Medical robots, as a deepening application of artificial intelligence in the medical field, can effectively assist doctors in a series of medical diagnoses and auxiliary treatments, promoting the development of medical information technology while alleviating the tension of medical resources.

In recent years, with the development of artificial intelligence, breakthroughs in technology, and the gradual expansion of application fields, the medical sector, as an important aspect of people’s well-being, has attracted significant attention. Medical robots, as a deepening application of artificial intelligence in the medical field, can effectively assist doctors in a series of medical diagnoses and auxiliary treatments, promoting the development of medical information technology while alleviating the tension of medical resources.

Continuous breakthroughs in medical robot technology, with strong downstream demand

Currently, the medical robot industry chain is becoming increasingly complete. The upstream consists of robot components, mainly including servo motors, sensors, controllers, reducers, and system integration; the downstream primarily meets the demand of the smart medical market, mainly applied in surgery, rehabilitation, nursing, patient transfer, and drug transportation.

Figure 1: Analysis of the Upstream and Downstream Industry Chain of Medical Robots

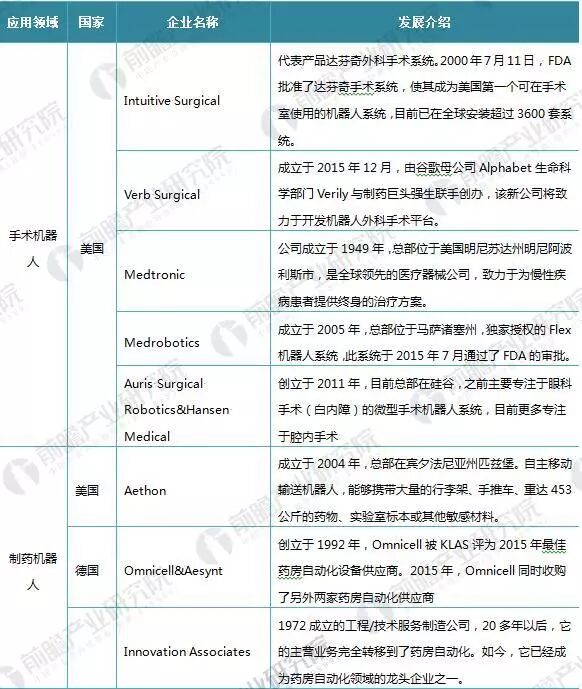

Currently, based on the application fields of medical robots, they can be roughly divided into six categories: the first category is surgical robots; the second category is robots in the pharmaceutical field; the third category is exoskeleton rehabilitation robots; the fourth category is hospital disinfection robots; the fifth category is telemedicine robots; and the sixth category is companion robots. Analyzing representative companies in these application fields, the development of medical robots worldwide is currently led and represented by American companies, with the da Vinci surgical system dominating the surgical robot field and holding an absolute advantage in the industry.

Additionally, in the fields of pharmaceutical robots and exoskeleton robots, German companies hold certain advantages; while in the research and development of exoskeleton robots and telemedicine robots, Japan, with companies like Cyberdyne and Honda Robotics, plays a leading role in the industry.

Figure 2: Analysis of Representative Companies in Various Fields of Medical Robots

Since Kwoh et al. used the PUMA500 robot as an auxiliary positioning device to complete the first brain surgery in 1985, medical robots have undergone 29 years of development. Currently, over 800 hospitals in 33 countries have successfully performed more than 600,000 robotic surgeries, covering various disciplines such as urology, obstetrics and gynecology, cardiac surgery, thoracic surgery, hepatobiliary surgery, gastrointestinal surgery, and otolaryngology.

After nearly thirty years of development, thousands of surgical robots are now in use in hospitals and medical centers worldwide. In 2016, the global sales of medical robots reached 1,600 units, with sales revenue of $1.612 billion, both showing significant growth compared to 2015. In 2017, with the implementation of medical robots in various application fields, it is predicted that sales will reach 1,800 units.

Figure 3: International Medical Robot Sales from 2010 to 2017 (Units: units, billion USD)

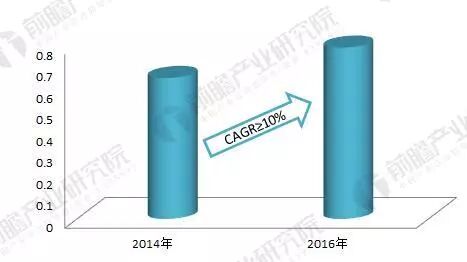

In 2014, China began to experience a surge in robotic surgical procedures. Subsequently, influenced by favorable policies, an aging population, an increasing consumer base, and accelerated industrial development, the Chinese medical robot market has developed rapidly. In 2014, the market size of medical robots in China was approximately $0.65 billion, accounting for 4.96% of the global industry market share. With the improvement of domestic technology and the development of smart and digital healthcare, by 2016, the domestic medical robot market size reached $0.79 billion. With the development and popularization of smart healthcare in China, it is estimated that the medical robot market size will reach $1.13 billion in 2017, accounting for about 5% of the global market share.

Figure 4: Market Size of Medical Robots in China from 2014 to 2017 (Units: billion USD, %)

Since 2016, driven by technological reforms and developments in the international medical market, some domestic technologies and medical institutions have begun to engage in the research and development of medical robots. The clinical development of medical robots in various application fields can effectively alleviate the social reality of uneven resource distribution and medical disparities in China, effectively easing medical conflicts, and the development of telemedicine robots can further support the development of hierarchical diagnosis and treatment. As of now, there are 28 representative companies in the domestic medical robot sector, with companies like Siasun Robot, Chutian Technology, and Tianzhihang as representatives.

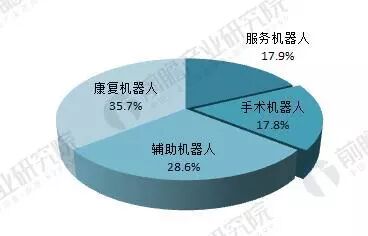

From the data in the figure below, it can be seen that 35.7% of the 28 medical robot manufacturing companies produce rehabilitation robots, while surgical robots and others rely heavily on foreign imports, indicating that domestic companies still need to make further breakthroughs in the research and development capabilities and technical fields of medical robots.

Figure 5: Product Attribute Proportion Analysis of 28 Medical Robot Manufacturing Companies in China (Units: %)

For more exciting content, please click

[$$$] Did you receive your “pocket money” for the first month of 2018?

[In-depth] Analysis of the Demand for Industrial Robots in the Chinese Automobile Manufacturing Industry

[Strong Partnership] Tuosida and Depute Sign Strategic Cooperation Agreement

[Focus] The world’s first unmanned cloud rail has opened, quietly ushering in a new era of rail transit

[FANUC] Review of the Top Ten Hot Topics of FANUC in Shanghai 2017

More

Exciting

Content

Please click the QR code on the right

Come and follow

China Robot Network