Medical robotsare a special field related to human life and health, and have been listed as a strategic emerging industry by several countries.

In the development roadmap of robotics in the United States,healthcare robotsare identified as one of the five key areas for development, and it is pointed out that robotic systems willbe applied tovarious aspects of healthcare (from operating rooms to home care, from young people to the elderly, from the weak/disabled to the healthy, from conventional surgeries to rehabilitation training without human intervention), to meet the new demands for precision/minimally invasive surgery, functional compensation and rehabilitation, and elderly services.

In the European robotics development plan, it is clearly stated thatmedical robotswill bring changes to the medical system comparable to the impact of robotic technology on the industrial sector decades ago;rehabilitation robotsare an inevitable development direction to address the aging population and the growing demand for medical resources, and the medical robot industry will become an important engine for driving national economic growth in the new century.

Context

On November 7, 2022, the National Health Commission, the National Administration of Traditional Chinese Medicine, and the National Center for Disease Control and Prevention jointly issued the“14th Five-Year Plan for National Health Informatization” (National Health Planning Document [2022] No. 30) which clearly states“to promote the integration and innovative development of digital health. Accelerate the development of digital health and the construction of new infrastructure, standardize and promote the deep application of a new generation of information technology in the health sector, further optimize factor allocation and service supply, fill development gaps, improve service efficiency, and promote the transformation and upgrading of the health industry.”With social development and continuous economic progress, the demand for high-level medical health is also increasing, and safe, precise, minimally invasive, and efficientmedical services have become the goals pursued by people. Such social demand is driving the rapid development of modern intelligent healthcare represented bymedical robots. Medical robots mainly include surgical robots, assistive rehabilitation robots, diagnostic robots, and hospital service robots. Currently, the ethical and legal issues surrounding medical robots are increasingly becoming important academic topics and practical problems.

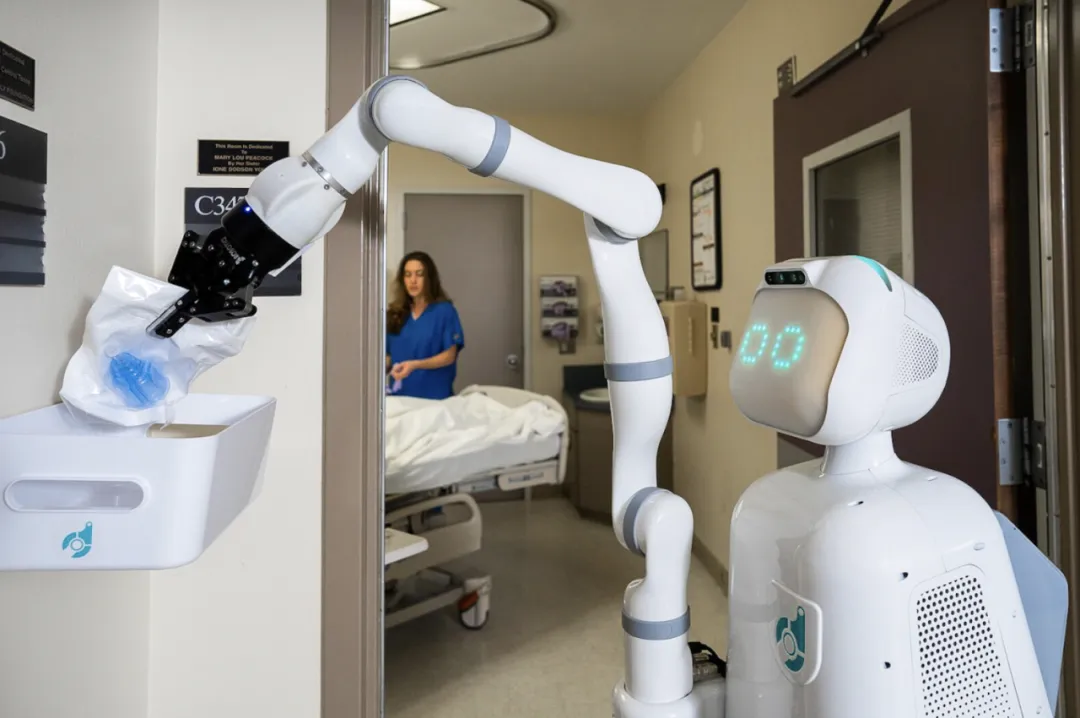

In a nursing center in Jinshui District, Zhengzhou City, Henan Province, China, elderly people interact with robots. In 2023, CGTN (China Global Television Network)

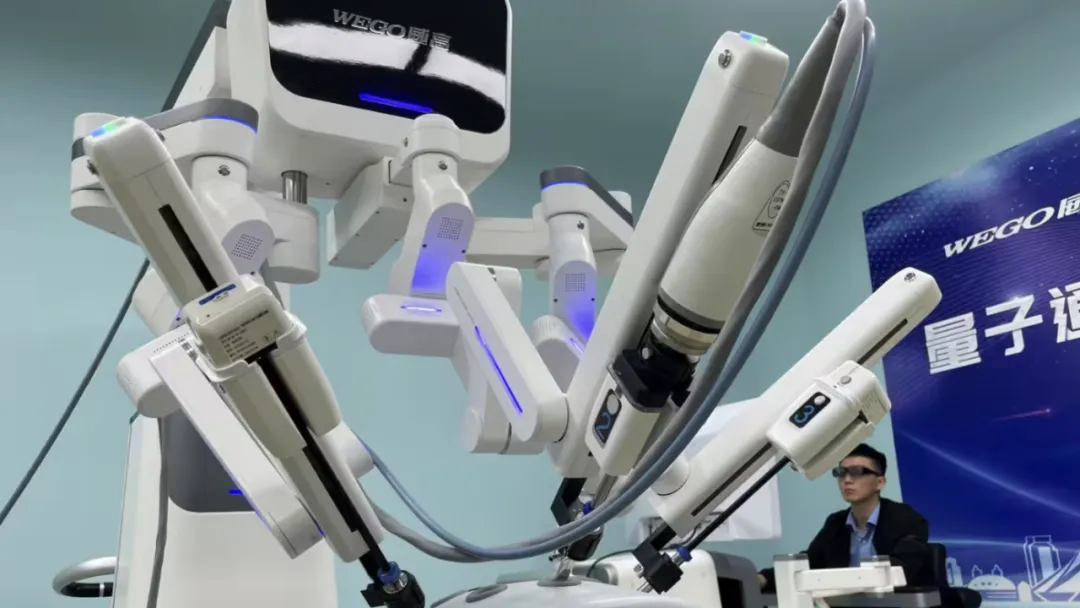

“The laparoscopic surgical robot developed and produced by Shandong Weigao Surgical Robot Co., Ltd. has officially passed the review of the National Medical Products Administration, becoming the first laparoscopic surgical robot approved in the country.” Jin Tai News (People’s Daily)

Fosun International is preparing to deliver its first locally manufactured Da Vinci surgical robot to customers through its healthcare division in Shanghai in 2023, South China Morning Post

According to Beijing Friendship Hospital affiliated with Capital Medical University, Chinese researchers have completed the first human clinical trial using a single-arm laparoscopic surgical robot in China in 2021, CCTV News

Concept Classification

Medical robots refer torobots used for medical or auxiliary medical purposes in hospitals and clinics, which are a type of intelligent service robot that can independently formulate operational plans, determine action procedures based on actual conditions, and then convert actions into movements of operational mechanisms,greatly improving the work efficiency of medical personnel.

Theapplication scenarios of medical robots are extensive, coveringsurgery, rehabilitation, logistics, assistance, and telemedicine and other aspects.With continuous technological advancements and the expansion of application scenarios, medical robots will play an increasingly important role in the future medical field.

Illustration of a medical robot performing surgery

Market Size

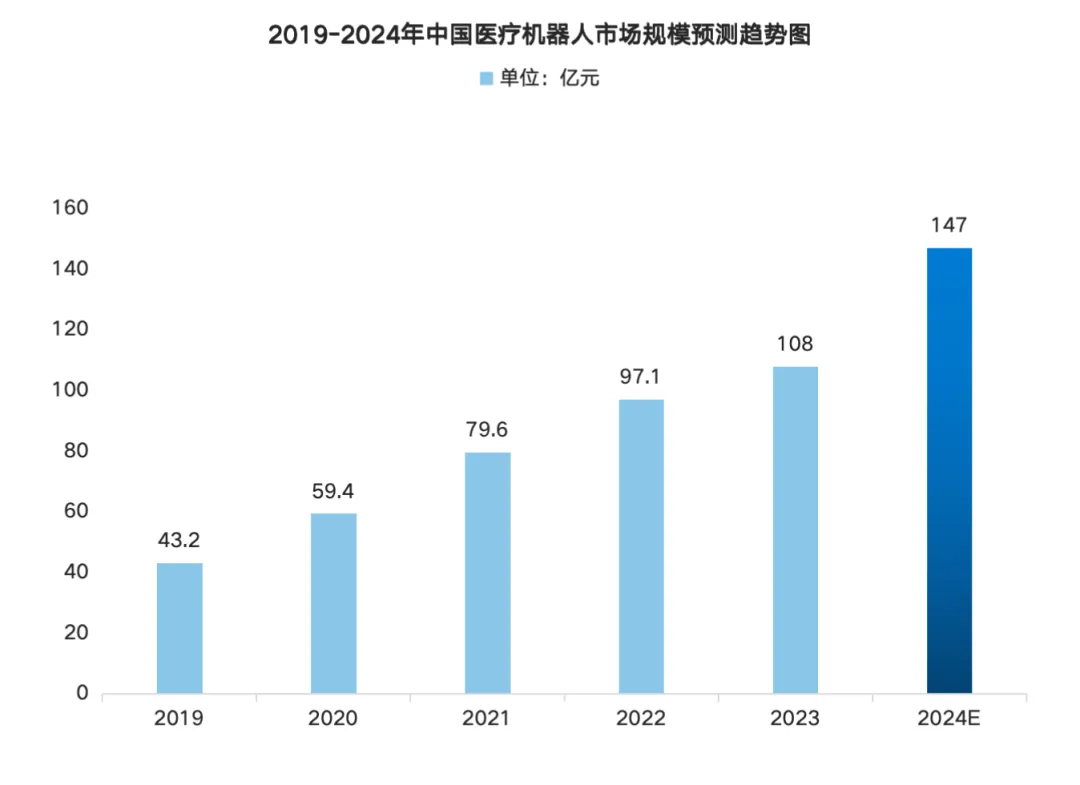

The rapid development and deep application of technologies such as artificial intelligence and intelligent sensing provide strong technical support for medical robots, and the medical robot industry in China is developing rapidly, with the market size of the industry continuously increasing.

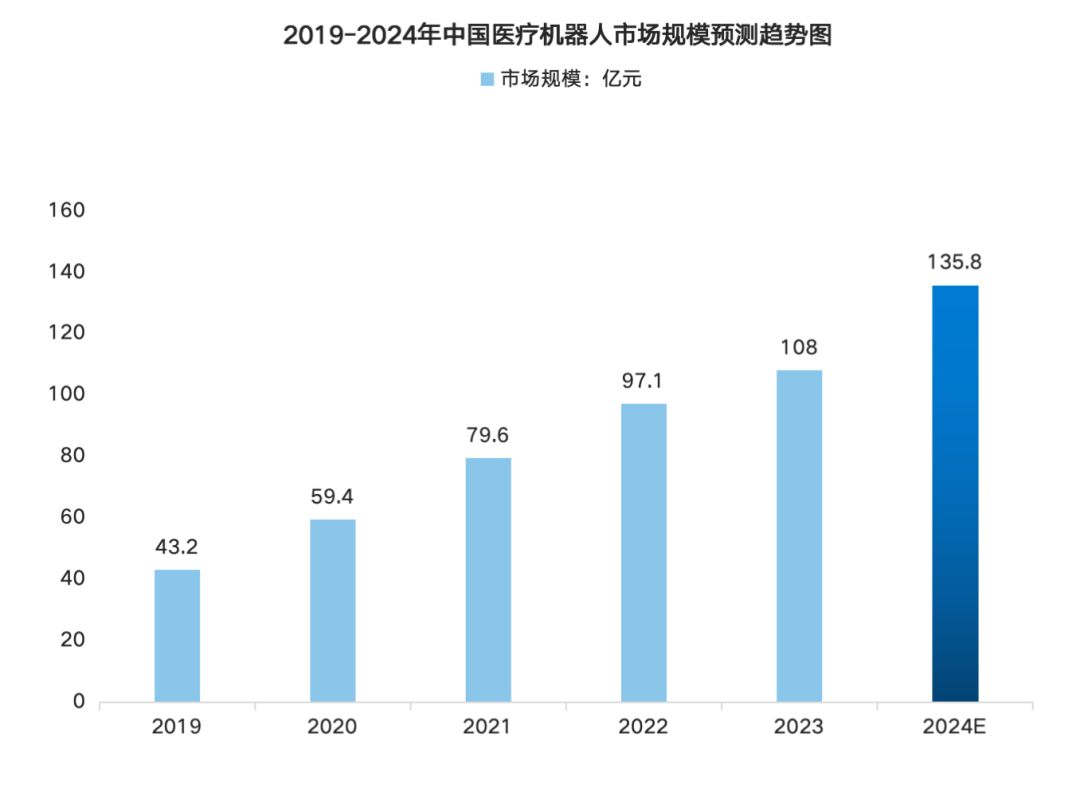

According to the report released by the China Business Industry Research Institute“Analysis and Development Forecast of the Chinese Medical Robot Industry from 2024 to 2029”,the market size of medical robots in China in 2023reached 10.8 billion yuan,with an average annual compound growth rate of25.74%. It is predicted thatthe market size of medical robots in China in 2024is expected to exceed 14 billion yuan.

Enterprise Layout

With the continuous development of medical technology and the increasing demand from patients, the medical robot industry will usher in a broader development prospect.

There are many key enterprises in the medical robot industry that are leading in terms of technological innovation, market share, and industry influence.Among them, major companies include Harbin Institute of Technology Intelligent, Tianzhihang, Weigao Orthopedics, etc.

Major Companies in China’s Medical Robot Sector:

Harbin Institute of Technology Intelligent: has successively cooperated with more than ten well-known hospitals in China, including the General Hospital of the Chinese People’s Liberation Army, Ruijin Hospital affiliated with Shanghai Jiao Tong University, Shanghai First People’s Hospital, Shanghai Sixth Hospital, Shanghai Ninth Hospital, Huashan Hospital affiliated with Fudan University, Zhongshan Hospital, and the First Affiliated Hospital of the Navy Medical University.

Tianzhihang: is a leading enterprise in the domestic orthopedic surgical robot industry, focusing on the research, production, sales, and service of orthopedic surgical navigation robots.

Weigao Orthopedics: is engaged in the research, production, and sales of orthopedic medical devices.

Kunbo Medical: A high-tech enterprise focused on the research and production of diagnostic technology for lung diseases.

Minimally Invasive Robotics: focuses on the development of orthopedic surgical robots.

Runmaide: is committed to creating a globally leading “platform-level” vascular interventional surgical robot.

Jingfeng Medical: designs, develops, and manufactures surgical robots, focusing on minimally invasive surgical robots and instruments, providing innovative solutions for surgical procedures.

Smart Medical Robot Industry Chain

Upstream

Raw materials and component supply: includes plastic materials, metal materials, composite materials, nano materials, etc. Core components include sensors, servo motors, reducers, controllers, etc.

Representative Enterprises

Sensors

· Chemical Technology

· TE Connectivity

Servo Motors

· Inovance Technology

· Hechuan Technology

Reducers

· Harmonic Drive

· Double Ring Transmission

Controllers

· Estun

· New Times

Midstream

Robot body manufacturing and system integration: mainly divided into three categories: surgical robots, rehabilitation robots, and medical assistive robots.

Representative Enterprises

Surgical Robots

· Tianzhihang Minimally Invasive

· Jingfeng Medical

· Jianjia Medical

· Huake Precision

Rehabilitation Robots

· Fourier Intelligent

· DAI Robot

· Jinghe Robot

· Cheng Tian Technology

· Ruihan Medical

Medical Assistive Robots

· Weibang Technology

· Anhan Medical

· Jinshan Technology

· Siasun Robot

· Taimi Robot

Downstream

Application scenarios: cover multiple aspects including surgery, rehabilitation, nursing, assistance, logistics, and telemedicine.

Medical Robot Industry Chain – Upstream

The core components mainly consist of servo motors, sensors, controllers, reducers, and system integration, among which the most critical components, the reducer, servo motor, and controller, account for about70% of the total cost of the robot, and currently, the domestic market relies heavily on imports. The technical barriers for reducers are the highest, mainly includingRV reducers and harmonic reducers. DomesticRV reducers are mainly monopolized by Japanese Nabtesco, Sumitomo, andSPINEA; in terms of harmonic reducers, due to their relatively simple structure and the expiration of patents from Japanese Harmonic Drive, the gap between domestic and foreign products is not significant. Domestic servo motors are mainly dominated by Japanese and European brands, with a domestic rate of about15%, mainly concentrated in the mid-to-low end.The technical difficulty of controllers is relatively low, and domestic controller products can already meet most functional requirements, with the gap between domestic and foreign products mainly in algorithms and compatibility.

Midstream

Medical robot complete machine production enterprises. In the business coverage of Chinese medical robot enterprises, the number of rehabilitation robots and assistive robots accounts for a high proportion, both exceeding30%. More than10 domestic rehabilitation robot companies have completed one or more rounds of financing, and there are approximately20 to 30 companies in the entire track, with fierce competition and significant product homogeneity. Companies will compete comprehensively in terms of clinical progress, technological advantages, marketing capabilities, sales capabilities, and product pricing.Except for some diagnostic robots, most assistive robot products have relatively low technical barriers and are mainly used for auxiliary diagnosis and treatment, with high demand in some large hospitals with significant patient flow. Diagnostic robots for major diseases are a key development direction.Surgical robots, due to their high technical barriers and significant R&D difficulty, account for about15%, with a large market space.

Upstream Raw Materials

01 Stainless Steel

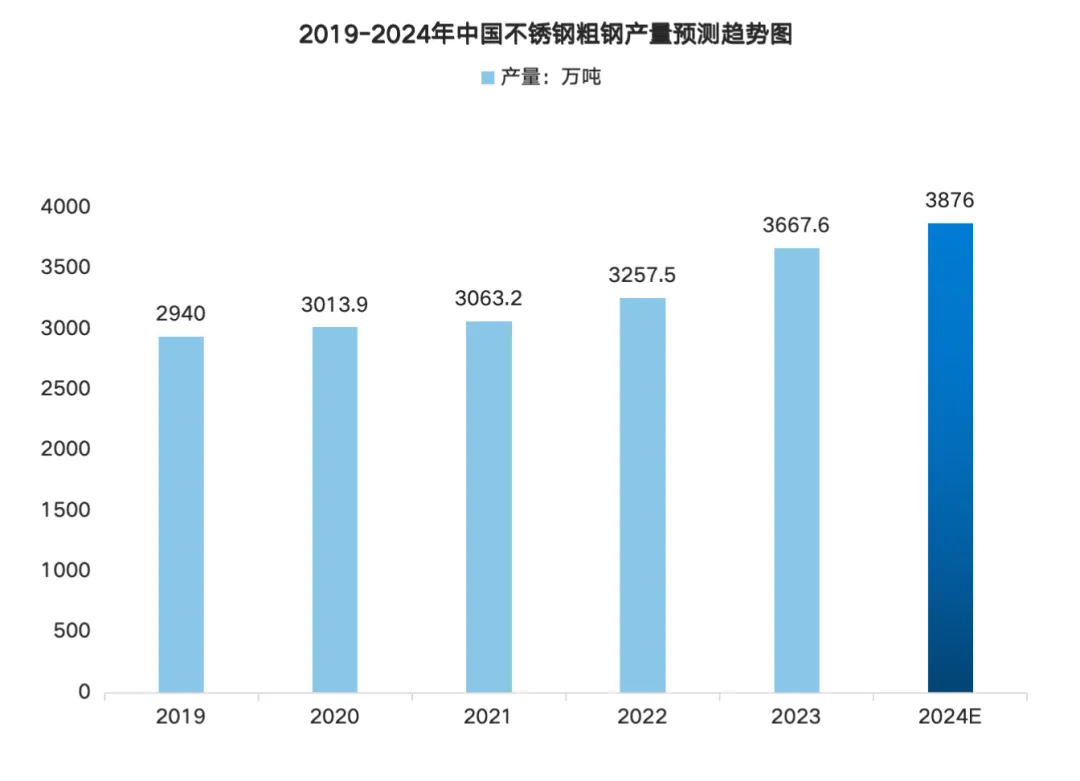

Stainless steel has corrosion resistance, heat resistance, low-temperature resistance, and good processing performance, making it one of the commonly used metal materials in medical robots. In recent years, with the growing demand in downstream application fields, China’s stainless steel production has continued to grow.

According to the report released by the China Business Industry Research Institute“Analysis of the Market Development of the Stainless Steel Industry in China from 2024 to 2029”,the crude steel production of stainless steel in China in 2023reached 36.676 million tons,an increase of 4.101 million tons year-on-year,an increase of 12.59%. It is predicted thatthe crude steel production of stainless steel in China willincrease to 38.76 million tons in 2024.

02 Aluminum Alloy

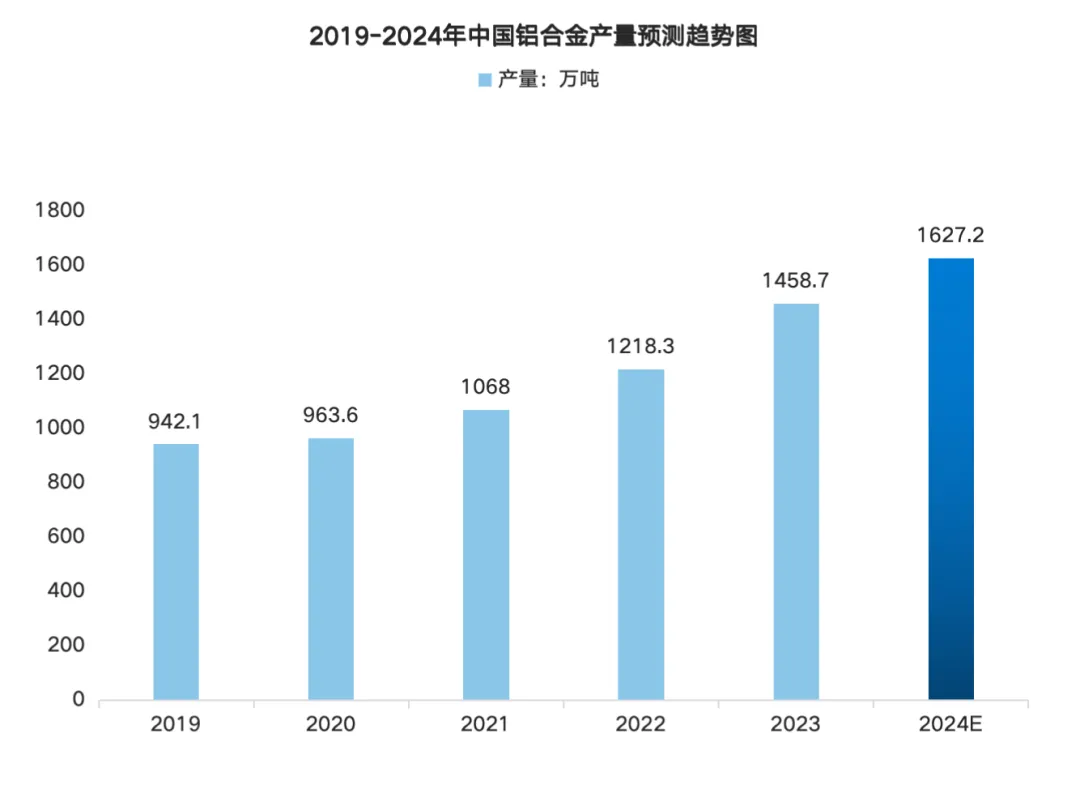

Aluminum alloy is widely used in medical robots where it is necessary to reduce weight while maintaining structural strength due to its lightweight and high strength characteristics. China is a major producer of aluminum alloys, and in recent years, the production of aluminum alloys in China has steadily increased.

According to the report released by the China Business Industry Research Institute“In-depth Analysis and Development Trend Research Report of the Aluminum Alloy Industry in China from 2024 to 2029”,the production of aluminum alloys in China in 2023reached 14.587 million tons,with an average annual compound growth rate of11.55%. It is predicted thatthe production of aluminum alloys in China will increase to 16.272 million tons.

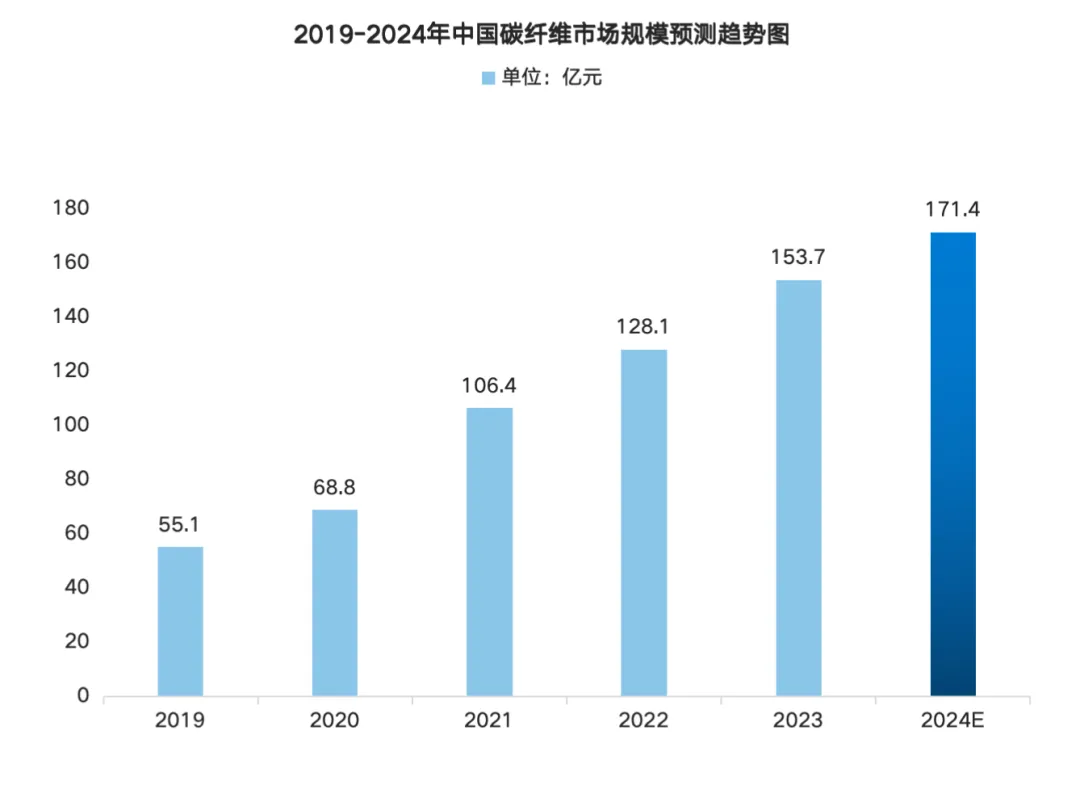

03 Carbon Fiber

Carbon fiber materials are gradually being widely used in the manufacturing of medical robots due to their lightweight, high strength, high temperature resistance, and corrosion resistance characteristics, especially in structural components that require high strength and low weight. The carbon fiber industry is a strategic emerging industry in the country, with broad development prospects in the lightweight market.

According to the report released by the China Business Industry Research Institute“Market Survey and Investment Prospect Research Report of the Carbon Fiber Industry in China from 2024 to 2029”,the market size of carbon fiber in China in 2022 was12.81 billion yuan,an increase of 20.69% year-on-year,and the market size in 2023is approximately15.37 billion yuan. It is predicted thatthe market size of carbon fiber will reach 17.14 billion yuan in 2024.

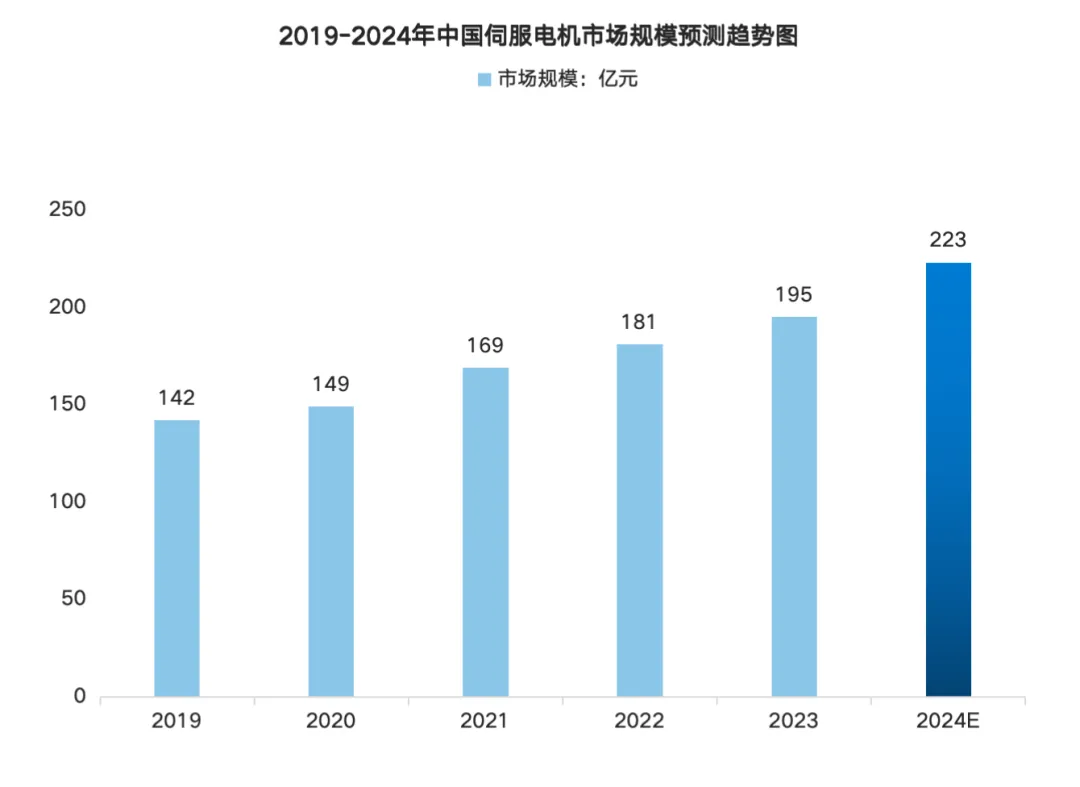

04 Servo Motors

Servo motors are motors that can adjust their output based on external feedback signals, typically consisting of the motor body, driver, encoder, and control algorithm. As one of the core components in robotic systems, servo motors play a crucial role in the motion control and performance of robots. In recent years, the market size of servo motors in China has been on a growth trend.

According to the report released by the China Business Industry Research Institute“Analysis and Development Forecast of the Servo Motor Industry in China from 2024 to 2029” shows thatthe market size of servo motors in China in 2023is approximately 19.5 billion yuan,an increase of 7.73% year-on-year. It is predicted thatthe market size of servo motors in China will exceed 20 billion yuan in 2024.

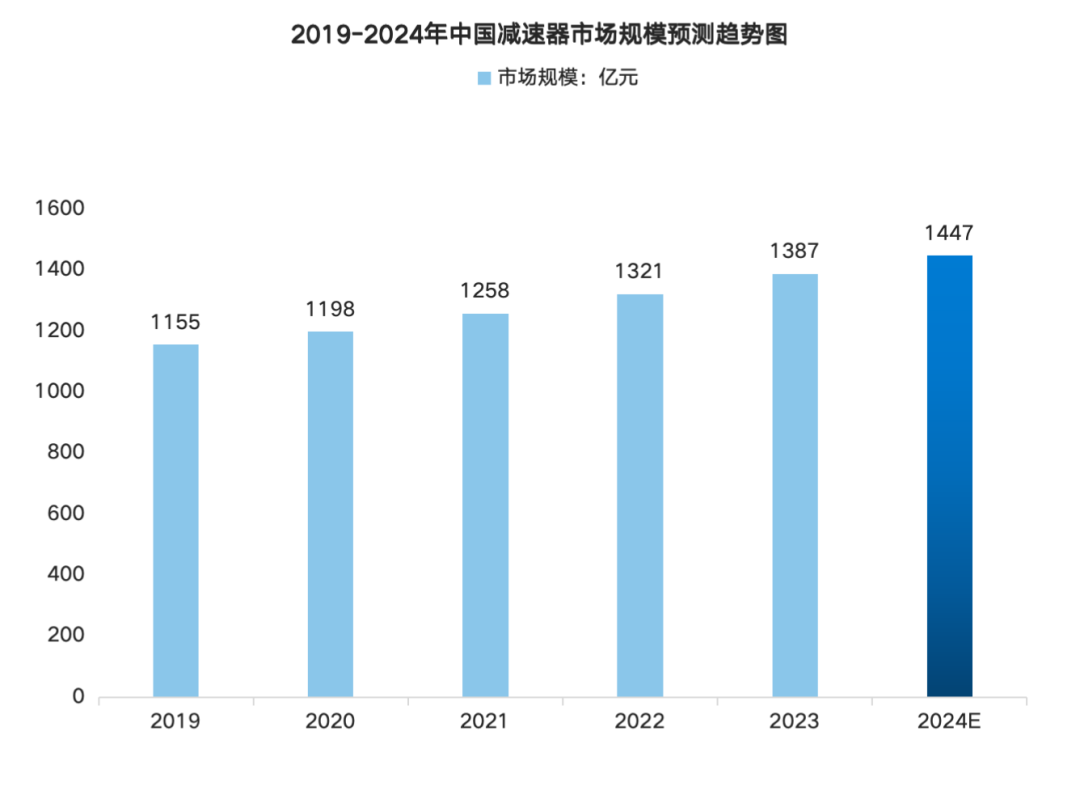

05 Reducers

Reducers, as key components in robotic systems, primarily serve to reduce speed, increase output torque, and reduce load inertia. Benefiting from policies and the drive of downstream industries, China’s reducer industry is developing rapidly.

According to the report released by the China Business Industry Research Institute“Research Report on the Global and Chinese Robot Reducer Industry from 2024 to 2029” shows thatthe market size of the reducer industry in China reached132.1 billion yuan in 2022,an increase of 5.01%, and the market size in 2023is approximately 138.7 billion yuan. It is predicted that the market size of reducers in China will grow to 144.7 billion yuan in 2024.

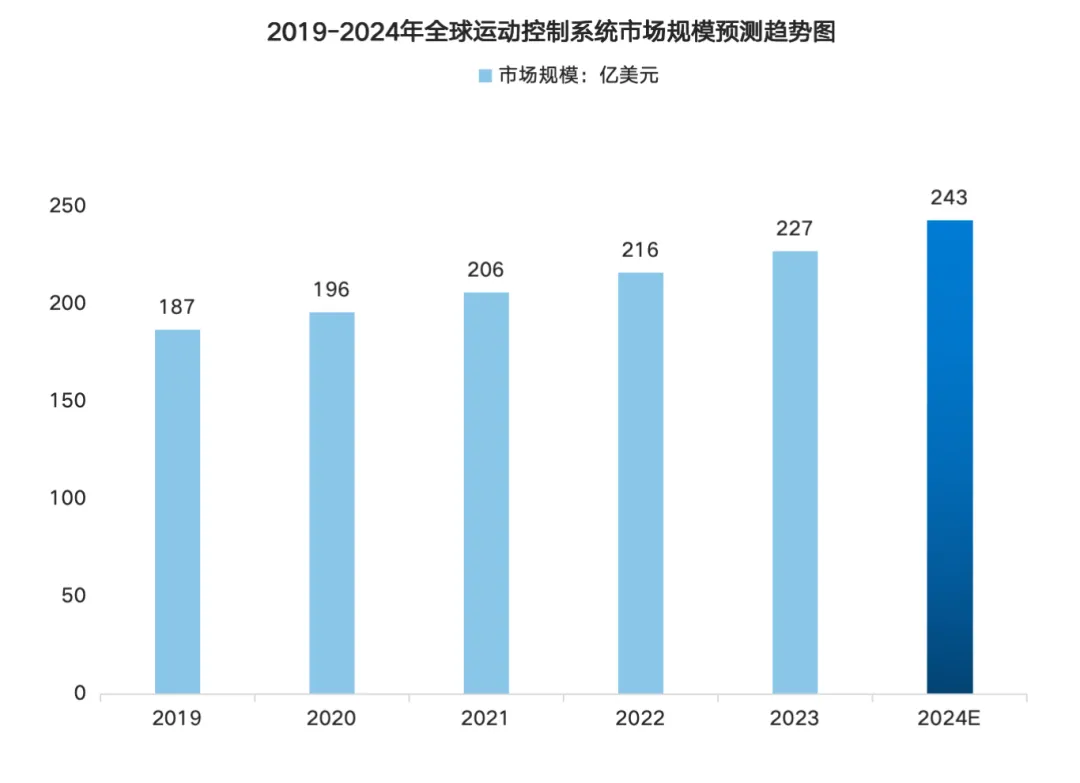

06 Controllers

Controllers, as the “brain and nerve center” of robots, are responsible for receiving instructions, parsing, and executing actions, controlling the robot’s motion trajectory and actions. Currently, major robot manufacturers at home and abroad, such as ABB, KUKA, Siasun, and New Times, are conducting independent research and development based on general multi-axis motion controller platforms.

According to the report released by the China Business Industry Research Institute“Current Status and Future Development Trends of the Motion Control Market in China from 2024 to 2029” shows thatthe global market size of motion control systems in 2023 is approximately22.7 billion US dollars. It is predicted thatthe global market size of motion control systems will increase to 24.3 billion US dollars in 2024.

UpstreamKey Enterprises

Stainless Steel

Yongjin Co., Ltd., Yongxing Materials, Tai Steel Stainless, Jiugang Hongxing,

Fushun Special Steel, Jiuli Special Materials, etc.

Aluminum Alloy

Aluminum Corporation of China, Yun Aluminum Co., Ltd., Shenhuo Co., Ltd.,

Nanshan Aluminum, Tianshan Aluminum, etc.

Carbon Fiber

China National Chemical Fiber, Jilin Carbon Valley, Jilin Baojing,

Jiangsu Hengshen, Guangwei Composite Materials, etc.

Servo Motors

Inovance Technology, Hechuan Technology, Keli’er, Jiangsu Leili, etc.

Reducers

Harmonic Drive, Double Ring Transmission, Zhongdali De, Laifu Harmonic,

Tongchuan Technology, Haozhi Electromechanical, Qin Chuan Machine Tool, etc.

Controllers

New Times, Estun, Robot, Reiser Intelligent,

Inovance Technology, Goko Technology, etc.

Midstream Robots

01 Medical Robots

The rapid development and deep application of technologies such as artificial intelligence and intelligent sensing provide strong technical support for medical robots, and the medical robot industry in China is developing rapidly, with the market size of the industry continuously increasing.

According to the report released by the China Business Industry Research Institute“Analysis and Development Forecast of the Chinese Medical Robot Industry from 2024 to 2029”,the market size of medical robots in China in 2023reached 10.8 billion yuan,with an average annual compound growth rate of25.74%. It is predicted thatthe market size of medical robots in China in 2024is expected to reach 13.58 billion yuan.

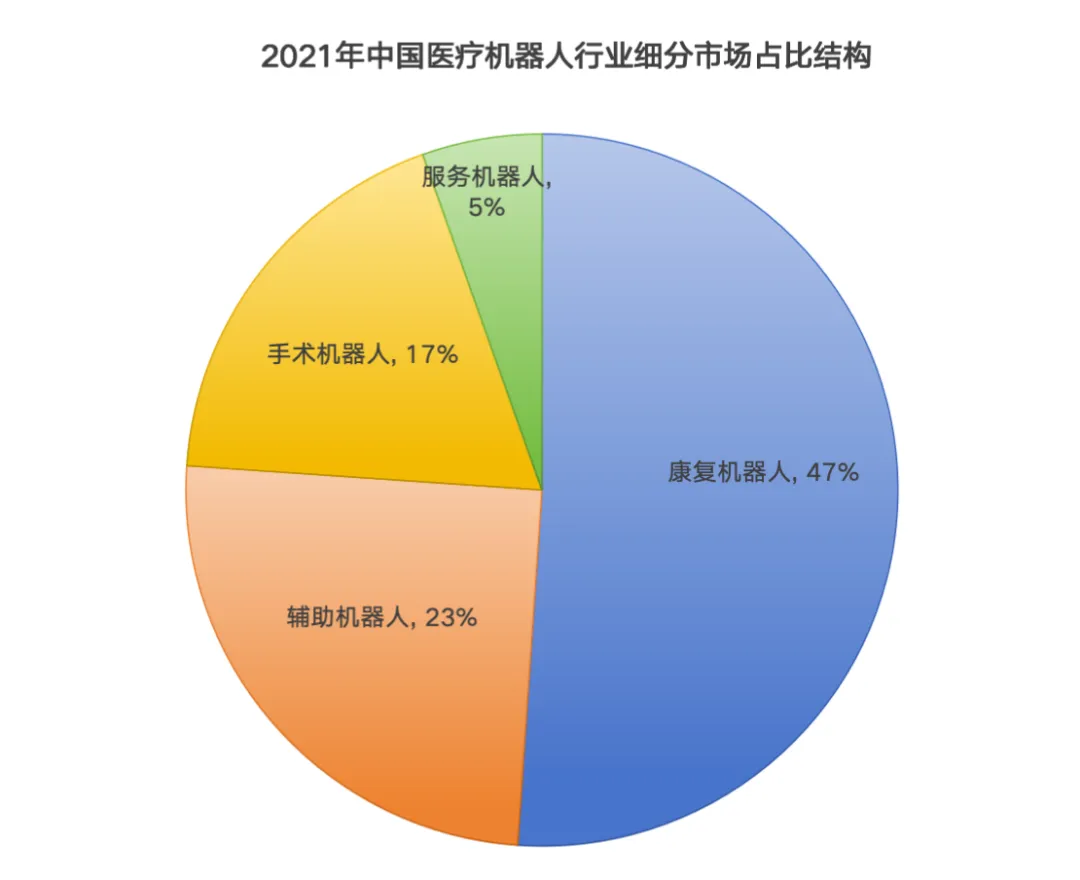

In the medical robot market, rehabilitation robots occupy a significant position, becoming the largest category in the segmented market of medical robots in China.

According to the report published by the China Research and Consulting Institute“In-depth Analysis and Investment Value Research Report of the Medical Robot Industry from 2023 to 2028” shows thatin 2021, rehabilitation robots accounted for47% of the entire market. Meanwhile,the global assistive robot market is still in its infancy, but inthe Chinese medical robot market it has already exceeded20% market share..

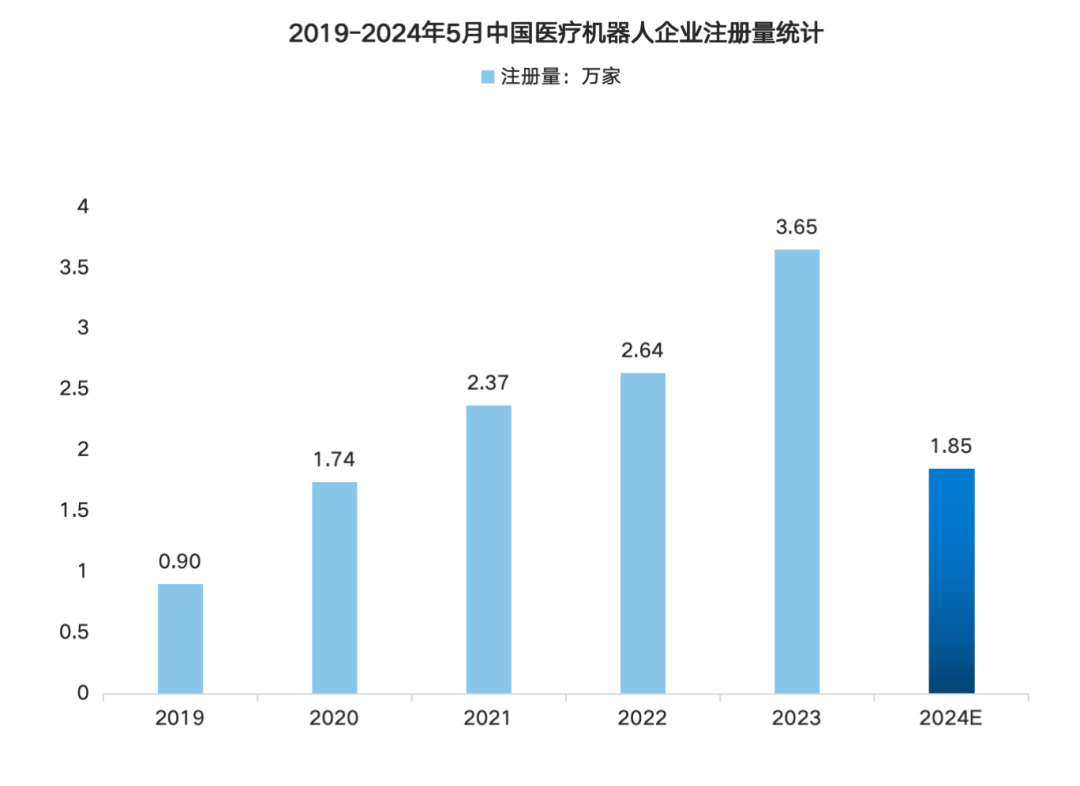

With the rapid development of the medical robot industry, the number of industry enterprises is also showing a growth trend.

According to Qichacha data,there are currently more than 175,100 enterprises in the field of medical robots in China. In terms of enterprise registration, the number of registered medical robot-related enterprises in China in 2023 reached a peak of 36,500.,and from January to May 2024, the number of registered enterprises has reached18,500, mainly distributed in Guangdong, Shandong, Jiangsu, Zhejiang, Beijing, Shanghai, and other provinces and cities.

02 Surgical Robots

Medical robots are mainly used in medical scenarios to assist healthcare work. According to IFR classification, they can be divided into surgical robots, rehabilitation robots, assistive robots, and other categories. With the strong support of national policies for the development of innovative medical devices, surgical robots are rapidly popularizing in domestic hospitals.

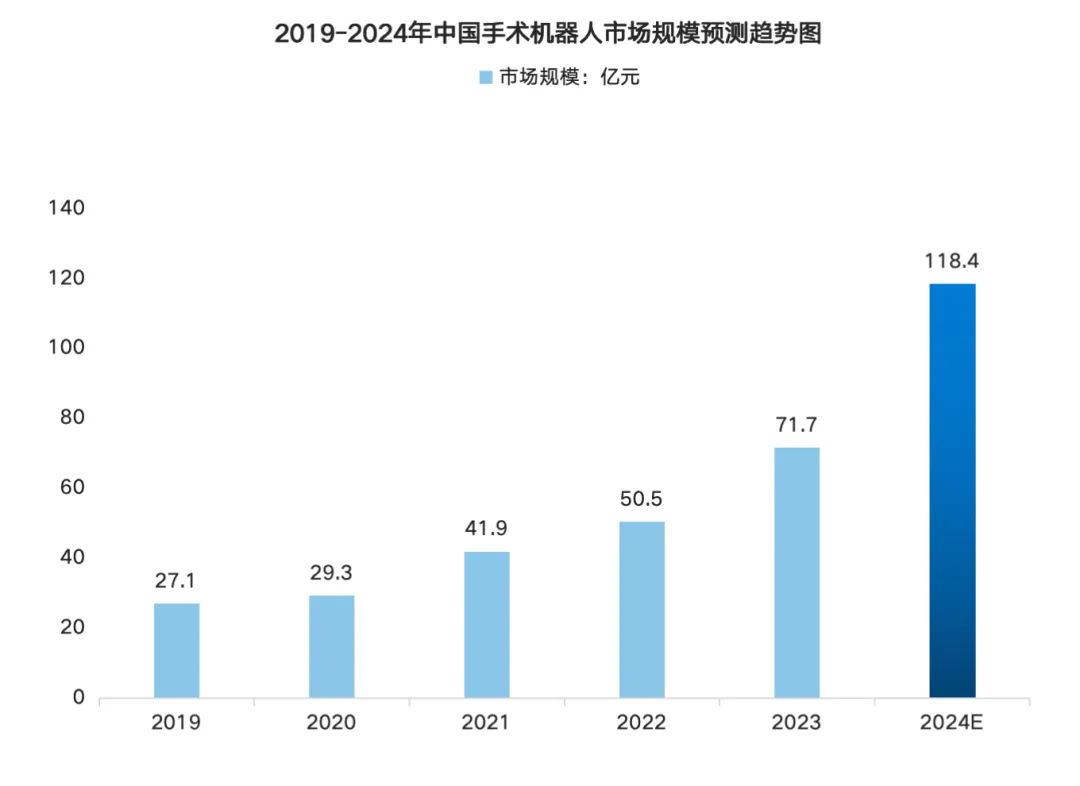

According to the report released by the China Business Industry Research Institute“In-depth Research Report on the Global and Chinese Surgical Robot Industry from 2024 to 2029” shows thatthe market size of surgical robots in China in 2023 reached approximately7.17 billion yuan,with an average annual compound growth rate of27.54%. It is predicted thatthe market size of surgical robots in China will reach 11.84 billion yuan in 2024.

03 Rehabilitation Robots

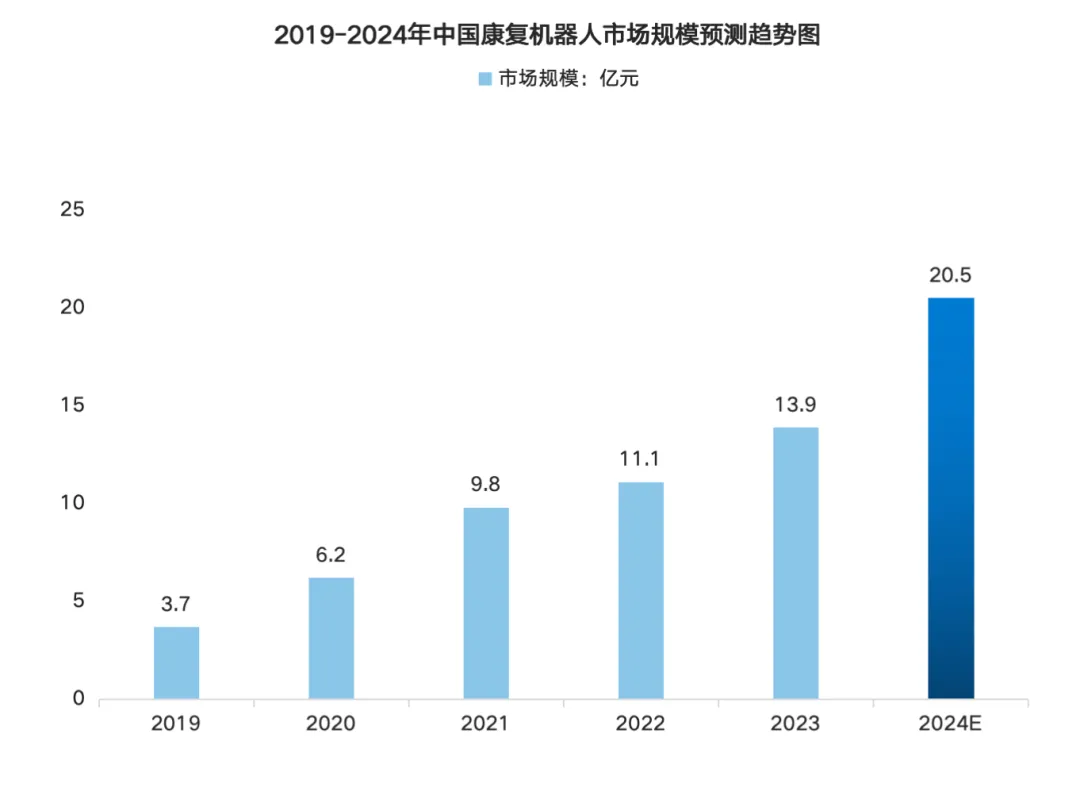

Driven by both the active promotion of national policies and the growing social demand, the rehabilitation medical device industry has achieved rapid development, and the market size of rehabilitation robots is expected to continue to expand in the future.

According to the report released by the China Business Industry Research Institute“Analysis and Development Forecast of the Rehabilitation Robot Industry in China from 2024 to 2029” shows thatthe market size of rehabilitation robots in China in 2023reached approximately 1.39 billion yuan,an increase of 25.2% year-on-year. It is predicted thatthe market size will exceed 2 billion yuan in 2024.

Investment and Financing Situation in the Medical Robot Industry

In recent years, the Chinese medical robot industry has attracted capital attention, with frequent financing events,the number of investment and financing events in the industry in 2023reached 48. The total investment and financing amountreached 7.762 billion yuan. From the perspective of enterprises,Wansi Medical, Shurui Robot, Konnos, Huake Precision, Ruilong Nofu, Banger Orthopedic Hospital Group, Zhenjiankang, AVIC Chuangshi, and Langhe Medical have all completed large financing exceeding 100 million yuan.

Key Enterprises in the Medical Robot Industry

Downstream Application Scenarios

Medical robots are widely used in medical institutions at all levels, including hospitals and clinics. They can assist healthcare personnel in performing surgeries, nursing, rehabilitation, and transferring patients, reducing contact between healthcare personnel, preventing cross-infection, and improving treatment efficiency.

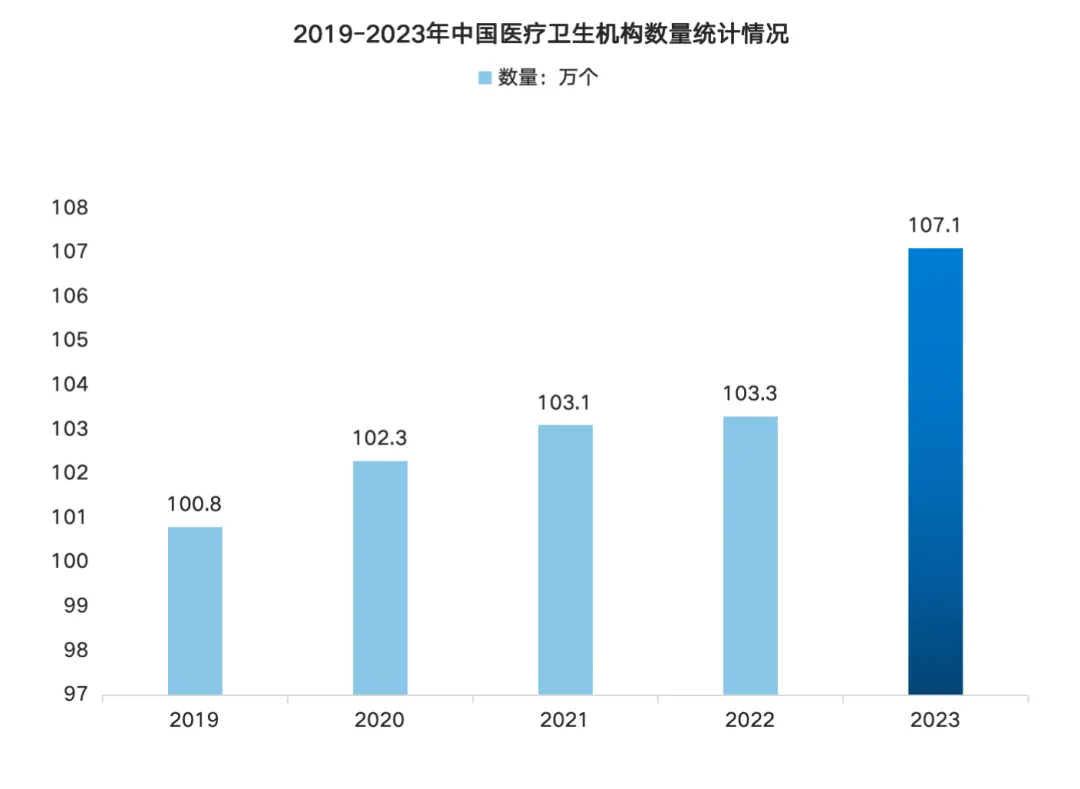

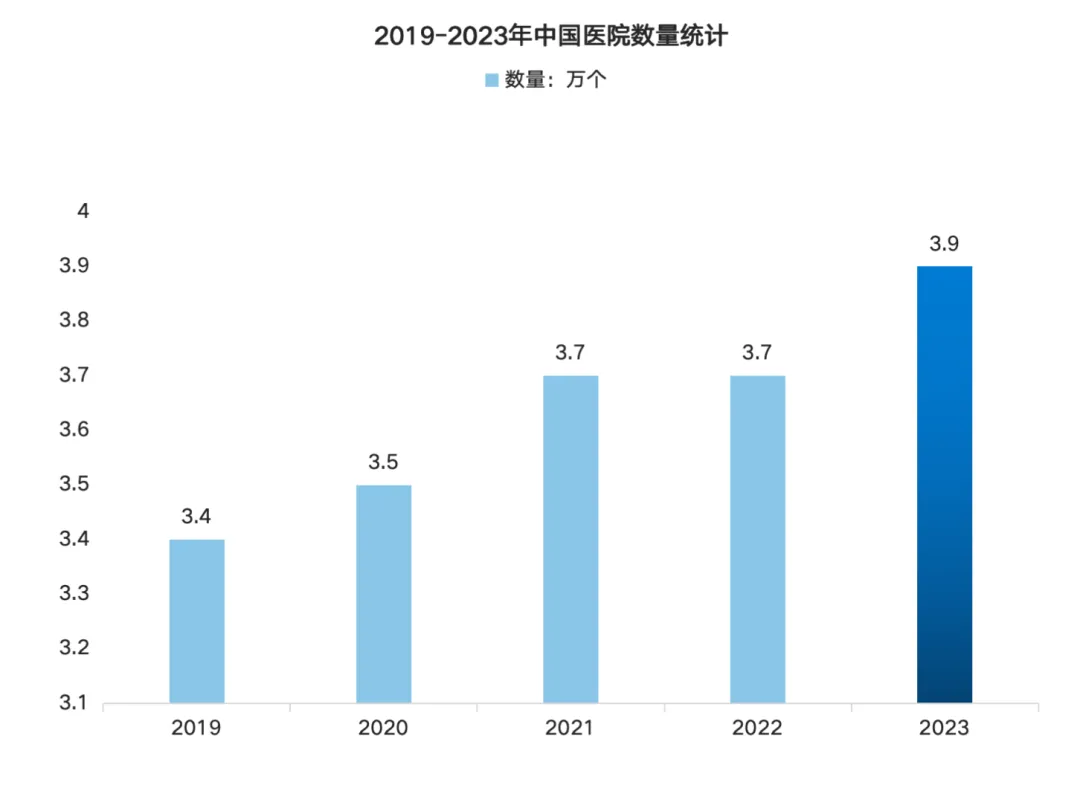

According to data,by the end of 2023, there are

1,071,000 medical and health institutions nationwide, including39,000 hospitals, among which there are12,000 public hospitals,

27,000 private hospitals;

1,016,000 primary medical and health institutions,

including34,000 township health centers,

37,000 community health service centers (stations),

362,000 outpatient departments (clinics),

583,000 village clinics;

12,000 specialized public health institutions,

including3,426 disease prevention and control centers,

2,791 health supervision offices (centers).

Prospects for the Development of the Smart Medical Robot Industry

1. Policy Benefits for Industry Development

The Chinese medical robot industry has received key support from national policies, and in recent years, the country has successively issued a series of important policy documents to promote the transformation and upgrading of Chinese manufacturing, with the medical field being an important livelihood sector. For example, the document “Notice on Issuing the Implementation Plan for the “Robot+” Application Action” proposes to accelerate breakthroughs in basic theory, common key technologies, and innovative applications of robots and medical artificial intelligence, promoting the application of medical robots in hospital rehabilitation, telemedicine, and health prevention and control scenarios.

2. Technological Advancements Driving Industry Development

Medical robot technology is making remarkable progress in mainstream medical fields at an unprecedented speed, with new applications and technologies continuously emerging.Surgical robots, rehabilitation robots, assistive robots, and medical service robots are playing important roles in their respective fields.

3. Market Demand Promoting Industry Development

With the intensification of population aging and the increase in chronic diseases, the demand for medical robots is also continuously increasing.Medical robots can alleviate the workload of healthcare personnel, improve the quality and efficiency of medical services, and meet the growing medical needs of patients.

Source: Zhongguancun Information Valley Technology Innovation Industry Service Platform