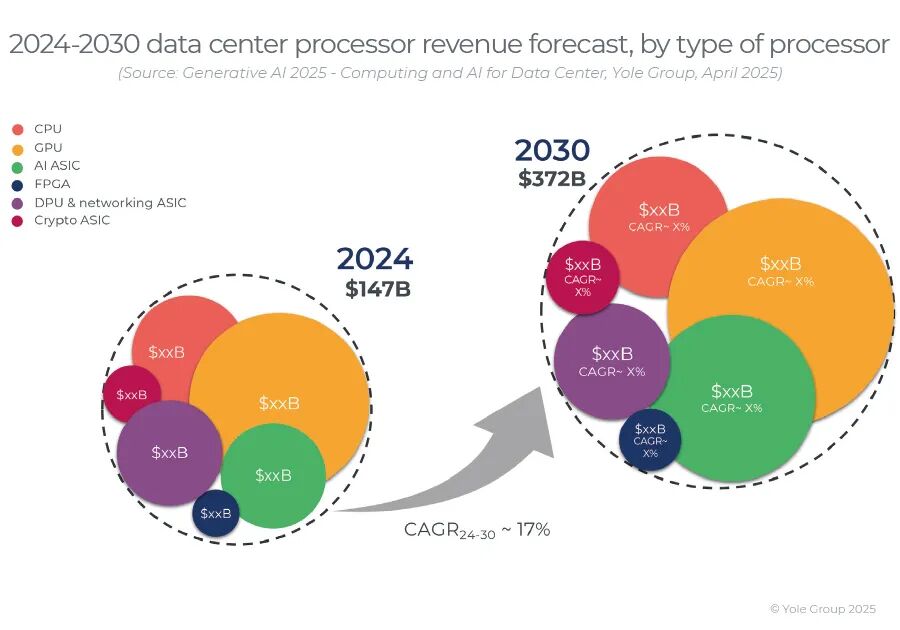

The wave of generative AI is driving explosive demand for data center GPUs, application-specific integrated circuits (ASICs), CPUs, DPUs, and network chips, with the market expected to exceed $370 billion by 2030.

1. Driven by Generative AI, the data center processor market is expected to reach $372 billion by 2030

The data center processor market is rapidly expanding due to the explosive growth of generative AI applications, which require high-performance computing support. The global data center processor market reached $147 billion in 2024 and is expected to grow to $372 billion by 2030. GPUs and ASICs, as the core hardware for generative AI, are leading the market with double-digit growth. CPUs and network processors (such as DPUs) are also critical, but their growth rate is relatively stable. In the AI field, although GPUs and ASICs dominate, the FPGA (Field Programmable Gate Array) market is sharply declining and is expected to remain flat in the short term. Meanwhile, the rapid expansion of the cryptocurrency market (such as Bitcoin) is driving strong demand for dedicated cryptocurrency chips (Crypto ASICs) used for validating crypto transactions.

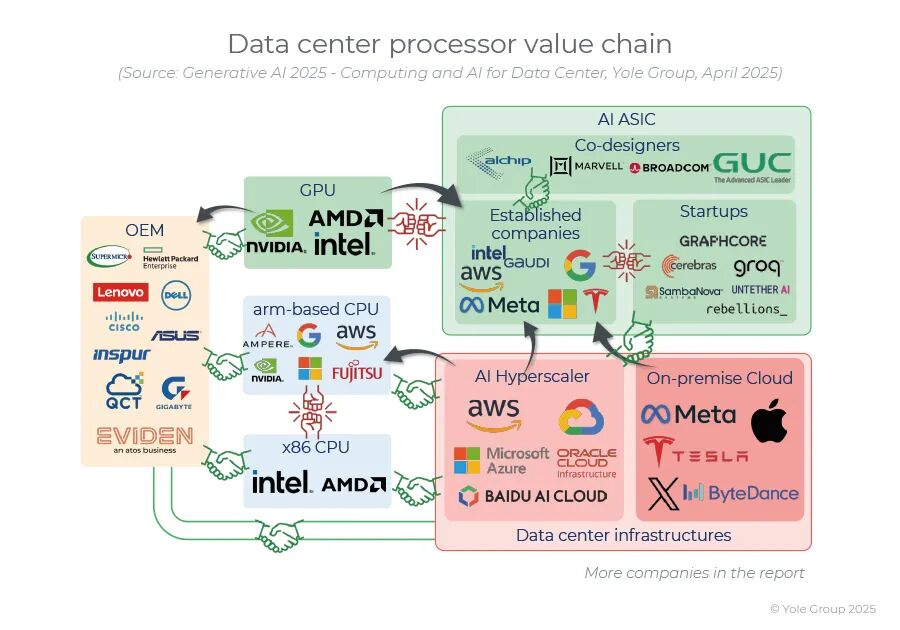

NVIDIA Leads the AI Race, but Google and AWS Seek Breakthroughs with In-House AI Chips

Since OpenAI propelled the generative AI revolution in 2022, NVIDIA GPUs have become the biggest beneficiaries. In light of NVIDIA’s dominance and the importance of AI strategies, large-scale cloud computing companies (such as Google and AWS) are collaborating with companies like Broadcom, Marvell, and Alchip to co-design their own AI-specific chips (ASICs) to achieve technological independence.

In the AI chip sector, numerous startups (such as Groq, Cerebras, Graphcore) are competing for market share through innovative architectures, driving a wave of mergers and financing. The pursuit of performance efficiency is also prompting the industry to shift towards ARM-based CPUs, thereby shaking Intel and AMD’s long-standing dominance in the x86 architecture. Blockchain mining farms, equipped with cooling solutions and high-power processing capabilities, are also emerging in the AI market, beginning to deploy the most powerful GPU clusters.

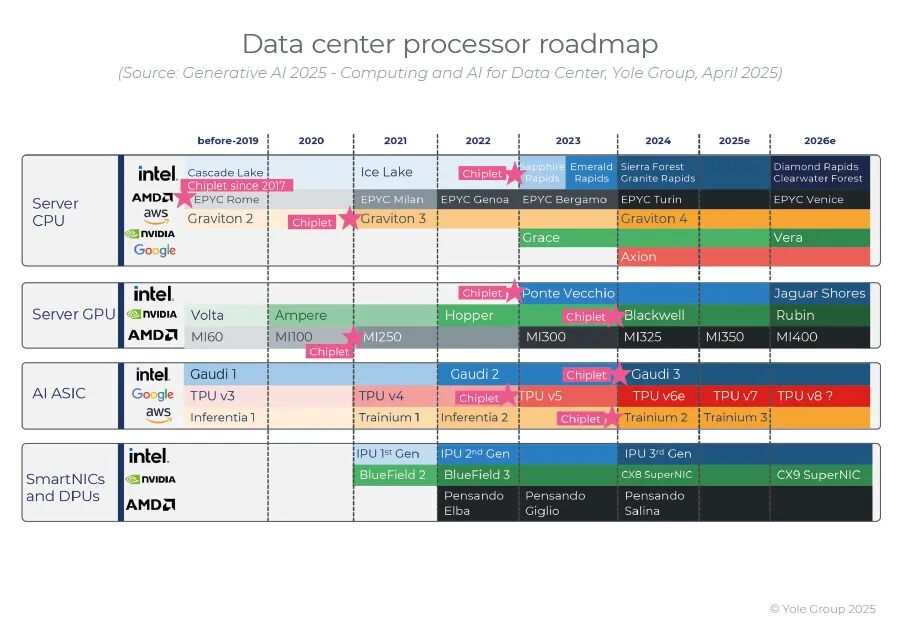

3. Multi-Chip Architecture and Advanced Processes Define the Future of Generative AI

Chiplet technology plays a key role in GPUs, CPUs, and ASICs by optimizing yield and supporting larger wafer sizes, driving the development of advanced processes. The latest CPUs in 2024 have adopted 3nm technology, while GPUs and AI chips are still primarily based on 4nm, but 3nm technology is expected to be fully implemented by 2025 (such as AWS Trainium 3).

To meet AI demands, computing power has increased eightfold since 2020 and continues to accelerate—NVIDIA has announced the launch of the Rubin Ultra chip in 2027, with FP4 precision inference performance reaching 100 PFLOPS. However, as the scale of AI models expands and the demand for low latency and high bandwidth grows, memory has become a core bottleneck. Current mainstream solutions from NVIDIA, AMD, Google, and AWS rely on high-bandwidth memory (HBM), but many AI chip startups (such as Groq, Graphcore) are attempting to break performance limits through SRAM architectures.

The wave of generative AI is driving explosive demand for data center GPUs, application-specific integrated circuits (ASICs), CPUs, DPUs, and network chips, with the market expected to exceed $370 billion by 2030:

https://www.yolegroup.com/product/report/gen-ai-2025—computing-and-ai-for-datacenter/