There is no doubt that as “autonomous driving” continues to dominate headlines, the so-called “ADAS” (Advanced Driver Assistance Systems) has quietly sparked a wave of transformation, fundamentally changing the way traditional cars are controlled and the user experience.

The current mainstream ADAS systems can achieve functions roughly divided into blind spot monitoring, lane departure warning, automatic emergency braking, lane change assistance, fatigue warning, and 360° surround view camera monitoring, primarily aimed at assisting driving and reducing the incidence of road traffic accidents. With the increasing popularity of ADAS, traditional cars are beginning to possess semi-autonomous driving capabilities, laying a solid foundation for the commercialization of driverless cars in the future.

The latest research report released by McKinsey Quarterly states that “To seize the opportunity of ADAS technology development, automakers and dealers must proactively introduce the system’s functions to consumers, accurately grasp individual user preferences, and satisfy them appropriately. Of course, reasonable pricing from the consumer’s perspective is also crucial. If manufacturers can handle these issues well, it will help them establish a core market position, gain additional bonus revenues, and assist in brand differentiation, accelerating the research and commercialization progress of semi-autonomous and even driverless cars.”

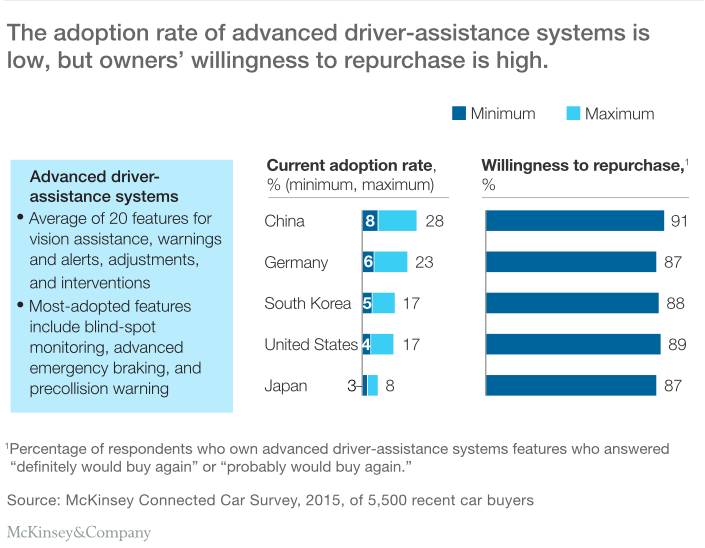

This conclusion is based on data research conducted by McKinsey at the end of 2015, with samples from China, Germany, Japan, South Korea, and the United States, totaling 5,500 new car owners. McKinsey researchers found that currently, very few consumers have had the opportunity to experience ADAS systems, as for the vast majority of models, ADAS features are still optional rather than standard; at the same time, more than 70% of surveyed users stated that they “know what driving assistance functions ADAS systems can provide,” while less than 30% of car owners have ever tried them, with about 50% of those ultimately choosing to purchase. From the chart below, it is not difficult to see that consumers who ultimately choose pre-installed or aftermarket ADAS systems show a high level of satisfaction with the product’s performance.

▲ The procurement rate of ADAS systems is low, but consumer purchase intention is strong; Source: McKinsey

Additionally, the research report lists several factors that can help increase the purchase rate of ADAS products.

First, lowering product prices may increase the likelihood of users adopting ADAS systems. Among consumers surveyed in the five countries, car owners in four of those countries believe that “price” is the main factor influencing their purchase of ADAS products. This also means that if consumers have the experience of trying the product before purchasing, the likelihood of making the final decision will increase significantly;

Secondly, the importance users place on driving safety and their understanding of the specific functions of the related technology are also crucial for purchasing ADAS products. If car owners show a sustained focus on driving safety, the presence or absence of ADAS products and the functions and nature of these products will accelerate the differentiation of product lines among car manufacturers, potentially turning ADAS systems into a bargaining chip for major manufacturers to compete for customers.

So, if automakers, suppliers, and dealers want to maximize their profits in the ADAS niche market, consumer attitudes towards their products are key. Let’s take a look at some tips from McKinsey analysts on how to “please” your customers.

“To boost ADAS product sales, you need to proactively educate your customers”

This means that 4S store dealers must come up with ways to clearly inform potential customers about the detailed functions of ADAS products. For example, they can build a virtual environment for consumers to personally experience the features of this system. Of course, automakers can also allow customers to try specific functions for free for a period, provided that the hardware supporting these functions has been pre-installed in the vehicle.

“Play with pricing to differentiate yourself from competitors”

If automakers wish to increase the purchase rate of ADAS products through a low-price strategy, they can limit the product functions to a few specific ones and offer them as standard on most models sold. This way, they can achieve higher profits from volume sales while also facilitating product standardization. Of course, this is not a universal solution; for some high-end luxury brands, they may choose to maintain high prices but offer comprehensive ADAS driving assistance solutions.

“Provide regionally customized ADAS functions”

Manufacturers should ensure that the models sold in different countries meet the local consumer usage needs, which may require automakers to customize the functions of ADAS products based on the characteristics of different consumer markets.

“Ensure ADAS functions can be upgraded via OTA”

It is foreseeable that the future development trend of automotive active safety technology will rely on artificial intelligence and continuously upgraded software algorithms, allowing different functions to be achieved using a fixed set of sensors. Therefore, convenient and quick upgrade methods are crucial for enhancing user experience, increasing user stickiness, and improving product innovation capabilities.

“Pay attention to cybersecurity issues to ensure worry-free ADAS product upgrades”

Automakers and dealers must ensure that users are aware of the flow and use of data within the vehicle, respect consumer privacy, and also need to have relatively complete response plans for possible hacker attacks. In addition, manufacturers should also invest energy and resources in cybersecurity to avoid user data leakage.

“Develop in-car entertainment system functions that can adapt to ADAS products”

According to McKinsey analysts, automotive manufacturers should consider a product development model that integrates ADAS and in-car entertainment systems. This way, it facilitates users to apply in-car safety technologies more comprehensively. For example, if information about ADAS product functions appears on the instrument display or central control screen, it helps establish a more efficient, seamless, and safe interaction method.

Summary from Car Cloud

According to the data from McKinsey’s latest research report, consumer satisfaction with ADAS products is quite high. With the advancement of driving assistance safety technology, the commercialization of semi-autonomous and even driverless cars is just around the corner. However, to achieve maximum profit from the ADAS market, manufacturers need to significantly change their existing business models, especially how to communicate the product value of new technologies to consumers, how to customize localized products for different markets, and how to protect user privacy and data security, among other considerations. But for manufacturers, suppliers, and dealers, whoever can seize the initiative in this complex transformation and form effective competitive strength will be the one to profit from the wave of automotive autonomous driving.