Edge AI is Exploding!

From 2024 to 2030, the global edge AI chip market is expected to grow from $18 billion to $85 billion.

Who will capture the trillion-dollar incremental space? Which SoC chip companies like Rockchip, Allwinner Technology, and Hengxuan Technology will prevail?

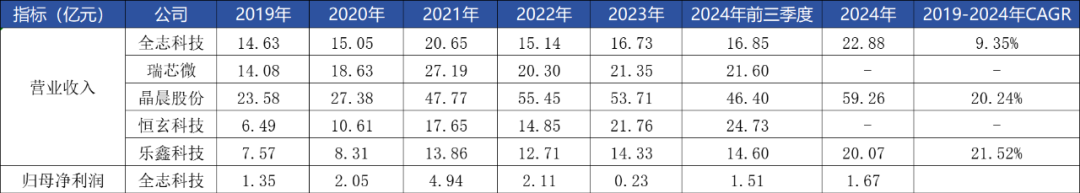

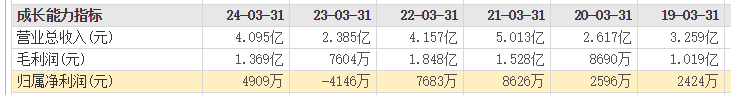

At first glance, based on revenue and profitability metrics, the winner does not appear to be Allwinner Technology.

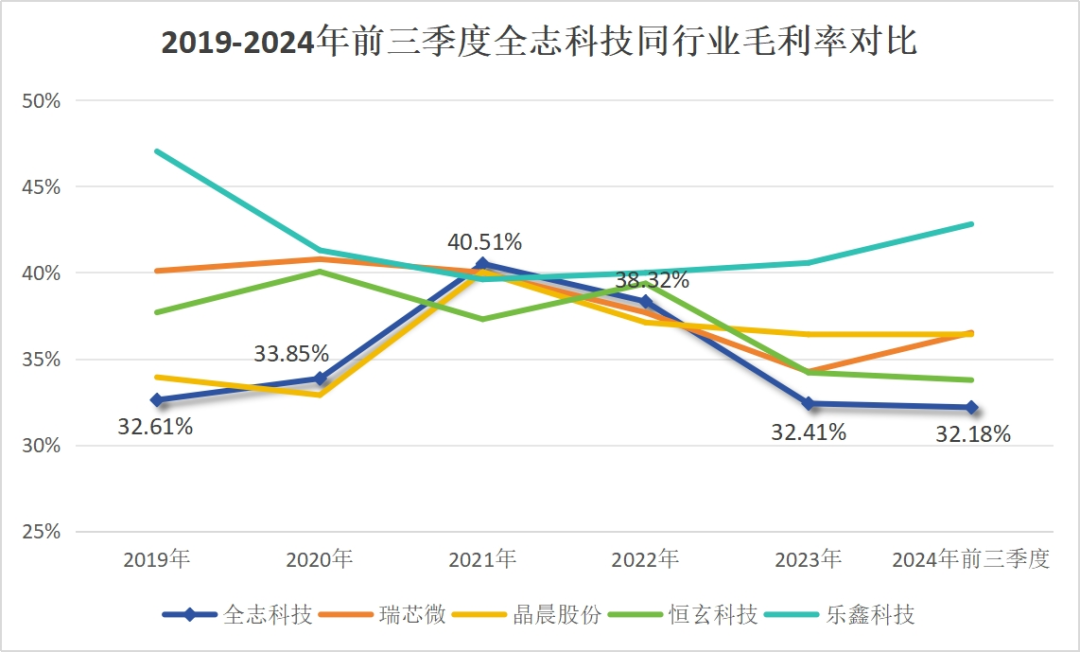

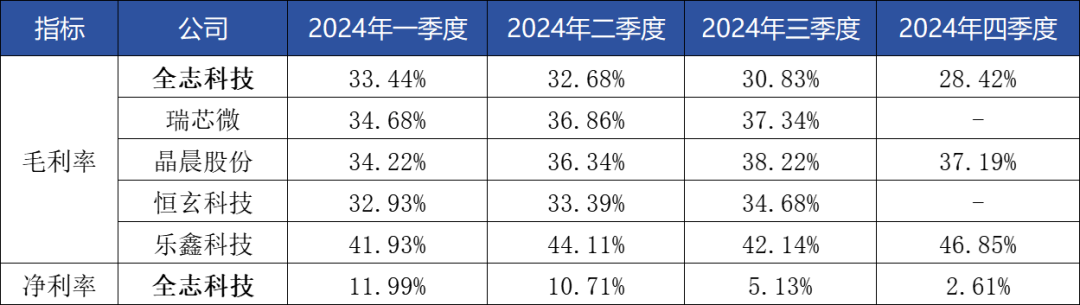

First, the gross margin has fallen to a low level in the industry.

Since peaking in 2021, Allwinner Technology’s gross margin has been on a downward trend.

From 2021 to the first three quarters of 2024, Allwinner Technology’s gross margin dropped from 40.51% to 32.18%. After being surpassed by Hengxuan Technology and Espressif Technology in 2022, it has further lagged behind Rockchip and Amlogic since 2023.It has fallen from a previous leading position to the lowest among five companies.

Moreover, in the context of a major recovery in consumer electronics and automotive electronics in 2024, Allwinner Technology’s gross margin and net profit margin are surprisingly declining quarter by quarter, which is almost unique in the industry.

Secondly, low gross margins are not aimed at capturing market share.

SoC chip manufacturers traditionally face a wide and scattered downstream market, so in addition to new products and technologies, the development of new application areas is also a battleground for companies in the industry.

Currently, several representative companies have cultivated considerable competitive advantages in niche markets.

For example, Hengxuan Technology focuses on Bluetooth headsets and smartwatches/wristbands, achieving a global market share of 22% for its TWS headset main control chip in 2023, the highest among domestic manufacturers; and Amlogic is the king in the smart set-top box and smart TV fields, currently with a full order book.

Rockchip and Allwinner Technology are currently the two companies with the broadest coverage, with more diversified revenue growth. Allwinner Technology categorizes its products into eight major categories, including the A series and F series.

This means that theoretically, Allwinner Technology’s revenue growth should be rapid.

However, the results are somewhat unexpected. In 2024, Allwinner Technology achieved revenue of 2.288 billion yuan, which is a new high, but the average annual compound growth rate from 2019 to 2024 is only 9.35%, lower than Amlogic (20.24%), Espressif Technology (21.52%), and Hengxuan Technology.

At the same time, in 2024, Allwinner Technology achieved a net profit of 167 million yuan, which, although a 149.13% increase, still did not reach the level of 2022.

Despite this backdrop, Allwinner Technology’s dividends remain generous.

In 2023, Allwinner Technology’s net profit was only 22.96 million yuan, but it distributed a substantial dividend of 94.7625 million yuan, resulting in a dividend payout ratio of 412.68%; in 2024, Allwinner Technology plans to distribute another generous dividend of 158 million yuan, a year-on-year increase of 67%, with a dividend payout ratio of 94.95%, which can even rival high-dividend benchmarks like Kweichow Moutai and Yangtze Power.

So, we can’t help but wonder, where does Allwinner Technology’s confidence come from? What is its foundation?

First, rapid implementation of R&D results.

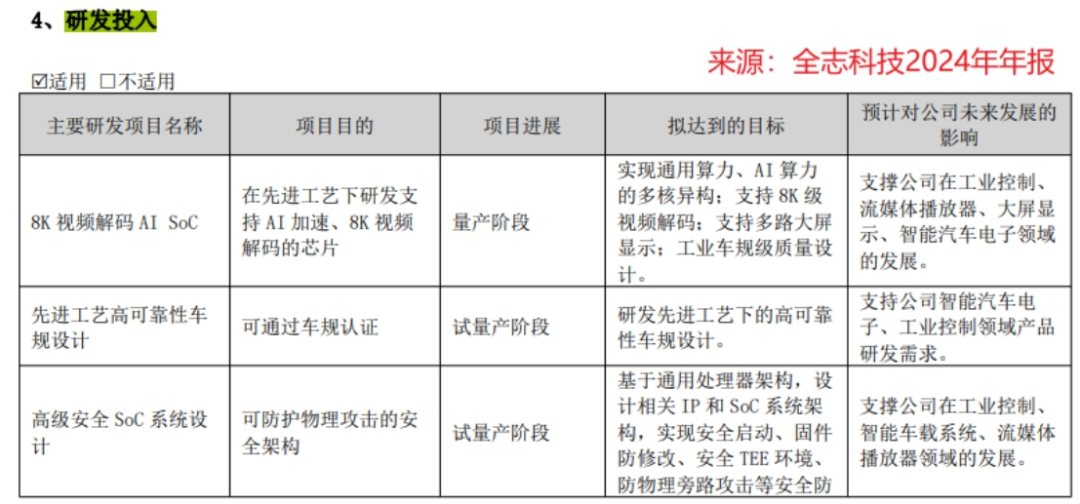

To win in the upcoming market, technology is essential. Observing Allwinner Technology’s R&D projects, we find that several projects have made significant progress.

In the 2023 annual report, Allwinner Technology disclosed ten ongoing projects, with eight in the R&D stage; in the 2024 annual report, seven of the ten ongoing projects have already reached mass production/testing stages, including high-performance automotive-grade SoCs, smart robot chips, and 8K video decoding AI SoCs, among other high-value-added products.

Specifically, Allwinner Technology has released two chips, T536 and MR536, in the fields of smart industrial and visual AI robotic vacuum cleaners, both integrating 3 Tops of NPU computing power, and samples have been sent to leading customers.

At the same time, the T527V chip used in automotive electronics has already passed automotive-grade certification; in 2024, the company’s A733 series chips will achieve 12nm advanced process technology and have completed mass production, providing Allwinner Technology with strong confidence.

Second, a pioneer in RISC-V architecture.

We all know that processors are powerful; they can perform arithmetic operations like addition and subtraction, as well as logical operations like AND, OR, and NOT. The instruction set can be seen as the unsung hero behind the processor, defining the commands and formats that the processor can execute.

Currently, there are four mainstream instruction sets in the market: X86, MIPS, ARM, and RISC-V. Among them, RISC-V is the only open-source instruction set.

The open-source model means it can be freely accessed, modified, and distributed by any individual or company, breaking the traditional closed-source architecture norms of ARM and X86, which are difficult to customize, and eliminating the need to pay exorbitant licensing fees that can reach millions of dollars.

More importantly, the RISC-V architecture also has advantages such as low power consumption and high efficiency, making it very suitable for the fragmented and differentiated needs of edge AI products, and it is currently in high demand in the market.

Institutions predict that the global market size for RISC-V chips will reach $92.7 billion by 2030, with a compound annual growth rate of 47.4% from 2023 to 2030.

Currently, Allwinner Technology not only has technical support in the RISC-V architecture ecosystem but also enjoys a first-mover advantage.

As early as 2020, Allwinner Technology collaborated with Alibaba’s T-Head based on RISC-V. In 2021, Allwinner Technology released the world’s first RISC-V SoC chip D1, equipped with T-Head’s Xuantie C906, applicable in various fields such as smart cities and smart vehicles. Not limited to this, recently Allwinner Technology has thrown out another bombshell.

In 2025, the company’s next-generation V821 will adopt a dual RISC-V architecture, having already completed mass production in typical security visual products and expanded into various markets such as smart wearables, further establishing Allwinner Technology as a benchmark enterprise in the RISC-V ecosystem.

Third, performance is gradually welcoming high growth.

On April 10, Allwinner Technology released its performance forecast, expecting a net profit of 85 million to 100 million yuan in the first quarter of 2025, a year-on-year increase of 73.16% to 103.72%.

Comparatively, this performance is a pleasant surprise. On one hand, the company’s product expansion in the automotive electronics field is accelerating, which is a significant improvement;

on the other hand, if we calculate based on the median net profit of 93 million yuan, Allwinner Technology’s net profit in the first quarter of 2025 has already surpassed its peak levels in the first quarters of 2021 and 2022, indicating that the company’s expansion speed is accelerating.

Finally, to summarize.

Based on past comparisons of revenue, gross margin, and other indicators, Allwinner Technology’s development pace in recent years has been somewhat slow in the industry.

Fortunately, Allwinner Technology’s multiple R&D achievements in automotive electronics and other fields are gradually being realized, and it has a leading advantage in the RISC-V architecture field, while the company’s performance is also gradually welcoming high growth.

In the future, against the backdrop of a major explosion in edge AI, Allwinner Technology is still expected to maintain a high growth momentum and achieve new successes.

This analysis does not constitute specific investment advice. The stock market has risks; investment should be cautious.

Finally, don’t forget to click the bottom right corner“” to share the roses, leaving the fragrance in hand, and grow together on the investment journey!