Author: Jun Nagayama Source: EE Times Japan Translated by: Xiaoxin

Renesas Electronics announced its annual financial performance for 2022, showing strong double growth in both sales and profits, setting a new historical record.

Renesas attributed its impressive performance in 2022 to the acquisition of Dialog and strong sales in the automotive and infrastructure sectors. Renesas noted that the strong demand for automotive business centered around 40nm microcontrollers will continue, but inventory adjustments in other business areas are still ongoing, and they will manage cautiously to avoid inventory buildup.

Regarding market supply and demand, Renesas believes that the previously tight supply-demand relationship has eased somewhat, showing uneven distribution, with 8-inch mature process products still in tight supply and limited capacity.

Below is the full translation of “Renesas 2022 Annual Sales and Profits Increased to Record Levels”.

On February 9, 2023, Renesas Electronics (Renesas) announced its full-year results for the year ending December 31, 2022 (FY2022). The results showed (non-GAAP) that the total sales for 2022 were 1,502.7 billion yen (an increase of 51.1% year-on-year), with operating profit of 559.4 billion yen (an increase of 262.8 billion yen), achieving double growth.

The operating profit margin was 37.2% (up 7.4 percentage points), and net profit was 377.3 billion yen (an increase of 155.1 billion yen). Each item set a historical record. Excluding foreign exchange effects, net profit was 429.2 billion yen (an increase of 182.8 billion yen), reflecting the consolidation effect of Dialog Semiconductor, acquired on August 31, 2021, and the impact of the weaker yen, as well as strong sales in automotive and infrastructure sectors such as data centers.

Full Year and Fourth Quarter Performance for FY2022

Source: Renesas Electronics

01

Inventory Adjustments Will Continue

Severe Shortage of Industrial Products

Renesas also announced its forecast for the first quarter of 2023. Sales are expected to decline by 9.3% quarter-on-quarter (a 3.3% decline quarter-on-quarter after excluding foreign exchange effects), reaching 355 billion yen (±7.5 billion yen), with gross margin expected to decrease by 1.5 percentage points to 54.5%, and operating profit margin expected to decrease by 2.2 percentage points to 32.5%.

In the automotive business, strong demand centered around 40nm process microcontrollers will continue. However, in the industrial, infrastructure, and IoT (Internet of Things) sectors, the adjustment phase will continue, focusing on PC, mobile, and consumer products. Renesas stated, “To avoid inventory buildup, we will manage cautiously. Renesas predicts that sales will decline in the first quarter of 2023, and the overall gross profit margin is expected to be affected by production adjustments, rising manufacturing costs, raw materials, and electricity prices.”

First Quarter Forecast for FY2023

Source: Renesas Electronics

Regarding the adjustment phase related to PCs, Renesas’ President and CEO, Hidetoshi Shibata, stated that the mainstream view is that it will bottom out around the second quarter. In the industrial, infrastructure, and IoT sectors, due to factors related to zero carbon and the transition from combustion boilers to electric heat pumps, the industrial sector is expected to remain robust. Shibata stated, “In terms of overall quantity and value, although the scale is small, the output will continue to grow. There is very little channel inventory in the industrial sector, and there is a significant shortage of chips, so we are in a situation where we need to continuously produce products for the industry.“

Regarding data centers, he added, “Investment in data centers themselves may be at a high level. As MPUs (microprocessors) enter the next generation, structural content is expected to increase, and we currently do not see the previous momentum continuing.”

Shibata stated that industrial and data centers are “driving growth with structural tailwinds” for Renesas. He added, “In data centers, there is a generational shift in MPUs between AMD and Intel. In particular, AMD is currently expanding its market share, and as it increases, our business will also grow.“

02

Automotive Demand Exceeds Initial Expectations

Due to favorable exchange rate effects and strong automotive sales, sales in the fourth quarter of FY2022 reached 391.3 billion yen, exceeding forecasts by 1.6%. The gross margin increased by 2.0 percentage points compared to the forecast, reaching 56.0%, mainly due to positive exchange rate effects and improvements in product mix, as well as improvements in manufacturing costs, including lower periodic inspection costs and lower contract manufacturing costs, mainly OSAT (Outsourced Semiconductor Assembly and Test), with business expenses lower than forecast. Operating expenses were below forecast, and the operating profit margin was 34.7%, exceeding the forecast by 4.2 percentage points.

Sales, Gross Margin, and Operating Income for Q4 FY2022 (by Business Segment) Source: Renesas Electronics

From the fourth quarter performance, due to growth mainly in MCUs and SoCs (System on Chip), sales in the automotive sector increased by 7.5%, reaching 169.6 billion yen; while sales in the industrial, infrastructure, and IoT sectors decreased by 3.5% to 218.9 billion yen due to declining demand for PCs, smartphones, and other products.

Overall, sales only increased by 1.0%. Excluding foreign exchange effects, sales decreased quarter-on-quarter. Due to negative currency effects, lower production returns, and higher manufacturing costs, the gross margin decreased by 1.0 percentage point year-on-year. The operating profit margin also decreased by 2.2 percentage points due to increased operating expenses within seasonal ranges.

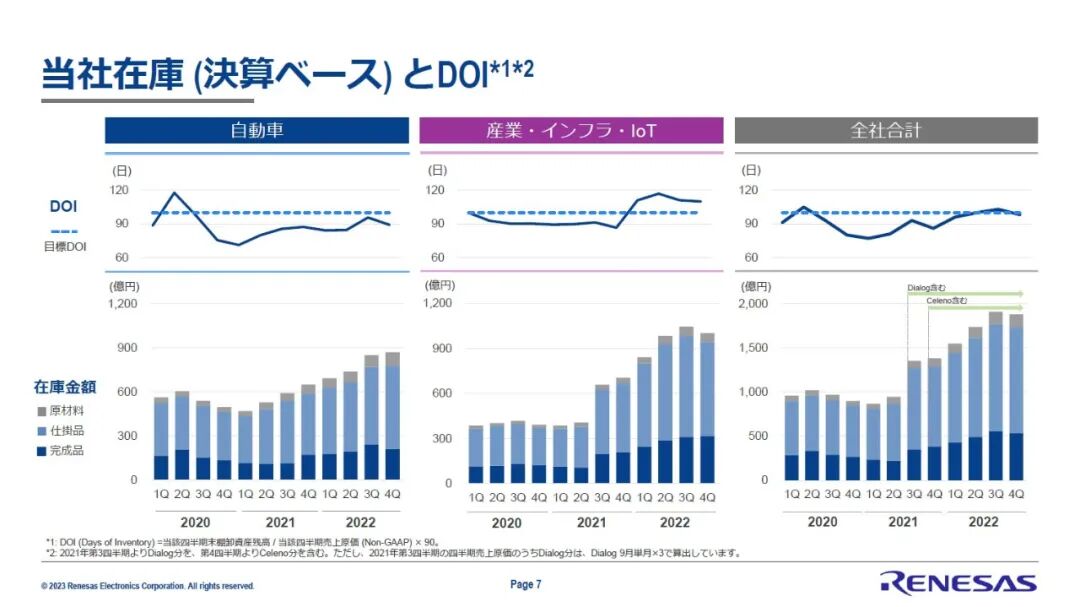

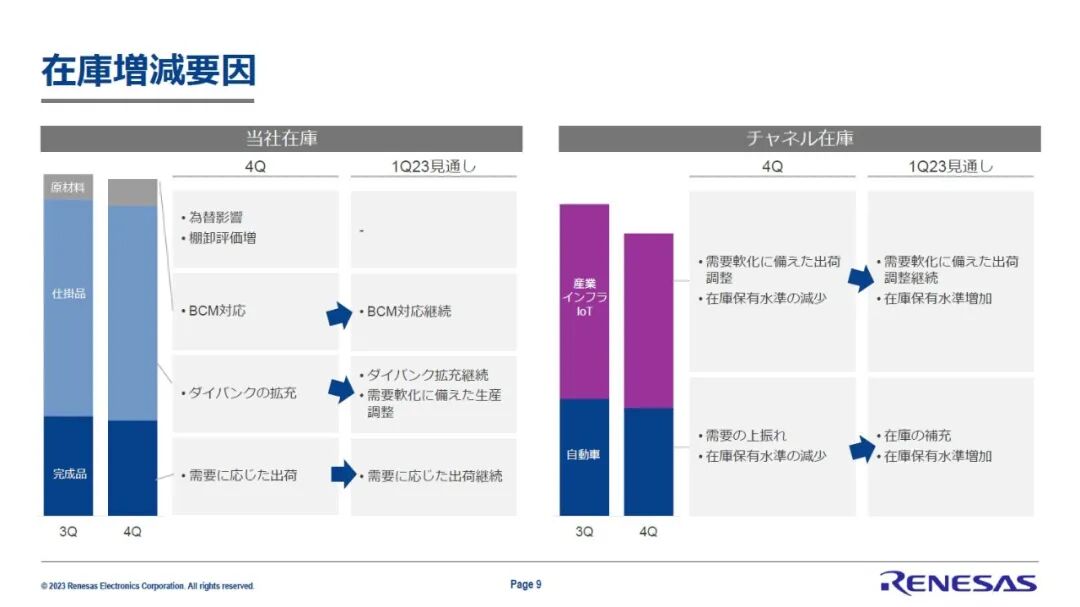

Regarding the inventory levels in the fourth quarter, the days of inventory on hand (DOI) overall decreased compared to the previous quarter. By business segment, both automotive and industrial, infrastructure, and IoT sectors saw declines. Additionally, this was influenced by the appreciation of the yen at the end of the fourth quarter; excluding foreign exchange effects, there would have been a slight increase.

Internal Inventory and DOI Trends / Factors for Inventory Increase or Decrease Source: Renesas Electronics

By carefully observing the factors behind internal inventory fluctuations beyond exchange rate effects, it can be seen that overall inventory has increased, reflecting rising material and electricity costs. Additionally, in terms of raw materials, to support business continuity plans (BCM), we have expanded maintenance parts to stabilize the operation of factory equipment. BCM will continue to support in the first quarter of FY2023.

In terms of work-in-progress, the company has expanded its mold library, reserving wafers processed in the front-end process. The company’s CFO (Chief Financial Officer) Shinkai Souhei stated, “In internal production, we have expanded the mold library for traditional products, but for growth products, the mold library is still insufficient and needs to be expanded.” In addition to expanding the chip library, the company plans to curb wafer input and procurement of foundry products based on demand and expects a slight decrease in overall work-in-progress.

In terms of finished products, in the fourth quarter of FY2022, the shipment of pre-produced products (mainly automotive) increased, while industrial, infrastructure, and IoT were limited in channel shipments due to demand. Therefore, sales reached the same level as the previous quarter. Shinkai stated that he expects stability after the first quarter of FY2023, as channel shipments will be adjusted based on demand conditions.

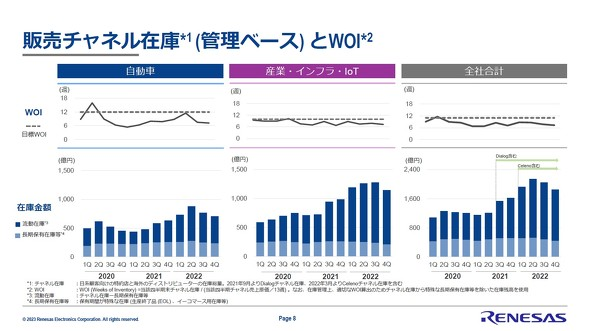

Sales channel inventory for automotive, industrial, infrastructure, and IoT has decreased compared to the previous quarter, with WOI (Weeks of Inventory) dropping to just over seven weeks. “We are all carefully observing demand trends and adjusting shipments to avoid excess inventory,” Shinkai said, “For automotive, although shipments compensated for the decline in the previous quarter, final demand exceeded initial forecasts,” he explained. Due to increased demand primarily in Japan in preparation for increased production in the first quarter of FY2023, inventory levels have decreased. Therefore, it is expected that the first quarter will replenish the excessively reduced inventory from the previous quarter, raising inventory levels.

Changes in Sales Channel Inventory and WOI

Source: Renesas Electronics

Shinkai stated, “40nm microcontrollers have been tight from the moment they were manufactured.” But he explained, “Overall, it is not that we have not kept up with demand. We believe it is necessary to maintain inventory everywhere, partly because our view of the supply chain has changed. Regarding the first quarter, we are considering providing a bit more for the anticipated channel demand.”

For industrial, infrastructure, and IoT, although inventory itself may slightly decrease in the first quarter, WOI is expected to increase due to declining demand.

03

Rising Concerns Over Geopolitical Risks

Fab-lite Policy Remains Unchanged

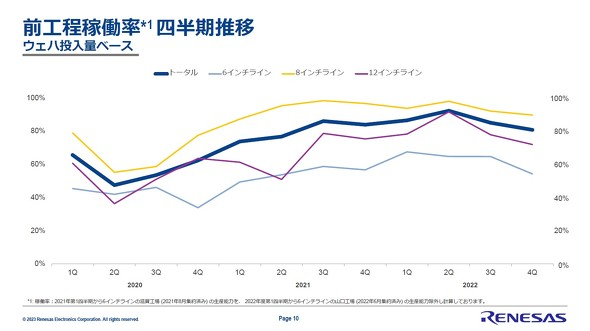

In the fourth quarter of FY2022, the front-end process utilization rate based on wafer input exceeded 80%. Due to regular maintenance at various factories at the end of the year and the beginning of the year, the number of working days decreased. In the first quarter of FY2023, due to reduced working days and production adjustments, output is expected to decline by several percentage points.

Quarterly Trends in Front-End Process Utilization Rate

Source: Renesas Electronics

Concerns over geopolitical risks are rising, such as the tightening of measures against China by the United States, but Shinkai mentioned that measures to address geopolitical risks are being discussed. However, the fab-lite policy has not changed, he said: “We will communicate with partners (mainly foundries and OSAT), for example, Taiwanese companies are actively expanding capacity outside of Taiwan, and we will keep up with these actions. We plan to gradually improve the resilience of the supply chain.”

Additionally, Shinkai provided an explanation of the current supply situation. In the foundry, OSAT, and raw materials sectors, he stated that overall, the tight supply-demand situation has eased compared to before. However, the situation is uneven, with some areas experiencing easing and others still tight, such as foundries, where 8-inch products and mature node products have limited capacity and remain very popular.

Chip Superhero Hua Jie Fan BenefitsScan to add friendsReceive100GSemiconductor Industry Data Package (including automotive chips, chip design, and other text and video materials) Discuss market trends, buy and sell chips, and talk about cooperationScan to add Chip Superhero Hua JieRecommended Reading:▶ Renesas CEO: Other than automotive chips, not much is going well▶ Chips, Inventory Surplus▶ 2023, the surge of automotive MCUs▶ The semiconductor chill is biting: layoffs followed by pay cuts▶ Will domestic chip companies with severe losses still recruit talents with annual salaries of one million?

Discuss market trends, buy and sell chips, and talk about cooperationScan to add Chip Superhero Hua JieRecommended Reading:▶ Renesas CEO: Other than automotive chips, not much is going well▶ Chips, Inventory Surplus▶ 2023, the surge of automotive MCUs▶ The semiconductor chill is biting: layoffs followed by pay cuts▶ Will domestic chip companies with severe losses still recruit talents with annual salaries of one million? Click to view past content↓↓↓

Click to view past content↓↓↓

Are you “watching” me?