★

Welcome to Star Mark Guoke Hard Technology

★

Selling water is a highly profitable industry, with profit margins reaching 60% at one point, and selling gas might also be a good business. As the largest industrial gas supplier, the French Air Liquide Group has maintained a gross margin of over 60% in recent years, with a gross margin of 55% in the last 12 months.In the field of hard technology, gases are rarely mentioned, but they are much more important than one might think. Last year, geopolitical frictions caused the price of neon gas to soar by 20 times, and even at such exorbitant prices, it was still in high demand. This is because electronic gases are to modern intelligent manufacturing what air is to humans; without them, all production would come to a halt.Now, with the gradual increase in domestic electronic gas production capacity, the price of neon gas has significantly decreased[1]. So, how far has domestic production developed?This article is the nineteenth in the “Domestic Substitution” series planned by “Guoke Hard Technology,” focusing on the domestic substitution of electronic gases. In this article, you will learn about: what electronic gases are, the supply situation at home and abroad, and the challenges faced by the domestic electronic gas industry.Fu Bin | Author Li Tuo | Editor Guoke Hard Technology | Planning

Products Fed by Dozens of Types of Staple Foods

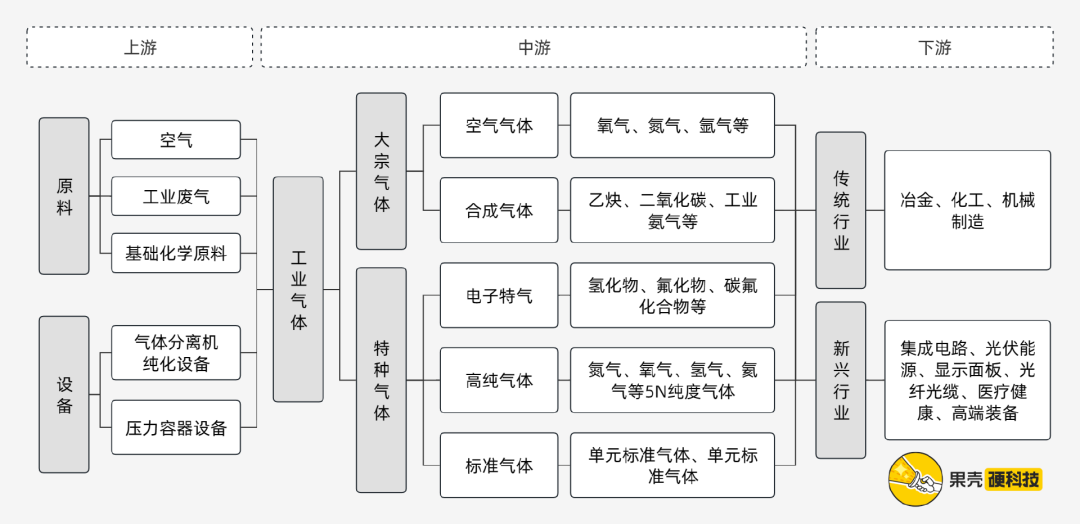

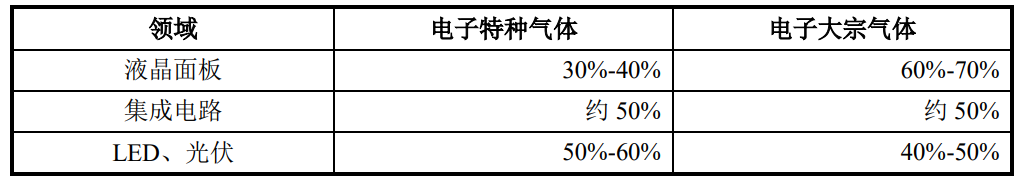

Every electronic product cannot escape the use of electronic gases; they are important basic raw materials, often referred to as the “blood” or “food” of industrial manufacturing.Broadly speaking, any gas used in electronic industrial production falls under the category of electronic gases, while narrowly, electronic gases specifically refer to the special gases used in the semiconductor industry.[2]In the industry, a broader interpretation is preferred. In the “Classification of Strategic Emerging Industries (2018),” the key products of electronic special materials manufacturing categorize electronic gases into two major categories: electronic special gases and electronic bulk gases[3], both of which are extremely important for manufacturing.

Panorama of the Industrial Gas Industry Chain, Illustration by Guoke Hard Technology

References: Yidu Data[4], Qianzhan Economist[5], Minsheng Securities[6]

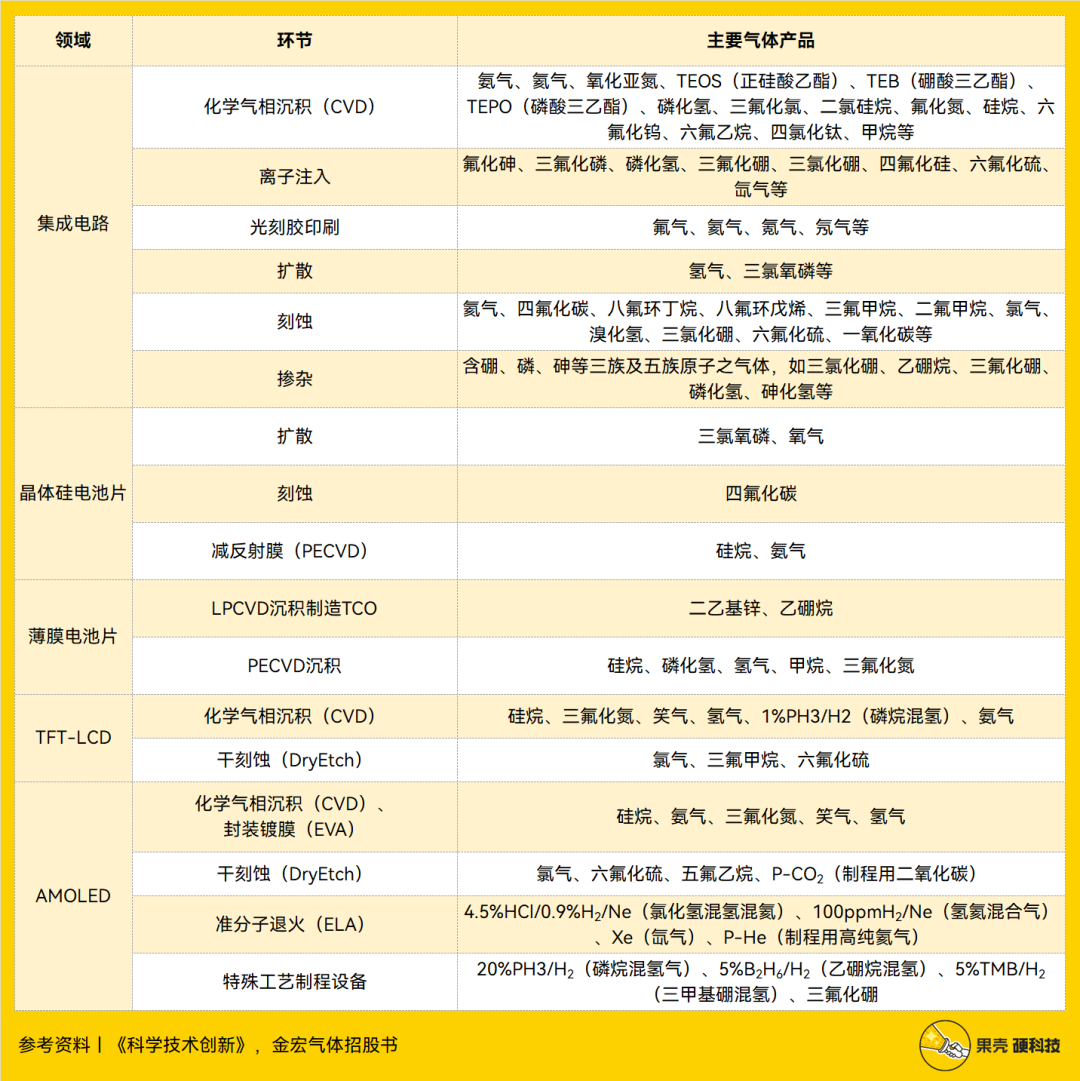

Electronic bulk gases and special gases are widely used in fields such as integrated circuit manufacturing, photovoltaic manufacturing, and display panel manufacturing, with some overlap in the gases used across different fields:

- Electronic bulk gases often serve as ambient gases, protective gases, and carrier gases, used in high-temperature thermal annealing, protective gas, cleaning gas, etc. Common gases include nitrogen (N2), hydrogen (H2), oxygen (O2), argon (Ar), and helium (He);

- Electronic special gases are involved in various processes of the semiconductor and microelectronics industries, such as cleaning, deposition, photolithography, etching, ion implantation, film formation, and doping. Common gases include silane (SiH4), germane (GeH4), hydrogen bromide (HBr), phosphine (PH3), arsine (AsH3), diborane (B2H6), nitrous oxide (N2O), sulfur hexafluoride (SF6), tungsten hexafluoride (WF6), nitrogen trifluoride (NF3), carbon tetrafluoride (CF4), boron trichloride (BCl3), boron trifluoride (BF3), trifluoromethane (CHF3), hexafluoroethane (C2F6), dichlorodihydrosilane (Si2H2Cl), silicon tetrafluoride (SiF4), ethyl silicate [(C2H5O)4Si], octafluorobutane (C4F8), high-purity ammonia (NH3), and high-purity chlorine (Cl2), etc.[7]

Among these, nitrogen trifluoride (NF3), silane (SiH4), and ammonia (NH3) are the three main gases used in integrated circuit manufacturing, photovoltaic manufacturing, and display panel manufacturing.

Gas Requirements in Various Manufacturing Fields, Table by Guoke Hard Technology

It is important to emphasize that electronic gases play an irreplaceable role in the thin film deposition process, being one of the main raw materials for forming thin films. For example, polysilicon is deposited from silane (SiH4). To put it simply, it is like using physical or chemical methods to turn electronic gases into solids, evenly sprinkling them from the air to ultimately form a film as thin as paper, on which fine circuits will be drawn.[8]

Special Gases Used in Production, Table by Guoke Hard Technology

References: “Science and Technology Innovation”[9], Jin Hong Gas IPO Prospectus[10]

Electronic products are gluttons, requiring dozens or even hundreds of types of electronic gases. Taking integrated circuits as an example, about 100 types of electronic gases are involved, with around 40-50 types being core processes[10]. Although the amount of each gas is not large, the variety is extensive, leading to a significant overall quantity. From a global market share perspective, silane accounts for about 22%, nitrogen trifluoride for 13%, ion implantation gases for 10%, fluorocarbons for 6%, tungsten hexafluoride for 4%, nitrous oxide for 4%, germane for 3%, high-purity ammonia for 3%, and many other gases.[11]Different products have different requirements for electronic gases, with the highest specifications for gases used in integrated circuit manufacturing. Typically, the certification cycle for photovoltaic energy and fiber optic cable fields is 0.5 to 1 year, for display panels is 1 to 2 years, and for integrated circuits is 2 to 3 years.[12]Currently, the integrated circuit market is the most dynamic, advanced, and competitive in the electronic gas market, while solar manufacturers need electronic gas supply methods that can simultaneously increase production, improve battery efficiency, and reduce manufacturing costs, and flat panel display manufacturers require large-scale supplies of ultra-pure gases.[13]

Proportions of Electronic Special Gases and Electronic Bulk Gases Required in Various Fields, Source: Jin Hong Gas IPO Prospectus[10]

The industrial gas sector itself is a relatively traditional industry, but what makes electronic gases different? Compared to traditional industrial gases, electronic gases have stricter requirements and more technical challenges, specifically including:

Electronic Products are Perfectionists

The purity requirements for electronic gases are much higher than in other industries. Any slight difference in gas purity, such as impurities like oxygen, moisture, metals, and particles, can lead to reduced product performance or even scrapping. To ensure product quality, electronic gases must meet both ultra-pure and ultra-clean requirements.Purity is the most important indicator of electronic gas quality. Typically, the industry uses N to measure purity, with a larger number in front of N indicating higher purity. The purity of electronic gases often needs to reach levels above 5N, and may even need to reach 6N or 7N. Additionally, the content of metallic impurities in electronic gases must be purified to levels of 10-9 to 10-12.

Relationship Between Gas Grade and Purity, Table by Guoke Hard Technology

References: Dongfang Caifu Securities[14], Minsheng Securities[6]

For products, the purer the electronic gas, the better. For integrated circuits, the process technology has advanced from 28nm, 14nm, 7nm, and 5nm to 4nm/3nm, meaning that any minute difference invisible to the naked eye can impact production. Purer electronic gases are necessary to ensure that the performance, integration, and yield of the produced devices do not have errors.[15] However, while it may seem like just adding a digit after the decimal point, it actually represents a significant technological upgrade. The purer the substance, the harder it is to produce; each increase of 1N in electronic gas purity means that the concentration of particles and metallic impurities must be reduced by an order of magnitude. To pursue extreme purity, the entire production process of electronic gases will undergo technological upgrades, involving gas synthesis, separation and purification, mixing (for mixed gases), container treatment, filling, and analysis detection processes. Relevant technologies include gas synthesis, deep purification, mixed gas configuration, and analysis detection technologies for ppm/ppb/ppt level impurities, along with supporting devices and gas cylinders and pipelines. The characteristics of different gases vary widely, and no step can be overlooked. In simple terms, gas suppliers will first conduct a comprehensive analysis of upstream raw material industrial gases, then design production processes and equipment based on the complexity of impurity components, and finally use online automatic monitoring equipment for high-precision analysis.[12]

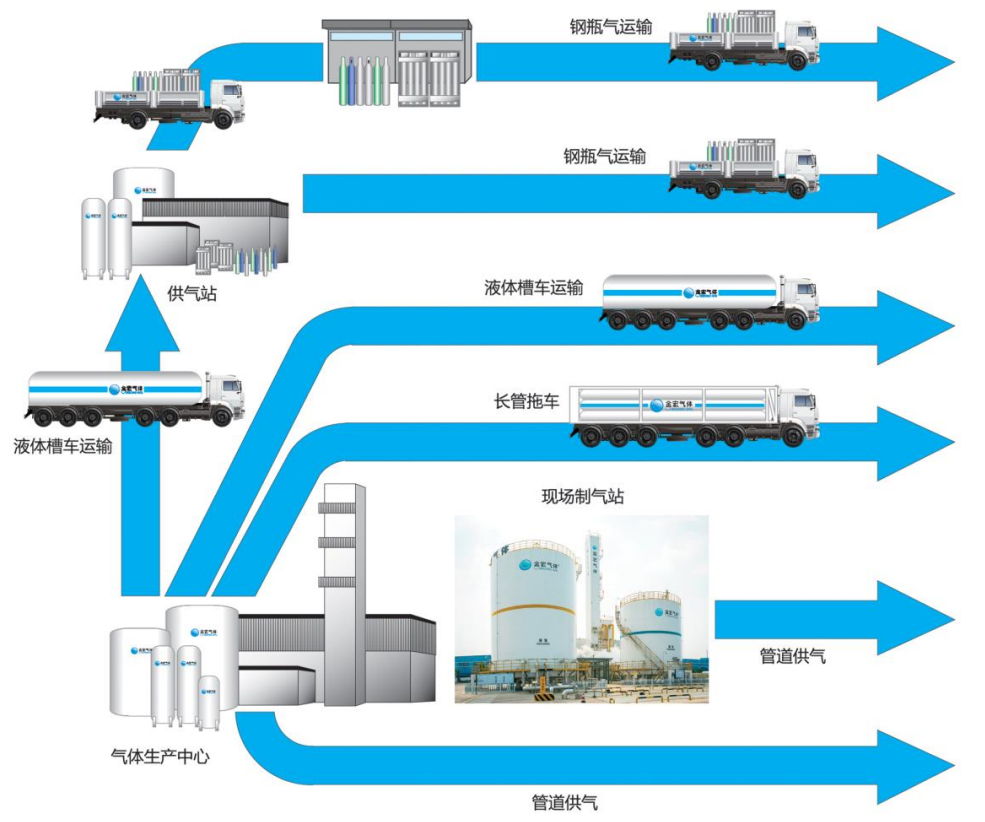

Production Capability Must Match Transportation Capability

Transportation requirements for electronic gases are much higher than in traditional industries. First, high-purity gases may have a short or long journey from the factory to actual production, with contamination risks along the way. In the production and transportation of electronic gases, specialized packaging storage containers, gas delivery pipelines, valves, and interfaces must be used to ensure gas purity, and operations must strictly follow safety production and transportation regulations[16]. Secondly, some electronic gases have unstable characteristics, and long-term transportation can lead to spontaneous decomposition or increased impurity content due to strong corrosiveness. Additionally, many electronic gases are well-known toxic gases, and the packaging and transportation of these hazardous chemicals are subject to strict regulations. It must be said that these challenges inevitably lead to increased costs. For example, currently, most high-end gases in China are almost entirely dependent on imports, and the cumbersome procedures and long cycles for imports make gas prices 2-3 times higher than domestic gases or even more.[17] Of course, in addition to long-distance transportation, the electronic gas industry also has a TGM (Total Gas and Chemical Operation Management Service) supply model. Simply put, this means providing customers with a full-process gas supply service. However, this model requires companies to have on-site gas production experience, professionalism, and safety control capabilities[18], which is not something that can be done easily.

The Electronic Gas Industry Has Various Business Models[12]

Don’t Throw It Away After Use

When electronic gases have served their purpose, it does not mean the end; there is still the issue of exhaust gas treatment. Directly discharging untreated exhaust gas can have a significant impact on the environment and is also a waste of resources. After recovery and purification, electronic gases can be reintroduced into production. Typical gases include: carbon dioxide and nitrous oxide are typical greenhouse gases, which can be used in semiconductor, biomedicine, and food processing industries after recovery and purification; hydrogen and natural gas, after recovery and purification, are excellent clean energy sources that can be used in semiconductor production; hydrogen chloride and chlorine, which are highly corrosive and toxic, can be recovered and purified for use in semiconductor etching, epitaxy, and crystal production processes.[10] Under the requirements for energy conservation, emission reduction, and carbon neutrality, higher technical requirements are also imposed on exhaust gas treatment and recovery technologies.

Finding Business in a Monopolized Market

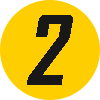

Electronic gases are a profitable business. Although there are differences in product variety structure, downstream gas usage segmentation markets, and supply methods among companies, the overall profit margin is relatively high. From the perspective of total production costs, the proportion of electronic gases is very low, but they can leverage a relatively stable market. For example, electronic gases account for only 5%-6% of the total cost of chips[19], but downstream manufacturers have a rigid and stable demand for electronic gases, leading to low sensitivity to price, thus giving electronic gases strong cost transfer capabilities. Moreover, both electronic bulk gases and electronic special gases have stable markets. Data shows that the market size of electronic bulk gases in China was 163.2 billion yuan in 2020, a year-on-year increase of 10.49%, and it is expected to exceed 200 billion yuan in 2023, reaching 217.22 billion yuan. Due to high barriers in segmented industries, the current domestic substitution rate is relatively low[20]. In 2021, the market size of China’s special gases is expected to reach 34.2 billion yuan, with electronic special gases expected to reach 21.6 billion yuan, accounting for nearly 60% of special gases.[21] However, obtaining this profit is not as easy as it seems. Looking at the entire history of electronic gas development, it has followed a path from low purity to high purity, from a multitude of flowers to integration and mergers, and has now become a technology-intensive industry with high barriers, requiring strict standards for gas sources and supply systems[22]. The domestic electronic gas industry began to emerge in the 1980s, starting relatively late and always lagging behind international advanced products.

History of Electronic Gas Development, Table by Guoke Hard Technology

References: Qianzhan Economist[17]

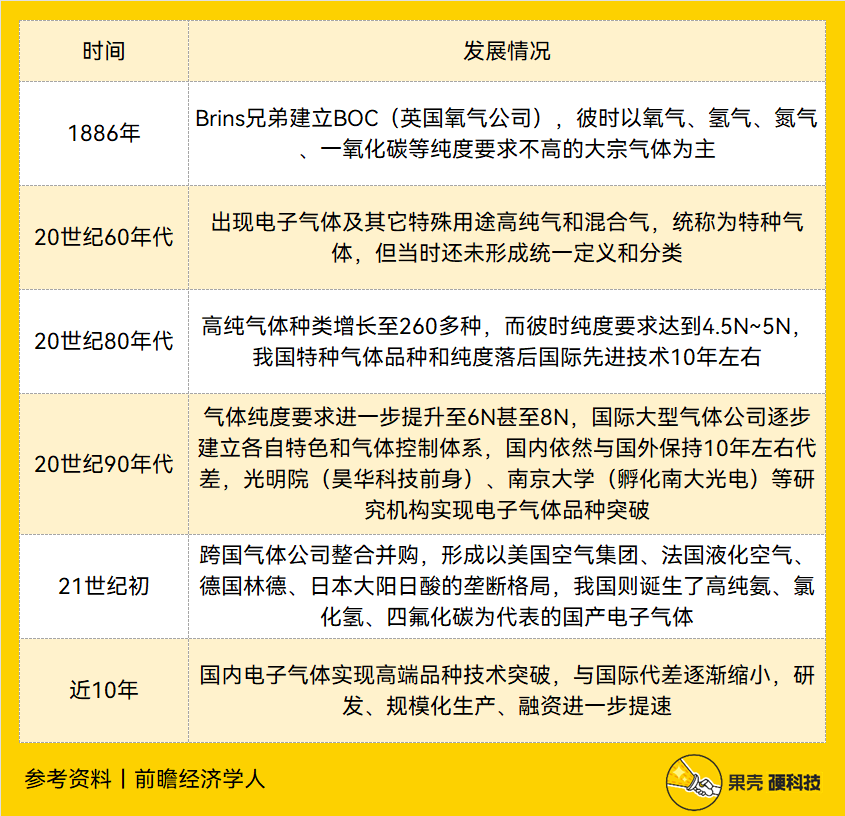

Since the early 21st century, the global electronic gas market has maintained a high concentration, with four overseas giants—Air Products in the US, Linde Group in Germany, Air Liquide in France, and Taiyo Nippon Sanso in Japan—occupying about 90% of the global market.[21] The electronic gases used in China are also predominantly foreign, and although some domestic companies have the capability to produce high-purity electronic gases, they find it difficult to enter the integrated circuit field[23]. Currently, China can only produce about 20% of the varieties of electronic special gases used in integrated circuits[24], with a domestic substitution rate of less than 15%[25]. Meanwhile, high-end electronic special gases are almost entirely dependent on imports.[26] Although the road ahead is challenging, development is imperative; just from a price perspective, the average price of domestic high-purity electronic gases can reach about 60% of international prices.[27]

Where is the Future of Domestic Production?

So far, domestic electronic gas players can be divided into three categories:

- The first category consists of companies whose main business is industrial gases, covering some varieties of electronic gases, represented by Huate Gas and Jin Hong Gas;

- The second category focuses on deep cultivation of electronic special gases, represented by Praxair and Haohua Technology;

- The third category consists of electronic materials platform companies, which, in addition to electronic gases, also involve other electronic materials, represented by Yake Technology and Nanda Optoelectronics.[28]

Comparing the development situation at home and abroad, international suppliers serve cutting-edge manufacturers, with a wider range of product varieties and more diverse supply models, most of which can provide TGM supply models. Domestically, there is a lack of high-end gas technology, and only a few companies have TGM models.

Supply Models of Major International and Domestic Companies[29]

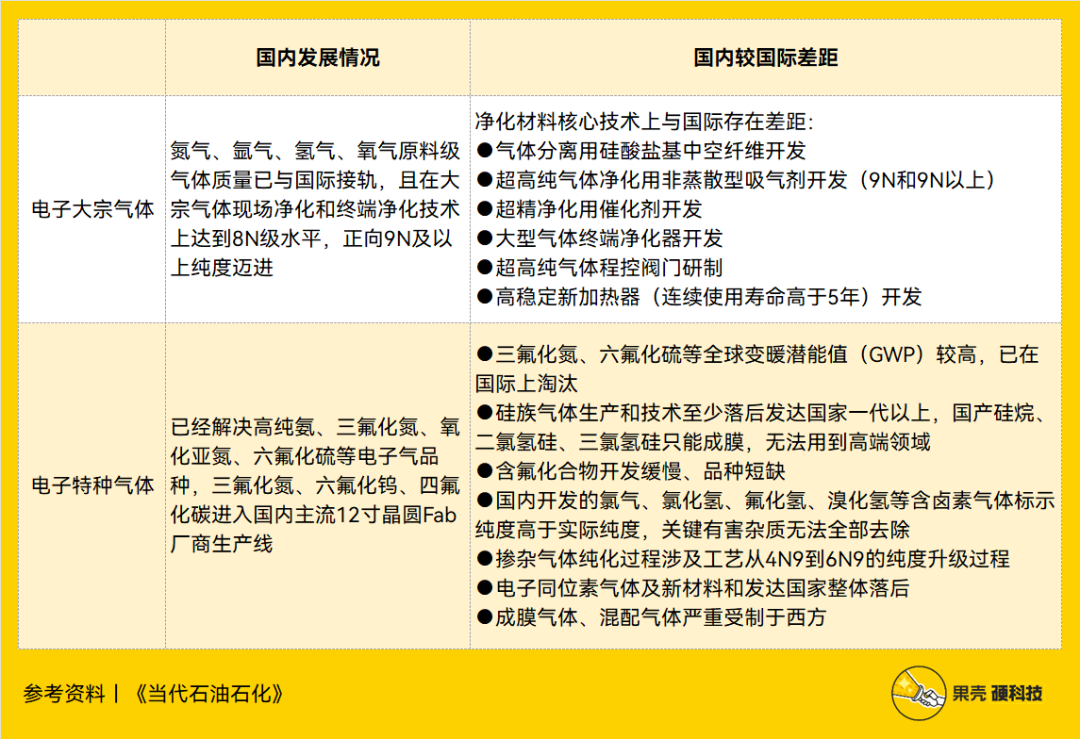

From a technical perspective, although China has reached internationally accepted standards in gas purification technology, container treatment technology, gas filling technology, and detection technology[30], the overall level still lags behind internationally:

- In bulk gas production, China has a gap in core purification material technology compared to international standards;

- In special gas production, China’s overall technology is inadequate and is in a state of supply shortage;

- In terms of metal surface treatment for pipelines, valves, and packaging, there is a significant gap between domestic and international manufacturing materials and internal processing technologies, and ultra-high purity gas containers and pipelines are mainly imported;

- In exhaust gas treatment and recovery technology, the market is basically monopolized by foreign capital;

- In gas detection technology, China has mastered basic gas chromatography and chemical analysis methods, but there is a large gap in some ultra-trace analysis detection technologies compared to international standards.[31]

Development Status of Domestic Electronic Gas Production Technology, Table by Guoke Hard Technology

References: “Contemporary Petroleum and Petrochemicals”[31]

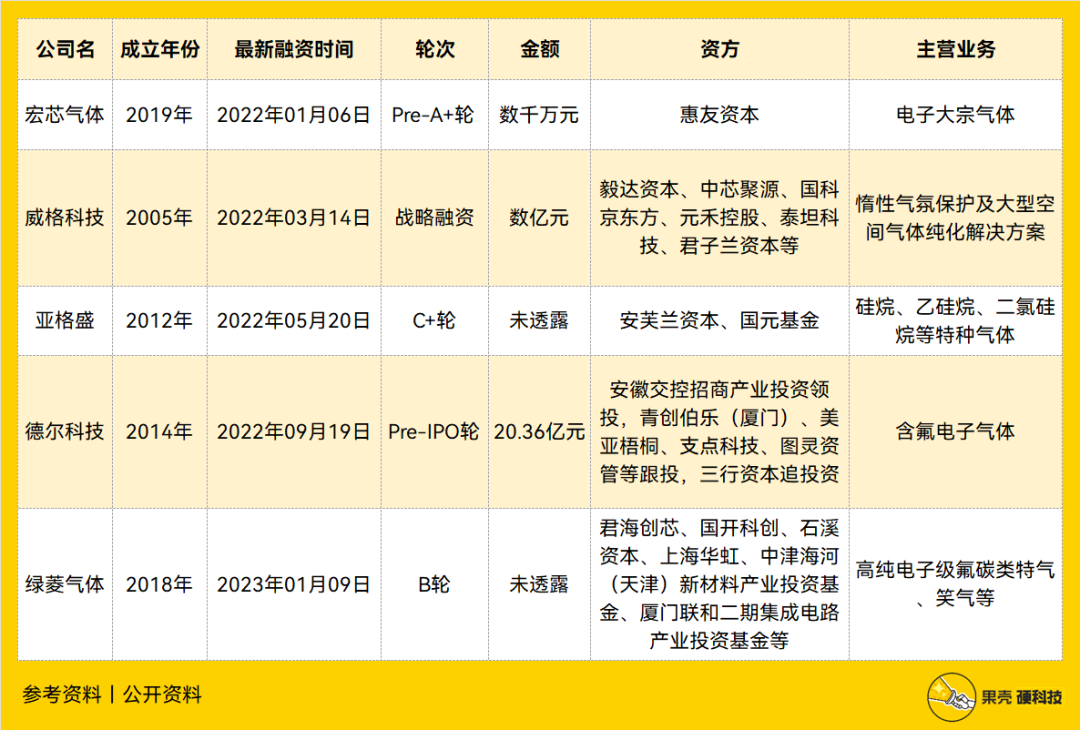

From the investment and financing market perspective, the heat of electronic gases is not very high, with only a few related events in the past two years, and new companies generally focus on a few types of gases as their main business and market entry point.

Recent Financing Situation of Electronic Gases, Table by Guoke Hard Technology

Regarding the development situation of domestic gases, the Guoke Hard Technology team believes:

- Raw material supply is an unavoidable issue; in fact, some gases are extremely unevenly distributed geographically. For example, by the end of 2021, the total proven helium resource in the US accounted for 35.33% of the global total[32], and the US also controlled 43.6% of global helium production[33]. Domestically, attention should be paid to the supply of specific gas raw materials, and multiple supply channels should be established as much as possible;

- The demand for electronic bulk gases and electronic special gases is roughly equivalent, and both production lines are worth paying attention to. Currently, domestic operations are relatively scattered, while international leading enterprises have a comprehensive range of gas supply varieties, and their related capabilities are formed through mergers and acquisitions. It can be foreseen that the future domestic market will inevitably face a trend of consolidation, which may gradually intensify the Matthew effect;

- In terms of bulk gases, due to the high initial investment required for self-built gas supply facilities, the supply should shift from self-built to outsourcing. Data shows that in 2019, the outsourcing rate of industrial gases in China was about 55%, while the outsourcing rate in developed countries was 80%;[29]

- In terms of special gases, international manufacturers generally adopt TGM supply business models, which are relatively monopolized. Although a few domestic manufacturers have already adopted TGM models, further alignment is still needed;

- Electronic gases belong to a technology-intensive industry with high R&D difficulty. Experts suggest strengthening cooperation with higher education institutions and research institutions to explore the establishment of electronic gas technology innovation centers. Additionally, gas suppliers can collaborate with electronic components, software, and complete machine enterprises through strategic alliances, capital cooperation, and technological collaboration to achieve collective advancement;[22]

- Standardization of electronic gases is conducive to unified industry development. Currently, China has formulated new standards for nitrogen trifluoride, boron trichloride, hexafluorobutadiene, and fluoromethane, which will be implemented soon;[30]

- Policies have created more opportunities for the market. For example, in the “Guidelines for the First Batch of Application Demonstration Directory of Key New Materials (2019 Edition)” published by the Ministry of Industry and Information Technology, high-purity chlorine, trichlorosilane, hydrogen chloride, and nitrous oxide have been listed as key new materials.[28]

In summary, there is a gap in high-end gases in the domestic electronic gas sector, and there is still room for breakthroughs in filling technology, exhaust gas treatment and recovery, detection technology, and supply models. Through years of interaction with foreign enterprises, domestic companies have generally recognized that foreign enterprises can restrict domestic production through delivery delays and pricing limitations[34]. Nowadays, breaking the monopoly has become a consensus, and the industry should not be choked by a single breath.