Antibody-drug conjugates (ADC) are a new type of targeted therapeutic drug, composed of monoclonal antibodies that specifically target antigens linked to small molecule cytotoxic drugs via linkers. They combine the powerful killing effect of traditional small molecule chemotherapy with the tumor-targeting capability of antibody drugs. This structure allowsADC to deliver drugs directly to specific cancer cells, maximizing efficacy while minimizing damage to normal cells.

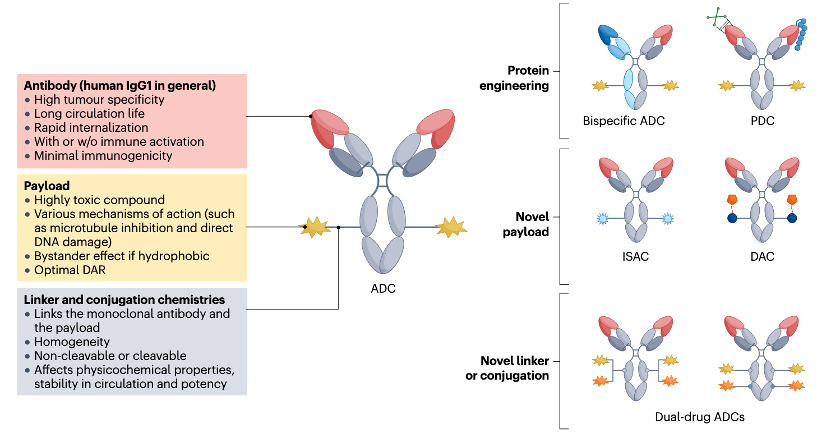

ADC typically consists of three parts: Antibody (Antibody), Linker (linker), and Payload (Payload) (Figure 1). The antibody is usually a specific monoclonal antibody that can recognize and bind to specific antigens on the surface of cancer cells. The payload is a small molecule drug with cytotoxic properties that can kill cancer cells or inhibit their proliferation. The linker is a chemical link that connects the antibody and the payload, which can be cleavable or non-cleavable, determining how the payload is released after reaching the cancer cell.

ADC has good targeting and selectivity, which can reduce damage to healthy tissues, lower drug side effects, and improve efficacy. They have shown great potential in cancer treatment and have been widely researched and applied in clinical therapy.

Figure 1 Important Components of ADC Drugs

Image Source:Nat Rev Clin Oncol. 2024, 21(3): 203-223.

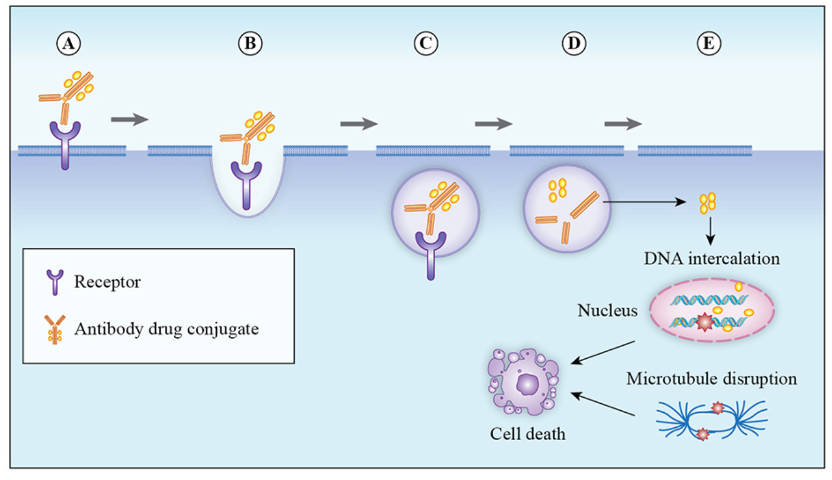

The mechanism of action of ADC drugs typically includes the following steps (Figure 2):

-

The antibody binds to the specific antigen on the surface of the cancer cell. -

After binding to the antigen, the ADC drug is brought into the tumor cell through endocytosis. -

The antigen-antibody-drug complex is delivered to the lysosomal compartment. -

Inside the cell, the linker is cleaved by specific enzymes, releasing the payload. -

The released cytotoxic drug kills the cancer cells.  Figure2 Mechanism of Action of ADC Drugs

Figure2 Mechanism of Action of ADC DrugsImage Source: Molecules. 2020, 25(20): 4764.

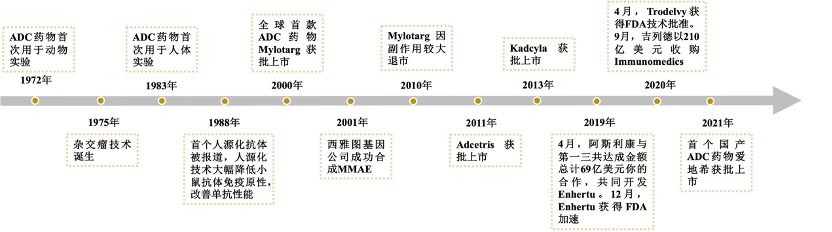

The concept of ADC originated from the “magic bullet” theory proposed by German scientist Paul Ehrlich over 100 years ago, which stated that by designing a special chemical substance, it could precisely target pathogens without harming normal human cells. Based on this, the first true ADC was introduced in 1958, which coupled methotrexate with antibodies for the treatment of leukemia, but it failed due to technical limitations. The advent of hybridoma technology in the 1970s put ADC development on the right track. In recent years, advancements in antibody engineering, the development of highly toxic cytotoxic drugs, the introduction of new linkers, and improvements in coupling technology have further propelled the field. After more than half a century of exploration, the performance of ADCs has gradually improved and stabilized. From the perspective of drug composition and technical characteristics, the development of ADC drugs can be divided into three stages.

Figure3 History of ADC Drug Development

The initial ADC technology used conventional chemotherapeutic drugs such as doxorubicin and methotrexate as cytotoxic agents, coupled with murine monoclonal antibodies through non-cleavable linkers. Their efficacy was mostly lower than that of the corresponding free cytotoxic drugs and often accompanied by strong immunogenicity. Later, the development of humanized monoclonal antibodies and the enhancement of cytotoxic drug activity significantly improved the therapeutic effects of ADC drugs, leading to the approval of the first-generation ADC drug Mylotarg by the FDA. Mylotarg used calicheamicin as the cytotoxic drug, linked to the humanized IgG4 targeting CD33 through a linker that contains acid-unstable hydrazones and redox-sensitive disulfide bonds, used for the treatment of acute myeloid leukemia. However, Mylotarg’s coupling showed some instability, with the linker breaking down in other acidic conditions in the body, and the conjugation joint slowly hydrolyzing in circulation, leading to uncontrolled release of calicheamicin, causing severe toxicity that resulted in Mylotarg being withdrawn from the market.

The second-generation ADCs optimized the first generation by using more active cytotoxic drugs and enhancing targeting specificity to tumor sites with advancements in monoclonal antibody technology. The development of new linkers and coupling strategies improved the coupling efficiency of ADCs, overall solubility, and stability in plasma. Most currently marketed ADCs fall into the second generation, with the representative drug Trastuzumab Emtansine (T-DM1) being the first ADC with indications for solid tumors. It is composed of the humanized anti-HER2 IgG1 antibody trastuzumab (the active ingredient of Herceptin) linked to the microtubule inhibitor Mertansine (DM1) via a stable non-cleavable linker (MCC-linker), used for HER2-positive breast cancer patients. Second-generation ADCs have better clinical efficacy and safety but still have shortcomings, such as off-target toxicity leading to insufficient therapeutic windows, poor distribution due to traditional non-site-specific coupling methods, the presence of unbound antibodies, and aggregation or rapid clearance of high drug-antibody ratio (DAR) ADCs.

The main innovation of third-generation ADCs lies in the change of coupling methods, employing site-specific coupling technology to prepare ADCs with a DAR of 2 or 4, which exhibit better consistency, lower off-target toxicity, and improved pharmacokinetic efficiency. Additionally, the use of more efficient cytotoxic drugs, such as pyrrolobenzodiazepines (PBD) and doucamycin, as well as the expansion of linker types, has further enhanced the stability and anti-cancer activity of ADCs. Currently, a large number of new ADC drugs are in clinical research, continuously optimizing aspects such as antibodies, cytotoxic drugs, linkers, and coupling methods to improve the overall performance of ADCs.

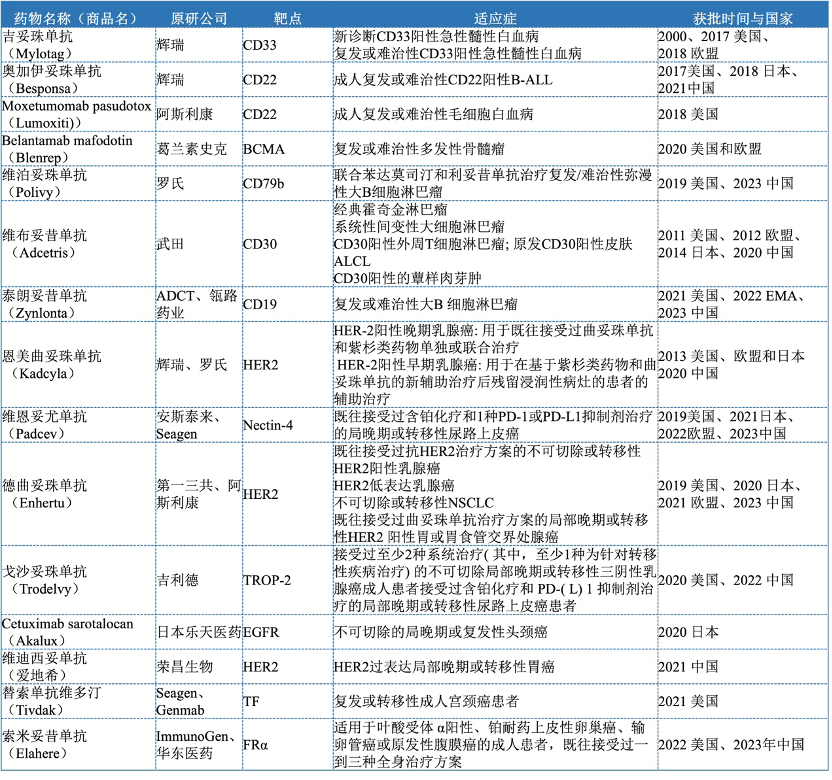

As of mid-2024, there are 15 ADC drugs approved globally (Table 1), including Pfizer’s Mylotarg, Besponsa, Roche’s Kadcyla, Polivy, AstraZeneca’s Lumoxiti, Enhertu, Seagen/Takeda’s Adcetris, Seagen/Amgen’s Padcev, Seagen/Genmab’s Tivdak, GlaxoSmithKline’s Blenrep, Gilead’s Trodelvy, Lotte’s Akalux, ADCTherapeutics’ Zynlonta, Rongchang Bio’s Aidiqi, and ImmunoGen/East China Pharmaceutical’s Elahere, targeting diseases including lung cancer, lymphoma, leukemia, breast cancer, multiple myeloma, head and neck cancer, and urothelial carcinoma.

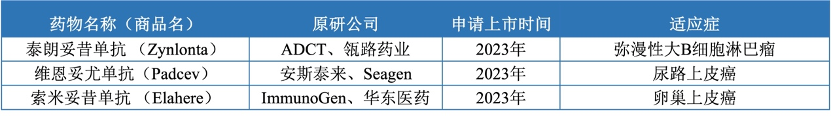

There are 7 ADC drugs approved in the Chinese market (Table 2), including Roche’s Enmetuzumab approved in 2020, Seagen/Takeda’s Vabomere approved in 2020, Pfizer’s Ogarizumab approved in 2021, Rongchang Bio’s Vidisizumab approved in 2021, Immunomedics/Gilead’s Gozalizumab approved in November 2022, Roche’s Vabosizumab approved in 2023, and Daiichi Sankyo/AstraZeneca’s Dercizumab approved in 2023. These drugs cover multiple therapeutic areas, including hematologic tumors and solid tumors, mainly used for the treatment of advanced, relapsed/refractory, and metastatic tumors. In addition, ADCT/Linglu Pharmaceutical’s Talazoparib, Amgen/Seagen’s Veenetumab, and ImmunoGen/East China Pharmaceutical’s Somatuzumab have submitted applications for market approval in 2023 (Table 3).

There are over 1,000 drugs at various stages of development globally, with popular targets including HER2, EGFR, TROP2, MET, etc. The leading targets in research are primarily used for solid tumor treatment. According to the Dingxiangyuan Insight database statistics (Figure 4), the target with the most ADC drugs under development is HER2, with over 90 ongoing projects. HER2-ADCs are mainly explored for the treatment of breast cancer, gastric cancer, urothelial carcinoma, non-small cell lung cancer, colorectal cancer, etc. Additionally, TROP2 andEGFR have over 50 ongoing projects, with TROP2-ADCs primarily explored for breast cancer, non-small cell lung cancer, pancreatic cancer, and ovarian epithelial cancer, while EGFR-ADCs are mainly explored for non-small cell lung cancer, glioblastoma, colorectal cancer, and pancreatic cancer.

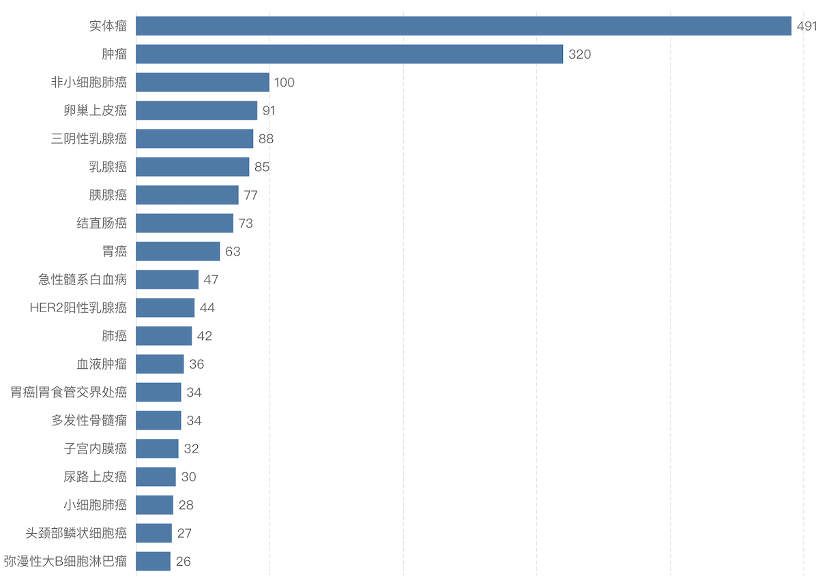

The indications for ADC drugs under development are currently mainly concentrated in the oncology field (Figure 5), with solid tumors being the most popular. There are numerous subtypes of solid tumors, with breast cancer, lung cancer, and gastric cancer having the most ongoing products, all of which present significant unmet clinical needs.

With the increasing number of ADC drug products on the market, the advancement of treatment lines, and the expansion of treatment indications, the global ADC drug market has shown rapid growth trends. In 2022, the global sales of ADC drugs reached 7.9 billion yuan, and in 2023, sales exceeded 10.2 billion dollars for the first time. According to Frost & Sullivan data, the global ADC drug market is expected to grow from 7.9 billion dollars in 2022 to 64.7 billion dollars in 2030, with a compound annual growth rate of 37.3% from 2017 to 2022, and a compound annual growth rate of 30.0% from 2022 to 2030 (Figure 6).

The representative drug of third-generation ADCs Daiichi Sankyo/AstraZeneca’s HER2-ADC drugEnhertu (DS8201) has rapidly expanded its sales from 14 million dollars in 2020 to 2.7 billion dollars in 2023 after being approved in 2019, becoming the best-selling ADC drug (Figure 7).

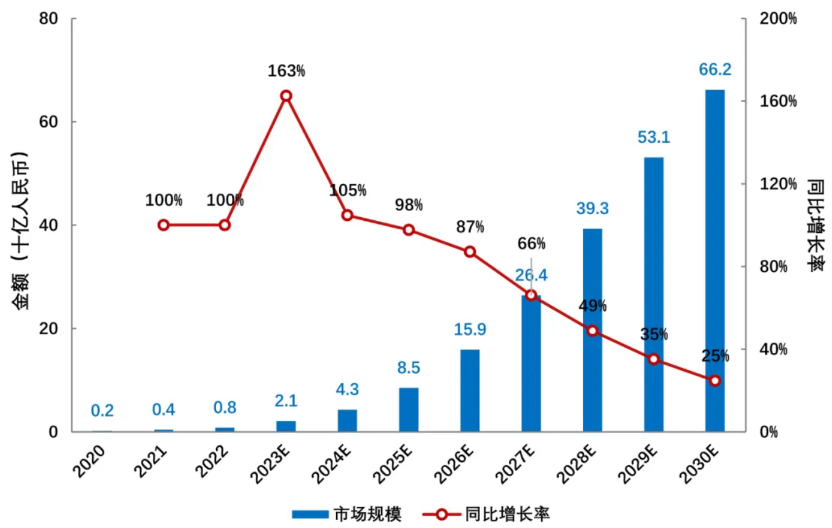

China’s ADC drug research started late but has shown a rapid growth trend. As multiple overseas-approved ADC products are gradually launched domestically and several domestically developed ADC products enter late-stage clinical development, the domestic ADC drug market size is expected to grow from 800 million yuan in 2022 to 66.2 billion yuan in 2030, with an annual compound growth rate of 72.8% from 2022 to 2030 (Figure 8). The existing chemotherapy drug market in China exceeds 100 billion yuan, and ADC drugs, as precision chemotherapy products, are expected to gradually replace chemotherapy in multiple indications, while ADCs also show great potential in non-chemotherapy tumor treatments and non-tumor indications, making future market space promising.

Since the concept of ADC was proposed, it has been over 100 years, yet the varieties available on the market remain few, and most of the varieties under research are still at early stages. The main reason is the high difficulty and technical barriers in ADC drug development. After entering the human body, ADC drugs need to go through multiple steps to become effective, and each step poses technical challenges that need to be overcome. Despite the increasing number of approved ADCs, there are still challenges for those exhibiting excellent safety and efficacy in clinical settings.

One unexpected issue faced by many developers during clinical evaluation is that ADCs fail to show benefits compared to control groups, such as Rovalpitumab tesirine (RovA-T), which reported an objective response rate (ORR) of 18% in evaluable patients in Phase I trials and 38% ORR in DLL3 high-expressing patients. However, the results of Phase II trial TRINITY (NCT02674568) raised safety and efficacy concerns, as the trial did not meet its primary endpoint and reported high toxicity rates. The most common adverse event among patients was pleural effusion, which was thought to be toxicity related to PBDE dimers. Ultimately, the results of Phase III trials TAHOE (NCT03061812) and MERU (NCT03033511) led AbbVie to completely halt the development of RovA-T due to a lack of survival advantage compared to the control group. Another challenge of ADCs is off-target toxicity, caused by the premature release of cytotoxic small molecules into the bloodstream. Antibodies are clumsy transport vehicles that struggle to penetrate tumor tissues, with only an estimated 0.1% of the drug reaching the tumor tissue. To ensure that the remaining 99% of highly toxic payloads do not cause systemic toxicity, the chemical link between the payload and the antibody must be sufficiently stable. However, ensuring that the payload is released within the cells while maintaining some instability clearly complicates drug design.

Additionally, ADCs are prone to aggregation. Aggregation of ADCs can lead to modifications that reduce their ability to bind to antigens. Protein aggregation is a major obstacle in the development of ADCs. It can occur at every stage as well as during transport and long-term storage. Aggregation is immunogenic. Furthermore, protein aggregation may lead to product loss. Overall, any chemical or physical degradation can lead to structural changes in ADCs and excessive protein aggregation.

Another challenge for ADCs is off-target toxicity, caused by the premature release of cytotoxic small molecules into the bloodstream. Antibodies are clumsy transport vehicles that struggle to penetrate tumor tissues, with only an estimated 0.1% of the drug reaching the tumor tissue. To ensure that the remaining 99% of highly toxic payloads do not cause systemic toxicity, the chemical link between the payload and the antibody must be sufficiently stable. However, ensuring that the payload is released within the cells while maintaining some instability clearly complicates drug design.

In addition to the above issues, ADC drugs also face challenges related to resistance and immunogenicity.

Despite these numerous challenges, this is an era of innovative drugs, with the iterative updates of different technologies. As more issues are studied in depth, ADCs require broader clinical coverage and confirmation.