There are predictions that the growth pace of the global semiconductor market will slow down. The World Semiconductor Trade Statistics (WSTS) organization released forecasts on June 5, stating that although the semiconductor market grew at a double-digit rate annually before 2018, the growth rate for 2019 is only 4%, falling back to single-digit growth for the first time in three years. The demand for storage semiconductors used for data recording continues to grow due to the expansion of big data utilization, but prices are expected to drop due to increased production.

According to a report by the Nikkei on June 6, WSTS members include major global semiconductor companies such as Intel from the United States and Samsung Electronics from South Korea, which release a two-year market forecast every six months. Based on the numbers released this time, the actual performance in 2017 grew by 22% compared to 2016, breaking the $400 billion mark for the first time, reaching $412.2 billion. In 2018, it is expected to grow by 12%, an increase of 5 percentage points from the previous forecast. However, the growth for 2019 is expected to be only 4%, reaching $483.7 billion.

The main reason for the slowdown in growth is the drop in memory prices

Reports indicate that the main reason for the slowdown in growth is the drop in memory prices. The use of memory in smartphones and data center servers has surged, accounting for about 30% of the overall semiconductor market. WSTS pointed out that the memory market grew by 62% in 2017 and is expected to expand by 27% in 2018, but will slow to 4% in 2019.

In addition to memory, there are also analog semiconductors for home appliances and sensors for autonomous driving. Unlike memory, which has fewer varieties and large production volumes, the prices of multi-variety, small-batch production semiconductors for different applications are not easily subject to fluctuations. With market demand continuing to grow steadily, the overall market size of semiconductors is greatly influenced by the trends in memory.

The head of WSTS in Japan commented on the expected slowdown in memory growth, stating, “We considered past cyclical factors.” The memory market also experienced continuous double-digit growth from 2013 to 2014, but as demand expanded and manufacturers increased production, prices fell in 2015 and 2016, leading to a contraction in market size.

In fact, a price drop has already occurred. The trading price of NAND flash memory is now about 20% cheaper than at the beginning of 2018. Despite the drop in unit prices, demand is rapidly expanding, so the market remains in good shape.

▲ On May 3, Cambricon Technologies released the first domestic cloud-based artificial intelligence chip. (Xinhua News Agency)

The extent of demand expansion is key to market stability

The president of Toshiba Memory, Katsuaki Nomura, stated, “The price drop has not exceeded the growth in storage capacity,” believing that the current situation will continue. However, Akira Nanokawa, chief analyst at the UK research firm IHS Markit, cautiously pointed out, “The market size will reach its peak in 2017 and 2018.” IHS predicts that the drop in memory prices will lower the growth rate for 2018 to single digits, and it will remain flat in 2019.

Semiconductor manufacturers are eager to invest. Samsung Electronics invested 2.8 trillion yen in semiconductor businesses such as large-scale integrated circuits (LSI) in 2017. According to statistics from the US research firm IC Insights, semiconductor companies’ equipment investment is expected to grow by 45% year-on-year in 2018. China’s Tsinghua Unigroup is expected to start production at its 3 trillion yen Wuhan memory factory within this year.

On one hand, the drop in memory prices will help promote demand expansion. The president of Tokyo Electron, Toshiro Kawai, believes, “Although NAND flash prices have fallen, the market for data centers will expand.” Some overseas memory manufacturers’ sales personnel believe that “Chinese smartphone manufacturers will increase the storage capacity in new models.”

As memory prices drop, the extent to which demand will expand is likely to be the key to whether the semiconductor market can maintain growth.

▲ Huawei’s open laboratory in Paris officially opened on April 3. Currently, this laboratory has attracted over 50 leading companies in the industry, providing an open technological innovation platform for Huawei and its partners to jointly develop interconnectivity, IoT, cloud computing, and big data businesses. (Xinhua News Agency)

IoT chips are the new blue ocean

The most significant changes in semiconductor memory demand are occurring in the smartphone market.

According to the Nikkei, Apple’s flagship model, the iPhone X, reduced production by 50% from January to March. Rapidly growing Chinese smartphone manufacturers such as OPPO and vivo are also facing tough battles. According to statistics from the US research firm IDC, global smartphone sales fell by 0.1% year-on-year in 2017, dropping to 1.47 billion units. Changes in the smartphone market have directly led to a slowdown in the supply and demand of flash memory. In the case of NAND flash memory used in smartphone memory devices, spot prices, which are sensitive to demand, have dropped by about 10% compared to three months ago. The price increase that had been ongoing since the second half of 2016 has changed.

Hisashi Moriyama, an executive director at JP Morgan Securities, stated, “NAND flash will enter an adjustment period.” Moriyama believes that as manufacturers improve their yield rates, the supply of NAND flash will increase, alleviating the supply shortage situation compared to 2017.

On the other hand, the impact of changes in the smartphone market on the chip industry is limited. The semiconductor industry is undergoing structural changes due to the arrival of a new era—the IoT era.

The Internet of Things (IoT) is considered to be the next peak of the industrial technology revolution following computers and the internet. The interconnection of all things is giving birth to an unprecedented large market, and achieving this interconnection relies on the brain of the IoT—chips. With the rapid development of the IoT industry, IoT chips are expected to surpass PC and smartphone chips, becoming the largest chip market in the future.

Domestic and foreign manufacturers are actively developing IoT chips. Currently, leading foreign IoT chip providers such as Qualcomm, Intel, and ARM, along with domestic leaders like Huawei HiSilicon, SMIC, and TSMC, are all expanding their innovation capabilities in equipment, components, and software development, leveraging their advantages to optimize for the IoT era.

In the IoT field, NB-IoT (Narrowband IoT) is an important branch, which has been well-validated in commercial projects due to its advantages of “wide area coverage, low power consumption, and massive connectivity.” Giants like Intel, Qualcomm, and Ericsson have joined the NB-IoT camp. China’s NB-IoT is in a vigorous development stage, significantly ahead of other countries and competitors. For example, in May 2014, Huawei proposed narrowband technology NB M2M; in May 2015, it integrated NB OFDMA to form NB-CIOT; in July, NB-LTE further integrated with NB-CIOT to form NB-IOT. Industry insiders predict that a major development of China’s NB-IoT is on the horizon.

The NB-IoT chip is responsible for receiving, processing, and storing data for NB-IoT cellular IoT signals, and it can be said that in the NB-IoT industry, chips are the key element for the development of NB-IoT; whoever occupies the leading advantage in new technology will hold the power of discourse in the industry. The new generation of IoT technology, NB-IoT, provides Chinese technology companies with an opportunity to overtake.

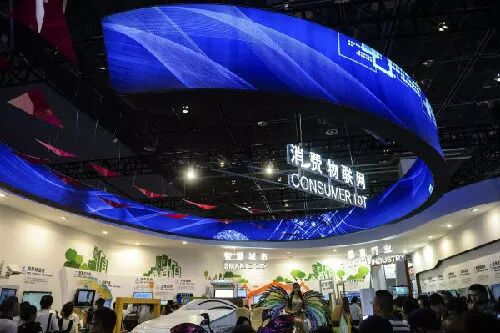

▲ Archive photo: The 2017 World Internet of Things Expo opened in Wuxi. (Xinhua News Agency)