Introduction:

“Industrial Internet” has been difficult to define since its promotion in China. Many people are still unclear about what the Industrial Internet actually is; it seems to be an all-encompassing concept. Originally, the term “Industrial Internet” originated in the United States, but now the American Industrial Internet Consortium has also renamed itself to “Industrial IoT“, making the concept even more ambiguous.

Earlier terms like “Smart Manufacturing” or “Industry 4.0” and the recently emerging “Industrial Internet” have become mainstream in many circles. In specific contexts and projects, some people wish to distinguish their concepts from the Industrial Internet and particularly emphasize their uniqueness, seemingly wanting to disassociate themselves from the Industrial Internet.

Note: This is somewhat akin to how people from Chongqing always want to clarify that they are not from Sichuan; on one hand, there is a need for clarification, but on the other hand, they seem to be Sichuanese.

Lastly, another important concept is “Digital Transformation“. In general contexts, digital transformation conflicts with concepts like digitization and intelligence.

Therefore, when we put the terms Industrial Internet, IoT, Industry 4.0, Industrial Internet, Digital Transformation together, it seems everyone knows them, but they cannot be fully clarified. Some people even intentionally blur these concepts to “fish in troubled waters”.

Reflection:

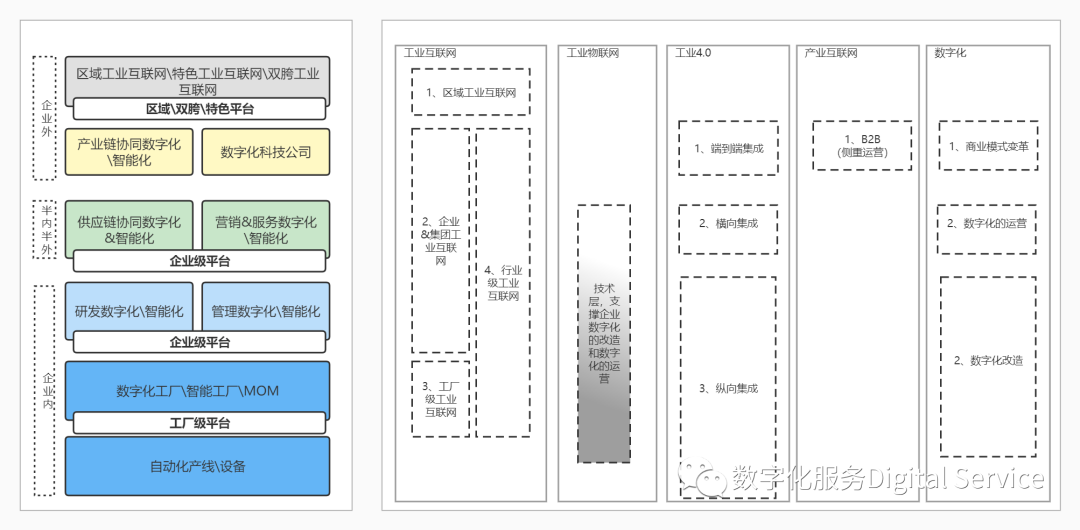

To be frank, my own research on these concepts is not very deep. Based on my personal understanding and contextual summaries from communication with clients, I categorize these concepts as follows:

As shown in the figure: on the far left are some major application scenarios, and on the right are their mapping relationships. Among them:

Scenario 1: Digital & Intelligent Factory Scenario: This includes three subcategories: R&D, manufacturing (including production lines), and management. A typical example is the transformation of digital production lines and MOM. Scenario 1 can be mapped to factory-level Industrial Internet platforms (which can essentially be equated to an Industrial IoT platform) or industry-level Industrial Internet platforms’ factory application parts. The mapping to Industrial IoT mainly involves industrial gateways, data access (such as MQTT/OPCUA; currently, there is a heated debate abroad about which of the two protocols is the future of Industrial IoT), and visualization designers (similar to traditional configuration HMI capabilities). The mapping to Industry 4.0 is also a primary part of vertical integration. There is basically no mapping relationship with the Industrial Internet. The mapping to digitization relates to the transformation and integration of traditional technologies based on new technologies (such as IoT, AI, cloud & edge computing, etc.).

Scenario 2: Digital R&D and Management in Enterprises, which includes more popular R&D cloud, PDM, and other hardware and software system constructions, as well as integration and construction of ERP/OA systems, etc. The mapping with the Industrial Internet is mainly enterprise-level Industrial Internet platforms (which generally have little value and are not often considered) or industry Industrial Internet platforms targeting R&D and management APP applications. The mapping to Industrial IoT is relatively weak, basically nonexistent. Mapping to Industry 4.0 still belongs to the realm of vertical integration. Similarly, the Industrial Internet and digital transformation.

Scenario 3: Collaboration focused on upstream and downstream enterprises led by chain-leading enterprises, and most importantly, user-centered operations. Here, due to the need for external services (which means that while Scenario 4 is the most operation-heavy, Scenario 3 also requires certain operational capabilities), there is a strong demand for enterprise-level Industrial Internet platforms. The mapping to Industrial IoT is mainly focused on product service innovations led by smart products and some logistics-related supply chain collaboration. The mapping to Industry 4.0 is horizontal integration. There is still no mapping relationship with the Industrial Internet. The mapping to digital transformation is an enhancement of digital operational capabilities.

Scenario 4: Scenario 4 is divided into two parts: one part is independent of a certain chain-leading enterprise, providing digital empowerment or B2B transaction facilitation to the upstream and downstream of the industry chain. The other part is many companies currently thinking they can become independent digital technology companies. I won’t discuss the mapping relationships separately.

Scenario 5: Finally, the area of industrial internet platforms that most current industrial internet vendors are engaged in.

In summary, it appears that the logic of digital transformation and Industry 4.0 is relatively closely related, covering a broad range on the enterprise side without being overly conceptual. The Industrial Internet, because it often discusses technical aspects (such as data + models, etc.), has less description of scenarios or is too dispersed without convergence (such as remote operations and numerous scenarios), which does indeed make it difficult for everyone to understand the Industrial Internet. Therefore, whether related parts can be further organized in scenarios in the future or whether existing scenarios can be aligned with the three major tasks of Industry 4.0, allowing industry professionals to have more references.

Extension:

I initially thought that after drawing this diagram today, I would be done, but I suddenly realized that if this logic is basically correct, then there is a more important question to explore: how should businesses in the Industrial Internet space position themselves and how should they collaborate?

First, let’s look at who the typical players are:

1. Automation companies, such as domestic process industry companies like Holley and Zhejiang University Control, as well as discrete industry players like Inovance, all have layouts; these companies excel in automation. Clearly, Scenario 1 is their core battlefield, and their current scale is insufficient to delve too much into Scenario 2’s business (some European and American automation companies have that capability). These companies should focus on building factory-level Industrial Internet platforms and matching related digital consulting and delivery capabilities. Another point is that the domestic process and discrete industries have slightly different business models (the process industry is more familiar with end customers and is basically project-based sales, while the discrete industry has a large amount of product-based sales (targeting OEMs) and is relatively distant from the end user—due to OEM and SI reasons). This has caused Inovance’s challenge in achieving transformation and upgrading to be much greater than that of the process industry. This actually requires some complex organizational design, business design, and product design. Due to the former employer and Inovance, although they are not of the same scale, they share a logic, so I won’t elaborate further.

2. Traditional IT companies, primarily UFIDA, Kingdee, etc. These companies see Scenario 2 as a defensive position and should pay more attention to Scenario 3. I recently saw a slogan that says “Building and Operating a Globally Leading Business Innovation Platform” perhaps this is also somewhat related.

Regardless, companies in categories 1 and 2 are actually extending their existing businesses and technological foundations to higher levels to achieve their own digital transformation, and the relative paths are very clear.

3. Technology companies in manufacturing, such as RootCloud, XCMG, Meiyun Zhishu, and Guangyu Mingdao, etc. These companies often hope to leverage their best internal practices and empower external enterprises. Such enterprises face considerable risks. On one hand, they need to undergo a thorough transformation internally, and on the other hand, they need to find replicable industry boundaries and other issues. Currently, it seems that only Meiyun Zhishu is doing relatively well. A friend in my circle originally worked for Company A and later moved to Company B, and often complains about Company A’s capabilities, while Company B is clearly engaged in real transformation. I have also learned from other channels that Company A is currently unable to reimburse expenses, indicating that they may indeed lack any substantial accumulation. In summary, utilizing the advanced experiences of the manufacturing industry to establish a technology company may be more challenging than most people imagine; if pursued, one must have patience and determination.

4. Other companies entering via B2B, most of which have industrial backgrounds. Given the current international situation, perhaps there are greater opportunities for state-owned and central enterprises; I won’t elaborate here.

5. Internet companies, which have strong capabilities in technology, operations, and branding. Currently, most are still entering from a regional perspective. Scenarios 1 (where automation companies dominate), Scenarios 2 and 3 (where traditional enterprise IT dominates), and Scenario 4 (which is resource-heavy, capital-intensive, and not necessarily technology-heavy—B2B part) are already competitive landscapes. Therefore, I believe the focus for internet companies should be on becoming integrators, using their branding, technology, and operational capabilities to integrate different players effectively. Because the current regional platform models resemble a marketing route rather than a genuine demand. Real needs still primarily originate from the enterprise side.

In summary, current enterprise demands are still predominantly focused on Scenarios 1 and 2, with a few leading enterprises engaged in Scenario 3 and some startups working on Scenario 4. As practitioners, we also need to build our core capabilities according to priority.