Click the title below “Guo Xin Nan Fang” for quick attention

Source: Semiconductor Industry Observation (ID: icbank)

Computer chips are the engine room of the digital economy, and their ever-growing capabilities are driving the development of technologies such as artificial intelligence, which are expected to transform multiple industries. Their critical role was highlighted when the coronavirus pandemic disrupted chip production in Asia, throwing the global technology supply chain into chaos. Therefore, it is not surprising that these devices have become the focal point of fierce competition among the world’s economic superpowers.

1. Why Are Chips So Important?

They are necessary for processing and understanding vast amounts of data, which have become the lifeblood of the economy, competing with oil. Chips are made from materials deposited on silicon wafers (abbreviated as semiconductors or integrated circuits) and can perform various functions. Storage chips that store data are relatively simple and traded like commodities. Logic chips that run programs and act as the brain of devices are more complex and expensive. Access to components like Nvidia’s H100 AI accelerator has been linked to national security and the fates of tech giants like Alphabet’s Google and Microsoft as they compete to build giant data centers and capture data centers that are viewed as the future of computing. However, even everyday devices are increasingly reliant on chips. In cars filled with gadgets, each button press requires simple chips to convert touches into electronic signals. All battery-powered devices require chips to convert and regulate current.

2. Why Is There a Chip Manufacturing Race?

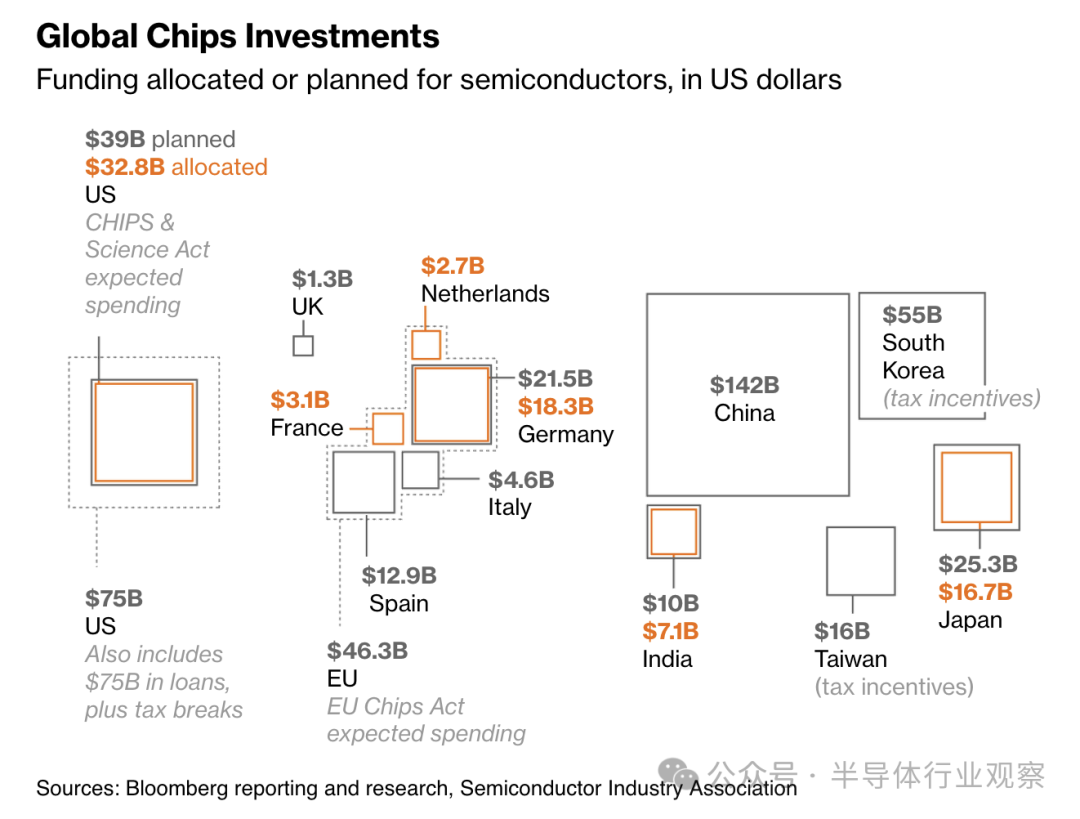

Most of the world’s leading semiconductor technologies originated in the United States, but today Taiwan and South Korea dominate the chip manufacturing sector. China is the largest market for electronic components and is increasingly eager to produce more chips for its own use. This has made the industry a focal point for Washington as it seeks to curb the rise of its Asian competitors and address what it calls national security concerns. The U.S. is implementing export controls and import tariffs to curb China’s chip ambitions. It has also allocated massive government funding to restore actual component production and reduce dangerous reliance on a few factories in East Asia. Several other countries, including Germany, Spain, India, and Japan, are also following suit.

3. Who Controls the Supply?

Chip manufacturing has become an increasingly unstable and exclusive industry. The cost of building new factories exceeds $20 billion, takes years to complete, and requires running 24 hours a day to be profitable. The scale required reduces the number of companies with leading technologies to just three—TSMC, South Korea’s Samsung Electronics, and the U.S.’s Intel. TSMC and Samsung serve as so-called foundries, providing outsourced manufacturing for companies around the world. The largest tech companies rely on the best manufacturing, most of which is located in Taiwan. Intel, which previously focused on producing chips for its own use, is now also trying to compete with TSMC and Samsung for foundry business. There is a huge industry downstream in the food chain that produces so-called analog chips. Leading manufacturers of components, such as Texas Instruments (TI) and STMicroelectronics NV, include those that regulate power inside smartphones, control temperature, and convert sound into electrical pulses. Due to the inability to access many machines required to manufacture more cutting-edge parts, China is targeting this area and investing heavily to increase production and capture market share.

4. How Is the Chip War Progressing?

Despite China’s spending spree, its chip manufacturers still rely on U.S. technology, and their opportunities to acquire overseas chip production technology are dwindling. The U.S. implemented stricter export controls on certain chips and chip manufacturing equipment in 2023 to prevent China from developing capabilities deemed a potential threat by Washington, such as supercomputers and artificial intelligence. It has also urged allies to tighten restrictions on China’s access to chip technology to close export control loopholes and take steps to limit its own imports of Chinese chips.

Leading Chinese tech companies, including Huawei Technologies Co., have been placed on a so-called U.S. entity list, meaning U.S. chip technology suppliers must obtain government approval to sell products to these blacklisted companies.

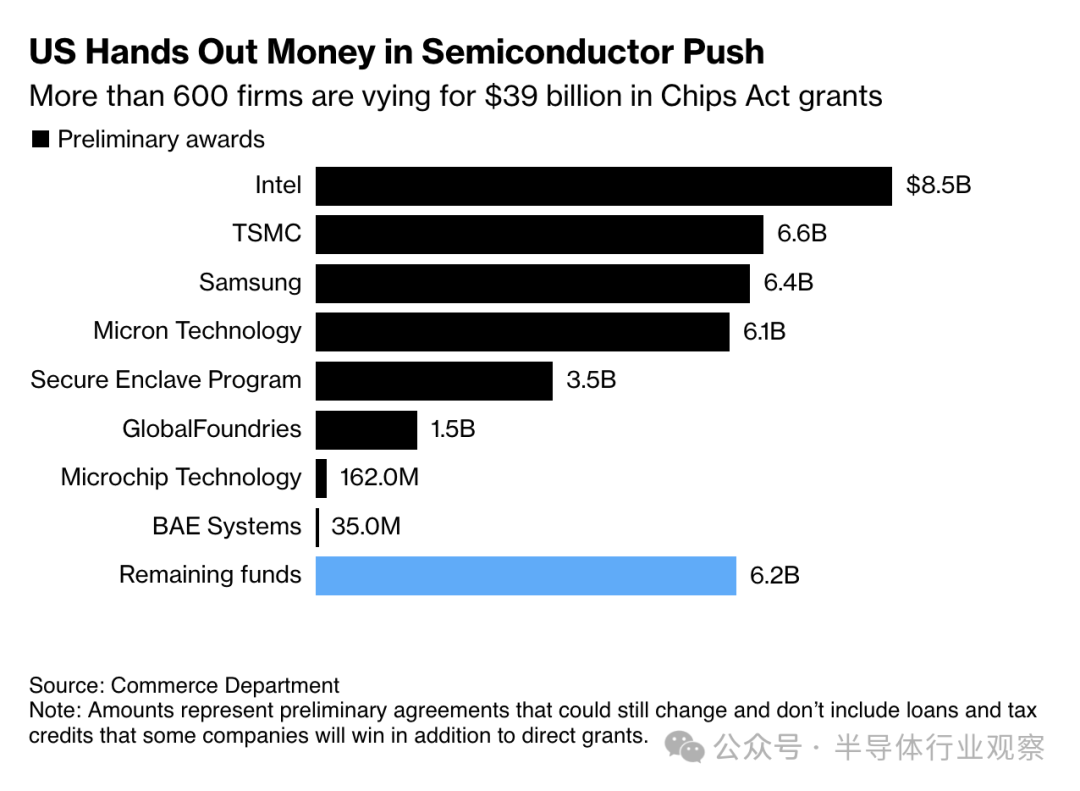

U.S. lawmakers have decided that they need to do more than just curb China. The 2022 CHIPS and Science Act allocated $39 billion for direct grants, along with $75 billion in loans and loan guarantees to revitalize U.S. chip manufacturing.

China is not idle and is working to improve its own capabilities through various efforts.

The EU has developed its own $46.3 billion plan to expand local manufacturing capacity. The European Commission estimates that the total public and private investment in the industry will exceed $108 billion. The goal is to double the group’s output by 2030 to capture 20% of the global market.

India approved an investment supported by a $10 billion government fund in February, which includes Tata Group’s bid to build the country’s first large-scale chip manufacturing plant.

In Saudi Arabia, the Public Investment Fund is considering an unspecified “large-scale investment” to launch the country’s entry into the chip sector to diversify its fossil fuel-dependent economy.

Japan’s Ministry of Economy, Trade and Industry has raised about $25.3 billion for a chip program launched in 2021. The project includes two TSMC foundries in southern Kumamoto and another foundry in northern Hokkaido, with Japanese company Rapidus Corp. aiming to mass-produce 2nm logic chips by 2027.

There are potential conflicts over Taiwan, where most of the world’s advanced logic semiconductors and many lagging chips are produced.