Among the various application scenarios for storage devices, the automotive sector is recognized as the next blue ocean market with high growth potential. However, in the past decade, global automobile sales have stabilized at around 80 to 90 million units per year. Therefore, the industry is not only focused on the incremental market brought about by electric vehicles replacing fuel vehicles but is also paying more attention to the enormous market space created by the massive data storage demands generated by automotive intelligence.

Statistics show that each smart car typically contains over 1,400 semiconductor devices to control functions such as airbags, engines, and brakes. This has led to the saying that “the future car is essentially a server/phone on four wheels” to describe people’s imaginations of future vehicles.

People are indeed working towards this goal in developing smart cars. Currently, the main onboard storage products are eMMC and UFS, with a small number of models using SSDs, which undergo automotive-grade verification, including extended temperature ranges, stricter quality standards, longer lifecycles, and lower failure rates.

However, is this onboard storage solution truly the “Mr. Right” for automotive applications? Or what kind of storage solutions do smart cars need? This is a question worth pondering by the industry.

1. How Did eMMC/UFS Take Root in the Automotive Market?

In the early mechanical fuel era of automobiles, the components requiring storage devices were few. The so-called infotainment system consisted of in-car players like MP3 and MP4, so relevant storage devices evolved from tapes and CDs to USB drives and TF cards. With the development of network communication technology, infotainment systems gradually evolved to resemble smart phones, and eMMC naturally entered the automotive field.

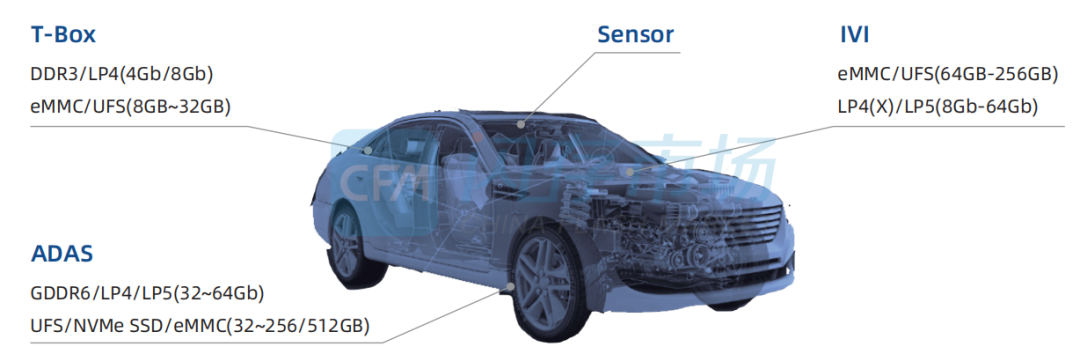

Market data shows that eMMC is still the primary form of onboard storage, while UFS is also developing rapidly. Why, despite the fact that automotive intelligence has developed to the point where data storage needs have spread across almost the entire vehicle, including digital dashboards, gateways/T-boxes, central entertainment, assisted driving, and data/drive recorders, do eMMC and UFS remain the main storage forms?

1. The Fundamental Reason is That eMMC/UFS Can Basically Meet Current Onboard Storage Needs

To date, eMMC products have evolved to version 5.1, offering storage capacities from 4GB to 256GB, with sequential read/write speeds reaching 330MB/s and 200MB/s (based on 64GB).

As for UFS products, the highest version has now reached 4.0, capable of providing 1TB of storage capacity, with sequential read speeds up to 4200MB/s and write speeds up to 2800MB/s.

With the development of electrical intelligence in vehicles, the form of storage devices is gradually transitioning from eMMC to UFS, with some models also introducing NVMe SSDs. At the current stage, ADAS (Advanced Driver Assistance Systems) and IVI (In-Vehicle Infotainment) are the two components with the largest storage demands in vehicles, and UFS products indeed meet the mainstream market needs in terms of capacity and performance.

Distribution of Automotive Storage Applications

Source: Public Information

Source: Public Information

2. SoCs from Automotive Platform Chip Manufacturers Support Embedded Storage Products

In the process of automotive intelligence, chip platform manufacturers play a crucial role. Currently, mainstream automotive platform manufacturers such as Qualcomm, NVIDIA, and MediaTek have launched automotive SoC products that support embedded storage products like LPDDR, eMMC, and UFS, similar to applications in smart phones.

Currently, Qualcomm’s SA8155P and NVIDIA’s Orin-X are high-end smart cockpit and ADAS solutions, supporting storage products of 12GB LPDDR4X/5, 128/256GB UFS, and 6GB/8GB LPDDR5, 128GB/256GB UFS/eMMC. MediaTek, Horizon Robotics, and other mid-to-low-end automotive platform chips also support embedded products.

Source: Public Information

Source: Public Information

Recently, MediaTek also launched its automotive solution, Dimensity Auto, which includes four major solutions covering the Dimensity Auto cockpit platform, Dimensity Auto connectivity platform, Dimensity Auto driving platform, and Dimensity Auto key components, essentially covering all scenario needs for smart vehicles.

2. Current Onboard Storage is Usable, But Not Convenient! Automotive Terminal Manufacturers Still Have Many Demands That Need to Be Addressed

As we all know, eMMC and UFS are storage products originally designed for smart phones, whose main advantages lie in their compact size, allowing phone manufacturers more design flexibility in cramped spaces. However, this feature is not the most necessary in automotive applications.

So, as a relatively emerging storage application scenario, aside from the basic automotive-grade, capacity, and bandwidth requirements, what other demands are there for storage products?

Lu Zhongqiang, embedded director at Xiaopeng Motors, stated in his speech at CFMS2023 that there are currently two major pain points in onboard storage: first, the current onboard storage is a managed black box type, making it difficult to directly access the Flash status and the state between the main control and Flash; second, storage product failures can lead to the entire machine being unable to start, with long analysis cycles and very high replacement costs.

3. The Standardization Path for Smart Cars is Still Exploring, Customization is the Best Solution for Now

Although the industry generally holds a positive outlook on the future development of smart cars, as of now, automotive intelligence is still at a relatively low level of L1/L2, and so-called intelligent assisted driving has not yet become a necessity for consumers; many consumers have never even activated the so-called assisted driving function.

From an architectural perspective, current smart cars have evolved from the initial distributed development to a domain-centralized approach. Despite some progress, the transmission efficiency between different control domains remains low, and the wiring harness increases the weight of the vehicle. Therefore, the future development of smart cars towards a central computing model is an inevitable trend.

With the continuous evolution of smart car architecture, the current market landscape is also undergoing a major reshuffle, as Huawei’s Yu Chengdong stated, the development of smart electric vehicles will replicate the transformation from feature phones to smart phones over a decade ago.

In this era of fierce competition in the automotive market, as Wallace Kou, general manager of Silicon Motion Technology, pointed out at CFMS2023, “for storage manufacturers, the most challenging aspect of entering the automotive market is the lack of standardized platforms in the automotive industry, whether it be SoC or OS.”

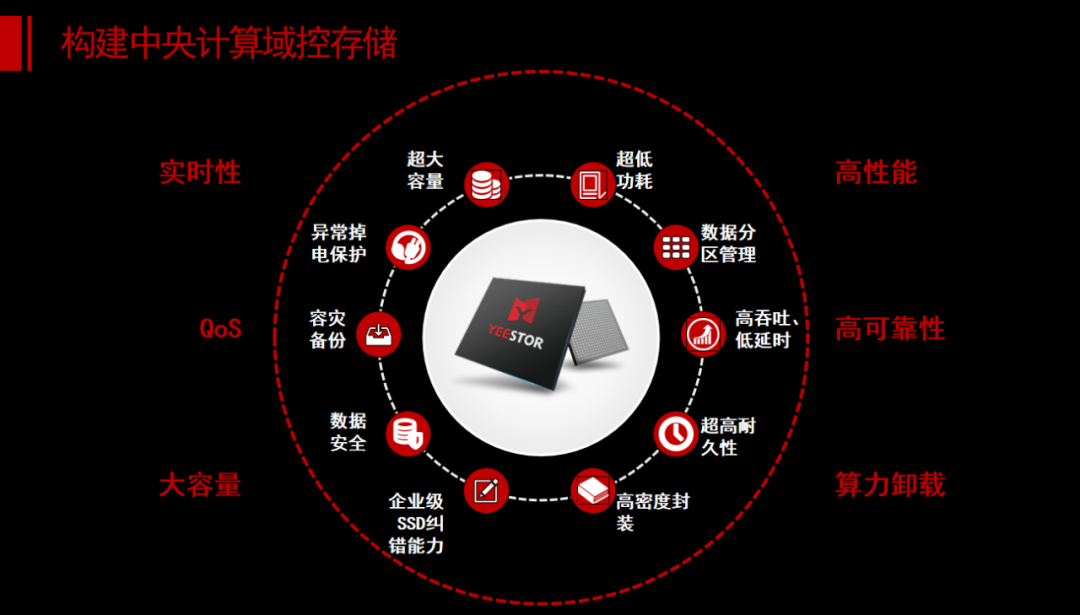

This lack of standardization is not only between different manufacturers but also varies by the needs of different functional domains within each vehicle. Wu Dawei, CEO of Deyi Microelectronics, stated, “although the automotive scene is limited, its various demands cover all key points of storage, such as real-time performance, QoS, large capacity, high performance, high reliability, and computational offloading, which must be met with different storage solutions, requiring customized solutions.“

Source: Deyi Microelectronics

Source: Deyi Microelectronics

Currently, for storage manufacturers, smart vehicles still belong to a relatively small industry market. According to CFM flash memory market data, automotive applications account for only about 0.5% of the entire NAND Flash market. We see more and more storage manufacturers using firmware optimization technology to deeply integrate with application scenarios, enabling storage to closely align with the read and write characteristics of use cases, providing optimal solutions for customers.

4. Envisioning the Future: Will There Be Auto Memory?

The intelligence of automobiles has created a beautiful blueprint for storage manufacturers, but it is still in its infancy, with a small scale, and the market landscape and product architecture are still being optimized and transformed, continuing to use existing product forms.

In the future, if the automotive market develops to a certain scale, will there be a specialized Auto memory, just like in the mobile phone market? I believe that in the face of a sufficiently large market scale, anything is possible! Let us wait and see together.

Latest Recommended Reading:

-

This week’s channel DRAM market is stagnant, with the market cautiously viewing price increases for some resources, and a consensus on the bottoming of the storage market gradually increasing.

-

Reports indicate that the EUV equipment rush has cooled; TSMC is said to be considering lowering its capital expenditures for this year; and Unisplendour’s Q1 AI server orders have significantly increased…

-

Samsung explores forward-looking technologies in the storage industry, gaining insights into the global storage market.

-

In March, South Korea’s memory chip exports saw a narrowed decline; Intel abandons its server business…

-

Q1 results are out for some companies in the storage industry; Korean media reports Samsung’s Q1 memory market share has increased by at least 1%; and Wingtech Technology claims no surge in server orders…