Main Listed Companies in the Industry: Pegatron Corporation (002938.SZ), Dongshan Precision (002384.SZ), Shenzhen South Circuit (002916.SZ), Jingwang Electronics (603228.SH), Huadian Co., Ltd. (002463.SZ), Xingsen Technology (002436.SZ), Shiyun Circuit (603920.SH), etc.

Core Data of This Article: PCB Product Structure; PCB Application Structure; PCB Market Size, etc.

Product Structure: Rigid Boards are Currently the Main Product Type

A Printed Circuit Board (PCB), also known as a printed wiring board or printed circuit board, is a board made of insulating and heat-resistant materials that serves to fix various components in a circuit and provide connections between them. Broadly speaking, it is a finished product that carries electronic components such as LSI, IC, transistors, resistors, and capacitors on the printed circuit board and connects them electrically through soldering. In a narrow sense, it refers to a semi-finished board that has only the wiring circuit pattern without installed components.

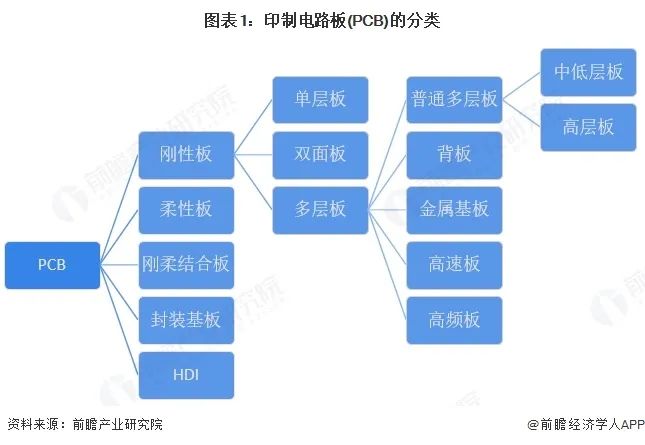

PCBs come in a variety of types. Based on the flexibility of the substrate, they can be classified into rigid boards (R-PCB), flexible boards (FPC), and rigid-flex boards. Based on the number of conductive layers, they can be divided into single-sided boards, double-sided boards, and multi-layer boards. Additionally, there are special product classifications such as high-speed and high-frequency boards, high-density interconnect boards (HDI), and packaging substrates.

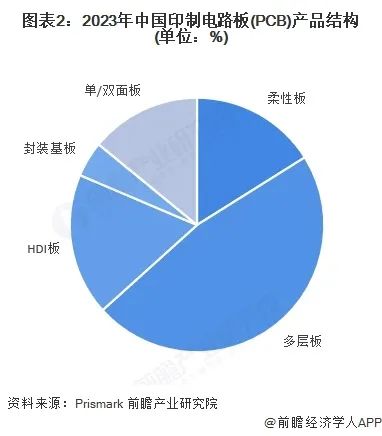

According to Prismark data, rigid boards are currently the main product type, with multi-layer board products accounting for over 45%, while single/double-sided boards account for about 15%. The proportion of high-end printed circuit board products is relatively low, especially for packaging substrates, which accounted for only 5% in 2023, far below the global level of 18%.

Application Structure: Communication and Computing are the Main Application Markets

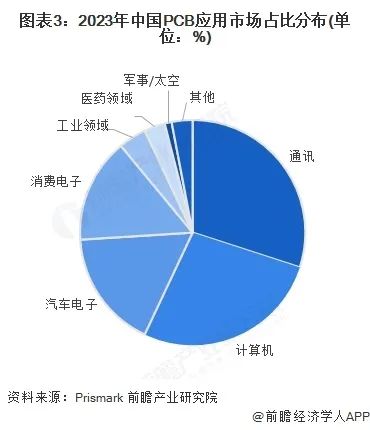

Based on existing major application fields, the main application areas of PCBs can be divided into seven categories: communication (including mobile phones, wired infrastructure, wireless infrastructure), computing (including PCs, servers/storage, other computers), consumer electronics, automotive electronics, industrial electronics, medical devices, and aerospace. Among these, communication, computing, automotive electronics, and consumer electronics are the four main application markets, collectively accounting for over 85% in 2023.

PCB has Long Been in a Trade Surplus Position

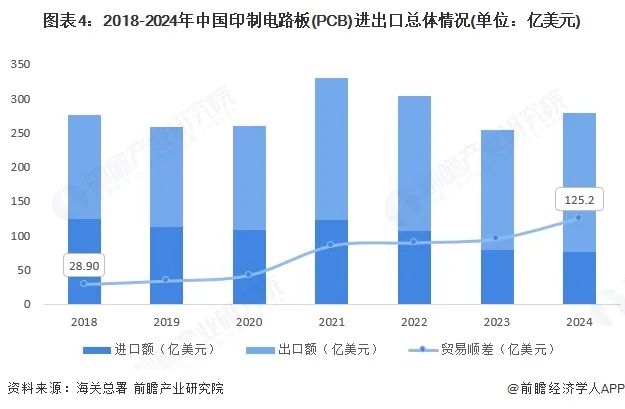

Since 2006, mainland China has surpassed Japan to become the world’s largest PCB production region, with both output and value ranking first globally. In terms of foreign trade, China’s PCB industry has long been in a trade surplus position. According to data from the General Administration of Customs, from 2018 to 2024, the trade surplus of China’s PCB industry has shown an overall expanding trend, reaching $12.52 billion in 2024, a year-on-year increase of 31.2%.

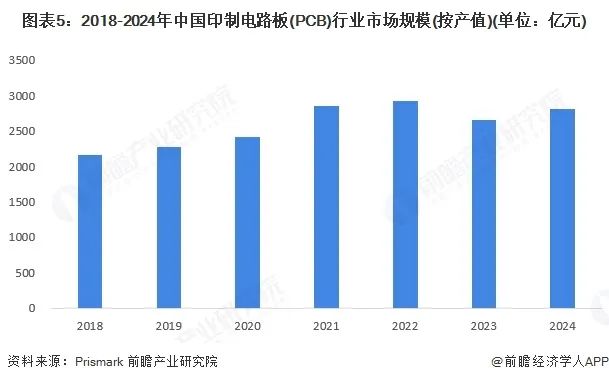

The Market Size of Printed Circuit Boards (PCBs) has Expanded

PCBs are widely used in downstream fields, including communication electronics, computing, consumer electronics, automotive electronics, industrial control, medical devices, defense, and aerospace. In recent years, with the rapid development of China’s industry and the increasing demand in emerging fields, the PCB industry has also welcomed new development opportunities. From 2018 to 2023, the market size of China’s PCB industry grew from 216.39 billion yuan to 266.29 billion yuan, with a compound annual growth rate of 4.2%. Based on historical statistical data and market changes, it is preliminarily estimated that the market size of China’s PCB industry will reach approximately 280.6 billion yuan in 2024, a year-on-year increase of 5.4%.

Note: Currency units are uniformly converted to RMB, with exchange rates based on the average annual USD to RMB rates for the years 2018-2024 being 6.6174, 6.8985, 6.8974, 6.4515, 6.7261, 7.0467, 7.1217.

For more industry research and analysis, please refer to the “Market Outlook and Investment Strategy Planning Analysis Report for China’s PCB Manufacturing Industry” by the Forward Industry Research Institute.

Neutral Credible Popular Valuable

Source: Forward Industry Research Institute

Statement:We respect originality and emphasize sharing; the copyright of text and images belongs to the original author. The purpose of reprinting is to share more information and does not represent the position of this account. If your rights are infringed, please contact us promptly, and we will delete it immediately. Thank you.

NoteWe are – Follow PCB Job Opportunities – Quickly find good jobs! The job-seeking base for PCB professionals.

– Follow PCB Job Opportunities – Quickly find good jobs! The job-seeking base for PCB professionals.