The analyst team of ASPENCORE’s “Electronic Engineering Magazine” conducted first-hand tracking surveys and analyses, combined with information from various companies’ official websites and public data, to select 30 domestic power management chip and power semiconductor manufacturers. They have provided appropriate quantitative assessments and comprehensive strength statements. This is another heavyweight report in the China Fabless 100 series of industry analyses, which is believed to provide readers with a more comprehensive and in-depth understanding of the current situation and future development trends of the Chinese power semiconductor market and local manufacturers.

This report is divided into the following nine parts:

-

Introduction to Power Management Chips and Power Semiconductor Devices

-

Global Power Management Chip (PMIC) Market Size and Major Manufacturers

-

Domestic Power Management Chip (PMIC) Market Size and Major Manufacturers

-

Wireless Charging/Fast Charging Submarket and Major Domestic Manufacturers

-

Global Power Semiconductor Market Size and Major Manufacturers

-

Domestic Power Semiconductor Market Size and Major Manufacturers

-

Wide Bandgap Semiconductor Market and Major Domestic Manufacturers

-

Basic Information of 30 Domestic Power Management Chip and Power Semiconductor Manufacturers

-

Appendix: Comprehensive Strength Comparison of 30 Domestic Power Management Chip and Power Semiconductor Manufacturers

1. Introduction to Power Management Chips and Power Semiconductor Devices

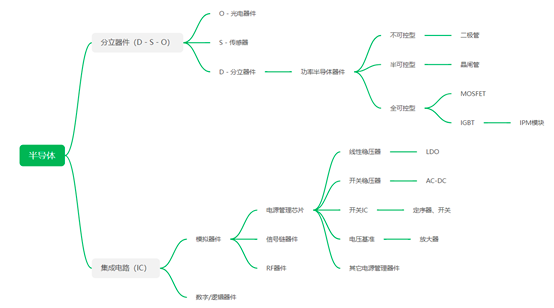

Power management and power (POWER) devices are fundamental to all electronic products and devices. From high-voltage transmission, AC-DC conversion, DC-DC conversion, to linear voltage regulation and stable output, various power discrete devices, integrated circuits, and modules are required for stable operation.

Power devices can be divided into power management integrated circuits and discrete power semiconductor devices. The former includes AC-DC, DC-DC conversion, LDO, battery management ICs, charging chips, and switching ICs; the latter includes rectifier diodes, thyristors, MOSFETs, and IGBTs.

Power management chips are integrated power management devices, mainly functioning in voltage regulation, step-up and step-down, constant current, AC-DC conversion, etc. They can be divided into linear regulators (LDO), charge pump chips, DC-DC converters, AC-DC converters, LED driver chips, etc. Typical applications include chargers for consumer electronics such as mobile phones and laptops, LED drivers, and power management for battery-powered devices. Additionally, industrial applications such as industrial automation devices and smart meters are also major application markets for power management chips.

Among power semiconductor devices, MOSFETs operating at the power output stage are usually used as standard devices paired with driver circuits, and their applications are very common in consumer electronics and automotive electronics. IGBTs (Insulated Gate Bipolar Transistors) are particularly suitable for current conversion systems with DC voltages of 600V and above, such as AC motors, frequency converters, switch-mode power supplies, lighting circuits, and traction drives. Discrete devices such as rectifier diodes, Zener diodes, and thyristors are also widely used in fields such as 5G, aerospace, power electronics, consumer electronics, security, industrial control, automotive electronics, green lighting, and new energy.

Moreover, the development of wireless charging technology and the market demand for fast charging for mobile phones have also driven the rapid growth of the market for wireless charging transceiver devices and power management chips compatible with various fast charging protocols. As the process technology of wide bandgap semiconductor devices matures and manufacturing costs decline, third-generation semiconductor devices primarily based on Gallium Nitride (GaN) and Silicon Carbide (SiC) are also beginning to enter the mainstream market, showing a trend of gradually replacing traditional silicon-based semiconductor devices.

2. Global Power Management Chip (PMIC) Market Size and Major Manufacturers

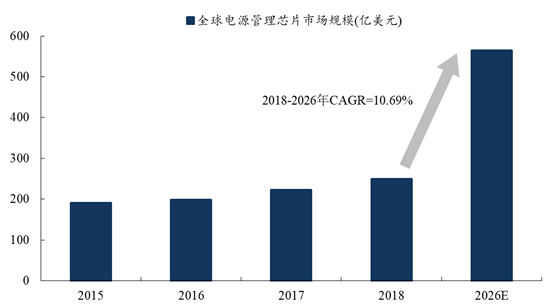

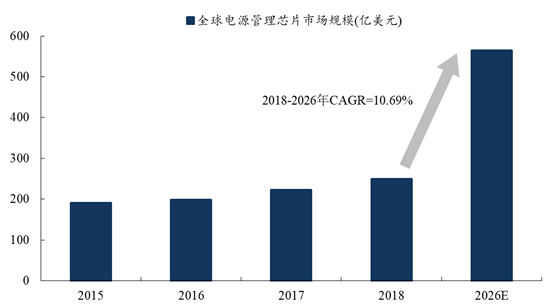

According to statistics and forecasts from Qianzhan Industry Research Institute, the global power management chip market size grew from $19.1 billion in 2015 to $25 billion in 2018. It maintained rapid growth in 2019, with the Asia-Pacific region, led by mainland China, being the largest growth area in the future. It is expected that by 2026, the global market size will reach $56.5 billion, with a compound annual growth rate (CAGR) of 10.69% from 2018 to 2026.

Data Source: Qianzhan Industry Research Institute

As the demand for battery-powered devices and the requirements for energy conservation and environmental protection in society and markets continue to rise, the power management of electronic devices is becoming more refined and differentiated. Power management chips have become key to improving overall performance and achieving differentiated competition. Chips are continuously developing towards high performance and miniaturization, with the internal circuit density of chips continually increasing. During the power supply process, the electric field strength endured by the internal circuits of the chip increases linearly as the distance decreases. Taking the conventional 5V power voltage as an example, its electric field strength is sufficient to cause chip breakdown. Therefore, electronic systems need power management chips with step-down, voltage stabilization, and anti-interference capabilities.

Wireless communication, consumer electronics, IoT devices, 5G, and new energy electric vehicles are all hot applications with strong demand for power management and power devices, but they also pose higher requirements. Power management devices and modules must not only achieve smaller sizes and higher power densities, complying with EMI radiation and safety isolation standards, but also attain low quiescent current, low noise, and high precision performance. Specifically, in terms of product categories, 5G mobile phones, 5G base stations, TWS wireless headsets, wireless/fast charging chargers, battery-powered IoT devices, as well as electric vehicles and charging piles will be the main driving forces for power management devices.

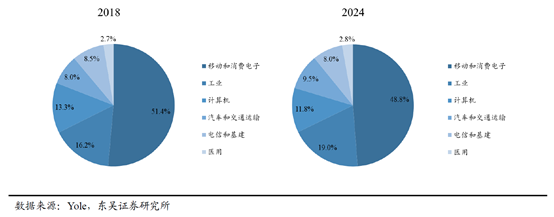

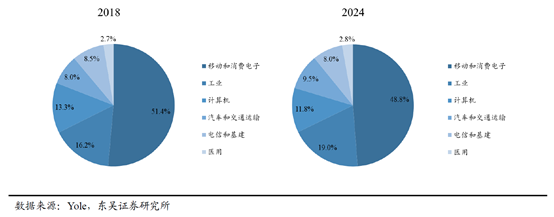

According to statistics from Yole, it is expected that from 2018 to 2024, the share of mobile communication and consumer electronics applications in the global power management chip market will decrease from 51.4% to 48.8%, but it will still be the largest submarket for power management chips. In addition, industrial and computing fields are also major sub-application areas for power management chips.

Although the largest terminal market for power management chips is still mobile phones and consumer electronics products, the price competition in this category is fierce, and the profits for chip manufacturers are relatively low. In the automotive and industrial power IC market application fields, due to higher application technology requirements, product gross margins are high, and foreign manufacturers mostly focus on the higher threshold automotive and industrial power sectors. For example, over half of ADI’s revenue comes from automotive and industrial fields. Overall, the future trend of the power management chip application field will shift from the low-end consumer electronics market to the high-end industrial and automotive markets.

Currently, the global power management chip market is mainly monopolized by international giants. According to market share in 2018, TI, Qualcomm, ADI, Maxim, and Infineon together accounted for 71%. In addition, NXP, MPS, ON Semiconductor, and Diodes also possess strong technical and market strength. In contrast, domestic power management chip manufacturers are relatively small and scattered, with overall strength still quite weak.

3. Domestic Power Management Chip Market and Major Manufacturers

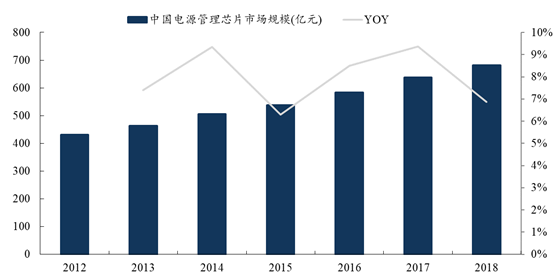

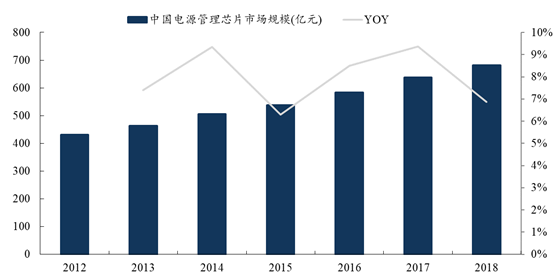

According to statistics from CCID Consulting, from 2012 to 2018, the domestic power management chip market size grew from 43.068 billion yuan to 68.153 billion yuan, with a compound annual growth rate of 7.95%, maintaining a stable growth trend overall.

Data Source: CCID Consulting

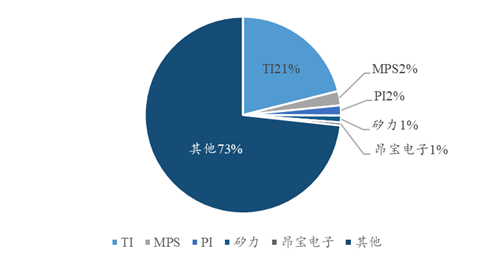

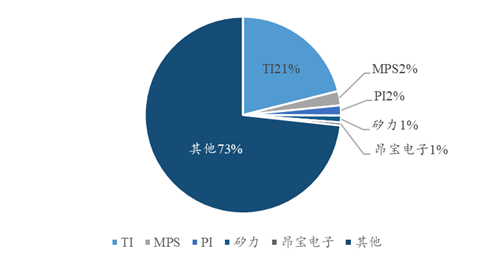

In the domestic power management chip market, overseas manufacturers such as TI, MPS, and PI together occupy about 80% of the market share. The competition in the consumer electronics market is exceptionally fierce, and domestic power management IC manufacturers are rapidly rising in this market. Meanwhile, overseas manufacturers have shown a trend of gradually withdrawing from the consumer market, shifting towards high-performance and high-profit markets such as automotive, industrial, military, and aerospace.

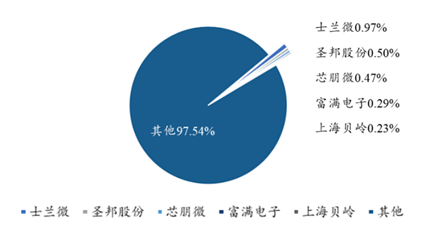

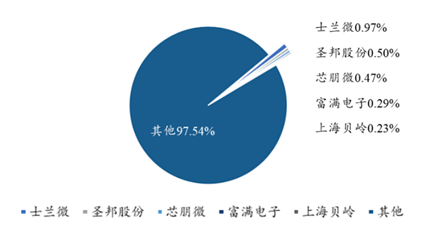

Among domestic power management IC manufacturers, companies such as Singatron, Chipown, Silan Microelectronics, and Shanghai Belling occupy a leading position in the domestic market, especially Singatron, Silan Microelectronics, and Chipown, whose sales of power management chips reached 663 million yuan, 340 million yuan, and 312 million yuan respectively in 2018.

The market share of domestic power management chip manufacturers in 2018 is as follows:

In the seven major sectors of new infrastructure, 5G, artificial intelligence, and big data centers are aimed at achieving “digital industrialization,” while new energy vehicles, intercity high-speed rail, ultra-high voltage, and industrial IoT aim to achieve “industrial digitization.” Whether in traditional industries or emerging digital industries, they cannot do without foundational elements such as power and semiconductors. Power semiconductors used for power transmission, conversion, and management will undoubtedly be the most fundamental driving force behind new infrastructure. The trend of new infrastructure and “domestic substitution” will create enormous development space and opportunities for domestic power management chip manufacturers.

4. Wireless Charging/Fast Charging Submarket and Major Domestic Manufacturers

In recent years, fast charging and wireless charging, driven by global mainstream smart terminal manufacturers such as Apple, Huawei, Samsung, and OPPO, have gained favor among consumers. Since each smartphone or laptop is typically equipped with at least one or multiple power adapters or chargers, the vast terminal applications are expected to significantly boost the market demand for power management chips.

The USB PD fast charging technology, with its rich charging voltage and current configurations, allows various electronic devices to meet power supply needs through a single USB cable, not only powering mobile devices but also directly powering laptops and monitors, achieving bidirectional charging. Given the high penetration of USB interfaces in the electronics market, the application prospects for USB PD fast charging are very broad.

Additionally, the application of Gallium Nitride (GaN) devices is also driving the continuous upgrade of fast charging technology. GaN transistors outperform traditional silicon-based MOSFETs in switching performance, enabling higher switching frequencies, thereby improving power density and transient performance while maintaining reasonable switching losses. With higher energy conversion efficiency, GaN fast charging has lower power consumption and reduced heat generation, allowing for smaller charger product designs, and is expected to become an important direction for fast charging upgrades.

In the wireless charging and fast charging charger market, several domestic chip manufacturers are competing, including EasyCharge Wireless, Ingenic Semiconductor, and Zhonghui Chuangzhi. In the GaN fast charging charger market, companies such as Zhuhai InnoSic and Suzhou Liangwei Semiconductor have also begun mass production and delivery.

5. Global Power Semiconductor Market Size and Major Manufacturers

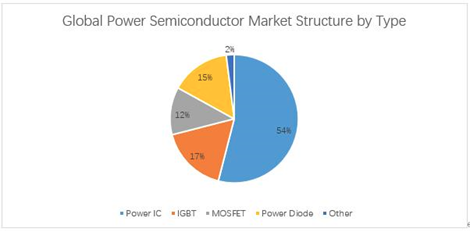

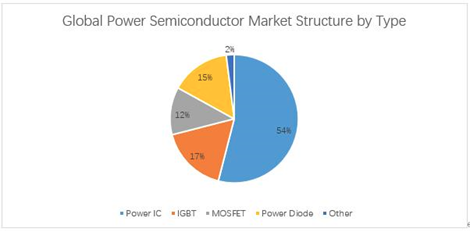

Power ICs, IGBTs, MOSFETs, and power diodes are the four most widely used power semiconductor products. According to authoritative market research agencies, in 2017, power ICs accounted for 54% of the global power semiconductor market, making it the largest power semiconductor product by market share. Power ICs integrate components such as transistors, diodes, resistors, and capacitors on semiconductor chips, providing the required circuit functions. Depending on their applications, power ICs include AC-DC conversion, DC-DC conversion, power management, and driver ICs.

IGBTs accounted for 17%, and due to their wide operating frequency range, they can cover higher power ranges, making them widely used in fields such as railway transportation, photovoltaic power generation, and automotive electronics. MOSFETs accounted for 12%, mainly used in uninterruptible power supplies, switch-mode power supplies, and inverters; power diodes accounted for 15%, mainly used in power supplies, adapters, automotive, and consumer electronics.

According to IHS data, the global power semiconductor market size was approximately $39.1 billion in 2018, reaching $40.3 billion in 2019. It is expected that the market size will grow to $44.1 billion in 2021, with a CAGR of 4.1% from 2018 to 2021. Among these, the Chinese market accounts for about 35%, with a market size of $13.8 billion, a year-on-year growth of 9.5%, making it the largest single market for power semiconductors globally.

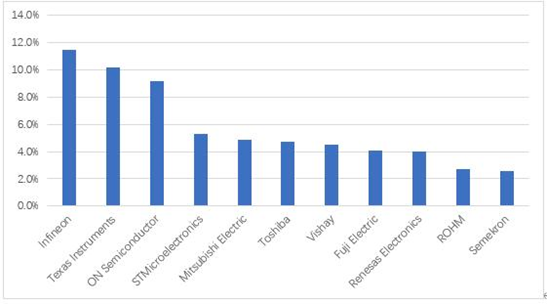

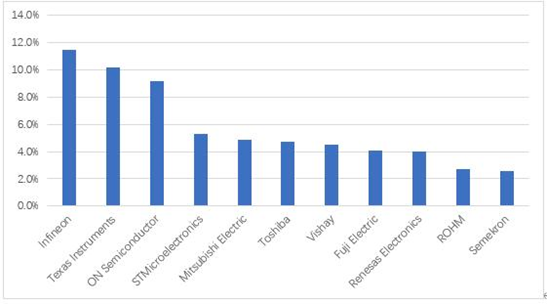

The major manufacturers and market shares in the global power semiconductor market in 2019 are as follows:

Currently, the global power semiconductor market is mainly monopolized by overseas manufacturers such as Infineon, TI, ON Semiconductor, and ST. Domestic manufacturers have a relatively low self-sufficiency rate in multiple sub-markets, making the localization of power semiconductors imperative.

6. Domestic Power Semiconductor Market Size and Major Manufacturers

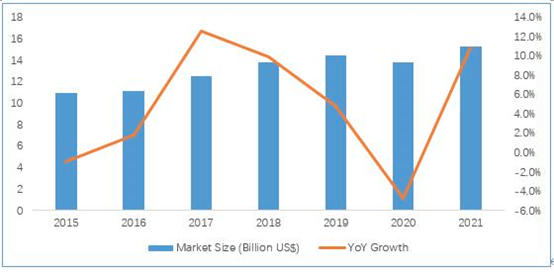

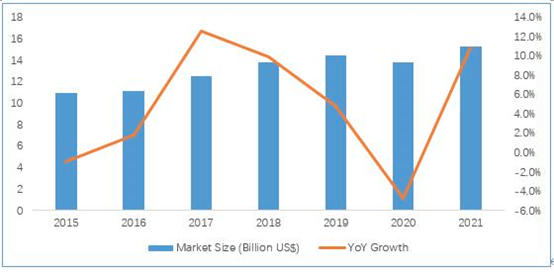

Due to the impact of the global COVID-19 pandemic, the growth trend of the global power semiconductor market in 2020 became difficult to predict. The expected outlook is a negative growth of -9.1%, with the market size reaching $36.7 billion. From 2020 to 2021, it will grow by 8.1%, reaching $39.6 billion.

In 2019, China’s power semiconductor market was approximately $14.48 billion, accounting for 35.9% of the global power semiconductor market. A negative growth is expected in 2020, dropping to $13.8 billion. It is anticipated that growth will resume in 2021, with a growth rate exceeding 10%.

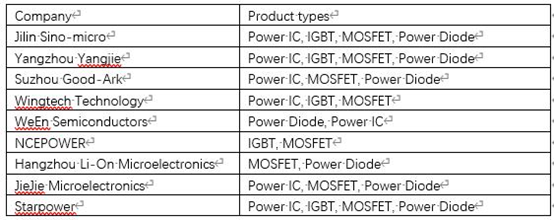

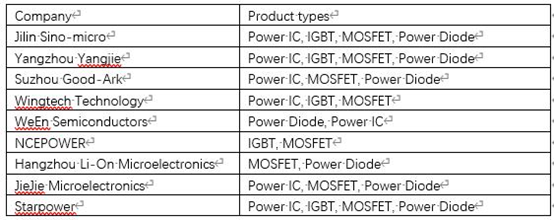

Although China’s market size occupies one-third of the global power semiconductor market, the proportion of domestic manufacturers is relatively low. International giants like Infineon, ST, and Renesas still dominate the domestic market. However, we can also see that traditional power semiconductor manufacturers such as Jilin Huayi, Yangzhou Yangjie, and Suzhou Gude have shown strong competitiveness in the low-end MOSFET, diode, and thyristor markets. Companies like Huazhong Microelectronics, Silan Microelectronics, and BYD Semiconductor are also gradually gaining market position in the IGBT field.

The following table lists some domestic power semiconductor manufacturers and their main products.

Products represented by MOSFETs in the mid-to-low-end power semiconductor category have relatively mature technology and applications, with low industry barriers, facilitating rapid entry for domestic manufacturers. As overseas giants gradually withdraw from the mid-to-low-end power semiconductor market to focus on high-profit products in automotive electronics and new energy sectors, the global mid-to-low-end power semiconductor industry is gradually shifting towards Taiwan and mainland China. With cost advantages and a closer geographical advantage to the local market, domestic power semiconductor manufacturers are expected to achieve breakthroughs in the mid-to-low-end of the industry chain first, continuously increasing their market share.

7. Wide Bandgap Semiconductor Market and Major Domestic Manufacturers

Research and application of wide bandgap semiconductor materials represented by Gallium Nitride (GaN) and Silicon Carbide (SiC) have a history of over 20 years, but their commercial development prospects have only recently begun to emerge. The RF front-end of 5G communication has strict requirements for high frequency and high efficiency, which is where GaN comes into play. Additionally, the rapid demand for efficient charging in electric vehicles and portable electronic products will also drive GaN power devices into the mass market, gradually replacing traditional silicon power devices.

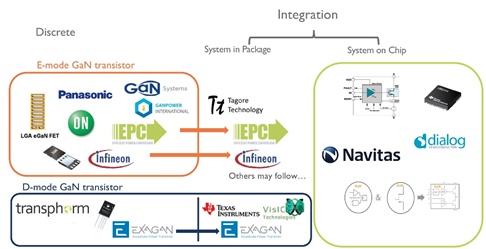

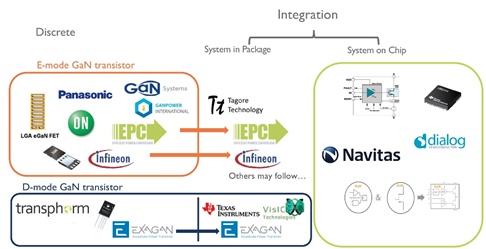

GaN devices can be divided into two major categories: discrete devices and integrated devices. Discrete devices mainly include enhancement-mode (E-Mode) GaN transistors and depletion-mode (D-Mode) GaN transistors, with representative manufacturers including Panasonic, EPC, Infineon, ON Semiconductor, GaN Systems, and Transphorm. Integrated devices are further divided into system-level package integration and system-level chip integration, with representative manufacturers including TI, EPC, Infineon, Navitas, Power Integrations (PI), and Dialog.

Classification of GaN devices and representative manufacturers. (Source: Yole)

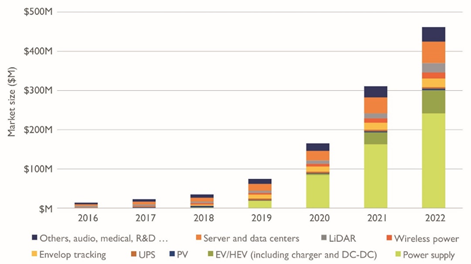

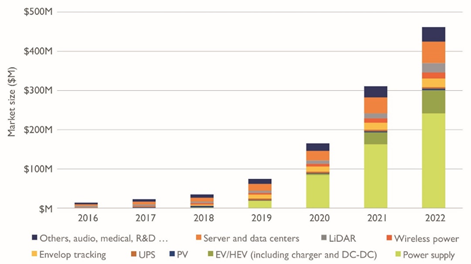

According to Yole’s forecast of the segmented market for GaN applications, GaN began to grow rapidly in the power application field from 2019, and it is expected to exceed $200 million by 2022, with mobile device fast charging chargers being the main driving force.

Growth and scale of the main application markets for GaN devices, with non-automotive power applications growing the fastest. (Source: Yole)

Although domestic research and manufacturing of third-generation semiconductors in China started relatively late, a number of significant projects for GaN and SiC are currently under construction, including Xiamen Sanan Integrated’s production line covering GaAs, GaN, and SiC chips and epitaxy; CR Microelectronics’ 8-inch silicon-based GaN production line; InnoSic’s 8-inch silicon-based GaN production line in Suzhou; and Silan Microelectronics’ 12-inch advanced compound semiconductor production line in Xiamen. In addition to these heavily capitalized IDM or foundry manufacturing lines, startups such as Basic Semiconductor in Shenzhen and Nitride Silicon Technology in Chengdu are also entering the market, with expectations for more domestic manufacturers to establish and grow in the emerging wide bandgap semiconductor industry in the future.

8. Basic Information of 30 Domestic Power Management Chip and Power Semiconductor Manufacturers

The ASPENCORE analyst team selected 30 of the most representative domestic power management and power device manufacturers from numerous companies, categorized as follows:

-

Power Management Chips: 15

-

Wireless Charging/Fast Charging Devices: 5

-

Power Semiconductor Devices: 5

-

Wide Bandgap Semiconductors: 5

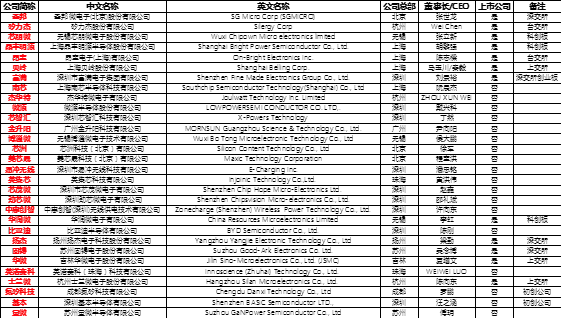

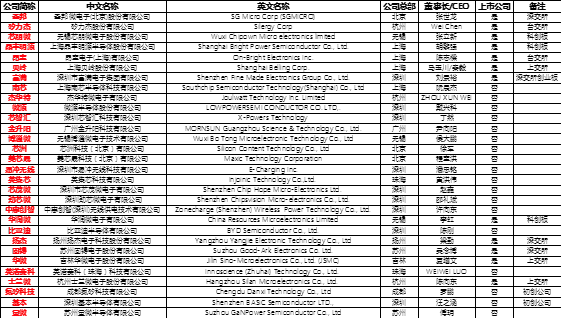

Statistical table of information for 30 domestic power management chip and power semiconductor manufacturers:

Among these 30 manufacturers, 12 are publicly listed companies, and two are startups established less than five years ago. From the distribution of company headquarters, Shenzhen has the most with 9; Shanghai has 4; Beijing, Wuxi, and Hangzhou each have 3; Suzhou and Zhuhai each have 2; and Chengdu, Guangzhou, Yangzhou, and Jilin each have 1.

9. Appendix: Comprehensive Strength Comparison of 30 Domestic Power Management Chip and Power Semiconductor Manufacturers

Core Technology: Low-power analog signal chain and power management technology

Main Products: Over 1,400 models across 16 major series of high-performance analog IC products, including operational amplifiers, comparators, audio/video amplifiers, ADCs/DACs, analog switches, level shifters and interface chips, small logic chips, LDOs, microprocessor power monitoring chips, DC/DC converters, backlight and flash LED drivers, OVP and load switches, motor drivers, MOSFET drivers, battery protection and charging/discharging management chips, etc.

Key Applications: Communication equipment, consumer electronics, industrial control, IoT smart devices, wearable devices

Main Customers: General strong in analog devices, with a wide range of applications and many customers

Competitive Advantage: A complete product line for analog signal chains and power management

Core Technology: 30W isolated charging pump fast charging technology, MiniLED driver

Main Products: Battery management chips, DC-DC converters, overcurrent protection devices, LED drivers, PMU

Key Applications: Consumer electronics, industrial applications, computers, communication network devices

Main Customers: Smart TV manufacturers, computer and tablet manufacturers

Competitive Advantage: Over 1,200 PMIC-related patents

Core Technology: High-voltage industrial-grade power management technology

Main Products: AC-DC converters, DC-DC converters, charging management, AC-DC industrial power chips

Key Applications: Household appliances, standard power, mobile digital devices, industrial drives

Main Customers: Midea, Gree, Skyworth, Philips, ZTE, Huawei

Competitive Advantage: High and low voltage integration technology platform

Main Products: LED lighting driver chips, motor control chipsets

Core Technology: Smart lighting driver chip technology

Key Applications: LED lighting, motor driving

Main Products: Power management, LED control and driving, MOSFETs, MCUs, non-volatile memory, RFID, RF front-end

Core Technology: Type-C PD controller, temperature control for LED lighting systems

Key Applications: Consumer electronics, automotive electronics

Main Products: Smart metering SoC, power management, non-volatile memory, high-speed high-precision ADCs, industrial control semiconductors

Core Technology: Next-generation smart meter metering, 5G communication data converter technology

Key Applications: Electric meters, mobile phones, LCD TVs and tablet displays, set-top boxes

Core Technology: Sub-micron CMOS, Bipolar, Bicmos, BCD process technologies for analog and digital mixed ICs

Main Products: AC/DC power management chips, lighting and backlight driver chips, MCU products

Key Applications: Communications, consumer electronics, computers, and interface devices

Competitive Advantage: Leading manufacturer of AC/DC power management chips for computer and mobile phone chargers, with over 300 power management-related patents

Core Technology: Buck-boost technology

Main Products: Buck-boost power chips, charging management chips, charge pump chips, wireless charging devices

Key Applications: Mobile phone chargers, consumer electronics, portable power supplies, vehicle-mounted chargers

Main Customers: Huawei, Xiaomi, and other mobile phone manufacturers

Competitive Advantage: Dominant position in charging devices for smart terminals

Core Technology: High-efficiency battery management systems

Main Products: DC-DC converters, battery management systems, linear power supplies, LED lighting drivers

Key Applications: Consumer electronics, industrial applications, communication and enterprise computing fields

MicroSource Semiconductor

Core Technology: Power management and battery charging

Main Products: Battery charging chips, battery management system chips, overvoltage/overcurrent protection chips, boost/buck devices, LED driver chips

Key Applications: Battery systems, display systems, wireless communication systems, and personal wearable devices, etc.

Shenzhen Chip Intelligence

Core Technology: Unique leading technologies in power measurement, power management, audio codec, etc.

Main Products: Power management units, battery management units, audio codecs, interface chips

Key Applications: Tablets, TV boxes, dash cameras, sports DV, wireless storage devices, smart hardware, handheld payment terminals, e-books, micro projectors, etc.

Core Technology: System integration packaging (Chiplet SiP) platform technology, magnetic isolation technology, and research and application of products

Main Products: CAN/485 isolated transceiver modules, AC/DC power control chips, DC/DC power control chips, interface chips, startup chips, digital isolators, contactor power-saving control chips

Key Applications: Industrial control, power, rail transit, automotive electronics, IoT, 5G, medical

Competitive Advantage: Over 500 invention patents and independent R&D technology, Chiplet SiP packaging process, providing one-stop power solutions

Global Semiconductor/Wuxi Botong Micro

Core Technology: Digital power management chips

Main Products: 120-180V compatible DCM-CCM-QR mode synchronous rectification, 85V process SSR chips

Key Applications: 5G smart terminals, consumer communication, industrial control, TV power and white goods, motor-power applications, network communication products, medical device power

Main Customers: Alibaba, Baidu, Xiaomi, Lenovo, JD, ZTE, Changhong, Meiling, Tencent

Emerging Projects: Motor-power management, lithium battery charging package management

Competitive Advantage: Innovator of third-generation digital power management chips, chip supplier for one-stop power solutions

Core Technology: Power conversion and power control

Main Products: High-voltage input buck DC-DC converters, high-power boost DC-DC converters, high-power power device gate drivers, wireless charging transmitter PMICs

Key Applications: Industrial control, industrial power, BMS, smart tools, robotics, white goods, automotive electronics, communication base stations, audio systems, wireless charging power transmission

Main Customers: Invech, Roborock Technology, Hemai, Midea, TCL Air Conditioning, Gree Jinghong, Inovance, Huayang, Zhirui, Guoguang, Beland, Lingtong

Emerging Projects: Automotive-grade DC-DC converters

Core Technology: Focused on power semiconductors and smart sensors, providing customers with a series of semiconductor products and services

Main Products: MOSFETs, IGBTs, power ICs, smart sensors, MCUs, etc.

Key Applications: Power devices focus on three electric applications: battery, power supply, motor; smart sensors focus on IoT and health fields

Main Customers: Major appliance manufacturers such as Midea and Haier, dominating the market share in low-speed electric vehicle motor controllers, as well as some small appliances and mobile phone charger manufacturers

Competitive Advantage: Semiconductor enterprise with integrated operations capability across chip design, wafer manufacturing, and packaging testing, with strong product technology and manufacturing process capabilities in discrete devices and integrated circuits, forming advanced specialty processes and a series of product lines.

Core Technology: Magnetic resonance wireless power supply technology, wireless power supply solutions for kitchen appliances

Main Products: Various power wireless power supply ICs and modules

Key Applications: Wireless charging for mobile phones, wireless power supply for robots, wireless power supply for electric tools, wireless charging for electric vehicles

Main Customers: State Grid Smart, Midea, Xinbao Co., Mu Yuan Co., Yijiahe

Competitive Advantage: The first company to commercialize wireless power supply for kitchen appliances

Core Technology: Gallium Nitride power devices, GaN ICs, advanced power solutions based on GaN

Main Products: Gallium Nitride power devices

Key Applications: USB-PD adapters, smart homes, PC/server power, electric vehicle OBC

Main Customers: BYD, Midea, Xiaomi, Furi Kang, Hanjia, TCL, and others

Competitive Advantage: Cutting-edge technology and solutions for Gallium Nitride power devices

Core Technology: High voltage, high current, high power analog power management and digital circuit design

Main Products: Wireless charging receiver chips, transmitting chips integrated with USB-PD protocol, LED driver chips

Key Applications: Wireless chargers, mobile fast charging, TWS earphone charging cases, and other smart terminal devices

Competitive Advantage: Focused on high-performance analog power, digital, and software integrated high-integration power management chips and system development

Core Technology: Instant charging without alignment, flat-plane fast charging wireless charging technology

Main Products: Multi-mode wireless charging receiver chips EC4016 and EC3016, various wireless charging transmitter solutions, wireless charging system optimization tools and coil design tools

Key Applications: Wireless charging applications for electronic devices such as mobile phones and tablets

Competitive Advantage: Holding over 30 core US patents in wireless charging, with years of engineering R&D experience in wireless charging system architecture, power electronics technology, electromagnetic compatibility design, electromagnetic radiation protection, and electromagnetic safety. Partnered with Hong Kong’s leading wireless charging technology manufacturer Convenient Power to establish EasyCharge Wireless Group (ConvenientPower Systems, CPS)

Core Technology: Power management, battery management, wireless signal processing, and high-performance audio signal processing technologies

Main Products: Power management, audio processing, and battery management (including mobile power SoC)

Key Applications: Smart phones, tablets, set-top boxes, IPC, vehicle charging, etc.

Core Technology: Integrated high-voltage synchronous rectification

Main Products: AC-DC converters, high-voltage synchronous rectification devices, fast charging chips

Key Applications: Consumer electronics, communications, computing, robotics, drones, power electronics, medical electronics, etc.

Core Technology: Reverse wireless charging solution CV8035D, supporting up to 20W receiving + 10W transmitting.

Main Products: Wireless charging transmitting and receiving chips

Key Applications: Focused on wireless charging, wearable devices, health care, mobile terminals, and other emerging fields

Core Technology: Design, manufacturing, and testing of automotive-grade IGBT and SiC devices

Main Products: Power semiconductor devices, IGBT power modules, power management ICs, CMOS image sensors, sensing and control ICs, audio and video processing ICs, etc.

Key Applications: New energy vehicles, industrial control

Competitive Advantage: The only domestic supplier of automotive-grade IGBT devices, with integrated advantages in semiconductor devices and electric vehicle systems

Core Technology: R&D technology platform for SiC/IGBT/MOSFET/Clip packaging and wafer design

Main Products: Discrete device chips, rectifier devices, protection devices, small signals, MOSFETs, power modules, silicon carbide, etc.

Key Applications: Power supply, home appliances, lighting, security, networking, consumer electronics, new energy, industrial control, automotive electronics, etc.

Competitive Advantage: Vertical integration (IDM) semiconductor manufacturer

Core Technology: Focused on semiconductor rectifiers, power diodes, rectifier bridges, and IC packaging testing

Main Products: Bridge rectifiers, diodes, polymer electrostatic suppressors, MOSFETs, automotive rectifiers, etc.

Key Applications: Power management modules, consumer electronics, automotive electronics, industrial equipment, computing devices, lighting, and communication devices

Main Customers: HW, Apple, BYD, Panasonic, Flextronics, Wistron, Hella, Omron

Competitive Advantage: A complete product line of semiconductor discrete devices, MEMS-CMOS three-in-one integrated manufacturing platform

Core Technology: Design, terminal design, and process control technology for power semiconductor devices

Main Products: Fully controlled power devices mainly based on IGBTs, MOSFETs, and BJTs (bipolar transistors); semi-controlled power devices mainly based on thyristors; uncontrollable power diode devices mainly based on Schottky diodes, FRDs (fast recovery diodes); IPMs (power modules); TVS (transient voltage suppression diodes), Zener diodes, TSS (semiconductor discharge tubes), and other semiconductor protection devices.

Key Applications: New energy vehicles, photovoltaics, frequency conversion, industrial control, consumer electronics, etc.

Competitive Advantage: A complete power semiconductor wafer production line

Core Technology: R&D and production of third-generation semiconductor power electronic devices

Main Products: 30V-650V GaN power and 5G RF devices

Key Applications: New energy vehicles, 5G communication, data centers, wireless charging, and fast charging

Emerging Projects: 8-inch silicon-based GaN production line

Competitive Advantage: Established China’s first 8-inch silicon-based GaN epitaxy and chip mass production line

Core Technology: High-voltage BCD, ultra-thin chip trench gate IGBT, super junction high-voltage MOSFET, high-density trench gate MOSFET, fast recovery diodes, MEMS sensors, and other process R&D, forming a relatively complete specialty process manufacturing platform;

Main Products: Power and drive product lines, MCU product lines, digital audio and video product lines, RF and mixed-signal product lines, discrete device product lines, etc.;

Key Applications: Consumer electronics, industrial control, automotive electronics, home appliances;

Main Customers: Global brand customers such as Huawei, Hikvision, Midea, Gree, Hisense, Haier, Samsung, Sony, Delta, Dako, Japan’s NEC, etc.;

Emerging Projects: Expansion project for an annual production capacity of 890 million MEMS sensors, production line project for specialty power modules and power device packaging testing;

Competitive Advantage: Integrated design and manufacturing of semiconductor and integrated circuit products (IDM) model

Core Technology: 650V~10kV silicon carbide process technology

Main Products: Silicon carbide Schottky diodes across all current and voltage levels, 1200V silicon carbide MOSFETs, automotive-grade all-silicon carbide power modules, and series products; 150mm silicon carbide epitaxial wafers

Key Applications: New energy, electric vehicles, smart grids, rail transit, industrial control, national defense, and military industries, etc.

Competitive Advantage: R&D and industrialization of silicon carbide power devices

Nitride Silicon Technology

Core Technology: Domestic mass production level 650V enhancement mode GaN MOSFETs

Main Products: Discrete high-speed GaN gate driver chips (DX1SE-A), 650V enhancement mode GaN MOSFETs, GaN power ICs (DX2SE65A150)

Key Applications: Mobile fast charging, data centers, on-board charging (OBC), LED power drivers, and 5G communication power, etc.

Content Source: Electronic Engineering Magazine, Author Gu Zhengshu, thank you!

China’s Advanced Unit for Innovation Services for Small and Medium Enterprises | Shenzhen Public Service Demonstration Platform for Small and Medium Enterprises

5A-level Social Organization | Guangdong Province’s Four Good Chamber of Commerce | Shenzhen’s Four Good Chamber of Commerce

Find Funding | Find Projects | Find Resources | Find Channels

Please contact the Shenzhen Electronic Chamber of Commerce