1. Industrial Software: The Soul of Modern Manufacturing

1.1. Definition and Classification of Industrial Software

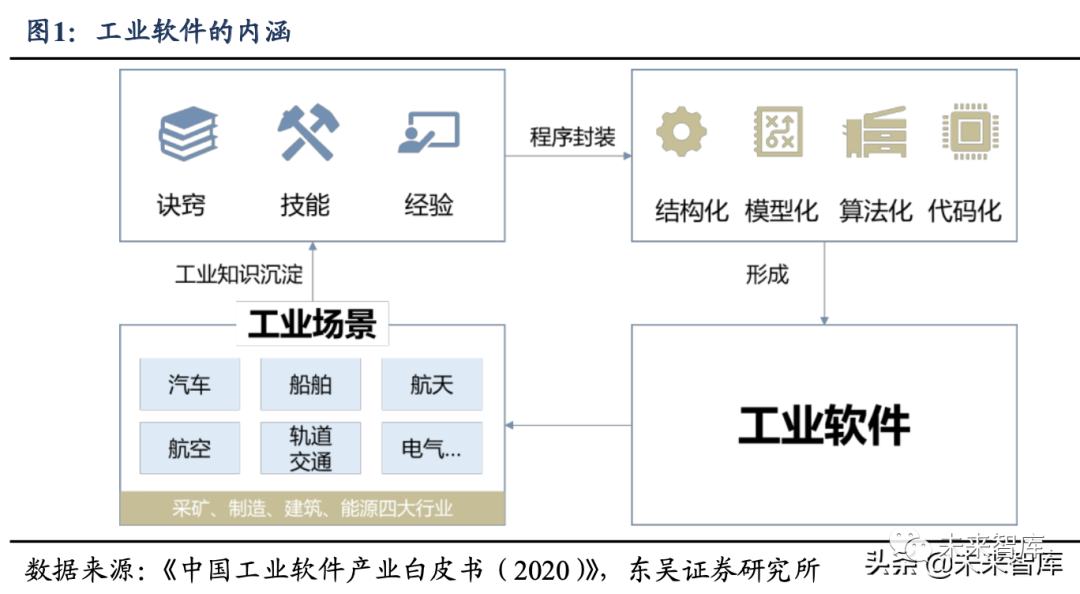

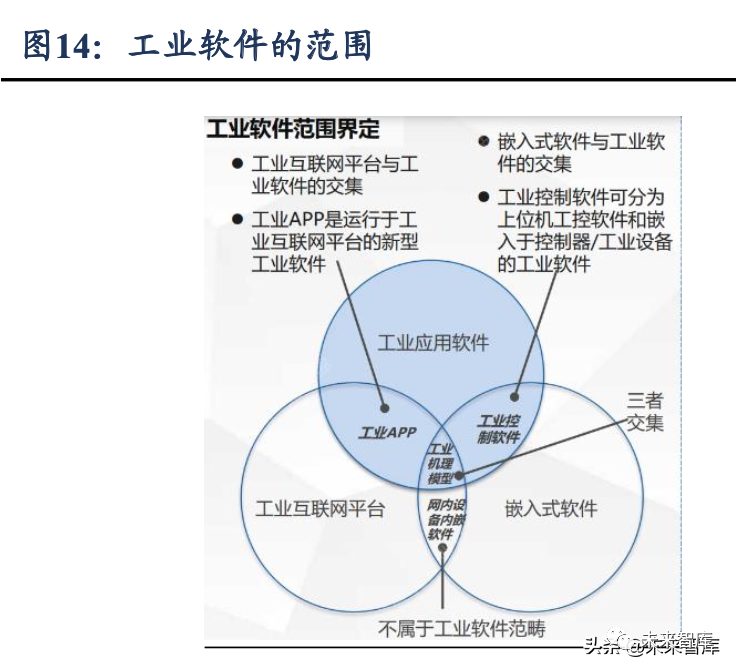

The Ministry of Industry and Information Technology defines industrial software as software specifically designed for or primarily used in the industrial sector, aimed at improving the R&D, manufacturing, production management levels, and performance of industrial equipment.

Industrial software is a programmatic encapsulation and reuse of industrial technology and knowledge, representing the pinnacle of industrialization. In practical industrial scenarios, such as automotive and ship manufacturing, expertise, skills, and experience have been encapsulated into industrial software through programmatic, algorithmic, and modeling methods. Industrial software can control production equipment, optimize manufacturing and management processes, and enhance productivity, making it the “soul” of modern industry.

1.2. Market Size of Industrial Software

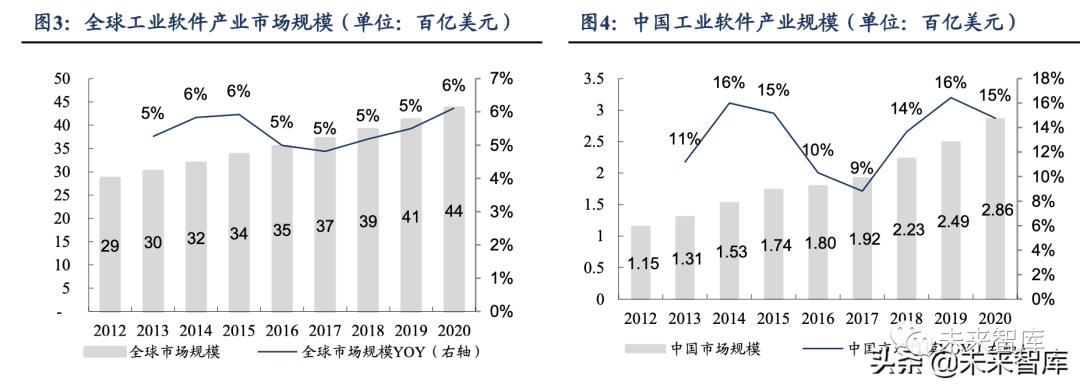

The domestic industrial software market has a small global share but significant growth potential. According to data from Zhiyan Consulting, the global industrial software market size was $435.8 billion in 2020, with a compound annual growth rate (CAGR) of 5% from 2012 to 2020. In 2020, the domestic industrial software market size was $28.6 billion, accounting for only 6% of the global market, but the domestic market experienced a CAGR of 12% from 2012 to 2020, significantly higher than the global level, indicating rapid development. According to World Bank data, China’s manufacturing value added accounted for 28.61% of the global total in 2020, maintaining its position as the world’s largest manufacturing country for ten consecutive years from 2011 to 2020. In contrast, the global share of industrial software was only 6%, suggesting vast development space ahead.

The year-on-year growth rate of the industrial software market is more stable compared to the volatility of downstream industries. Although industrial software is closely linked to industry, its market growth rate is less volatile than that of downstream industries, making it more stable. We believe this is primarily due to the relatively flexible demand of industrial enterprises for software compared to industrial production equipment; on the other hand, the penetration rate and value of industrial software are still rapidly increasing.

1.3. Competitive Factors in Industrial Software: R&D, Ecosystem, Mergers and Acquisitions

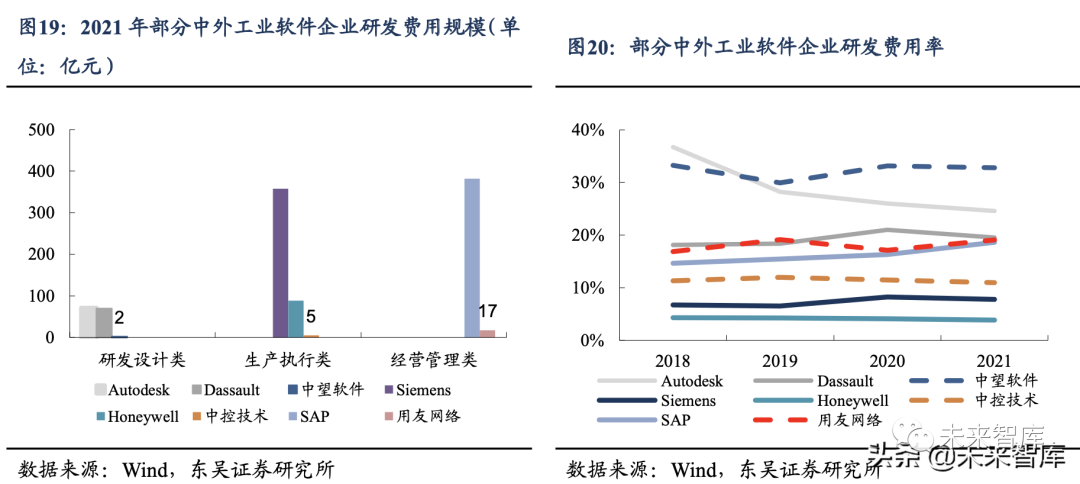

Industrial software requires continuous high investment in R&D. As industrial technology evolves, industrial software must continuously iterate and update to meet the latest industrial demands. In 2021, leading global industrial software companies had R&D expense ratios exceeding 10%, with some exceeding 35%. For example, in the EDA industry, the evolution of Moore’s Law drives continuous upgrades in manufacturing processes, from microns to nanometers, and now to 2nm, which raises the requirements for EDA design software. EDA companies must continuously invest in R&D to keep pace with advanced process chip design requirements. Global EDA giants Synopsys and CAD leader Autodesk have maintained R&D expense ratios above 20% for ten consecutive years from 2011 to 2021. To establish and maintain competitive barriers in the industrial software field, it is crucial to stay aligned with industrial needs and continuously invest in R&D.

Customer empowerment: Ecosystem collaboration continuously refines industrial software products, enhancing product competitiveness. The vitality of industrial software lies in its integration with actual industry, requiring users to continuously propose improvement needs during application and deeply interact with industrial software developers for ongoing iteration and improvement. Almost every excellent industrial software has a manufacturing giant running alongside it, such as Dassault’s CATIA 3D design software growing alongside Dassault Aviation, ultimately becoming the global standard for aircraft manufacturing design. Every year at Dassault’s SolidWorks global user conference, after announcing new software versions, executives collect and filter user demands raised on-site to determine which requests will be improved and released in the next version.

Empowering customers: Customer needs are diverse, personalized, and open. Building an open ecosystem can achieve significant customer acquisition effects. Openness is a crucial method for ecosystem construction; only by addressing the system’s openness issues and providing good secondary development tools can software companies avoid consuming large amounts of their development resources while attracting numerous third-party developers to meet customer personalized needs through secondary development, thus acquiring more customers. AutoCAD provides the AutoLisp language for secondary development of the software and later supported High C and C++ for secondary development, making the convenient secondary development environment a de facto standard in the 2D CAD field.

Mergers and acquisitions help industrial software companies quickly enhance their strength and capture markets. 1) There are numerous sub-sectors in the industrial field, giving rise to various industrial software, with small segmented markets; 2) Industry is gradually moving towards interconnectivity and intelligence, with different industrial links gradually integrated, leading to the consolidation of corresponding industrial software, such as the integration of CAD, CAE, and CAM; 3) Industrial software is the accumulation of years of industrial knowledge, with high technical barriers and high self-research costs, making acquisition more feasible than self-development. These three factors together make mergers and acquisitions a common method for growth in the industrial software industry. For instance, Moldflow is a leading company in injection molding simulation, and Delcam is a CAD/CAM software company widely used in mold processing, both of which have undergone numerous acquisitions and were ultimately acquired by Autodesk, completing Autodesk’s product chain.

The final competitive landscape of the industrial software industry: Oligopoly. When emerging industrial software appears, the market may be relatively fragmented due to unstable technology, but as technology develops, ecosystems form, and mergers and acquisitions intensify, it will eventually evolve into an oligopoly. From a global market perspective, the industrial software market in various segments and fields is ultimately divided among a few giants.

1.4. Future Development Directions of Industrial Software

Underlying Data Platforms: Integration, Open Source, and Standardization. Integration refers to achieving interoperability among various software. In R&D design software, manufacturers are gradually realizing CAX integrated software and platforms, attempting to create an all-in-one platform for the entire product R&D process, achieving interoperability from 2D CAD and 3D CAD to CAE and CAM. Some industrial software is moving towards open-source platforms. Manufacturers are gathering and connecting numerous industry chain partners through development platforms, helping enterprises reduce the cost of providing customized services to customers through secondary development. Software integration requires standardization. Currently, various standards have been established, such as interface standards CGI and file standards CGM. To achieve software integration, data conversion is necessary, and current data conversion has certain errors, which can lead to significant workloads in later modifications due to design errors. PLM can better achieve product life analysis through standardized data and files.

Service Provision: Cloud-based and Service-oriented. Cloud computing can enable collaborative development across society, freeing up manufacturers’ hardware resource space and reducing maintenance costs. PTC’s cloud-based CAD application Onshape allows design work to be conducted through browsers on computers, phones, and tablets. Industrial software provides personalized custom services to customers through the industrial internet. Manufacturers are no longer limited to simply selling software products but also include development engineering services, industrial data analysis, and abstract mechanism models.

Technological Innovation: Automation and Intelligence. The development of cloud computing, the Internet of Things, and AI has ushered in the Fourth Industrial Revolution, accelerating the release of digital and intelligent product demands in the industrial field. Cloud computing and the Internet of Things help enterprises collect data, while AI assists in data analysis, ultimately achieving intelligent manufacturing. In the R&D design field, this is reflected in parameter selection, forming intelligent CAD systems, and reducing the proportion of manual labor; in the production manufacturing field, it is reflected in intelligent control of production, reducing the proportion of manual intervention, and achieving automated production to minimize uncertainties caused by human intervention. In management, intelligent ERP helps enterprises achieve interconnectivity across the supply chain, enabling intelligent decision-making and taking production or other actions.

2. The Importance of Industrial Software: Why Develop Industrial Software?

Industrial software originates from industry, is used in industry, and optimizes industry, inherently carrying industrial genes. Therefore, the importance of industrial software is reflected in all aspects of industrial production, and it is also an indispensable part of China’s intelligent manufacturing journey.

2.1. The Localization of Industrial Software is Crucial for Industrial Security

Industry is the lifeblood of the national economy. According to data from the National Bureau of Statistics, from 2015 to 2021, the industrial sector consistently accounted for over 30% of China’s GDP, making it the country’s largest pillar industry. The healthy operation of industry is not only related to the stable development of the national economy but also to the safety of people’s livelihoods.

“Dare not use”: Industrial software is a core component of modern industry, and its safety determines whether industry can operate normally. Modern industry is inseparable from informatization; all equipment and systems are based on industrial software. If industrial software encounters problems, the industry may face paralysis. Every year, many industrial accidents caused by industrial software security issues occur globally. In September 2010, the Iranian government announced that approximately 30,000 network terminals were infected with “Stuxnet,” a virus targeting nuclear facilities, specifically attacking industrial control systems.

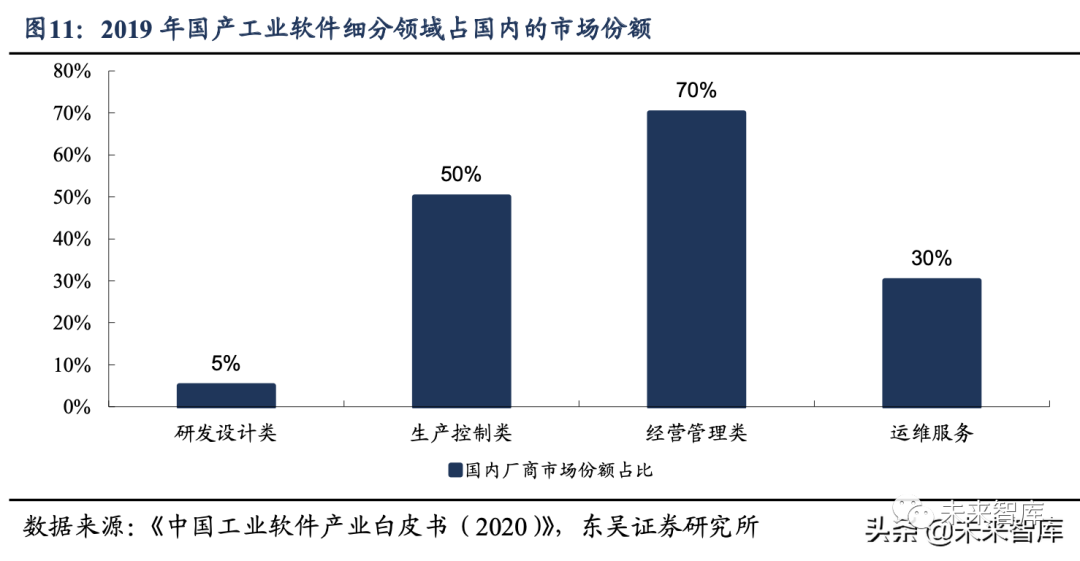

China’s industrial software largely relies on overseas products, posing security risks. According to the “White Paper on China’s Industrial Software Industry (2020),” in 2019, the localization rate of R&D design industrial software in China was only 5%, while that for production control was 50%, and for management was 70%. In high-end industrial markets, the localization rate is even lower. A large number of industrial enterprises use overseas industrial software products, and if security issues arise, it could cause significant losses to the national economy and people’s livelihoods.

“Cannot use”: Some Chinese industrial software has already been sanctioned by the West, and the Russia-Ukraine conflict tells us that industrial software must be localized. On May 16, 2019, the U.S. Department of Commerce announced that Huawei and 70 related companies were placed on the so-called “entity list,” prohibiting EDA software companies from providing services to Huawei. After the onset of the Russia-Ukraine conflict, Western giants such as Oracle, SAP, Siemens, and ABB announced the suspension of their operations in Russia, meaning that industrial enterprises using these industrial software may face paralysis. The comprehensive sanctions imposed by the West on Russia indicate that any link that cannot guarantee autonomy and control will become a target for attack. For China, all aspects of industrial software, whether in R&D design, production manufacturing, or management, need to have autonomous and controllable backup preparations to ensure the healthy operation of industry, national security, and people’s happiness.

2.2. Industrial Software is Key to Seizing the High Ground of the Fourth Industrial Revolution

Industrial software helps enterprises reduce costs and increase efficiency. Cost reduction: Taking R&D design software as an example, the cost during the product design phase accounts for only 5% of the total product development investment, but product design determines 75% of the product cost. Additionally, the cost of fixing defects during the demand collection phase, design phase, production phase, and after the product is put into use increases incrementally. Therefore, fixing product defects during the design phase has a significant cost leverage effect on the final quality of the product. Improving production efficiency and increasing output: Currently, industrial product structures are complex, and industrial software can help enterprises improve production efficiency. For example, in aircraft development, the use of the new technology “digital prototype” has shortened the design cycle from the conventional 2.5 years to 1 year, reducing design rework by 40%. MES systems can promote less human-intensive production, improving efficiency and increasing capacity without changing the existing number of personnel and production area. As noted in the “White Paper on China’s Industrial Software Industry (2020),” a company leveraging Dassault’s Apriso platform, combined with lean improvements in the factory, achieved a 25% increase in production efficiency and a 20% reduction in work-in-progress.

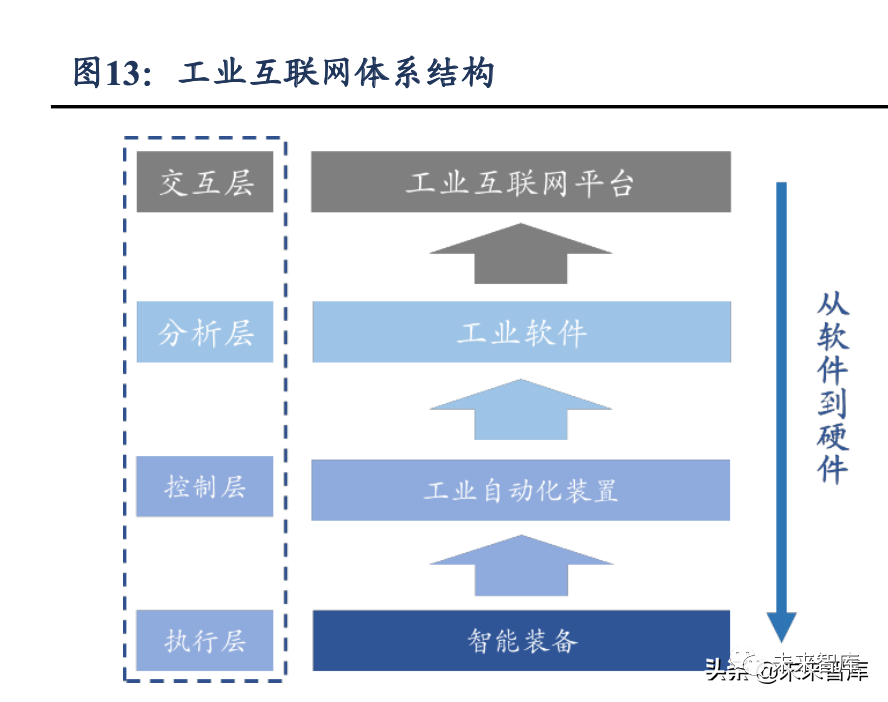

The industrial internet is an important means to achieve the Fourth Industrial Revolution. The Fourth Industrial Revolution aims to achieve intelligent manufacturing, and the industrial internet is a crucial means to realize intelligent manufacturing. Intelligent manufacturing includes three main stages: intelligent design, simulation and verification, intelligent procurement, production and delivery, and intelligent operation, maintenance, and recycling. The industrial internet connects people, machines, materials, and systems through an open industrial-grade network platform, enabling efficient sharing of various information in the industrial economy, thus achieving intelligent development of industry and even the entire industry.

Industrial software is a core component of the industrial internet. In the production process of the industrial internet system, automated devices control intelligent equipment to perform specific operations, then feedback relevant data to industrial software, which analyzes and issues commands to direct the execution layer. Industrial software and intelligent equipment connect to the industrial internet platform, enabling information exchange within and outside the factory. Therefore, industrial software is the hub and core component of the industrial internet; whoever possesses the most advanced industrial software occupies the high ground of the Fourth Industrial Revolution.

3. Current Status of Industrial Software in China

3.1. Comprehensive but Weak, Catching Up

China’s industrial software is generally characterized by a wide range of product categories but relatively backward technology. In the field of R&D design software, domestic industrial software has the lowest market share, although some self-developed software companies, such as ZWSOFT and Huada Jiutian, have emerged, they mainly serve industries with simple industrial mechanisms, single system functions, and low industry complexity, including molds, furniture and home appliances, general machinery, and simulation chips. In the field of production manufacturing software, some companies like Baoxin Software, Holley Technology, and Zhongkong Technology have certain strengths, but they do not dominate the high-end market. In the field of management software, domestic manufacturers mainly occupy the mid-to-low-end market, including Yonyou Network, Kingdee International, and Inspur International, but in the high-end market (especially among multinational companies), they are largely dominated by SAP and Oracle. In the field of operation and maintenance service software, domestic software mainly focuses on simple capabilities such as data collection and monitoring, lacking mature engineering applications and data and experience accumulation, with domestic companies like Rongzhi Rixin and Bohua Xinzhi.

Awareness: Heavy on Hardware, Light on Software.

On one hand, enterprises are reluctant to spend money on software. According to Gartner data, from 2019 to 2020, software spending accounted for about 12% of global IT spending, with total scales of $458.1 billion and $465 billion, while China’s software spending during the same period was less than 4%, with scales of only 100.8 billion and 109.9 billion yuan, far below the global average. Enterprises are more willing to spend on hardware equipment. On the other hand, China’s manufacturing industry is primarily based on low-value-added assembly production, leading to a higher demand for hardware such as automated production and relatively less demand for R&D production software, deepening the phenomenon of being heavy on hardware and light on software.

R&D: Low R&D Investment, Lack of Talent, Insufficient Industrial Knowledge Accumulation.

1) Low R&D Investment. Most of China’s industrial software companies are secondary agents or commercialized enterprises from universities, while foreign companies are specialized R&D enterprises or hardware automation companies. For example, among CAD software companies, ZWSOFT has a higher R&D expense ratio in 2021, but Autodesk’s absolute R&D expenses are 35 times that of ZWSOFT. 2) Lack of Composite Talent. Industrial software is a combination of industrial knowledge, practical experience, and other disciplines such as mathematics, computer science, and physics. Currently, composite engineers with industry experience and software coding capabilities are very scarce in China. 3) Insufficient Industrial Knowledge Accumulation. China’s industrialization process started late, while other developed countries completed their industrialization process earlier and accumulated vast amounts of industrial knowledge. The industrial software that developed concurrently also achieved synchronous iteration and updates. However, China lacks such a foundation, and the pace of industrial informatization construction is relatively slow, with a small volume and scale of industrial data, making it difficult to support software development.

Product Aspect: High Replacement Difficulty.Overseas industrial software has developed alongside the industrial system, occupying a large share of the global market, and the industrial knowledge embedded in it is more aligned with actual industrial production. Therefore, overseas software often leads domestic products in usability and advancement. 95% of R&D design software in China relies on imports, and domestic industrial enterprises tend to prefer overseas products, exhibiting strong customer stickiness and are unlikely to easily switch software, making it a long road to capture market share.

Ecological Aspect: A Good Ecosystem Has Yet to Form.1) The number of top manufacturing enterprises in China is fewer than overseas, failing to provide sufficient feedback for the iteration of industrial software products; 2) The ecosystem construction of China’s industrial software companies has just begun, compared to overseas companies that have already formed prosperous community ecosystems, the domestic industrial software ecosystem is relatively lacking and needs to gradually strengthen the development of the developer ecosystem.

3.2. Dual Support from Policies and Capital Markets

On the policy front, the government has issued a series of policies to strongly support the development of industrial software. Industrial digitalization is an important goal of the “14th Five-Year Plan for Digital Economy Development.” During the 14th Five-Year Plan period, the development of the digital economy and the integration of informatization and industrialization face new challenges and opportunities, with “intelligent manufacturing” being an important direction and breakthrough point, and industrial software being a key development area.

On the capital market side, the number of listed industrial software companies has gradually increased since 2020, with companies like Zhongkong Technology, ZWSOFT, and Gaolun Electronics successively entering the capital market, while companies like Haochen Software, Huada Jiutian, Sierxin, and Guangliwei are in the IPO process. In the primary market, companies like Xinhua Zhang and Huatian Software have also received financing. According to data from EEO Intelligence, from January to September 2021, the industrial software industry had 26 financing rounds, nearly double the number of financing rounds in 2020.

3.3. The Best Time for Investment in Industrial Software

Large Market Space: Domestic Replacement Combined with Industrial Transformation. On one hand, the development of China’s industrial software is still in its early stages, with significant room for improvement in localization rates across various segments. On the other hand, China’s industry is undergoing an upgrade and transformation, with intelligent manufacturing being the main direction of transformation, and the demand for industrial software is expected to increase significantly. The combination of these two factors indicates that China’s industrial software is just beginning to take off.

High Track Prosperity: Policy Support and Capital Attention. From 2021 to the first quarter of 2022, the state has frequently issued support policies for industrial software. We expect that the state will likely introduce more targeted policies for different sub-sectors of industrial software in the future, including mandatory use of domestically produced software.

High Investment Certainty: Current Small Companies are the Future Industry Oligopolies. Industrial software has both industrial and software attributes, thus the global mature industrial software market is characterized by oligopoly, which is very stable. Without strong external intervention, it is difficult to shake this structure. Based on this, the industrial software companies we invest in now are likely to become industry oligopolies in the future, obtaining stable returns for a long time.

4. Key Segments of Industrial Software

4.1. R&D Design: A Long Way to Go

4.1.1. CAX: The Foundation of Modern Design and Production

CAX is a comprehensive term for computer-aided technologies such as CAD, CAE, and CAM.

CAD:

CAD (Computer Aided Design) refers to software that uses computers and graphic devices to assist designers in virtual design. When the R&D department receives an order, it conducts demand analysis (GA) and requirement engineering (GE), using CAD software for geometric modeling design, such as 2D drawing, detailed drawing, design documentation, and basic 3D design. CAD/CAM is one of the three pillars of modern industrial control (PLC, robotics, and CAD/CAM).

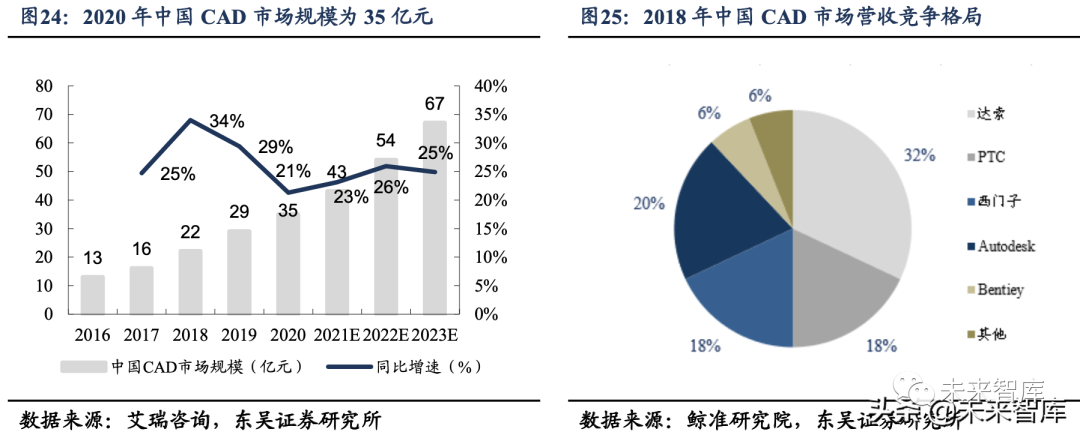

The revenue growth rate of China’s CAD market is far higher than the global rate, with overseas giants monopolizing the Chinese market. According to data from iResearch, the revenue scale of China’s CAD market was 3.5 billion yuan in 2020, with a year-on-year growth of 21%, far exceeding the global growth rate of 6.4% during the same period. According to data from Whale Index Research Institute, in 2018, the Chinese CAD market was mainly monopolized by overseas giants, with Dassault, PTC, Siemens, and Autodesk accounting for nearly 90% of the revenue share.

Domestic manufacturers of 2D CAD products have begun to show their capabilities, while the 3D CAD market urgently needs breakthroughs. Domestic CAD manufacturers’ 2D products can already meet most customer needs, while 3D products are still under development and can only meet some low-end demands, with ongoing efforts to tackle high-end application scenarios. According to data from Whale Index Research Institute, in 2018, ZWSOFT, Suzhou Haochen, and Digital Dafa accounted for nearly 20% of the revenue share in China’s 2D CAD market, with ZWSOFT accounting for nearly 11%, making it the leader in domestic 2D CAD.

From the perspective of product capabilities, global CAD industrial software developers can be divided into two camps. The first camp includes international companies such as Dassault, Autodesk, and Siemens, whose products have superior performance and comprehensive functions. Autodesk’s 2D CAD products have the highest revenue market share, while Dassault and Siemens’ 3D CAD products are globally leading in performance. The second camp consists of domestic manufacturers that master key software development technologies but have lower brand recognition, expanding market share through targeted development and price advantages.

The technical core of CAD is the geometric kernel. The geometric kernel is the technology that expresses geometric objects in computer language and processes them, providing various underlying mechanisms such as constraint modeling, parametric modeling, and driven modeling, facilitating the development of upper-layer CAD applications. The content involved in the geometric kernel is rich, with high requirements for stability and reliability, requiring practical application iteration and long-term technical accumulation.

Only a few domestic CAD products have independent kernels. ZWSOFT and Huatian Software have independent kernels, with ZWSOFT’s Overdrive kernel originally being the kernel of the American VX CAD, acquired by ZWSOFT in 2010; Huatian’s CRUX IV is derived from the source code of CADmeister software from Japan’s UEL company. Other companies mostly use kernels licensed from foreign companies.

CAE:

CAE (Computer Aided Engineering) is software used to solve optimal structures and performance of products. After the R&D department obtains the initial geometric model using CAD software, CAE software is used to optimize the model’s performance from a physical perspective, including static structural analysis, dynamic analysis, and electromagnetic analysis.

The core of CAE is numerical analysis solving methods, such as the widely used finite element method. By adopting these numerical analysis methods, the structure is discretized, meaning that the actual structure is broken down into a finite number of regular unit combinations, and the physical performance of the actual structure can be analyzed through the discrete body to obtain approximate results that meet engineering accuracy, thus solving many complex problems that theoretical analysis cannot address.

The domestic CAE market size only accounts for 9% of the global market. In 2018, the global CAE software market size was $6.575 billion, with the domestic market size approximately $600 million, accounting for 9%. The twelve leading companies in the global CAE market (such as ANSYS, MathWorks, Siemens, Dassault Systems, and ESI Group) monopolize the global market, occupying 95% of the international market.

Domestic CAE products started late and still need time to catch up with industry leaders. Foreign CAE products are strong in generality, stability, and reliability, gradually achieving integrated software for CAD/CAE/CAM. China’s domestic CAE software started relatively late, mainly serving specific industry clients in non-high-end fields, providing low-cost but highly specialized products to gain market share. Due to the gap in core technologies, the degree of autonomy and control over key CAE technologies in domestic products is low. According to data from the China Business Industry Research Institute, in 2020, the revenue market localization rate of China’s CAE was less than 5%, and there are still significant gaps in productization and integration compared to foreign software, making it a long road to catch up with industry leaders.

CAM:

CAM (Computer Aided Manufacturing) is software that encodes and controls the processing of products and the CNC machining process, linking the product design and production manufacturing stages. CAM mainly includes two types of software: Computer Aided Process Planning (CAPP) and Numerical Control Programming (NCP). CAPP automatically outputs model information from CAD into process documents such as process routes and content, while NCP encodes for subsequent CNC machine production.

According to data from the China Research Institute, in 2019, the market size of China’s CAM software was 24.52 billion yuan.

The core of CAM is computer numerical control (CNC). CAM uses CNC machines to control tool movement digitally, completing part processing. This process requires geometric kernel support for complex two-dimensional areas and three-dimensional free surfaces, providing CAM trajectory planning algorithms for various CAD/CAM systems, dedicated CNC programming systems, and robot offline programming and simulation systems, such as the constant cutting force trajectory planning algorithm for complex two-dimensional areas. Currently, South China University of Technology has developed an independently controllable “IntelliCAM – Computer Aided Manufacturing (CAM) core algorithm library.”

The competitive landscape of the CAM market is similar to that of CAD and CAE, with overseas giants monopolizing the market and domestic shares being low. CAM software is generally bundled with CAD sales, and global 3D CAD software giants all have their own CAM products, with the Chinese CAM market mainly dominated by international giants.

There are already various CAM software on the market. CAM mainly exists in three forms: built into CAD software, standalone software, and plugin type. Built-in types include CATIA and Fusion360, which have high modification efficiency and a high correlation between CAD and tool paths. Standalone types, such as BobCAD-CAM, are comprehensive in functionality. Plugin types can import drawings from many third-party software solutions, offering significant convenience, such as CAMWorks.

4.1.2. EDA: The “Industrial Mother Machine” of Chip Design

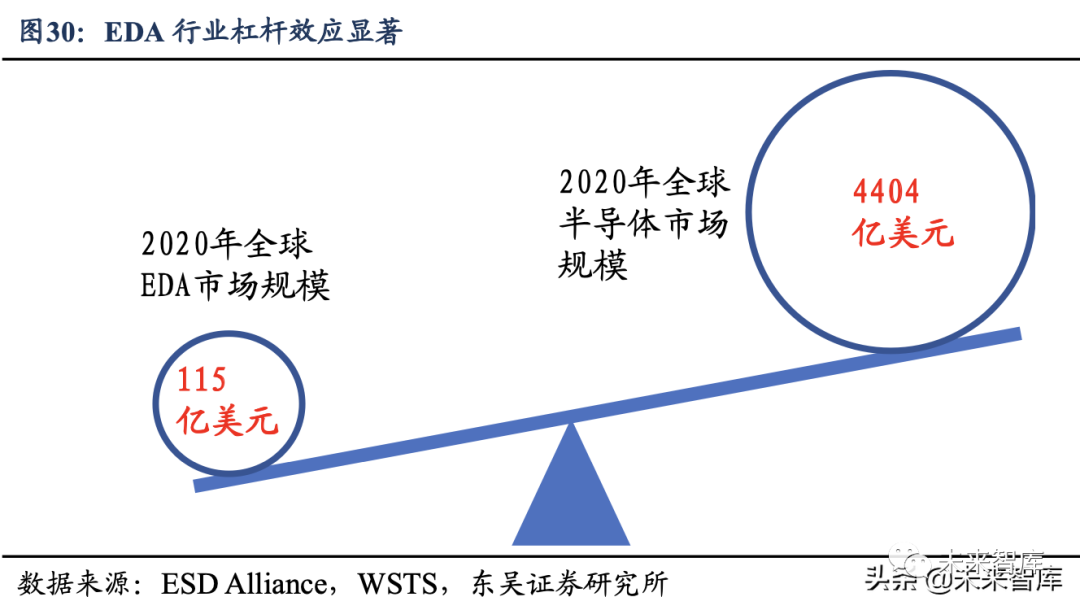

EDA is industrial software used to assist in the design and production of large-scale integrated circuits. EDA stands for Electronic Design Automation, referring to computer software used to assist in completing the entire process of designing, manufacturing, packaging, and testing large-scale integrated circuit chips. As the complexity of chip design continues to increase, integrated circuits based on advanced process nodes can reach billions of semiconductor devices, making it impossible to complete chip design without EDA. EDA has become a key driver for improving design efficiency and accelerating technological progress, becoming increasingly integrated with the industry chain.

EDA has significant leverage and economic effects. According to data from the ESD Alliance and WSTS, the global EDA market size was only $11.5 billion in 2020, yet it drives a semiconductor industry market size of $440.4 billion. If issues arise in the EDA industry, the entire integrated circuit industry will be significantly impacted, and the EDA industry is also one of the key areas most easily “choked” by foreign entities. Furthermore, EDA plays a crucial role in saving chip design costs. According to Professor Andrew Kahng from the University of California, San Diego, in 2013, the cost of designing a consumer-grade application processor chip in 2011 was about $40 million. Without considering the advancements in EDA technology from 1993 to 2009, the related design costs could have reached $7.7 billion, with EDA technology advancements improving design efficiency by nearly 200 times.

Compared to the international market, China’s EDA market is growing faster. According to data from CCID Consulting, in 2018, China’s EDA market total sales were 4.49 billion yuan, and by 2020, the sales had reached 6.62 billion yuan, with a two-year compound growth rate of 21.42%, far exceeding the global market revenue growth rate of 9% from 2018 to 2020.

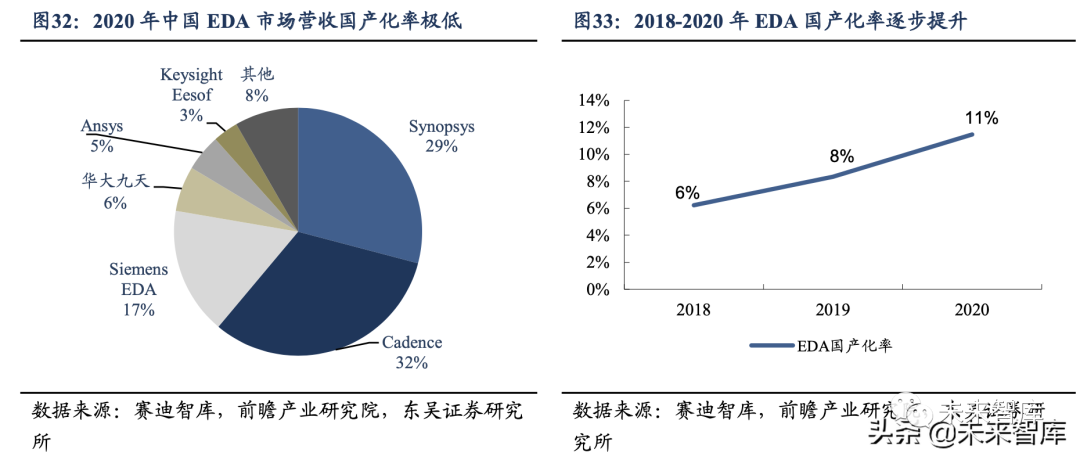

China’s EDA market has an extremely low localization rate, with three major giants still monopolizing it. Although the revenue growth rate of China’s EDA market is much higher than the global growth rate, due to the late start of Chinese EDA manufacturers, they are at a disadvantage in product performance and ecosystem collaboration, with most domestic market shares occupied by foreign manufacturers. According to data from CCID Consulting and Qianzhan Industry Research Institute, in 2020, the combined revenue market share of the three major international EDA giants, Synopsys, Cadence, and Siemens EDA, accounted for 78% of China’s market, while domestic manufacturers accounted for less than 15%, indicating a very low localization rate and vast potential for domestic replacement.

Talent is the core of EDA development. EDA software involves knowledge in semiconductors, mathematics, and chip design, requiring composite talents who master these three areas. According to Mr. Chen Zhichang, Vice President of Synopsys China, cultivating an EDA talent is not easy; it often takes ten years from university research projects to practical employment. According to data disclosed at the 23rd China Integrated Circuit Manufacturing Annual Conference, there are only about 40,000 people working in the global EDA industry, making the EDA talent cultivation system extremely important.

For example, Synopsys emphasizes talent cultivation, with its talent cultivation strategy including Synopsys University course systems, Synopsys University programs, and active participation in national talent strategies. Synopsys has developed a complete set of tutorials for integrated circuit design, including 131 undergraduate and graduate courses, 24 training courses, and 37 lectures and experiments, suitable for university undergraduates and master’s students in integrated circuit-related majors. In terms of EDA talent cultivation results, in just one year from 2019 to 2020, 30,000 people participated in Synopsys’s talent programs, and 20 domestic universities established cooperative relationships with Synopsys for talent cultivation.

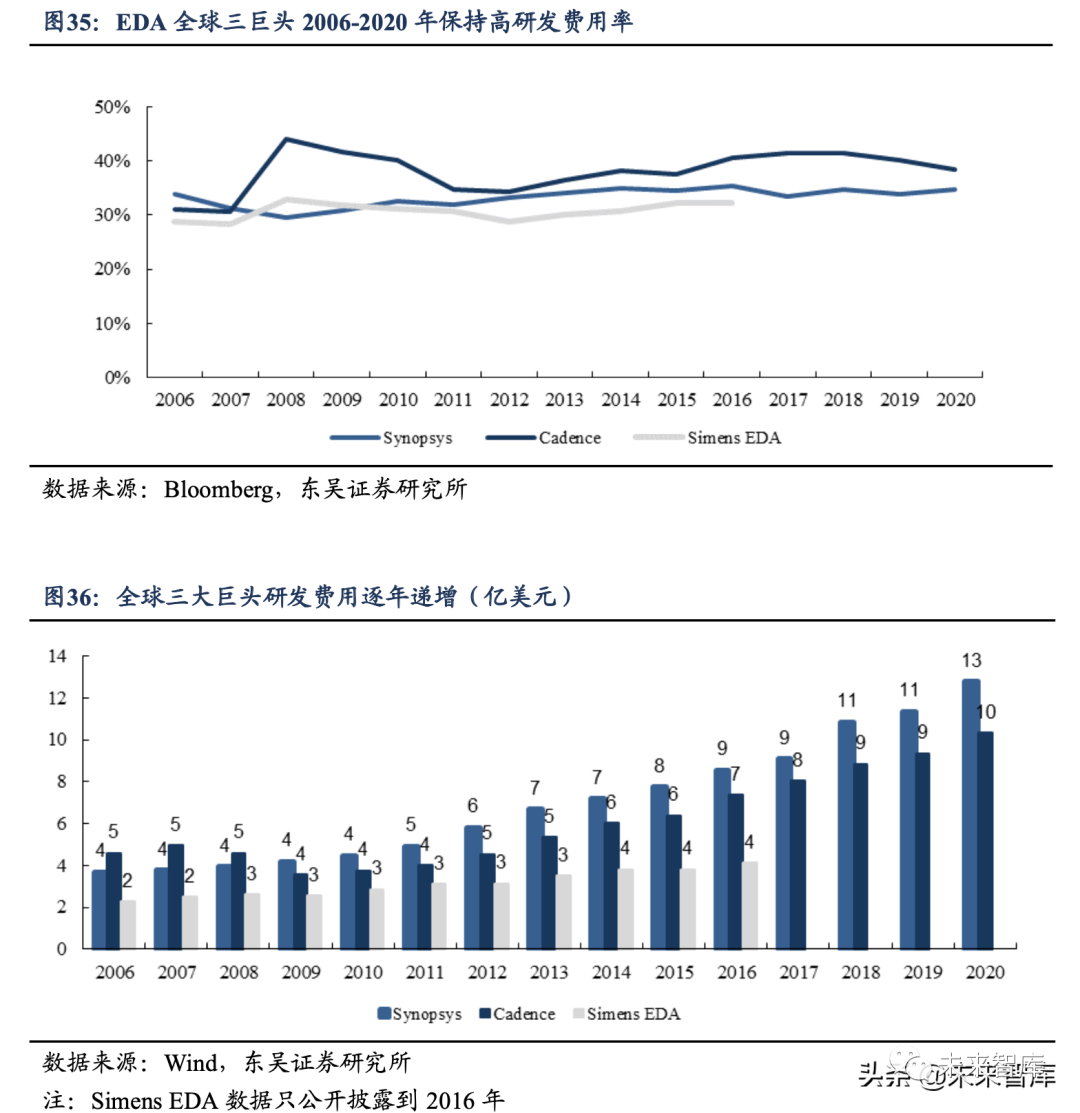

Continuous R&D is the driving force behind EDA development. EDA software is a large industrial software system that is algorithm-intensive, requiring knowledge from various fields such as computer science, physics, and mathematics. As the speed of chip design iterations accelerates, EDA software companies need to continuously increase R&D investment to ensure their technology remains leading. At the same time, EDA giants maintain their leading positions through a large number of intellectual property rights. The oligopoly structure dominated by the three giants has been relatively stable since 2000, with their annual revenue compound growth rates approaching 10% from 2010 to 2020, while still maintaining R&D expense ratios of 30%-40%, with some years exceeding 40%. In 2020, Synopsys and Cadence’s R&D expenses reached $1.3 billion and $1 billion, respectively, nearly double the sales scale of China’s EDA market in 2020.

Industry chain collaboration is the guarantee for EDA development. The advanced processes of chip design are the results of collaboration among wafer fabs, design companies, and EDA software vendors. Wafer fabs seek process breakthroughs from materials, chemistry, and manufacturing steps; EDA companies improve EDA software using test data and process detail documents from wafer fabs; chip design companies use new EDA models for design and trial production, providing feedback to wafer fabs and EDA companies to improve manufacturing processes and software models. Wafer fabs, EDA software companies, and design companies complement each other, collaborating to advance technological progress.

4.1.3. PLM: Integrated Product Management

PLM (Product Lifecycle Management) can be seen as the integration of CAD, CAE, CAM, and PDM (Product Data Management). It helps expanding enterprises integrate data, processes, business systems, and personnel information to manage information throughout the entire product lifecycle (from conception, design, manufacturing to maintenance) in an economical and efficient manner. PLM is used to convey information between management software like ERP and products, such as bill of materials (BOM) information, product design information, and customer improvement requests, serving as a bridge.

The core of PLM is PDM (Product Data Management). PDM is the technology that manages all information related to products (such as part information, configurations, documents, CAD files, etc.) and related processes (such as process definition and management). In the 1980s, PLM was first used for document management, including electronic drawings, and software was used to realize electronic image browsing and modification. After the 1990s, the emergence of multinational enterprises promoted real-time collaboration among employees in different regions using specialized PDM. Now, PLM has expanded and replaced PDM’s functions, integrating business functions and serving as a platform for CAD/CAPP/CAM integration.

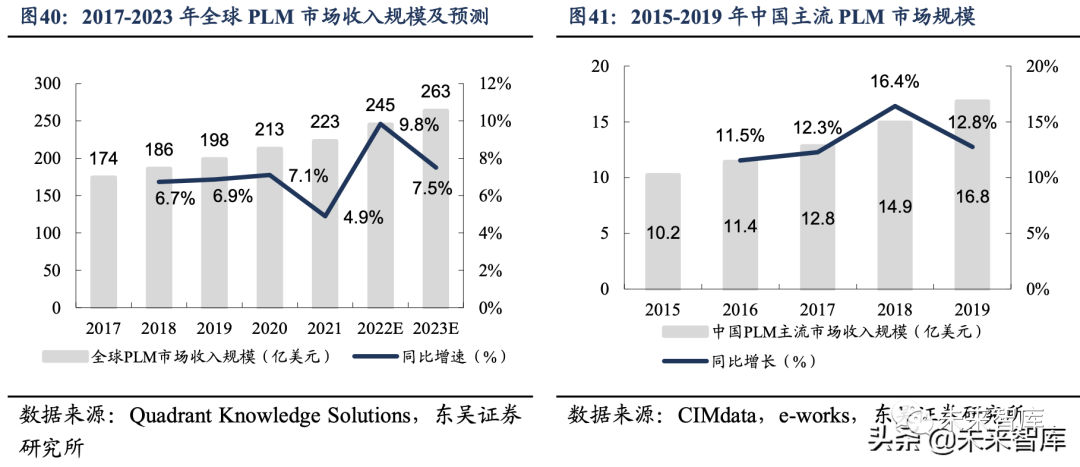

The growth rate of PLM in the Chinese market is higher than the global rate, with the market share mainly held by overseas giants. According to data from Quadrant Knowledge Solutions, the global PLM market size is expected to grow from $18.6 billion in 2018 to $26.3 billion in 2023, with a stable annual compound growth rate of about 7.2%. According to CIMdata estimates, in 2019, the mainstream PLM market in China reached $1.68 billion, with a year-on-year growth of 12.75%, exceeding the global growth rate during the same period. In terms of competitive landscape, PTC, Dassault, and Siemens are global PLM market leaders, while domestic companies include SiP, Yonyou, Kingdee, and Qingtongqi.

Internationally renowned PLM vendors mainly include Siemens, PTC, and Dassault. 1) Siemens PLM has ambitious goals: to dominate the automotive industry, acquire all possible software; seek to dominate the electrical and electronic fields, integrating mechanical, electronic, and electrical; strengthen the integration of CAD and CAE; develop control over PLM core components, including AR/VR; maintain a leading position in the development of industrial APP software, and continue to safeguard its new generation IoT platform MindSphere. 2) PTC aims to develop an IoT platform while deepening the experience of scenarios and seeking connections with end-users, heavily developing industrial application scenarios in AR/VR. 3) Dassault Systems focuses on brand effects, such as acquiring the German fluid phase calculation software company COSMOlogic and directly incorporating it into Biovia’s brand (which is Dassault Systems’ brand for scientific computing in biology, chemistry, and materials). Other brands include simulation brand Simulia, with many simulation software incorporated under its umbrella.

4.1.4. BIM: The Next Stop for Building Informationization

BIM generally refers to Building Information Modeling, which is based on various relevant information data of construction engineering projects to establish building models, simulating the real information of buildings through digital information. BIM constructs a 3D model based on the real information of buildings, and when an element in the model changes, every view updates, including section views, elevation views, and drawing views. The power of BIM lies in its ability to help architects, engineers, and contractors collaborate on coordinated models, allowing everyone to understand their work’s position in the project. BIM is the latest direction in the development of building informationization, with commonly used BIM software including Revit, Bentley, and ArchiCAD.

BIM affects the entire lifecycle of buildings. The building cycle can be divided into four main stages: project planning, design, construction, and operation. 1) In the planning stage, BIM has functions such as current state modeling and model maintenance, site analysis, and cost estimation. 2) In the design stage, BIM aids in design creation, collaborative design, building performance analysis, and structural analysis. 3) In the construction stage, BIM can solve collision coordination and construction scheme analysis issues. 4) In the operation stage, BIM can participate in the delivery of completion models, maintenance planning, and asset management.

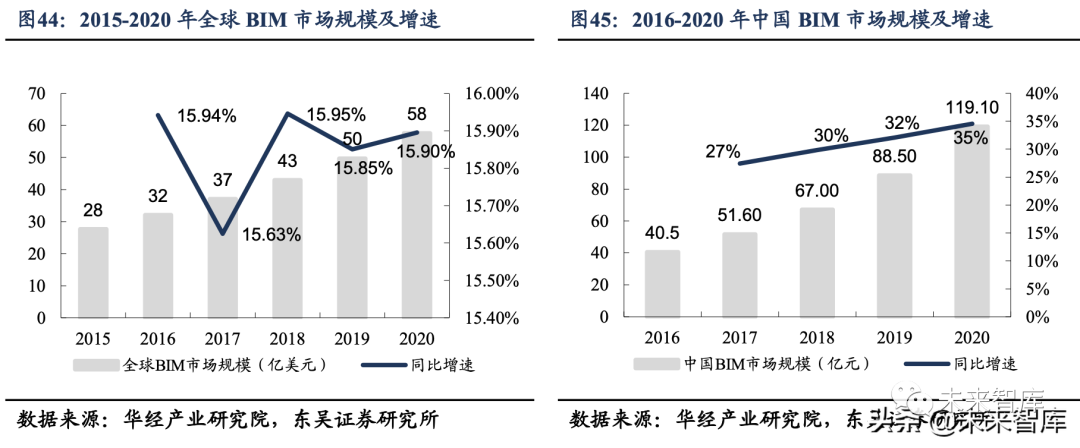

The global BIM market size is rapidly growing, with Autodesk’s revenue market share approaching 70% in 2020. According to data from Huajing Industry Research Institute, the global BIM market size was $5.8 billion in 2020, with a year-on-year growth of 15.90%. In 2020, China’s BIM market size was 11.91 billion yuan, with a year-on-year growth of 35%, far exceeding the global market growth during the same period. In terms of competitive landscape, according to data from Huajing Industry Research Institute, in 2020, global CAD giant Autodesk accounted for nearly 70% of the revenue market size, while the localization rate of China’s BIM market was less than 10%. The combination of significantly higher market growth rates than the global average and a low localization rate indicates substantial development potential for the domestic BIM market.

Overseas software mainly covers the core design links, while domestic software has gained advantages in some links. Different BIM software is used at various stages of construction projects. Foreign manufacturers’ software has significant advantages in key links such as design modeling, such as Autodesk’s Revit. Domestic manufacturers have advantages in design analysis and construction, closely integrating with localized business to provide more personalized services, such as Glodon’s budget pricing products and management control products.

R&D design software has the highest technical barriers, with the most severe “choke points,” making the path to domestic replacement long. R&D design is the initial step in industrial production, and modern industrial production of complex industrial products relies on the assistance of R&D design industrial software. R&D design software integrates knowledge from various fields such as chemistry, mathematics, and physics, creating extremely high technical barriers. R&D design software requires interdisciplinary talents, which are relatively scarce in China. The ecosystem of R&D design software is complex, making it difficult for China to rebuild in the short term. Therefore, among all industrial software, the path to domestic replacement for R&D design software is the longest.

4.2. Production Manufacturing: Competing on Equal Terms

4.2.1. PLC: Originating from Local Logic Control

PLC (Programmable Logic Controller) is a digital operation electronic system applied in industrial environments. PLC is a general industrial automation control device that integrates computer technology, automatic control technology, and communication technology, featuring high reliability, small size, strong functionality, simple program design, flexibility, and ease of maintenance, making it one of the three pillars of modern industrial control (PLC, robotics, and CAD/CAM).

China’s PLC market size exceeds 10 billion yuan, with overseas giants occupying the main market share. According to data from Huajing Industry Research Institute, in 2020, China’s PLC market size was 12.5 billion yuan, with a year-on-year increase of 10%. In terms of competitive landscape, according to data from Huajing Industry Research Institute, in 2020, the combined revenue market share of the three overseas giants, Siemens, Mitsubishi, and Omron, accounted for about 70%.

By product, domestic manufacturers have made breakthroughs in small and medium-sized PLCs, while large PLCs still lag behind overseas. PLCs can be classified into large, medium, and small types based on the number of I/O points. German companies have advantages in large and medium-sized PLCs; domestic companies like Zhongkong Technology and Huichuan Technology mainly occupy a portion of the small PLC market. In terms of core hardware technology, foreign companies still maintain a monopoly on core components such as microcontrollers (MCUs), digital signal processors (DSPs), and field-programmable gate arrays (FPGAs).

In terms of product scale, PLCs will develop in two directions. 1) Faster and more cost-effective small and ultra-small PLCs will emerge to meet the needs of single-machine and small-scale automation control. 2) Development will trend towards high-speed, large-capacity, and well-structured large PLCs to meet the high demands of complex system control, such as information processing speed and memory capacity requirements.

4.2.2. DCS/SCADA: Distributed Control and Monitoring

DCS (Distributed Control System) is an industrial automation control system based on controllers and field devices, gathering relevant process signals into the system, monitored or controlled by operator stations, characterized by decentralized control, centralized operation, and hierarchical management. DCS has been widely applied in various industries, including power, metallurgy, and petrochemicals.

Domestic manufacturers have achieved a significant market share in DCS, further narrowing the gap with overseas competitors. According to statistics from Rui Industrial, in 2020, Zhongkong Technology’s core product, the distributed control system (DCS), achieved a market share of 28.5% in China, ranking first in the domestic DCS market for ten consecutive years, with a market share of 44.2% in the chemical industry and 34% in the petrochemical industry, achieving international advanced levels in reliability, stability, and usability.

SCADA (Supervisory Control And Data Acquisition) is a data acquisition and monitoring control system. SCADA plays an important role in remote systems, allowing monitoring and control of on-site operating equipment to achieve data acquisition, equipment control, measurement, parameter adjustment, and various signal alarm functions.

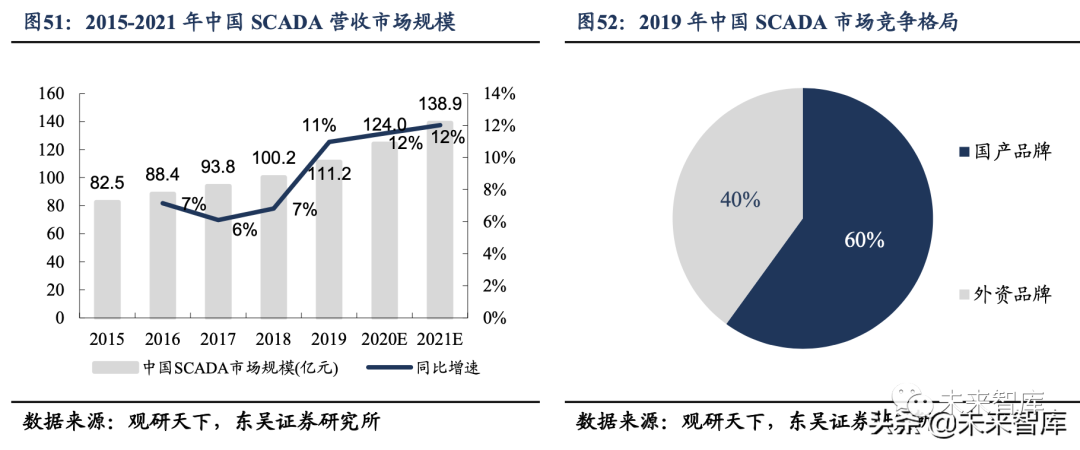

The SCADA market size is gradually accelerating, with a localization rate exceeding 50%. According to data from Guanyan Tianxia, in 2021, China’s SCADA revenue market size was 13.89 billion yuan, with a year-on-year growth of 12%, and the growth rate has been gradually accelerating from 2017 to 2021. In 2019, domestic brands accounted for as much as 60% of the SCADA market, gaining a certain advantage.

The differences between DCS, SCADA, and PLC. In terms of functionality, DCS focuses on process control, excelling in handling analog control, commonly used in process industries such as petrochemicals, power, and pharmaceuticals, while also having data acquisition and monitoring capabilities. PLC focuses on logic control, excelling in handling switch control, commonly used in discrete industries such as machining and CNC machines. SCADA emphasizes data acquisition rather than control. In terms of complexity, DCS and SCADA are system concepts, while PLC is a product device. In industrial automation systems, PLC is often applied in DCS and SCADA as a sub-component, and we can consider “PLC + SCADA = DCS.” However, with industrial development, the logic control capabilities of DCS and the continuous control capabilities of PLC are both strengthening, gradually blurring the boundaries between the two.

4.2.3. MES: Intelligent Production Execution

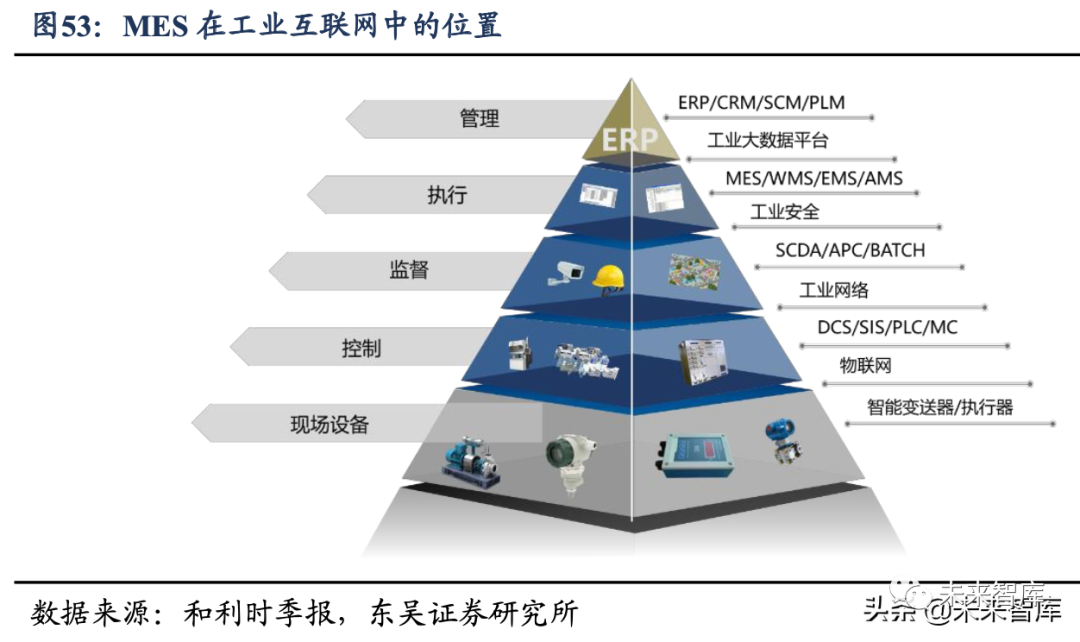

MES (Manufacturing Execution System) is defined by the Advanced Manufacturing Research (AMR) as a management information system oriented towards the workshop layer, bridging the upper-level planning management system and the lower-level industrial control. MES software serves as a management system at the workshop level, responsible for executing production plans issued by ERP systems based on the various manufacturing processes required for products or parts and the actual conditions of production equipment, supporting functions such as production traceability, quality information management, production reporting, and equipment data collection.

China’s MES market size is continuously expanding, with a relatively fragmented competitive landscape. According to e-works data, in 2020, China’s MES market size was 4.3 billion yuan, with a year-on-year growth of 8%. In 2021, with national policy support and the gradual elimination of the pandemic’s impact, the growth rate of China’s MES market is expected to return to double digits. In terms of competitive landscape, due to significant differences in production execution processes across various manufacturing sub-sectors, it is challenging to form a unified standard product, leading to a relatively fragmented competitive landscape in China’s MES market. According to IDC data, in 2020, the market share of the leading company Siemens in China’s manufacturing MES market was only 11.1%, with Baoxin Software ranking second at 7.6%. In the global market, MES is mainly dominated by giants like Siemens and Honeywell, and as the Chinese market matures, it is expected to see an increase in industry concentration similar to overseas markets.

With numerous market participants, domestic companies mainly cover mid-to-low-end industries, and the industry is in a developmental stage. Leading foreign manufacturers each choose to cultivate their strengths in specific industries, with Siemens occupying a significant market share in electrification, machinery, and automotive industries, while Honeywell has advantages in aerospace and petrochemical fields. Domestic manufacturers like Baoxin Software have advantages in the steel metallurgy sector.

The future of MES is MOM (Manufacturing Operations Management). With the continuous development of industrial informatization, customers are presenting increasingly diverse personalized demands. If all these new demands are placed in MES, it will ultimately lead to an overly bloated MES that affects production management. The solution is MES + development platforms, which will more deeply complete functions such as quality management (QMS) and equipment management (EMS), giving rise to MOM. Industrial internet giant Siemens defines its MOM product as connecting PLM with automation and providing manufacturers with core elements of real-time industrial software layers, including MES, QMS, APS, and HMI.

Production manufacturing industrial software already possesses high-end market replacement logic, and as application scenarios open up, the localization rate is expected to accelerate. Compared to R&D design software, production manufacturing industrial software has lower technical barriers and is more closely aligned with industrial production processes. With the rapid development of China’s industry, certain sectors such as petroleum, chemicals, and steel are at the world-leading level, and the corresponding production manufacturing software also has the potential for high-end market replacement. As China’s intelligent manufacturing transformation progresses and industrial application scenarios gradually increase, domestic production manufacturing software will continue to be refined, and product performance will gradually improve, leading to an accelerated localization rate.

4.3. Operation and Maintenance Services: Emerging Market

Monitoring the status of industrial equipment and fault diagnosis is one of the development directions of intelligent manufacturing. The “14th Five-Year Plan for Intelligent Manufacturing Development” explicitly mentions fault prediction and health management software (PHM) and comprehensive operation and maintenance management (MRO) in the actions to enhance industrial software. As the level of industrial automation and intelligence continues to rise, modern operation and maintenance management of industrial equipment has become an essential part of industrial digital transformation.

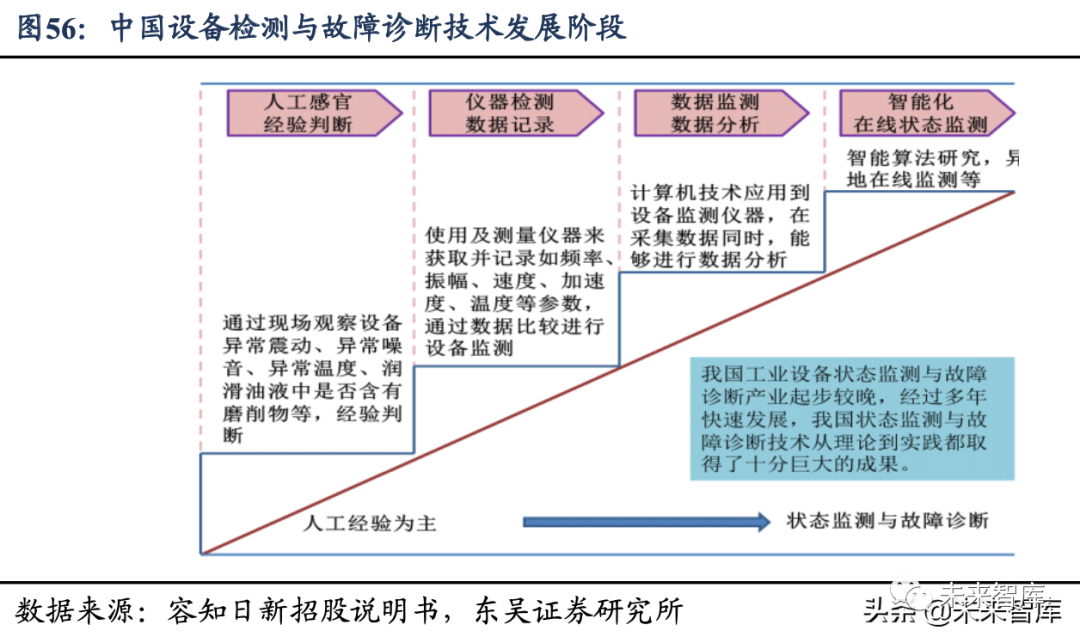

Status monitoring and fault diagnosis technology originated in industrially developed countries such as the United States and Europe. As early as the late 1960s, NASA established the American Mechanical Fault Prevention Group. In 1971, Dr. Beard from MIT first proposed using analytical redundancy to replace hardware redundancy in his doctoral thesis, marking the birth of fault diagnosis technology based on analytical redundancy. China’s equipment monitoring and fault diagnosis industry started relatively late but has developed rapidly, now moving towards intelligent monitoring and maintenance.

Strong downstream demand is gradually opening up market space. China’s industrial equipment status monitoring and fault diagnosis is mainly applied in fields such as wind power, petrochemicals, and metallurgy, where equipment investment is substantial, and there are high requirements for operational continuity and stability. With the national push for intelligent manufacturing and the promotion of “dark factories,” these fields will have significant demand for intelligent operation and maintenance. According to IoT Analytics data, the global predictive maintenance market size is expected to reach $28.2 billion by 2026. According to World Bank data, in 2020, China’s manufacturing value added accounted for about 30% of the global total. Assuming this proportion remains unchanged, China’s predictive maintenance market could reach $8.46 billion by 2026.

Operation and maintenance service industrial software has just emerged, with a small gap compared to overseas. With the development of intelligent manufacturing, industrial software specifically for operation and maintenance services has just begun to emerge, and the market space is gradually opening up. Due to the advantages of local services, domestic operation and maintenance industrial software is even more competitive than overseas. As of April 2022, domestic operation and maintenance service industrial software companies are still small in scale, with no giants emerging, making the market a blue ocean.

5. Related Companies

5.1. Huada Jiutian: The Pinnacle of Domestic EDA, the Only National Team

Inheriting from “Panda,” Huada Jiutian is the leader in domestic EDA. The company’s founder participated in the design of China’s first EDA tool with independent intellectual property rights, the “Panda ICCAD system,” with solid technical foundations and rich industry experience. Established in 2009, the company mainly engages in the development, sales, and related services of EDA tool software. Its main products include full-process EDA tool systems for analog circuit design, digital circuit design EDA tools, full-process EDA tool systems for flat panel display circuits, and wafer manufacturing EDA tools. According to data from CCID Consulting, in 2020, Huada Jiutian accounted for about 6% of China’s EDA market revenue, leading domestic EDA companies with over 50% of the domestic EDA market revenue share.

With the largest revenue scale in the domestic market, it places a high emphasis on technological R&D. In 2021, Huada Jiutian’s revenue reached 579 million yuan, a year-on-year increase of 40%, making it the largest company among domestic EDA manufacturers. In 2021, the net profit attributable to the parent company was 139 million yuan, a year-on-year increase of 35%. The EDA industry is technology-intensive, and Huada Jiutian places a high emphasis on technological R&D, maintaining an R&D expense ratio above 40% from 2018 to 2021. As of June 30, 2021, the company had 145 authorized patents and 51 registered software copyrights.

5.2. ZWSOFT: A Leader in Domestic CAx

ZWSOFT is a leading domestic All-in-one CAx (CAD/CAE/CAM) solution provider. Founded in 1998, ZWSOFT initially focused on the R&D and sales of 2D CAD software, launching its first generation of 2D CAD platform products in 2002. In 2010, the company acquired the intellectual property and team of VX Corporation and officially launched its first 3D CAD software, ZW3D2010. In 2018, the company established a CAE R&D center. In 2020, the company released the ZWSim2021 simulation solution, forming a product matrix covering 2D CAD, 3D CAD/CAM, and CAE simulation analysis.

Steady revenue growth, with gradually improving net profit margin. In 2021, ZWSOFT’s revenue was 619 million yuan, a year-on-year increase of 36%. From 2016 to 2019, the company’s revenue growth rate gradually accelerated, with a growth rate of 26% in 2020 due to the impact of the pandemic and changes in accounting standards. In 2021, the company returned to high growth. From 2016 to 2021, the net profit attributable to the parent company maintained rapid growth, reaching 182 million yuan in 2021, a year-on-year increase of 51%.

5.3. Baoxin Software: A Leader in the Steel Industry’s Industrial Internet

Deeply engaged in the steel information industry for over 40 years, continuously expanding the boundaries of industrial internet products. Baoxin Software originated from the automation department of Shanghai Baosteel, established in 1978, and was renamed Shanghai Baoxin Software Co., Ltd. in 2001. In 2014, Shanghai Baoxin Data Center Co., Ltd. was established, entering the data center and cloud computing industry, and in 2020, it launched the industrial internet platform xIn3Plat, further enhancing its industrial internet construction capabilities. In 2021, it released PLC products, achieving breakthroughs in key software and hardware for the industrial internet.

Baoxin Software’s business mainly consists of software development and engineering services (industrial internet) and outsourcing services (IDC). Baoxin’s industrial internet products can be divided into informatization, automation, and intelligence. Informatization includes industrial software, ERP software, and other pure software products; automation includes intelligent equipment, PLCs, and other hardware or hardware-software integrated products; intelligence mainly includes smart city and intelligent transportation products. Baoxin Software has a comprehensive product matrix, capable of providing a one-stop product and solution for digital transformation.IDC business mainly provides independent third-party IDC providers with services such as cabinet leasing.

5.4. Zhongkong Technology: A Giant in Process Industry Automation, Advancing Towards Industry 4.0

Zhongkong Technology started with distributed control systems (DCS) to connect upstream and downstream businesses. Established in 1999, the company’s development can be divided into three stages: the first stage from 1999 to 2006, mainly providing self-developed DCS products to small and medium-sized customers; the second stage from 2007 to 2015, expanding its business to downstream automation instruments and upstream advanced control and optimization software, breaking through medium and large projects and establishing industry-leading positions; the third stage from 2016 to the present, closely following the development trend of Industry 4.0, shifting its focus towards industrial software and providing integrated intelligent manufacturing solutions.

5.5. Saiyi Information: A Rising Star in Discrete Manufacturing MES

Deeply engaged in discrete industries, from ERP implementation to MES layout, gradually launching self-developed products. Saiyi Information was established in 2005, initially providing consulting implementation and related secondary development services for internal ERP and supply chain system construction. In 2012, the company entered the intelligent manufacturing field, launching industrial management software products centered around S-MES for discrete manufacturing enterprises, and in 2018 expanded into a family of integrated industrial management software products (S-MOM).

Steady development of general ERP business, with intelligent manufacturing driving company performance. In 2021, Saiyi Information’s revenue was 1.934 billion yuan, a year-on-year increase of 40%, with a compound annual growth rate of 26% from 2016 to 2021. The net profit attributable to the parent company was 228 million yuan in 2021, a year-on-year increase of 30%. The general ERP business of the company was relatively stable due to fluctuations in China-U.S. relations in 2019, but the growth rate began to recover in 2020 and accelerated in 2021. The rapid growth in revenue from 2019 to 2021 was mainly driven by the rapid development of the company’s intelligent manufacturing business, with revenue rising from 73 million yuan in 2017 to 592 million yuan in 2021, achieving a high compound growth rate of 68%, with the revenue share of intelligent manufacturing business steadily increasing, reaching 31% in 2021.

5.6. Rongzhi Rixin: A Leader in Domestic Industrial Operation and Maintenance Market Landscape

From hardware to integrated hardware and software solutions, continuously improving product performance to meet customers’ intelligent operation and maintenance needs. Rongzhi Rixin was established in 2007, initially focusing on the production and sales of industrial equipment status monitoring and fault diagnosis systems, with a relatively simple structure. In 2008, the company independently developed wired system products. In 2010, the company launched its independently developed wireless system products. Subsequently, the company built a cloud diagnosis center based on intelligent algorithms and a big data platform. By July 20, 2021, the company had remotely monitored over 40,000 devices, with monitored device types exceeding a hundred, accumulating over 4,500 fault cases across various industries, collaborating with several large well-known companies in wind power, petrochemicals, and metallurgy.

The main products include industrial equipment status monitoring and fault diagnosis hardware systems and the self-developed iEAM software. The company’s industrial equipment status monitoring and fault diagnosis hardware systems mainly include wired systems, wireless systems, and handheld systems, including wired acquisition stations, various types of sensors, sensor signal cables, data transmission optical cables, and system servers. The company also provides its self-developed iEAM software for intelligent device lifecycle management in large industrial enterprises, featuring graphical, digital, mobile, and intelligent technologies.