Author: IoT Queen (Peng Zhao)

IoT Think Tank Original

Reprint must indicate source and origin

—— [Introduction] ——

The implementation paths of three IIoT platforms: Tmall model, Taobao model, and JD model, how should one choose?

| IoT Queen Column | This is the 58th article written.

Recently, I heard that JD is also going to create an industrial IoT (IIoT) platform. Although it’s not surprising, I still find it unexpected. Good food is never late, but it’s bad to remain stagnant, of course, the latter part is my addition. In recent years, with the rising concept of industrial IoT, IIoT platforms have entered a period of full explosion. There are at least dozens of IIoT platforms in China, if not hundreds, with some being grounded, some boasting, and even more just muddling through. To find a feasible implementation path amidst this noise is urgent. This article is born to analyze this question.

At the beginning of the topic, let’s review the definition of industrial IoT — an IIoT platform is a service system built to meet the digital, networked, and intelligent needs of the manufacturing industry, based on massive data collection, aggregation, and analysis, supporting ubiquitous connection, flexible supply, and efficient allocation of manufacturing resources in an industrial cloud platform.

Many well-known companies have launched their industrial IoT platforms, such as Siemens MindSphere, GE Predix, ABB Ability, Schneider EcoStruxure, RootCloud, Fanuc FIELD system, HiasCloud, Haier COSMO, Aerospace Cloud Network INDICS, PTC Thingworx, Microsoft Azure IoT, Huawei OceanConnect, Alibaba Cloud Link… With so many well-known companies launching their own industrial IoT platforms, how do they compare in terms of implementation paths on this key issue? We summarize and organize to look at several mainstream models:

Model One

From my observation, the implementation paths of most IIoT platforms are highly uniform, which is to start from the leading enterprises in vertical industries, following the principle of “eating the cream first when having cake”. Although the number of these leading manufacturing enterprises is limited, they have a high degree of automation, excellent personnel quality, and data collection is easier, making it easier to get hands-on with the IIoT platform.

Positive thinking naturally attracts a group of players. It is steady and pragmatic, focusing on the current incompleteness of the industrial IoT ecosystem. The IIoT platform first expands the market based on its own sales force, adopting traditional sales models starting from large consulting projects, directly building vertical industry SaaS, promoting IIoT platform implementation, and hoping for a demonstration effect from top (leading enterprises) to bottom (small and medium enterprises).

To better illustrate and understand this model, I temporarily compare the industrial IoT platform to an e-commerce platform and call this model the Tmall model. We all know that if Taobao is likened to a flea market where small vendors sell goods, then Tmall is a shiny shopping center with beautifully decorated stores and well-trained customer service staff.

Moreover, Taobao’s customers are mostly fighting alone, budgeting carefully, unwilling to pay fees and commissions, lacking a mutual benefit awareness of the “platform.” In contrast, the big brands on Tmall consider paying commissions and fulfilling orders as normal processes, and they can accept a payment ratio of about 5%, providing a stable cash flow. Therefore, the Tmall model IIoT platform can easily accumulate certain practical cases in the early stages, establish a good value demonstration, and create positive cash flow.

But does it have no potential problems? Actually…

-

Leading enterprises like to customize “stores” on Tmall, and after completing a single IIoT platform project, they have high requirements for horizontal scalability.

-

Water can also overturn the boat: leading enterprises accumulate experience and technical strength while relying on the platform to achieve IIoT, and when they have both scale and strength, the hidden dangers of flying solo to build their own platforms cannot be ignored.

-

Small and medium-sized enterprises can recognize the actual value of the “Tmall store” in the IIoT platform from leading enterprises, but there are many breakpoints in this logic.

Model Two

The model corresponding to the Tmall model is the Taobao model, and some IIoT platforms are advancing their business implementation along this path. The reasoning for adopting the Taobao model is very sufficient; it’s very difficult to increase the production efficiency of leading enterprises from 99% to 99.5%, but if we reduce the costs of small and medium-sized enterprises from 98% to 95%, it’s relatively easier, and multiplied by the absolute large long-tail base of small and medium-sized enterprises, such a huge IIoT platform value is enough to attract attention.

As the creator of the Taobao model, Jack Ma said back then: “Foreign e-commerce sites follow big companies, big companies are whales, while in Asian business, small shrimp dominate, so we follow the small shrimp. Catching shrimp is easy, but if you want to catch a whale, you might get hurt.”

However, the IIoT Taobao model is much more arduous than the Tmall model because it is almost impossible to reach a large number of long-tail small and medium-sized enterprises through its own sales team, and the Taobao model does not allow direct engagement in vertical industry SaaS; it must first cultivate the IIoT ecosystem steadily, gathering a certain number of system integrators or solution providers to truly empower the small and medium-sized enterprise group.

Due to the price sensitivity of small and medium-sized enterprises, the IIoT platform in the early stage finds it hard to make a profit, and high profits are “far away.” The low-price or even free model will last for a long time, requiring enough money to keep it alive. History always repeats itself; to simulate the future of the IIoT platform, as a technology “archaeology” enthusiast, how can I not insert a piece of “cultural relic” here?

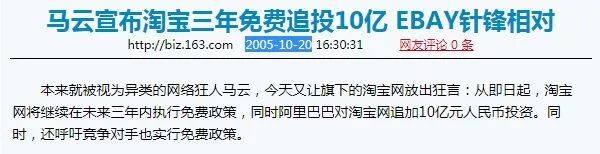

Do you remember the battle between Taobao and eBay back in the day? In 2005, Jack Ma announced in a “provocative” manner that Taobao would continue to be free for three years and called on eBay not to charge Chinese consumers. “We call on eBay to do things suitable for the development stage of Chinese e-commerce, not to charge Chinese users,” said Jack Ma. “eBay cannot just lower the fee rate; now it should allow all consumers and entrepreneurs to afford their services.”

The trick of the Taobao model is to be free at first and then make a profit. Jack Ma said, “We do Taobao to do business, and to do business, we need a practical profit plan. From the operations of Alibaba and Taobao, we concluded that only when users make money through our platform can we make money.”

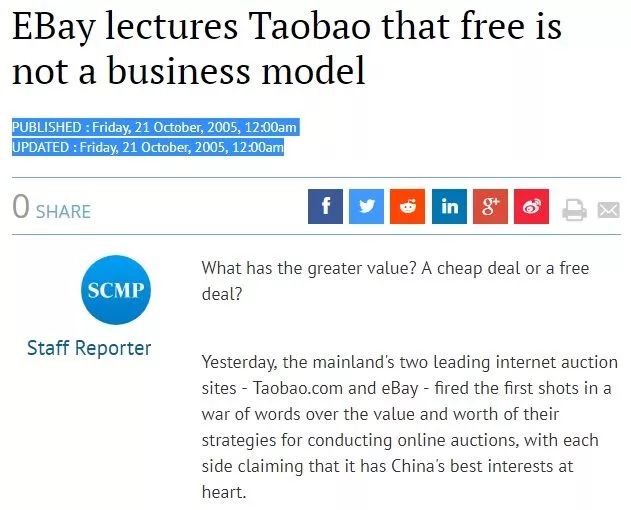

Not reading military books, not practicing Tai Chi, not recognizing provocation, eBay translated Jack Ma’s statement into English and then translated its own response into Chinese, but still struggled to calm the emotional outburst: “Free is not a business model. Taobao’s announcement today that it cannot charge for its services in the next three years further illustrates eBay’s strength in China. eBay is building a sustainable business model in China, and we are very proud of that.”

Will there be a similar direct confrontation between the IIoT platforms of the Tmall model and the Taobao model in the future? The outcome seems to be clear; I hope that those who have read this article can resolve conflicts invisibly.

In the early stages, the Taobao model also has a risk, which is that a cluster of small and medium-sized enterprises in a vertical industry unite and slowly separate from Taobao, establishing their own IIoT platform through shared services, completely bypassing Taobao.

Model Three

Of course, there is also a labor-intensive, but the most exhausting IIoT platform model: the JD model. In this model, industrial IoT companies not only provide IIoT cloud platforms but also focus on providing various industrial hardware and integration services.

The strongest competitor to Taobao is JD. JD’s B2C retail website went online in 2004, and after 10 years of development, it captured 22% of the Chinese e-commerce market. JD’s platform model is completely different from Taobao; Taobao only provides network services without inventory, while JD is a half-large retailer modeled after Amazon.

JD has inventory and delivers through its powerful self-built warehousing and logistics system. JD also follows Amazon’s long-term investment strategy, making substantial investments in infrastructure, even at a loss to achieve scale growth. JD hopes to provide a more reliable user experience than Taobao and Tmall by controlling the entire process from ordering to delivery.

As the industrial market is highly fragmented, with hardware being difficult to generalize and protocols being varied, we have not yet seen an IIoT platform that walks the JD model blindly. If the IIoT platform wants to fully implement the heavy JD model, its primary task is to establish standards to integrate the fragmented market into a larger granularity, thus finding more leverage.

Above, I explained the possible three implementation paths for IIoT platforms: Tmall model, Taobao model, and JD model. The IIoT platform is a field with a clear Matthew effect; regardless of the model adopted, various IIoT platforms are in the same battlefield. So who will ultimately win?

To think about this question, we need to determine the fundamental focus: the industrial IoT is merely a means for manufacturing enterprises to achieve their goals, not the goal itself. Solving various development problems of industries, such as saving money, improving quality, and increasing efficiency, is fundamental. No matter how technology develops, the basic needs of manufacturing enterprises will not change; it is always about meeting the diverse needs of more users with less investment to create greater economic value. However, the expression of this demand will vary at different stages. The main problem faced by manufacturing enterprises today is the huge contradiction between high-quality, diverse user demands and traditional manufacturing systems.

Looking at the entire manufacturing industry, analyzing from both time and space dimensions, the following two characteristics are becoming increasingly prominent:

1. Industry cycles and fluctuations are becoming faster

As the globally renowned management master Kenichi Ohmae said, we should use the term “Dog Year” to measure the speed of industry iteration. Dog Year means that one year of a dog is equivalent to seven years of a human, in other words, less than two months is equivalent to a year. In short, every two to three months, society undergoes a complete transformation. Whether you like it or not, we are already in this economic space and cannot go back.

From the industrial data of 2017, many fields exhibited explosive growth, with production increasing by over 50% or even doubling. Here are a few industries as examples:

-

In Q3 of 2017, Chinese smartphone manufacturers showed impressive shipment volumes, with Huawei shipping 22.3 million units, a year-on-year increase of 23%, ranking first. The second and third places were OPPO and Vivo, with shipments of 21.6 million and 18.9 million units, respectively. Xiaomi saw a 56.5% surge in shipments thanks to the release of several flagship products like Xiaomi MIX2 and Note3.

-

According to data released by the China Association of Automobile Manufacturers, the production and sales of new energy vehicles in China in 2017 were 794,000 and 777,000 units, respectively, representing year-on-year increases of 53.8% and 53.3%. The popularity of new energy vehicles continues to drive the rapid growth of demand for power lithium batteries. Statistics show that over the past three years, from 2014 to 2016, the shipment volume of power lithium batteries in China has achieved year-on-year growth of 293%, 188%, and 79%.

-

Even the traditional textile industry had a bumper year in 2017. From January to September 2017, the main business income and total profit of the textile machinery industry showed double-digit growth, with the total import and export volume of textile machinery increasing year-on-year, and the performance of the textile machinery industry improved significantly. In the first nine months of 2017, the textile machinery industry achieved a total profit of 6.78 billion yuan, a year-on-year increase of 26.21%.

With the increase in shipments of smartphones, 3C electronics, lithium batteries, textiles, etc., there will inevitably be a huge demand for the procurement of production equipment. It is reported that in 2017, Japanese, European, and American transmission equipment manufacturers faced a significant number of orders flowing to domestic small and medium enterprises due to their habitual thinking, slow response to rapid market changes, and lengthy approval processes.

To meet such a large procurement demand, many domestic transmission enterprises have found that traditional JIT and Six Sigma management methods are no longer sufficient to solve the pain points of continuously optimizing production capacity, leading to a desire to further utilize IIoT platforms and other means to enhance lean management efficiency.

Apart from the demand for “quantity” from consumer end users, the pursuit of “quality” in terms of variety and standards is becoming increasingly significant. This change is very rapid, but the manufacturing end is restricted by cycles and cannot respond quickly. Moreover, the manufacturing end must consider economic factors and cannot leap but can only evolve; otherwise, effective cost control cannot be achieved. Therefore, for manufacturing enterprises, increasing production flexibility through IIoT platforms and achieving continuous evolution based on the existing system is one of the alternative solutions.

Whether they can accurately locate the fluctuating pain point demands based on the development trends of the industrial market will test the flexibility and responsiveness of the IIoT cloud platform.

2. Demand from second-tier enterprises is becoming increasingly clear

Have you noticed a phenomenon of knowledge “inversion”? With the popularity of mobile internet, compared to first-tier cities and leading enterprises, engineers from second-tier cities and enterprises not only grasp the latest knowledge in artificial intelligence, IoT, blockchain, etc., but sometimes they are even clearer about what industrial IoT is than the IIoT companies themselves.

There are a large number of random, segmented, and fragmented lean improvement demands in these second-tier enterprises, and they are very urgent. Clear demands come from frontline engineers such as section leaders, workshop directors, and production managers. For example, in a factory, due to the heavy magnetic core of the motor, the 90s workers are overwhelmed. Even though raising salaries cannot retain them, buying KUKA robots is also unaffordable. As a result, the class director designed a mechanical arm to assist in handling, which, although not very sophisticated and with low automation, alleviates labor while improving handling efficiency.

In the eyes of these engineers from second-tier enterprises, whether using artificial intelligence or industrial IoT is irrelevant; solving practical problems is what matters. Therefore, they have strong hands-on abilities, quickly accept new knowledge, and are more clear about their demands and pain points. As long as the capabilities provided by the IIoT platform have practical value and economic viability in their eyes, they will be among the first to act.

The “simple and crude” development of the manufacturing industry over the past few decades has led to many technological gaps at the basic level that need to be filled. Moreover, while many detailed issues have been exposed, we are also facing problems that have never been encountered abroad. Mobilizing the enthusiasm of engineers from second-tier enterprises to realize a multi-driven evolution of the manufacturing industry will be a positive evolution model.

Whether they can timely deliver the “tools” to the hands of numerous engineers from second-tier enterprises will test the ecological construction capabilities and spatial layout capabilities of the IIoT platform.

So returning to the previous question, how should one choose among the three implementation paths of IIoT platforms: Tmall model, Taobao model, and JD model? In fact, the process of choice is interdependent with the result; it is not a single-choice question.

If you find that there is a fourth model disappearing beyond Tmall, Taobao, and JD, feel free to leave me a message.

Finally, next Thursday, January 25, IOT101 will closely observe the implementation path of Alibaba Cloud Link IoT platform. If you want to join in, please click “Read the original” to register as soon as possible.

If you like this column, please scan the code to buy the Queen a coffee, and the editor will pass the coffee fee to the author!

Previous hot articles (click on the article title to read directly):

-

《IoT Queen’s Heart | Cloud computing cannot continue, IoT vulnerabilities are rampant, and a new savior has appeared》

-

《IoT Queen’s Heart | This landmine in IoT, if you don’t step on it, I will》

-

《IoT Queen’s Heart | IAI’s virgin land hides the biggest opportunity for the transformation investment of China’s manufacturing industry》

-

《IoT Queen’s Heart | New third board innovation layer unexpectedly “hides” so many IoT companies》

-

《IoT Queen’s Heart | GE, Siemens, KUKA, Rockwell, have fired the first shot in the 2017 industrial IoT ecological war》