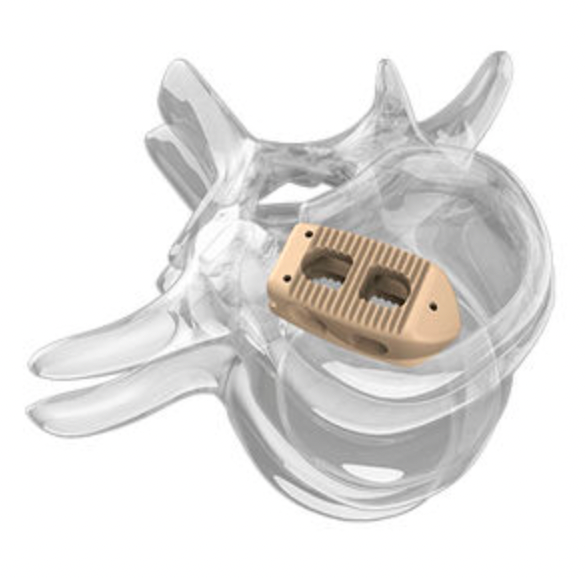

In the many subfields of medical devices, orthopedic implants have long been known for their “high technology, high barriers, and high profits”. However, with the iteration of orthopedic surgical techniques and the accelerated evolution of clinical precision demands, this once highly standardized and steadily developing field is undergoing structural reorganization. Its technological core is shifting from traditional metal processing and mechanical structure optimization to a “materials + equipment + software” integrated intelligent system paradigm.From 3D printed titanium alloys and biodegradable bone substitute materials to intraoperative robotic navigation and personalized design, key links in the orthopedic industry chain are being redefined. Especially in high-value consumable-intensive areas such as spine, joints, and trauma, the integration of these new technologies not only changes the form of instrument products but also profoundly impacts surgical processes and hospital procurement logic, even driving updates in payment mechanisms and regulatory systems.In the international market, industry giants represented by Stryker and Zimmer Biomet are accelerating their transformation from “instrument companies” to “digital surgical solution providers” through mergers of navigation systems, layout of intraoperative imaging, and construction of personalized printing platforms. In the Chinese market, the combination of policies, domestic substitution, and medical digitization is driving a technological leap from “capable of being made” to “capable of being made precisely”.01The New Triangle of Orthopedic TechnologyIn the orthopedic device industry, technological innovation has always revolved around three main goals: “more stable, less invasive, and better matching”. Over the past two decades, major technological advancements have focused on optimizing material strength, improving bonding structures, and standardizing surgical techniques, forming a mature industrial logic centered on metal implants.However, with the deepening of precision medicine concepts and the comprehensive penetration of digital technology, orthopedic technology is shifting from “instrument design” to “overall reconstruction of surgical scenarios”. In this context, 3D printed metal materials, biodegradable implants, and robotic navigation systems constitute the current technological innovation triangle, each acting on the “implant end”, “biological interaction end”, and “intraoperative delivery end”, collectively driving a structural leap in orthopedic treatment paradigms.3D Printed Titanium Alloys: Breaking Through “Shape” Limitations to Define “Functional Structures”3D printing (additive manufacturing) has injected a possibility of personalization into orthopedic devices, especially in the field of metal implants such as titanium alloys. Through technologies like Selective Laser Melting (SLM) or Electron Beam Melting (EBM), manufacturers can construct porous structures and complex geometries that are difficult to achieve with traditional processing techniques. This not only helps reduce the stiffness of implants and minimize stress shielding effects but also significantly enhances bone integration performance and biocompatibility.Currently, its application in the market is no longer limited to “concept validation” but is gradually entering the stage of standardized mass production. For example, Stryker’s Tritanium series interbody fusion devices utilize a 3D printed porous titanium mesh structure, whose porosity, biomechanical properties, and bone ingrowth characteristics have been systematically validated, becoming one of its technological moats in the spinal surgery market. In the Chinese market, Wego, Sanyou, and Chuangli are also accelerating the deployment of 3D printing platforms and collaborating with hospitals to promote personalized design paths. Stryker’s Tritanium series interbody fusion devicesHowever, the value of 3D printing goes far beyond the manufacturing dimension; it essentially opens up an era of “deconstructing standard parts”. Future implants will no longer be industrial products of “one-size-fits-all” but rather “on-demand manufactured” therapeutic tools, with their functional definitions driven by doctors, patient lesion characteristics, and algorithms. Furthermore, it also requires companies to possess digital modeling capabilities, material control mechanisms, and clinical data closed loops, posing a challenge for traditional orthopedic companies to undergo systematic capability reconstruction.Biodegradable Materials: Redefining the Clinical Value of “Retention Time”For a long time, orthopedic implants have been set as “permanently retained”, with their core value lying in stability and mechanical strength. However, with advances in tissue regeneration and materials science, biodegradable and absorbable alternative materials have begun to achieve breakthrough progress in specific surgical techniques, particularly in pediatric orthopedics, sports medicine, arthroscopic surgery, and soft tissue fixation scenarios.Currently, mainstream biodegradable materials include polylactic acid (PLA), polycaprolactone (PCL), polyglycolic acid (PGA) and their copolymers, as well as emerging magnesium alloy-based biomaterials. Among them, magnesium-based materials have become a global research hotspot due to their elastic modulus close to cortical bone, excellent biodegradability, and potential antibacterial properties.Bioretec in the United States focuses on bioabsorbable orthopedic implants, with its first magnesium screw Remeos having received FDA breakthrough device and CE certification; while domestic companies such as Innocare and Ketech are also promoting the commercialization of biodegradable magnesium alloy bone screws.

Stryker’s Tritanium series interbody fusion devicesHowever, the value of 3D printing goes far beyond the manufacturing dimension; it essentially opens up an era of “deconstructing standard parts”. Future implants will no longer be industrial products of “one-size-fits-all” but rather “on-demand manufactured” therapeutic tools, with their functional definitions driven by doctors, patient lesion characteristics, and algorithms. Furthermore, it also requires companies to possess digital modeling capabilities, material control mechanisms, and clinical data closed loops, posing a challenge for traditional orthopedic companies to undergo systematic capability reconstruction.Biodegradable Materials: Redefining the Clinical Value of “Retention Time”For a long time, orthopedic implants have been set as “permanently retained”, with their core value lying in stability and mechanical strength. However, with advances in tissue regeneration and materials science, biodegradable and absorbable alternative materials have begun to achieve breakthrough progress in specific surgical techniques, particularly in pediatric orthopedics, sports medicine, arthroscopic surgery, and soft tissue fixation scenarios.Currently, mainstream biodegradable materials include polylactic acid (PLA), polycaprolactone (PCL), polyglycolic acid (PGA) and their copolymers, as well as emerging magnesium alloy-based biomaterials. Among them, magnesium-based materials have become a global research hotspot due to their elastic modulus close to cortical bone, excellent biodegradability, and potential antibacterial properties.Bioretec in the United States focuses on bioabsorbable orthopedic implants, with its first magnesium screw Remeos having received FDA breakthrough device and CE certification; while domestic companies such as Innocare and Ketech are also promoting the commercialization of biodegradable magnesium alloy bone screws. Bioretec’s magnesium screw RemeosThe introduction of biodegradable materials is not only a material substitution but also an innovation in surgical design logic. When “removal surgery” can be avoided, postoperative infections, secondary trauma, and medical insurance costs will decrease simultaneously. In the future, these products may form integrated solutions with tissue engineering scaffolds, drug release systems, and smart implant chips, further expanding the biological functional space.Robotic Navigation: Making “Intraoperative Precision” a System CapabilityIf 3D printing has changed the “production method of implants”, and biodegradable materials have restructured the “biological fate of implants”, then robotic navigation systems have changed the “placement accuracy of implants and surgical paths”.Orthopedics is a discipline that is extremely dependent on intraoperative operational precision, especially in complex anatomical areas such as the spine, pelvis, and hip-knee joints, where millimeter-level deviations can lead to postoperative complications. In the past, it mainly relied on the surgeon’s experience and intraoperative C-arm guidance, but now, technologies represented by robotic navigation + intraoperative imaging systems are modularizing and systematizing this capability. For example, Stryker’s Mako robot platform introduces CT three-dimensional modeling and mechanical path planning in hip and knee joint replacements, achieving preoperative customization + intraoperative dynamic guidance, significantly improving postoperative alignment accuracy and patient recovery speed after its launch.

Bioretec’s magnesium screw RemeosThe introduction of biodegradable materials is not only a material substitution but also an innovation in surgical design logic. When “removal surgery” can be avoided, postoperative infections, secondary trauma, and medical insurance costs will decrease simultaneously. In the future, these products may form integrated solutions with tissue engineering scaffolds, drug release systems, and smart implant chips, further expanding the biological functional space.Robotic Navigation: Making “Intraoperative Precision” a System CapabilityIf 3D printing has changed the “production method of implants”, and biodegradable materials have restructured the “biological fate of implants”, then robotic navigation systems have changed the “placement accuracy of implants and surgical paths”.Orthopedics is a discipline that is extremely dependent on intraoperative operational precision, especially in complex anatomical areas such as the spine, pelvis, and hip-knee joints, where millimeter-level deviations can lead to postoperative complications. In the past, it mainly relied on the surgeon’s experience and intraoperative C-arm guidance, but now, technologies represented by robotic navigation + intraoperative imaging systems are modularizing and systematizing this capability. For example, Stryker’s Mako robot platform introduces CT three-dimensional modeling and mechanical path planning in hip and knee joint replacements, achieving preoperative customization + intraoperative dynamic guidance, significantly improving postoperative alignment accuracy and patient recovery speed after its launch. Stryker’s Mako robot platformDomestically, teams focusing on orthopedic navigation and robotic solutions, such as Tianzhihang, Tuodao Medical, and Liuyedao, are emerging, catching up with international giants in core sensors and algorithm loops, and possessing rapid replication and landing advantages in adapting to domestic implant systems and meeting localized scenarios.The value of robotic navigation systems goes beyond “improving surgical efficiency”; it lies in transforming experiential medicine into a data-driven replicable process, while also expanding the business boundaries of traditional “instrument manufacturers” to “intraoperative information providers” and “clinical closed-loop operation platforms”.02

Stryker’s Mako robot platformDomestically, teams focusing on orthopedic navigation and robotic solutions, such as Tianzhihang, Tuodao Medical, and Liuyedao, are emerging, catching up with international giants in core sensors and algorithm loops, and possessing rapid replication and landing advantages in adapting to domestic implant systems and meeting localized scenarios.The value of robotic navigation systems goes beyond “improving surgical efficiency”; it lies in transforming experiential medicine into a data-driven replicable process, while also expanding the business boundaries of traditional “instrument manufacturers” to “intraoperative information providers” and “clinical closed-loop operation platforms”.02

Transforming from Instrument Manufacturers to Surgical Platforms

The orthopedic device industry currently forms an oligopolistic competitive pattern dominated by a few multinational companies. Stryker, Zimmer Biomet, DePuy Synthes (a subsidiary of Johnson & Johnson), and Smith & Nephew have long held core implant systems and channel systems. However, in the face of generational changes in surgical techniques and shifts in hospital procurement logic, these traditional giants are reconstructing from “instrument product companies” to “full-process surgical platform providers”, with the main axis being: system upgrades driven by technology integration + capability extension + mergers and acquisitions.This trend is not merely a simple product expansion or market defense but an active layout for the core links of the future surgical value chain. In the context of surgical digitization, scenario dataization, and doctors relying on software-assisted decision-making, companies must build a closed loop of materials, equipment, and software to maintain intraoperative control and long-term customer stickiness.Stryker: Building a Closed-Loop Ecosystem of “Preoperative-Intraoperative-Postoperative”Stryker is one of the most representative companies in the transformation of orthopedic technology platforms, with its core strategy divided into three levels:

- Core Support Point of Intraoperative Platformization

Since acquiring Mako Surgical in 2013, Stryker has developed this system into the digital control hub for joint replacement surgeries. Mako is not just a navigation device but an integrated platform connecting preoperative CT modeling, intraoperative path planning, real-time robotic arm guidance, and postoperative data feedback. Its greatest value lies in: The Mako system is not sold as a standalone product but is bound to Stryker’s own hip and knee implants, forming a commercial closed loop of “hardware + consumables + data services”.This model of “platform anchoring + product synergy” allows Stryker to escape pure price competition in the market and shift to providing comprehensive solutions. Data shows that the complication rates and functional recovery indicators of joint replacement surgeries guided by Mako are superior to traditional paths, helping maintain technical stickiness at the hospital end.

- Extending to Soft and Hard Integration

After acquiring Mobius Imaging and Cardan Robotics in 2019, Stryker integrated intraoperative imaging capabilities (such as mobile CT) with the Mako platform, further enhancing the data support for intraoperative decision-making. This integration of intraoperative visualization and robotic navigation provides replicable expansion paths for complex scenarios such as spine and trauma.

- Extending to Rehabilitation and Postoperative

In 2021, Stryker acquired OrthoSensor, introducing smart sensors and data analysis technology into postoperative rehabilitation scenarios, attempting to create a feedback mechanism for postoperative rehabilitation. This layout means it is no longer limited to the implant end but seeks to continuously extend the value chain in the “postoperative-follow-up” stage, thus building a closed-loop data operation system.Therefore, Stryker’s platform transformation is not limited to improving intraoperative efficiency but is about constructing a surgical service ecosystem centered on robots and data, with a focus on continuously maintaining control over the surgical process.Zimmer Biomet: Transitioning from Consumable Dominance to Digital-DrivenZimmer Biomet, as one of the largest orthopedic implant manufacturers globally, has historically focused on product breadth and multi-surgical coverage, but in recent years has also been strengthening its transition to digital platform systems.

- Simultaneous Advancement of Tools and Platforms

Since 2020, Zimmer Biomet has launched the ZBEdge digital orthopedic technology solution, which includes preoperative analysis tools, intraoperative integrated systems (Rosa robot), and postoperative remote monitoring platforms (mymobility App). Among them, the Rosa robot, although starting later, has been widely used in neurosurgery and spinal surgery, forming competitive barriers through deep integration with its consumable system. In addition, the group has promoted the digital monitoring of postoperative rehabilitation through the mymobility platform launched in collaboration with Apple. This approach of extending to “digital follow-up” and “data closed loop” has become a key focus of its transformation.

In addition, the group has promoted the digital monitoring of postoperative rehabilitation through the mymobility platform launched in collaboration with Apple. This approach of extending to “digital follow-up” and “data closed loop” has become a key focus of its transformation.

- Prudent but Focused Acquisition Rhythm

Compared to Stryker’s aggressive acquisition strategy, Zimmer Biomet prefers internal integration and long-term product synergy, but is also making small-scale strategic investments in intraoperative imaging, artificial intelligence, and other directions, aiming for a “gentle transformation” without disrupting the stability of its core product system.Observing the paths of global leading companies reveals that platformization is not merely about “packaging and selling” robots, imaging, and consumables, but about the meticulous control of the entire surgical process, allowing the company’s role to shift from “tool supplier” to “surgical system service provider”. In this model:

- Material properties are no longer isolated, but deeply coupled with surgical paths and intraoperative imaging;

- Software capabilities are no longer ancillary, but become key variables affecting instrument design and payment cycles;

- The value of data is not reflected in “pre-sale demonstrations”, but in “postoperative continuity” and “medical insurance path optimization”;

Therefore, the ultimate goal of platformization is: control over clinical pathways. This is also why robotics, imaging, modeling, and digital rehabilitation have become hotspots for acquisition and research and development — they are not new products but new control nodes.03Industry Chain Collaboration Behind the Upgrade of Orthopedic Surgical TechniquesAs 3D printing, biodegradable materials, and robotic navigation technologies gradually land in orthopedic surgeries, orthopedic device companies are facing not just simple absorption of single-point innovations but the adaptation, integration, and redefinition of an entire surgical implementation system. Technological advancements have changed product forms and restructured product development logic, manufacturing processes, quality control, physician education, and data closed-loop methods. The result is: the original linear industrial chain centered on “materials + manufacturing” is being dismantled and reorganized into a dynamic collaborative system anchored by “surgical process”.The core challenge of this change lies in: how heterogeneous capabilities can collaborate to build new system performance. This not only poses composite capability requirements for companies but also profoundly affects investment judgments and the reconstruction of industry barriers.Material Side: “Structure-Function-Degradation” Triple Coupling DesignThe material development of traditional metal implants mainly focuses on mechanical strength, stiffness matching, and processing performance, with a relatively closed R&D path relying on standardized design. However, with the introduction of 3D printing and biodegradable materials, material R&D has become a multi-objective optimization process, especially involving: controllability of microstructures, performance changes over time, and batch controllability under customization.Therefore, material companies can no longer act merely as “upstream suppliers” but must deeply engage in product design logic and even participate in clinical scenario modeling. This participation reshapes the definition of “good materials”: no longer the strongest or lowest cost, but rather high surgical coupling, wide clinical tolerance, and strong system compatibility.Equipment Side: Promoting “Instrument-Path” IntegrationIntraoperative navigation and robotic technologies are rising from “surgical auxiliary tools” to “surgical standard setters”. The value of such devices lies not only in improving operational precision but also in providing a structured, quantifiable, and traceable intraoperative path control system, which directly impacts instrument design, clinical validation, and postoperative tracking. Their collaborative requirements manifest as: instrument design needs to embed “navigation presets”, software updates affect hardware iteration cycles, and imaging systems become “verification hubs”.Therefore, equipment companies must shift from “selling devices” to “building process platforms”, while also possessing cross-domain capabilities in sensor integration, real-time control, image processing, and intraoperative workflow modeling.Software Side: Decision Support and Process ControlIn the traditional orthopedic instrument system, software exists merely as an auxiliary role, such as preoperative modeling and postoperative assessment. However, under the trend of technological integration, software has begun to assume key control nodes and process management functions, with its role showing two directions: one is the “surgical decision hub” using algorithms to replace some of the surgeon’s experience, and the other is the “closed-loop operation tool” linking preoperative, intraoperative, and postoperative software as connectors.The development of such software is not a generic SaaS model but requires deep understanding of clinical pathways, surgical differences, and instrument collaboration logic, with the development threshold stemming from “multidisciplinary integration capabilities” rather than IT technology itself. This also means that the commercial boundaries of companies have shifted from “selling implants” to “managing patient pathways”, opening up possibilities for subsequent digital services and insurance support.04ConclusionThe orthopedic implant industry is undergoing a deep reconstruction driven by technology towards system evolution. Innovations such as 3D printing, biodegradable materials, and robotic navigation are not isolated breakthroughs but systematic challenges to traditional surgical techniques, instrument design, and clinical collaboration logic. It requires companies to shift from a “product perspective” to the overall construction of a “surgical platform”, building a closed-loop system of “materials + equipment + software” collaboration at every stage of preoperative, intraoperative, and postoperative.For the Chinese market, this transformation is not merely a follow-up to global paths but a self-initiated window period formed under the interplay of multiple variables in systems, payments, and clinical structures. Companies no longer need to ask themselves “Do we master an advanced technology?” but must answer: “Can this technology truly change the surgeon’s operational path and the patient’s recovery experience?”Ultimately, what determines the industry landscape is not the competition of technological advancement but who can first integrate technology into clinical decision-making, surgical processes, and ecological collaboration. Surgical platformization is moving from trend to reality, from narrative to implementation.