Domestic leader in smart terminal SoCs, deeply engaged in diversified application tracks.

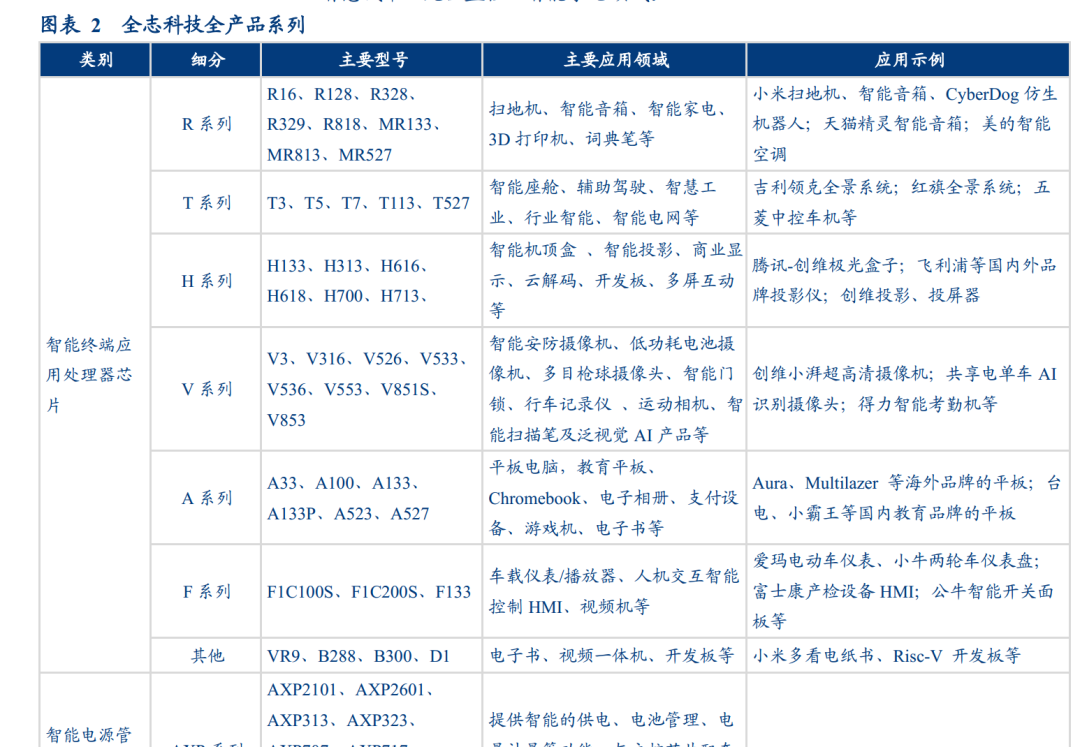

Founded in 2007 and listed on the Shenzhen Stock Exchange’s Growth Enterprise Market in 2015, the company’s main products include smart application processor SoCs, high-performance analog devices, and wireless interconnect chips. These products are widely used in smart hardware, quadruped bionic robots, smart home appliances, smart IoT, smart automotive electronics, tablets, network set-top boxes, as well as power simulation devices and wireless communication modules, accumulating a rich and high-quality customer base, making it a mainstream supplier of smart terminal chips in China.

The AIoT foundation is solid, and automotive SoCs benefit from the wave of automotive intelligence.

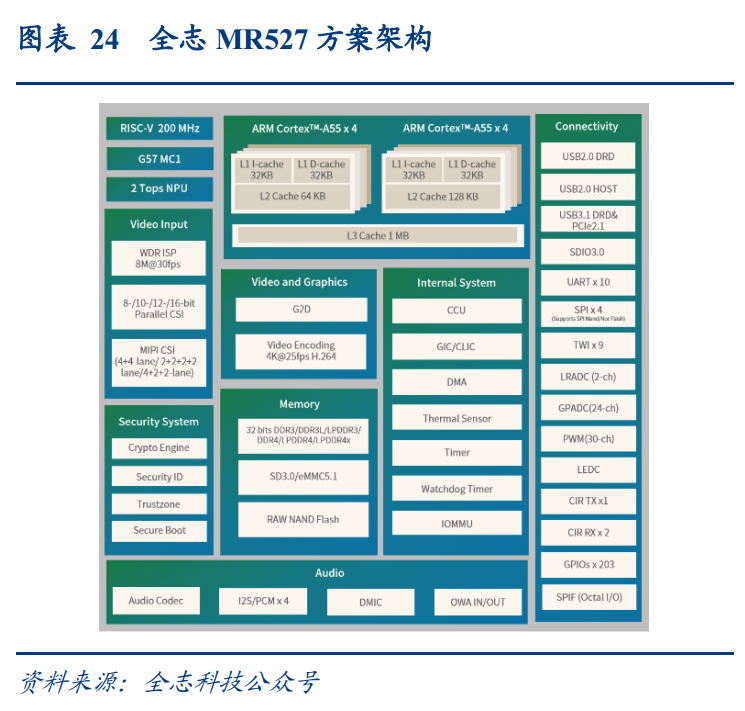

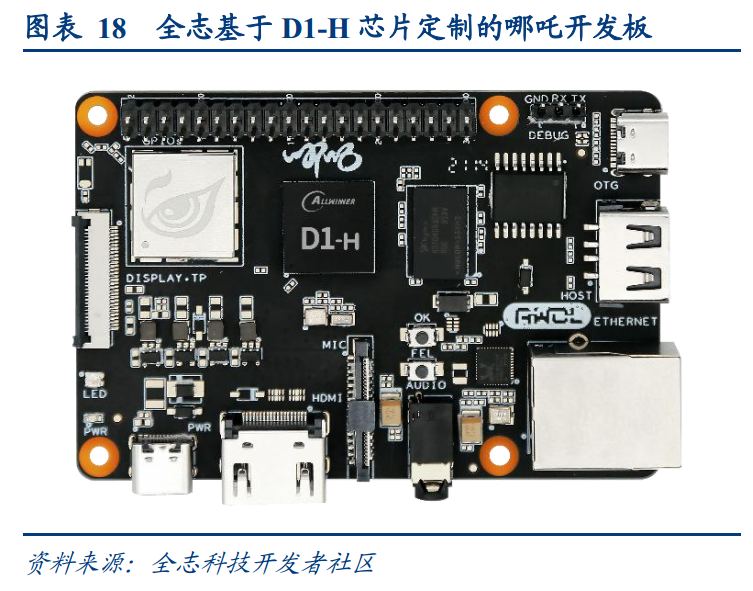

(1) Computing power decentralization drives the implementation of edge AI applications, with AI + RISC-V leading a new trend in SoCs: The iteration of large models drives the upgrade of edge AI technology, catalyzing the demand for technological innovation in chips and software solutions. SoCs, with their high integration and computing power advantages, continue to expand in value and market space. The RISC-V architecture, relying on real-time hardware characteristics and the flexibility of software ecosystem reconstruction, breaks the traditional closed-source architecture ecological barriers. With high policy attention, many local governments support RISC-V chip research and application, and the architecture’s penetration rate is expected to soar. As a well-known enterprise in the domestic RISC-V ecosystem, Allwinner has achieved large-scale commercial use of related products and is expected to benefit deeply from industry trends.

(2) AIoT Business: Leading in China, continuously iterating products and upgrading technology: Allwinner’s traditional AIoT business focuses on three major areas: robotic vacuum cleaners, smart security, and smart speaker SoCs, deeply engaging with top customers. Continuous technological upgrades and product iterations, such as equipping with NPU, self-developed ISP, and improving voice recognition rates, meet different application needs for edge computing power, visual processing, and voice recognition.

(3) Automotive SoCs: The trend of automotive intelligence is unstoppable, continuously pushing forward smart cockpit SoCs. As the core controller of the vehicle, the SoC field has high technical barriers, with overseas manufacturers still dominating the market. Domestic manufacturers like Horizon and Black Sesame are accelerating breakthroughs in high-end SoC technology. The company has achieved key technological breakthroughs in the smart cockpit and assisted driving fields, with its existing automotive-grade product matrix covering diverse scenarios such as smart cockpits, digital dashboards, and AR-HUDs.

Interest in edge AI and robotics is surging, with relevant products already in mass production.

(1) AI Glasses: The entry of numerous tech giants is driving innovation in AI glasses technology and market expansion, with 2025 expected to be the breakout year for AI glasses. In response to the demand for smart glasses, Allwinner’s new generation V821 has further optimized the existing security product technology, expanding into various markets for smart wearables to achieve comprehensive product deployment.

(2) AI Toys: Cost optimization of the Doubao visual model combined with hardware solution iterations creates a synergistic effect, accelerating market demand release. The Tom Cat AI companion has been equipped with Allwinner’s R128 wireless audio chip, and the newly launched V821 chip leverages audio and video processing advantages, integrating DeepSeek-R1 and the Doubao visual large model through a cloud architecture, laying the foundation for the next generation of AI toy visual interaction technology.

(3) Robotics: The robotics industry is rapidly entering an “AI-driven + scenario generalization” explosion period, with technological iterations and commercial applications driving global market expansion. Allwinner’s R series chips have been deeply embedded in the Xiaomi AIoT ecosystem, covering robotic vacuum cleaners, smart home appliances, and providing the main control chip MR813 for the CyberDog quadruped bionic robot and the R329 voice interaction chip.

Investment Recommendation: The company is a leader in domestic smart terminal SoCs, and with the rapid implementation of edge AI applications, it significantly benefits from the release of industry dividends. The company has strategically positioned itself in emerging high-growth tracks such as AI toys, AI/AR glasses, and robotics, and has launched competitive chip products and solutions, providing continuous driving force for performance. We expect the company’s operating revenue for 2025-2027 to be 2.997 billion, 3.796 billion, and 4.619 billion yuan, with net profit attributable to the parent company of 326 million, 490 million, and 678 million yuan, corresponding to EPS of 0.51, 0.77, and 1.07 yuan, respectively, and we initiate coverage with a “recommend” rating.

This is an excerpt from the report, the original report:

“Allwinner Technology (300458) In-depth Research Report: Domestic SoC Leader, Riding the Wave of Edge AI – Huachuang Securities [Geng Chen, Yue Yang, Wu Xin] – 20250331 [33 pages]”

Please click the “Read Original” link below to jump to the [Value Directory] computer site for download and reading.