There is an unwritten rule in the chip industry: those who want to go it alone will inevitably lose. This statement may sound absolute, but looking at the current situation— from design to manufacturing, the global industrial chain has long been ‘divided’.

Taiwan Semiconductor Manufacturing Company (TSMC) focuses on chip manufacturing, ARM specializes in architecture, and EDA companies only provide design tools… Everyone has their own role, and efficiency has actually increased.

Recently, ARM has made a significant move by launching the CSS (Compute Subsystem) model, which directly cuts the barriers to chip design in half. What exactly is going on?

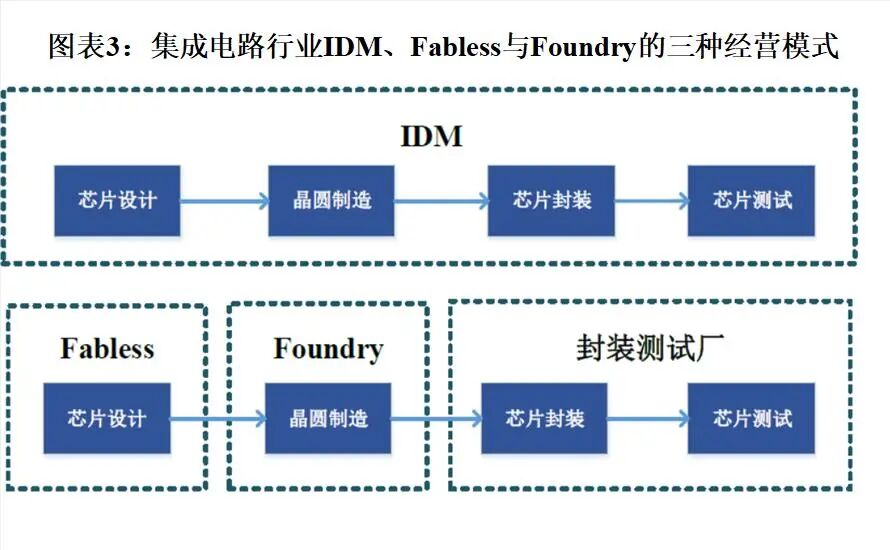

From ‘All-Rounder’ to ‘Specialized Subcontracting’Twenty years ago, chip companies had a particularly tough time. A single company had to handle all aspects of design, manufacturing, and testing, a model known as IDM (Integrated Device Manufacturing).

Later, TSMC emerged, separating the manufacturing process, and since then, the industry has completely ‘divided’. Design companies no longer need to worry about building factories or buying lithography machines; they just need to draw circuit diagrams. Foundries like TSMC rely on technological upgrades to capture global orders, while testing and packaging companies focus on ‘refining’ chip details. With the division of labor, the entire industry has seen a surge in efficiency—technologies that used to take ten years to iterate can now be achieved in three to five years.

The chip design field is also undergoing similar changes. In the early days, designing a chip required companies to develop their own EDA software, design architecture, and tinker with IP cores (such as CPU and GPU core modules), akin to building a skyscraper from scratch. Later, EDA tools were contracted out to specialized companies like Synopsys and Cadence; ARM became the ‘arms dealer’ of the industry by selling architectures and IP cores. As the division of labor became more detailed, the entry barriers lowered—now even startups can purchase ready-made tools and solutions to create their own chips.

ARM’s CSS Model: The ‘Pre-Packaged Meal’ of the Chip WorldIf past chip design was like buying groceries and cooking, ARM’s newly launched CSS model is more like providing a semi-finished meal kit. Previously, ARM only sold ‘raw houses’ (architecture) and ‘furniture’ (IP cores), and manufacturers had to handle the renovation, circuit modifications, and performance tuning, completing about 80% of the workload. The CSS model directly packages core modules like CPU, GPU, and memory controllers, pre-integrating and debugging these components, so manufacturers only need to add remaining functionalities, such as custom AI units or imaging modules, effectively halving the workload.

This model is somewhat like building with LEGO: ARM provides the assembled base framework, and manufacturers just need to add their specially designed parts. For example, using CSS, a smartphone manufacturer can enhance image processing, while an automotive company can add autonomous driving modules. This significantly shortens the design cycle and reduces costs—after all, there’s no need to start from scratch with general components like CPUs and GPUs.

Lowering Barriers: Laziness or Progress?There are always complaints: ‘Using ready-made solutions isn’t true self-research!’ But the reality is that even giants like Apple and Qualcomm cannot completely ‘go it alone’. Apple’s A-series chips use ARM architecture, and Qualcomm’s Snapdragon relies on TSMC for manufacturing; everyone has long enjoyed the benefits of division of labor and collaboration. ARM’s CSS model merely pushes collaboration a step further—standardizing the common parts of the industry, allowing companies to focus their energy on innovative features.

This reflects the survival rule of the chip industry: speed determines life and death. Designing a flagship chip used to cost $1 billion and take three years; now, with the CSS model, it may only take one year. For new players like Xiaomi and OPPO, it is far more realistic to stabilize their footing with mature solutions and gradually tackle core technologies than to insist on ‘100% self-research’. Just look at Huawei’s HiSilicon; the Kirin chips also started from a public architecture and took ten years to reach today’s level.

The Future Chip Battle: Competing with ‘Combined Innovation’As the industry division of labor reaches a certain level, ‘full autonomy’ has become a false proposition. Just as no one would expect smartphone manufacturers to mine and refine metals themselves, chip design is destined to move towards a model of ‘global collaboration + localized innovation’. Services like CSS are significant because they allow more companies to participate in the chip battlefield—whether it’s smartphone manufacturers customizing imaging chips, automotive companies developing smart cockpit chips, or even home appliance brands creating IoT chips.

Lowering barriers does not mean a lack of technical content. How to combine ARM’s basic framework with one’s unique features? How to optimize energy efficiency and performance? These still test the R&D capabilities of manufacturers. However, the industry no longer requires everyone to reinvent the wheel; instead, it encourages innovation while standing on the shoulders of giants.

Ultimately, the chip industry has long passed the era of ‘individual heroism’. ARM’s latest move to cut the design threshold in half may foster more ‘small but beautiful’ chip players—after all, who wouldn’t want to try making differentiated products at lower costs and faster speeds?