Produced by Big Data Digest

Translated by: Travis, Hu Jia, Da Jieqiong, Xia Yawen

Life is short, and not just for programmers; Python is attracting the attention of big names from the financial sector.

In the wave of financial technology, countless traditional finance professionals are eager to strike gold. How can you find your opportunity and take off in the fintech boom?

This new technology is sweeping the globe, but its complexity is hard to describe.

First, you need to be familiar with national regulations while collaborating with different services and institutions to connect to bank APIs; secondly, you need to win the hearts and trust of users. To achieve these goals, your product must combine high-level security, functionality, and alignment with business needs.

All of this means you need the most unique and suitable technology to provide reliable solutions.

No matter the background (market), everyone wants their money to be safe. People are tirelessly searching for a sustainable financial technology; this article analyzes the reasons for Python’s popularity from the perspective of the fintech industry.

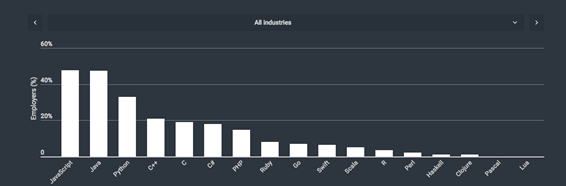

It is worth noting that Python has now become the most popular coding language in the world: a fast development stack, simple language, suitable for data analysis, and open libraries that facilitate API integration are all its advantages.

The Contradictory Financial Era

The modern financial world consists of two contradictory entities that still coexist:

Once upon a time, the millennial generation mastered contactless payments, used online banking, and various digital financial services, trading freely in life. Disregarding old-fashioned bureaucracy, new technologies established a new world for millennials;

On the other hand, there is the old traditional financial world. Disappointingly, it is a very old and rusty machine that cannot stop at will. Even if it accepts new technologies and their impact on finance, the traditional financial system still does not see new technologies as a threat or a valuable competitor.

This unshakeable machine can be found in the G7’s most developed countries. All accumulated funds gather there, along with most of the people ready to operate high-tech startups. Changing such a traditional financial system will be a huge challenge.

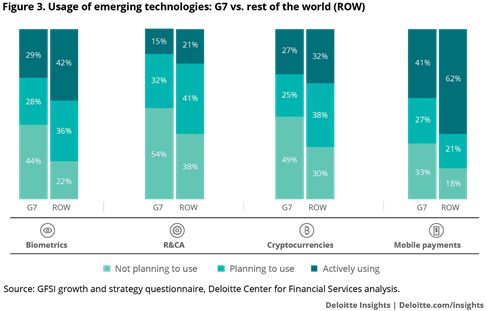

For example, Deloitte’s 2017 statistics show that the habits of the G7 regarding fintech are contrary to those in the rest of the world. Deloitte researchers pointed out: Surprisingly, 40% of American executives believe that mobile payments have little or no impact on their industry. In a relatively small sample survey, 7 out of 17 American banks (about 41%) believe that mobile wallets and other payment technologies have no impact on them, while 14 out of 36 non-bank financial units (about 37%) hold the same opinion.

Developing countries present a completely different picture. Without the strong dominance of traditional financial sectors, there is more room for the growth and development of fintech. It also provides more opportunities and ways for people to easily collaborate with developed countries and obtain safer returns. Frankly, this is the most attractive aspect of fintech—it eliminates financial boundaries!

The Use of Emerging Technologies: The Financial World Taken Over by Fintech

Figure 3: The Use of Emerging Technologies: G7 vs Other Countries

Data Source: GDSI Growth and Strategy Survey, Deloitte Financial Center

The G7 still seems skeptical about fintech, but in reality, technology is constantly changing finance. The problem is that everything in this world changes quickly, and technology is no exception. It is flexible and can adapt to the new needs of users.

But this is exactly what millennials want: new consumption habits, high digital sensitivity, and demand for online products, all of which are part of a new generation lifestyle. They waste no time and demand to be efficient around the clock. This is why they value financial freedom at all times and places.

According to the Wall Street Journal, the convenience of payments attracts those who demand technological innovation and lead busy lives. Mobile payment users are mostly well-educated, full-time employed, primarily male, and exhibit very active financial behavior. Compared to non-mobile payment users, they are more likely to have bank accounts, retirement accounts, own homes, and utilize auto loans and mortgages.

Related Link

https://blogs.wsj.com/experts/2018/06/07/the-uncomfortable-relationship-between-mobile-payments-and-financial-literacy/

What conclusions can we draw?

Statistics from the Wall Street Journal show that mobile payment users have higher incomes than non-mobile payment users, are more active in transaction activities, possess more financial knowledge, and use a wider variety of financial products. At the same time, they are more careless with their spending and are at a high risk of falling into debt. Sometimes, they even withdraw money from their retirement accounts. This calls for a simple tool in the new wave of fintech to help millennials manage their funds. Despite their high income and education levels, it has been reported that millennials using mobile payments face higher risks of financial distress and mismanagement.

Our research found that mobile payment users need more than just mobile transactions. Users want to manage short-term debts and daily expenses through products, which will be the innovative direction of fintech products in the future.

The financial industry is extremely sensitive to new customer demands, especially in the digital age. When similar products become too ubiquitous and convenient, customers may stop using your product services. How can this be prevented? Can companies create a product that withstands the test of time, accompanying young people’s financial growth and continuously serving the millennial generation? Just like some financial companies currently provide products for young people. Of course, mortgage, investment, and wealth management financial branches should also be particularly cautious in creating their products.

Returning to the previous topic. To survive and gain a large following and loyal customers, a company’s technology must be unique, stable, secure, and customized to meet customer needs. In this regard, fintech companies cannot avoid the need to integrate with traditional financial and national institutions. This is why you must first ensure that the collaboration runs smoothly and that you appear to be a reliable business partner in their eyes, using your technology rather than someone else’s. The worst-case scenario is that they abandon you and choose to create their own technology!

Python: The First Language for Fintech Products

So what do we really need? A technology robust enough to withstand global financial disruption pressures and flexible enough to meet the challenges of the new world and the growing demands of customers.

For us, using Python and the Django framework is a very good choice, and we have found that this combination offers us various possibilities.

This is not to suggest that Python is the solution to all problems, but rather to discuss the advantages of Python in financial products.

1. Using the Python/Django tech stack can accelerate time to market.

This is easy to understand: with the Python/Django tech stack, you can build products (MVP: Model-View-Presenter) very quickly, thereby increasing the chances of finding a suitable product/market fit.

Fintech can only compete and/or cooperate with traditional banks and finance by adapting to changes and customer needs, providing value-added services based on customer ideas and improving them. Your technology must be flexible enough to provide a solid foundation for numerous value-added services.

The Python/Django framework combination meets the MVP specification requirements and can save some development time costs. Their development is basically similar to Lego—you don’t need to develop small modules like permissions or user management from scratch. You just need to find the modules you need from the Python libraries (Numpy, Scipy, Scikit-learn, Statsmodels, Pandas, Matplotlib, Seaborn, etc.) to build your own MVP.

Another advantage of Django is that it provides a simple management panel or CRM during the MVP architecture development phase—it is built-in; you just need to set it up in your product. Of course, during the MVP phase, the product’s functionality is not complete, but you can test and easily refine features because Django is very flexible.

After the MVP architecture is completed, this tech stack allows for adjustments to some code. That is, after you have completed the functionality of the MVP architecture, you can easily modify certain codes or add new codes to ensure the perfect operation of product functions.

Millennials are used to living in a fast-paced world; they need to improve work efficiency around the clock. Their expectations of others and the services they use are maximum transparency and high-quality service. This is also why customer development is so important—a whole generation relies on it. Therefore, the sooner you bring your product to market, the faster you can collect user feedback and improve the product. Developing financial products with Python can help you complete the entire process more easily.

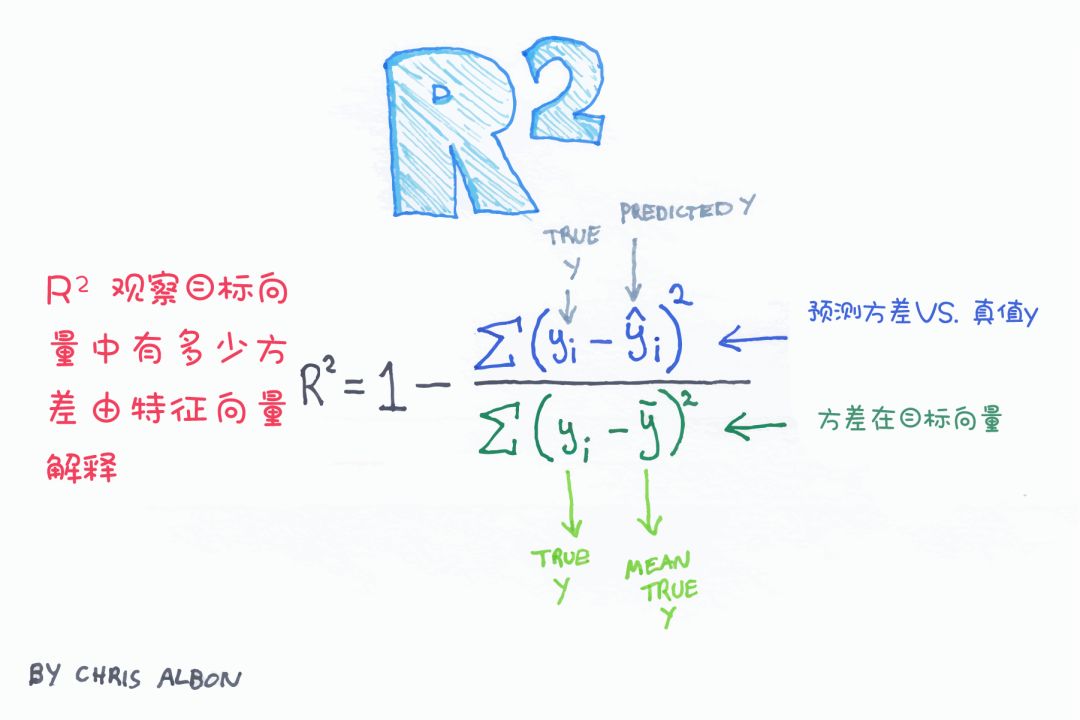

2. Mathematics and economics commonly use Python.

It is clear that it is because of those mathematicians and economists who use Python to compute algorithms and formulas that fintech exists. Languages like R and Matlab are rarely used among economists, but Python is relatively the most commonly used financial programming language and is the “universal language” of data science. Economists use Python for calculations, so it is evident that integrating their code with products developed in Python will be easier. However, sometimes even code snippets written in the same language can be difficult to integrate, which is why the presence of technical partners and mutual communication is crucial.

3. Simple syntax—collaboration is easier.

Less is more.

The simplicity and easy-to-understand syntax of Python make it very clear, and everyone can quickly get started. This is also why I believe Python will become the “universal language”; it is just a matter of time. Python’s creator, Guido van Rossum, confirmed my thoughts by describing Python as “a high-level programming language whose core design philosophy emphasizes code readability and allows programmers to express ideas in fewer lines of code.”

Therefore, the benefit of Python is that it is easy to understand not only for technical experts but also for clients. During the development process, both parties can grasp different levels of technical understanding. With Python, engineers can explain code more easily, and clients can better understand development progress. It seems to be a win-win process.

As economists discuss Python: The two main advantages of the Python language are its simplicity and flexibility. Its simple syntax and indentation format make it easy to learn, read, and share. Its loyal followers, the Python programming experts (Pythonistas), have uploaded 145,000 custom data packages to online libraries. These packages cover everything from game development to astronomy and can be installed in seconds and applied in Python programs.

This also leads to the next point.

4. Python’s open libraries include tools for API integration.

Thanks to Python’s open libraries, you do not need to develop tools from scratch and can complete product development and analyze large amounts of data in the shortest time. If you are in the MVP development stage, these open libraries can save you a lot of time and money.

As I mentioned earlier, fintech products need to integrate with a large number of third-party products. Python libraries can help your product integrate more easily with other systems through different APIs (interfaces). In finance, APIs can help you collect and analyze the necessary data about users, real estate, and institutions. For example, in the UK, you can obtain people’s credit records through APIs, which is also a necessary step for in-depth financial operations. By using APIs in the online mortgage industry, you can check real estate data and verify someone’s identity. Most importantly, you can query or filter data with one click without using and combining different libraries/packages to develop new tools.

For example, Django Stars (a software development company) uses the Django Rest architecture to build APIs or integrate with external APIs while using Celery (a Python parallel distributed framework) to complete queues or distribute tasks.

5. The growing popularity of Python and ample talent pool.

According to the HackerRank 2018 Developer Skills Report, Python has become the second language that programmers need to learn and is one of the top three languages in the financial services industry and other developing industries.

This is a good trend because Python will continue to evolve, and more experts will get involved, indicating that there will be enough talent in the future to continue developing and maintaining our products.

According to our Love-Hate Index, Python has won the hearts of developers of all ages. Python is also the most popular language that developers want to learn, and the vast majority are aware of it.

—HackerRank

Python’s applications are more extensive than you might think: from traditional software like web development to cutting-edge technologies like AI. It combines flexibility and functionality, and has over 125,000 third-party Python libraries that allow you to build products like Lego. It is also the preferred language for data analysis, making it attractive for non-technical fields like business; Python is also the best programming language for financial analysis.

Again, I am not saying that Python is the only solution. I am just sharing my own experience that Python is very successful. I find that using Python in combination with Django is indeed fantastic.

This is also what you need to build fintech products—a super tool that can help your product gain trust, be completely secure, and functionally practical. Complying with national laws, perfectly integrating with other services, institutions, and bank APIs—all of this requires attention to software details and lifecycle to serve the future inheritors—the new millennial generation. Thus, reaching the peak and becoming one of the changers of the financial market, or even further, changing the world. Unique, efficient, user-oriented, and future-focused development. This is the essence of Python.

Related Reports:

https://www.ft.com/content/1e2db400-ac2d-11e8-94bd-cba20d67390c

[Today’s Machine Learning Concept]

Have a Great Definition

Volunteer Introduction

Reply “Volunteer” to join us