Application for “China IC Unicorn” Selection

Collection of Innovative Achievements in High-Quality Development of Semiconductors

Unlike leading MCU manufacturers such as NXP, ST, and TI, domestic MCU manufacturers are experiencing significant benefits due to the optimistic recovery of domestic market demand. What new changes have emerged in the market? Chip Eight will reveal the latest financial reports of leading domestic MCU manufacturers.

Author/Editor: Don

From Chip Eight’s 600th original article.

This article has 2875 words, estimated reading time is 8 minutes.

In 2024, against the backdrop of generally dismal financial reports from overseas MCU giants, domestic MCU new forces represented by Zhaoyi Innovation are accelerating their rise.

Strong Recovery in Revenue and Profit, Optimistic Expectations

In 2024, based on the specific annual financial forecast information released, the leading domestic MCU manufacturers show a clear recovery in orders, with revenue and net profit continuing to rise. Among them, Espressif Technology, Chipsea Technology, and Fengcai Technology all reported revenue growth of over 40% year-on-year, with significant profit improvements.

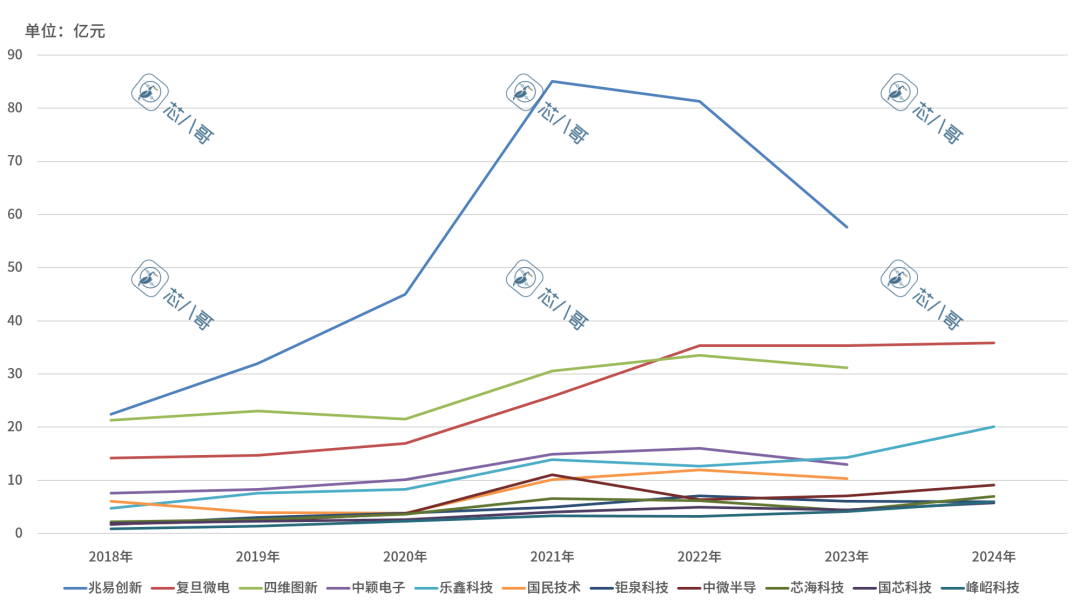

Annual Revenue Review of Major Chinese MCU Listed Companies

Data Source: Company financial reports and forecasts, compiled by Chip Eight

Specifically, domestic MCU leader Zhaoyi Innovation stated that after experiencing a sluggish market demand in 2023 and gradually reducing inventory, since the beginning of the year, demand in the consumer and networking markets has warmed, and Q3 industrial, storage, and computing market inventories have effectively decreased, leading to significant revenue growth. Home appliance MCU leader Zhongying Electronics also pointed out that MCU inventory has decreased quarter by quarter, and demand for home appliance MCUs has rebounded. The “new star” in automotive MCUs, Guoxin Technology, has also seen explosive growth in order shipments in the mid-to-high-end automotive chip market.

It is noteworthy that Zhaoyi Innovation’s revenue for the first three quarters reached 5.65 billion yuan, with MCU revenue exceeding 800 million yuan, firmly maintaining its leading position in the domestic market, and the gap in market share with leading manufacturers like ST is gradually narrowing.

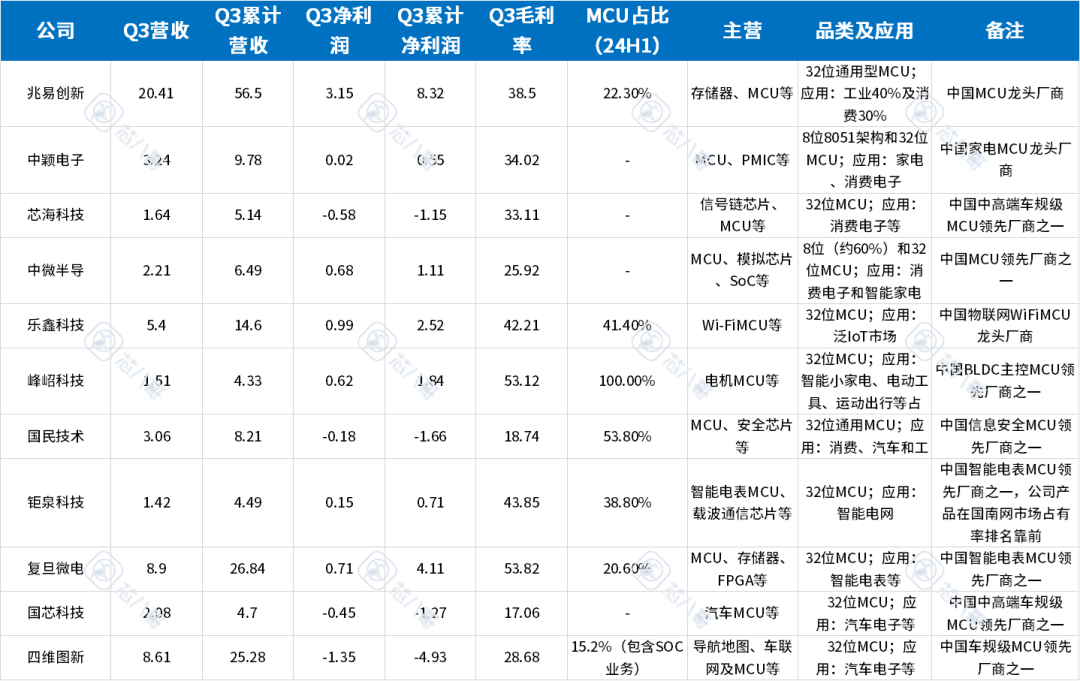

Q3 2024 Operational Status of Major Domestic MCU Manufacturers (Unit: 100 million yuan)

Data Source: Company financial reports and forecasts, compiled by Chip Eight

From the perspective of revenue and net profit growth rates, the recovery of domestic consumption is clearly beneficial to manufacturers, with Zhaoyi Innovation, Zhongwei Semiconductor, and Espressif Technology leading the way.Among them, industry leader Zhaoyi Innovation shows steady growth, with a significant increase in consumer orders, and industrial demand remains stable during the industry downturn; Zhongwei Semiconductor has seen rapid profit recovery due to overall demand recovery. Additionally, 60% of Espressif Technology’s revenue growth comes from the smart home sector, with optimistic growth expectations for its IoT business.

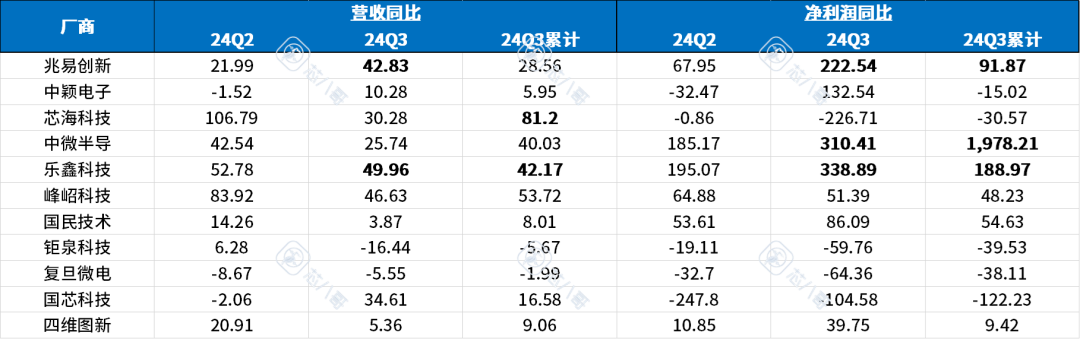

Q3 2024 Revenue and Net Profit Growth Rates of Chinese MCU Manufacturers (Unit: %)

Data Source: Company financial reports and forecasts, compiled by Chip Eight

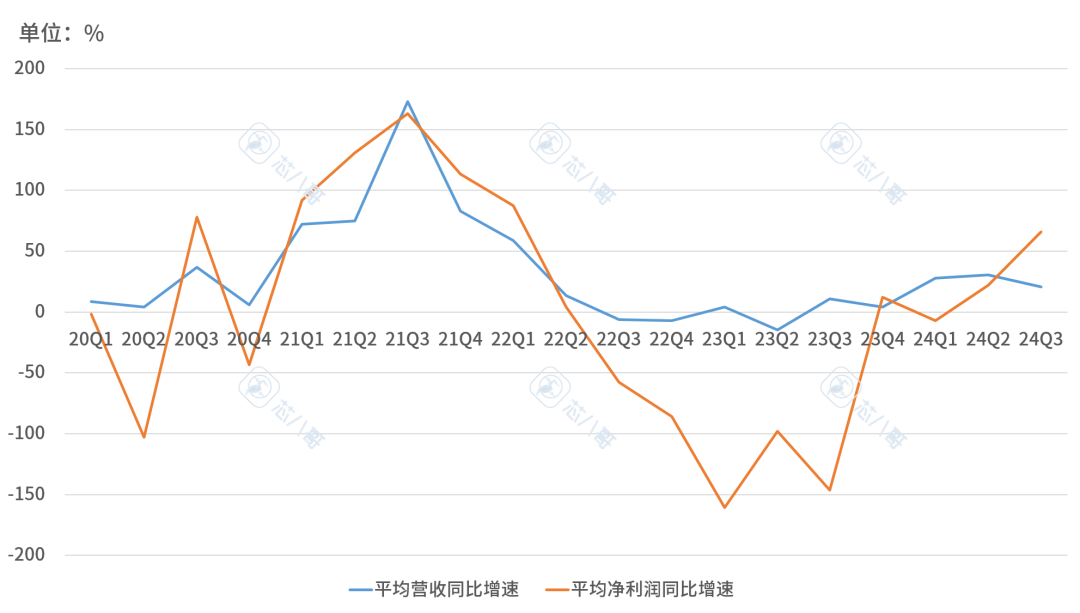

Based on the assessment of industry average revenue and net profit trends, the revenue growth of the domestic MCU industry has basically bottomed out since the second half of 2023, with continuous recovery in revenue and profit since early last year, and significant profit improvement.

Average Revenue and Profit Trends of Chinese MCU Manufacturers Since Q1 2024

Data Source: Company financial reports and forecasts, compiled by Chip Eight

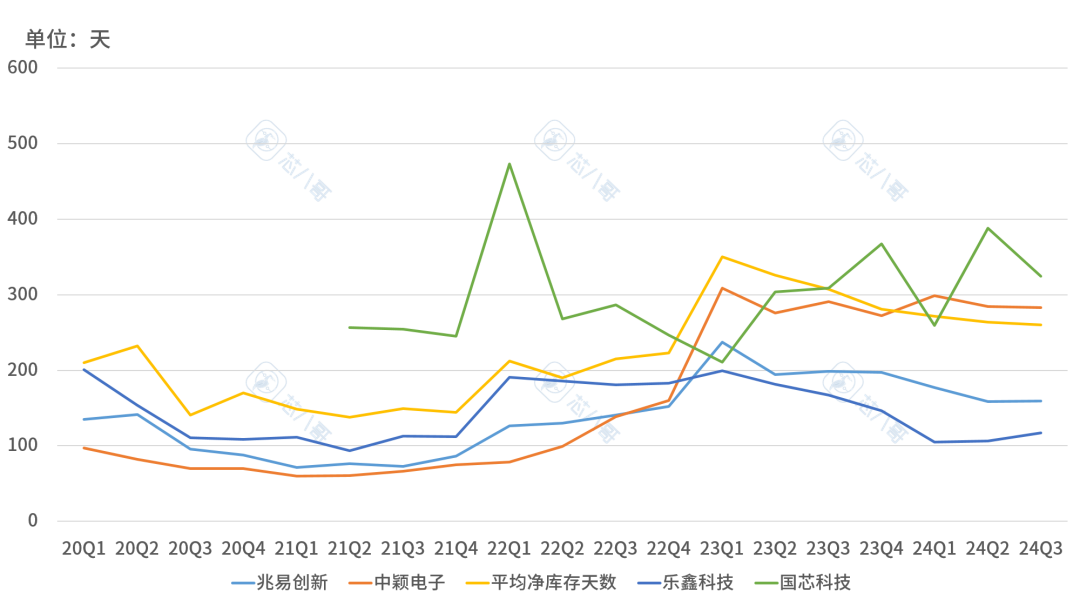

In terms of inventory, since Q1 2023, industry inventory has continued to decline, with significant reductions observed among consumer and IoT manufacturers represented by Zhaoyi Innovation and Espressif Technology, while automotive and industrial inventories represented by Guoxin and Zhongying Electronics have decreased but remain at high levels.

Average Inventory Trends of Chinese MCU Manufacturers Since Q1 2024

Data Source: Company financial reports and forecasts, compiled by Chip Eight

In summary, domestic MCU demand continues to recover, with positive development trends in consumer and IoT sectors, while industrial and automotive sectors require close attention due to fluctuations.

Analysis of Fastest Growing Order Segments and Trends

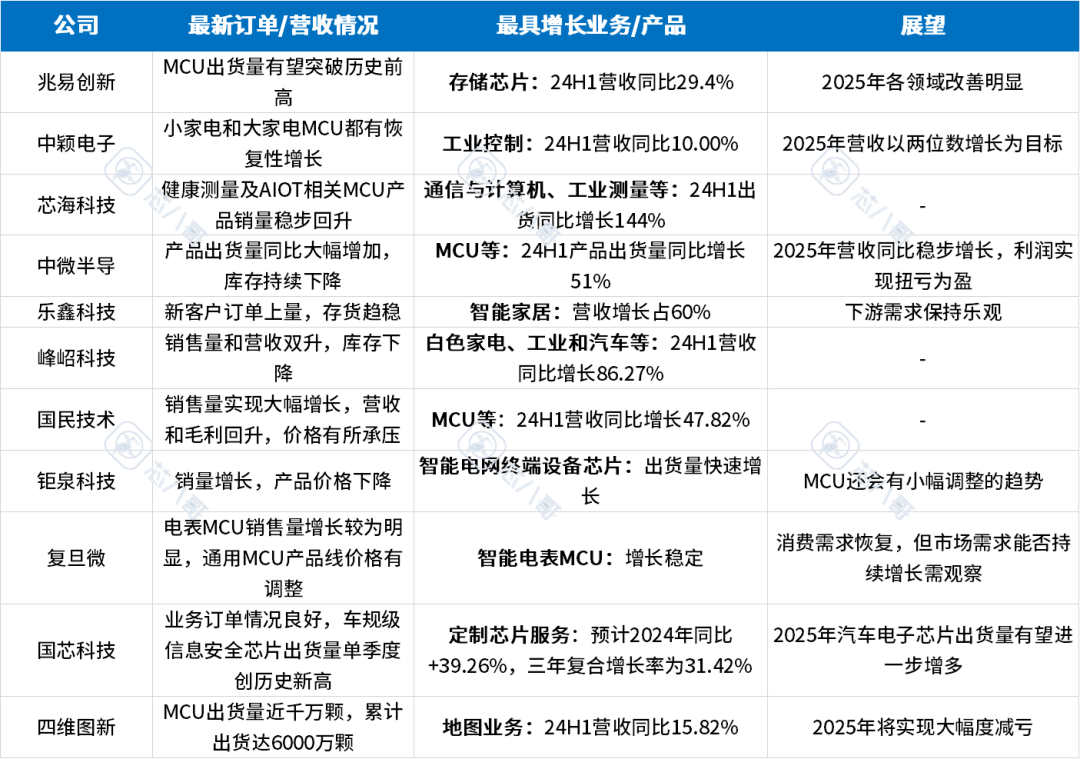

From the order situations disclosed by various manufacturers, the recovery of demand in consumer, IoT, and home appliance sectors is the driving force behind the recovery of the domestic MCU market, while automotive and industrial sectors are sub-markets with significant growth potential. Among them, Zhaoyi Innovation and Zhongwei Semiconductor mainly benefit from the recovery of domestic consumer demand; Espressif Technology has strong orders due to the growth in AIoT demand; and mid-to-high-end automotive MCU application manufacturers represented by Guoxin Technology have seen rapid order growth, while general automotive MCU manufacturers represented by Siwei Tuxin have shown good replacement trends.

It is important to note that Zhaoyi Innovation believes that a relatively positive change compared to last year in 2025 is that the inventory levels of customers and agents have become relatively healthy, and demand across various fields can be expected to improve significantly.

Current Order Status and Development Expectations of Chinese MCU Manufacturers

Data Source: Company financial reports and forecasts, compiled by Chip Eight

1. Increase in Market Share of Domestic Manufacturers

ST’s financial report shows that in 2024, the company’s general MCU sales fell by over 50%, with more than half related to inventory adjustments, which exceeded expectations. At the same time, customer demand for the company has also declined this year, with a particularly significant drop in the Chinese market.

As the first choice for domestic alternatives to ST, domestic general MCU leader Zhaoyi Innovation announced that its MCU product sales grew rapidly in the first three quarters of last year, mainly due to an increase in market share in China and shipments of new products in new fields.

In this context, domestic manufacturers’ market share in the Chinese general MCU market is expected to continue to rise this year. Zhaoyi Innovation predicts that MCU shipments will accelerate recovery in 2024, with shipments expected to exceed historical highs. In 2025, with significant improvements in demand across various terminals, domestic MCU manufacturers such as Zhaoyi Innovation, Zhongying Electronics, Zhongwei Semiconductor, and Espressif Technology are optimistic about growth.

2. General Consumer-Related Demand Recovers First

From the perspective of downstream applications, based on the financial reports of leading MCU manufacturers, demand for consumer electronics, IoT, and home appliances grew significantly last year, while automotive and industrial sectors have seen a rebound but inventory reduction is still ongoing.

Specifically, consumer application representatives Zhaoyi Innovation and Zhongwei Semiconductor have benefited from the recovery of demand for mobile phones and related consumer products, showing significant performance growth. In the IoT sector, Espressif Technology and Chipsea Technology have seen continuous increases in orders and sales, with Espressif Technology indicating that market conditions at home and abroad have improved, with new applications and customers continuously increasing, and new products rapidly ramping up. In the home appliance sector, Zhongying Electronics reported that current orders are growing rapidly, with the home appliance MCU market expected to grow year-on-year in 2024, and overseas market demand returning, with reasonable client inventory levels. In the metering sector, Fudan Micro and Jiuquan Technology have seen significant growth in orders for metering applications.

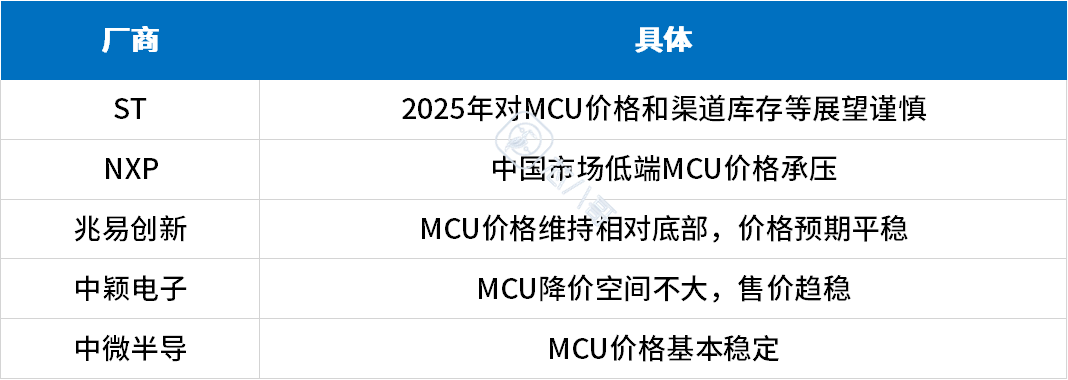

3. Stable Pricing for General Products

According to incomplete data compiled by Chip Eight, the delivery times for 8-bit and 32-bit general MCUs from leading manufacturers continue to decline, while price trends remain stable month-on-month. It is noteworthy that ST remains cautious about MCU prices this year, and NXP’s financial report indicates that low-end MCU prices in the Chinese market continue to be under pressure. Among domestic manufacturers, Zhaoyi Innovation believes that MCU prices have remained relatively low in the absence of significant demand improvement, with price expectations remaining stable.

Price Trend Predictions of Some MCU Manufacturers

Data Source: Company financial reports and forecasts, compiled by Chip Eight

4. Explosion of Investment and Applications in Automotive Categories

Benefiting from the explosive growth of domestic electric vehicle demand, mainstream domestic MCU manufacturers are actively accelerating their layout in the automotive MCU market, with financial reports mentioning related R&D investments in automotive applications. Manufacturers represented by Guoxin Technology, Jiefa Technology, and Zhaoyi Innovation have seen rapid growth in revenue and orders.

It is noteworthy that Guoxin Technology is expected to deliver over 4 million chips in 2024, Jiefa Technology has completed the layout of a full range of automotive MCU product lines, and Zhaoyi Innovation has collaborated with several leading domestic and international Tier 1 companies, with automotive MCU shipments exceeding 2 million pieces.

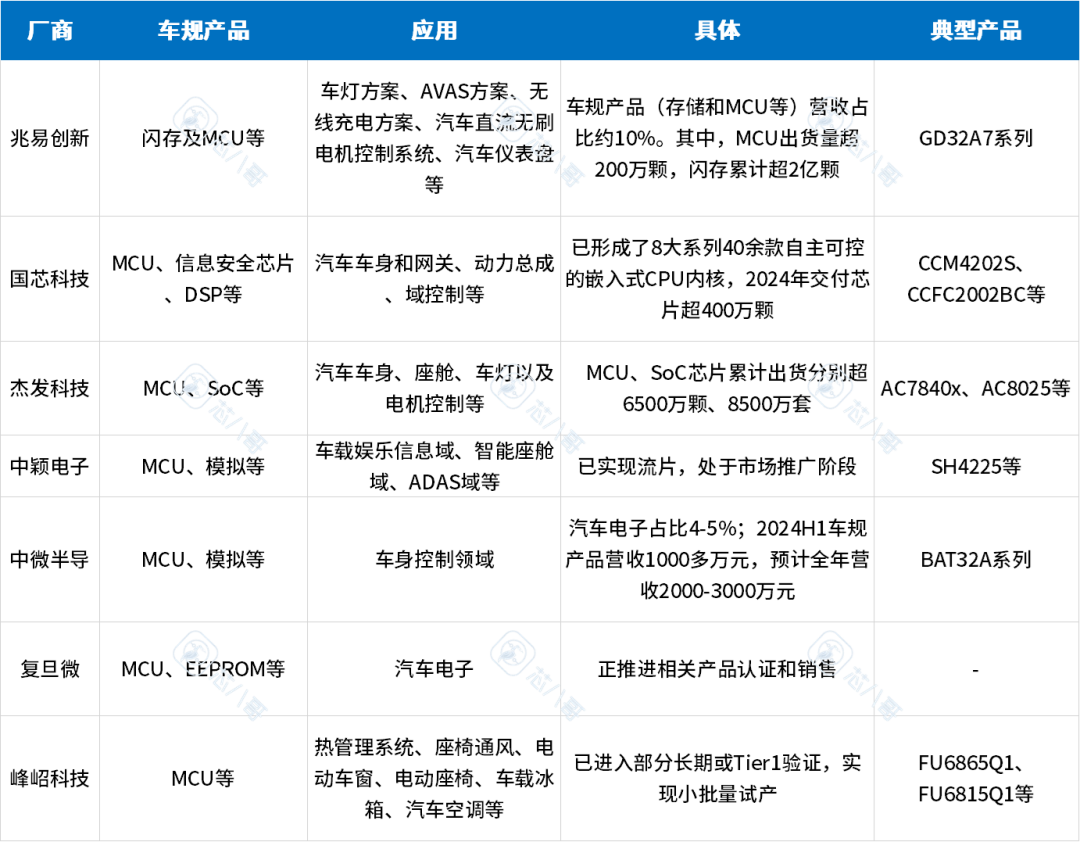

Application Status of Some Automotive MCU Manufacturers

Data Source: Company financial reports and forecasts, compiled by Chip Eight

Currently, the global MCU market is showing a “half sea water, half flame” trend, with consumer applications at the core, supported by automotive and industrial sectors, and Chinese manufacturers continue to benefit from the recovery of domestic demand. Industry leaders like Zhaoyi Innovation are gradually achieving domestic substitution in consumer applications, while the industrial and automotive sectors are becoming key battlegrounds for new rounds of competition among domestic manufacturers. In the long run, as one of the segments with a large import scale, the domestic MCU manufacturers are clearly favored against the backdrop of the global semiconductor industry moving towards differentiation. Especially in the mid-to-high-end application fields represented by automotive-grade products, the demand and profit potential are enormous.

It is important to note that competition in the general MCU market remains intense, and while product prices have basically bottomed out, there is significant uncertainty regarding the expectations for recovery. Therefore, Chip Eight recommends that all parties carefully assess the risks and opportunities in the procurement and sales processes of related products to ensure the scientific and forward-looking nature of decision-making.

To join the “China IC Unicorn Alliance”, please click here

The content of this article comes from the internet. If there is any infringement, please contact us. For submissions and business cooperation, please contact via WeChat dolphinjetta.

Speaking of chips, welcome to follow and share