The MCU market has undergone significant changes in recent years due to various factors such as the pandemic, supply chain destocking, and technological advancements. With the rise of Chinese MCU manufacturers, global market competition has intensified, and technological innovation has accelerated, promising continuous growth in multiple fields in the future.

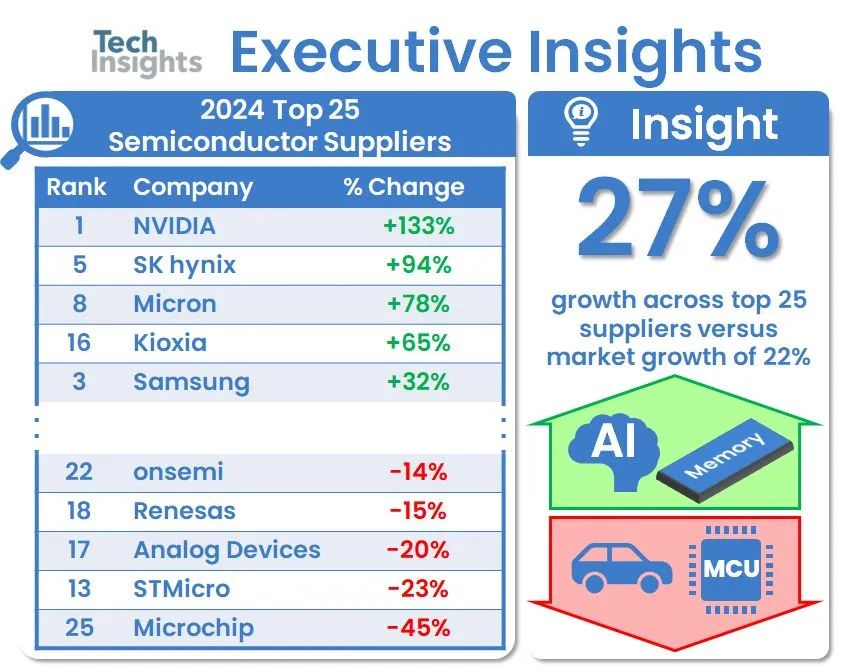

What everyone wants to know is whether the MCU market is expected to improve this year after the semiconductor downturn in 2023 and 2024. According to the 2024 TOP 25 semiconductor suppliers ranking released by Techinsights, the top five companies experiencing growth are from the AI and storage sectors, while the five companies facing declines are from the automotive and MCU sectors. Having reached such a low point, we should anticipate a rebound in 2025.

On March 28, 2025, during the IIC Shanghai 2025 International Integrated Circuit Exhibition, the MCU and Embedded Systems Application Forum attracted significant attention from both industry insiders and outsiders. Technical leaders from companies such as Feilin Micro, Fudan Microelectronics, Jingyuxing, Wuhan Xinyuan, and Chipone gathered to engage in in-depth discussions on technological breakthroughs, market changes, and future trends in the MCU industry.

MCU and Embedded Systems Application Forum on March 28, Shanghai

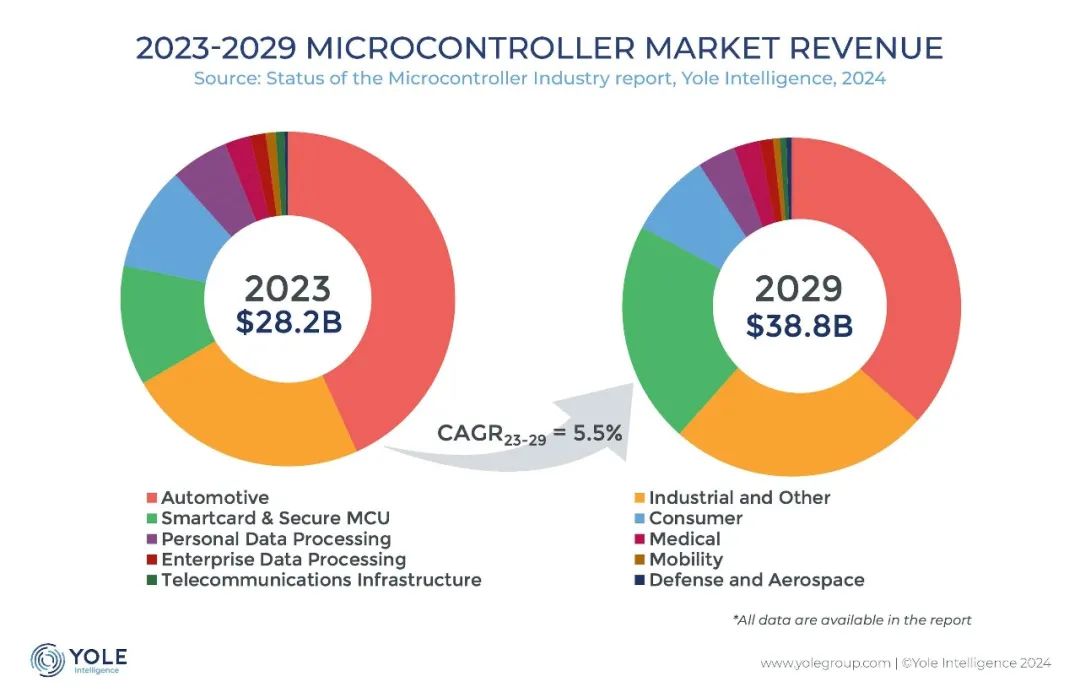

This conference comes at a critical juncture for the global MCU industry, which is undergoing structural adjustments—international giants are experiencing performance declines due to weak demand in consumer electronics, while Chinese manufacturers are achieving counter-cyclical growth in high-value-added fields such as automotive electronics and industrial control through technological innovation and market insight. According to Yole Group’s forecast, the global MCU market size is expected to reach $38.8 billion by 2028, with the automotive and industrial sectors contributing over 60% of the incremental growth. Against this backdrop, the forum not only showcased the rise of domestic MCUs but also outlined a clear trajectory for the evolution of industry technology.

Overview of the MCU Market and Development Trends

During the pandemic, supply chain disruptions, foundry capacity shortages, and inventory backlogs led to a significant increase in average selling prices (ASP), rising from approximately $0.60 in 2020 to $0.93 in 2023. Although the supply chain has regained a certain level of stability and immediate ordering was restored by the end of 2023, the overall ASP has not returned to pre-pandemic levels. Emerging suppliers, particularly from China, have driven a gradual decline in ASP through price wars. Luffy Liu, the chief analyst at Electronic Engineering Times, analyzed the current status, challenges, and future trends of the MCU industry based on global and Chinese market data.

Luffy Liu, Chief Analyst at Electronic Engineering Times

In the global market, Infineon, Renesas, and NXP are fiercely competing in the automotive MCU market, while Chinese automotive OEMs are inclined to strengthen supply chain control by designing and manufacturing their own MCUs. The demand for smart home, automotive electrification, and AI applications is driving growth for Chinese companies. From a regional demand perspective, the entire Asia-Pacific region remains the most robust, accounting for 40% in 2024, and is expected to reach 67% in the next five years.

Looking back at 2024, global MCU demand was primarily driven by three major trends: the Internet of Things, automotive electronics, and industrial automation. High-growth areas include automotive, industrial control, edge computing, IoT, and AI embedded applications. Some institutions predict that from 2024 to 2029, the global MCU market size will grow by $12.67 billion, with a compound annual growth rate (CAGR) of 5.5%. The year 2025 is expected to see a year-on-year growth rate of 8.4%, higher than the historical average (CAGR of 7.3% from 2019 to 2023).

What kind of products does the market prefer? Luffy Liu stated that MCUs with high integration and low power consumption characteristics are the most popular, reflecting the industry’s pursuit of efficiency and sustainability. Additionally, the rise of edge computing and IoT has led to an increased demand for powerful mixed MCUs to replace complex system-on-chip (SoC) and microprocessor units (MPU). Although there are predictions that 4/8-bit and 16-bit MCUs will be phased out, they remain popular due to advantages in price and power consumption, albeit with slower growth compared to 32-bit MCUs. Among them, 16-bit MCUs will maintain stability between low power consumption and high performance demands.

In terms of technological trends, MCU packaging has traditionally relied on wire bonding and flip-chip technology. As the integration of eNVM (Embedded Non-Volatile Memory) increases, the MCU market will accelerate its shift towards more advanced process technologies, narrowing the process gap with SoCs. Especially with the emergence of eFlash below 28nm facing expansion and cost challenges, leading manufacturers are attempting to replace it with new technologies such as PCM, RRAM, and MRAM.

Outside of China, the automotive, industrial, and consumer electronics markets are experiencing weak demand, resulting in a challenging year for international MCU giants in 2024. In stark contrast, Chinese manufacturers have shown impressive performance.

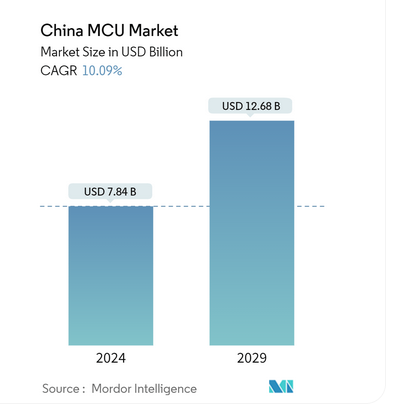

With the acceleration of domestic substitution, multiple analysis agencies predict that the scale of China’s MCU market will reach 45.5 billion yuan in 2024, growing at a compound annual growth rate of 10.09%. Additionally, domestic MCU manufacturers are actively pursuing technological transformation, focusing on AI edge chips, storage chips, analog chips, and more to enrich their product lines. In subsequent guest presentations, we also saw domestic MCU companies innovating in response to market demands, striving to capture more market share in the mid-to-high-end market.

Edge-side Visual Combination Solutions: Diverse Intelligent Terminal Perception “Core” Power

Shenzhen Feilin Microelectronics CEO Shao Ke emphasized the edge-side visual combination solution, which centers on the collaboration between edge-side visual AI SoC and CIS. Based on a multi-core heterogeneous architecture, this solution boasts five prominent advantages: first, it achieves high real-time processing, ensuring rapid information response; second, it guarantees data privacy and security, alleviating user concerns about data leakage; third, it saves bandwidth, reducing data transmission costs; fourth, it has high adaptability, applicable in various scenarios; and fifth, it offers cost advantages, enhancing product competitiveness.

Shenzhen Feilin Microelectronics CEO Shao Ke

In the automotive field, Feilin Micro has launched the M1 series automotive-grade visual processing chips. These chips integrate advanced ISP full-link algorithms, self-developed NPU, and low-power technologies to meet the needs of various application scenarios such as front/rear view, cabin monitoring, and electronic rearview mirrors.

Its cabin DMS (Driver Monitoring System)/MS (Passenger Monitoring System) solution supports 1 – 8MP CIS, enabling RGB/IR image processing; the electronic rearview mirror solution supports 2 – 8MP CIS, featuring high-performance AI ISP enhancement and RGB-IR processing capabilities, which not only improve imaging in low-light and adverse conditions but also enable pedestrian detection and road sign recognition; the rear-view pedestrian detection solution supports 1 – 2MP CIS, achieving a combination of high-performance ISP and lightweight computational perception.

Shao Ke stated, “Currently, this series of chips has been adapted to domestic CMOS sensors, providing development platforms and customized services, combining low power consumption with high performance.”

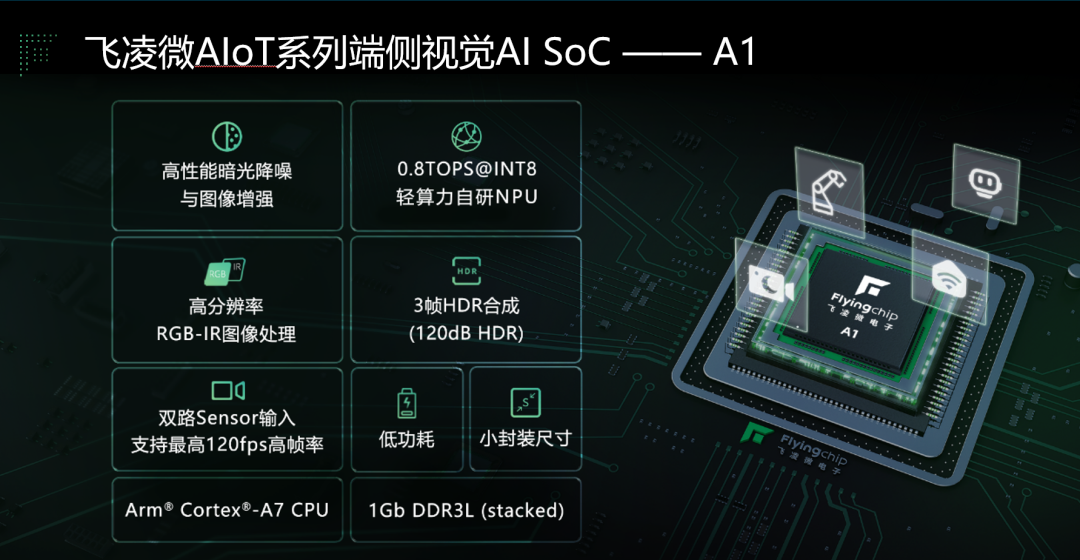

For the AIoT field, Feilin Micro has launched the A1 series edge-side visual AI SoC. This SoC supports a maximum frame rate of 120fps, has a computing power of 0.8TOPS@INT8, and uses an Arm Cortex – A7 CPU and 1Gb DDR3L (stacked), providing solutions for various scenarios such as smart hardware, smart homes, industrial scanning, and night vision modules. For example, the smart home solution supports 3 – 6MP low-power fast-start CIS, integrating dark light noise reduction and distortion correction algorithms, with high-performance AI ISP; the night vision module solution supports 4 – 8MP night vision full-color CIS, significantly enhancing imaging in low-light conditions.

Shao Ke also pointed out that edge-side visual technology will continue to develop towards enhanced computing power and efficiency, multi-modal integration, and expansion of application scenarios. Feilin Micro will continue to promote the application and development of edge-side visual technology in diverse intelligent terminals with four advantages: precise quality imaging, efficient edge-side intelligence, extreme system integration, and comprehensive customer support.

MCU Motor Control Technology Under the Background of Domestic Substitution

The national “14th Five-Year Plan” for the integrated circuit industry and market demand are jointly promoting the domestic substitution process of MCUs. It is expected that by 2024, the global motor control MCU market size will exceed $8 billion, with the domestic substitution rate increasing from less than 20% in 2021 to 35% in 2024.

Fudan Microelectronics software engineer Chang Weibin pointed out that there is strong demand in fields such as Industry 4.0, new energy vehicles, and smart homes, but high-end applications (such as automotive-grade and industrial servo) place higher requirements on MCU performance, reliability, and ecosystem. While domestic substitution is accelerating, it is also reducing peripheral circuit costs by integrating MCU, pre-driver, operational amplifier, and other devices into a single chip, enhancing competitiveness.

Fudan Microelectronics Software Engineer Chang Weibin

Fudan Microelectronics, relying on over 20 years of MCU R&D experience, has shipped over 800 million units, forming a complete product line covering automotive-grade, industrial-grade, and consumer-grade. Its automotive MCU products have passed AEC-Q100 certification, and its industrial-grade MCUs lead the domestic market in low power consumption, offering diverse options from Cortex-M0 to ARM-China STAR cores, supporting ASIL-B/D functional safety levels.

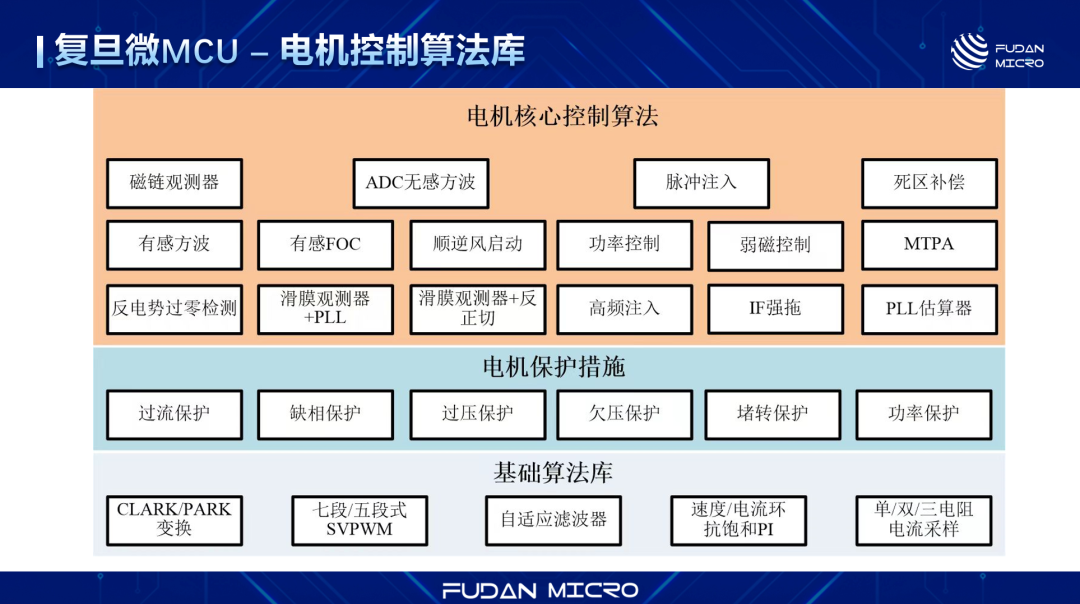

Regarding core technologies for motor control, Fudan Microelectronics has launched a self-developed algorithm library covering over 20 algorithms, including FOC/pulse control, single/dual/three-resistor sampling, forward/reverse wind startup, and high-frequency injection, along with more than 10 protection features such as overcurrent, overvoltage, and phase loss.

Chang Weibin stated that at the hardware level, Fudan Microelectronics reduces peripheral components by integrating pre-drivers, comparators, operational amplifiers, LIN PHY, and other modules, achieving a brake response time of <2μs. At the same time, by combining 2M~4M SAR ADC with hardware dividers, it integrates an injection preemption mechanism, improving algorithm execution efficiency by over 30%. Especially in algorithm hardwareization, it accelerates sensorless observer calculations through hardware dividers and square root calculators, further reducing the load on M0/M3 cores.

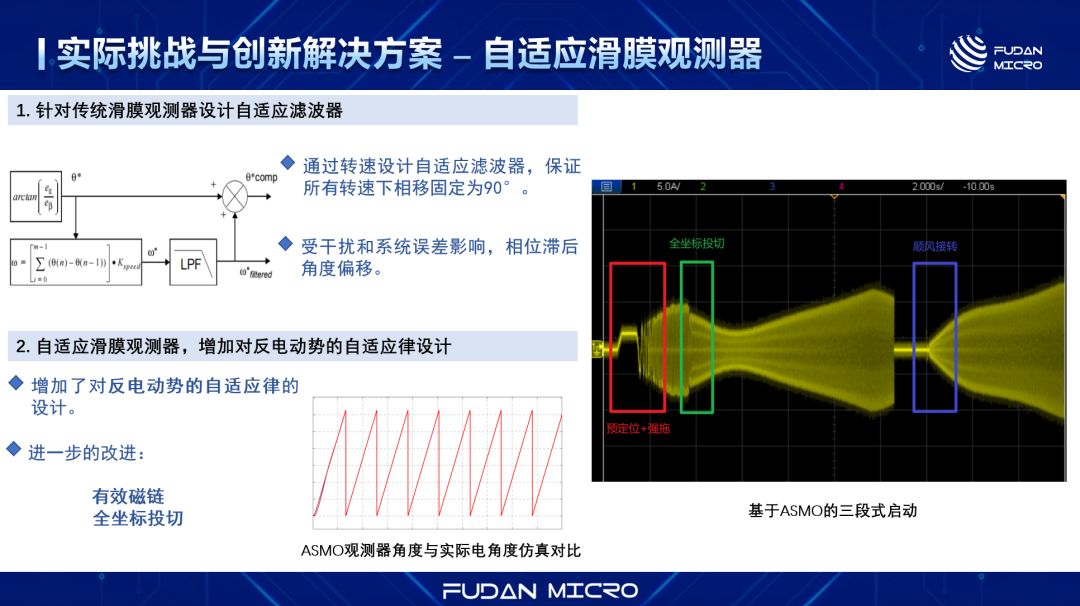

“Fudan Microelectronics has also launched a series of innovative solutions such as adaptive sliding mode observers and magnetic flux observers optimization.” Chang Weibin said that dynamic gain adjustment can suppress oscillation, reducing oscillation by 60%, supporting speed control as low as 1Hz; using nonlinear observers and static compensation voltage models (SCVM) can shorten low-speed startup time, reducing convergence error by 50%.

To accelerate the construction of a domestic ecosystem, Fudan Microelectronics provides motor control development kits, online debugging tools, and multi-scenario reference designs covering home appliances (refrigerator compressors, range hoods), automotive (air conditioning compressors, seat ventilation), and industrial (cement mixers, linear drives) fields. Its innovative adaptive sliding mode observer technology reduces oscillation by 60% compared to traditional solutions, expands the speed control range to lower speeds, and achieves an ultra-short execution time of 4.2μs, demonstrating outstanding performance in low-speed stability and dynamic response.

Chang Weibin emphasized that Fudan Microelectronics continues to promote the upgrade of motor control technology through a three-pronged strategy of “highly integrated hardware + original factory technical support + supply chain resilience.”

MCU’s “Small Heart”—Domestic Replacement Solutions for Automotive-grade High-reliability Quartz Crystals

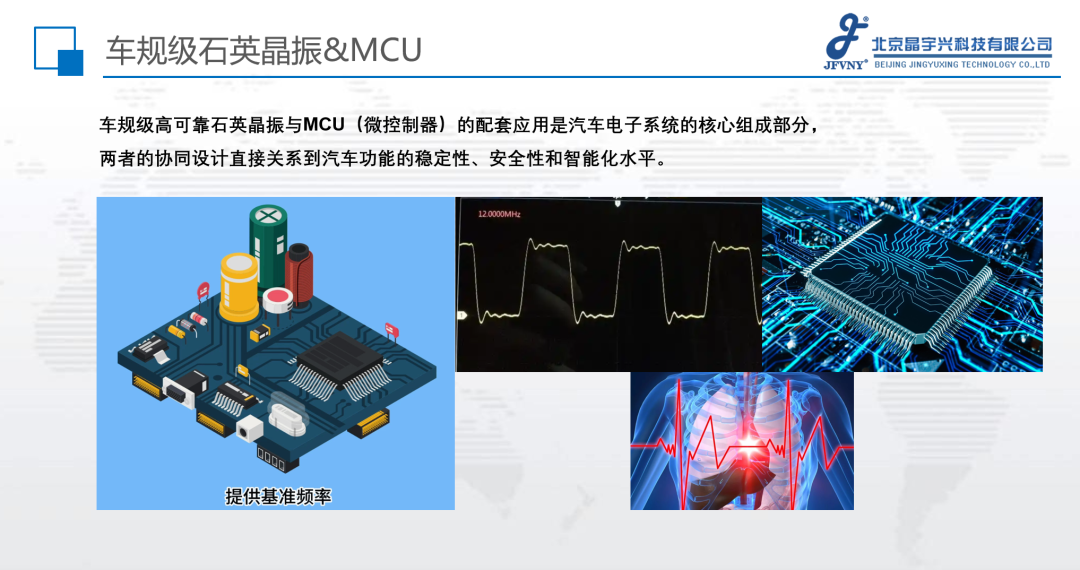

Quartz crystals are core components that generate high-precision oscillation frequencies using the piezoelectric effect of quartz crystals, divided into crystal resonators (passive) and crystal oscillators (active). Currently, the acceleration of intelligence and electrification in new energy vehicles is driving the demand for automotive-grade crystals, with the global market size expected to exceed $8 billion by 2024. The national “14th Five-Year Plan” also clearly supports the domestic production of high-frequency, high-precision frequency components, promoting the self-control of automotive-grade crystals.

Jingyuxing Technology Sales Vice President Shi Meilin

Automotive-grade crystals must pass IATF16949 and AEC-Q100 certifications, possessing high reliability (wide temperature range of -40℃ to 125℃), anti-interference, and long lifespan characteristics. Shi Meilin, Sales Vice President of Jingyuxing Technology, shared the core technological breakthroughs, product layout, and domestic substitution strategies for quartz crystals in the automotive-grade field. She pointed out that quartz crystals, as the “heart” of electronic systems, ensure the synchronization and stability of onboard control systems (such as BMS, motor drives, ADAS), and their stability directly affects MCU performance.

Jingyuxing has been deeply involved in the crystal oscillator field for 22 years, forming a complete product line covering industrial, automotive, and military applications, serving over 6,000 customers, and obtaining dual certification of IATF16949 and GJB9001C. Its automotive-grade crystals meet AEC-Q100/200 standards, featuring a wide temperature range (-40℃ to 125℃), anti-interference, and high precision (±10ppm), suitable for core scenarios such as new energy vehicle BMS, motor drives, and ADAS, supporting multi-frequency requirements such as 25MHz and 125MHz.

Shi Meilin stated that automotive-grade crystals include the following typical application scenarios:

-

Battery Management System (BMS): TCXO crystals support a wide temperature range (-40℃ to 125℃), ensuring precise control of battery charging and discharging.

-

Motor Drive System: High-frequency crystals (such as 25MHz) match SiC power devices, enhancing motor control efficiency.

-

Autonomous Driving (ADAS): Anti-interference crystals provide low-latency signals for radars and cameras, ensuring real-time performance of perception systems.

-

In-vehicle Infotainment (IVI): Multi-frequency crystals (such as 125MHz) support 5G and Wi-Fi communication, enhancing user experience.

To address the challenges of domestic substitution, Jingyuxing has established a comprehensive quality control system covering 13 core processes, including automated scheduling, vacuum packaging, and phase noise testing, and holds 9 patented technologies for shock resistance and vibration stability. Its high-reliability products include temperature-compensated crystals (TCXO), differential crystals (RMS jitter < 0.3pS), and oven-controlled crystals (OCXO), with OCXO phase noise as low as -160dBc/1KHz, already applied in high-end fields such as radar and synchronized clocks.

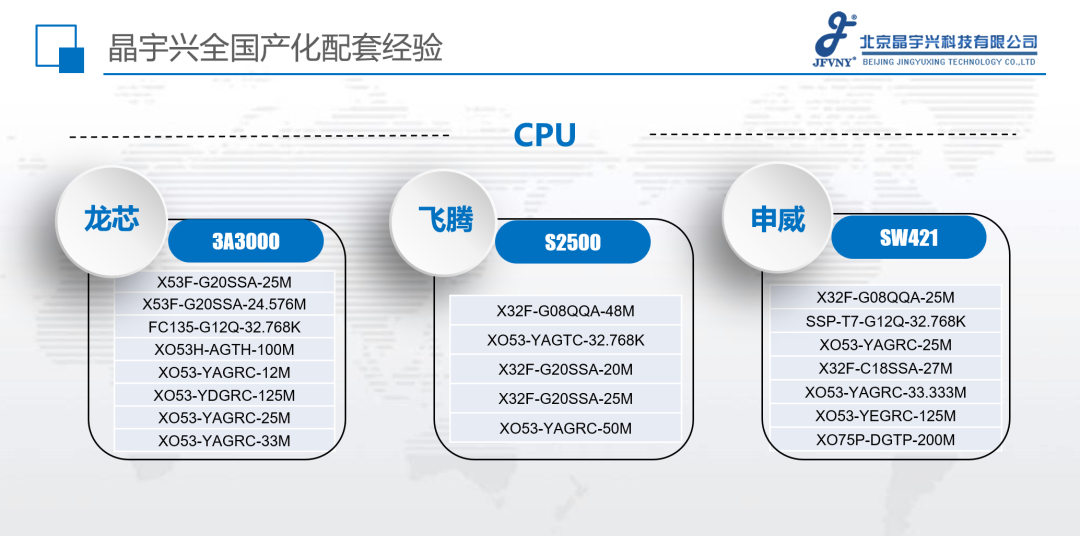

In terms of ecosystem construction, Jingyuxing has achieved deep adaptation with domestic CPUs such as Loongson and Feiteng, providing a full range of clock solutions including 25MHz and 32.768KHz, and assisting customers in shortening development cycles through localized technical support and onboard matching tests.

Shi Meilin emphasized that Jingyuxing, as the only crystal company in China to pass both IATF16949 and GJB9001C dual certifications, will continue to uphold the mission of “high-reliability crystals guarding Chinese chips,” promoting the domestic substitution process of automotive-grade crystals, and assisting domestic MCUs in achieving higher performance and safety standards in new energy vehicles and industrial automation.

Chipone Integrates RISC-V Automotive Chip Innovations and Breakthroughs

In 2024, manufacturers like Renesas began launching RISC-V MCUs in the mass market, accelerating their market penetration, but in the short term, they have not shaken the dominant position of the Arm ecosystem. This year, we have seen major companies like Infineon also increasing their investment in RISC-V MCUs and planning to launch dedicated RISC-V MCU products in the automotive market. With policy support, Chinese companies may increase their investment in the open-source RISC-V architecture to reduce dependence on the Arm architecture.

Chipone Integrated Circuit (Suzhou) Senior Technical Marketing Director Wang Chao

Wang Chao, Senior Technical Marketing Director of Chipone Integrated Circuit (Suzhou) Co., Ltd., systematically elaborated on the company’s technological layout and product innovations in the RISC-V architecture automotive MCU field. He pointed out that as global automotive electronics evolve towards intelligence and connectivity, the RISC-V architecture, with its advantages of self-control, flexible customization, and high cost-performance ratio, has become a key direction for domestic automotive chips to break through.

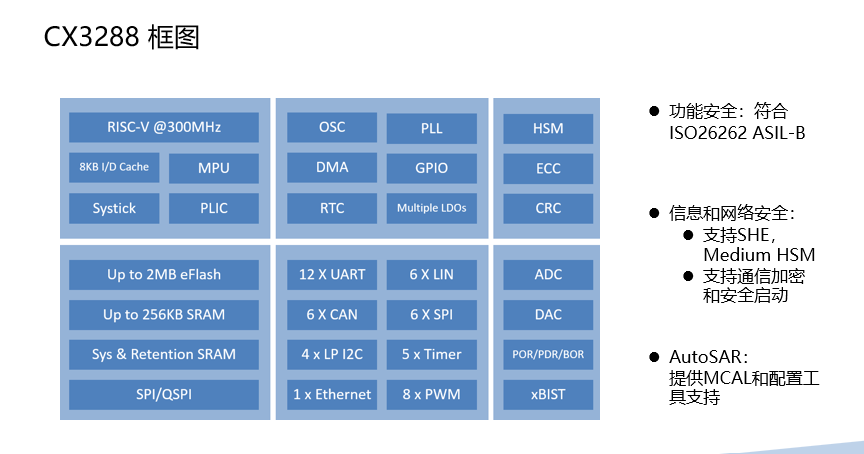

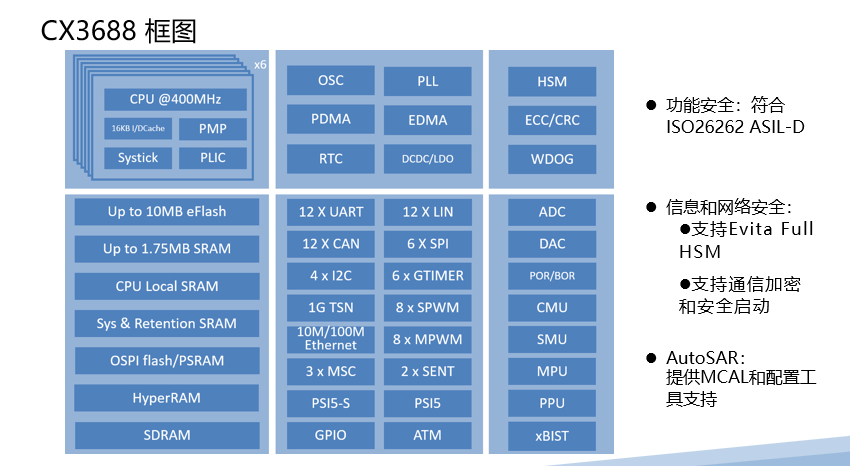

Chipone Integrated Circuit has launched two series of automotive-grade MCUs, CX3288 and CX3688, covering body control and high-safety power domain applications.

The CX3288 series focuses on high cost-performance body control, based on a single-core RISC-V core, with a frequency of 240-400MHz, integrating 4MB Flash, 256KB SRAM, and rich interfaces (6x CAN/LIN, 12x UART, 100M Ethernet), supporting ASIL-B functional safety certification and HSM encryption, suitable for body control, digital dashboards, T-Box, and other scenarios.

The CX3688 series targets high-safety power domain cores, adopting a multi-core lock-step RISC-V core architecture, with a frequency exceeding 400MHz, integrating DSP instructions, FPU, motor control units, TSN networks, SMU safety monitoring modules, and motor control units, passing ASIL-D certification and AEC-Q100 Grade 1 testing, meeting the functional safety and high computing power requirements of autonomous driving domain controllers, BMS, and braking/steering systems.

According to Chipone Integrated Circuit’s official website, its products have achieved key technological breakthroughs: the CX3288 enhances system reliability to a zero-defect target through hardware ECC verification and BIST self-testing technology; the CX3688 supports μs-level response and fault tolerance through redundant design and real-time communication optimization.

In addition, Chipone Integrated Circuit also provides MCAL compliant with AUTOSAR standards and a complete development toolchain to accelerate customer product implementation. Wang Chao emphasized that Chipone Integrated Circuit is collaborating with leading domestic automotive companies and Tier 1 suppliers to promote the large-scale application of RISC-V automotive chips in new energy vehicles and intelligent driving, assisting in the self-control of the domestic automotive electronic supply chain.

Conclusion: Will the MCU Industry Improve This Year?

This forum has pointed out a clear path for the future development of the MCU industry: technological innovation will focus on AI integration, automotive-grade reliability, and low-power architectures, while domestic manufacturers’ breakthroughs will rely on ecosystem construction and high-end market penetration. As Fudan Microelectronics’ Chang Weibin stated, “Domestic substitution is not a simple replacement, but a reshaping of the industrial landscape through technological upgrades.” With AI algorithms penetrating to the edge and the maturation of the RISC-V architecture ecosystem, MCUs are evolving from mere control units to intelligent decision-making centers. The emphasis on “clock precision determines system limits” by Jingyuxing’s Shi Meilin and the call for “safety and low power consumption to set industry benchmarks” by Wuhan Xinyuan’s Zhang Yafan reveal the core direction of technological breakthroughs.

Standing at the starting point of 2025, the MCU industry is at a critical period of transitioning from old to new momentum. The strategic contraction of international giants has created market space for domestic manufacturers, but technological barriers and supply chain challenges remain severe. As Luffy Liu pointed out in trend analysis, 2025 will be a year of “technological differentiation and market reshuffling,” with companies possessing automotive-grade certification, AI integration capabilities, and ecosystem stickiness standing out. With the penetration rate of new energy vehicles expected to exceed 40% (predicted data for 2025) and the deepening of Industry 4.0, the MCU industry is expected to welcome a market blue ocean of $38.8 billion by 2028. This technological revolution is not only about the iteration of chip performance but also a comprehensive competition regarding ecosystem construction and industrial discourse power, with the rise of Chinese strength injecting new vitality into the global MCU landscape, benefiting from new energy vehicles, the Internet of Things, and policy support, and is expected to maintain rapid growth in the next five years. (Editor: Luffy)