Click the blue text above to follow us

ING91870CQ is an automotive-grade low-power SoC chip released by Peach Core Technology. This chip underwent 9 months of reliability testing and ultimately obtained AEC-Q100 certification.

ING91870CQ is a 32-pin, QFN32 4×4 packaged BLE 5.1 SoC. It uses TSMC 40nm process technology, with a main frequency of 48M, 512KB eFlash, and 128KB RAM, operating within a temperature range of -40 to 125°C. It supports positioning, multi-connection, low power consumption, and other full specifications of BLE 5.1, meeting various existing automotive BLE application scenarios.

Certification Report

01

Reliability of Automotive Chips

AEC Q100 is a standard for active devices. Due to safety reasons in automobiles, there are strict reliability standards for components, subsystems, and complete systems. For example:

-

Environmental Requirements: Automotive components near the engine must meet a temperature standard of -40 to 150°C; other factors such as humidity, mold, dust, water, EMC, and corrosive gases have higher standards than most industrial or consumer electronics.

-

Vibration and Shock: Automobiles operate under varying conditions while in motion, so they must have high resistance to vibration and shock.

-

Reliability: The typical lifespan of a vehicle is hundreds of thousands of kilometers, requiring all components to function normally throughout the vehicle’s lifecycle. With thousands of components in a system, maintaining normal operation is a significant challenge, often requiring PPM failure rates or even zero failure rates.

-

Consistency: Due to mass production needs, consistent characteristics are required across tens of millions of vehicles. If the consistency of components is poor, the overall vehicle’s discrete characteristics become more pronounced. Therefore, aging tests and tracking product consistency in real-world scenarios are necessary.

-

Other Issues: For reliability considerations, automotive-grade products may not always use the most advanced processes and performance; the sustainability of suppliers is also a concern, as the lifecycle of a vehicle is long.

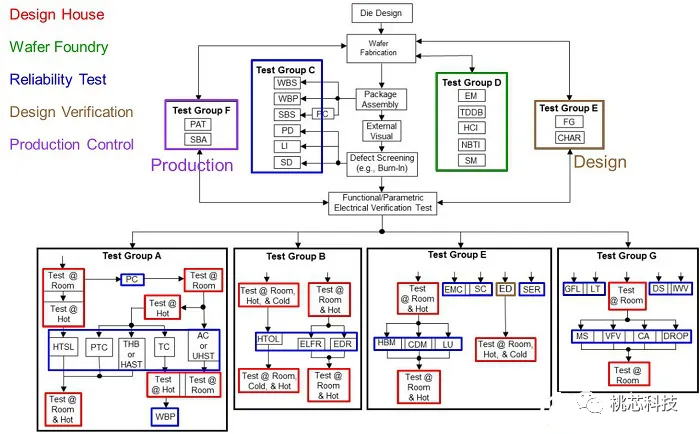

The reliability of chips is typically verified using the AEC-Q100 standard system promoted in North America, addressing the issues mentioned above. Not only AEC-Q100, but to control failure rates, a chip company’s quality control system must also be established, such as IATF-16949 for quality control; for functional safety, ISO 26262 must be certified. Thus, automotive-grade chips have higher requirements than consumer or industrial-grade chips, requiring longer certification times and higher entry barriers compared to consumer-grade chips.

It must be acknowledged that various automotive-grade certifications are necessary but not sufficient conditions for automotive chips. The use of automotive-grade chips requires extensive reliability testing and a historical accumulation of experience for chip manufacturers.

AEC-Q100 Certification Process

02

Classification of Automotive Chips

Automotive-grade chips are classified into five categories based on function: computing control chips (mainly functional MCU and control SOC chips), storage chips, power semiconductors (mainly IGBT and MOSFET), communication chips, and sensor chips (mainly CIS, MEMS, gyroscopes, etc.).

From the perspective of chip process technology, different automotive chips have significant differences in process requirements. Due to the need for reliability and stability, MCUs mainly rely on mature processes. With the rise of new energy vehicles, the concept of automobiles has undergone significant changes; internal combustion engines are being replaced by batteries, and automobiles are becoming more intelligent and smartphone-like, especially in areas like cockpits and autonomous driving. This has led to a continuous pursuit of advanced process technology and high computing power in control chips, with high-level autonomous driving pushing automotive computing platforms to processes of 7nm and below. For example, Qualcomm’s 8815 stands out in intelligent cockpits.

Power devices, especially IGBTs, have wide applications in new energy vehicles due to the need for high voltage and large current for charging and power systems. MOSFETs are used in scenarios requiring smaller currents and faster switching frequencies.

With the increasing intelligence of vehicles, communication chips have become particularly important, such as 4G and 5G communications. In vehicle-to-infrastructure (V2X) collaboration, low latency is a critical requirement, making 5G one of the solutions. Additionally, body sensors and in-car entertainment systems require real-time sensing of all components in a vehicle, making in-vehicle local area networks particularly important, with traditional CAN communication gradually being replaced by new wireless communication methods like WiFi, BLE, and UWB. Applications of BLE systems include TPMS, keyless entry, ETC, BMS, and more.

Sensors act as the sensory organs of vehicles, responsible for collecting all vehicle states such as pressure, position, temperature, acceleration, angle, fluid, gas, liquid, and radar.

03

Market for Automotive Chips

Typically, chip design companies serve as Tier 2 suppliers, providing chips and services to Tier 1 system manufacturers, who in turn provide final solutions to automotive OEMs. Whether Tier 1 or Tier 2, or chip manufacturing foundries, most are currently dominated by foreign manufacturers. For fabless design companies focusing on automotive chips, the main control suppliers still include NXP, Infineon, Renesas, TI, ST, ADI, Qualcomm, Nvidia, and others. Other categories of automotive chips are also primarily from foreign manufacturers.

Automotive Chip Industry Chain

In 2021, the global automotive semiconductor market reached $43.6 billion, with an expected growth to $67.6 billion by 2026, representing a compound annual growth rate (CAGR) of 9%. In 2020, control chips accounted for 23% of semiconductor product market demand, power semiconductors 22%, sensor chips 13%, storage chips 9%, and others 33%. Developed countries such as Europe, the U.S., Japan, and South Korea accounted for 37%, 30%, and 25% of the market, respectively. The top 8 companies in the industry occupy over 60% market share, with NXP, Infineon, and Renesas ranking as the top three, holding 14%, 11%, and 10% market shares, respectively.

04

Current State of Domestic Automotive Chips

Currently, the domestic chip industry is generally at a low level, exhibiting several characteristics: 1. EDA software is the weakest link in the industry; without the leading foreign EDA companies like Synopsys, Cadence, and Mentor, domestic chip design would come to a halt; 2. Materials can be used but are not the best, such as wafers and various chemical agents; 3. Core equipment can be used but is not the most advanced, such as photolithography machines; 4. In design, the gap has narrowed, but there is still a lack of CPU architecture, core IP standards, and high-speed analog technology; 5. Packaging and testing are not major issues.

Peach Core Technology faces significant challenges in communication chips, as communication protocols are still dominated by international giants, and domestic manufacturers are in a following stage, which is a fundamental issue. This leads to product problems, such as low-end products, lack of evolution, and consequently low profit margins, preventing sustained high investment for further technological accumulation. Therefore, domestic substitution needs to avoid low-end duplication and price competition, striving to move upwards. Although Peach Core Technology’s BLE SoC chip has passed automotive-grade certification, we deeply understand that the road ahead is still long; we are still in the early stages, and certification itself is just a small step in industrialization. However, we will continue to pursue excellence and depth in the path of chip localization, striving to catch up with international standards as soon as possible.

With the trend of automotive electrification and intelligence, the average number of chips per vehicle reached nearly 1000 in 2021. Mainstream new energy vehicles require nearly 2000 chips per vehicle.

Statistics show that the self-sufficiency rate of automotive chips in China is less than 10%, and the localization rate is even less than 5%. However, we are pleased to see more and more Chinese companies entering the automotive chip field. “Domestic automotive-grade chip manufacturers have a certain industrial foundation, including MCU fields like Zhaoyi Innovation, Beijing Junzheng, Allwinner Technology, and Zhongying Electronics; IGBT fields like BYD Semiconductor, CRRC Times Electric, Silead Semiconductor, and Silan Microelectronics; MEMS fields like Weir Shares; and packaging and testing fields like Changdian Technology, Huatian Technology, and Tongfu Microelectronics.”