In November 2020, the country released the “Intelligent Vehicle Development Roadmap 2.0”, providing a policy direction for the long-term development of autonomous driving, while the domestic car market is accelerating its transition to electrification. The development of new energy vehicles has lived up to expectations, climbing to the top of the “2021 Hot Consumption List” with soaring sales.

According to reports from CCTV Finance, in the first 11 months of 2021, wholesale sales of new energy passenger vehicles reached 2.807 million units, a year-on-year increase of 190.2%; retail sales reached 2.514 million units, a year-on-year increase of 178.3%. Various automotive manufacturers have launched models with autonomous and assisted driving capabilities, presenting a situation of a hundred flowers blooming and a hundred schools of thought contending. Behind the new energy boom is the trend of electrification and intelligence, which gives vehicles greater potential to achieve intelligence more quickly.

While autonomous driving brings new opportunities to car manufacturers, it also requires embracing several challenges: first, national regulations; second, functional safety requirements; third, the time to market for models; and fourth, the costs incurred to achieve autonomous and assisted driving. These factors determine whether a vehicle can gain recognition and attention in the market.

Three Leading Directions in the ADAS Field

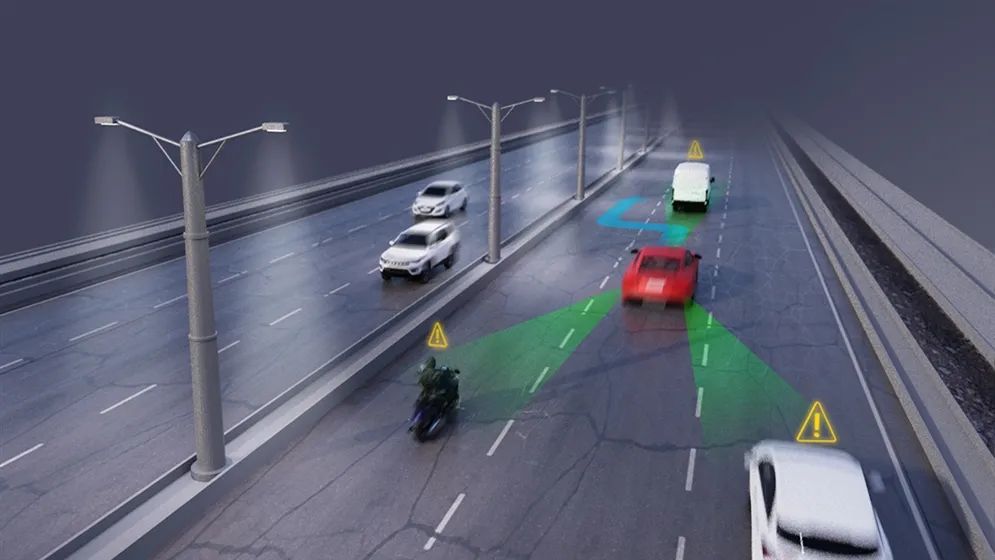

The current mainstream application of autonomous driving in the Chinese market is Level 2 or Level 2+, where ADAS (Advanced Driver Assistance Systems) primarily focuses on the vehicle’s ability to control steering and acceleration or deceleration.

Level 4 is the direction the industry is striving for, where vehicles can drive completely autonomously but cannot eliminate driver control. Many manufacturers have successively launched autonomous vehicles that can achieve Level 4, but the widespread use of Level 4 depends on two factors: first, national regulations, as driving on the road also involves pedestrians and complex traffic situations; second, costs. The increased costs of core chips that meet Level 4 requirements come not only from the chips themselves but also from their auxiliary power supply systems, cooling systems, and the overall system costs. “These may be the main factors limiting the expansion rate of Level 4 in the future,” said Kelvin Cai, General Manager of Texas Instruments (TI) Automotive Division in China. He also stated that the development of ADAS is driven and promoted by three major directions:

Kelvin Cai, General Manager of TI Automotive Division in China

First, related regulations. According to the 2018 “Global Road Safety Survey Report”, more than 1.35 million people die due to traffic accidents worldwide. According to the U.S. Federal Highway Administration, over 50% of fatal injuries occur at intersections and their vicinity. The United Nations has set new regulations in Regulation No. 79, clarifying new safety requirements for motor vehicles: automotive manufacturers must improve their advanced driver assistance steering systems to support intelligent assistance and autonomous driving functions. These requirements will drive continuous advancements in ADAS technology.

Second, the architecture of vehicles. The time to market and costs are critical, depending on how the architecture is defined. A good vehicle architecture can be reused, greatly accelerating the iteration speed while reducing costs.

Third, the promotion and application of emerging sensing technologies in autonomous driving. For example, the extensive use of 77GHz millimeter-wave radar and 60GHz millimeter-wave radar in DMS and automated parking assistance.

The Importance of “Precise Perception”

At a recent media communication meeting for TI’s AWR2944 millimeter-wave radar sensor, Kelvin Cai told reporters from Electronic Engineering Magazine, “Millimeter-wave radar is a core device used for perception, and it is part of vehicle intelligence. We are very optimistic about millimeter-wave radar in the current situation.”

According to reports, TI’s second-generation single-chip solution, the 77 GHz AWR2944 millimeter-wave radar sensor, has improved RF comprehensive performance by 50% compared to the second-generation front-end chip AWR2243 launched in December 2020. The AWR2944 sensor also integrates four transmitters, achieving a resolution 33% higher than existing millimeter-wave radar sensors, allowing vehicles to detect obstacles more clearly and avoid collisions. The hardware configuration of AWR2944 provides signal processing capabilities based on Doppler Division Multiple Access (DDMA), enabling it to perceive oncoming vehicles at detection distances 40% farther than before.

Moreover, the AWR2944 is about 30% smaller than current millimeter-wave radar sensors and complies with AEC-Q100 certification, meeting ASIL-B requirements.

Moreover, the AWR2944 is about 30% smaller than current millimeter-wave radar sensors and complies with AEC-Q100 certification, meeting ASIL-B requirements.

“Navigating in lane changes and sharp turns is one of the most complex design challenges our customers currently face,” said Yariv Raveh, TI’s millimeter-wave radar business manager. “To create a safer driving experience, driver assistance systems must quickly and accurately process massive amounts of data and interact clearly with the driver.”

“Perception” is the core part of autonomous driving. For example, there are requirements for sensors to work in all weather conditions, detection distances need to be longer, and the dimensionality of perception information needs to be increased. As the requirements for autonomous driving systems continue to rise, the accuracy and precision of sensor “perception” will also demand higher standards. As autonomous driving transitions from L2 and L3 to L4, the development of sensors must also align with corresponding regulatory requirements.

In addition, the small size of the 77GHz millimeter-wave radar faces the challenge of high design difficulty for radar RF lines, which can lead to generally low yield rates for finished products. In this regard, Howard Jiang, Director of Embedded Product Systems and Applications at TI China, stated, “The issues of RF lines and yield rates are multifaceted considerations, as antenna design is a highly specialized field that involves not only theoretical problems but also aspects like line simulation testing, materials, processes, and board fabrication that require professional technical accumulation. Back to TI itself, TI’s chips have many self-calibration modules. For example, if a radar is installed in a vehicle, it has a wide operating temperature range. In winter, temperatures can drop to minus twenty degrees or even lower, while in summer, temperatures can reach sixty to seventy degrees. In such cases, TI has extensive on-chip self-calibration and open-loop self-calibration to ensure that products can operate stably.”

Howard Jiang, Director of Embedded Product Systems and Applications at TI China

It is understood that many of TI’s customers are currently using the AWR2944’s angular radar and forward radar to design blind spot detection systems (BSD), automatic emergency braking systems (AEB), and even meet L3 driving under limited conditions, making the AWR2944 a sensing unit within the entire system.

Applications of Onboard Millimeter-Wave Radar

TI has been involved in the automotive field for a long time and holds a leading position in the industry. In the past, vehicle body architecture relied on multiple distributed ECUs for control, but now the architecture iteration is moving towards integration, with a focus on the development of perception and control fusion. TI has recognized the more demanding requirements for in-vehicle communication upgrades, such as effective throughput capacity and transmission efficiency.

TI’s products related to ADAS systems are divided into three main categories: perception, processing, and communication. As a leading company, what trends does TI see in the millimeter-wave radar application market?

“In fact, since last year, 4D millimeter-wave radar has been very popular, which is related to certain national regulatory policies. The forward radar market in China is growing rapidly, and many consulting companies have predicted that by 2023, China will become the largest forward radar market in the world. The trend of intelligence has also brought new opportunities, such as intelligent LED headlights, which not only fulfill a lighting function but may also complete human-machine interaction functions,” said Howard Jiang. “There are many applications for 5R1V, and we are now seeing the emergence of the ‘sensor fusion’ trend, where data fusion is done between cameras and millimeter waves, progressing from traditional post-fusion and result fusion to hybrid fusion and then to pre-fusion.”

Currently, the application of millimeter-wave radar is still in its early stages. More possibilities, such as multi-level cascading, have yet to be developed. With the trend of intelligence brought by new energy, TI believes it will generate more new applications in the future. The new energy vehicle boom will promote the development of millimeter-wave radar as a whole.