1. The Past: The Emergence and Bottlenecks of Automotive ECU

ECU (Electronic Control Unit) is also known as the “driving computer” of the car. Its purpose is to control the driving state of the vehicle and realize its various functions. It mainly utilizes data collection and exchange from various sensors and buses to determine the vehicle’s status and the driver’s intentions, and to control the car through actuators.

Figure: Bosch 16bit Engine Controller (Mechanical Throttle)

The Core of ECU is the Microprocessor. ECU is a dedicated microcomputer controller for automobiles, similar to ordinary microcontrollers, composed of a microprocessor, memory, input/output interfaces, analog-to-digital converters, and integrated circuits for shaping and driving. The core of the automotive ECU is the microprocessor, which includes MCU, MPU, DSP and logic IC and so on. Leading companies in the ECU field include Bosch, Denso, Continental, Aptiv, and Visteon.

The Scope of ECU Usage is Expanding. In 1993, Audi A8 used 5 ECUs, initially, ECUs were only used to control engine operation. With the advancement of automotive technology today, ECUs have taken on more and more responsibilities, such as anti-lock braking systems, 4-wheel drive systems, active suspension systems, airbag systems, and automatic transmission systems all require separate control systems. An increasing number of ECUs are appearing in cars, and many additional devices added to cars require the management of ECUs. Today, ECUs have become one of the most common components in automobiles, categorized into different types based on functionality. The most common include EMS/TCU/BCM/ESP/VCU, etc.

Figure: Common ECU Applications and Functions in Cars

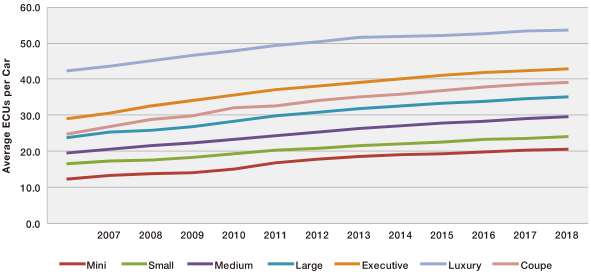

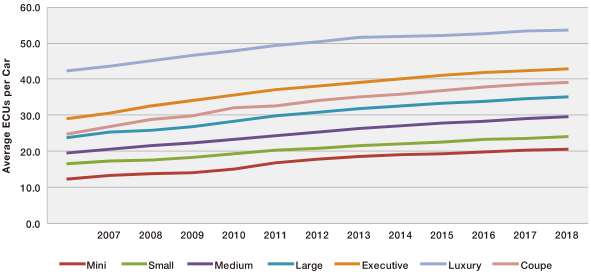

The Number of ECUs is Rapidly Increasing. As the electronicization of vehicles gradually increases, ECUs have taken over the entire car, from traditional engine control systems, airbag systems, anti-lock systems, electric power steering, body electronic stability systems, lighting control, air conditioning, water pumps, oil pumps, instruments, to now widely used tire pressure monitoring systems, keyless entry and start systems, electric seat heating adjustments, and the continuously maturing and emerging advanced driver-assistance systems, matrix headlights, and ambient lights. Additionally, electric vehicles have electric drive control, battery management systems, on-board charging systems, and the thriving in-vehicle gateways, T-BOX, and autonomous driving systems. These applications have driven a significant increase in the number of electronic control units ECUs, with high-end models averaging 50-70 ECUs, and models with relatively complex electronic structures having more than 100 ECUs.

The Number of ECUs is Rapidly Increasing. As the electronicization of vehicles gradually increases, ECUs have taken over the entire car, from traditional engine control systems, airbag systems, anti-lock systems, electric power steering, body electronic stability systems, lighting control, air conditioning, water pumps, oil pumps, instruments, to now widely used tire pressure monitoring systems, keyless entry and start systems, electric seat heating adjustments, and the continuously maturing and emerging advanced driver-assistance systems, matrix headlights, and ambient lights. Additionally, electric vehicles have electric drive control, battery management systems, on-board charging systems, and the thriving in-vehicle gateways, T-BOX, and autonomous driving systems. These applications have driven a significant increase in the number of electronic control units ECUs, with high-end models averaging 50-70 ECUs, and models with relatively complex electronic structures having more than 100 ECUs.

Figure: The Increase in ECUs Across All Levels of Vehicles

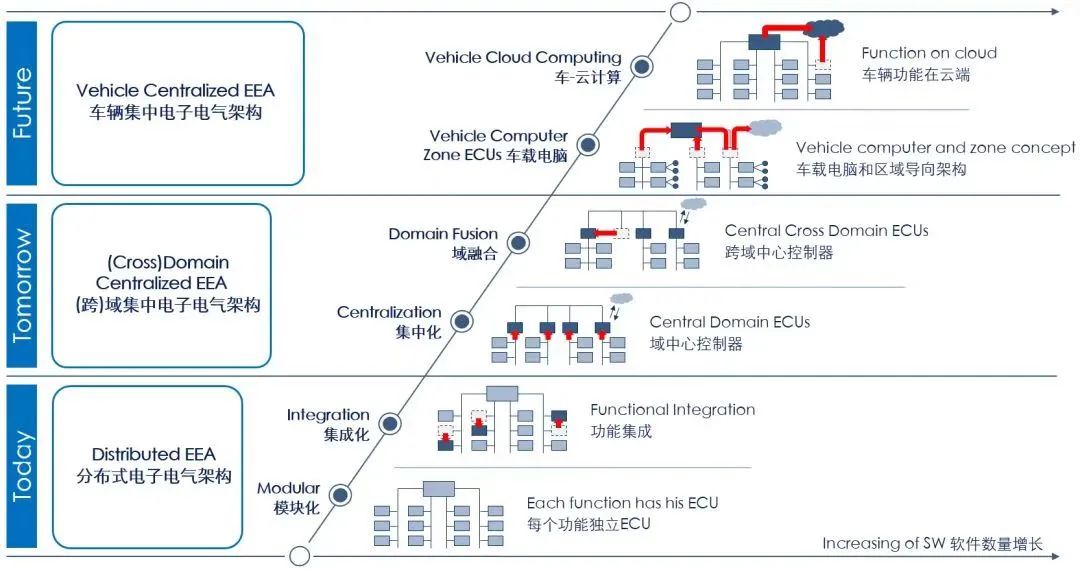

The Increase in ECUs Faces Cost and Technical Bottlenecks, Leading to the Emergence of Domain Controllers. Autonomous driving requires higher computing power and more sensors. The growth of ECUs will eventually reach an explosion point, while traditional automotive electronic and electrical architectures are distributed. Each ECU in the car is connected through the CAN and LIN buses. If this distributed ECU architecture expands without limits, it will face huge challenges on both cost and technology fronts.

Figure: The Evolution of Electronic and Electrical Architecture from Distributed to Centralized

1) Redundant Waste of Computing Power. The computing power of ECUs cannot collaborate and redundantly overlaps, leading to significant waste;

2) Increased Harness Costs. This distributed architecture requires a lot of internal communication, objectively leading to a significant increase in harness costs, while also increasing assembly difficulty.

3) Multi-sensor fusion algorithms require unified processing by domain controllers. In ADAS systems, there are various sensors such as cameras, millimeter-wave radar, and laser radar, generating a large amount of data. Different functions require this data, and each sensor module can preprocess the data and transmit it via on-board Ethernet. To ensure optimal data processing results, it is best for all functional controls to be centralized in one core processor, which creates the demand for domain controllers;

4) Distributed ECUs cannot be uniformly maintained and upgraded. A large number of separate embedded OS and application firmware, provided by different Tier 1 suppliers, with varying languages and programming styles, make it impossible to maintain and perform OTA upgrades uniformly;

5) Distributed ECUs restrict software ecosystem applications. Third-party application developers cannot conveniently program with these hardware, becoming a bottleneck for software definition.

6) The need to ensure automotive safety. With the increase in ECUs, the likelihood of external attacks also increases. Modern cars exchange more data with external sources, and the development of the Internet of Vehicles provides hackers with potential attack opportunities. If the architecture remains distributed, it will not be easy to protect critical systems, such as engine control and braking systems, which belong to power and transmission control. These systems can be isolated into a domain through a central gateway, reducing the likelihood of attacks while enhancing the network security protection of this domain, thus creating demand for domain controllers.

7) The need for platformization and standardization. Compared to distributed architectures, centralized architectures require DCUs to have stronger multicore and greater computing power, while other processors in the domain can reduce performance and resources. Various sensors and actuators can become separate modules, making it easier to achieve standardization of components. DCUs can access signals from different sensors and analyze and process these signals, facilitating the expansion of external sensors, thus better adapting to different development needs and paving the way for platformization.

In summary, as the number of in-vehicle sensors increases, the one-to-one correspondence between sensors and ECUs leads to a decline in overall vehicle performance and a sharp increase in wiring complexity. At the same time, the distributed ECU architecture faces many technical bottlenecks in realizing autonomous driving functions. At this point, DCUs (Domain Controllers) and MDCs (Multi-Domain Controllers) emerge to gradually replace the distributed architecture with a more powerful centralized architecture.

2. The Present: DCUs (Domain Controllers) Take the Stage

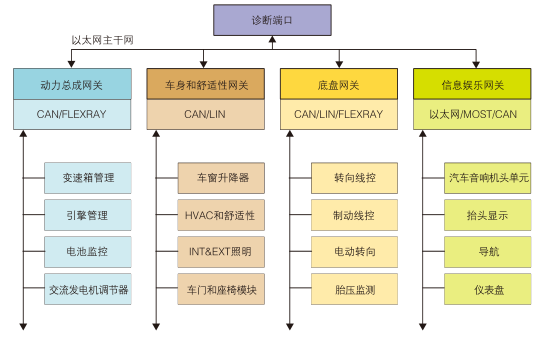

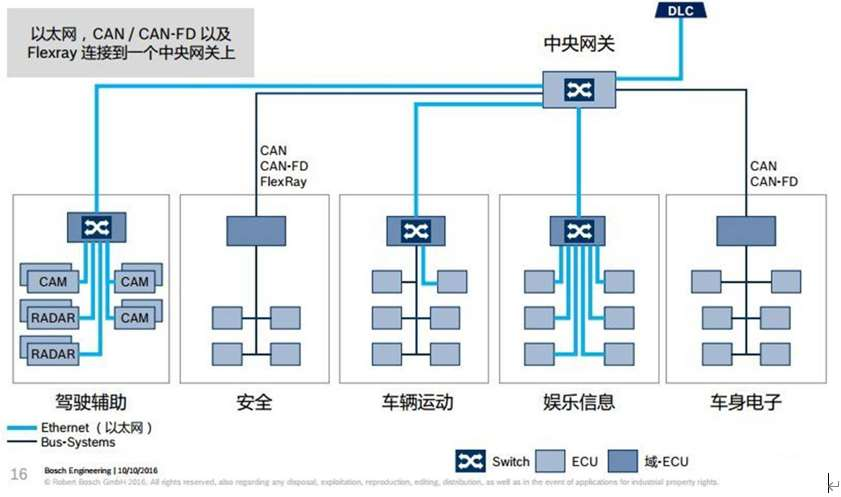

Domain controllers divide the vehicle body into multiple functional modules. The term “domain” refers to dividing the automotive electronic system into several functional blocks based on functionality, with the internal system architecture of each functional block being led by the domain controller. The interconnection of systems within each domain can still use the commonly used CAN and FlexRay communication buses. However, communication between different domains requires a higher-performance Ethernet as the backbone network to undertake information exchange tasks. Different vehicle manufacturers will have their design philosophies regarding the specific division of functional domains; the following figure presents one possible division method.

In each functional domain, the domain controller is at the absolute center, requiring powerful processing power, ultra-high real-time performance, and a large number of communication peripherals.

Figure: On-board Network Divided by Application Domain

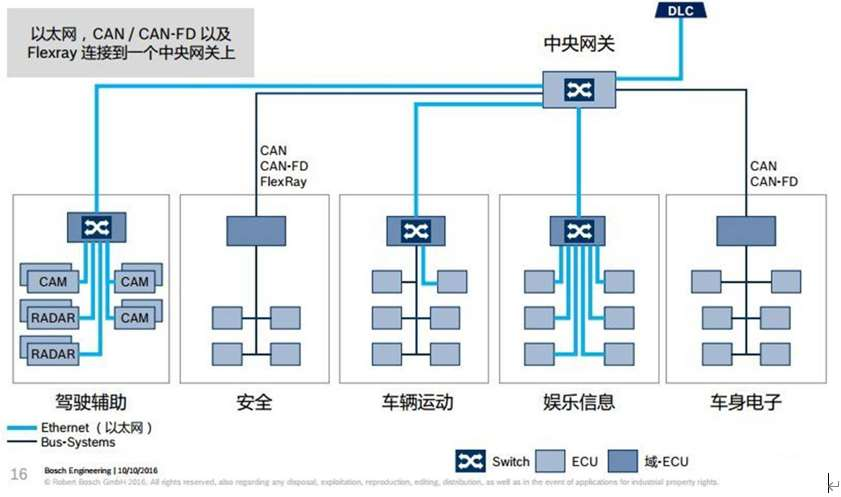

Domain Controller Network Topology is More Centralized. The concept of the Domain Control Unit (DCU) was first proposed by Tier 1 companies such as Bosch, Continental, and Delphi to address information security and ECU bottleneck issues. The entire vehicle is divided into five major domains based on the functions of automotive electronic components: Body & Convenience, Infotainment, Chassis and Safety, Powertrain, and Advanced Driver Assistance Systems (ADAS), with various subdomains under each major domain. Each domain or subdomain has a corresponding domain controller DCU and various ECUs, all of which constitute the network topology of the automotive electronic and electrical architecture. Utilizing more powerful multicore CPU/GPU chips to relatively centralize the control of each domain replaces the current distributed electronic and electrical architecture.

Figure: Bosch DCU Electronic Architecture

Figure: The Increase in ECUs Across All Levels of Vehicles

The Increase in ECUs Faces Cost and Technical Bottlenecks, Leading to the Emergence of Domain Controllers. Autonomous driving requires higher computing power and more sensors. The growth of ECUs will eventually reach an explosion point, while traditional automotive electronic and electrical architectures are distributed. Each ECU in the car is connected through the CAN and LIN buses. If this distributed ECU architecture expands without limits, it will face huge challenges on both cost and technology fronts.

Figure: The Evolution of Electronic and Electrical Architecture from Distributed to Centralized

1) Redundant Waste of Computing Power. The computing power of ECUs cannot collaborate and redundantly overlaps, leading to significant waste;

2) Increased Harness Costs. This distributed architecture requires a lot of internal communication, objectively leading to a significant increase in harness costs, while also increasing assembly difficulty.

3) Multi-sensor fusion algorithms require unified processing by domain controllers. In ADAS systems, there are various sensors such as cameras, millimeter-wave radar, and laser radar, generating a large amount of data. Different functions require this data, and each sensor module can preprocess the data and transmit it via on-board Ethernet. To ensure optimal data processing results, it is best for all functional controls to be centralized in one core processor, which creates the demand for domain controllers;

4) Distributed ECUs cannot be uniformly maintained and upgraded. A large number of separate embedded OS and application firmware, provided by different Tier 1 suppliers, with varying languages and programming styles, make it impossible to maintain and perform OTA upgrades uniformly;

5) Distributed ECUs restrict software ecosystem applications. Third-party application developers cannot conveniently program with these hardware, becoming a bottleneck for software definition.

6) The need to ensure automotive safety. With the increase in ECUs, the likelihood of external attacks also increases. Modern cars exchange more data with external sources, and the development of the Internet of Vehicles provides hackers with potential attack opportunities. If the architecture remains distributed, it will not be easy to protect critical systems, such as engine control and braking systems, which belong to power and transmission control. These systems can be isolated into a domain through a central gateway, reducing the likelihood of attacks while enhancing the network security protection of this domain, thus creating demand for domain controllers.

7) The need for platformization and standardization. Compared to distributed architectures, centralized architectures require DCUs to have stronger multicore and greater computing power, while other processors in the domain can reduce performance and resources. Various sensors and actuators can become separate modules, making it easier to achieve standardization of components. DCUs can access signals from different sensors and analyze and process these signals, facilitating the expansion of external sensors, thus better adapting to different development needs and paving the way for platformization.

In summary, as the number of in-vehicle sensors increases, the one-to-one correspondence between sensors and ECUs leads to a decline in overall vehicle performance and a sharp increase in wiring complexity. At the same time, the distributed ECU architecture faces many technical bottlenecks in realizing autonomous driving functions. At this point, DCUs (Domain Controllers) and MDCs (Multi-Domain Controllers) emerge to gradually replace the distributed architecture with a more powerful centralized architecture.

2. The Present: DCUs (Domain Controllers) Take the Stage

Domain controllers divide the vehicle body into multiple functional modules. The term “domain” refers to dividing the automotive electronic system into several functional blocks based on functionality, with the internal system architecture of each functional block being led by the domain controller. The interconnection of systems within each domain can still use the commonly used CAN and FlexRay communication buses. However, communication between different domains requires a higher-performance Ethernet as the backbone network to undertake information exchange tasks. Different vehicle manufacturers will have their design philosophies regarding the specific division of functional domains; the following figure presents one possible division method.

In each functional domain, the domain controller is at the absolute center, requiring powerful processing power, ultra-high real-time performance, and a large number of communication peripherals.

Figure: On-board Network Divided by Application Domain

Domain Controller Network Topology is More Centralized. The concept of the Domain Control Unit (DCU) was first proposed by Tier 1 companies such as Bosch, Continental, and Delphi to address information security and ECU bottleneck issues. The entire vehicle is divided into five major domains based on the functions of automotive electronic components: Body & Convenience, Infotainment, Chassis and Safety, Powertrain, and Advanced Driver Assistance Systems (ADAS), with various subdomains under each major domain. Each domain or subdomain has a corresponding domain controller DCU and various ECUs, all of which constitute the network topology of the automotive electronic and electrical architecture. Utilizing more powerful multicore CPU/GPU chips to relatively centralize the control of each domain replaces the current distributed electronic and electrical architecture.

Figure: Bosch DCU Electronic Architecture

Domain Controllers Reduce the Functional Complexity of Original Distributed ECUs. Domain controllers, due to their powerful hardware computing capabilities and rich software interface support, allow more core functional modules to be centralized within the domain controller, greatly improving system function integration. This reduces the hardware requirements for perception and execution functions. However, the emergence of domain controllers does not mean the massive disappearance of underlying hardware ECUs; many ECUs’ functions will be weakened (software and processing functions downgraded, execution-level functions retained), and most sensors can directly transmit data to the domain controller or preprocess data before sending it to the domain controller. Many complex calculations can be performed in the domain controller, and even most control functions can be completed in the domain controller, meaning that original ECUs only need to execute commands from the domain controller. In other words, peripheral components focus only on their basic functions, while the central domain controller focuses on system-level function realization. Furthermore, the standardization of data interaction interfaces will make these components standard parts, thus reducing the development/manufacturing costs of these components.

3. Industry Chain Analysis of Domain Controllers

The core of automotive electronic controller hardware lies in microcontrollers (MCUs), MCU = CPU + storage + interface units, where CPU is a category of chips.

From the production process perspective, the automotive electronic controller industry chain mainly goes through: wafer production, (chip) packaging testing, and system applications (MCUs and various controllers). The raw material for wafers is silicon, which is purified, melted, injected with seed crystals, drawn into single crystal silicon rods, and then cut, ground, sliced, beveled, polished, laser etched, and packaged, becoming the basic raw material for integrated circuit factories—silicon wafers, which are the raw materials for chip manufacturing. After receiving the wafers, chip factories use chemical and circuit photolithography techniques to etch transistors onto the silicon wafers. After etching, individual chips are cut from the wafer and undergo packaging testing, completing the chip manufacturing process. They are then sent to downstream controller manufacturing plants for SMT production lines to perform PCBA (Printed Circuit Board Assembly). Various chips are mounted onto the circuit board, and finally, housing assembly is completed.

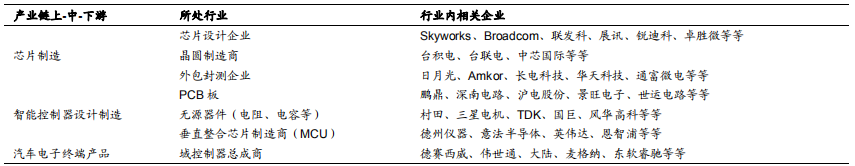

In summary, the upstream of the automotive electronic controller (DCU/ECU, etc.) industry chain is chip manufacturing (chip design – wafer production – packaging testing), the midstream is intelligent controller design and manufacturing (SMT placement, integration of passive components and PCB boards), and the downstream is automotive electronic terminal products (embedded code). The industry chain enterprises from top to bottom include chip designers, wafer manufacturers, outsourced packaging testing companies, vertically integrated chip manufacturers, passive components, circuit boards (PCBs), MCU manufacturers, and domain controller manufacturers.

Figure: Overview of the Domain Controller Industry Chain

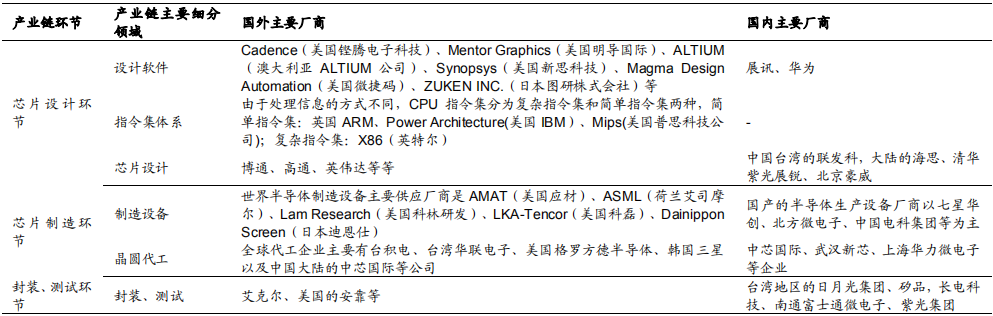

The chips upstream of the domain controller directly reflect the technology applications and product performance. Domestically, there has been some accumulation in wafer foundry and packaging testing, but there is still a gap in chip design, which is precisely where the gap between domestic and foreign automotive controllers lies.

Figure: Chip Industry Chain and Major Manufacturers Overview

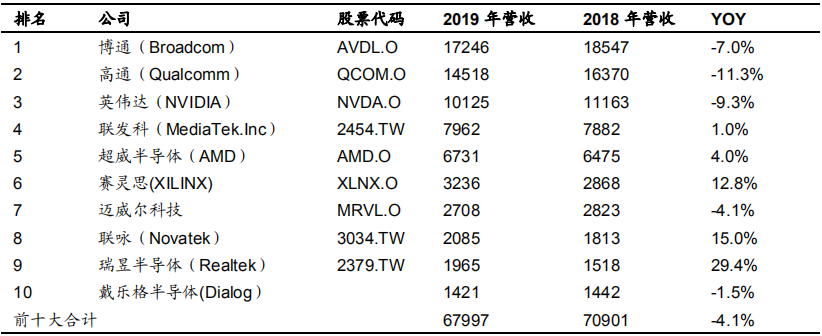

Figure: The Top Ten Global IC Design Companies in 2019 (Unit: Million USD)

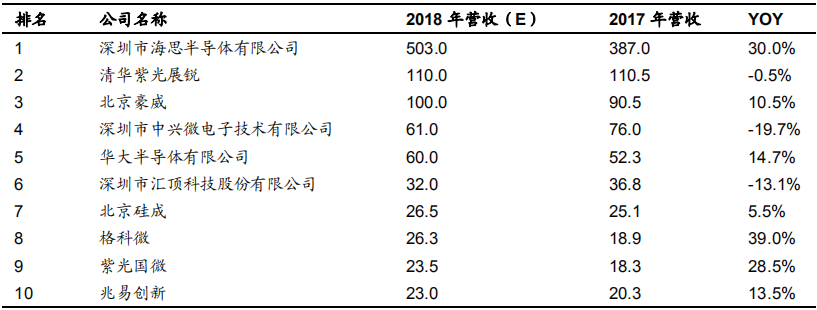

Figure: The Top Ten Domestic IC Design Manufacturers in 2018 (Unit: Billion RMB)

(2) Midstream MCU (Microcontroller) Side, PCB Side, Passive Component Side

MCU (Microcontroller) Side: The midstream link of the domain controller mainly involves microcontroller units (MCUs), also known as single-chip microcomputers or microcontrollers. These are designed to appropriately reduce the frequency and specifications of CPUs (central processing units) and integrate memory, counters, USB, A/D conversion, UART, PLC, DMA, and other peripheral interfaces, even LCD driver circuits, into a single chip, forming a chip-level computer for various application scenarios with different combination controls. MCUs can be viewed as small controllers, and most ECUs are designed based on multiple MCUs and PCBs for more complex control functions.

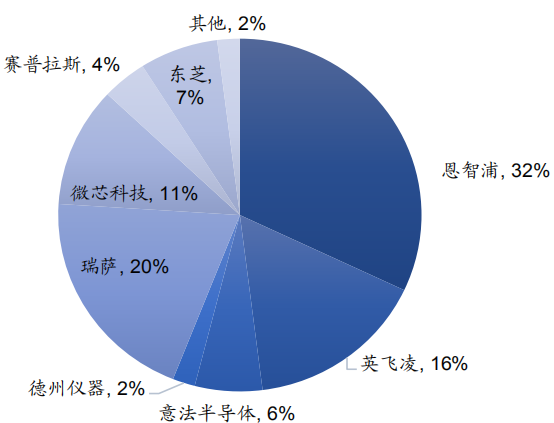

Figure: The Competitive Landscape of the Chinese Automotive Electronics Market for MCUs in 2017

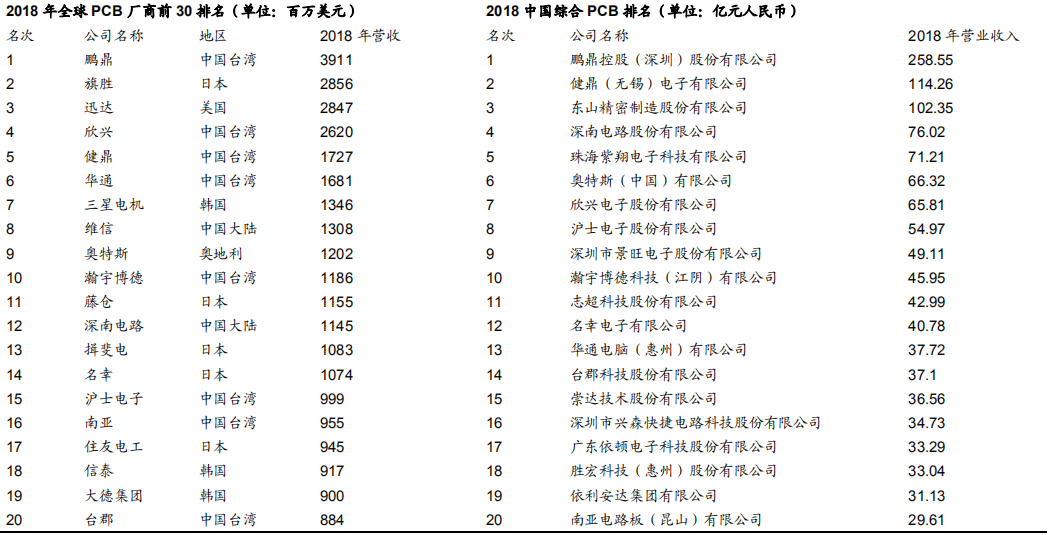

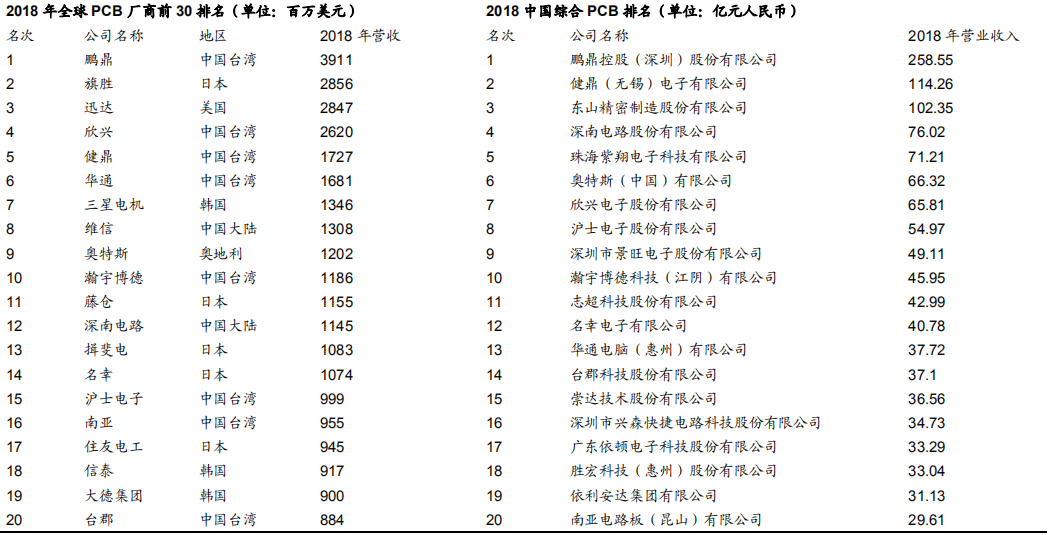

PCB Side: PCB (Printed Circuit Board) is the carrier for the electrical connections of components inside automotive controllers, mainly made of copper-clad laminate, which currently has a high localization rate, with Chinese PCB manufacturers occupying an important position globally.

Figure: The Top 20 PCB Manufacturers Globally/Domestically

Domain Controllers Reduce the Functional Complexity of Original Distributed ECUs. Domain controllers, due to their powerful hardware computing capabilities and rich software interface support, allow more core functional modules to be centralized within the domain controller, greatly improving system function integration. This reduces the hardware requirements for perception and execution functions. However, the emergence of domain controllers does not mean the massive disappearance of underlying hardware ECUs; many ECUs’ functions will be weakened (software and processing functions downgraded, execution-level functions retained), and most sensors can directly transmit data to the domain controller or preprocess data before sending it to the domain controller. Many complex calculations can be performed in the domain controller, and even most control functions can be completed in the domain controller, meaning that original ECUs only need to execute commands from the domain controller. In other words, peripheral components focus only on their basic functions, while the central domain controller focuses on system-level function realization. Furthermore, the standardization of data interaction interfaces will make these components standard parts, thus reducing the development/manufacturing costs of these components.

3. Industry Chain Analysis of Domain Controllers

The core of automotive electronic controller hardware lies in microcontrollers (MCUs), MCU = CPU + storage + interface units, where CPU is a category of chips.

From the production process perspective, the automotive electronic controller industry chain mainly goes through: wafer production, (chip) packaging testing, and system applications (MCUs and various controllers). The raw material for wafers is silicon, which is purified, melted, injected with seed crystals, drawn into single crystal silicon rods, and then cut, ground, sliced, beveled, polished, laser etched, and packaged, becoming the basic raw material for integrated circuit factories—silicon wafers, which are the raw materials for chip manufacturing. After receiving the wafers, chip factories use chemical and circuit photolithography techniques to etch transistors onto the silicon wafers. After etching, individual chips are cut from the wafer and undergo packaging testing, completing the chip manufacturing process. They are then sent to downstream controller manufacturing plants for SMT production lines to perform PCBA (Printed Circuit Board Assembly). Various chips are mounted onto the circuit board, and finally, housing assembly is completed.

In summary, the upstream of the automotive electronic controller (DCU/ECU, etc.) industry chain is chip manufacturing (chip design – wafer production – packaging testing), the midstream is intelligent controller design and manufacturing (SMT placement, integration of passive components and PCB boards), and the downstream is automotive electronic terminal products (embedded code). The industry chain enterprises from top to bottom include chip designers, wafer manufacturers, outsourced packaging testing companies, vertically integrated chip manufacturers, passive components, circuit boards (PCBs), MCU manufacturers, and domain controller manufacturers.

Figure: Overview of the Domain Controller Industry Chain

The chips upstream of the domain controller directly reflect the technology applications and product performance. Domestically, there has been some accumulation in wafer foundry and packaging testing, but there is still a gap in chip design, which is precisely where the gap between domestic and foreign automotive controllers lies.

Figure: Chip Industry Chain and Major Manufacturers Overview

Figure: The Top Ten Global IC Design Companies in 2019 (Unit: Million USD)

Figure: The Top Ten Domestic IC Design Manufacturers in 2018 (Unit: Billion RMB)

(2) Midstream MCU (Microcontroller) Side, PCB Side, Passive Component Side

MCU (Microcontroller) Side: The midstream link of the domain controller mainly involves microcontroller units (MCUs), also known as single-chip microcomputers or microcontrollers. These are designed to appropriately reduce the frequency and specifications of CPUs (central processing units) and integrate memory, counters, USB, A/D conversion, UART, PLC, DMA, and other peripheral interfaces, even LCD driver circuits, into a single chip, forming a chip-level computer for various application scenarios with different combination controls. MCUs can be viewed as small controllers, and most ECUs are designed based on multiple MCUs and PCBs for more complex control functions.

Figure: The Competitive Landscape of the Chinese Automotive Electronics Market for MCUs in 2017

PCB Side: PCB (Printed Circuit Board) is the carrier for the electrical connections of components inside automotive controllers, mainly made of copper-clad laminate, which currently has a high localization rate, with Chinese PCB manufacturers occupying an important position globally.

Figure: The Top 20 PCB Manufacturers Globally/Domestically

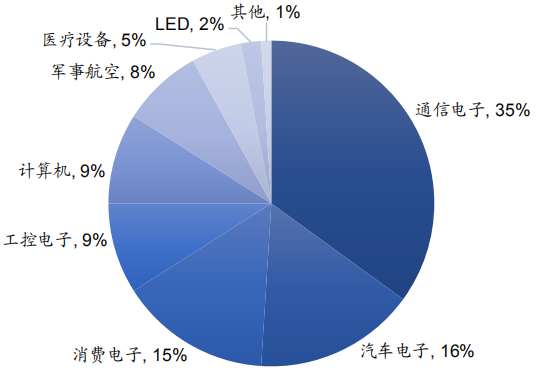

Automotive PCBs are an important application in the PCB industry. In 2017, the three most downstream applications of the Chinese PCB market were communication electronics, automotive electronics, and consumer electronics, accounting for 35%, 16%, and 15% of the application proportions, respectively. The electrification, intelligence, and connectivity of vehicles will accelerate the electronicization of automobiles. Prismark forecasts that from 2018 to 2023, the average annual growth rate of the most important ADAS in automotive intelligence will be 17%. According to the N.T. Information report, the global automotive electronics output value in 2017 was approximately 195 billion USD, with the automotive electronics value per vehicle estimated to account for 30%, projected to increase to 50% by 2030. The continuous deepening of automotive electronicization will increase demand for high thermal dissipation, high multi-layer, and high-density PCBs.

Figure: Distribution of Downstream Applications in the Chinese PCB Market

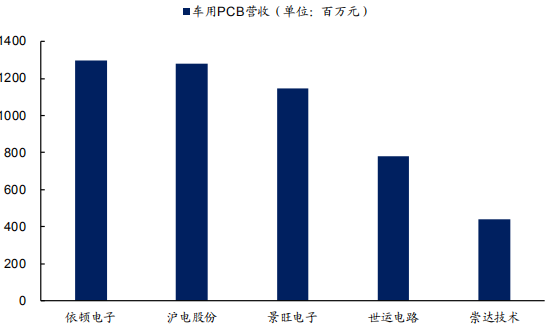

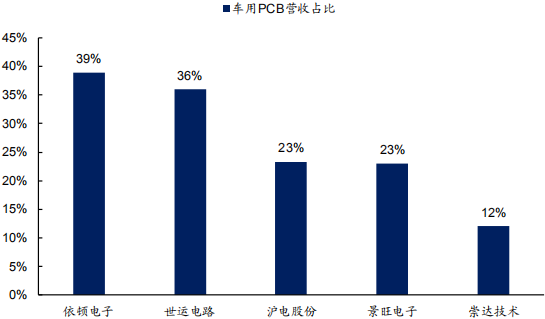

Among the core domestic PCB manufacturers, those with a high proportion of automotive business include Yidun Electronics, Hude Electronics, Jingwang Electronics, Shiyun Circuit, and Chongda Technology, with automotive PCB business proportions reaching 39%, 36%, 23%, 23%, and 12%, respectively.

Figure: Revenue of Major Domestic PCB Manufacturers in Automotive Business

Figure: Revenue Proportions of Major Domestic PCB Manufacturers in Automotive Business

Downstream customers include major international Tier 1 companies such as Valeo, Delphi, Bosch, Continental, Koito, and international automakers such as Tesla.

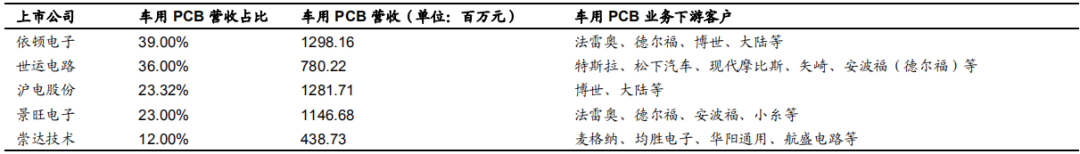

Figure: Overview of Major Domestic PCB Manufacturers in Automotive Business

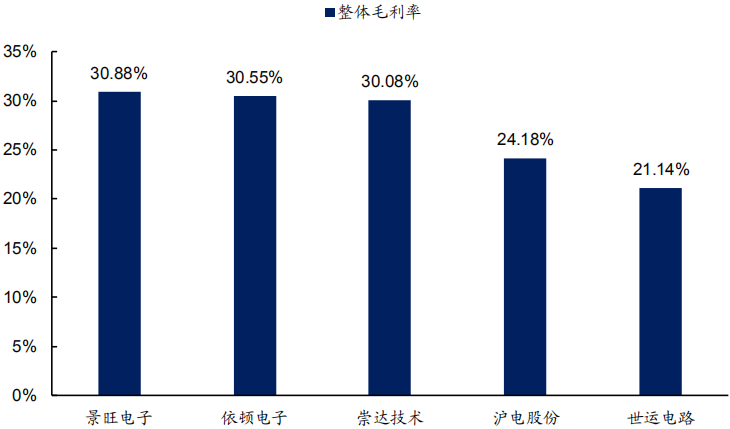

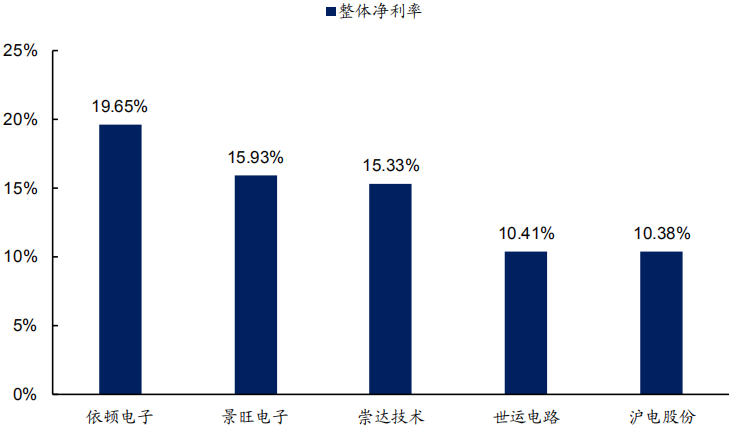

In terms of profitability, Jingwang Electronics, Yidun Electronics, and Chongda Technology are relatively advanced among PCB companies, with overall gross margins above 30% and overall net margins above 15%.

Figure: Comparison of Overall Gross Margins of Major Domestic Automotive PCB Manufacturers

Figure: Comparison of Overall Net Margins of Major Domestic Automotive PCB Manufacturers

Passive Component Side: Passive components are divided into RCL and RF components, with RCL accounting for about 90% of passive components. Among RCL, capacitors, resistors, and inductors are the three main types. The primary functions of capacitors are bypassing, decoupling, filtering, and energy storage, accounting for about 66% of the output value of passive components; inductors mainly serve filtering, current stabilization, and electromagnetic interference resistance, accounting for about 14%; resistors mainly function in voltage division, current division, filtering, and impedance matching, accounting for about 9%.

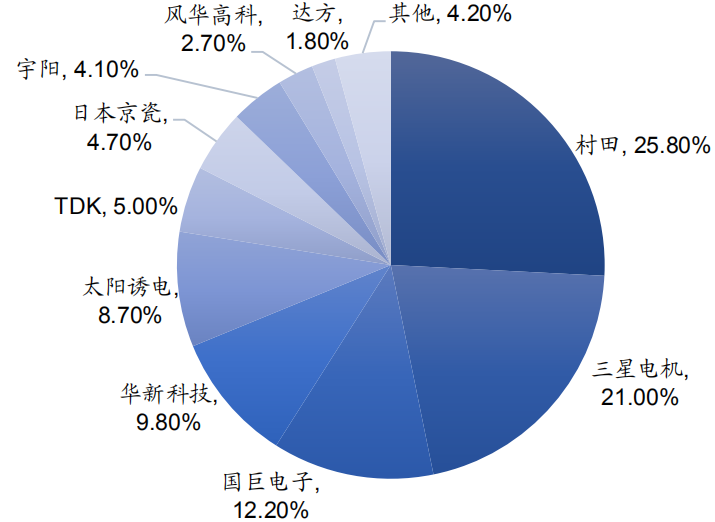

Capacitors mainly include ceramic capacitors, aluminum electrolytic, tantalum electrolytic, and film capacitors, among which ceramic capacitors can achieve smaller sizes, wider voltage ranges, and lower prices, accounting for about 50% of the entire capacitor field. Among ceramic capacitors, MLCC (Multi-layer Ceramic Capacitors) dominate (accounting for over 90%). Global MLCC manufacturers include Japan’s Murata Manufacturing, South Korea’s Samsung Electro-Mechanics, Taiwan’s Yageo, Japan’s TDK, etc.; in mainland China, MLCC manufacturers mainly include Fenghua Advanced Technology, Torch Electronics, Sanhuan Group, Yuyang, and Hongyuan Electronics.

Figure: The Competitive Landscape of Global MLCC Brands in 2017

(3) Downstream Domain Controller Assembly Side

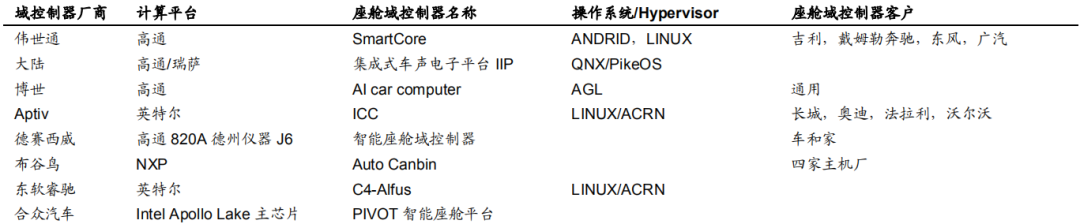

Leading enterprises in domain controller assembly mainly include Bosch, Denso, Continental, TTTech, Aptiv, and Visteon, among international Tier 1 giants. Among them, the Austrian company TTTech has deep cooperation with Audi A8 and SAIC on autonomous driving domain controllers, and Visteon’s cabin domain controller has already been assembled and mass-produced in companies like Geely and Mercedes-Benz. In China, parts companies represented by Desay SV have also established supporting relationships with some new car-making forces (such as Chehejia and Xpeng Motors) in recent years, while other domain controller layout companies include Huawei, Neusoft Ruichi, Hozon Auto, Cuckoo, Baidu, Huanyu Zhixing, Zhixing Technology, Haigao Automotive, Lingmu Technology, etc.

Figure: Typical Cabin Domain Controller Manufacturers and Their Solutions and Clients

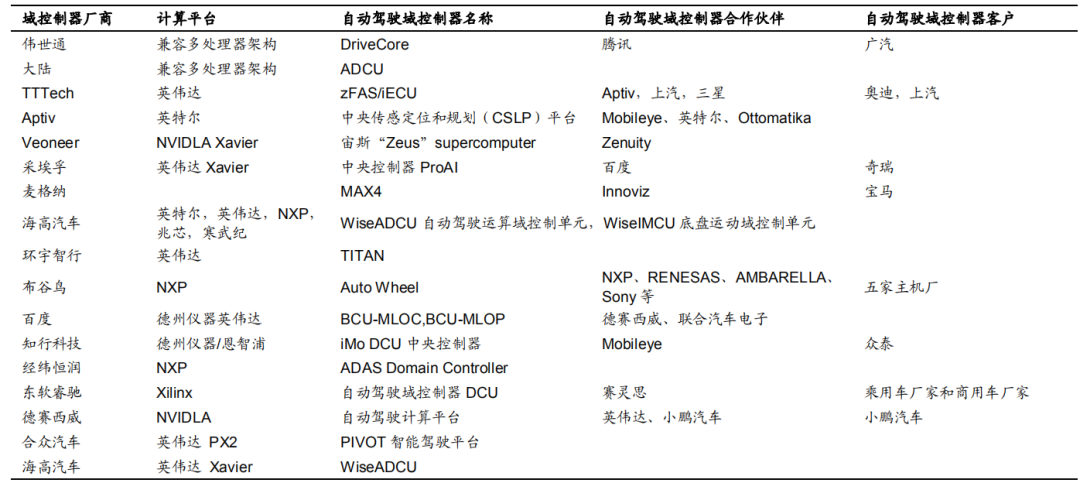

In the field of autonomous driving domain controllers, it is expected that in the future, Tier 1 and vehicle manufacturers will adopt two cooperation methods.

First, Tier 1 is responsible for the intermediate layer and hardware production, while vehicle manufacturers are responsible for the autonomous driving software part. The advantage of Tier 1 is to produce products at reasonable costs and accelerate product landing. Therefore, the cooperation between vehicle manufacturers and Tier 1 for production is inevitable, where the former is responsible for the autonomous driving software part and the latter is responsible for hardware production, intermediate layers, and chip solution integration, such as Desay SV’s IPU03S.

Second, Tier 1 collaborates with chip manufacturers to develop central domain controllers after solution integration and sells them to vehicle manufacturers, such as Continental’s ADCU, ZF’s ProAI, and Magna’s MAX4.

Figure: Typical Autonomous Driving Domain Controller Manufacturers and Their Clients and Partners

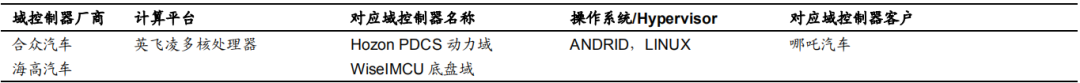

Figure: Power Domain, Chassis Domain Manufacturers and Their Solutions and Clients

Software Algorithms Are Another Core of Automotive Electronic Controllers.

Automotive software systems include two main parts: system software and application software. System software includes operating systems and a series of utility programs, generally provided by processor chip manufacturers. Application software includes data acquisition and process monitoring modules, data processing modules, control algorithm modules, actuator control modules, and fault self-diagnosis modules. As automotive intelligence continues to improve, software systems are becoming increasingly complex, with the total number of lines of automotive software code exceeding 10 million. The value of software is continuously rising, with development costs accounting for more than half of the total costs of automotive electronic systems, highlighting its importance.

Automotive PCBs are an important application in the PCB industry. In 2017, the three most downstream applications of the Chinese PCB market were communication electronics, automotive electronics, and consumer electronics, accounting for 35%, 16%, and 15% of the application proportions, respectively. The electrification, intelligence, and connectivity of vehicles will accelerate the electronicization of automobiles. Prismark forecasts that from 2018 to 2023, the average annual growth rate of the most important ADAS in automotive intelligence will be 17%. According to the N.T. Information report, the global automotive electronics output value in 2017 was approximately 195 billion USD, with the automotive electronics value per vehicle estimated to account for 30%, projected to increase to 50% by 2030. The continuous deepening of automotive electronicization will increase demand for high thermal dissipation, high multi-layer, and high-density PCBs.

Figure: Distribution of Downstream Applications in the Chinese PCB Market

Among the core domestic PCB manufacturers, those with a high proportion of automotive business include Yidun Electronics, Hude Electronics, Jingwang Electronics, Shiyun Circuit, and Chongda Technology, with automotive PCB business proportions reaching 39%, 36%, 23%, 23%, and 12%, respectively.

Figure: Revenue of Major Domestic PCB Manufacturers in Automotive Business

Figure: Revenue Proportions of Major Domestic PCB Manufacturers in Automotive Business

Downstream customers include major international Tier 1 companies such as Valeo, Delphi, Bosch, Continental, Koito, and international automakers such as Tesla.

Figure: Overview of Major Domestic PCB Manufacturers in Automotive Business

In terms of profitability, Jingwang Electronics, Yidun Electronics, and Chongda Technology are relatively advanced among PCB companies, with overall gross margins above 30% and overall net margins above 15%.

Figure: Comparison of Overall Gross Margins of Major Domestic Automotive PCB Manufacturers

Figure: Comparison of Overall Net Margins of Major Domestic Automotive PCB Manufacturers

Passive Component Side: Passive components are divided into RCL and RF components, with RCL accounting for about 90% of passive components. Among RCL, capacitors, resistors, and inductors are the three main types. The primary functions of capacitors are bypassing, decoupling, filtering, and energy storage, accounting for about 66% of the output value of passive components; inductors mainly serve filtering, current stabilization, and electromagnetic interference resistance, accounting for about 14%; resistors mainly function in voltage division, current division, filtering, and impedance matching, accounting for about 9%.

Capacitors mainly include ceramic capacitors, aluminum electrolytic, tantalum electrolytic, and film capacitors, among which ceramic capacitors can achieve smaller sizes, wider voltage ranges, and lower prices, accounting for about 50% of the entire capacitor field. Among ceramic capacitors, MLCC (Multi-layer Ceramic Capacitors) dominate (accounting for over 90%). Global MLCC manufacturers include Japan’s Murata Manufacturing, South Korea’s Samsung Electro-Mechanics, Taiwan’s Yageo, Japan’s TDK, etc.; in mainland China, MLCC manufacturers mainly include Fenghua Advanced Technology, Torch Electronics, Sanhuan Group, Yuyang, and Hongyuan Electronics.

Figure: The Competitive Landscape of Global MLCC Brands in 2017

(3) Downstream Domain Controller Assembly Side

Leading enterprises in domain controller assembly mainly include Bosch, Denso, Continental, TTTech, Aptiv, and Visteon, among international Tier 1 giants. Among them, the Austrian company TTTech has deep cooperation with Audi A8 and SAIC on autonomous driving domain controllers, and Visteon’s cabin domain controller has already been assembled and mass-produced in companies like Geely and Mercedes-Benz. In China, parts companies represented by Desay SV have also established supporting relationships with some new car-making forces (such as Chehejia and Xpeng Motors) in recent years, while other domain controller layout companies include Huawei, Neusoft Ruichi, Hozon Auto, Cuckoo, Baidu, Huanyu Zhixing, Zhixing Technology, Haigao Automotive, Lingmu Technology, etc.

Figure: Typical Cabin Domain Controller Manufacturers and Their Solutions and Clients

In the field of autonomous driving domain controllers, it is expected that in the future, Tier 1 and vehicle manufacturers will adopt two cooperation methods.

First, Tier 1 is responsible for the intermediate layer and hardware production, while vehicle manufacturers are responsible for the autonomous driving software part. The advantage of Tier 1 is to produce products at reasonable costs and accelerate product landing. Therefore, the cooperation between vehicle manufacturers and Tier 1 for production is inevitable, where the former is responsible for the autonomous driving software part and the latter is responsible for hardware production, intermediate layers, and chip solution integration, such as Desay SV’s IPU03S.

Second, Tier 1 collaborates with chip manufacturers to develop central domain controllers after solution integration and sells them to vehicle manufacturers, such as Continental’s ADCU, ZF’s ProAI, and Magna’s MAX4.

Figure: Typical Autonomous Driving Domain Controller Manufacturers and Their Clients and Partners

Figure: Power Domain, Chassis Domain Manufacturers and Their Solutions and Clients

Software Algorithms Are Another Core of Automotive Electronic Controllers.

Automotive software systems include two main parts: system software and application software. System software includes operating systems and a series of utility programs, generally provided by processor chip manufacturers. Application software includes data acquisition and process monitoring modules, data processing modules, control algorithm modules, actuator control modules, and fault self-diagnosis modules. As automotive intelligence continues to improve, software systems are becoming increasingly complex, with the total number of lines of automotive software code exceeding 10 million. The value of software is continuously rising, with development costs accounting for more than half of the total costs of automotive electronic systems, highlighting its importance.

Business Cooperation WeChat: 18008462630. There are dozens of groups in the automotive industry, including complete vehicles, key components, new energy vehicles, intelligent connected vehicles, aftermarket, automotive investment, autonomous driving, and the Internet of Vehicles. To join the group, please scan the administrator’s WeChat (please specify your company name). There is also a group for startup financing, and angel round and A-round companies are welcome to join;