, while the other indicates a classification of displays.

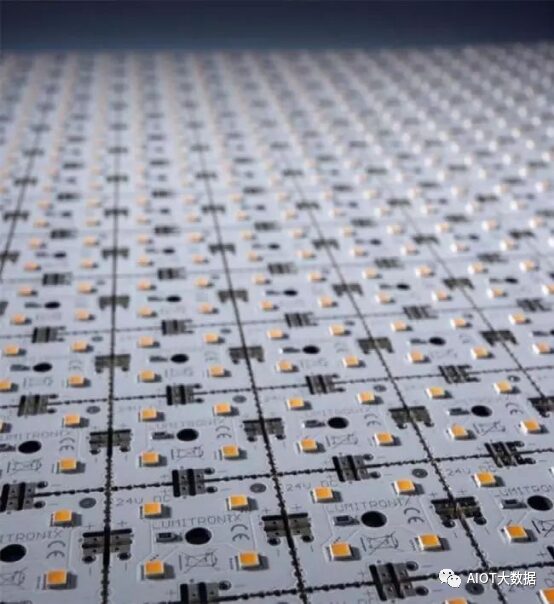

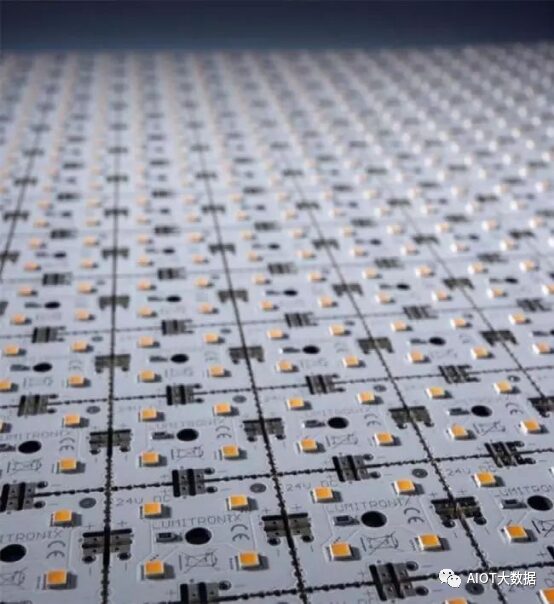

Mini LED has two main applications in display technology: one is as self-emitting LED displays, similar to small-pitch LED displays, where the packaging form does not require gold wire bonding. Compared to small-pitch LEDs, Mini LEDs can achieve smaller pixel pitches even with the same chip size. The other application is in backlighting. Compared to traditional backlight LED modules, AIOT big data believes that Mini LED backlight modules will adopt a denser chip arrangement to reduce light mixing distance, achieving ultra-thin light source modules. Additionally, when combined with local dimming control, Mini LED will provide better contrast and HDR display effects.

Due to the size of Mini LED chips and packaging technology limitations, the current pixel pitch limit for RGB self-emitting displays using Mini LED is about 0.5 mm. When made into a 4K screen, the entire screen size exceeds 85 inches, and the large number of LED chips (~24 million) makes the screen exceptionally expensive. To enhance the competitiveness of LEDs in the display market and improve the display quality of existing LCD backlights, the application of Mini LED in backlighting (hereafter referred to as Mini BLU) is increasingly gaining attention in the industry, often compared with AMOLED.

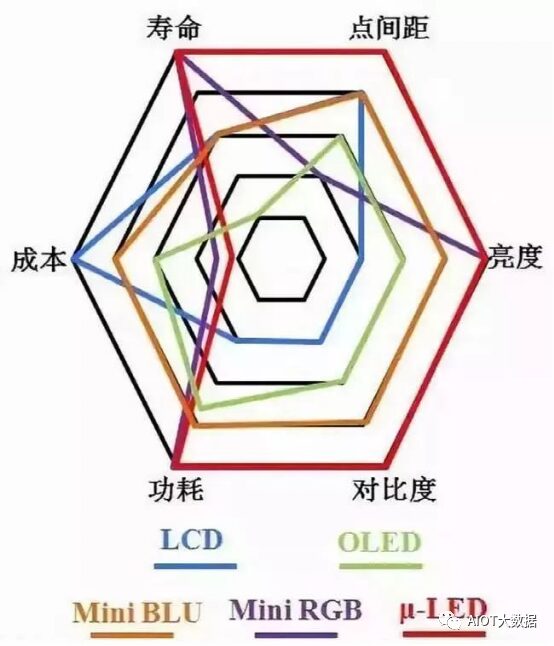

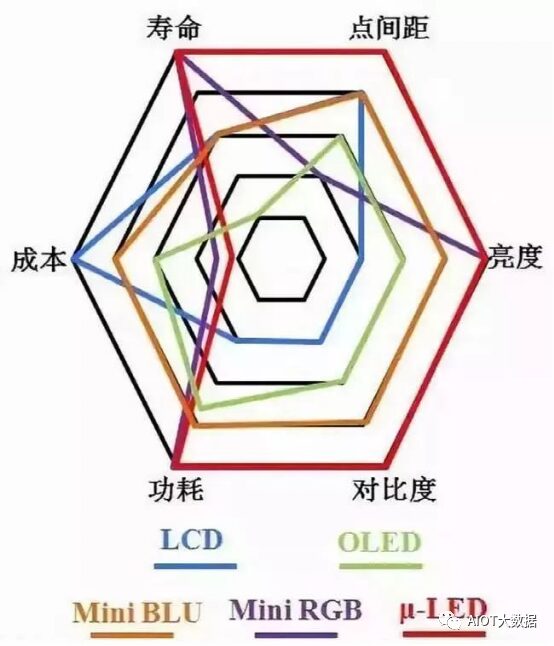

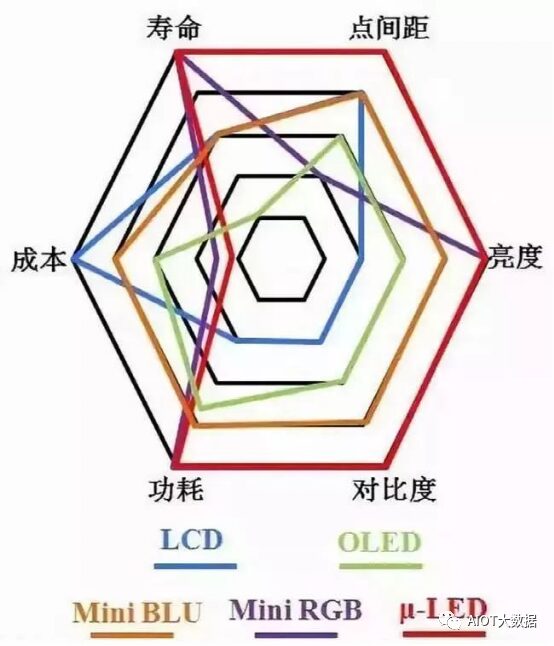

Mini BLU’s advantages and disadvantages compared to several display technologies are illustrated in the following image. In terms of the basic elements of display, including power consumption, cost, lifespan, pixel pitch, brightness, and contrast, Mini LED is essentially an all-around player. However, in today’s market where AMOLED has become popular, products applying Mini LED in backlighting are still questioned and have yet to enter the market. This is primarily due to the relatively late development of Mini BLU technology (mainly starting in the second half of 2017) and the fact that it still relies on LCD display technology. Even those involved in LED chip production might assume that its display performance is inferior to AMOLED, hesitantly positioning it below AMOLED.

Due to the size of Mini LED chips and packaging technology limitations, the current pixel pitch limit for RGB self-emitting displays using Mini LED is about 0.5 mm. When made into a 4K screen, the entire screen size exceeds 85 inches, and the large number of LED chips (~24 million) makes the screen exceptionally expensive. To enhance the competitiveness of LEDs in the display market and improve the display quality of existing LCD backlights, the application of Mini LED in backlighting (hereafter referred to as Mini BLU) is increasingly gaining attention in the industry, often compared with AMOLED.

Mini BLU’s advantages and disadvantages compared to several display technologies are illustrated in the following image. In terms of the basic elements of display, including power consumption, cost, lifespan, pixel pitch, brightness, and contrast, Mini LED is essentially an all-around player. However, in today’s market where AMOLED has become popular, products applying Mini LED in backlighting are still questioned and have yet to enter the market. This is primarily due to the relatively late development of Mini BLU technology (mainly starting in the second half of 2017) and the fact that it still relies on LCD display technology. Even those involved in LED chip production might assume that its display performance is inferior to AMOLED, hesitantly positioning it below AMOLED.

However, AIOT big data believes that this is not the case. Compared to AMOLED, Mini BLU has undeniable advantages in cost and lifespan. Due to the higher optoelectronic conversion efficiency of LED chips compared to OLED, combined with local dimming control, Mini BLU can achieve close to or even lower power consumption, thus achieving higher contrast and brightness. The pixel pitch is mainly limited by LCD technology, and currently, it can also outperform self-emitting AMOLED.

Based on these advantages, Mini BLU will always find its place in suitable fields, regardless of whether AMOLED has insufficient production capacity; it is indeed reliable. Of course, in today’s consumer market, where personalization is increasingly pursued, Mini BLU has a fatal weakness: it cannot be made flexible (though it can still be made curved), which is primarily restricted by LCD technology.

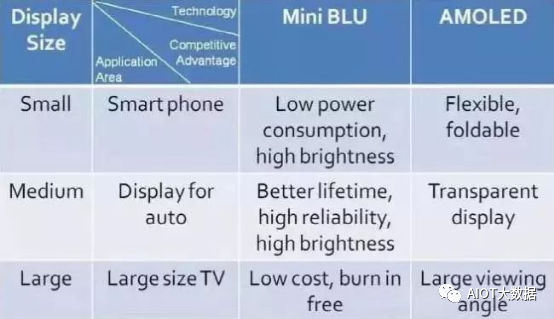

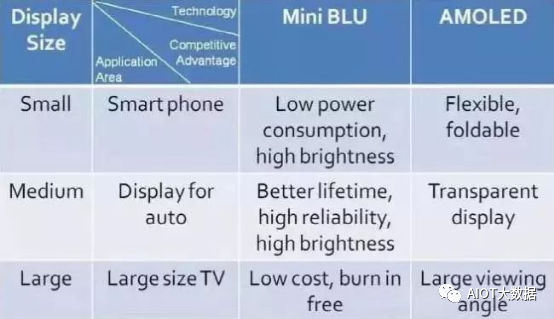

In terms of end applications, from small screens like mobile phones and tablets to medium screens like automotive displays and monitors, and to large screens like TVs, both Mini BLU and AMOLED have their competitive advantages, and it may take some time before one can replace the other. Especially in automotive and medium to large screen displays, Mini BLU will have more apparent cost advantages and better lifespan and reliability, which are currently irreplaceable advantages of AMOLED.

Mini LED Backlight Technology

Compared to traditional LED backlighting, Mini LED has more advantages, making it suitable for high-end LCD display solutions:

1. It can directly adopt RGB three-color LED modules, achieving a display effect without loss of RGB primary colors, and can cover 100% of the BT2020 wide color gamut, with color vibrancy comparable to OLED.

2. Mini LED can achieve uniform heat dissipation at high brightness (>1000 nits), which is unattainable with traditional discrete LED solutions.

3. Mini LED backlighting can achieve ultra-thin direct-lit LCD displays, with OD ≈ 0 mm, offering vast applications in lightweight portable consumer electronics, such as AR/VR glasses, mobile phones, laptops, etc.

4. Mini LED, combined with precise local dimming, can achieve ultra-high contrast (1,000,000:1), making blacks deeper and whites brighter.

The Mini LED backlight packaging uses flip-chip Mini LED chips to directly achieve uniform light mixing without requiring lenses for secondary optical design. Due to the small chip structure itself, it is conducive to making the number of local dimming zones more detailed, thereby achieving a higher dynamic range (HDR) and higher contrast effects. On the other hand, it can also shorten the optical mixing distance (OD), reducing the overall thickness to achieve ultra-thin designs.

Mini LED backlight can combine local dimming technology to control the on-off and brightness adjustment of corresponding backlight areas in real-time according to the brightness and darkness of various parts of the television signal, making blacks deeper, whites brighter, and colors more natural and vibrant, providing a lifelike visual experience.

During CES 2019, ASUS unveiled its new flagship professional monitor “ProArt Studio PA32UCX,” a 32-inch Mini LED backlight 4K gaming LCD monitor, with its BLU employing over 10,000 Mini LEDs produced by Longda Electronics.

Challenges and Market Trends of Mini LED Technology

After Apple did not use Micro LED in the next-generation iWatch, perspectives on its technology and application have become more rational, and related manufacturers are actively cooperating to push towards application.

Meanwhile, Mini LED is gradually becoming a reality, with manufacturers following suit. After a year of trials, major terminal application manufacturers have basically completed prototype designs. Recent exhibitions show that manufacturers like Samsung and Lumens have launched Mini LED applications.

However, whether it is the Mini LED products from mainland manufacturers or the Mini LED displays referred to by Taiwanese manufacturers, discussions inevitably revolve around Micro LED.

However, AIOT big data believes that this is not the case. Compared to AMOLED, Mini BLU has undeniable advantages in cost and lifespan. Due to the higher optoelectronic conversion efficiency of LED chips compared to OLED, combined with local dimming control, Mini BLU can achieve close to or even lower power consumption, thus achieving higher contrast and brightness. The pixel pitch is mainly limited by LCD technology, and currently, it can also outperform self-emitting AMOLED.

Based on these advantages, Mini BLU will always find its place in suitable fields, regardless of whether AMOLED has insufficient production capacity; it is indeed reliable. Of course, in today’s consumer market, where personalization is increasingly pursued, Mini BLU has a fatal weakness: it cannot be made flexible (though it can still be made curved), which is primarily restricted by LCD technology.

In terms of end applications, from small screens like mobile phones and tablets to medium screens like automotive displays and monitors, and to large screens like TVs, both Mini BLU and AMOLED have their competitive advantages, and it may take some time before one can replace the other. Especially in automotive and medium to large screen displays, Mini BLU will have more apparent cost advantages and better lifespan and reliability, which are currently irreplaceable advantages of AMOLED.

Mini LED Backlight Technology

Compared to traditional LED backlighting, Mini LED has more advantages, making it suitable for high-end LCD display solutions:

1. It can directly adopt RGB three-color LED modules, achieving a display effect without loss of RGB primary colors, and can cover 100% of the BT2020 wide color gamut, with color vibrancy comparable to OLED.

2. Mini LED can achieve uniform heat dissipation at high brightness (>1000 nits), which is unattainable with traditional discrete LED solutions.

3. Mini LED backlighting can achieve ultra-thin direct-lit LCD displays, with OD ≈ 0 mm, offering vast applications in lightweight portable consumer electronics, such as AR/VR glasses, mobile phones, laptops, etc.

4. Mini LED, combined with precise local dimming, can achieve ultra-high contrast (1,000,000:1), making blacks deeper and whites brighter.

The Mini LED backlight packaging uses flip-chip Mini LED chips to directly achieve uniform light mixing without requiring lenses for secondary optical design. Due to the small chip structure itself, it is conducive to making the number of local dimming zones more detailed, thereby achieving a higher dynamic range (HDR) and higher contrast effects. On the other hand, it can also shorten the optical mixing distance (OD), reducing the overall thickness to achieve ultra-thin designs.

Mini LED backlight can combine local dimming technology to control the on-off and brightness adjustment of corresponding backlight areas in real-time according to the brightness and darkness of various parts of the television signal, making blacks deeper, whites brighter, and colors more natural and vibrant, providing a lifelike visual experience.

During CES 2019, ASUS unveiled its new flagship professional monitor “ProArt Studio PA32UCX,” a 32-inch Mini LED backlight 4K gaming LCD monitor, with its BLU employing over 10,000 Mini LEDs produced by Longda Electronics.

Challenges and Market Trends of Mini LED Technology

After Apple did not use Micro LED in the next-generation iWatch, perspectives on its technology and application have become more rational, and related manufacturers are actively cooperating to push towards application.

Meanwhile, Mini LED is gradually becoming a reality, with manufacturers following suit. After a year of trials, major terminal application manufacturers have basically completed prototype designs. Recent exhibitions show that manufacturers like Samsung and Lumens have launched Mini LED applications.

However, whether it is the Mini LED products from mainland manufacturers or the Mini LED displays referred to by Taiwanese manufacturers, discussions inevitably revolve around Micro LED.

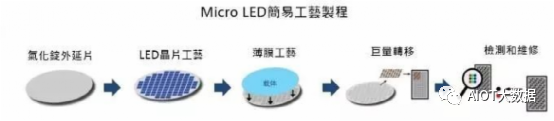

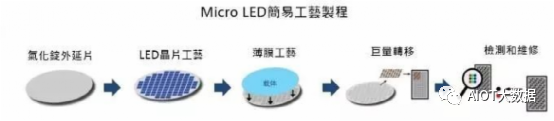

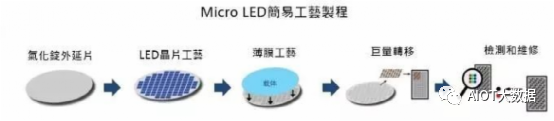

Micro LED is viewed as the next generation of display products, possessing advantages over current LCDs and OLEDs. However, it is well-known that Micro LED has yet to achieve substantial breakthroughs in the “mass transfer” phase and key equipment. Moving millions or even tens of millions of micron-sized LED crystals correctly and efficiently onto circuit boards is a significant challenge facing Micro LED. The industry generally believes that Micro LED needs at least two to three more years to break through the bottleneck of mass production. However, the development of display technology is rapid, and with the strong rise of OLED, some companies developing Micro LED are anxious. If OLED seizes the initiative and captures the majority of the market share, even if Micro LED can overcome technical challenges in the coming years, it may be too late.

Micro LED is viewed as the next generation of display products, possessing advantages over current LCDs and OLEDs. However, it is well-known that Micro LED has yet to achieve substantial breakthroughs in the “mass transfer” phase and key equipment. Moving millions or even tens of millions of micron-sized LED crystals correctly and efficiently onto circuit boards is a significant challenge facing Micro LED. The industry generally believes that Micro LED needs at least two to three more years to break through the bottleneck of mass production. However, the development of display technology is rapid, and with the strong rise of OLED, some companies developing Micro LED are anxious. If OLED seizes the initiative and captures the majority of the market share, even if Micro LED can overcome technical challenges in the coming years, it may be too late.

In other words, no matter how good Micro LED is, it ultimately cannot solve immediate needs. In light of this situation, related manufacturers are certainly not sitting idle and have begun to seek a compromise. It is in this urgent context that Mini LED, viewed as a transitional technology, has been proposed. Mini LED generally refers to LED chips with sizes between 50 to 100 microns. Compared to Micro LED, Mini LED is more feasible in terms of processing, with significantly lower technical difficulty and easier mass production, allowing for rapid market entry.

Compared to current conventional applications, Mini LED has unique advantages:

(1) For backlight applications, Mini LED typically adopts a direct-lit design, utilizing a large number of densely packed chips to achieve localized dimming within smaller ranges. Compared to traditional backlight designs, it can achieve better brightness uniformity and higher color contrast within shorter mixing distances, leading to ultra-thin products with high color rendering and energy savings.

Additionally, due to its design, it can be paired with flexible substrates, allowing for curved displays similar to OLED while ensuring picture quality. On the other hand, since OLED is based on organic materials and self-emitting, Mini LED has significant reliability advantages; based on the mature LED supply chain, AIOT big data believes that the cost of backlit Mini LED is only about 60% of that of OLED of the same size, making it highly competitive in all aspects.

(2) For display applications, RGB Mini LED overcomes the wiring and reliability issues of traditional chip-on-board (COB) solutions, while combining the advantages of COB packaging, allowing for further reduction in pixel pitch and significantly enhancing the visual effect of corresponding terminal products, while also significantly reducing the viewing distance, enabling indoor displays to further replace traditional LCD markets.

On the other hand, the use of RGB Mini LED with flexible substrates can also achieve high-quality curved displays, and its self-emitting characteristics provide vast market potential for special-shaped requirements (such as automotive displays).

As seen above, Mini LED has significant advantages relative to other competitors in the current LED landscape, leading various manufacturers to conduct research. Although its chip size is similar to that of conventional small-pitch chips, there are still many differences.

Technical Characteristics and Challenges:

a. Chip Miniaturization: Since Mini LED requires pixel pitches below 1mm, the chips also need to be smaller, with current Mini LED chips generally requiring sizes below 200um. This imposes higher requirements on the photolithography and etching processes during LED chip production. Existing mature production equipment struggles to meet the production needs for chips smaller than 100um, and for small-sized chips, challenges include the flatness of the welding surface, electrode structure design, solderability, adaptability to welding parameters, and packaging tolerance. Additionally, the production process for Mini LED chips often employs a low-efficiency full test and full sorting mode, leading to inefficiencies in processing large volumes of high-density, high-precision chips, which inadvertently increases costs.

b. Red Flip Chip: Since flip chips do not require wire bonding, they meet the dense spatial requirements of Mini LED. Therefore, all current Mini LEDs utilize flip chip structures. While blue and green flip LED chip production is relatively mature, producing red flip LED chips is technically challenging due to substrate transfer requirements, and the yield and reliability during the transfer process are not high.

c. Consistency and Reliability: As display chips, Mini LED chips require high consistency and reliability. Key indicators for consistency include low current consistency, consistency under non-operating currents, high and low position consistency, color uniformity, and low capacitance consistency. Given the complex usage environment of Mini LED displays, the difficulty of maintenance is high, necessitating stringent production control to ensure product stability.

a. High-Efficiency Die Bonding and Mounting: Since Mini LED chips range from 50-200um, and the unit area usage of Mini LED chips and bulbs is massive and closely packed, higher requirements are set for the flatness of the welding surface and the precision of the circuits. The adaptability of welding parameters and packaging tolerance requirements are also stricter. Thus, achieving high efficiency and precision in die bonding for Mini LED presents a significant challenge. Traditional solder paste bonding can lead to chip misalignment and increased hole rates, failing to meet the high precision bonding requirements of Mini LED. More precise bonding substrates and equipment are urgently needed. Traditional pick-and-place machines must reduce their speed by 30-50% when placing Mini LED packaging devices below P1.0, greatly reducing manufacturing efficiency. More efficient pick-and-place machines are a major challenge facing Mini LED.

b. Thin Packaging: As backlighting, Mini LED products are ideally as thin as possible. However, when PCB thickness is below 0.4mm, issues such as virtual soldering can occur during reflow soldering and molding processes due to differing thermal expansion coefficients between the resin substrate and copper layer. Additionally, differences in thermal expansion coefficients during the molding process can lead to adhesive cracking.

c. Light Mixing Consistency: Variations in light color due to differences in chips or bulbs, or circuit issues, can lead to inconsistencies in display or backlighting effects, adversely affecting Mini LED display performance.

d. Reliability and Yield: The operating environment for Mini LED displays is relatively complex. Moisture in the air can easily seep through packaging materials or brackets, reaching the LED chip electrodes and causing short circuits. Moreover, the densely packed nature of Mini LED products significantly increases the number of packaging devices used, necessitating higher reliability in Mini LED packaging components given the high maintenance difficulty and costs.

a. Current Control and Heat Dissipation: As Mini LED pixel pitches decrease, the number of LED chips used increases, and chip sizes shrink, leading to increasingly smaller driving currents. Precise control of these currents becomes more challenging for driver ICs, necessitating new circuit designs for precise control of small currents. Furthermore, the use of numerous driver ICs and LED chips complicates rapid heat dissipation on PCBs, and excessive heat can cause color distortion in driver IC modules. Therefore, highly integrated and low-power driver ICs will be the future direction for display driver ICs.

b. Local Dimming: For Mini LED backlight applications, current static dimming technology is becoming inadequate due to high costs associated with the number of ICs needed in series, large I/O counts for driver circuits, and low refresh rates that can lead to flickering. Local dimming driver ICs can address the shortcomings of static dimming; however, implementing local dimming solutions entails several challenges, including enhancing brightness uniformity and consistency across backlight zones, increasing refresh rates, improving backlight efficiency, achieving high integration, and fine-tuning dimming resolution.

Under the premise of Mini LED thinness, the high requirements for display and backlight effects impose new challenges for the uniformity, flatness, and alignment precision of PCB backplane processing. Additionally, with numerous LED chips and driver ICs mounted on the backplane, the Tg point must exceed 220℃. The backplane must withstand various external forces during Mini LED processing to maintain its thickness uniformity and dimensional stability, necessitating high tear strength and moisture resistance.

To expand Mini LED applications, upstream and downstream manufacturers actively invest in research and development of new technologies and cost reduction. Current focus areas for Mini LED manufacturers include light output adjustment chips, COB and IMD packaging, Mini LED mass transfer, TFT circuit backplanes, and flexible substrates.

1. Light Output Adjustment Chips

When Mini LED is used as backlighting, numerous LED chips are often employed as direct-lit sources. To adjust the output of these chips for easier ultra-thin design implementation, Huacan Optoelectronics has added optimized layers to traditional backlight chips to enhance the chip’s output angle, resulting in more uniform light output and improved display effects.

Currently, COB (Chip on Board) packaging directly embeds LED bare chips onto module substrates and then encapsulates them as a whole. Compared to traditional SMD packaging, this COB packaging for full-color LED modules features fewer manufacturing processes, lower packaging costs, higher integration, and better reliability and uniformity in display effects, making it a significant future packaging form for high-density LED displays.

As the COB supply chain has yet to mature, the unit area cost of COB products is higher than that of SMD. However, as the COB display packaging supply chain gradually matures, its market share is expected to rise rapidly. In Mini LED applications, COB packaging offers higher reliability and stability and facilitates ultra-small pitch displays, aligning with Mini LED technology trends; thus, COB packaging is also one of Mini LED’s technological trends.

3. Mini LED Mass Transfer

Compared to Micro LED’s mass transfer technology, Mini LED’s larger chip size makes the transfer process relatively easier. By combining mass transfer and COB packaging technologies, Mini LED production cycles can be effectively reduced. Currently, Uniqarta’s laser transfer technology can transfer approximately 14 million 130×160 micron LED chips per hour using single or multiple laser beams.

To compete with OLED in terms of display performance, Mini LED backlight combined with LCD must achieve top-tier HDR, necessitating hundreds or even thousands of local dimming zones. However, using traditional LED backlight circuit architectures would result in excessive component usage, compromising cost and thin design. In response, Innolux proposed using active matrix TFT circuits to drive the AM Mini LED architecture.

Mini LED backlighting typically uses a direct-lit design with densely packed chips to achieve localized dimming. Its design can be paired with flexible substrates, allowing for curved displays similar to OLED while ensuring picture quality. However, due to the large number of Mini LEDs generating significant heat, developing flexible substrates with high thermal resistance will also be a future technological trend.

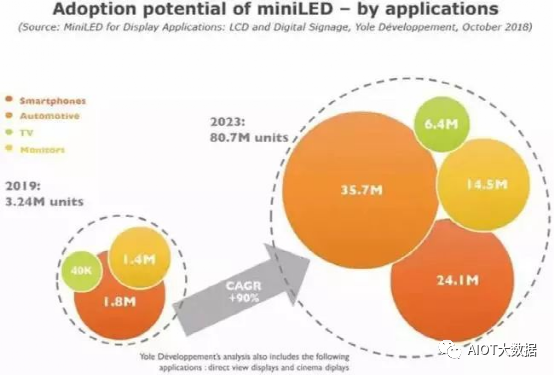

Market Applications and Trends for Mini LED

In terms of market applications, Mini LED is expected to cover part of the current small-pitch LED display market. From the information released by major companies regarding Mini LED, its applications can be broadly categorized into two directions: one is the LED display market, and the other is the backlight application market.

According to GGII’s forecast, the market size for Mini LED applications is expected to reach 500 million yuan in 2018. Among these, mobile phone backlighting will lead the Mini LED application, and as costs decrease, Mini LED will gradually penetrate into display and medium to large size backlighting.

For small-pitch LED displays, the clear direction is indoor commercial applications. Currently, small-pitch LED displays are continuously expanding in this field, but AIOT big data believes that as pixel pitches decrease, small-pitch LED displays face numerous challenges due to inherent issues, leading to a potential bottleneck in technical processes and cost.

In the context of a hundred billion commercial display market, if some issues with small-pitch LED displays cannot be effectively resolved, their hard-won advantages in competition with LCD, DLP, or OLED display products may gradually diminish, potentially restricting their further expansion in the commercial display market.

In this situation, whether companies launch COB small-pitch displays or Mini LED, their intention is to better address the current challenges faced by small-pitch LED displays.

The backlight application market presents a vast development opportunity for Mini LED. According to TrendForce’s estimates, as the next generation of backlight technology, the overall value of Mini LED is expected to reach 1 billion USD by 2023. Additionally, due to limited production capacity of OLED panels, Mini LED is expected to be first applied in well-known consumer electronics terminals such as Huawei, OPPO, and VIVO in 2018.

In the LED display field, we have not yet seen practical application cases for Mini LED, but some companies have indicated that Mini LED has already received orders and is currently shipping. It is expected that by the end of September, there will be Mini LED application cases emerging. Once Mini LED begins to scale up its applications, what impact will it have on LED displays?

For Mini LED, some view it as a transitional product from LED displays to Micro LED, while others hold a different opinion, believing that Mini LED is not merely a transitional technology; its lifecycle will be long. After all, the trend of decreasing pixel pitches in LED displays is quite evident. However, small-pitch LED displays are indeed facing severe challenges in technology and cost as they develop below P1.0, and the challenges and pain points of small-pitch LED displays undoubtedly provide significant development opportunities for Mini LED. Driven by the two main technological application directions of displays and backlighting, Mini LED appears to have a bright future ahead, which is also a key reason for its popularity among Taiwanese and mainland manufacturers.

Indeed, while Mini LED has great potential and a broad market outlook, we should not overly exaggerate its impact on LED displays. From the current development status, small-pitch LED displays have not yet reached an insurmountable bottleneck; there remains considerable room for technical optimization and potential for further cost reduction. Additionally, small-pitch LED displays are still in a rapid development phase.

High-End LCD Displays Leading Mini LED Applications

For smartphone applications, Mini LED faces strong competition from OLED, as OLED’s cost-performance ratio has already positioned it favorably in the high-end/flagship sub-market. With the sharp increase in the number of OLED suppliers and global production capacity over the next five years, OLED costs are expected to continue to decline, and its market share will further increase, gradually dominating the market.

However, Mini LED has opportunities in various small to medium-sized high-value display fields where OLED’s weaknesses, such as cost, availability, and longevity issues (like burn-in or image retention), still need to be addressed. In high-end displays, tablets, laptops, and gaming applications, Mini LED can deliver excellent contrast, high brightness, and a lightweight form factor at a lower cost than OLED.

The automotive segment is particularly attractive, primarily due to the strong growth potential in terms of quantity and revenue, as well as Mini LED’s ability to meet various requirements desired by automotive manufacturers: very high contrast and brightness, longevity, adaptability to curves, and durability.

Regarding durability, Mini LED offers significant advantages over OLED, as it relies solely on proven technologies, LED backlighting, and LCD units, which are not substantially different from mature LCD technologies. Therefore, automotive manufacturers do not need to take risks, hoping that new technologies will meet their high requirements for longevity, environmental conditions, and operating temperatures.

In the television sector, Mini LED can help LCDs close the gap and regain market share in the high-end, large-size (65 inches and above) and high-profit segments from OLED. For panel and display manufacturers that have not invested in OLED technology, this opportunity is particularly attractive, allowing them to extend the lifespan and profitability of their LCD factories and technologies.

Direct View LED Technology

For direct view LED displays, Mini LED, when combined with chip-on-board (COB) architecture, can achieve a higher penetration rate for narrow pixel pitch LED displays across various applications, thereby expanding the market it can serve. Chip sizes will continue to shrink, potentially down to 30-50um, to further reduce costs. Applications in cinemas still hold high uncertainty, but even slight adoption would yield significant growth potential.

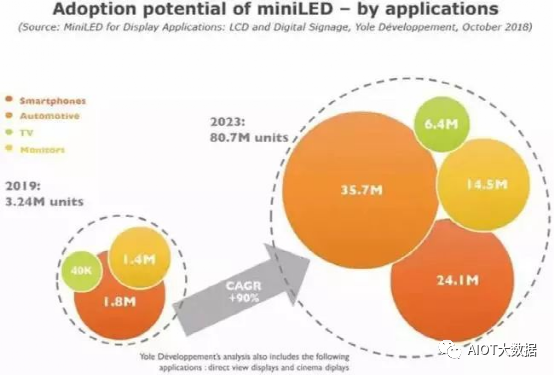

Market Size Forecast for Mini LED by Application from 2019 to 2023

Incremental Innovation and Limited Investment Amid Supply Chain Disruptions

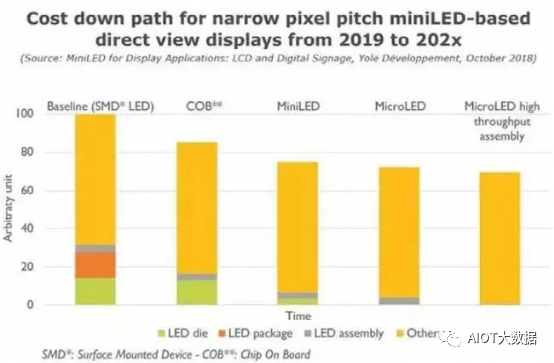

Unlike Micro LED, which requires significant investment, Mini LED can be produced by established LED chip manufacturers in existing fabs without major investments. However, it could potentially displace LED packaging factories from the LCD and large LED video wall digital signage supply chains, causing significant disruptions. For many major LED packaging manufacturers, these applications represent a large portion of their revenue.

Companies facing these issues are quickly responding by moving up the supply chain and offering complete Mini LED backlight modules (like Refond and Lextar) or developing new innovative packaging to remain competitive in the Mini LED trend. For instance, new “4-in-1” surface mount devices (SMD) packaging from companies like Harvatek or Nationstar helps LED direct view display manufacturers overcome the critical barrier of needing to update equipment and transition from SMD to direct chip bonding assembly.

Mini LED is expected to benefit chip manufacturers by expanding its available market. Some manufacturers are attempting to seize market opportunities by offering Mini LED packaging and/or BLU modules. For example, Epistar is spinning off its operations but still maintains control over its Mini LED business.

The remaining question is how quickly equipment manufacturers will develop the next generation of Mini LED dedicated assembly equipment, which will help accelerate Mini LED applications by lowering manufacturing costs. These devices must achieve higher throughput and handle chips of 100um or smaller. The first to enter the market is Kulicke & Soffa, which recently launched equipment developed in collaboration with startup Rohinni.

Efficient handling of smaller chips will enable LCD and LED direct view display manufacturers to reduce chip sizes to the lowest levels for each application, further lowering costs.

Finally, for most target segments, the performance offered by Mini LED is already close to existing technologies, such as OLED for high-end consumer displays and SMD LED for narrow pixel pitch digital signage. Therefore, cost will be the primary factor hindering or promoting Mini LED applications.

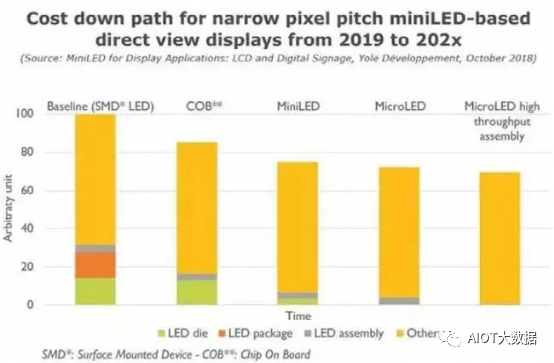

Cost Reduction Path for Narrow Pixel Pitch Mini LED Direct View Displays (2019-202x)

In summary, while Mini LED currently holds advantages over OLED in terms of cost, brightness, energy consumption, and product lifespan in backlighting, its impact on LED displays remains limited. Only when Mini LED matures and enters the market on a large scale will it create a significant impact on current display products and pose challenges.

Cost of Mini LED Backlight in the New 12.9-Inch iPad Pro: $90

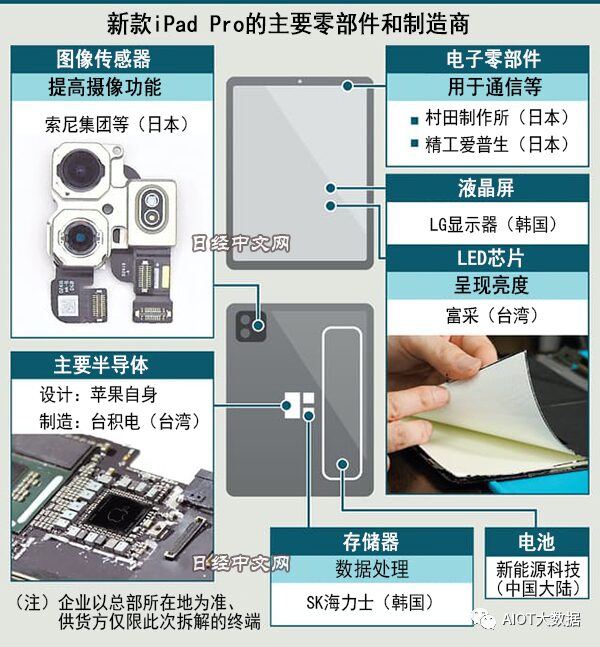

The new iPad Pro introduces two symbolic changes in technology: the adoption of miniLED for enhanced contrast in display and Apple’s self-designed semiconductor chips.

The LCD light source uses a rare design with approximately 0.3mm x 0.2mm LEDs embedded like mosaics across the screen. It features 59 vertical and 44 horizontal groups of Mini LEDs, totaling around 10,000 Mini LEDs. These LEDs enhance the contrast in brightness by turning on and off, allowing for better representation of black.

The new iPad Pro (close-up) presents black more effectively than the older model, which appears slightly blue from a distance.

Apple’s latest iPhone 12 features an OLED display. Approximately 70% of the OLEDs are supplied by Samsung Electronics, which represents a “Achilles’ heel” (fatal weakness) due to reliance on specific companies. Some believe that Mini LED may be superior to self-emitting OLED, indicating Apple’s desire to reclaim dominance in display technology.

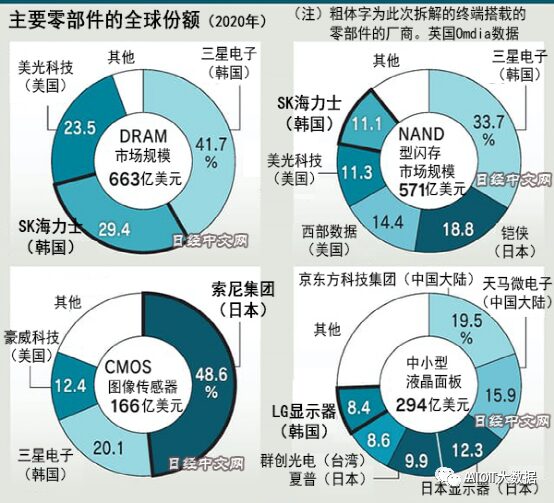

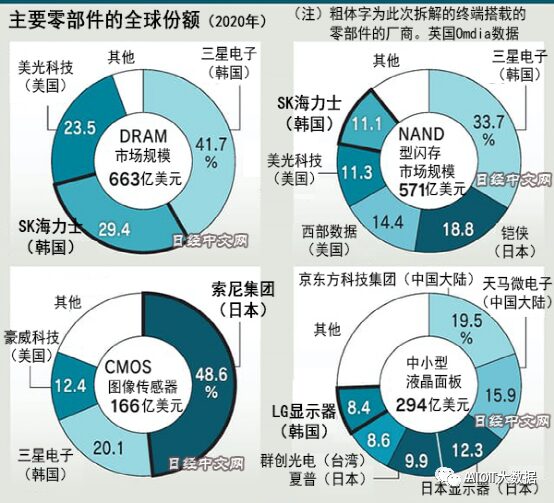

The 12.9-inch iPad Pro features the Liquid Retina XDR display (capable of rendering high dynamic range content) for the first time using miniLED technology, enabling this nearly 13-inch screen to achieve peak brightness levels of up to 1600 nits, supporting a resolution of 2732 x 2048 pixels, an adaptive refresh rate of 120Hz, and supporting the P3 wide color gamut with a contrast ratio of 1,000,000:1. The LCD panel (LCD) is supplied by LG Display, with LCD costs exceeding $100. Additionally, the DRAM and NAND flash in this iPad Pro are manufactured by SK Hynix, costing over $40.

In other words, no matter how good Micro LED is, it ultimately cannot solve immediate needs. In light of this situation, related manufacturers are certainly not sitting idle and have begun to seek a compromise. It is in this urgent context that Mini LED, viewed as a transitional technology, has been proposed. Mini LED generally refers to LED chips with sizes between 50 to 100 microns. Compared to Micro LED, Mini LED is more feasible in terms of processing, with significantly lower technical difficulty and easier mass production, allowing for rapid market entry.

Compared to current conventional applications, Mini LED has unique advantages:

(1) For backlight applications, Mini LED typically adopts a direct-lit design, utilizing a large number of densely packed chips to achieve localized dimming within smaller ranges. Compared to traditional backlight designs, it can achieve better brightness uniformity and higher color contrast within shorter mixing distances, leading to ultra-thin products with high color rendering and energy savings.

Additionally, due to its design, it can be paired with flexible substrates, allowing for curved displays similar to OLED while ensuring picture quality. On the other hand, since OLED is based on organic materials and self-emitting, Mini LED has significant reliability advantages; based on the mature LED supply chain, AIOT big data believes that the cost of backlit Mini LED is only about 60% of that of OLED of the same size, making it highly competitive in all aspects.

(2) For display applications, RGB Mini LED overcomes the wiring and reliability issues of traditional chip-on-board (COB) solutions, while combining the advantages of COB packaging, allowing for further reduction in pixel pitch and significantly enhancing the visual effect of corresponding terminal products, while also significantly reducing the viewing distance, enabling indoor displays to further replace traditional LCD markets.

On the other hand, the use of RGB Mini LED with flexible substrates can also achieve high-quality curved displays, and its self-emitting characteristics provide vast market potential for special-shaped requirements (such as automotive displays).

As seen above, Mini LED has significant advantages relative to other competitors in the current LED landscape, leading various manufacturers to conduct research. Although its chip size is similar to that of conventional small-pitch chips, there are still many differences.

Technical Characteristics and Challenges:

a. Chip Miniaturization: Since Mini LED requires pixel pitches below 1mm, the chips also need to be smaller, with current Mini LED chips generally requiring sizes below 200um. This imposes higher requirements on the photolithography and etching processes during LED chip production. Existing mature production equipment struggles to meet the production needs for chips smaller than 100um, and for small-sized chips, challenges include the flatness of the welding surface, electrode structure design, solderability, adaptability to welding parameters, and packaging tolerance. Additionally, the production process for Mini LED chips often employs a low-efficiency full test and full sorting mode, leading to inefficiencies in processing large volumes of high-density, high-precision chips, which inadvertently increases costs.

b. Red Flip Chip: Since flip chips do not require wire bonding, they meet the dense spatial requirements of Mini LED. Therefore, all current Mini LEDs utilize flip chip structures. While blue and green flip LED chip production is relatively mature, producing red flip LED chips is technically challenging due to substrate transfer requirements, and the yield and reliability during the transfer process are not high.

c. Consistency and Reliability: As display chips, Mini LED chips require high consistency and reliability. Key indicators for consistency include low current consistency, consistency under non-operating currents, high and low position consistency, color uniformity, and low capacitance consistency. Given the complex usage environment of Mini LED displays, the difficulty of maintenance is high, necessitating stringent production control to ensure product stability.

a. High-Efficiency Die Bonding and Mounting: Since Mini LED chips range from 50-200um, and the unit area usage of Mini LED chips and bulbs is massive and closely packed, higher requirements are set for the flatness of the welding surface and the precision of the circuits. The adaptability of welding parameters and packaging tolerance requirements are also stricter. Thus, achieving high efficiency and precision in die bonding for Mini LED presents a significant challenge. Traditional solder paste bonding can lead to chip misalignment and increased hole rates, failing to meet the high precision bonding requirements of Mini LED. More precise bonding substrates and equipment are urgently needed. Traditional pick-and-place machines must reduce their speed by 30-50% when placing Mini LED packaging devices below P1.0, greatly reducing manufacturing efficiency. More efficient pick-and-place machines are a major challenge facing Mini LED.

b. Thin Packaging: As backlighting, Mini LED products are ideally as thin as possible. However, when PCB thickness is below 0.4mm, issues such as virtual soldering can occur during reflow soldering and molding processes due to differing thermal expansion coefficients between the resin substrate and copper layer. Additionally, differences in thermal expansion coefficients during the molding process can lead to adhesive cracking.

c. Light Mixing Consistency: Variations in light color due to differences in chips or bulbs, or circuit issues, can lead to inconsistencies in display or backlighting effects, adversely affecting Mini LED display performance.

d. Reliability and Yield: The operating environment for Mini LED displays is relatively complex. Moisture in the air can easily seep through packaging materials or brackets, reaching the LED chip electrodes and causing short circuits. Moreover, the densely packed nature of Mini LED products significantly increases the number of packaging devices used, necessitating higher reliability in Mini LED packaging components given the high maintenance difficulty and costs.

a. Current Control and Heat Dissipation: As Mini LED pixel pitches decrease, the number of LED chips used increases, and chip sizes shrink, leading to increasingly smaller driving currents. Precise control of these currents becomes more challenging for driver ICs, necessitating new circuit designs for precise control of small currents. Furthermore, the use of numerous driver ICs and LED chips complicates rapid heat dissipation on PCBs, and excessive heat can cause color distortion in driver IC modules. Therefore, highly integrated and low-power driver ICs will be the future direction for display driver ICs.

b. Local Dimming: For Mini LED backlight applications, current static dimming technology is becoming inadequate due to high costs associated with the number of ICs needed in series, large I/O counts for driver circuits, and low refresh rates that can lead to flickering. Local dimming driver ICs can address the shortcomings of static dimming; however, implementing local dimming solutions entails several challenges, including enhancing brightness uniformity and consistency across backlight zones, increasing refresh rates, improving backlight efficiency, achieving high integration, and fine-tuning dimming resolution.

Under the premise of Mini LED thinness, the high requirements for display and backlight effects impose new challenges for the uniformity, flatness, and alignment precision of PCB backplane processing. Additionally, with numerous LED chips and driver ICs mounted on the backplane, the Tg point must exceed 220℃. The backplane must withstand various external forces during Mini LED processing to maintain its thickness uniformity and dimensional stability, necessitating high tear strength and moisture resistance.

To expand Mini LED applications, upstream and downstream manufacturers actively invest in research and development of new technologies and cost reduction. Current focus areas for Mini LED manufacturers include light output adjustment chips, COB and IMD packaging, Mini LED mass transfer, TFT circuit backplanes, and flexible substrates.

1. Light Output Adjustment Chips

When Mini LED is used as backlighting, numerous LED chips are often employed as direct-lit sources. To adjust the output of these chips for easier ultra-thin design implementation, Huacan Optoelectronics has added optimized layers to traditional backlight chips to enhance the chip’s output angle, resulting in more uniform light output and improved display effects.

Currently, COB (Chip on Board) packaging directly embeds LED bare chips onto module substrates and then encapsulates them as a whole. Compared to traditional SMD packaging, this COB packaging for full-color LED modules features fewer manufacturing processes, lower packaging costs, higher integration, and better reliability and uniformity in display effects, making it a significant future packaging form for high-density LED displays.

As the COB supply chain has yet to mature, the unit area cost of COB products is higher than that of SMD. However, as the COB display packaging supply chain gradually matures, its market share is expected to rise rapidly. In Mini LED applications, COB packaging offers higher reliability and stability and facilitates ultra-small pitch displays, aligning with Mini LED technology trends; thus, COB packaging is also one of Mini LED’s technological trends.

3. Mini LED Mass Transfer

Compared to Micro LED’s mass transfer technology, Mini LED’s larger chip size makes the transfer process relatively easier. By combining mass transfer and COB packaging technologies, Mini LED production cycles can be effectively reduced. Currently, Uniqarta’s laser transfer technology can transfer approximately 14 million 130×160 micron LED chips per hour using single or multiple laser beams.

To compete with OLED in terms of display performance, Mini LED backlight combined with LCD must achieve top-tier HDR, necessitating hundreds or even thousands of local dimming zones. However, using traditional LED backlight circuit architectures would result in excessive component usage, compromising cost and thin design. In response, Innolux proposed using active matrix TFT circuits to drive the AM Mini LED architecture.

Mini LED backlighting typically uses a direct-lit design with densely packed chips to achieve localized dimming. Its design can be paired with flexible substrates, allowing for curved displays similar to OLED while ensuring picture quality. However, due to the large number of Mini LEDs generating significant heat, developing flexible substrates with high thermal resistance will also be a future technological trend.

Market Applications and Trends for Mini LED

In terms of market applications, Mini LED is expected to cover part of the current small-pitch LED display market. From the information released by major companies regarding Mini LED, its applications can be broadly categorized into two directions: one is the LED display market, and the other is the backlight application market.

According to GGII’s forecast, the market size for Mini LED applications is expected to reach 500 million yuan in 2018. Among these, mobile phone backlighting will lead the Mini LED application, and as costs decrease, Mini LED will gradually penetrate into display and medium to large size backlighting.

For small-pitch LED displays, the clear direction is indoor commercial applications. Currently, small-pitch LED displays are continuously expanding in this field, but AIOT big data believes that as pixel pitches decrease, small-pitch LED displays face numerous challenges due to inherent issues, leading to a potential bottleneck in technical processes and cost.

In the context of a hundred billion commercial display market, if some issues with small-pitch LED displays cannot be effectively resolved, their hard-won advantages in competition with LCD, DLP, or OLED display products may gradually diminish, potentially restricting their further expansion in the commercial display market.

In this situation, whether companies launch COB small-pitch displays or Mini LED, their intention is to better address the current challenges faced by small-pitch LED displays.

The backlight application market presents a vast development opportunity for Mini LED. According to TrendForce’s estimates, as the next generation of backlight technology, the overall value of Mini LED is expected to reach 1 billion USD by 2023. Additionally, due to limited production capacity of OLED panels, Mini LED is expected to be first applied in well-known consumer electronics terminals such as Huawei, OPPO, and VIVO in 2018.

In the LED display field, we have not yet seen practical application cases for Mini LED, but some companies have indicated that Mini LED has already received orders and is currently shipping. It is expected that by the end of September, there will be Mini LED application cases emerging. Once Mini LED begins to scale up its applications, what impact will it have on LED displays?

For Mini LED, some view it as a transitional product from LED displays to Micro LED, while others hold a different opinion, believing that Mini LED is not merely a transitional technology; its lifecycle will be long. After all, the trend of decreasing pixel pitches in LED displays is quite evident. However, small-pitch LED displays are indeed facing severe challenges in technology and cost as they develop below P1.0, and the challenges and pain points of small-pitch LED displays undoubtedly provide significant development opportunities for Mini LED. Driven by the two main technological application directions of displays and backlighting, Mini LED appears to have a bright future ahead, which is also a key reason for its popularity among Taiwanese and mainland manufacturers.

Indeed, while Mini LED has great potential and a broad market outlook, we should not overly exaggerate its impact on LED displays. From the current development status, small-pitch LED displays have not yet reached an insurmountable bottleneck; there remains considerable room for technical optimization and potential for further cost reduction. Additionally, small-pitch LED displays are still in a rapid development phase.

High-End LCD Displays Leading Mini LED Applications

For smartphone applications, Mini LED faces strong competition from OLED, as OLED’s cost-performance ratio has already positioned it favorably in the high-end/flagship sub-market. With the sharp increase in the number of OLED suppliers and global production capacity over the next five years, OLED costs are expected to continue to decline, and its market share will further increase, gradually dominating the market.

However, Mini LED has opportunities in various small to medium-sized high-value display fields where OLED’s weaknesses, such as cost, availability, and longevity issues (like burn-in or image retention), still need to be addressed. In high-end displays, tablets, laptops, and gaming applications, Mini LED can deliver excellent contrast, high brightness, and a lightweight form factor at a lower cost than OLED.

The automotive segment is particularly attractive, primarily due to the strong growth potential in terms of quantity and revenue, as well as Mini LED’s ability to meet various requirements desired by automotive manufacturers: very high contrast and brightness, longevity, adaptability to curves, and durability.

Regarding durability, Mini LED offers significant advantages over OLED, as it relies solely on proven technologies, LED backlighting, and LCD units, which are not substantially different from mature LCD technologies. Therefore, automotive manufacturers do not need to take risks, hoping that new technologies will meet their high requirements for longevity, environmental conditions, and operating temperatures.

In the television sector, Mini LED can help LCDs close the gap and regain market share in the high-end, large-size (65 inches and above) and high-profit segments from OLED. For panel and display manufacturers that have not invested in OLED technology, this opportunity is particularly attractive, allowing them to extend the lifespan and profitability of their LCD factories and technologies.

Direct View LED Technology

For direct view LED displays, Mini LED, when combined with chip-on-board (COB) architecture, can achieve a higher penetration rate for narrow pixel pitch LED displays across various applications, thereby expanding the market it can serve. Chip sizes will continue to shrink, potentially down to 30-50um, to further reduce costs. Applications in cinemas still hold high uncertainty, but even slight adoption would yield significant growth potential.

Market Size Forecast for Mini LED by Application from 2019 to 2023

Incremental Innovation and Limited Investment Amid Supply Chain Disruptions

Unlike Micro LED, which requires significant investment, Mini LED can be produced by established LED chip manufacturers in existing fabs without major investments. However, it could potentially displace LED packaging factories from the LCD and large LED video wall digital signage supply chains, causing significant disruptions. For many major LED packaging manufacturers, these applications represent a large portion of their revenue.

Companies facing these issues are quickly responding by moving up the supply chain and offering complete Mini LED backlight modules (like Refond and Lextar) or developing new innovative packaging to remain competitive in the Mini LED trend. For instance, new “4-in-1” surface mount devices (SMD) packaging from companies like Harvatek or Nationstar helps LED direct view display manufacturers overcome the critical barrier of needing to update equipment and transition from SMD to direct chip bonding assembly.

Mini LED is expected to benefit chip manufacturers by expanding its available market. Some manufacturers are attempting to seize market opportunities by offering Mini LED packaging and/or BLU modules. For example, Epistar is spinning off its operations but still maintains control over its Mini LED business.

The remaining question is how quickly equipment manufacturers will develop the next generation of Mini LED dedicated assembly equipment, which will help accelerate Mini LED applications by lowering manufacturing costs. These devices must achieve higher throughput and handle chips of 100um or smaller. The first to enter the market is Kulicke & Soffa, which recently launched equipment developed in collaboration with startup Rohinni.

Efficient handling of smaller chips will enable LCD and LED direct view display manufacturers to reduce chip sizes to the lowest levels for each application, further lowering costs.

Finally, for most target segments, the performance offered by Mini LED is already close to existing technologies, such as OLED for high-end consumer displays and SMD LED for narrow pixel pitch digital signage. Therefore, cost will be the primary factor hindering or promoting Mini LED applications.

Cost Reduction Path for Narrow Pixel Pitch Mini LED Direct View Displays (2019-202x)

In summary, while Mini LED currently holds advantages over OLED in terms of cost, brightness, energy consumption, and product lifespan in backlighting, its impact on LED displays remains limited. Only when Mini LED matures and enters the market on a large scale will it create a significant impact on current display products and pose challenges.

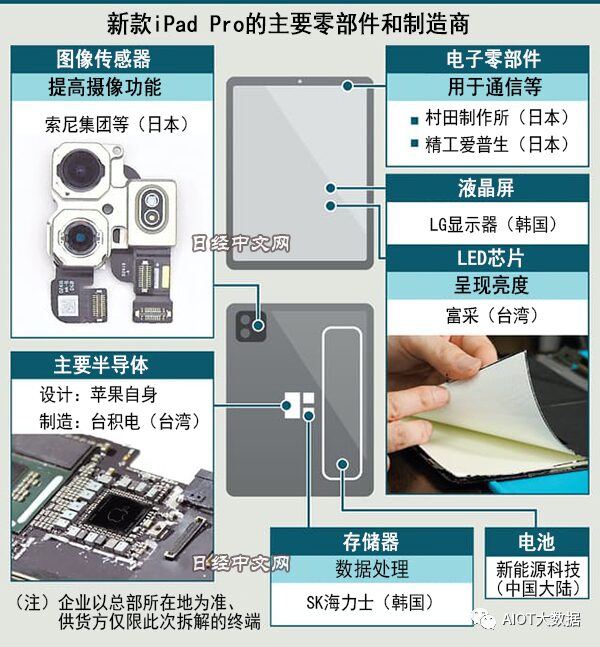

Cost of Mini LED Backlight in the New 12.9-Inch iPad Pro: $90

The new iPad Pro introduces two symbolic changes in technology: the adoption of miniLED for enhanced contrast in display and Apple’s self-designed semiconductor chips.

The LCD light source uses a rare design with approximately 0.3mm x 0.2mm LEDs embedded like mosaics across the screen. It features 59 vertical and 44 horizontal groups of Mini LEDs, totaling around 10,000 Mini LEDs. These LEDs enhance the contrast in brightness by turning on and off, allowing for better representation of black.

The new iPad Pro (close-up) presents black more effectively than the older model, which appears slightly blue from a distance.

Apple’s latest iPhone 12 features an OLED display. Approximately 70% of the OLEDs are supplied by Samsung Electronics, which represents a “Achilles’ heel” (fatal weakness) due to reliance on specific companies. Some believe that Mini LED may be superior to self-emitting OLED, indicating Apple’s desire to reclaim dominance in display technology.

The 12.9-inch iPad Pro features the Liquid Retina XDR display (capable of rendering high dynamic range content) for the first time using miniLED technology, enabling this nearly 13-inch screen to achieve peak brightness levels of up to 1600 nits, supporting a resolution of 2732 x 2048 pixels, an adaptive refresh rate of 120Hz, and supporting the P3 wide color gamut with a contrast ratio of 1,000,000:1. The LCD panel (LCD) is supplied by LG Display, with LCD costs exceeding $100. Additionally, the DRAM and NAND flash in this iPad Pro are manufactured by SK Hynix, costing over $40.

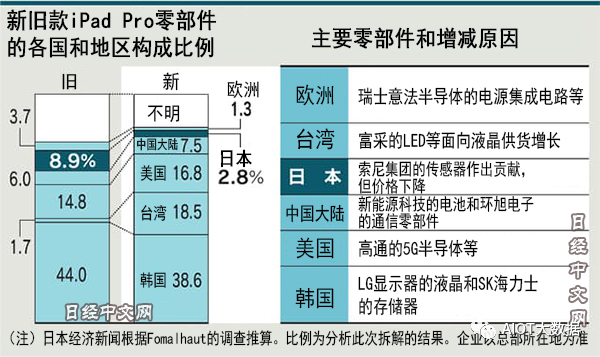

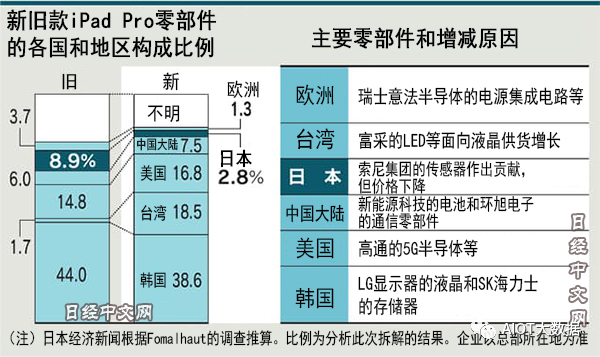

Recently, Nikkei News collaborated with research firm Fomalhaut Techno to analyze the new 12.9-inch iPad Pro, which went on sale in May. The teardown report estimates the total cost of the new iPad Pro at $510, an increase of over 30% compared to the previous generation. From the perspective of component cost share, Korean manufacturers account for the highest share at 38.6%, although this is a decrease from 44% in the previous generation; Taiwanese manufacturers’ share rose from 1.7% to 18.5%, ranking second; US components account for 16.8%, ranking third; while components from mainland China (including Hong Kong) account for 7.5%, ranking fourth. Japan, which ranked third last year, has dropped to fifth place, with its component cost share shrinking from 8.9% to 2.8%.

According to Fomalhaut Technology Solutions’ estimates, the total cost of the latest iPad Pro is $510, which is over 30% higher than the previous model.

Among these, the LCD screen of the iPad Pro uses LGD products, accounting for nearly 30% of the total cost (over $100), while the backlight using Taiwanese company Richtek’s LED chips costs about $90, accounting for nearly 20% of the new iPad Pro’s total cost, raising Taiwan’s share to 18.5%.

Due to the cost of Mini LED, the share of US components has been surpassed by Taiwanese components, dropping to third place, but the share has increased to 16.8%, a 2 percentage point increase compared to the previous model.

From mainland China, the latest iPad Pro’s wireless LAN components are supplied by Unisoc Electronics (USI), and the lithium battery is provided by ATL (Amperex Technology Limited). In the field of small to medium-sized LCD screens, BOE Technology Group holds nearly a 20% share, ranking first in the world, but the company mainly supplies to Chinese mainland companies like Huawei. Although BOE has entered Apple’s supplier list, it has not supplied to Apple’s high-end models.

From Apple’s disclosed 2020 supplier list, mainland Chinese and Hong Kong companies account for the highest number at 51 out of 200. However, many mainland companies are involved in lower-priced components such as modules (composite components) and metal processing.

This does not indicate a tendency for Apple to reduce transactions with mainland China amid US-China high-tech frictions. However, it is reported that Apple has ceased transactions with OFILM Group.

In terms of supplier selection, besides adopting the latest technology and cost considerations, geopolitical risks cannot be ignored. Securities analysts point out that “Apple seems to be actively diversifying its suppliers.”

Source: Nikkei News AIOT Big Data

Recently, Nikkei News collaborated with research firm Fomalhaut Techno to analyze the new 12.9-inch iPad Pro, which went on sale in May. The teardown report estimates the total cost of the new iPad Pro at $510, an increase of over 30% compared to the previous generation. From the perspective of component cost share, Korean manufacturers account for the highest share at 38.6%, although this is a decrease from 44% in the previous generation; Taiwanese manufacturers’ share rose from 1.7% to 18.5%, ranking second; US components account for 16.8%, ranking third; while components from mainland China (including Hong Kong) account for 7.5%, ranking fourth. Japan, which ranked third last year, has dropped to fifth place, with its component cost share shrinking from 8.9% to 2.8%.

According to Fomalhaut Technology Solutions’ estimates, the total cost of the latest iPad Pro is $510, which is over 30% higher than the previous model.

Among these, the LCD screen of the iPad Pro uses LGD products, accounting for nearly 30% of the total cost (over $100), while the backlight using Taiwanese company Richtek’s LED chips costs about $90, accounting for nearly 20% of the new iPad Pro’s total cost, raising Taiwan’s share to 18.5%.

Due to the cost of Mini LED, the share of US components has been surpassed by Taiwanese components, dropping to third place, but the share has increased to 16.8%, a 2 percentage point increase compared to the previous model.

From mainland China, the latest iPad Pro’s wireless LAN components are supplied by Unisoc Electronics (USI), and the lithium battery is provided by ATL (Amperex Technology Limited). In the field of small to medium-sized LCD screens, BOE Technology Group holds nearly a 20% share, ranking first in the world, but the company mainly supplies to Chinese mainland companies like Huawei. Although BOE has entered Apple’s supplier list, it has not supplied to Apple’s high-end models.

From Apple’s disclosed 2020 supplier list, mainland Chinese and Hong Kong companies account for the highest number at 51 out of 200. However, many mainland companies are involved in lower-priced components such as modules (composite components) and metal processing.

This does not indicate a tendency for Apple to reduce transactions with mainland China amid US-China high-tech frictions. However, it is reported that Apple has ceased transactions with OFILM Group.

In terms of supplier selection, besides adopting the latest technology and cost considerations, geopolitical risks cannot be ignored. Securities analysts point out that “Apple seems to be actively diversifying its suppliers.”

Source: Nikkei News AIOT Big Data