In the past, when discussing China’s technology industry, the phrase “lack of chips and screens” was unavoidable. But now, looking at the screen industry, the scene is like riding a rocket—those days when Japanese and Korean companies had us under their thumb are long gone! Currently, Chinese manufacturers dominate 96% of the global LCD TV screen market, with Japanese and Korean companies either going bankrupt or being acquired, leaving only Sharp barely hanging on, with a market share of less than 5%. To put it bluntly, this is no different from a complete rout.

Speaking of this turnaround, it is truly inspirational. Twenty years ago, when we were working on LCD screens, it was like a primary school student copying homework. Japanese and Korean companies were reaping the benefits, while we could only pick up their discarded second-hand production lines and learn technology from behind. Brands like Sony, Sharp, and Samsung were synonymous with “high-end” in consumers’ minds, while domestic screens? Forget it, they weren’t even considered a second-rate brand. Who would have thought that after twenty years, the tables have turned, and now only seven global LCD manufacturers are still breathing, six of which are Chinese!

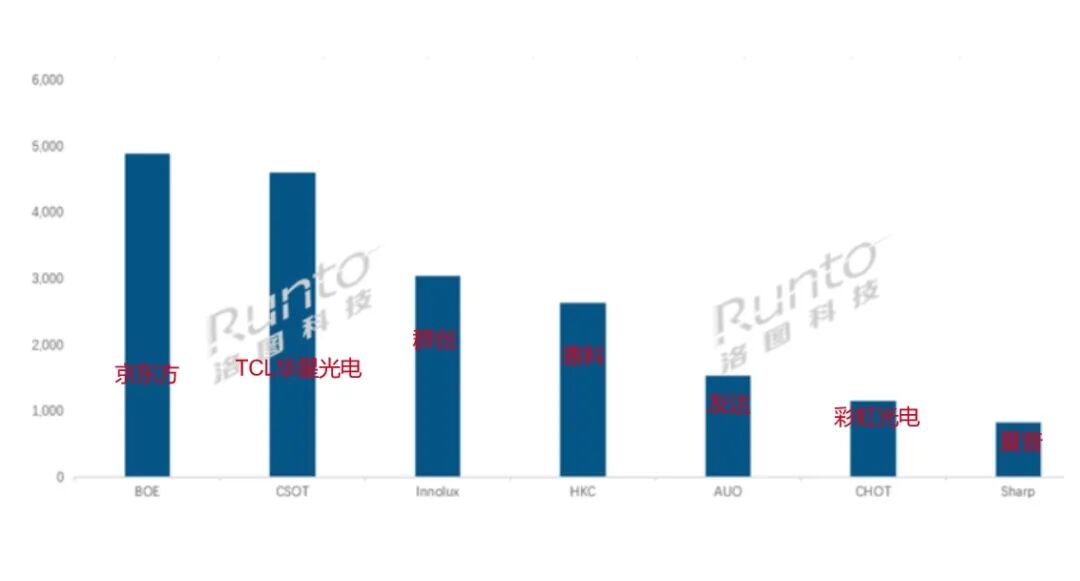

Take a look at this list: BOE, Huaxing Optoelectronics, HKC, and Rainbow Optoelectronics, these four mainland manufacturers together account for 71.1% of the market. Adding Taiwan’s Innolux and AU Optronics, the Chinese influence directly reaches 95.6%. The remaining 4.4% held by Sharp is like a candle in the wind, uncertain of when it will go out. In my opinion, this industry is now more ruthless than raising a poisonous insect; small manufacturers simply cannot survive—opening a production line requires an investment of billions, and without enough market share, they can’t even cover their electricity bills. It’s a miracle if they don’t go bankrupt.

The most satisfying part is that those once-mighty Japanese and Korean giants are now all defeated. Samsung and LG’s LCD businesses have long been shut down, and if Sharp hadn’t been acquired by Foxconn, it would probably be six feet under by now. In contrast, our Chinese companies, BOE and Huaxing Optoelectronics, the “dual heroes,” hold 28.1% and 25.3% of the market, respectively, leaving nothing but scraps. This isn’t just a case of catching up; it’s clearly a case of overtaking while riding on the heads of Japanese and Korean companies!

However, on the higher-end battlefield of OLED, Samsung and LG still hold the fort. But looking at the LCD script—back then, Japanese and Korean companies were also suppressing us, and what happened? They were crushed by our price wars and technological catch-up. Now it’s OLED’s turn; although the Korean companies are temporarily ahead, our production capacity is already ramping up, and the technological gap is visibly narrowing. I believe that given a few more years, the Chinese screen industry may very well take over the OLED field too!

Some may argue: “Isn’t the Chinese screen industry just relying on low prices to seize the market?” This statement may have held true ten years ago, but it no longer stands today. Companies like BOE are no longer the small players picking up leftovers behind others; from production lines to patented technologies, from yield rates to cost control, every aspect is at a world-class level. Even picky clients like Apple treat Chinese screens as treasures, stuffing them into iPhones. Isn’t that enough to prove the point?

Ultimately, the rise of the Chinese screen industry is driven by a fierce determination to “roll up and roll to death.” Japanese and Korean companies have grown accustomed to easy profits; they have never seen our approach of maximizing production capacity even at a loss. The result is that the market has been taken over by us, the technology has been leveled, and even their original business has been completely wiped out. Looking back now, those who said that Chinese manufacturing could only “assemble” must be feeling quite embarrassed.