(Report Producer/Author: CITIC Securities, Huang Yayuan)

Detailed Explanation of Switch Chips: Core Components of Switches, Responsible for Forwarding Functions

Switches: The Core Foundation of the Digital Economy

A switch is a network device used for forwarding electrical (optical) signals, providing a dedicated telecom signal pathway for any two network nodes connected to it, thus forwarding data packets. When a switch receives a data packet, it reads the target MAC address of the packet and forwards it to the port of the target device. Currently, the mainstream switches in the industry are Ethernet switches.

The main application scenarios for switches include data center networks, industrial internet, and various network environments, making them important infrastructure for China’s digital economy. With China’s 14th Five-Year Plan providing guidelines for accelerating the modernization, digitization, and greening of new network infrastructure, we believe that digital infrastructure represented by switches and other network facilities will continue to benefit from the development of China’s digital economy.

Switch Chips: Core Components of Switches, Responsible for Data Forwarding Functions

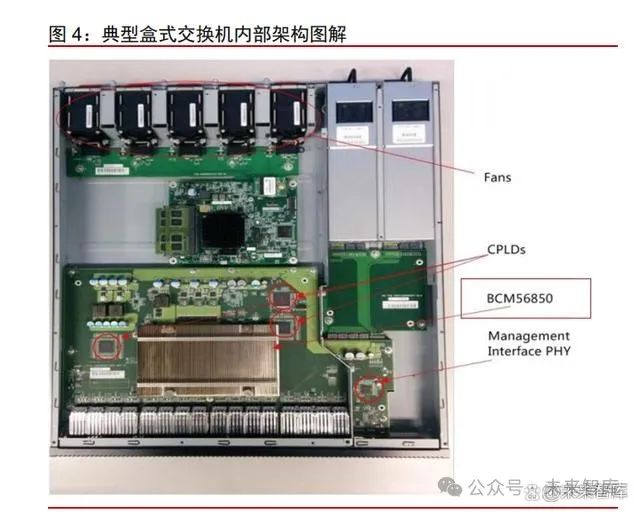

The internal hardware of a switch includes PCB boards, main chips, auxiliary chips, memory devices, heat sinks, power modules, and interface/port subsystems, among which the main chips include switch chips, PHY chips, and CPUs, while auxiliary chips include other digital chips, power chips, signal chain chips, etc. The signal forwarding of a switch is mainly completed by the main chip: external analog signals enter the switch port via cables, and under the instruction scheduling of the internal CPU, the PHY (Physical Layer) chip converts the analog signals into digital signals and transmits them to the switch chip, which then performs security checks, scheduling, and forwarding of the digital signals, and finally converts the signals back to analog signals via the PHY chip for output through the port. The remaining auxiliary chips and devices mainly support the connections between components, provide the power energy required for signal forwarding, and manage heat dissipation. Ethernet switch chips undertake the core forwarding functions of switches and determine key performance indicators. Switch chips are specifically used for preprocessing and forwarding data packets, connecting to the CPU via dedicated PCIE lines, receiving invocation instructions from the central processor, and completing data forwarding. The main functions of switches are to provide high-performance switching and low-latency switching within subnets, which directly determines the overall switching capacity, port rate, and other important performance indicators of the entire machine.

Technological Evolution: Current Highest Forwarding Rate of Switch Chips Reaches 51.2T

Evolution of Ethernet Technology

The origin of Ethernet switch chips can be traced back to the birth of Ethernet in the 1970s. The ALOHA protocol was designed to achieve “point-to-multipoint” communication between the Hawaiian Islands, essentially being a “radio channel collision domain negotiation mechanism.” On May 22, 1973, the world’s first personal computer local area network, the ALTO ALOHA network, operated, marking the official birth of Ethernet.

In July 1975, the epoch-making Ethernet I protocol was released, which included using clock pulses as signals for data exchange with the main memory. Many related technical terms originated from this protocol, such as Ethernet, Interface cable, etc. In September 1980, the general Ethernet standard ETHE80 was officially released, and the first generation of Ethernet technology DIX 1.0 was developed that year, later modified to DIX 2.0, which is the basis for the IEEE 802.3 standard. The “802.3u 100Mbps Ethernet standard” released in 1995, also known as Fast Ethernet, marked the industry’s entry into the 100M fast Ethernet era. In the 21st century, the application range of Ethernet further expanded, and in 2010, IEEE released the 40G and 100G 802.3ba standards, used for large-scale data centers/supercomputers and data center interconnect/backbone networks; in 2017, IEEE released the 200G and 400G 802.3bs standards; in December 2022, the 800G standard P802.3df and 1.6T standard P802.3dj were released, further increasing bandwidth for cloud data center scenarios. P802.3dj is currently the highest transmission rate Ethernet standard released by IEEE. Currently, Ethernet technology has undergone over 50 years of exploration and development, with network transmission rates continuously increasing, and communication ranges expanding from local area networks to metropolitan area networks and wide area networks.

Evolution History of Switches

With the development of Ethernet-related technologies, switch product types have also evolved through four generations. Since the first switch was launched in 1989, there has been rapid development and significant improvement in port rates and switching capacities. The predecessor of switches was a physical layer device that could not isolate collision diffusion—hubs, which integrated multiple interfaces and transmission lines. However, at that time, Ethernet standards had not yet been established, making it difficult to improve network performance due to its inherent properties. In 1989, Kalpana Company in the United States invented the world’s first Ethernet switch, the EtherSwitch EPS-700, which provided 7 fixed ports. As a Layer 2 network device capable of isolating collisions, switches greatly improved network performance. Today’s switches have long surpassed the old framework, capable of not only completing Layer 2 forwarding but also Layer 3 forwarding based on IP addresses, and even Layer 4 and higher-layer multi-service switches have emerged.

Market participants in switches have been continuously increasing. In 1994, Cisco launched its first switch, the Catalyst 1200, based on the switching technology acquired from Crescendo the previous year. This switch supported 8 10M Ethernet interfaces, along with two module slots for uplink connections, officially marking the beginning of the era of competition among global leading manufacturers in switches. In December 1997, Huawei launched the first domestically produced Ethernet switch, the Quidway S2403; in October 2002, ZTE launched the first 10G Ethernet high-end routing switch in China that complied with the 802.3ae standard; in March 2006, Ruijie Networks globally launched the RG-S8600 and RG-S9600 series designed for 100G platforms. During this period, the industry still utilized large-scale hardware coupling to construct switches for information exchange, with no manufacturer introducing clear and mass-producible switching chips.

In 2010, Broadcom released the industry’s first mass-producible switching chip, and switches quickly took off. In January 2013, Cisco launched the Catalyst 3850 series switch using its self-developed UADP chip, supporting the Cisco ONE programmable network model. The American upstart Arista launched the industry’s first leaf switch with a 100G uplink in 2014. Domestic manufacturers have also developed rapidly, with Huawei and Ruijie Networks continuously launching high-performance switch products. In 2019, Ruijie Networks took the lead in the industry by introducing 100G data center core switches and 25G/100G data center solutions, opening up the data center market. In April 2022, H3C released the industry’s first 400G campus core switch; in June 2023, Huawei launched the 800GE data center core switch Cloud Engine 16800-X series, mainly targeting big data and cloud computing applications; in the same month, H3C globally launched the new generation data center switch S9827 series, with a bandwidth of 51.2T, further assisting in the release of computing power.

Evolution History of Switch Chips

Mass production era of chips: Over 20 years after the launch of switches, Broadcom introduced the first mass-producible switching chip. In the early 21st century, the rapid development of semiconductor materials in the electronic communication industry enabled manufacturers to integrate a large amount of data forwarding functions onto a single dedicated integrated circuit, gradually replacing large-scale coupled hardware with chips. Meanwhile, the IEEE802.3ba standard paved the way for switching chips. In 2010, Broadcom launched the industry’s first mass-producible Ethernet switching chip series, BCM88600, achieving a switching capacity of 640G and continuously introducing higher-performance products every two years. Subsequently, American giants such as Mellanox, Cisco, and NVIDIA also launched Ethernet switching chip products, quickly capturing the majority of the market share, becoming absolute leaders in the industry; while Chinese manufacturers such as Huawei, ZTE, and Shengke Communication, although starting later, successfully developed domestic Ethernet switching chips by overcoming technical challenges. Thus, switching chips entered a high-speed development phase, becoming the primary driving force and core barrier for the performance iteration of switches.

The era of fierce competition: In August 2022, Broadcom released the industry’s most advanced switching chip, Tomahawk 5, which is the first chip on the market with a mass-produced 51.2Tbps switching bandwidth, with a maximum port rate of 800G, mainly targeting the commercial switching and routing chip market for hyperscale enterprises and cloud builders. Previously, NVIDIA launched the Spectrum-4 switch at its spring 2022 press conference, which also features the “51.2T+800G” configuration, but this chip is not sold through mass production. Subsequently, American giants successively launched Ethernet switching chips with similar performance indicators: Marvell launched Teralynx 10 in March 2023; Cisco launched the Silicon One G200/G202 series network chips; all these switching chips represent the highest performance levels in the industry today.

Market Size: A $40 Billion Global Market, Self-Developed and Commercial Chips Progressing Together

Long-Term Digitalization Growth, Rapid Growth of Switches Continues

Since 2021, the global Ethernet switch market has resumed rapid growth. IDC data shows that the global Ethernet switch market size reached 308.2 billion yuan in 2022, a year-on-year increase of 17%. We believe that the global switch industry has gradually emerged from the difficulties of upstream supply chain shortages during the pandemic, with the market experiencing accelerated recovery after a brief decline in 2020. The domestic switch market also began to grow rapidly after 2021, and it is expected that by 2025, China’s switch market will reach 64.1 billion yuan.

Product Value: Switch Chips as Core Components

In terms of cost, the chip procurement cost includes main chips (covering Ethernet switch chips, PHY chips, MAC chips, CPU chips, etc.) and auxiliary chips (other digital chips, power management chips, signal chain chips, power chips, etc.). The main chip undertakes core functions, and its procurement unit price is much higher than that of auxiliary chips, constituting the main value in switch hardware. (1) From the perspective of unit price: the unit price of a single Ethernet switch chip is relatively high. According to Shengke Communication’s prospectus, the company’s highest-end product is the TsingMa.MX (2.4Tbps, 400G) series chip product CTC8186, with an average sales unit price of 2252.33 yuan per chip during the trial production stage, reflecting a high pricing level. The Tomahawk series BCM56960 from Broadcom (2014, 3.2Tbps, 400G) currently has a unit price of around $4100 (according to data from distribution websites Avnet, Mouser Electronics). The highest-end Tomahawk 5 series switching chip has not yet been publicly priced. (2) From the perspective of value proportion: chips are the most important raw material upstream. According to the prospectus of Ruijie Networks, in 2020, the chip procurement cost accounted for 45% of the raw material procurement cost; according to the prospectus of Sanwang Communication, the proportion of all chip procurement costs in the total raw material procurement in the first half of 2020 was 36%. Combining the disclosed prices of some switch chips from Shengke Communication’s prospectus and the overall cost of switches, we roughly estimate that the main chip inside a switch accounts for about 25% to 30% of the raw materials, with the switch chip accounting for about 10% to 15%.

Market Size Continues to Grow, Commercial and Self-Developed Progressing Together

The market size is steadily growing: In recent years, the waves of 5G universalization and the rise of AI have significantly increased internet data traffic, driving steady expansion in the switch chip market size. According to Zhiyan Consulting’s forecast data, the global switch chip market size was approximately 36.8 billion yuan in 2020, and it is expected to reach 43.4 billion yuan by 2025, with a CAGR of about 11%. Among these, it is expected that the proportion of commercial switch chips will slightly increase from 50% to 55%; China’s switch chip market was approximately 12.5 billion yuan in 2020, and it is expected to reach 22.5 billion yuan by 2025, with a CAGR of about 13%. China’s switch chip market growth rate is significantly higher than the global average.

Ethernet switch chips can be divided into self-developed and commercial categories from a market perspective. Self-developed chips are manufactured by manufacturers and directly supplied to their own switches to build transmission networks, serving as the cornerstone of the company’s digital communication business, and are generally not sold externally. Major manufacturers include Cisco, Huawei, ZTE, etc.; commercial chips are manufactured by chip manufacturers and sold to downstream customers through the market, with major manufacturers including Broadcom, Marvell, Shengke Communication, etc. Both self-developed and commercial directions have their advantages and disadvantages: self-developed chips are often developed in conjunction with the corresponding switches, offering strong specificity and brand differentiation, while their generality and flexibility are inferior to commercial switch chips; although self-developed chips have a lower market share than commercial chips, they are generally equipped in the manufacturers’ top products, with performance indicators often leading over large-scale commercial publicly available chips, and the corresponding complete products provide certain guidance for the market in terms of technical solutions upon public release. Therefore, we believe that the two directions of self-developed and commercial chips will coexist in the overall market for a long time and complement each other.

Competitive Landscape: High Technical Barriers, Overseas Giants Dominate

High Barriers of “Chip Design + Customer Ecosystem”

Ethernet switch chips are a technology-intensive industry with high barriers, characterized by the dual high barriers of “chip design + customer certification,” making it generally difficult for new companies to enter the industry. The specific analysis is as follows: Barrier analysis.

(1) Technical Barriers: The technical difficulties of switch chips mainly lie in the design phase, including high-performance switching chip architecture design, high-density port design, and pipeline design for different application scenarios, along with developing supporting SDK software interfaces. For example, in high-performance architecture design, the challenge lies in how to reasonably design a traffic management module to avoid conflicts in cache usage while transmitting data packets through multiple message preprocessing modules simultaneously. Therefore, self-manufacturing switching chips requires manufacturers to have high verification and testing capabilities in ASIC.

(2) Customer Barriers and Ecosystem: The downstream customers of switch chips are mainly network equipment manufacturers, with a relatively fixed supply model, and their high requirements for the performance of switch chips necessitate manufacturers to invest years in research and development and testing. Additionally, after receiving samples, customers must undergo a series of processes such as testing, project initiation, and hardware-software integration to ensure the successful operation of the corresponding complete products. Therefore, it often takes switch chip manufacturers 5-7 years to establish stable supply relationships with downstream customers, resulting in strong customer stickiness. Similarly, new startup manufacturers, lacking supply experience and customer bases compared to established giants, find it difficult to quickly onboard downstream customers.

Market Share: Oligopoly, Huge Space for Domestic Substitution

Ethernet switch chips are a technology-intensive industry with high barriers to entry, resulting in a high concentration in the global Ethernet switch chip market, presenting an oligopolistic market structure. Analysis of the commercial and self-developed markets is as follows. Self-developed chip market: Major players Cisco and Huawei entered the market earlier. In the Chinese self-developed switch chip market, the main players are Huawei and Cisco. Cisco officially entered the Chinese market in 1995, leveraging early funding and technical advantages to initiate self-development of switching chips. It has now launched the SiliconOne G200/G202 series network chips for AI supercomputers, with a switching capacity of 51.2Tbps and a port rate of 800G; Huawei began its self-development journey in switch chips in 1990 and started self-developing the Solar series switch chips in 1999, currently having launched the 5.0 series, such as SD5121/SD5122. According to Zhiyan Consulting data, in 2020, Huawei and Cisco held market shares of 88% and 11% respectively in China’s self-developed Ethernet switch chip market.

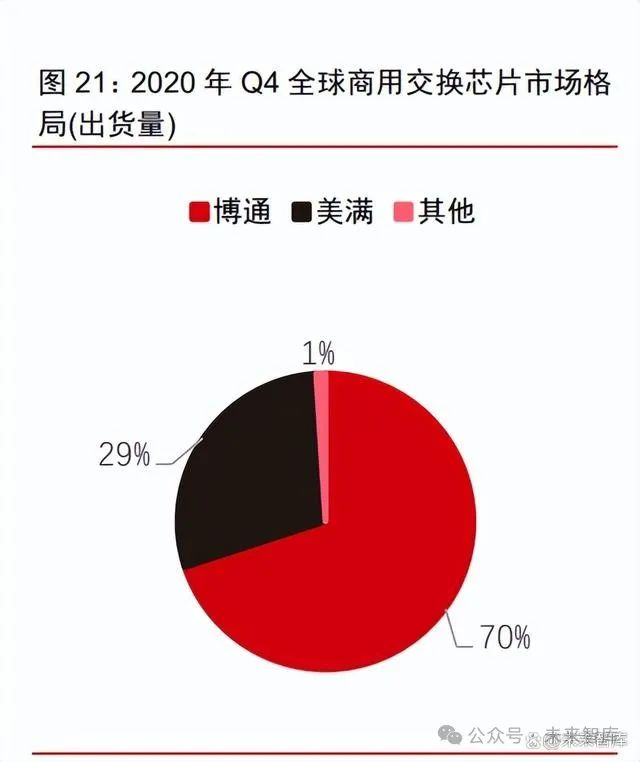

Commercial chip market: Broadcom leads the industry, with significant substitution space, and Shengke Communication is the only domestic company among the top five market share players. Globally, Broadcom and Marvell are the absolute leaders, with data from 650 Group showing that in Q4 2020, Broadcom and Marvell together accounted for 99% of the global commercial switch chip market share. According to Zhiyan Consulting data, in 2020, Shengke Communication held a market share of 1.6% in China’s commercial Ethernet switch chip market, ranking fourth globally and first domestically. Based on Shengke Communication’s revenue structure for 2022, it is estimated that its domestic market share rose to 5%; in the Chinese market for commercial Ethernet switch chips above 10G, Shengke Communication’s market share was 2.3%, also ranking fourth globally and first domestically, indicating huge space for domestic substitution.

Overseas Giants Have Early Layouts, Domestic Acceleration

Overseas giants such as Broadcom, Marvell, and Cisco have leveraged their accumulated technological and financial advantages to initiate the layout of switching chips earlier. Domestic companies like Shengke Communication, compared to global industry leaders like Broadcom and Marvell, still have gaps in product line coverage and highest-end product indicators, temporarily lagging behind industry leaders.

Broadcom: Global Leader in Commercial Switching Chips

The company has been deeply involved in switching chips for 13 years, owning the Tomahawk, Trident, and Jericho series of switching chips, which are applied to high, medium, and low-end scenario needs, mainly developing high-end product lines, primarily used in data center networks and operator networks, holding a significant market share in the high-end sector. The Tomahawk series features high bandwidth, suitable for hyperscale data centers, with products iterated and upgraded every two years. In August 2022, Broadcom released the Tomahawk 5 series network chip, which is the first mass-producible switching chip with a bandwidth of 51.2Tbps, mainly targeting the commercial switching and routing chip market for hyperscale enterprises and cloud builders. The Tomahawk 5 has a bandwidth of 51.2T and can support 64 800G ports or 128 400G ports, with data exchange performance twice that of Tomahawk 4. The Tomahawk 5 uses a 5nm process, supporting both traditional pluggable optical modules and the option of CPO (Co-Packaged Optics) to reduce the distance between optical modules and switching chips, enhancing transmission efficiency.

Marvell: Leading in Switching Chips

The company primarily focuses on the Teralynx and Prestera flagship product lines, with Prestera targeting the enterprise and edge data center markets, while Teralynx focuses on cloud data centers. In October 2021, the company acquired Innovium, whose main business is the production of Ethernet switching ASICs for data centers, which helped Marvell supplement its data center product lineup, further strengthening its advantages in the network switching chip field.

Marvell also launched a programmable switching chip, Teralynx 10, in March 2023, claiming to have the “lowest latency in the industry.” This chip is specifically designed for the 800G era, with a switching capacity of 51.2Tbps, addressing the ultra-high bandwidth needs of operators and applicable in leaf spine switches within data center networks to meet high-performance computing requirements. The Teralynx 10 single chip measures 93X93 mm, with an input/output count of 8855, and uses the latest Low Dk/Df material designed PCB.

NVIDIA: Accelerating Switch Development, Adapting to AI Needs

NVIDIA is simultaneously laying out Ethernet and InfiniBand technology solutions in the switch field. The company has launched the Nvidia Quantum switch product for the IB solution, providing massive throughput and excellent network computing capabilities, targeting high-performance computing and AI scenarios, with the high-end QM9700 series switch capacity reaching 51.2T and single port capacity reaching 400G. For the Ethernet solution, NVIDIA introduced the Spectrum-X Ethernet switching platform at its spring 2022 press conference, where the core component, the Spectrum-4 switch, optimizes performance for large-scale cloud computing, enterprise AI, and simulation, perfectly matching data center demands. The Spectrum-4 switch features a switching capacity of 51.2Tbps and a port rate of 800G, specifically designed for AI.

Cisco: Global Leader in Switches, Leading in Self-Developed Chips

Cisco is the global leader in the switch industry, with a market share exceeding 40%, ranking first globally, having initiated its self-development path for switching chips early on. In 1999, Cisco acquired semiconductor company StratumOne Communications, and subsequently accumulated rich talent and technological resources through multiple acquisitions of semiconductor-related companies. In December 2019, Cisco launched the Silicon One chip architecture for the first time, which was planned to establish a universal foundation for “future networks,” with applications including modular systems and central systems.

Cisco launched the SiliconOne G200/G202 series network chips for AI supercomputers in June 2023: the G200 has a switching capacity of 51.2Tbps and a port rate of 800G; the G202 features the same characteristics as the G200 but has only half the switching performance of the G200. The G200 uses a 5nm process, offering strong controllability and programmable features, greatly increasing the flexibility of application scenarios.

Shengke Communication: Domestic Leader in Commercial Switching Chips

The product line covers: The company currently covers Ethernet switching chips with a switching capacity ranging from 100Gbps to 2.4Tbps and port rates from 100M to 400G, applied on a large scale in enterprise networks, operator networks, data center networks, and industrial networks. Currently, the company still has certain gaps compared to global industry leaders like Broadcom and Marvell in terms of product line coverage and highest-end product indicators, temporarily lagging behind.

Comparison of Highest Switching Capacity Chips: In the data center field, Shengke Communication has launched the TsingMa.MX (switching capacity 2.4Tbps) and GoldenGate (switching capacity 1.2Tbps) series, both of which have been introduced to mainstream domestic network equipment manufacturers and achieved mass production. The company’s high-performance switching products for hyperscale data centers, the Arctic series, are still in trial production, with the highest switching capacity reaching 25.6Tbps, which we expect to launch in 2024-2025.

High Customer Concentration: The company has established long-term and stable partnerships with major domestic communication and information technology manufacturers. From 2020 to 2022, the company’s top five customers remained relatively stable, with revenue proportions of 56.65% /68.87%/74.97%, gradually increasing concentration, with Maiputong Communication + China Electronics Port (controlled by China Electronics), Suzhou Siweitong, and Wuhan Lantu consistently being the top five customers with a high proportion and stable share. The main customers of the company’s high-end product TsingMa.MX series include China Electronics Port (main terminal customers being H3C), Siweitong (main terminal customers being Ruijie Networks), and Maiputong Communication.

Financial Overview: The company’s operating income has surged, with Shengke Communication actively expanding its business and market share, experiencing rapid growth from 192 million yuan to 768 million yuan from 2019 to 2022, with revenue of 877 million yuan in the first three quarters of 2023, a year-on-year increase of 58.72%. Net profit turned from loss to profit: the company, being in the technology-intensive integrated circuit industry, had high initial R&D investments to maintain product competitiveness, and in the first three quarters of 2023, it turned profitable, earning 43 million yuan.

Self-Developed Chips: ZTE’s Ten-Year Endeavor, Initial Success

ZTE is a global leading integrated communication information solution provider, founded in 1985, dedicated to providing innovative technologies and products to global telecom operators, government and enterprise customers, and individual consumers. The company insists on long-term investment and mastering core underlying technologies. ZTE began its journey of self-developing chips as early as the 1990s, establishing a wholly-owned subsidiary, ZTE Microelectronics, in 2003, primarily responsible for the R&D of core communication technologies. The company has nearly 30 years of R&D accumulation in the chip field, continuously promoting core chip self-development in wireless networks, wired networks, and data communication devices, building a full-stack computing network foundation. In 2008, ZTE initiated the self-development of switching network chips and successfully launched the first generation of self-developed switching network chips in 2011, quickly applying them in routers and other products. In the following years, ZTE continuously improved switching network technology, closely following the pace of process innovation, updating switching network chips at a speed of one generation every three years, sharing process dividends with customers as quickly as possible. In 2018, ZTE launched the fourth generation of self-developed switching network chips with a switching capacity of 9Tbps, achieving industry-leading levels. In 2020, ZTE initiated the R&D of the fifth generation of self-developed switching network chips.

Currently, ZTE is building a new generation of switches based on self-developed core components and software platforms. The company’s ZXR10 9900X series core switches feature large capacity, high performance, and high reliability, targeting cloud computing virtualized data center networks, providing enormous switching capacity and high-density 10GE, 40GE, and 100GE interfaces. Additionally, ZTE’s switches, such as the ZXR10 S600E, are equipped with CLOS architecture switching chips, achieving non-blocking cell switching and fast, flexible business adaptation capabilities, while the system provides high-density full-line-speed gigabit, 10-gigabit, and 100GE port service boards to meet users’ multi-level link bandwidth needs.

Financial Situation Overview: From 2018 to 2022, ZTE’s financial situation has been good, with steady revenue growth, reported at 85.5 billion, 90.7 billion, 101.5 billion, 114.5 billion, and 123 billion yuan respectively; after experiencing the US sanctions storm in 2018, net profit quickly turned from loss to profit, with the last three years of net profit attributable to the parent company being 4.3 billion, 6.8 billion, and 8.1 billion yuan.

Welcome all companies in the automotive industry chain (including the power battery industry chain) to join the angel round and A round investment group (which will recommend over 1000 automotive investors from top-tier institutions at home);Around enterprise to join the group (There are communication groups for technology innovation companies, groups for the automotive industry including complete vehicles, automotive semiconductors, key components, new energy vehicles, intelligent connected vehicles, aftermarket, automotive investment, autonomous driving, vehicle networking, and dozens of other groups, please scan the administrator’s WeChat to join the group (please indicate your company name)).