PCB, known as printed circuit board, is an essential interconnection component in electronic products, often referred to as the “mother of electronic products.”As the foundation of the electronic information industry, the PCB printed circuit board market is vast. According to the report published by the China Business Industry Research Institute titled “2023-2028 Development Trends and Forecast Report of China’s Printed Circuit Board (PCB) Industry,” the market size of China’s PCB reached 307.816 billion yuan in 2022, and it has increased to 309.663 billion yuan in 2023, with an expected growth to 330.071 billion yuan in 2024.Regionally, global PCB manufacturing companies are mainly distributed in mainland China, Taiwan, Japan, South Korea, the United States, Europe, and Southeast Asia, with mainland China still holding the world’s leading position.In terms of application scenarios, communications and computers are the primary fields for PCB applications, accounting for nearly 70% of the global market share.In such a clearly growing market, with significant advantages in the PCB industry in mainland China, news of bankruptcies and reorganizations among PCB manufacturers has frequently emerged.

PCB, known as printed circuit board, is an essential interconnection component in electronic products, often referred to as the “mother of electronic products.”As the foundation of the electronic information industry, the PCB printed circuit board market is vast. According to the report published by the China Business Industry Research Institute titled “2023-2028 Development Trends and Forecast Report of China’s Printed Circuit Board (PCB) Industry,” the market size of China’s PCB reached 307.816 billion yuan in 2022, and it has increased to 309.663 billion yuan in 2023, with an expected growth to 330.071 billion yuan in 2024.Regionally, global PCB manufacturing companies are mainly distributed in mainland China, Taiwan, Japan, South Korea, the United States, Europe, and Southeast Asia, with mainland China still holding the world’s leading position.In terms of application scenarios, communications and computers are the primary fields for PCB applications, accounting for nearly 70% of the global market share.In such a clearly growing market, with significant advantages in the PCB industry in mainland China, news of bankruptcies and reorganizations among PCB manufacturers has frequently emerged. 01Several PCB Manufacturers Facing BankruptcyRecently, a recruitment announcement for investors for the restructuring of Guangzhou Taihua Multilayer Circuit Co., Ltd. has sparked heated discussions in the industry. Despite the company’s poor management leading to consecutive years of losses and its suspension of production for restructuring, it is not uncommon for PCB manufacturers to face reorganization or bankruptcy. However, as a well-established PCB company with nearly twenty years of operation and a wholly-owned subsidiary of the A-share listed company Super Hua Technology, the path of restructuring for Guangzhou Taihua is still lamentable.Coincidentally, earlier this year, another well-known PCB manufacturer, Kunshan Quan Ying Electronics Co., Ltd., entered bankruptcy liquidation. In January, according to the National Enterprise Bankruptcy Reorganization Case Information Network, Kunshan Quan Ying Electronics Co., Ltd. has entered bankruptcy liquidation procedures, and according to relevant regulations, the company’s labor contracts with employees were terminated on January 31, 2024. The unpaid wages and economic compensation owed by the company will be investigated and publicly announced by the administrator and settled according to relevant laws from the bankruptcy assets.In addition to Guangzhou Taihua and Kunshan Quan Ying Electronics facing difficulties, since 2023, more than 20 PCB-related companies have declared bankruptcy due to insolvency. For example, Shenzhen Xingqifa Circuit Board Co., Ltd., Kunshan Huasheng Circuit Board R&D Base Co., Ltd., Jiangxi Xinhua Sheng Electronic Circuit Technology Co., Ltd., Meizhou Huasheng Circuit Board Co., Ltd., and Shenzhen Senyu Tong Precision Circuit Co., Ltd. have all fallen into bankruptcy crises.The dynamic evolution of the PCB market reflects the harsh reality of market competition and highlights the urgency of industry reshuffling.The negative impact of accelerated competition is not only the shutdown of several companies, but also the continuous decline in product prices and the revenues and profits of many listed PCB companies during this process.

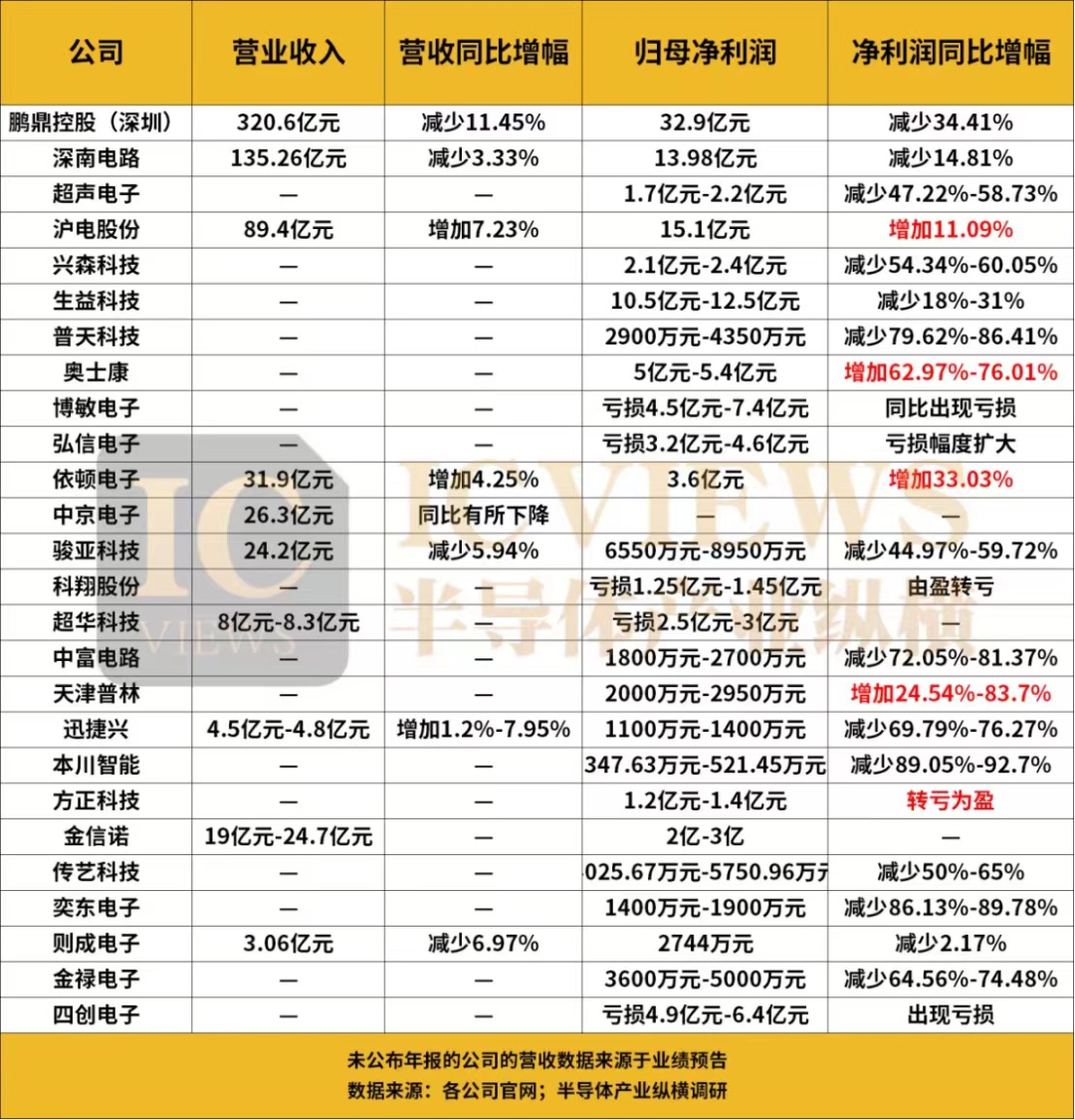

01Several PCB Manufacturers Facing BankruptcyRecently, a recruitment announcement for investors for the restructuring of Guangzhou Taihua Multilayer Circuit Co., Ltd. has sparked heated discussions in the industry. Despite the company’s poor management leading to consecutive years of losses and its suspension of production for restructuring, it is not uncommon for PCB manufacturers to face reorganization or bankruptcy. However, as a well-established PCB company with nearly twenty years of operation and a wholly-owned subsidiary of the A-share listed company Super Hua Technology, the path of restructuring for Guangzhou Taihua is still lamentable.Coincidentally, earlier this year, another well-known PCB manufacturer, Kunshan Quan Ying Electronics Co., Ltd., entered bankruptcy liquidation. In January, according to the National Enterprise Bankruptcy Reorganization Case Information Network, Kunshan Quan Ying Electronics Co., Ltd. has entered bankruptcy liquidation procedures, and according to relevant regulations, the company’s labor contracts with employees were terminated on January 31, 2024. The unpaid wages and economic compensation owed by the company will be investigated and publicly announced by the administrator and settled according to relevant laws from the bankruptcy assets.In addition to Guangzhou Taihua and Kunshan Quan Ying Electronics facing difficulties, since 2023, more than 20 PCB-related companies have declared bankruptcy due to insolvency. For example, Shenzhen Xingqifa Circuit Board Co., Ltd., Kunshan Huasheng Circuit Board R&D Base Co., Ltd., Jiangxi Xinhua Sheng Electronic Circuit Technology Co., Ltd., Meizhou Huasheng Circuit Board Co., Ltd., and Shenzhen Senyu Tong Precision Circuit Co., Ltd. have all fallen into bankruptcy crises.The dynamic evolution of the PCB market reflects the harsh reality of market competition and highlights the urgency of industry reshuffling.The negative impact of accelerated competition is not only the shutdown of several companies, but also the continuous decline in product prices and the revenues and profits of many listed PCB companies during this process. 02Accelerated Competition, 80% of Listed Companies SufferThe overall prosperity of the PCB industry has significantly declined since the fourth quarter of 2022, failing to maintain the high growth trend of 2021. In fact, after several years of strong expansion, coupled with the current chill in the industry, the new production capacity of enterprises is affected, and domestic PCB capacity may take longer to digest. Additionally, due to market conditions and objective factors, manufacturers previously overstocked inventory to prevent supply chain risks, which has prematurely exhausted market demand.In fierce competition, some companies have adopted malicious competition strategies to seize market share, leading to a significant drop in PCB product prices. For instance, in the first quarter of last year, some PCB manufacturers reduced prices for automotive PCB products by 10% to 15% to secure orders, a price drop rarely seen in recent years.Under pressure, many manufacturers have issued announcements of expected annual losses, and some small and medium-sized enterprises are facing survival pressures.According to incomplete statistics, there are currently over 30 PCB companies listed on the A-share market, including Pengding Holdings, Dongshan Precision, Shenzhen South Circuit, Huadian Co., Ltd., and Jingwang Electronics. From the performance situation in 2023, under insufficient order volume and significant price declines, only five companies, including Huadian Co., Ltd., Aoshikang, Yidun Electronics, Tianjin Purin, and Fangzheng Technology, have seen an increase in net profit compared to last year, while the net profits of more than 20 other companies have declined year-on-year.

02Accelerated Competition, 80% of Listed Companies SufferThe overall prosperity of the PCB industry has significantly declined since the fourth quarter of 2022, failing to maintain the high growth trend of 2021. In fact, after several years of strong expansion, coupled with the current chill in the industry, the new production capacity of enterprises is affected, and domestic PCB capacity may take longer to digest. Additionally, due to market conditions and objective factors, manufacturers previously overstocked inventory to prevent supply chain risks, which has prematurely exhausted market demand.In fierce competition, some companies have adopted malicious competition strategies to seize market share, leading to a significant drop in PCB product prices. For instance, in the first quarter of last year, some PCB manufacturers reduced prices for automotive PCB products by 10% to 15% to secure orders, a price drop rarely seen in recent years.Under pressure, many manufacturers have issued announcements of expected annual losses, and some small and medium-sized enterprises are facing survival pressures.According to incomplete statistics, there are currently over 30 PCB companies listed on the A-share market, including Pengding Holdings, Dongshan Precision, Shenzhen South Circuit, Huadian Co., Ltd., and Jingwang Electronics. From the performance situation in 2023, under insufficient order volume and significant price declines, only five companies, including Huadian Co., Ltd., Aoshikang, Yidun Electronics, Tianjin Purin, and Fangzheng Technology, have seen an increase in net profit compared to last year, while the net profits of more than 20 other companies have declined year-on-year.

As seen in the above image, most companies’ profit margins are being squeezed, falling into a situation of “increased revenue without increased profit” or double declines in revenue, with PCB manufacturers primarily serving consumer electronics being the hardest hit; while companies mainly focused on automotive electronics and new energy applications are relatively less affected.From the performance forecasts and annual reports of the above companies, it can also be observed that the phenomenon of larger domestic PCB manufacturers becoming more dominant is very evident, with major PCB manufacturers occupying the vast majority of the market share, while the remaining small and medium-sized companies are forced to accelerate competition in the limited market space. 03Market Showing Initial Signs of RecoveryIn fact, since the fourth quarter of 2023, many PCB companies have reported that the current situation has improved compared to the third quarter.Against the backdrop of recovering consumer demand and a surge in purchases following the release of new devices in the third quarter, PCB industry shipments have increased, and inventory turnover rates have improved, although overall industry inventory remains high. With the rising demand in the smartphone market, the industry’s destocking effect is accelerating in the fourth quarter.Shiyun Circuit stated in early December 2023, “Currently, the capacity utilization rate is at 85%-90%, slightly higher than in the third quarter”; a person from the securities department of Zhongjing Electronics mentioned that the overall capacity utilization rate is better than in the third quarter, indicating signs of recovery from the company’s internal perspective.Entering January 2024, from the current situation, issues such as price declines (especially the significant drop in HDI – high-density interconnect board prices), overcapacity, insufficient demand, and uncertainties for the future are still prevalent, but they are entering a concluding phase.Next, the industry is expected to re-enter a new growth trajectory.

03Market Showing Initial Signs of RecoveryIn fact, since the fourth quarter of 2023, many PCB companies have reported that the current situation has improved compared to the third quarter.Against the backdrop of recovering consumer demand and a surge in purchases following the release of new devices in the third quarter, PCB industry shipments have increased, and inventory turnover rates have improved, although overall industry inventory remains high. With the rising demand in the smartphone market, the industry’s destocking effect is accelerating in the fourth quarter.Shiyun Circuit stated in early December 2023, “Currently, the capacity utilization rate is at 85%-90%, slightly higher than in the third quarter”; a person from the securities department of Zhongjing Electronics mentioned that the overall capacity utilization rate is better than in the third quarter, indicating signs of recovery from the company’s internal perspective.Entering January 2024, from the current situation, issues such as price declines (especially the significant drop in HDI – high-density interconnect board prices), overcapacity, insufficient demand, and uncertainties for the future are still prevalent, but they are entering a concluding phase.Next, the industry is expected to re-enter a new growth trajectory. 04PCB is Entering a New Growth TrackThe main driving factors for the PCB market in 2024 include:First,the high-endization of smartphones is driving the demand for PCBs.According to Canalys data, in the third quarter of 2023, global smartphone sales declined year-on-year, but domestic high-end smartphone sales increased by 12.3% year-on-year; additionally, IDC data shows that the shipment volume of China’s foldable smartphone market reached 2.27 million units in the first half of 2023, a year-on-year increase of 102%. This indicates a trend towards “high-end” in the smartphone market, with the rise of foldable smartphones driving the demand for high-end PCB categories.Second,the vigorous development of AI also brings structural opportunities to the industry.The advancement of AI technology has driven the demand for high-performance computing chips, directly boosting the growth of the PCB industry scale. With the upgrade of the PCIe protocol, the demand for transmission rates and PCB layers is increasing, which continuously raises the requirements for PCB materials and manufacturing processes, thereby increasing the value of PCBs. For example, in the AI server market ignited by ChatGPT, the high computing power demand has spurred strong demand for large-size, high-layer, high-end HDI, and high-frequency high-speed PCBs.

04PCB is Entering a New Growth TrackThe main driving factors for the PCB market in 2024 include:First,the high-endization of smartphones is driving the demand for PCBs.According to Canalys data, in the third quarter of 2023, global smartphone sales declined year-on-year, but domestic high-end smartphone sales increased by 12.3% year-on-year; additionally, IDC data shows that the shipment volume of China’s foldable smartphone market reached 2.27 million units in the first half of 2023, a year-on-year increase of 102%. This indicates a trend towards “high-end” in the smartphone market, with the rise of foldable smartphones driving the demand for high-end PCB categories.Second,the vigorous development of AI also brings structural opportunities to the industry.The advancement of AI technology has driven the demand for high-performance computing chips, directly boosting the growth of the PCB industry scale. With the upgrade of the PCIe protocol, the demand for transmission rates and PCB layers is increasing, which continuously raises the requirements for PCB materials and manufacturing processes, thereby increasing the value of PCBs. For example, in the AI server market ignited by ChatGPT, the high computing power demand has spurred strong demand for large-size, high-layer, high-end HDI, and high-frequency high-speed PCBs.

Third,robotic products also require a large number of flexible, bendable, and high-precision demand scenarios, necessitating the use of FPC (flexible printed circuit) products.Recently, NVIDIA announced plans to enter the humanoid robot industry.

Fourth,the strong development of new energy vehicles is also driving the application of HDI, FPC, and other products in ADAS and intelligent cockpits.The requirements for PCBs in automobiles are diverse, with single-sided boards, double-sided boards, 4-layer boards, and 6-layer boards accounting for 26.93%, 25.70%, 17.37%, respectively, totaling about 73%. HDI, FPC, and IC substrates account for 9.56%, 14.57%, and 2.38%, respectively, totaling about 27%, indicating that multilayer PCBs remain the primary demand in automotive electronics. The demand for automotive PCBs is mainly for 2-6 layer boards, which account for about 2% of the total cost of electronic devices in vehicles.Looking back at the development of the PCB industry over the past year, while the market has shown price reductions and fierce competition, it has also demonstrated investment expansion and the vigorous development of high-end categories, and this series of positive signals indicates the rebirth and transformation of the industry. 05High-End PCBs are Highly AnticipatedFrom the development process of the PCB industry, developed countries such as the United States, Japan, and Europe started early, with mature industries and significant competitive advantages. Data shows that before the 21st century, the United States, Japan, and Europe accounted for over 70% of the global PCB production value. Since 2000, the Asian PCB industry has begun to rise comprehensively, especially in China, which has started to develop the PCB industry vigorously, leveraging its comprehensive advantages in resources, policies, and industrial clustering.During the process of the global industrial center shifting to Asia, China has become the global manufacturing center for PCBs. Data shows that since 2006, China officially surpassed Japan to become the largest PCB production base in the world. In 2022, the total output value of China’s PCB industry reached 44.2 billion USD, accounting for 54.1% of the global total. In recent years, as more companies increase their investment in technology research and development, the cluster advantages of China’s PCB industry have become more evident, with many PCB manufacturers forming their competitive advantages and bargaining power in various segments. However, it is worth noting that China’s technology and capacity in the high-end PCB sector still need improvement.With the rapid development of global electronic information technology, applications such as 5G, AI, cloud computing, and big data are accelerating their evolution, raising higher requirements for PCB performance, such as high frequency, high speed, high voltage, heat resistance, and low loss, thus generating strong demand for large-size, high-layer, high-end HDI, and high-frequency high-speed PCBs.For instance, just from the perspective of the number of layers in PCBs, AI models require increased computing power to manage an ever-growing amount of data, with the existing mainstream server and storage packaging generally being 6-16 layers. As we enter the era of large-scale commercial use of artificial intelligence, servers with more than 16 layers will become the market mainstream, and as technical demands continue to rise, the number of layers in PCBs will also continue to increase, with products exceeding 20 layers gradually increasing in market supply. Among them, PCBs for AI training phase servers will generally reach over 20 layers. Higher-end PCBs will undoubtedly provide more stable and efficient support for AI operations.In summary, high-end PCBs offer high reliability and stability, high integration and performance, low power consumption, high transmission rates, long service life, and low maintenance costs. Currently, many industry chain manufacturers are intensifying their layout in high-frequency high-speed PCBs and other high-end PCBs.For example, Pengding Holdings has begun mass production of AI server boards; Shengyi Electronics has successfully produced several PCBs for AI server products, with some projects entering the mass production stage; Zhongjing Electronics’ FPC products are being applied in small batches in the humanoid robot field; and Sihui Fushi can provide new automotive electronics PCBs, including millimeter-wave radar.Chongda Technology claims to accelerate the expansion of high-end board production capacity, and Kexiang Co., Ltd. plans to invest 2 billion to build a high-end PCB intelligent manufacturing factory. Recently, related projects in multiple locations have been signed and started, indicating that the high-frequency high-speed high-layer high-end PCB market is likely to continue to flourish.The investment direction in the industry also suggests a bright future for high multilayer boards. According to data released by CINNO Research, from January to June 2023, investment funds in the PCB industry in China (including Taiwan) mainly flowed into high multilayer boards, amounting to approximately 82.6 billion yuan, accounting for 58.3%; IC substrate investment totaled approximately 25.5 billion yuan, accounting for 18.1%; copper-clad laminate investment totaled approximately 17.3 billion yuan, accounting for 12.2%; and FPC investment totaled approximately 9.4 billion yuan, accounting for 6.6%.Looking at the market value of high-end PCBs, the latest report from QY Research titled “Global High-End PCB Market Report 2024-2030” predicts that by 2030, the global high-end PCB market size will reach 115.34 billion USD, with a compound annual growth rate (CAGR) of 6.8% in the coming years.Looking ahead to 2024, high-end PCBs are highly anticipated, with high-end products expected to continue penetrating the fields of AI servers, new energy vehicles, and 5G, and industry companies are also focusing on this competition.

05High-End PCBs are Highly AnticipatedFrom the development process of the PCB industry, developed countries such as the United States, Japan, and Europe started early, with mature industries and significant competitive advantages. Data shows that before the 21st century, the United States, Japan, and Europe accounted for over 70% of the global PCB production value. Since 2000, the Asian PCB industry has begun to rise comprehensively, especially in China, which has started to develop the PCB industry vigorously, leveraging its comprehensive advantages in resources, policies, and industrial clustering.During the process of the global industrial center shifting to Asia, China has become the global manufacturing center for PCBs. Data shows that since 2006, China officially surpassed Japan to become the largest PCB production base in the world. In 2022, the total output value of China’s PCB industry reached 44.2 billion USD, accounting for 54.1% of the global total. In recent years, as more companies increase their investment in technology research and development, the cluster advantages of China’s PCB industry have become more evident, with many PCB manufacturers forming their competitive advantages and bargaining power in various segments. However, it is worth noting that China’s technology and capacity in the high-end PCB sector still need improvement.With the rapid development of global electronic information technology, applications such as 5G, AI, cloud computing, and big data are accelerating their evolution, raising higher requirements for PCB performance, such as high frequency, high speed, high voltage, heat resistance, and low loss, thus generating strong demand for large-size, high-layer, high-end HDI, and high-frequency high-speed PCBs.For instance, just from the perspective of the number of layers in PCBs, AI models require increased computing power to manage an ever-growing amount of data, with the existing mainstream server and storage packaging generally being 6-16 layers. As we enter the era of large-scale commercial use of artificial intelligence, servers with more than 16 layers will become the market mainstream, and as technical demands continue to rise, the number of layers in PCBs will also continue to increase, with products exceeding 20 layers gradually increasing in market supply. Among them, PCBs for AI training phase servers will generally reach over 20 layers. Higher-end PCBs will undoubtedly provide more stable and efficient support for AI operations.In summary, high-end PCBs offer high reliability and stability, high integration and performance, low power consumption, high transmission rates, long service life, and low maintenance costs. Currently, many industry chain manufacturers are intensifying their layout in high-frequency high-speed PCBs and other high-end PCBs.For example, Pengding Holdings has begun mass production of AI server boards; Shengyi Electronics has successfully produced several PCBs for AI server products, with some projects entering the mass production stage; Zhongjing Electronics’ FPC products are being applied in small batches in the humanoid robot field; and Sihui Fushi can provide new automotive electronics PCBs, including millimeter-wave radar.Chongda Technology claims to accelerate the expansion of high-end board production capacity, and Kexiang Co., Ltd. plans to invest 2 billion to build a high-end PCB intelligent manufacturing factory. Recently, related projects in multiple locations have been signed and started, indicating that the high-frequency high-speed high-layer high-end PCB market is likely to continue to flourish.The investment direction in the industry also suggests a bright future for high multilayer boards. According to data released by CINNO Research, from January to June 2023, investment funds in the PCB industry in China (including Taiwan) mainly flowed into high multilayer boards, amounting to approximately 82.6 billion yuan, accounting for 58.3%; IC substrate investment totaled approximately 25.5 billion yuan, accounting for 18.1%; copper-clad laminate investment totaled approximately 17.3 billion yuan, accounting for 12.2%; and FPC investment totaled approximately 9.4 billion yuan, accounting for 6.6%.Looking at the market value of high-end PCBs, the latest report from QY Research titled “Global High-End PCB Market Report 2024-2030” predicts that by 2030, the global high-end PCB market size will reach 115.34 billion USD, with a compound annual growth rate (CAGR) of 6.8% in the coming years.Looking ahead to 2024, high-end PCBs are highly anticipated, with high-end products expected to continue penetrating the fields of AI servers, new energy vehicles, and 5G, and industry companies are also focusing on this competition.