1. Company Overview: Technology-Driven Domestic Chip Design Leader

Allwinner Technology, established in 2007, is a leading domestic designer of intelligent application processor SoCs (System on Chip), adopting a Fabless model (focusing on design, outsourcing manufacturing). Its products cover four core areas: consumer electronics, smart vehicles, industrial control, and AIoT (Artificial Intelligence of Things). Core businesses include smart terminal chips (tablets/OTT boxes), automotive-grade chips (smart cockpits/ADAS), AIoT chips (robots/smart homes), and wireless connectivity solutions. The company has technical advantages in RISC-V architecture, multi-core heterogeneous computing (CPU+GPU+NPU collaboration), and ultra-high-definition video encoding and decoding, with over 1,200 patents accumulated and R&D investment consistently exceeding 20%. In terms of ecosystem layout, it collaborates with Alibaba’s Pingtouge to develop RISC-V ecological chips, deeply binding with leading customers such as Xiaomi and BYD, and participates in formulating industry standards for automotive chips.

2. Industry Status: Explosive Demand for AIoT and Automotive Electronics Chips

- AIoT Market The global edge computing chip market is expected to exceed 50 billion yuan by 2025, driven by demand for edge-side AI (such as smart homes and robots), pushing the need for lightweight, low-power chips. Allwinner Technology holds over 40% market share in the sweeping robot chip market, with its MR series chips supporting 3T NPU computing power, suitable for localized operation of lightweight large models.

- Automotive Electronics The penetration rate of smart cockpits and L1-L2 level assisted driving is increasing, with the global automotive-grade chip market expected to reach 80 billion USD by 2025. Allwinner’s automotive-grade chip T527 has passed AEC-Q100 certification and is already equipped in models from BYD and Geely, with the automotive business revenue share increasing from 10% to 15%.

- Opportunities for Domestic Substitution In the context of US technology blockade, the RISC-V open-source architecture has become a breakthrough direction for domestic chips. Allwinner, in collaboration with Alibaba’s Pingtouge, launched the world’s first RISC-V application processor D1, building a self-sufficient ecosystem.

3. Competitive Landscape: Differentiation Breakthrough, Localization Services as a Moat

Major competitors include Rockchip (AIoT chips), Amlogic (smart TV/OTT chips), and Huawei HiSilicon (communication chips). Allwinner’s core advantages are reflected in the following aspects:

- Technical Barriers: Over 1,200 patents accumulated, significant first-mover advantage in RISC-V architecture, AI chip computing power reaching 8 TOPS, supporting localized Transformer models.

- Product Matrix: Covering three major scenarios: smart terminals (tablets/OTT), AIoT (vision/speech), and automotive, providing a complete solution of “SoC + power management + wireless connectivity”.

- Ecological Cooperation: Embedded in Xiaomi’s AIoT ecosystem, jointly developing motion control chips with Yushu Robotics (supplier for the Spring Festival Gala).

- Building a Core Technology Base for Multimodal Interaction: With years of deep cultivation in low-power, multimodal, and wireless connectivity technology, Allwinner chips have accumulated a solid technical foundation in smart speakers, children’s robots, sweeping robots, and other fields.

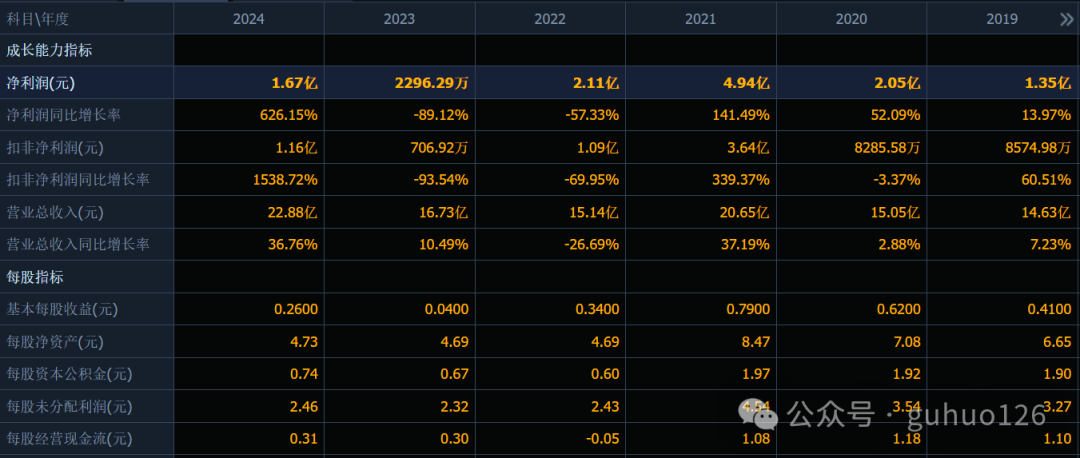

4. Operations and Performance: Concerns Behind High Growth

- 2024 Performance Highlights Revenue of 2.288 billion yuan (a year-on-year increase of 36.76%), net profit of 167 million yuan (a year-on-year increase of 626%), reaching a historical high. Revenue from smart terminal chips accounts for 95%, with sweeping robots and automotive chips being the main growth drivers.

- Financial Risks Gross margin under pressure, with a gross margin of 31.19% in 2024 (a year-on-year decrease of 1.21 percentage points), as rising raw material and outsourcing costs squeeze profits. Operating cash flow is 197 million yuan, but inventory turnover days are 150 days, higher than the industry average.

- R&D Investment In 2024, R&D expenses are 533 million yuan (23% of revenue), focusing on 6nm process and edge-side AI chips, but the absolute value is lower than Amlogic (over 1 billion).

-

Future Growth Points

AI edge computing power: The MR527 chip integrates 3 TOPS NPU, suitable for lightweight large models, already used in ByteDance AI toys.

Automotive Intelligence: Plans to launch the T736 chip supporting full vehicle intelligence, competing with international giants.

RISC-V Ecosystem: The new generation V821 chip adapts to multimodal perception, expanding into smart wearables and industrial control.

5. Investment Logic and Risk Warning

Core Logic:

- Technical Positioning: The layout of RISC-V architecture and edge-side AI chips aligns with the trend of domestic substitution.

- Track Dividend: With the increase in penetration rates of smart vehicles and AIoT, the company’s market share is expected to break through from 15% to 25%.

Risk Warning:

- Intensified Industry Competition: Pressure from technology iterations of competitors like Rockchip and Qualcomm.

- Customer Dependence: Xiaomi contributes over 40% of revenue; if self-developed chips or secondary suppliers are introduced, it may impact performance.

- Industry Competition: Companies like Qualcomm and Horizon are accelerating their layout in automotive-grade chips, which may squeeze the mid-range market.

6. Conclusion: Cautiously Optimistic, Focus on Technology Transformation and Valuation Digestion

Allwinner Technology, with its deep technical expertise and ecological positioning, is seizing the opportunity in the semiconductor recovery cycle in the AIoT and automotive sectors. However, the current PE ratio of 158 is significantly higher than the industry average (121), and short-term caution is needed against the pullback pressure from market sentiment.Risks and opportunities coexist; it is recommended to accumulate positions in long-term tracks during dips.

Disclaimer: The content described is only a personal review summary and does not constitute a basis for buying or selling. The ideas and logic are for reference only. Investment carries risks; please proceed with caution!