Click↑Follow Us

Set “Star” to Keep Updated

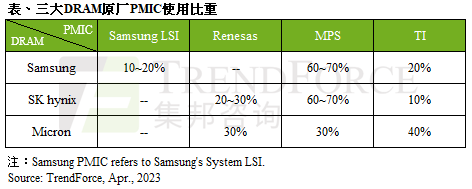

The new server platforms Intel Sapphire Rapids and AMD Genoa are about to go into mass production, but recent reports in the market indicate issues with the PMIC compatibility of Server DDR5 RDIMMs. Currently, both DRAM manufacturers and PMIC suppliers are addressing these issues.

According to TrendForce, this situation will have two impacts. First, as the PMICs supplied solely by MPS (Chip Source Systems) are unaffected, DRAM manufacturers will increase their procurement ratio from Chip Source in the short term. Secondly, as the current production of DDR5 Server DRAM remains at older processes, the supply volume is inevitably affected by this incident, thus it is estimated that the price decline of DDR5 Server DRAM in the second quarter will converge from the original forecast of 15-20% to 13-18%.

As mentioned earlier, the short-term supply of DDR5 Server DRAM is affected not only by PMIC issues but also by the production remaining at older processes. Even though SK Hynix has gradually increased production and sales of 1alpha nm, many buyers had previously validated 1Y nm, and since 1alpha nm has not yet completed validation, the current production process still relies primarily on Samsung and SK Hynix’s 1Y nm, and Micron’s 1Z nm, with 1alpha and 1beta nm expected to ramp up only in the second half of this year.

Therefore, with the expectation of low supply satisfaction for DDR5 Server DRAM in the short term, TrendForce estimates that the price of 32GB DDR5 Server DRAM will fall between $80 and $90 in April and May, slightly higher than the original second-quarter average estimate of $75, leading to a widening price gap between DDR5 and DDR4. Furthermore, for the second quarter, the price decline for DDR4 is expected to be between 18-23%, while DDR5’s decline converges to 13-18%, thus indicating that the quarterly price drop for DDR4 will exceed that of DDR5.

Demand Driven by AI, Latest Quotes for 128GB High-Capacity Modules Have Stabilized

Additionally, the ChatBOT craze has driven up the shipment volume of AI servers. Besides the increased discussion around HBM, it has indirectly boosted the procurement momentum for Server DDR5 RDIMM 128GB. To upgrade the GPT4.0 computing architecture, the demand for high-capacity RDIMMs has notably increased in early Q2, primarily concentrated among US-based Cloud Service Providers (CSPs).

The 128GB RDIMM currently uses 16Gb DDR5 mono die, and stacking to that capacity requires TSV (Through Silicon Via) for vertical architecture silicon through-hole packaging. However, the main suppliers’ TSV production lines have not been able to increase in the short term, which will further raise the price of SK Hynix’s high-capacity DDR5 modules this month, unlike the current downward pricing of DDR4 and other DDR5 products.

Overall, due to the additional PMIC components in DDR5 module designs compared to DDR4, there are significantly more risks in matching. Additionally, customers are generally delaying the mass production of new server platform models. Although DRAM manufacturers have been sending samples to CPU manufacturers and various buyers for validation since early 2022, the actual issues have only emerged recently as new platforms gradually ramp up. TrendForce believes that the changes in the price gap between DDR4 and DDR5 resulting from this incident will reflect in the second to third quarters, with the gap expected to converge as new process products begin to ramp up.

*For more in-depth reports on the server memory industry, click to learn about TrendForce’s Storage Membership Program.

▶ About Us

TrendForce is a global high-tech industry research institute spanning storage, integrated circuits and semiconductors, wafer foundry, optoelectronic displays, LEDs, new energy, smart terminals, 5G and communication networks, automotive electronics, and artificial intelligence. The company has accumulated years of rich experience in industry research, government industry development planning, project evaluation and feasibility analysis, corporate consulting and strategic planning, and brand marketing, making it a quality partner for government and enterprise clients in high-tech industry analysis, planning evaluation, consulting, and brand promotion.

Scroll up and down to view

Share

Collect

Like

View