1. Recent News Reports on Rare Earth Exports

According to the Ministry of Commerce website, on the evening of June 7, a reporter asked: Recently, many countries have expressed concern over China’s export control measures on rare earths. What measures will China take to address these concerns?

In response, the spokesperson of the Ministry of Commerce stated,“Rare earth-related items have dual-use properties for military and civilian purposes, and implementing export controls on them is in line with international practices. China implements export controls on rare earth-related items in accordance with the law, aiming to better safeguard national security and interests, fulfill international obligations such as non-proliferation, and reflect its consistent position of maintaining world peace and regional stability..

Regarding the issue of rare earth export controls, Wang Wentao further clarified China’s export control policies to the European side, emphasizing thatimplementing export controls on rare earths and other items is an international practice. China attaches great importance to the concerns of the European side and is willing to establish a green channel for qualified applications to expedite approvals, and has instructed working-level staff to maintain timely communication on this matter. Wang Wentao expressed hope that the European side would reciprocate and take effective measures to facilitate, ensure, and promote compliant trade in high-tech products with China..

The impact of China’s control policies has already begun to manifest. Due to the complex and lengthy approval process for export licenses, the export volume of Chinese rare earth magnets plummeted by nearly50% in April this year. According to data from Chinese customs, the export of rare earths in April was3,056 tons, compared to5,842 tons in March, a month-on-month decrease of2,786 tons (approximately a48% decrease).

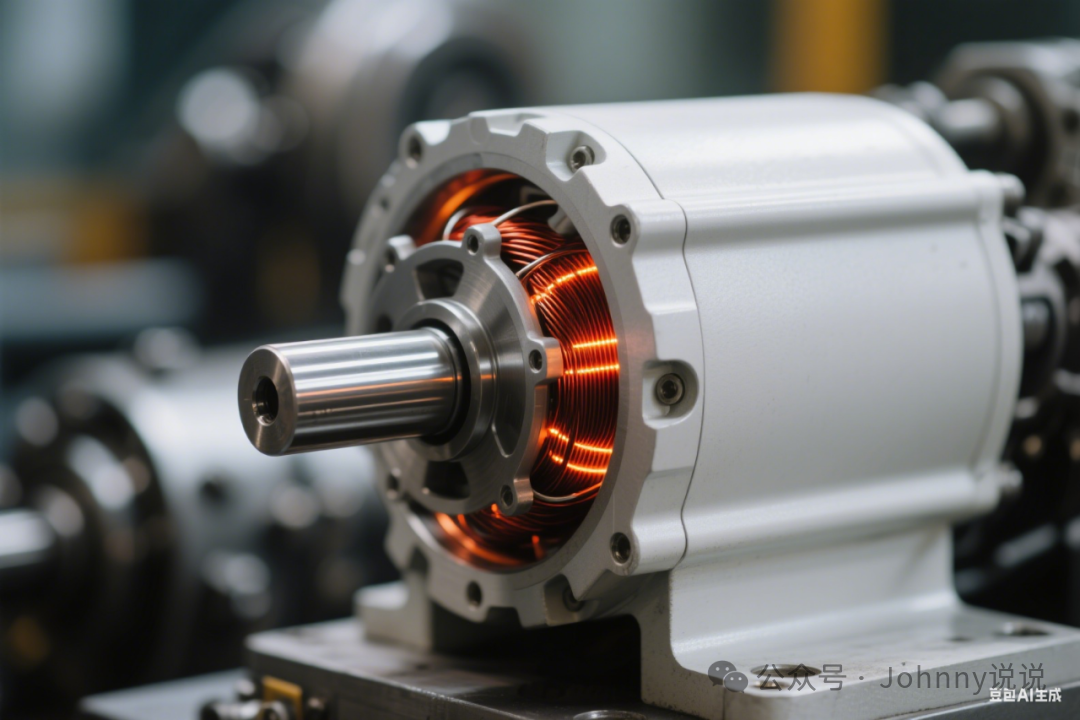

Rare earth permanent magnets are core materials for electric vehicle motors, power steering systems, and automatic transmissions. China’s control measures have put global automakers at risk of supply chain disruptions. The U.S. F-35 fighter jet requires417 kilograms of rare earths per aircraft for radar systems and engine coatings, and the Pentagon’s strategic reserves can only last for6 months. If the controls continue, the B-21 bomber project may suffer increased losses due to rare earth shortages. Rare earths are indispensable in high-end medical equipment, with93% of MRI contrast agents in the U.S. relying on Chinese rare earths. Johns Hopkins Hospital has seen a40% increase in equipment maintenance costs due to rare earth shortages, and the liver cancer treatment drug yttrium-90 microspheres face supply risks. The U.S. relies on China for70% of its rare earth imports, with90% of heavy and medium rare earth refining capacity concentrated in China.Trump had to find a way to ease China’s rare earth exports during his term.

2. Rare Earth Metals in Chip Manufacturing

Although the usage of rare earth elements in the semiconductor industry chain is relatively small, their role is critical and irreplaceable, mainly applied in chip manufacturing, packaging testing, core equipment, and emerging semiconductor materials. Rare earths, while not the main materials of semiconductors, are key support points throughout the entire chain of“design–manufacturing–packaging–testing.” From7nm advanced process polishing techniques toEUV lithography machines’ precision magnets, to doping technologies in third-generation semiconductors, the irreplaceability of rare earths makes them the “lifeline” of the global semiconductor industry chain. Through export controls, China is reshaping the geopolitical technology landscape in the semiconductor field, while the “de-China” efforts of Japan, South Korea, and the U.S. are unlikely to break through the dual barriers of rare earth materials and processes in the short term.

1.Chemical Mechanical Polishing (CMP)

The most critical surface treatment process in chip manufacturing, used to flatten wafer surfaces (such as silicon wafers and metal interconnect layers), ensuring nanometer-level precision. Cerium oxide (CeO₂), lanthanum oxide (La₂O₃) are used as polishing slurry abrasives, whose hardness and chemical activity can efficiently remove excess materials (such as copper, tungsten, and silicon dioxide) while reducing surface damage.

2.Photoresist

Eu³⁺ complexes are used inEUV photoresists to enhance light absorption and pattern resolution. The light absorption peak of Eu³⁺ matches theEUV wavelength (13.5nm), making it a core component of the next generation of photoresists.

3.Deposition and Etching Processes

Preparation of high dielectric constant (High-κ) gate oxides (such asLa₂O₃) to replace traditional silicon dioxide, used inFinFET,GAA and other advanced transistor structures, enhancing chip integration and energy efficiency. Rare earth fluorides (such asYF₃) are used as etching gas additives to optimize plasma characteristics and improve etching precision (such as controlling sidewall verticality in FinFET etching).

4.Target Materials and Coating Materials

Gadolinium (Gd), Terbium (Tb), and Dysprosium (Dy) metal target materials. Used to prepare multilayer structures for magnetic storage devices (such asMRAM, spintronic devices), leveraging the high magnetic anisotropy of rare earth elements to enhance storage density and read/write speeds. In optical communication chips (such as silicon photonic chips), rare earth-doped films are used to adjust the refractive index of optical waveguides, optimizing light signal transmission efficiency.

5.Semiconductor Equipment

Voice coil motors and guide rail bearings in precision mechanical systems rely on high coercivity neodymium-iron-boron magnets to ensure nanometer-level positioning accuracy of the objective stage (error <1nm). The excitation light source of optical microscopes uses europium-doped fluorescent materials to enhance the luminescence efficiency of deep ultraviolet light (DUV), detecting microscopic defects in chips below the7nm node. The magnetic analyzer of ion implanters uses rare earth magnets to filter and focus ion beams (such as boron and phosphorus ions), ensuring uniform doping concentration (error <2%). The RF power supply coils of etching machines use rare earth soft magnetic materials to enhance plasma excitation efficiency and reduce etching rate fluctuations (such as controlling sidewall roughness in gallium nitride power device etching).

6.Advanced Packaging Materials

Rare earth alloys of gallium (Ga) and indium (In), such asGd-In-Sn. Rare earth alloy solders are used for connections between chips and substrates, with high reliability (30% improvement in thermal cycling resistance) suitable for high-temperature environments such as AI chips and automotive electronics. Rare earth-doped epoxy resins are used as underfill materials to enhance the mechanical strength between chips and substrates, reducing the risk of cracking during drop tests (such as in Apple’s A series chip packaging).

7.Heat Dissipation and Electromagnetic Shielding

Yttrium (Y) stabilized zirconia (YSZ), Dysprosium (Dy) ferrite. YSZ ceramic sheets are used between chips and heat sinks, with a thermal conductivity of250W/m・K (twice that of copper), addressing overheating issues in 5G base station chips and data center CPUs. Dysprosium ferrite films deposited on packaging substrate surfaces suppress electromagnetic leakage of high-frequency signals (such as millimeter-wave chips), enhancing communication stability of 5G terminals.

8.Third Generation Semiconductors

In the epitaxial growth of silicon carbide (SiC), rare earth elements are used as dopants (such asLa-N co-doping) to adjust carrier concentration, enhancing the breakdown voltage of power devices (from1200V to1700V).

In gallium nitride (GaN) HEMT devices, the gate insulation layer usesY₂O₃, reducing interface state density and improving high-frequency performance (cut-off frequency from30GHz to50GHz).

3.Conclusion

China’s rare earth industry, with its resource endowment, technological accumulation, industrial chain integration, and policy regulation, occupies an irreplaceable strategic position in the global market. China possesses the world’s most advanced rare earth separation technology, with purity reaching 99.9999%, far exceeding international standards. This advantage gives China a significant strategic edge.

Likes will bring you good fortune and wealth~

Likes will bring you good fortune and wealth~

“No matter how far the rivers and mountains are, it’s always about feelings. Can I send you a cup of milk tea?”