Author | Wo Ting Xiao Xiao Zhu

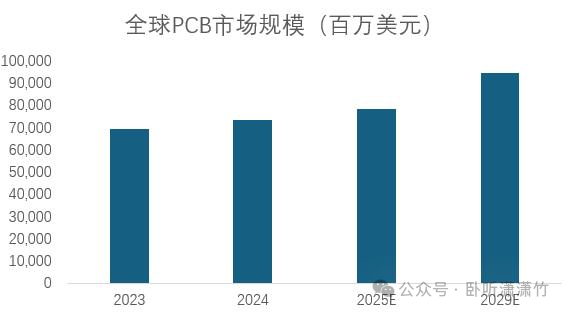

The PCB market scale continues to expand.ChipMOS Technologies’ annual report provides an optimistic assessment of the PCB industry development:According to Prismark statistics, in 2024, the global PCB total output value will reach $73.565 billion, a year-on-year increase of 5.8%. In the medium to long term, the global PCB industry is expected to experience a revival, with the global PCB output value expected to reach $94.661 billion by 2029, and a compound annual growth rate of 5.2% from 2024 to 2029, showing a stable growth trend.From a regional perspective, in 2024, among the major PCB production areas globally, Europe, Japan, and South Korea will see a year-on-year decline in PCB output value, with Europe experiencing the largest decline. Under the combined effects of technological iteration, policy support, and recovery in downstream demand, the PCB output value in the United States is expected to grow by 9.0% year-on-year to $3.493 billion; the PCB output value in mainland China is expected to grow by 9.0% year-on-year to $41.213 billion, remaining the largest PCB production base in the world; Southeast Asia/other regions are expected to see a year-on-year increase of 8.4% to $6.081 billion globally; and Taiwan’s PCB output value is expected to grow by 3.1% year-on-year to $8.669 billion.As a shovel stock for PCB development, ChipMOS Technologies has delivered an awkward annual report and first-quarter report. Not only did the company’s performance decline in the fourth quarter, but the first quarter also did not perform well. Previously, the company claimed: In 2024, 378 PCB equipment units are expected to be sold, corresponding to revenue of 780 million,with a unit price of 2.06 million. Based on this price, if 100 units are shipped in March, the corresponding revenue would be approximately 206 million, while the actual first-quarter revenue was only 240 million.

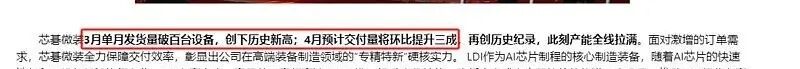

In 2024, 378 PCB equipment units are expected to be sold, corresponding to revenue of 780 million,with a unit price of 2.06 million. Based on this price, if 100 units are shipped in March, the corresponding revenue would be approximately 206 million, while the actual first-quarter revenue was only 240 million. This discrepancy in expectations directly led to panic selling by investors, with a maximum drop of 10% on the 24th.In fact, the company previously explained: The company’s current production capacity is indeed operating at full capacity, but order scheduling does not directly equate to current revenue; it must be completed according to contract agreements for equipment delivery, acceptance, and other processes before revenue can be recognized. The authenticity of the company’s orders and production capacity status are both real and not contradictory.

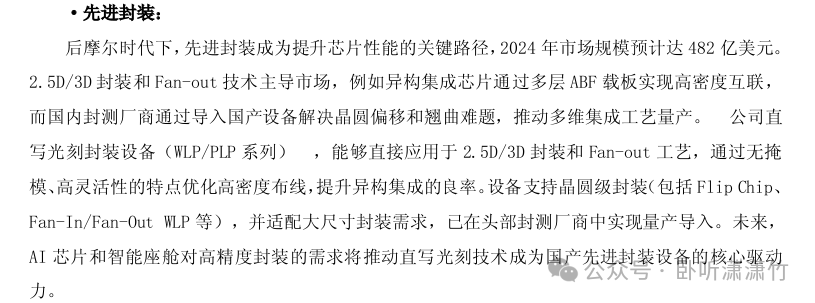

This discrepancy in expectations directly led to panic selling by investors, with a maximum drop of 10% on the 24th.In fact, the company previously explained: The company’s current production capacity is indeed operating at full capacity, but order scheduling does not directly equate to current revenue; it must be completed according to contract agreements for equipment delivery, acceptance, and other processes before revenue can be recognized. The authenticity of the company’s orders and production capacity status are both real and not contradictory. Order delivery does not directly confirm revenue; it is very difficult for companies to recover payments in business.The company’s annual report is still very noteworthy: in the PCB field,it has achieved full coverage of the top 100 PCB companies. For example, collaborations with companies such as Pegatron, Shunhong Technology, Shenzhen South Circuit, Jingwang Electronics, Shengyi Technology, Dingying Electronics, Huadian Co., and Hongban Company have been established, with good orders from international leading manufacturer Pegatron, and excellent performance in sub-markets such as soft boards, carrier boards, and solder mask.In the broad semiconductor field,it has accumulated enterprise-level customers such as Huatian Technology, Changjiang Electronics, Quliang Electronics, Visionox, Chenxian Optoelectronics, Fuzhixin, Ximaiwei, Lide Semiconductor, Huaxin Zhongyuan, and Zefeng Semiconductor;In the IC carrier board field,it has expanded to companies such as Lidin Semiconductor, Xingsen Technology, New Chuangyuan, Rixiang Co., Haoyuan Electronics, Weixin Electronics, Mingyang Circuit, and Shenzhen South Circuit;In the lead frame field,it has covered downstream customers such as Lide Semiconductor and Longteng Electronics;In the new display area,it has developed quality customers such as Visionox, Chenxian Optoelectronics, Woge Optoelectronics, and BOE Group.For 2025, I am not pessimistic: first, the new orders in the first quarter are very considerable, and the growth rate for the entire year of 2025 is definitely expected to be better than that of the first quarter (in 2024, there was only one customer with orders exceeding 100 million, while in 2025, it is expected to exceed three); moreover, the company’s packaging equipment has received continuous repeat orders from leading customers in mainland China, and the stability and functionality of the products have been verified.

Order delivery does not directly confirm revenue; it is very difficult for companies to recover payments in business.The company’s annual report is still very noteworthy: in the PCB field,it has achieved full coverage of the top 100 PCB companies. For example, collaborations with companies such as Pegatron, Shunhong Technology, Shenzhen South Circuit, Jingwang Electronics, Shengyi Technology, Dingying Electronics, Huadian Co., and Hongban Company have been established, with good orders from international leading manufacturer Pegatron, and excellent performance in sub-markets such as soft boards, carrier boards, and solder mask.In the broad semiconductor field,it has accumulated enterprise-level customers such as Huatian Technology, Changjiang Electronics, Quliang Electronics, Visionox, Chenxian Optoelectronics, Fuzhixin, Ximaiwei, Lide Semiconductor, Huaxin Zhongyuan, and Zefeng Semiconductor;In the IC carrier board field,it has expanded to companies such as Lidin Semiconductor, Xingsen Technology, New Chuangyuan, Rixiang Co., Haoyuan Electronics, Weixin Electronics, Mingyang Circuit, and Shenzhen South Circuit;In the lead frame field,it has covered downstream customers such as Lide Semiconductor and Longteng Electronics;In the new display area,it has developed quality customers such as Visionox, Chenxian Optoelectronics, Woge Optoelectronics, and BOE Group.For 2025, I am not pessimistic: first, the new orders in the first quarter are very considerable, and the growth rate for the entire year of 2025 is definitely expected to be better than that of the first quarter (in 2024, there was only one customer with orders exceeding 100 million, while in 2025, it is expected to exceed three); moreover, the company’s packaging equipment has received continuous repeat orders from leading customers in mainland China, and the stability and functionality of the products have been verified. The PCB industry’s prosperity has not beenfully recognized: for example, Shenzhen South Circuit stated that the PCB business benefits from the continuous growth in demand for computing power infrastructure and automotive electronics, with production bases maintaining full capacity operation; the packaging substrate business has seen an improvement in capacity utilization due to the recovery in demand in the memory market compared to the fourth quarter of 2024.The Jiangxi base of Jingwang was put into production in phases in 2014, 2018, and 2024, with capacity utilization rates remaining at high levels.Looking at the full year, at least a 50% growth is expected, waiting for a main rising opportunity.Weike Technology has recently shown strong performance, and the company stated that as an important supplier to Kollmorgen, it is supplying motor components, motor gears, etc., in the robotics field. In collaboration with partners, it is developing materials such as PEEK and PPS, which are expected to be applied in components like lead screws. Moreover,Yuke has mature in-mold insert technology and is currently exploring bionic robot electronic skin, which is a flexible bionic tactile sensor that simulates the perception mechanism of human skin.

The PCB industry’s prosperity has not beenfully recognized: for example, Shenzhen South Circuit stated that the PCB business benefits from the continuous growth in demand for computing power infrastructure and automotive electronics, with production bases maintaining full capacity operation; the packaging substrate business has seen an improvement in capacity utilization due to the recovery in demand in the memory market compared to the fourth quarter of 2024.The Jiangxi base of Jingwang was put into production in phases in 2014, 2018, and 2024, with capacity utilization rates remaining at high levels.Looking at the full year, at least a 50% growth is expected, waiting for a main rising opportunity.Weike Technology has recently shown strong performance, and the company stated that as an important supplier to Kollmorgen, it is supplying motor components, motor gears, etc., in the robotics field. In collaboration with partners, it is developing materials such as PEEK and PPS, which are expected to be applied in components like lead screws. Moreover,Yuke has mature in-mold insert technology and is currently exploring bionic robot electronic skin, which is a flexible bionic tactile sensor that simulates the perception mechanism of human skin.