Currently, the global automotive industry is at a turning point of transformation, and the development trend of the “new four modernizations” (electrification, connectivity, intelligence, and sharing) has become a consensus among people. The proportion of software in automobiles is rapidly increasing.

With the development of intelligence and connectivity, cars will gradually evolve from a mere transportation tool into a mobile intelligent space, providing various mobile services for people to live, entertain, and work in. Compared to traditional cars, which focus on the power system and chassis, intelligent cars will center around software, leveraging rich network resources to provide users with more and richer functionalities. Taking Tesla as an example, software services are beginning to play an increasingly important role in its revenue and profit share.

Just like the status of software in smartphones, as technology advances and competition intensifies, the hardware configuration of intelligent cockpits in cars will gradually become homogeneous, while differences in software will better reflect the disparities between brands and will gradually become a core competitive advantage for car manufacturers. The marginal cost of software is lower, making it easier to meet the diverse needs of users. Additionally, a well-developed software ecosystem can increase user stickiness, making it more likely for them to purchase new models from the same brand.

The operating system is the most fundamental software, responsible for maximizing hardware performance and carrying service content. As smart car manufacturers’ demand for product customization continues to rise, the development of in-vehicle operating system products will also become increasingly complex, and the workload for operating system R&D will rapidly increase. To enhance user experience, car companies need to continuously invest significant human and financial resources to enhance and improve the software functionalities of in-vehicle intelligent systems. At the same time, with the update of components, in-vehicle operating systems also need to adapt and undergo complex testing, developing and improving drivers at the system level.

In the process of automotive intelligence and connectivity, in-vehicle software system service providers will play an increasingly important role. The market size of in-vehicle software, as well as which companies have core competitive advantages, are issues we need to study.

Market Size

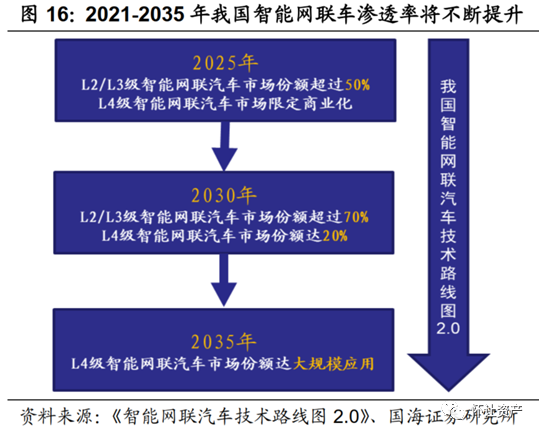

In 2020, the World Intelligent Connected Vehicle Conference released the “Intelligent Connected Vehicle Technology Roadmap 2.0”, describing several development stages of China’s intelligent connected vehicles: from 2020 to 2025 is the development period, by 2025, the market share of L2/L3 intelligent connected vehicles in China will exceed 50%, and L4 intelligent connected vehicles will gradually commercialize in limited scenarios; from 2026 to 2030 is the promotion period, by 2030, the market share of L2/L3 intelligent connected vehicles will exceed 70%, while L4 intelligent connected vehicles will reach 20%; from 2031 to 2035, it will enter the mature period, and by 2035, China’s intelligent connected vehicle industry system will be more complete, with L4 intelligent connected vehicles being widely applied.

The intelligent cockpit is an important component of smart cars and also serves as the carrier for in-vehicle software. According to data from Visteon, the global market size for major intelligent cockpit products (central control displays, infotainment solutions, instrument panels, HUDs) was approximately $32.9 billion in 2018. With the arrival of the 5G era, user demand for automotive safety and entertainment features continues to rise, and product penetration rates are expected to keep increasing, prompting further cost reductions. It is estimated that the market size for intelligent cockpits will reach $39.6 billion in 2020, and is expected to reach $46.1 billion by 2022, with a CAGR of approximately 8.8% from 2018 to 2022.

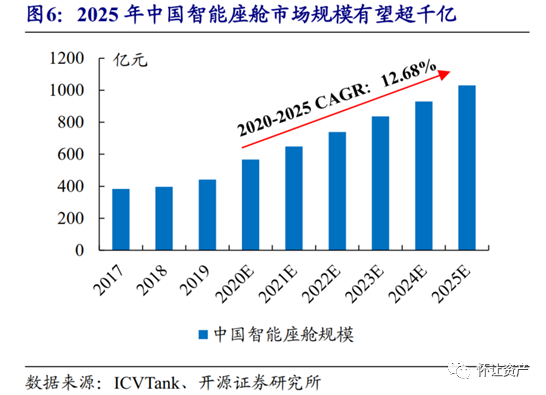

According to ICVTank data, the market size for intelligent cockpits in China was approximately 56.7 billion yuan in 2020, and is expected to exceed 100 billion yuan by 2025, with a CAGR of 12.68% from 2020 to 2025.

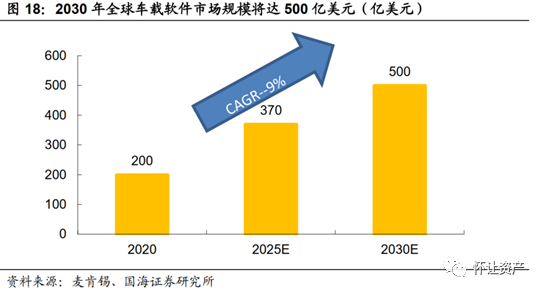

As the penetration rate of smart cars continues to rise, the number of in-vehicle software installations and the value per vehicle will also continue to increase, leading to continuous market growth. According to McKinsey, the global market size for in-vehicle software was approximately $20 billion in 2020, and is expected to increase to $37 billion by 2025, reaching $50 billion by 2030, with a CAGR of 9% from 2020 to 2030.

We can see that with continuous technological advancement and the growing demand for automotive personalization, the penetration rate of intelligent and connected vehicles will rise rapidly in the future, and the differentiation of in-vehicle software will gradually become the core competitiveness of car companies. The demand for in-vehicle software will grow rapidly in the future.

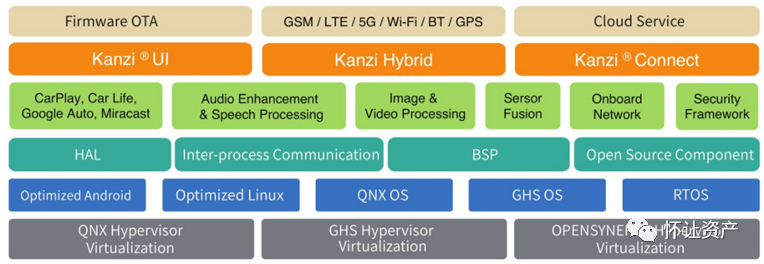

The automotive software operating system, as the most basic software in intelligent connected vehicles, includes mainstream in-vehicle operating systems such as QNX, Linux, Android, and WinCE. Domestic in-vehicle operating system suppliers mainly include ThunderSoft, Chinasoft International, Neusoft, etc. The in-vehicle operating system not only needs to provide a running environment for the application layer but also needs to adapt to different hardware, involving various core technologies such as kernel technology, driver development, security technology, communication protocols, performance optimization, and graphics image processing. At the same time, the operating system products also need to have a deep understanding of the mobile chip technology, hardware design technology, application development technology, and terminal production processes of various suppliers, involving multiple professional fields including mobile communication and computer software and hardware. Mastering and applying the above various core professional technologies requires long-term accumulation and practical experience. In the R&D and production process of the intelligent cockpit for OEMs, the operating system products need to respond quickly according to business needs and provide multi-dimensional, high-quality technical support and services in a short time.

Today, we focus on ThunderSoft and Chinasoft International. Since their establishment, both companies have mainly provided comprehensive software solutions for mobile terminals such as smartphones, helping smart terminal manufacturers quickly complete productization. With the rapid development of automotive intelligence and connectivity, both companies have increased cooperation with OEMs and intelligent cockpit suppliers, leveraging their technical advantages in mobile operating systems to begin developing intelligent connected vehicle businesses.

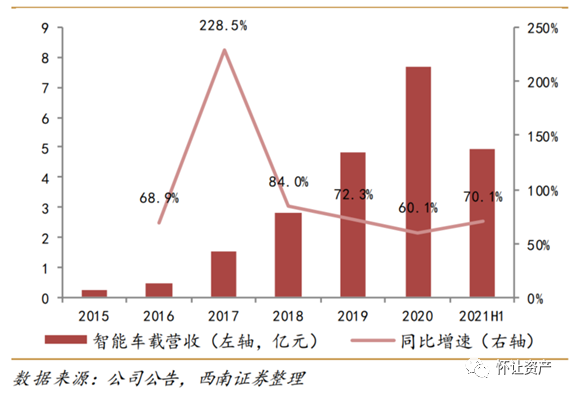

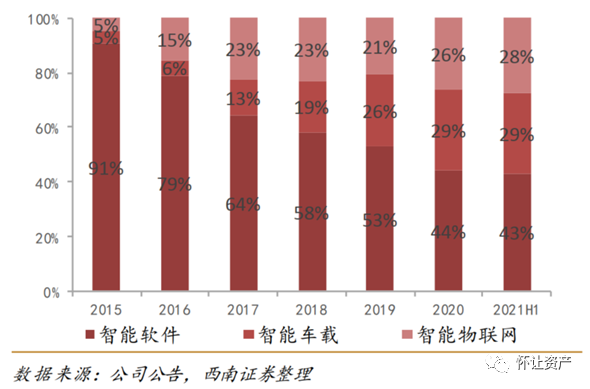

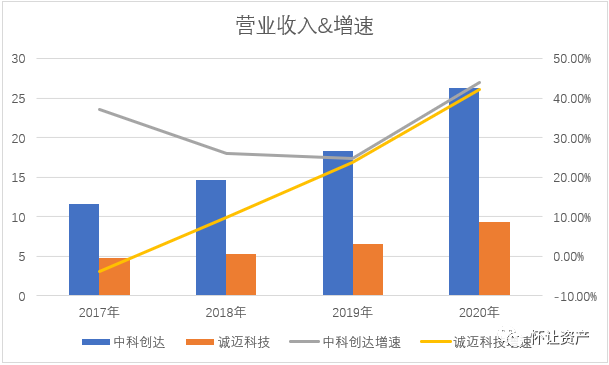

ThunderSoft was founded in 2008 and is a provider of intelligent operating system products and technologies. The company focuses on intelligent operating systems and expands its business into intelligent software, intelligent connected vehicles, and the Internet of Things. The company mainly provides software development, technical services, software licensing, etc., and also sells integrated hardware and software products for the Internet of Things. The company began to invest heavily in intelligent connected vehicle business in 2013, establishing a layout for intelligent cockpits, intelligent driving, intelligent connectivity, as well as toolchain + solutions and services. The company’s intelligent connected vehicle business continues to grow rapidly,with revenue from intelligent connected vehicles reaching770 million yuan in 2020, with a compound annual growth rate of102% from 2016 to 2020. The revenue from the intelligent connected vehicle business has also increased its share in the company’s total revenue, rising from5.45% in 2016 to29.31% in 2020.

Figure: ThunderSoft Intelligent Vehicle Revenue and Growth Rate

Figure: ThunderSoft Main Business Revenue Structure

Chinasoft International was founded in 2006 and has focused on the R&D services of intelligent connectivity and intelligent operating systems. It can provide comprehensive software solutions for mobile intelligent terminals and intelligent connected vehicles. The company’s revenue from intelligent connected vehicles was 130 million yuan in 2020, accounting for 13.75% of the company’s total revenue. From 2017 to 2020, the compound annual growth rate of this business revenue was 51.8%.

Figure: Revenue and Growth Rate of ThunderSoft and Chinasoft International

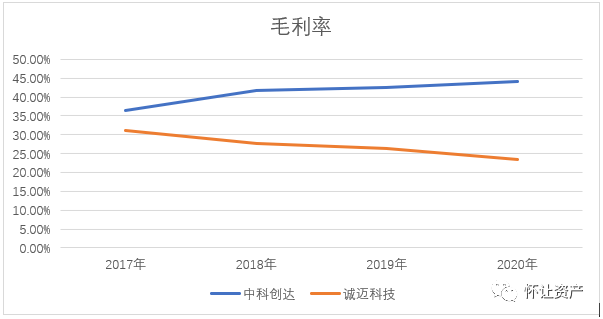

Gross Margin Comparison

Figure: Gross Margin Comparison of ThunderSoft and Chinasoft International

ThunderSoft’s gross margin was 44.22% in 2020, higher than Chinasoft International’s gross margin of 23.48% in 2020, mainly due to Chinasoft International’s primary business being labor outsourcing for software engineers, which has relatively low technical content and a lower gross margin.

We believe that in the field of intelligent automotive software services, companies that have rich R&D experience in mobile terminals, maintain good cooperative relationships with automotive-related clients, and continuously invest in R&D have a greater competitive advantage in the automotive software market.

Thus, we compare the two companies based on dimensions such as R&D experience, customer cooperation, and R&D investment.

1. R&D Experience

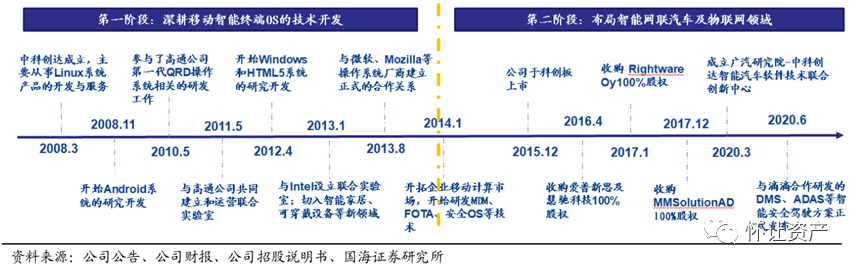

ThunderSoft has positioned itself as a provider of mobile intelligent terminal operating system products and technologies since its inception, leveraging the wave of smartphone intelligence to enter the Android development field, quickly growing into the largest independent operating system technology company in China. Subsequently, the company covered Windows Phone and other mobile intelligent terminal operating systems based on HTML5, further expanding the coverage of underlying operating systems. Since 2013, after achieving certain success in the mobile intelligent terminal business, the company began to explore the emerging markets of intelligent vehicles and the Internet of Things to seek new growth points. The company has undertaken a series of strategically clear acquisitions:

-

The company acquired Aipuxin and Huichi Technology in 2016, gaining technological accumulation and a wide market share in automotive pre-installed infotainment systems.

-

In 2017, the company acquired Rightware Oy, whose Kanzi series graphic development software is akin to Photoshop in the automotive UI field, widely used in the user interface design of global companies such as Audi and BMW. This acquisition improved the company’s business structure and expanded its client resources among OEMs and tier-one suppliers.

-

In the same year, the company acquired MM Solution AD, which has strong accumulation in image vision technology, mainly used in scenarios such as 360-degree surround stitching and electronic rearview mirrors.

Thus, ThunderSoft gained the ability to develop, optimize, and integrate graphic image processing algorithms, enhancing its competitiveness in the embedded imaging and computer vision fields.

-

In December 2020, ThunderSoft acquired a 51.48% stake in Fuyihang, one of the few domestic companies in the autonomous parking sector, which has strong technological capabilities. By the end of 2018, it successfully developed an automatic parking system and has successfully tested it in mass-produced vehicles, with its products now capable of covering about 80% of parking scenarios.

The company has achieved an extension from the development of underlying operating systems to the application layer through acquisition activities, gaining full-stack technology development and product development capabilities. Leveraging years of accumulated operating system optimization technology, 3D engines, machine vision, automatic parking, and voice and audio technology, the company provides comprehensive intelligent cockpit software solutions and services, including automotive entertainment systems, smart dashboards, integrated cockpits, ADAS, and audio products, offering users a rich and advanced intelligent driving experience.

Figure: Company Development History

Figure: ThunderSoft Intelligent Cockpit Solutions

Chinasoft International, since its establishment, has primarily focused on the application of the Android system in the mobile intelligent terminal field, possessing comprehensive technical capabilities such as Android system upgrades and integration services, software defect repair services, ROM customization services, customized software services for global telecom operators, and industry intelligent terminal reference designs. The company has gradually built an experienced expert team, forming a comprehensive technical capability advantage in areas such as underlying driver for mobile operating systems, power optimization management, camera graphic image processing, middleware customization, and system performance tuning. The company actively expands its intelligent connected vehicle software business, gathering its comprehensive capabilities in mobile operating systems and chip platform technologies in the intelligent cockpit system field, providing overall solutions for intelligent driving cockpits, including intelligent in-vehicle infotainment systems, smart dashboards, and TBOX, through deep cooperation with major automotive electronic chip manufacturers, combining development capabilities for operating systems such as BlackBerry QNX, Android Auto, ALiOS, and AGL, to create core technologies such as hardware virtualization, fast booting, 3D human-machine interfaces, natural language interaction interfaces, and multi-window systems, establishing industry-leading technological advantages, and gaining recognition and project cooperation from numerous automotive manufacturers and vehicle machine manufacturers. Meanwhile, the company is closely following the trend of the automotive “new four modernizations”, laying out domain controllers and SOA software, and enhancing its ability to provide comprehensive solutions for OEMs and tier-one suppliers.

From the perspective of R&D experience and business development paths, both companies have relied on the wave of smartphone intelligence to provide customization and matching services for mobile terminal manufacturers. With the development of automotive intelligence and connectivity, they have expanded their businesses into the automotive intelligent cockpit operating system field based on their experience in smartphone system development.

2. Customer Cooperation

ThunderSoft’s clients mainly include smart terminal manufacturers, OEMs, operating system manufacturers, mobile chip manufacturers, telecom operators, application software and Internet companies, and component manufacturers. Qualcomm has always been a leading player in mobile terminal processing chips, and in the process of automotive intelligence and connectivity, Qualcomm’s intelligent cockpit chips are also matched with multiple vehicle models. ThunderSoft has a binding cooperative relationship with Qualcomm. In 2017, when the company went public, Qualcomm was among its top ten shareholders. The company established a joint laboratory with Qualcomm in China, responsible for developing, debugging, and optimizing the driver software for various components, providing technical support to mobile intelligent terminal manufacturers, reducing their repetitive R&D work, and assisting these manufacturers in rapidly developing new products. The laboratory can also conduct in-depth testing of compatibility, performance, and power consumption of mobile Internet application software. The joint venture between the company and Qualcomm—Chuangtong Lianda released the latest intelligent cockpit solution based on the third-generation Qualcomm Snapdragon automotive digital cockpit platform in 2019, providing highly integrated and fully extensible intelligent cockpit solutions and basic software platforms for automotive manufacturers and tier-one suppliers. The company also established a joint laboratory with Intel to provide component development, testing, certification, and customer support for mobile terminals equipped with Intel chips, shortening customers’ development time. The company has over 200 intelligent connected vehicle clients globally, with deepened cooperation with leading automakers such as GAC, SAIC, FAW, Li Auto, Volkswagen, General Motors, and Toyota.

Figure: ThunderSoft R&D Center and Subsidiary Distribution

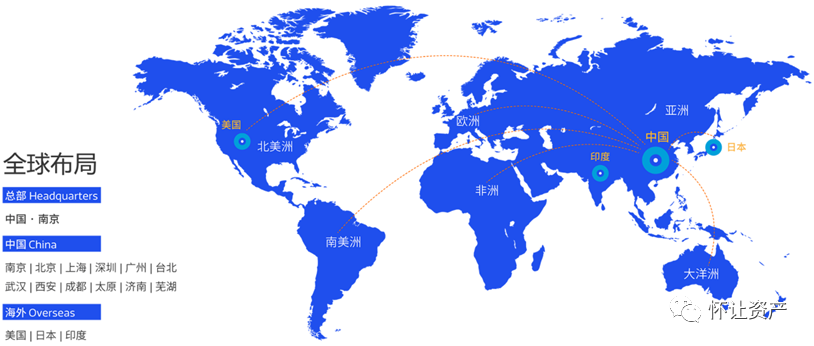

Chinasoft International maintains good cooperation with mobile terminal chip manufacturers such as Qualcomm, Renesas, Intel, and MTK. While maintaining close cooperation with traditional domestic automotive manufacturers, the company further expands its customer base to joint venture manufacturers and new energy vehicle clients, improving business scale and quality, with clients including Geely, SAIC, Great Wall, Ford, Volkswagen, WM Motor, XPeng, Visteon, Joyson Electronics, Desay SV, and more than 50 OEMs and tier-one suppliers. The company established a joint venture with BMW Group to leverage its expertise in automotive software development and BMW’s capabilities and strengths in vehicle integration to support BMW in creating better digital products and services for its customers. The company has set up R&D centers and solution delivery centers in cities such as Nanjing, Beijing, Shanghai, Guangzhou, Shenzhen, Wuhan, Xi’an, Chengdu, Taiyuan, Taipei, and Dongguan, while also having overseas resource centers in the United States, Japan, and India to serve global clients.

Figure: Chinasoft International R&D Center and Subsidiary Distribution

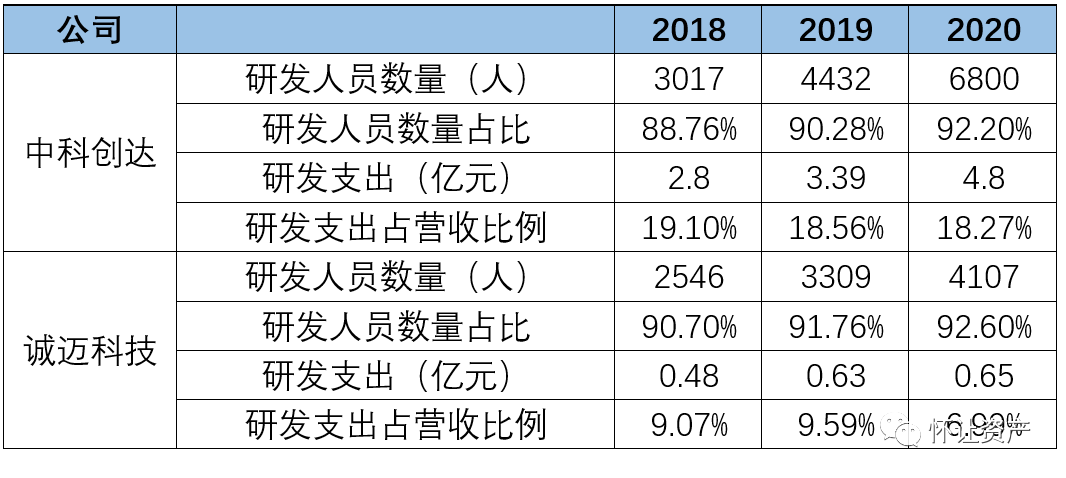

3. R&D Investment

Figure: Company R&D Personnel and Investment

It can be seen that ThunderSoft’s R&D expenditure and the proportion of R&D expenditure to revenue far exceed those of Chinasoft International, and the company’s continuous increase in R&D expenditure has led to continuous revenue growth, placing the company in a virtuous cycle.

ThunderSoft’s chairman Zhao Hongfei holds a master’s degree in computer applications from Beijing Institute of Technology. Before founding ThunderSoft, he served as the deputy general manager of the overseas business department of Beijing Tianqiao Beida Qingniao Technology Co., Ltd., and was an engineer and project manager at NEC-CAS Software Research Institute. The company’s director Zou Pengcheng graduated from Tsinghua University with a degree in automation and served as vice president of Guangzhou Xigemixin Electronic Technology Co., Ltd., manager of the server R&D department at CAS Hongqi Software Technology Co., Ltd., project manager at NEC-CAS Software Research Institute, and software engineer at EPIC in the United States before the establishment of ThunderSoft. The company’s executives have backgrounds in computer software-related education and experience in R&D and management within software enterprises.

Chinasoft International’s chairman Wang Jiping holds a master’s degree and served as a software engineer at a U.S. company before founding Chinasoft International. The company’s director and general manager Liu Bingbing previously worked as a network engineer at Beijing Beilian Morninglight Information System Co., Ltd., senior vice president of Yisuan Technology (Nanjing) Co., Ltd., general manager of Beijing Sinode Technology Co., Ltd., and vice president of Shanghai Weipu Network Technology Co., Ltd. The management team of Chinasoft International also has a technical background and experience in R&D and management within software enterprises.

Summary

The key to the intelligent in-vehicle software industry lies in rich R&D experience, good customer cooperation relationships, and continuous R&D investment. ThunderSoft has accumulated years of software technology for mobile terminal operating systems, maintaining good cooperation with chip manufacturers, smart terminal manufacturers, and automotive manufacturers, with R&D investment significantly exceeding that of its peers. The rapid growth of its intelligent connected vehicle business also confirms the company’s advantages. We believe ThunderSoft is an excellent company in the intelligent in-vehicle software industry, worthy of long-term tracking and attention.