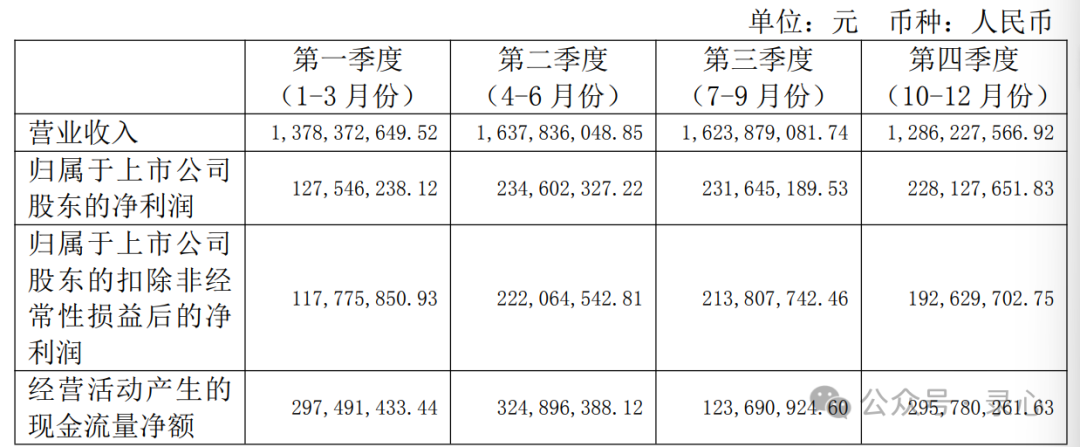

In 2024, the company achieved a revenue of 5.926 billion yuan, an increase of 555 million yuan year-on-year (growth of 10.34%); the net profit attributable to the parent company’s owners was 822 million yuan, an increase of 324 million yuan year-on-year (growth of 65.03%). The company’s current market value is 28.8 billion yuan, with a static valuation of 3.5 billion, which is relatively low among chip design companies. In comparison, another SoC chip company, Hengxuan Technology, has a valuation of over 100 times.The company is a globally positioned, domestically leading fabless semiconductor system design manufacturer, primarily engaged in the research, design, and sales of system-level SoC chips and peripheral chips. Its main products include multimedia smart terminal SoC chips, wireless connectivity chips, automotive electronics chips, etc., providing SoC main control chips and system-level solutions for numerous consumer electronics fields. The company’s products have been widely applied in various sectors including home, automotive, office, education, sports and fitness, industrial, commercial, agriculture, entertainment, and warehousing. The company possesses rich experience in the full-process design of SoCs and is committed to the development of core software and hardware technologies such as ultra-high-definition multimedia encoding and decoding, display processing, content security protection, and system IP. By integrating industry-leading CPU/GPU technologies and advanced process technologies, the company optimizes cost, performance, and power consumption, providing complete system solutions based on various open platforms to help global operators, OEMs, ODMs, and other customers quickly deploy in the market. The company’s business has covered major economic regions globally, including mainland China, Hong Kong, North America, Europe, Latin America, Asia-Pacific, and Africa. Relying on long-term technological accumulation, continuous research and development of new technologies and applications, as well as the geographical advantages and market resources of its global layout, the company has accumulated a stable and high-quality customer base worldwide.The factors contributing to the company’s performance growth are as follows:In 2024, the company made positive progress in the market performance of multiple product lines: (1) The S series achieved the largest share in multiple domestic operator tenders, continuously consolidating the company’s leading position in this field. The international market continues to break into operators in several developed countries or major economies, and the global market share continues to expand; (2) The T series saw a year-on-year sales increase of over 30%, continuously expanding market share, with current products covering the entire ecosystem of mainstream international TVs, laying a solid foundation for further expanding the international market share of the T series products; (3) The company continues to collaborate with top domestic and international smart terminal manufacturers to expand the application scenarios of the A series on the client side; (4) The W series sales exceeded 10 million units for the first time in a year, reaching nearly 14 million units. Since its launch in 2020, the cumulative sales of the W series have exceeded 30 million units. The company’s fourth-quarter sales declined sequentially due to delayed orders from operators. Looking ahead to the first quarter of 2025, sales revenue reached 1.530 billion yuan, a year-on-year increase of 10.98%, setting a historical high for the same period; the net profit attributable to the parent company’s owners was 188 million yuan, a year-on-year increase of 47.53%.The reasons for the growth in the first quarter are as follows:Benefiting from the rapid growth in demand for smart home markets and the increased penetration of intelligent technology on the client side, in the first quarter of 2025, the sales of the company’s smart home chips increased by over 50% year-on-year, with quarterly shipments exceeding 10 million units. Currently, the company has over 15 commercial chips across various product lines equipped with its self-developed intelligent edge computing units. In the first quarter of 2025, the shipment of chips carrying self-developed intelligent edge computing units reached nearly 4 million units, close to 50% of the total shipment of similar chips for the entire year of 2024.The company believes that, for a long period, the trend of rising market demand driven by intelligent technology in its field will not change, the trend of enhanced competitiveness brought by the continuous launch of new products will not change, and the trend of improved profitability due to enhanced operational efficiency will not change. Recently, after thorough and prudent assessment, the company expects that the operating performance in the second quarter of 2025 will further grow year-on-year and maintains the judgment that the annual operating performance in 2025 will further grow year-on-year as initially set at the beginning of 2025.If the growth in 2025 can match that of the first quarter, the annual profit will reach 1.1 billion, which corresponds to a valuation of 26 times, making such a valuation look reasonable.

The company’s fourth-quarter sales declined sequentially due to delayed orders from operators. Looking ahead to the first quarter of 2025, sales revenue reached 1.530 billion yuan, a year-on-year increase of 10.98%, setting a historical high for the same period; the net profit attributable to the parent company’s owners was 188 million yuan, a year-on-year increase of 47.53%.The reasons for the growth in the first quarter are as follows:Benefiting from the rapid growth in demand for smart home markets and the increased penetration of intelligent technology on the client side, in the first quarter of 2025, the sales of the company’s smart home chips increased by over 50% year-on-year, with quarterly shipments exceeding 10 million units. Currently, the company has over 15 commercial chips across various product lines equipped with its self-developed intelligent edge computing units. In the first quarter of 2025, the shipment of chips carrying self-developed intelligent edge computing units reached nearly 4 million units, close to 50% of the total shipment of similar chips for the entire year of 2024.The company believes that, for a long period, the trend of rising market demand driven by intelligent technology in its field will not change, the trend of enhanced competitiveness brought by the continuous launch of new products will not change, and the trend of improved profitability due to enhanced operational efficiency will not change. Recently, after thorough and prudent assessment, the company expects that the operating performance in the second quarter of 2025 will further grow year-on-year and maintains the judgment that the annual operating performance in 2025 will further grow year-on-year as initially set at the beginning of 2025.If the growth in 2025 can match that of the first quarter, the annual profit will reach 1.1 billion, which corresponds to a valuation of 26 times, making such a valuation look reasonable.