-

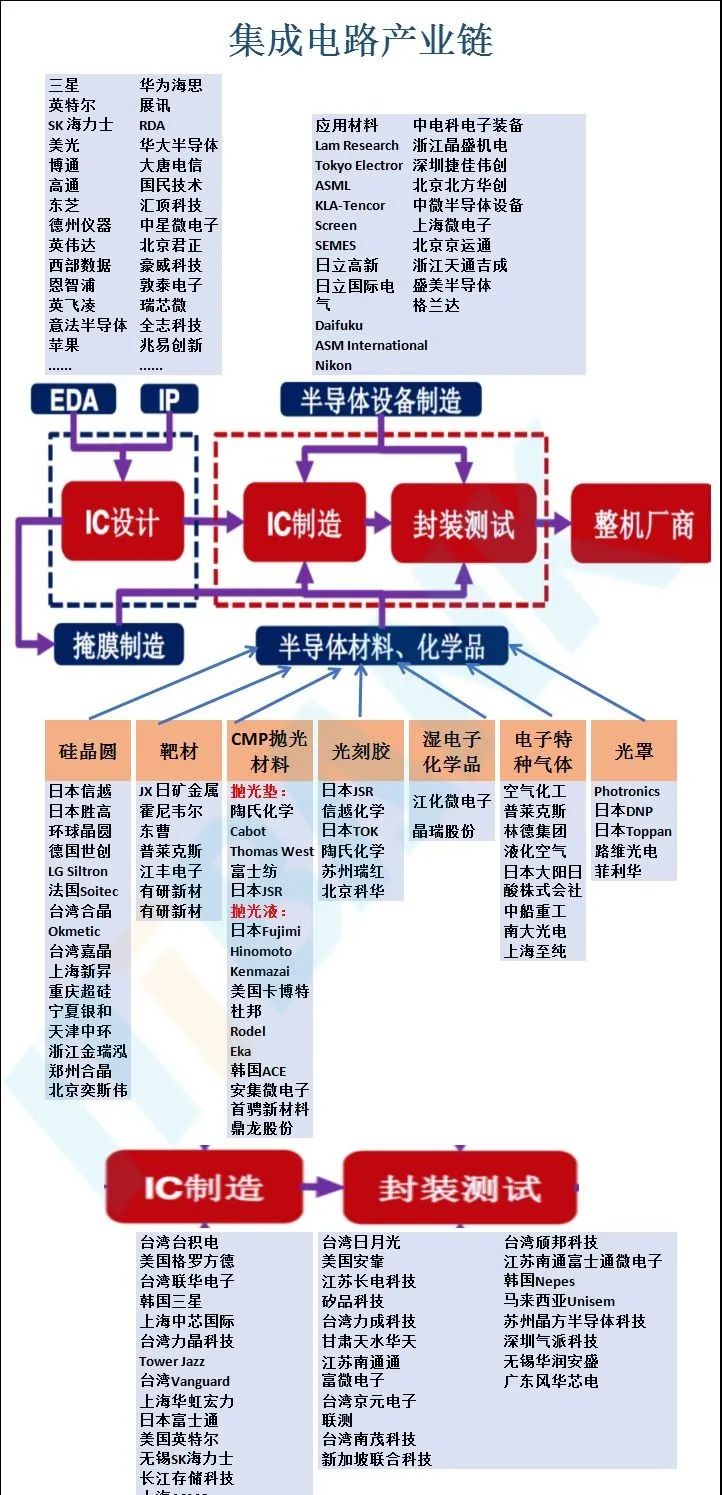

In the core aspects, IC design is upstream in the industry chain, IC manufacturing is in the midstream, and IC packaging is downstream.

-

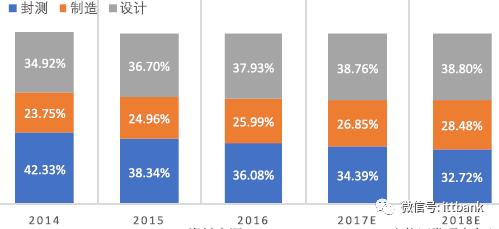

The global integrated circuit industry’s industrial shift has moved from the packaging and testing phase to the manufacturing phase, thus clarifying the division of labor in each segment of the industry chain.

-

The previous IDM (Integrated Device Manufacturer) model is gradually transforming into Fabless + Foundry + OSAT.

▲Global Semiconductor Industry Chain Revenue Composition Chart

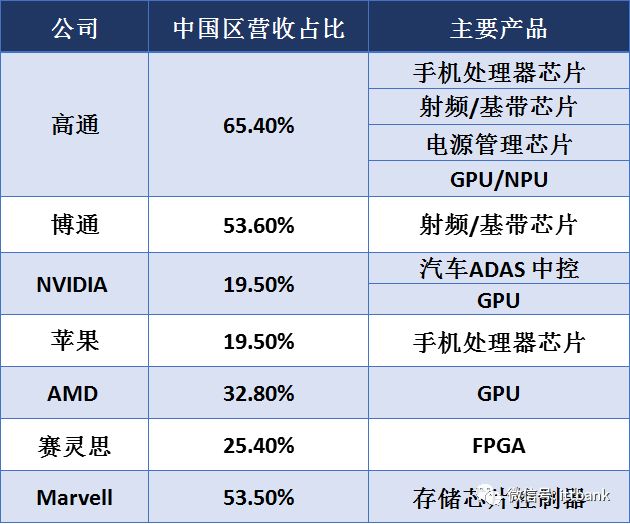

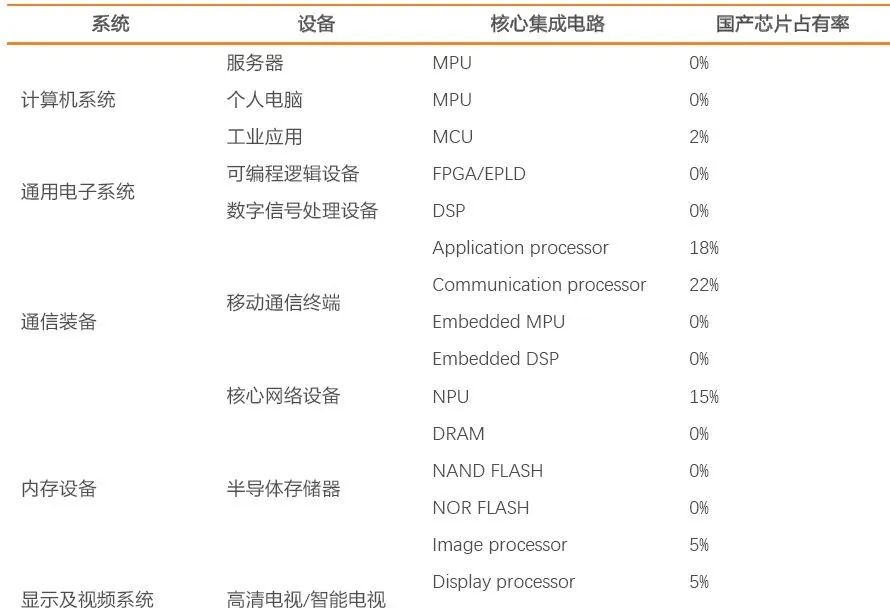

1Design:Subdivided fields have highlights, but core key areas lack design capability.From application categories (e.g.: smartphones to automobiles) to chip projects (e.g.: processors to FPGAs), the domestic self-sufficiency rate for high-end key chips is nearly zero, still highly reliant on American companies;

2Equipment:Low self-sufficiency rate, significant demand gap, currently achieving breakthroughs in mid-range equipment, initial complete layout of the industrial chain, but high-end processes/products still need to be tackled.Domestic semiconductor equipment manufacturers account for only 1-2% of the global market share, and in key areas such as deposition, etching, ion implantation, and testing, they still highly rely on American companies;

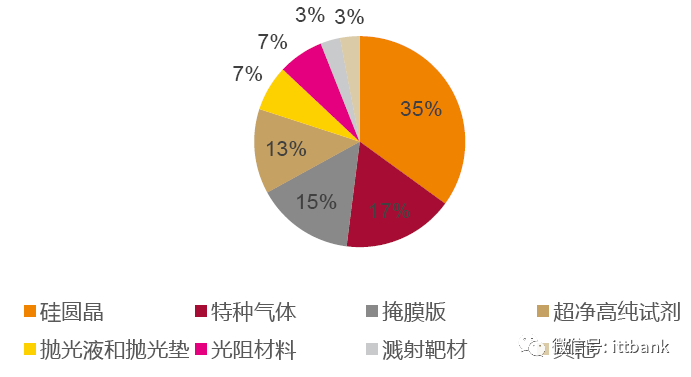

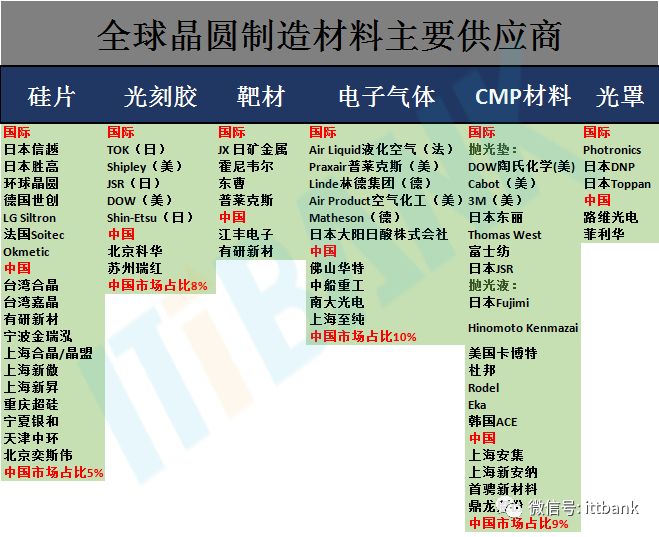

3Materials:In areas such as target materials, they are already on par with international levels, but in high-end fields such as photoresists, it will still take a long time to achieve domestic substitution.The global semiconductor materials market size is $44.3 billion, with China’s wafer manufacturing materials supply accounting for less than 10%, while some packaging materials supply accounts for over 30%. In some subdivided fields, they are on par with international leaders, but high-end fields have not yet achieved breakthroughs;

4Manufacturing:The global market is concentrated, with TSMC holding 60% of the share, and is relatively less affected by the trade war. Mainland China is in the second group, with global capacity expansion concentrated in mainland China.The foundry industry shows a very obvious head effect, with TSMC alone occupying 60% of the market share among the top ten foundry manufacturers globally. This industry is relatively unaffected by the trade war;

5Packaging and Testing:The first area to achieve autonomy and control.The overall strength of domestic enterprises in the packaging and testing industry is not weak, with strong competitiveness globally. In 2017, the combined global market share of Longsys + Huada + Tongfu reached 19%, with Amkor as the main competitor in the US. This industry is relatively unaffected by the trade war.

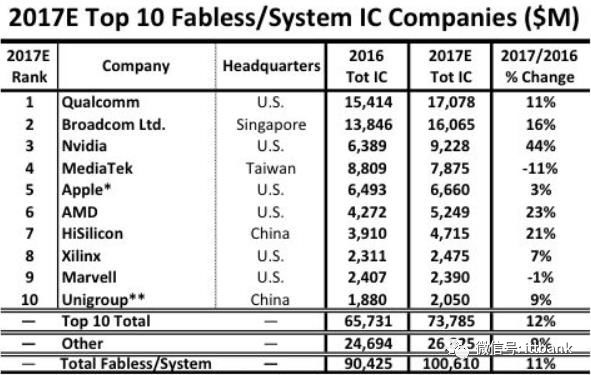

In terms of region, the current global IC design is still dominated by the United States, with mainland China being an important participant. In 2017, US IC design companies accounted for about 53% of the global market share, and IC Insights predicts that this share will rise to about 69% after Broadcom moves its headquarters entirely to the US. Taiwan’s IC design companies accounted for 16% of total sales in 2017, unchanged from 2010. Companies like MediaTek, Realtek, and RDA had IC sales exceeding $1 billion last year, ranking among the top twenty IC design companies globally.

Compared to non-US overseas regions, Chinese companies are performing outstandingly. The number of Chinese companies among the world’s top 50 fabless IC design companies has significantly increased from 1 in 2009 to 10 in 2017, showing a rapid catching up trend. Among the top ten fabless IC manufacturers globally in 2017, the US occupied 7 seats, including Qualcomm, NVIDIA, Apple, AMD, Marvell, Broadcom, and Xilinx; Taiwan’s MediaTek was on the list, while China’s HiSilicon and Unisoc ranked 7th and 10th respectively.

Top Ten Fabless IC Design Manufacturers in the World in 2017 (Million USD)

Since the outbreak of the China-US trade war, we can clearly see through the “ZTE Incident” and “Huawei Incident” that in the core high-end general-purpose chip field, domestic design companies can provide almost zero products.

The gap between mainland high-end general-purpose chips and foreign advanced levels mainly lies in four aspects:

1) The gap in mobile processors is relatively small.

Unisoc and Huawei HiSilicon have entered the global forefront in mobile processors.

2) Central Processing Units (CPUs) are the most challenging high-end chips to catch up.

Intel almost monopolizes the global market, with about 3-5 domestic related enterprises, but none have achieved commercial mass production, most still rely on applying for scientific research project funding and government subsidies to maintain operations. Domestic CPU design companies like Loongson can produce CPU products and may surpass foreign CPUs in certain or single metrics, but due to a lack of industrial ecosystem support, they still cannot compete with dominant products.

3) The gap in memory chips is also large.

Currently, there are three main types of global memory chips, ranked by sales volume: DRAM, NAND Flash, and Nor Flash. In the memory and flash memory fields, IDM manufacturers Samsung and SK Hynix have absolute advantages, with market shares of 75.7% and 49.1% respectively as of 2017, leaving very limited competition space for Chinese manufacturers. Wuhan Yangtze Memory Technologies is attempting to develop 3D NAND Flash technology, but is currently only at the sample stage of 32 layers, while global leaders like Samsung and Intel have begun mass production of 64-layer flash products; in the Nor flash market, which is about 3-4 billion dollars, GigaDevice is one of the main participants, with other mainstream suppliers including Winbond from Taiwan, Cypress from the US, Micron from the US, and Winbond from Taiwan.

4) For high-end general-purpose chips such as FPGAs and AD/DA, there is a significant technological gap between domestic and foreign.

These fields are all general-purpose chips, which require large R&D investments, have long life cycles, and are difficult to gather economic benefits in the short term, thus their development at the domestic company level is relatively slow, and some areas are even stagnant.

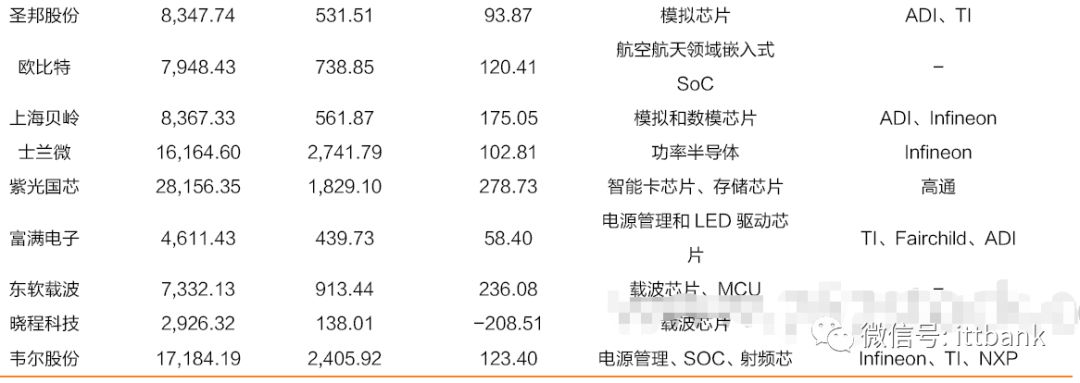

Overall, publicly listed companies in chip design are the strongest in their respective subdivided fields. For instance, Goodix Technology has surpassed FPC in the fingerprint recognition chip field, becoming the largest fingerprint IC supplier in the global Android camp, becoming one of the few global leaders in the domestic design chip in the consumer electronics subdivision. Silan Microelectronics started with integrated circuit chip design and has gradually built a chip manufacturing platform, extending its technology and manufacturing platform to the packaging fields of power devices, power modules, and MEMS sensors. However, compared to international semiconductor giants, there is still a significant gap in high-end chip design capability, scale, and profitability.

Currently, the situation of semiconductor equipment in our country is that low-end processes have achieved domestic substitution, while high-end processes remain to be tackled, with low self-sufficiency rates and significant demand gaps.

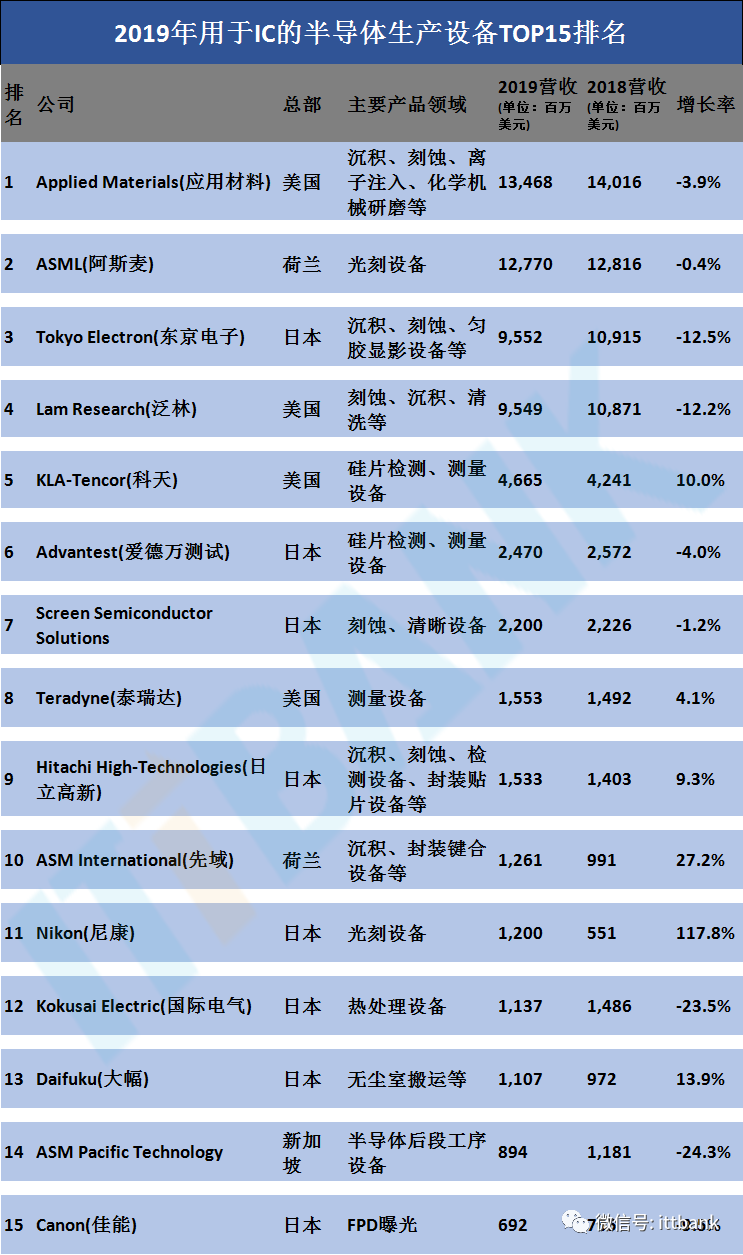

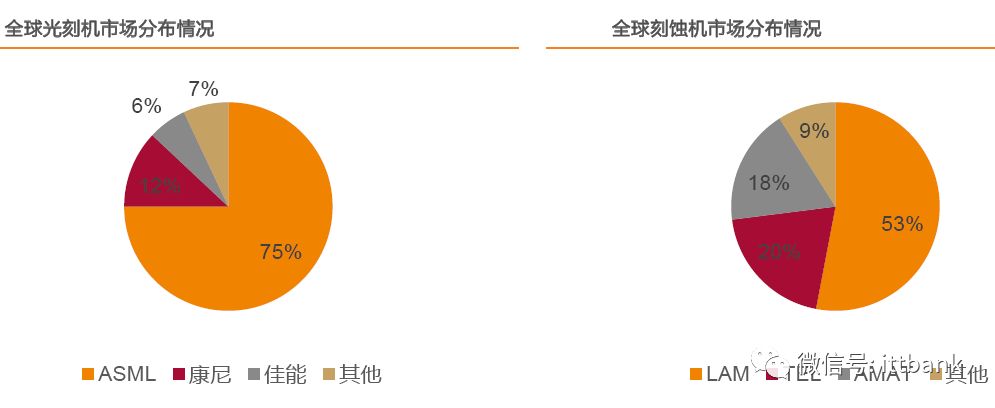

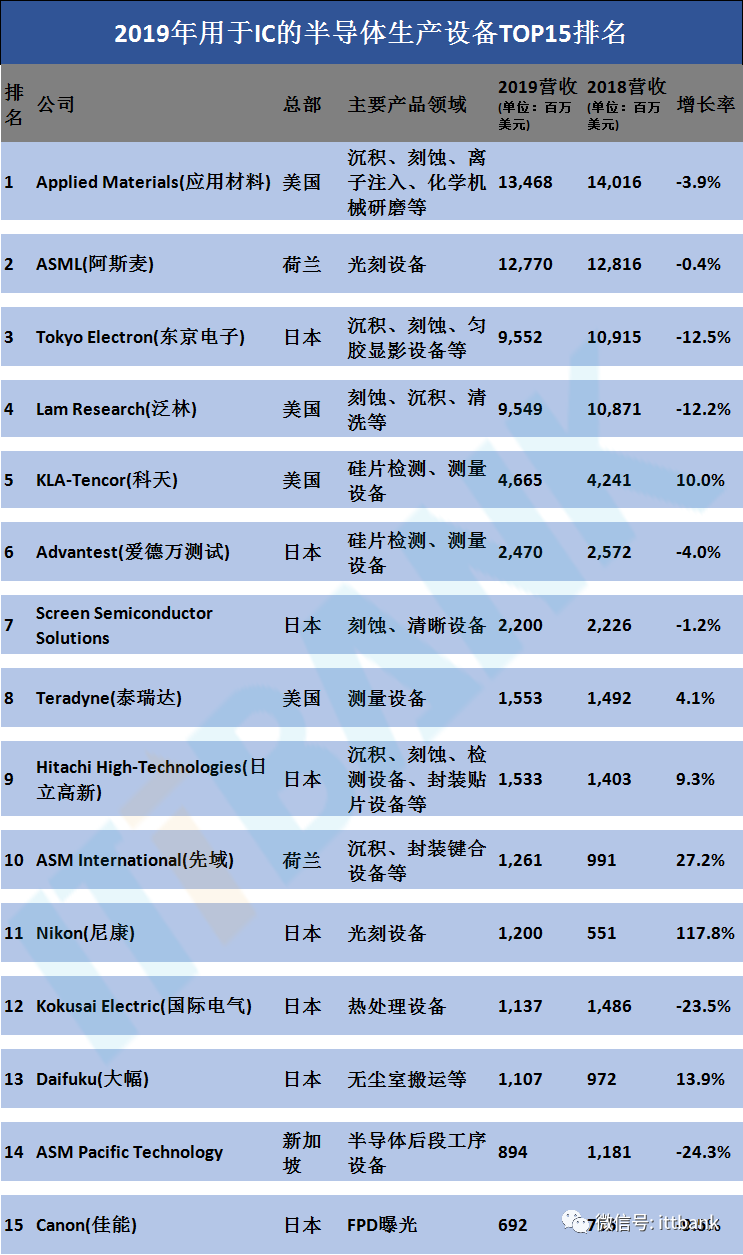

Key equipment has high technical barriers, and Japan and the US are technologically advanced, with a CR10 share close to 80%, presenting an oligopolistic situation. Semiconductor equipment is upstream in the industry chain and spans all aspects of semiconductor production. According to the process flow, it can be divided into four major sectors: wafer manufacturing equipment, testing equipment, packaging equipment, and front-end related equipment. Among them, wafer manufacturing equipment occupies 70% of the Chinese market share. More specifically, wafer manufacturing equipment can be mainly divided into 8 categories based on the process, with photolithography machines, etching machines, and thin-film deposition equipment occupying most of the semiconductor equipment market. At the same time, the equipment market is highly concentrated, with the production of photolithography machines, CVD equipment, etching machines, and PVD equipment concentrated in a few major companies from Europe and the United States.

China’s semiconductor equipment localization rate is low, with domestic semiconductor equipment manufacturers accounting for only 1-2% of the global market share.

Key equipment has not yet achieved breakthroughs in advanced processes. Currently, the world’s integrated circuit equipment research and development level is at 12 inches 7nm, while production has reached 12 inches 14nm; China’s equipment R&D level is still at 12 inches 14nm, with a production level of 12 inches 65-28nm. Overall, domestic equipment has a time gap of 2-6 years compared to advanced levels in the country; specifically, the localization rates of 65/55/40/28nm photolithography machines and 40/28nm chemical mechanical polishers are still 0, and the localization rates of 28nm chemical vapor deposition equipment and rapid annealing equipment are very low.

-

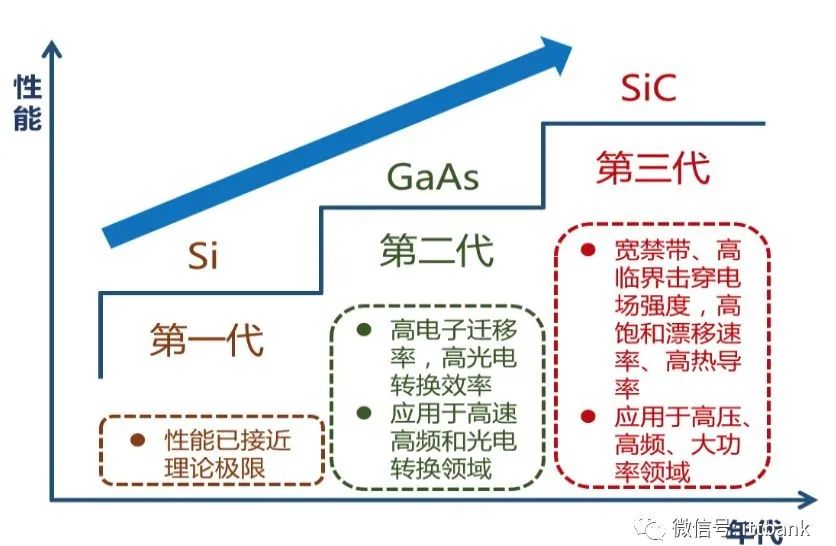

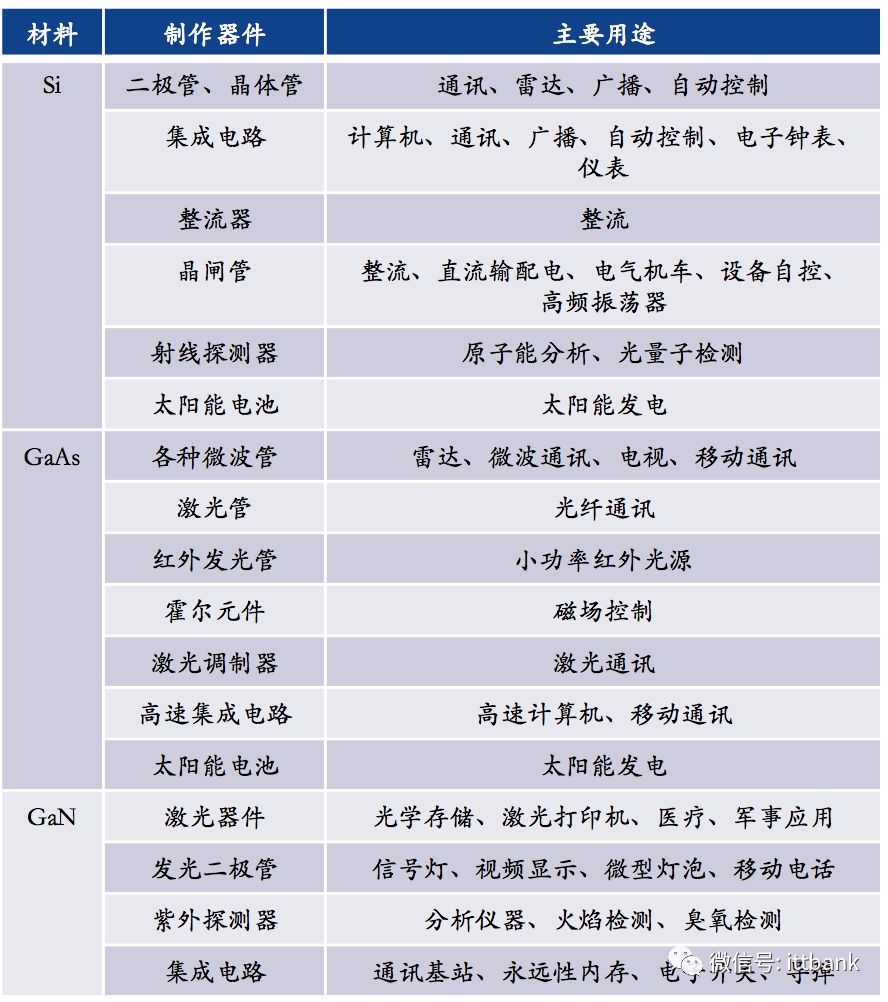

Si: Mainly used in integrated circuit wafers and power devices;

-

GaAs: Mainly used in high-power optoelectronic devices and RF devices;

-

GaN: Mainly used in optoelectronic devices and microwave communication devices;

-

SiC:: Mainly used in power devices

▲Main Applications of Representative Materials from Various Generations

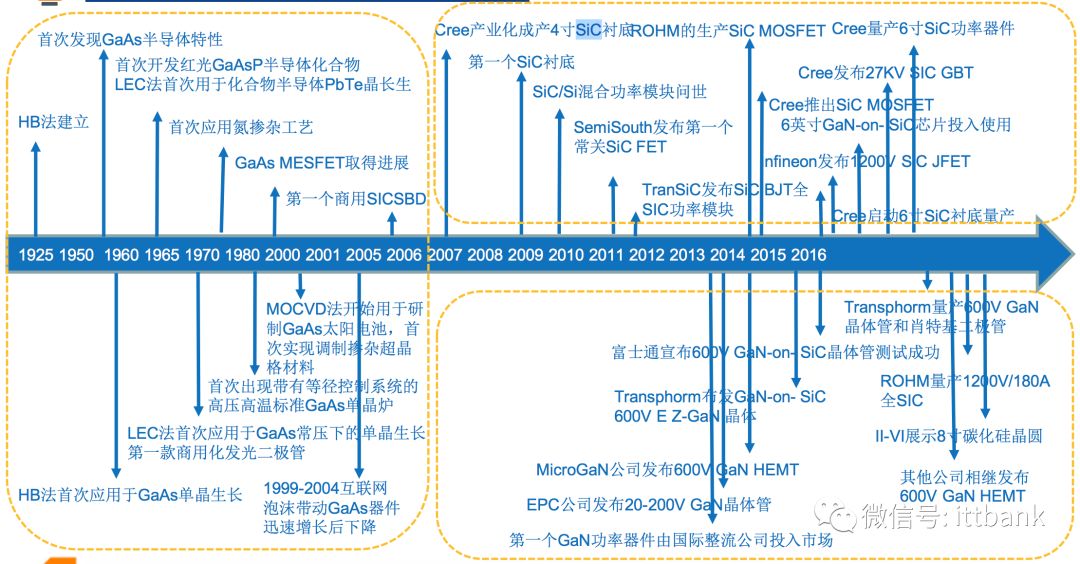

▲Technology Maturity of Second and Third Generation Semiconductor Materials

In subdivided fields, we have already achieved overtaking, but breakthroughs in core fields have yet to be realized. Semiconductor materials can be mainly divided into wafer manufacturing materials and packaging materials. In wafer manufacturing materials, silicon-based materials account for the highest proportion at 31%, followed by photomasks at 14%, photoresists at 5%, and their supporting reagents at 7%. In packaging materials, the highest proportion is for packaging substrates at 40%, followed by lead frames at 16%, ceramic substrates at 11%, and bonding wires at 15%.

Japan, the US, and Germany dominate the global semiconductor materials supply. Major players in various subdivided fields include: silicon wafers—Shin-Etsu, Sumco; photoresists—TOK, Shipley; electronic gases—Air Liquid, Praxair; CMP—DOW, 3M; lead frames—Sumitomo Metal; bonding wires—Tanaka Precious Metals; packaging substrates—Panasonic.

(1) Target materials, packaging substrates, CMP, etc., our country has already reached international advanced levels, achieving mass supply, and can be immediately localized. A typical example of semiconductor materials that have been localized is target materials.

(2) Silicon wafers, electronic gases, photomasks, etc., are technologies on par with international standards but have not yet achieved mass supply.

(3) Photoresists have not yet achieved breakthroughs in technology and will still require a long time to achieve domestic substitution.

The wafer manufacturing phase is a crucial process in the semiconductor industry chain, and the quality of manufacturing processes directly affects the advancement of the semiconductor industry. Over the past twenty years, the domestic wafer manufacturing phase has developed relatively slowly, but with the support of national policies and large funds, it is expected to catch up quickly, effectively boosting the technical density of the entire semiconductor industry chain.

Semiconductor manufacturing holds a pivotal position in the semiconductor industry chain. Manufacturing is the core link in the industry chain, and its importance is self-evident. By assessing the value of each link in the industry, the manufacturing link has the highest value, with a gross margin also at a relatively high level. As the Fabless + Foundry + OSAT model becomes the trend, the importance of Foundry in the entire industry chain is also gradually increasing. It can be said that Foundry is a bottleneck, and the output of capacity is controlled by manufacturing enterprises.

The foundry industry shows a very obvious head effect. According to IC Insights data, TSMC alone occupies more than half of the market share among the top ten foundry manufacturers globally, with the top eight accounting for nearly 90%. At the same time, foundries are mainly concentrated in East Asia, with very few such companies in the US, which is related to industrial transfer and division of labor. We believe that mainland China, through capital investment and talent aggregation, has the potential to surpass in foundry within the next decade.

“Made in China” needs to extend from downstream to upstream. In the route of technology transfer, semiconductor manufacturing is a technical fortress that “Made in China” has yet to conquer. China is a “manufacturing powerhouse”, but “Made in China” mainly consists of complete machine products; in the upstream “chip manufacturing” field, there is still a significant gap with international leading levels. In the transition from downstream manufacturing to “chip manufacturing”, a batch of technology-leading wafer foundry companies must emerge. At the onset of the chip trade war, the US’s technology blockade and suppression of our manufacturing industry is at the forefront. While we strive to inherit the spirit of “Two Bombs and One Satellite” and engage in self-reliance and hard work, how to handle the relationship with advanced companies like TSMC and UMC in Taiwan will also have a significant butterfly effect on subsequent developments.

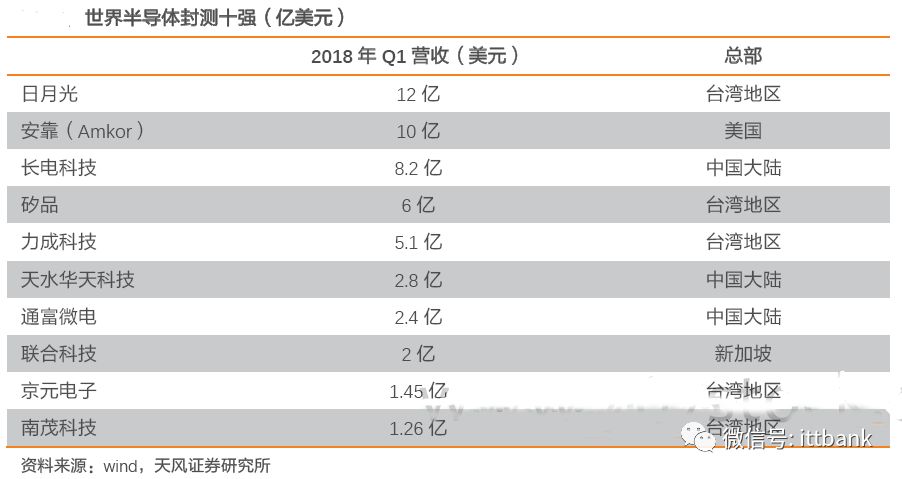

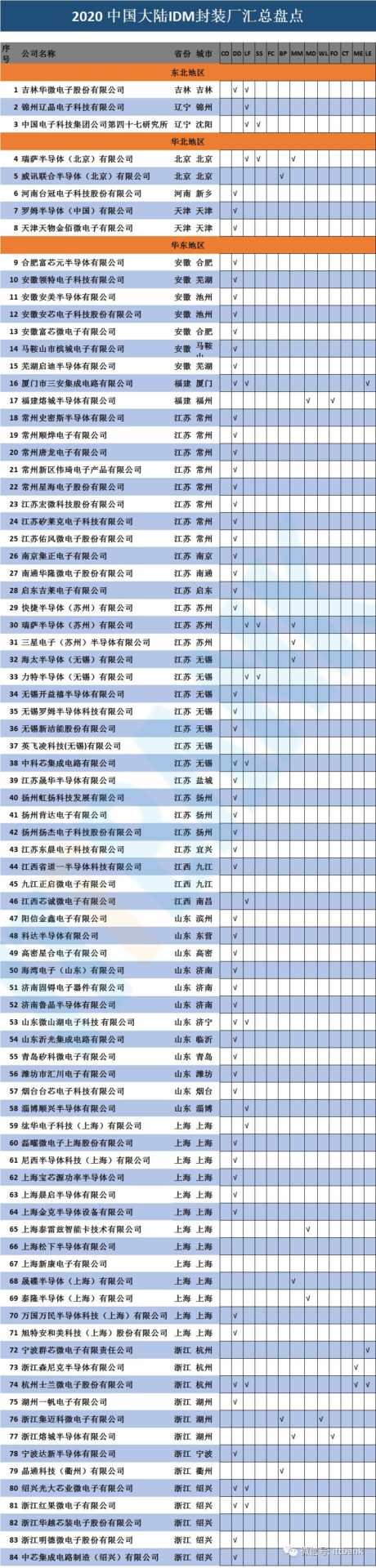

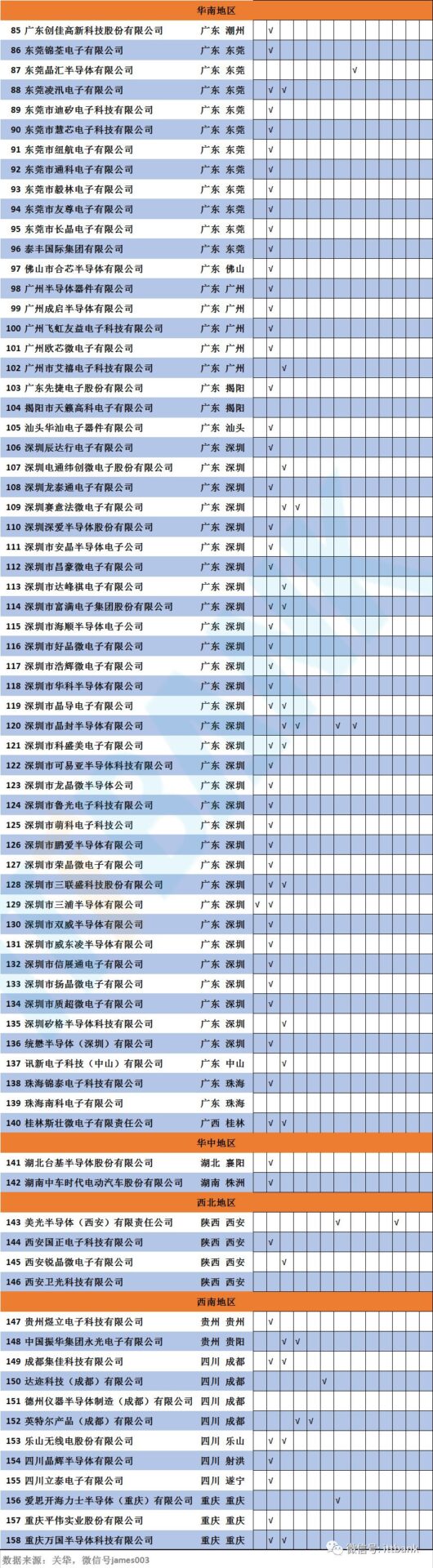

The current influence of the semiconductor industry in mainland China in the packaging and testing industry is the strongest, with excellent market share. Leading companies such as Longsys Technology / Tongfu Microelectronics / Huada Technology / Jingfang Technology are continuously increasing their market size, compared to companies in Taiwan, the overall growth potential of the mainland packaging and testing industry is not lagging behind. Well-known IC design companies in Taiwan such as MediaTek, Realtek, and RDA have gradually shifted their local packaging and testing orders to mainland counterparts. The packaging and testing industry presents a tripartite situation among Taiwan, the US, and mainland China, among which Longsys Technology / Tongfu Microelectronics / Huada Technology have achieved a market share ranking among the top ten globally (Longsys Technology ranks third in global market size), and their advanced packaging technology levels are basically synchronized with overseas leading companies, with advanced packaging technologies such as BGA, WLP, and SiP all capable of smooth mass production.

The overall strength of domestic enterprises in the packaging and testing industry is not weak, with strong competitiveness globally. Amkor is the main competitor in the US, with its revenue from operations in China accounting for about 18%. The packaging and testing industry has a generally low market share in the US, with only Amkor among the top ten packaging and testing manufacturers, indicating that the trade war has a minimal impact on the overall industry, and in the short to medium term, the possibility of Amkor’s business being replaced is relatively high.

The packaging and testing industry is at the end of the semiconductor industry chain, with lower added value, high labor intensity, and lower entry technical barriers. The leading packaging and testing company, ASE, spends about 4% of its annual revenue on R&D, which is far lower than that of the world’s leading semiconductor IC design, equipment, and manufacturing companies. As TSMC expands into the downstream packaging and testing industry, it will also pose a significant threat to traditional packaging and testing companies.

After 2017-2018, mainland packaging and testing (OSAT) players will maintain rapid growth. Currently, Longsys Technology / Tongfu Microelectronics can already provide high-end, high-margin products, and in the next 3-5 years, the CAGR growth rate of mainland packaging and testing companies will continue to surpass that of global peers.

Editor: Hou Fengya Review: Luo Xiao Final Review: Jin Chongxue

17805631111

0563-2626912/2626172