Yesterday, after Lao Zhang published “The 28th Extension of Trading Time, Is Qualcomm’s Acquisition of NXP Still Possible?”, an automotive electronics industry insider shared a lot of insider information with me. What struck me the most was his statement: “If Qualcomm merges with NXP, we will all be unemployed!” “MediaTek and Qualcomm are the grave diggers of our automotive electronics industry!”… Why would Qualcomm’s acquisition of NXP have such a significant impact? I have organized the content he shared, and I welcome everyone to leave comments or discuss.

It is clear that Qualcomm’s acquisition of NXP is aimed at entering the automotive electronics field, especially in the ADAS sector based on 5G technology. The high speed and low latency of 5G make the realization of autonomous driving truly possible. With NXP’s accumulation in automotive electronics and Qualcomm’s leading technology in 5G, they can essentially dominate the ADAS field. Additionally, many car manufacturers are concerned that Qualcomm will apply the same patent fee model used in the mobile phone sector to the automotive sector, which is why the EU hesitated for a long time before approving this acquisition. Currently, this acquisition has been approved in the US, Japan, and the EU, with only the Chinese Ministry of Commerce yet to approve it. Of course, such a large acquisition transcends the transaction between two companies; it will more significantly impact the semiconductor technology development of a country or region. Therefore, I have always emphasized that this acquisition should not be approved. I have stated many reasons for this, detailed in “Strongly Suggesting the Government Reject This Acquisition, We Cannot Let the Soaring Dragon Hit the Ceiling”. Currently, this acquisition has become a bargaining chip in the US-China trade war. Given President Trump’s approach, if he insists on establishing stricter trade barriers against China, the chances of this acquisition falling through are increasing. This is from the perspective of a country’s or region’s technological development. Below are the industry insights regarding this acquisition in the automotive electronics field.

First, let’s clarify ADAS and autonomous driving.

What are ADAS and Autonomous Driving?

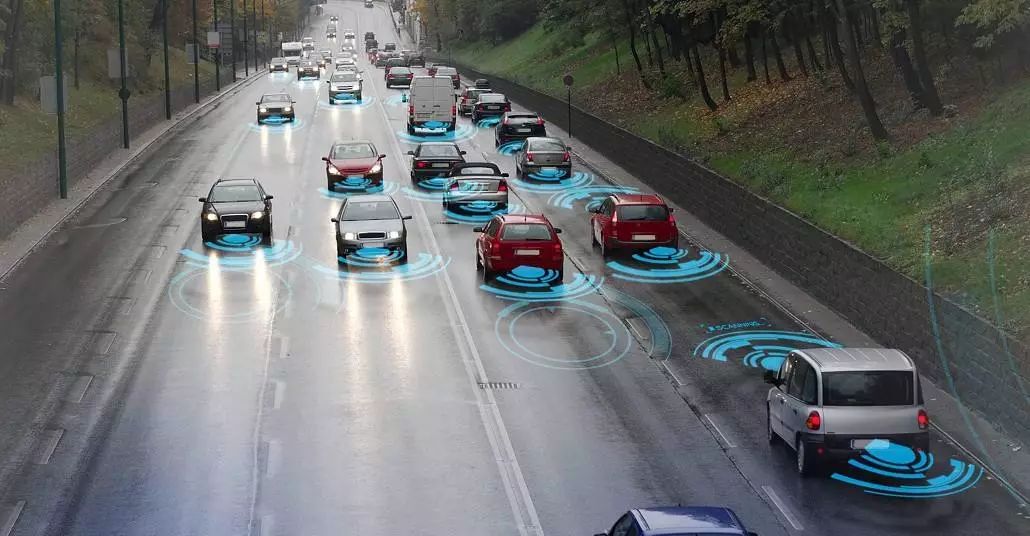

ADAS stands for Advanced Driver Assistance System, which translates to a system that assists drivers in various ways. In layman’s terms, it uses various sensors installed in the vehicle to collect data and combines it with map data for system calculations, thereby predicting potential dangers for the driver to ensure driving safety.

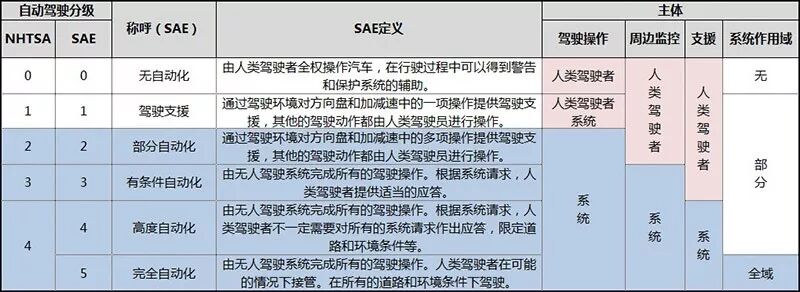

We need to clarify that ADAS is not autonomous driving; the research focuses of the two are entirely different. ADAS is about assisting driving, with a core focus on environmental perception, while autonomous driving involves artificial intelligence, with a significantly different system. However, ADAS can be seen as a prerequisite for autonomous vehicles, and there is a viewpoint that autonomous driving evolves continuously from ADAS. Let’s take a look at a diagram of the stages of vehicle automation published by the National Highway Traffic Safety Administration (NHTSA):

ADAS is not a single configuration but a system composed of several configurations working together. So what configurations make up ADAS? Currently, Wikipedia lists the following 17 configurations for ADAS:

1. Navigation

2. Real-time Traffic Management System (TMC)

3. Intelligent Speed Adaptation (ISA)

4. Vehicle Communication Systems

5. Adaptive Cruise Control (ACC)

6. Lane Departure Warning System (LDWS)

7. Lane Change Assistance

8. Collision Avoidance System or Pre-Crash System

9. Night Vision

10. Adaptive Light Control

11. Pedestrian Protection System

12. Automatic Parking

13. Traffic Sign Recognition

14. Blind Spot Detection

15. Driver Drowsiness Detection

16. Hill Descent Control

17. Electric Vehicle Warning Sounds System

Implementing all these functions essentially equates to achieving autonomous driving. Generally, ADAS functions are primarily reflected in six areas:

1. Night Vision (NV)

2. Pedestrian Detection (PD)

3. Traffic Sign Recognition (TSR)

4. Lane Departure Warning (LDW)

5. Blind Spot Monitoring (BSM)

6. Rear-Cross Traffic Alert (RCTA)

The transition from ADAS to autonomous driving is generally a viewpoint held by traditional automakers, while internet-based automakers believe that autonomous driving does not need to transition from ADAS and can directly achieve level 4 or level 5 driving through technology. For example, Google has directly reached level 5.

Returning to the main topic, I will express the industry’s views on Qualcomm’s acquisition of NXP in the first person.

Industry Experts’ Views on Qualcomm’s Acquisition of NXP

I am an engineer with 22 years of experience in automotive electronics products, having worked on Freescale i.MX2/3/5/6 series automotive processors and recently obtained the i.MX8 development board; I have also been studying Intel’s automotive processors, Atom Gen1 Tunnel Creek and Gen2 Apollo Lake.

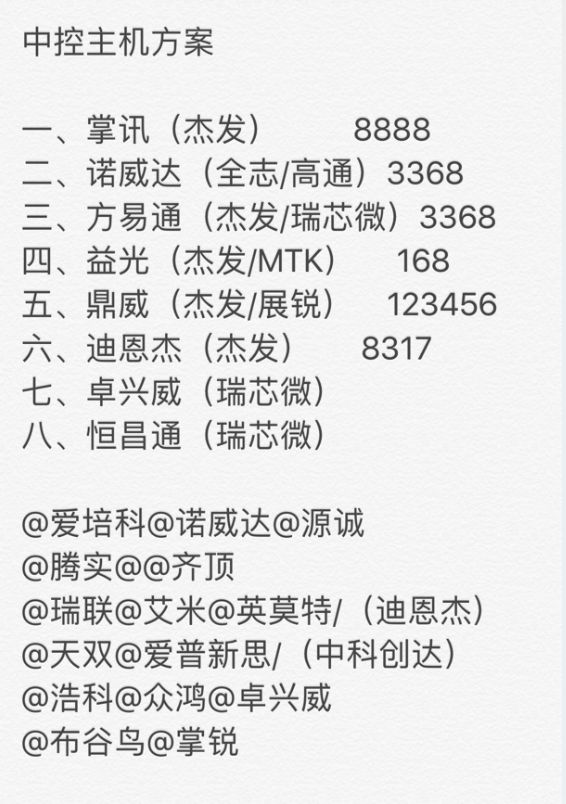

In the past three months, I have visited automotive electronics and central control host solution companies in Shenzhen and Beijing. Essentially, the domestic industry is at the level shown in the diagram, with everyone’s goal being survival. There are very few companies with a scale of over 100 million, and we are very far from chip design, not even on the same level as Qualcomm and NXP, completely in different worlds.

In the field of OEM automotive electronics, central control hosts, and autonomous driving, there are only a few automotive-grade chip suppliers available. Currently, NXP holds a 60% market share in the OEM central control host market, and NXP has an undisputed dominant position, while Renesas holds 20%.

Intel, NXP, Renesas, Qualcomm, Nvidia, TI, Samsung, and Xilinx are the eight major players. Intel, Nvidia, TI, Xilinx, Samsung, and Qualcomm all hold the title of world leaders in their respective subfields: CPU, GPU, DSP, FPGA, Memory, and Modem. This competitive advantage is too obvious, while NXP and Renesas are based on a series of companies that have gone bankrupt and been restructured. In my view, our gap is at least two generations wide. Although Huawei’s HiSilicon has this foundation, it will still take several years.

So, I joked with my colleagues yesterday that if Qualcomm merges with NXP, we will all be unemployed! Because the Chinese automotive electronics industry chain has no resistance or immunity!

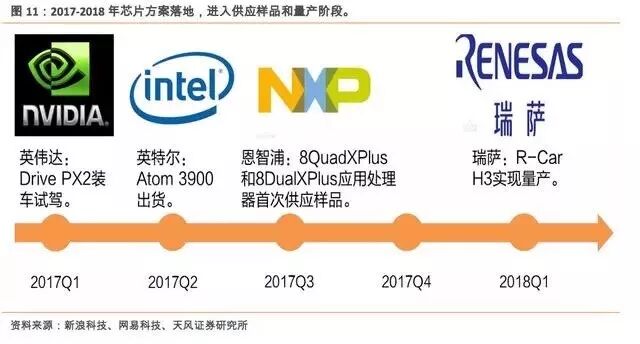

In the roadmap for automotive electronics chips, only companies with relative scale and strength can publish. Generally, it takes three years for chips to go into mass production, and it usually takes five years for mass-produced models to be commercially available. The complete lifecycle of automotive-grade chips is 7-15 or 10-20 years. The testing and certification process for AEC-Q100/101/200 Grade 1/2/3 and ISO26262 ASIL-A/B/C/D generally takes 18-36 months, and entry-level manufacturers typically need 3-5 years to complete.

In the central control host system SoC/ASIC field, it is generally dominated by the eight major players. Although ST is large, it has not yet entered the market. ST, ON, and Infineon are mainly suppliers of automotive electronic power devices, and our domestic OEM share is strictly speaking zero. Currently, Allwinner has only passed one T7, which is just the beginning of a long journey, and it will take at least two more years for large-scale applications.

Qualcomm has been preparing automotive electronic central control processors since the Snapdragon 820, while Allwinner and Rockchip have started around the same time. In fact, Philips’ core technology has long been hollowed out, and the real technology is in Freescale/Motorola.

NXP’s i.MX8 is expected to go into mass production for automotive-grade chips by the end of this year or early next year, while Intel’s Apollo Lake automotive processor A3900 was released at the end of last year. MTK’s automotive chips are also making a comeback, competing with 4D Mapping and Jiefa, but the rapid turnover of these products may not necessarily be valuable.

Personally, I believe that approving the merger of Mstar and MTK was a huge mistake, and Toshiba is even more ignorant. If the acquisition of NXP is approved, it would be utterly without bottom line. MTK and Qualcomm are the grave diggers of our engineers, as their solutions have essentially stifled our local design capabilities, and everyone just needs to become a boss and count money. Therefore, from our industry’s perspective, it is best not to approve this acquisition, as it would have a significantly negative impact on the industry.

What are your thoughts on this acquisition? Feel free to leave comments! Thank you!

Welcome to follow the annual technology conference. Click to read the original link for more information.

Recent Popular WeChat Articles

1. Zeng Xuezhong: Battling for the Top Two Markets, Transforming Unisoc into a Leading Chip Giant

2. In-Depth Reveal of Huawei’s “Scary Technology”

3. Domestic MCUs Need to Break Through, Learning These Five Points from ST

4. How Can Chinese Chips Break Through from the “Choke Point”? Looking at the Future of Chinese Chips from These 10 Models

5. Breaking the US and European Monopoly, Domestic Only Automotive-Grade TPMS Chips in Mass Production

6. Why Did Huawei’s Mobile Share Increase Instead of Decrease During the “Cold Winter”? Honor 10 Tells You the Answer

7. National Products Should Strengthen Themselves, Domestic MTP Assists Low-Power Design for IoT

8. Breaking News! MediaTek Enters the ASIC Design Service Field with 20 Years of Design Experience

9. What Warnings Did ZTE’s Ban Provide Us?

10. What Big Moves is Zhao Weiguo Planning?

If you find this valuable, please feel free to follow my WeChat account.

This account is personally operated by Zhang Guobin, with fans primarily being decision-makers in the semiconductor field. This account focuses on the latest technological trends and emerging technology applications in the global semiconductor industry, interpreting the latest dynamics of the semiconductor industry. Please extend your hand and click, and we will be inseparable good friends! For business cooperation, please add my personal WeChat: eetrend-richard. Recently, I have received many inquiries regarding investment and financing needs; feel free to add me on WeChat for details.