Automotive professionals should pay attention

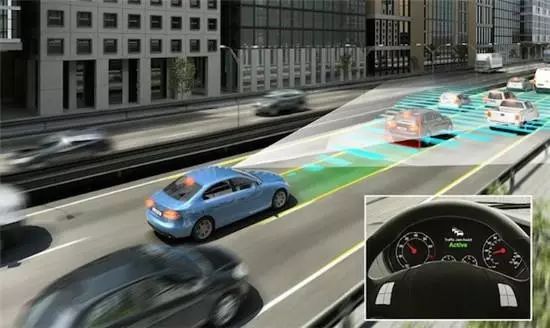

At a recent forum on intelligent connected vehicles, several industry insiders revealed that driven by policies and regulations, ADAS (Advanced Driver Assistance Systems), which has become a hot topic in the industry this year, will receive more attention in 2017. Meanwhile, startups engaged in the research and production of ADAS, especially those aiming to enter the OEM market, are expected to welcome a period of development opportunities.

However, is reality as people expect? What challenges do domestic ADAS startups face on their path forward? With opportunities ahead, are they ready?

Policies and Market Create Dual Driving Forces

As the market demand for intelligent driving continues to expand, automotive manufacturers have expressed that they will equip new models with ADAS features. While automakers can still choose traditional first-tier component suppliers from the supply chain, they are also attempting to collaborate with ADAS solution startups for joint research and development. According to reporters from China Automotive News, many domestic brands, including FAW, Great Wall, JAC, and BAIC, are in contact with various startups.

Why is there such a breakthrough? Rong Hui, Deputy Director of the New Technology Research Institute of BAIC Group, revealed to China Automotive News that this is based on considerations of both technological levels and product rhythms. He stated that domestic ADAS startups have reached a certain level in visual recognition and millimeter-wave radar perception research and have made targeted adaptations based on China’s unique traffic conditions. Moreover, the product pricing from these companies is more competitive.

In collaborations with automakers, startups have shown themselves to be trustworthy. “When we are working overtime for the final sprint, these startups are fighting alongside us,” Rong Hui said. “In contrast, first-tier suppliers only arrange their work based on their own timelines, which feels somewhat like ‘the big shop bullies the customer.'”

In fact, the efforts of car manufacturers and ADAS vendors are closely related to the promotion of regulations and policy environments. It has been reported that the revised draft of the “Technical Conditions for the Safe Operation of Motor Vehicles” (GB7258), formulated by the Ministry of Transport, proposes requirements for the installation of certain safety devices and systems, which includes some ADAS functions. There are also reports that some ADAS functions will be included in the C-NCAP evaluation criteria for new cars in 2018.

Millimeter-Wave Radar Applications Become a New Direction

Currently, domestic ADAS startups mainly have two product routes: one utilizes image recognition technology to achieve functions such as traffic sign recognition and lane departure warning (LDW); the other employs millimeter-wave radar technology to meet user demands for adaptive cruise control (ACC) and automatic following.

In the field of image recognition technology research and development, startups have started relatively early. According to incomplete statistics, at least eight companies have received financing. Chen Mao, founder and CEO of Chuanglai Technology, which specializes in developing commercial vehicle ADAS products, told China Automotive News that the focus of companies in this field is mainly on how to reduce false negatives and false positives to further enhance product accuracy. “Only by continuing to ‘refine’ the product can we win the favor of automakers and successfully complete contracts for OEM business.” He mentioned that Chuanglai Technology is currently in contact with two commercial vehicle companies and one new energy vehicle manufacturer, hoping to sign a mass production agreement in the first half of next year. Additionally, it has been reported that Hangzhou Haohao Driving Technology Co., Ltd., which is developing a new UBI insurance model based on ADAS, has reached an OEM intention with Kandi Electric Vehicles Group.

In the field of millimeter-wave radar technology, startups are still in the early stages of development. Guo Jian, Chairman of Suzhou Anzhi Automotive Parts Co., Ltd., told China Automotive News that the main work of various companies is to “fully understand” the technologies opened up by foreign chip manufacturers in the shortest possible time. “The technology protection period for NXP’s millimeter-wave radar RF chips expired a year ago, which provides an excellent opportunity for domestic startups.” He briefly explained the reasons for the rise of domestic millimeter-wave radar ADAS startups. “Compared to image recognition technology, the competition in millimeter-wave radar ADAS-related businesses is still not intense in China.” For technology companies like Suzhou Anzhi, the importance of seizing this opportunity is self-evident.

Insufficient Self-Development Capability and Inherent Mindsets of Automakers are Obstacles

Although ADAS startups have multiple favorable factors, their future development path is not smooth. Among them, the traditional mindset of automakers is the biggest obstacle that needs to be overcome. In this regard, Guo Jian provided a real example to China Automotive News. “If automotive executives choose startups like us, they will be held accountable by their superiors if any product issues arise,” he said. “However, if they choose a first-tier supplier with a well-known global market position, even if there are quality control issues, it is easier to shift the responsibility elsewhere.”

As a representative of automakers, Rong Hui admitted that this problem is indeed common. “Automakers must shift from a ‘responsibility-oriented’ approach to a ‘technology-level-oriented’ approach,” he stated. “Even world-class component suppliers can make mistakes. The key to solving the problem is how to work together with ADAS startups to ensure product adaptation and quality control.”

However, from a technological perspective, the concerns of automakers are not entirely unfounded. Compared to first-tier suppliers who have been deeply involved in related fields for many years, ADAS startups still have a lot of work to do. Especially in the chip field, well-known component companies like Bosch, which previously enjoyed the technology protection rights of NXP radar RF chips, have conducted years of ADAS technology research and development. Now, domestic ADAS manufacturers need to reacquaint themselves with chip architectures to design products, and the gap with multinational companies is evident.

“Companies like NXP and Freescale invited top global component suppliers like Bosch, Delphi, and Continental to help define product architectures and standards from the beginning of their chip development. Therefore, the latter had a full understanding of the chip architecture from the start and could quickly develop new products based on existing systems,” Guo Jian stated. “In contrast, many domestic ADAS manufacturers often do not understand why the other party adopts such architectural design ideas.” It seems that startups have a long way to go in this regard.

Copyright Statement

This is an original article. Readers are welcome to share it. For reprints, please contact hb-423 (WeChat); for business cooperation, please contact 010-56002721.

If you have any opinions or suggestions on this article, please scroll to the bottom and click to comment.