This article is reprinted with permission fromChina News Weekly(ID: chinanewsweekly)Author: Shi HanxuEditors: Yu Yuan, Wang LinHotel robots have become a familiar sight for domestic travelers, and many foreigners have exclaimed about the black technology of these new standard features in hotels, which are on the verge of launching a publicly traded company.This is Beijing Yunjike Technology Co., Ltd. (hereinafter referred to as “Yunjike Technology”), which has officially submitted its prospectus to the Hong Kong Stock Exchange. If successfully listed, it will become the first stock of “robot service intelligent agents.”Many may find the name Yunjike Technology unfamiliar, but in hotels under groups like Marriott, InterContinental, Huazhu, Atour, and Jinjiang, you may have encountered its robots more than once.

This article is reprinted with permission fromChina News Weekly(ID: chinanewsweekly)Author: Shi HanxuEditors: Yu Yuan, Wang LinHotel robots have become a familiar sight for domestic travelers, and many foreigners have exclaimed about the black technology of these new standard features in hotels, which are on the verge of launching a publicly traded company.This is Beijing Yunjike Technology Co., Ltd. (hereinafter referred to as “Yunjike Technology”), which has officially submitted its prospectus to the Hong Kong Stock Exchange. If successfully listed, it will become the first stock of “robot service intelligent agents.”Many may find the name Yunjike Technology unfamiliar, but in hotels under groups like Marriott, InterContinental, Huazhu, Atour, and Jinjiang, you may have encountered its robots more than once.

(Image/unsplash)

According to the prospectus, by the end of last year, Yunjike Technology’s robots had been employed in over 30,000 hotels in China. Based on 2023 revenue, Yunjike Technology holds a market share of 9% globally and 12.2% in the Chinese hotel scene, both ranking first.However, this leading company has not been entirely smooth sailing. Over the past three years, Yunjike Technology has accumulated a net loss of over 800 million yuan despite revenues exceeding 500 million yuan.Behind the losses lie the challenges faced by Yunjike Technology and the entire commercial service robot industry. Serving 30,000 hotels“Let robots liberate us humans, allowing us to return to our nature and do more of what we want to do.” Seven years after founding Yunjike Technology, its CEO and co-founder Zhi Tao spoke about the original intention of entering the robotics field in 2014.Today, when you open Yunjike Technology’s official website, the prominent phrase still reads, “Robots make humans happier.”For some frequent hotel guests, Yunjike Technology has indeed brought a certain sense of happiness.In moments when they do not want to go downstairs or are afraid to open the door to strangers, the chubby hotel robots can roll over and deliver the needed takeout, toiletries, water, and more to humans.

Serving 30,000 hotels“Let robots liberate us humans, allowing us to return to our nature and do more of what we want to do.” Seven years after founding Yunjike Technology, its CEO and co-founder Zhi Tao spoke about the original intention of entering the robotics field in 2014.Today, when you open Yunjike Technology’s official website, the prominent phrase still reads, “Robots make humans happier.”For some frequent hotel guests, Yunjike Technology has indeed brought a certain sense of happiness.In moments when they do not want to go downstairs or are afraid to open the door to strangers, the chubby hotel robots can roll over and deliver the needed takeout, toiletries, water, and more to humans.

(Image/unsplash)

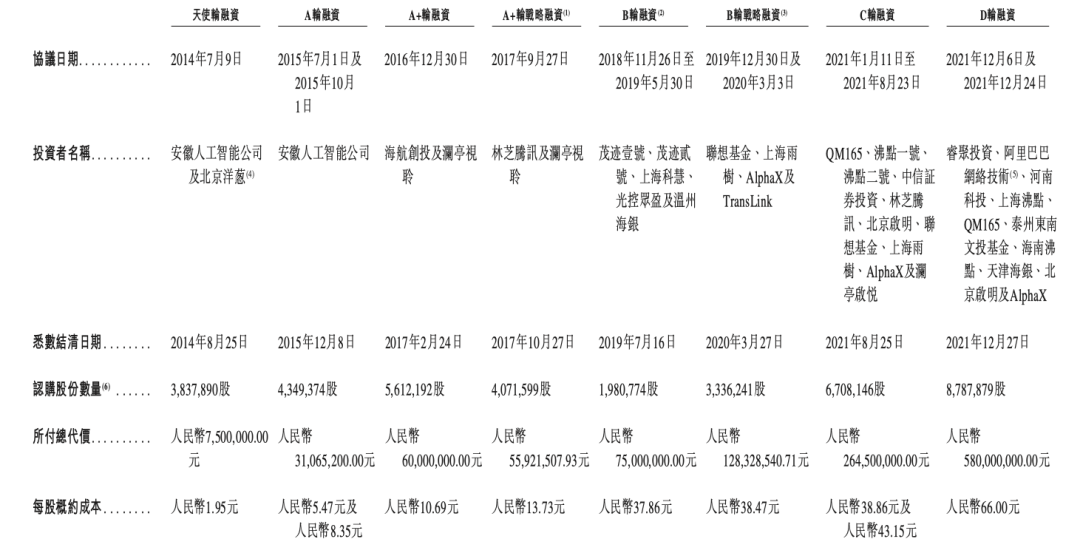

The hotel was the first market Yunjike Technology entered. At that time, Zhi Tao and the team considered factors such as group size, standardization, operational scale, payment ability, long-term service, and mobile environment before deciding to let their robots prove their commercial value in hotels before replicating to more scenarios.In 2015, Yunjike Technology’s “RUN” series robots were officially launched. These robots, equipped with laser radar, positioning navigation systems, and storage compartments, can perform delivery and reception tasks while autonomously calling elevators, avoiding obstacles, making phone calls to guests, and returning to charge.The following year, RUN began to apply for 24-hour staff positions in hotels, but the broad recruitment did not go smoothly. Zhi Tao recalled that at that time, she and the team visited hotels and often received responses of “not needed”; a manager of an international five-star hotel even bluntly stated that they needed human services more; hotels purchasing RUN were often considering the technological aspect rather than practicality.As the penetration rate of the takeout market continued to rise, from 4.2% in 2016 to 13% in 2019, and with the recent increase in demand for contactless services, service robots, including hotel robots, have gradually gained market recognition. According to data from CCID Consulting, in 2020, the demand for service robots experienced explosive growth, with the market size increasing by 37.4% year-on-year to 28.38 billion yuan.This also led to a significant increase in Yunjike Technology’s order volume. According to the prospectus, in 2023, its revenue from hotels surpassed that of other similar companies both domestically and internationally.In contrast to the difficulties in market expansion, Yunjike Technology’s early financing was smooth. The prospectus shows that from 2014 to 2021, Yunjike Technology completed eight rounds of financing, raising over 1.2 billion yuan in total. Its investors include major companies such as Alibaba, Tencent, iFlytek, Lenovo, as well as investment institutions like Qiming Venture Partners and Bole Capital. Public information indicates that after the D round of financing in 2021, its valuation was approximately 4.08 billion yuan.

Yunjike Technology’s financing history. (Image/screenshot from the prospectus)

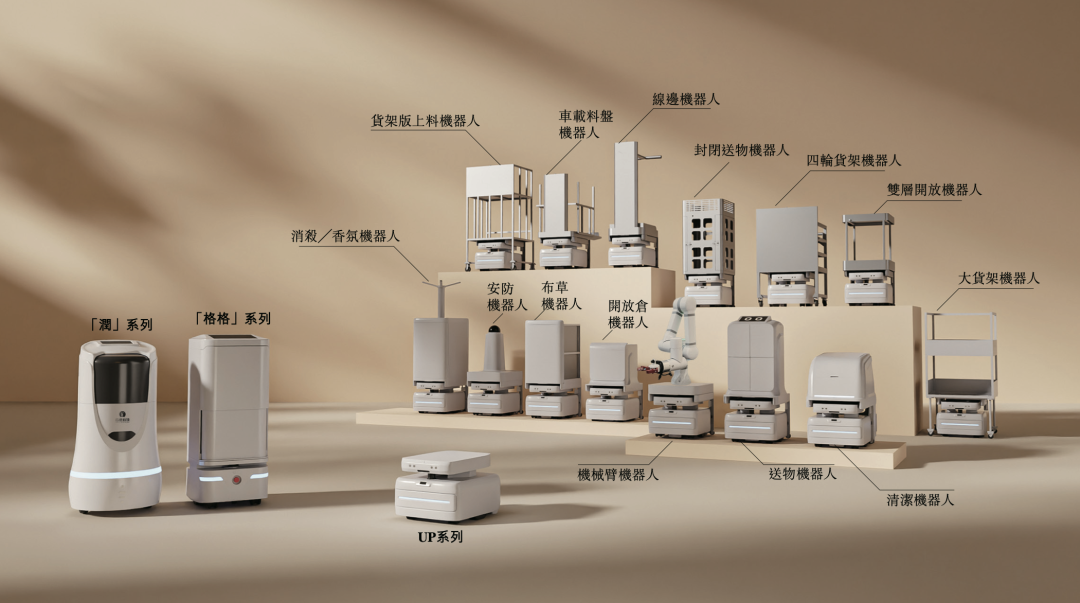

During this period, Yunjike Technology continued to innovate, launching the dual-compartment robot “Gege” series in 2021 and 2023, and the “UP” series robot chassis that can be combined with various upper compartments, adding skills such as cleaning, consulting, and vending to the robots beyond delivery and guidance.At the same time, it gradually expanded robot services to hospitals, commercial buildings, factories, and communities. In 2022, at the Beijing Winter Olympic Village and media center, Yunjike Technology’s robots also undertook tasks such as guiding, delivering, and collecting garbage. Yunjike Technology’s product line. (Image/prospectus)According to the prospectus, by the end of last year, Yunjike Technology had a total of 34,000 corporate clients, including over 30,000 hotels and more than 100 hospitals, completing over 500 million services.

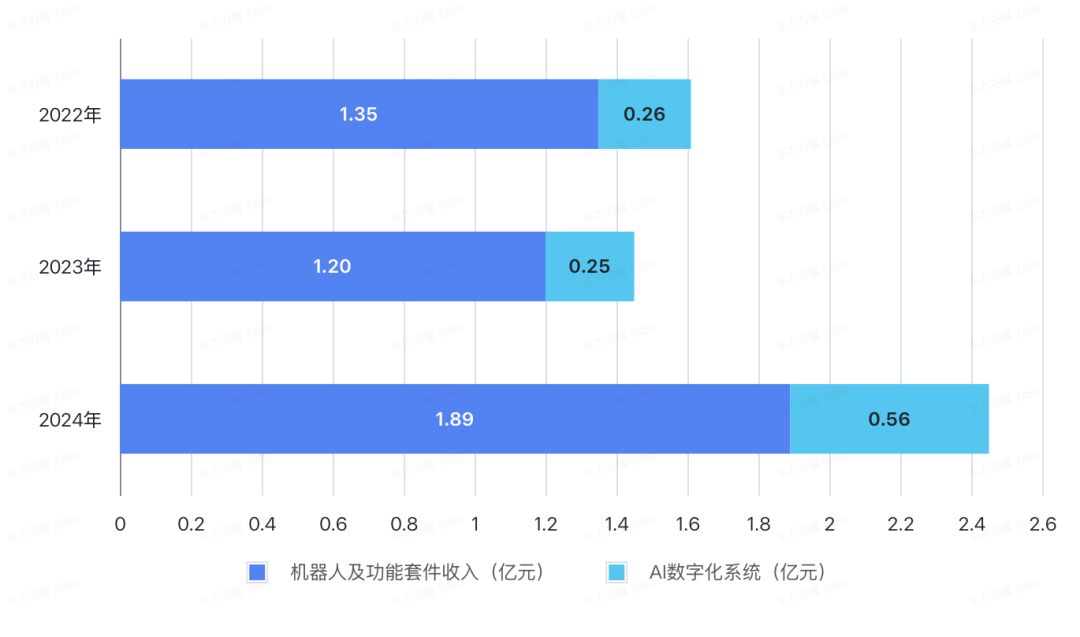

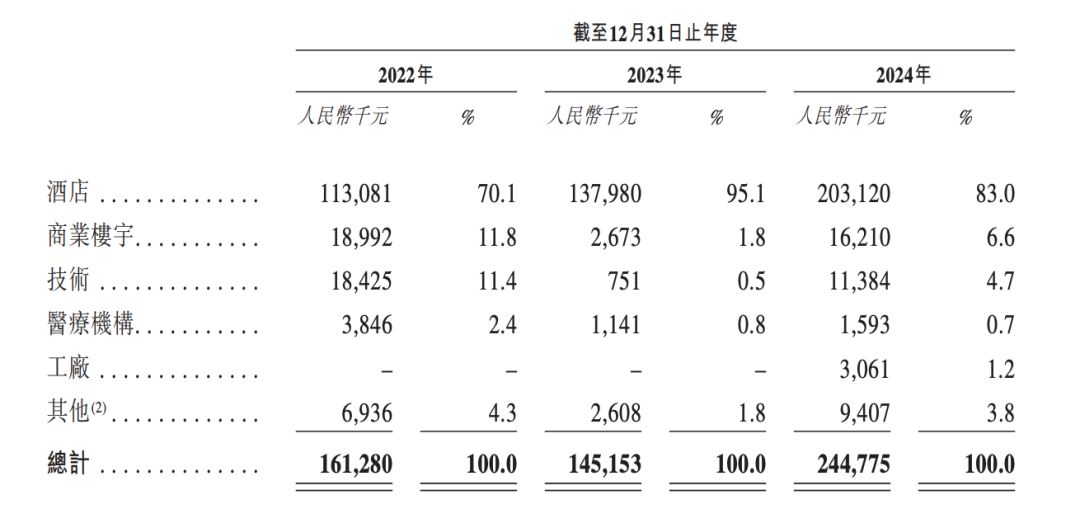

Yunjike Technology’s product line. (Image/prospectus)According to the prospectus, by the end of last year, Yunjike Technology had a total of 34,000 corporate clients, including over 30,000 hotels and more than 100 hospitals, completing over 500 million services. Severe cash shortageHowever, despite being a leader in a niche market, Yunjike Technology still faces many challenges.The most direct issue is the commercialization challenge in this industry.In terms of revenue, Yunjike Technology has reached a certain scale, with revenues of 161 million yuan, 145 million yuan, and 245 million yuan in 2022, 2023, and 2024, respectively. Its revenue mainly comes from the sales and leasing of robots and functional kits, as well as subscription fees for AI digital systems, with the former contributing about 80% of revenue over the past three years.

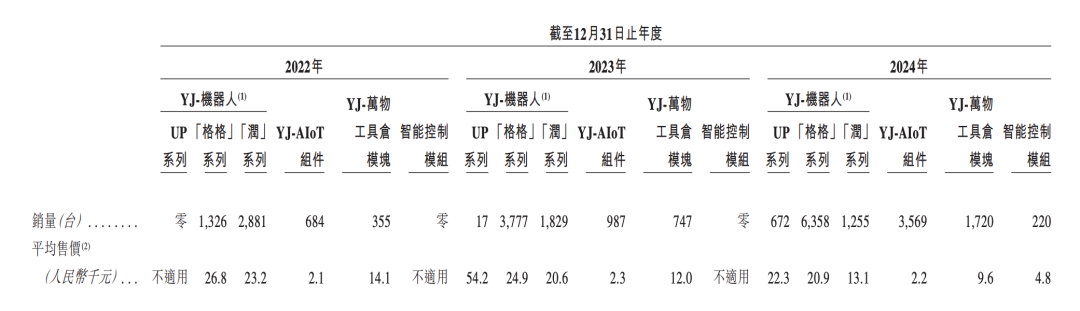

Severe cash shortageHowever, despite being a leader in a niche market, Yunjike Technology still faces many challenges.The most direct issue is the commercialization challenge in this industry.In terms of revenue, Yunjike Technology has reached a certain scale, with revenues of 161 million yuan, 145 million yuan, and 245 million yuan in 2022, 2023, and 2024, respectively. Its revenue mainly comes from the sales and leasing of robots and functional kits, as well as subscription fees for AI digital systems, with the former contributing about 80% of revenue over the past three years. Yunjike Technology’s revenue composition. (Image/compiled by China News Weekly from the prospectus)However, based on the three-year performance disclosed by Yunjike Technology, its revenue growth has not been stable. In 2023, due to a decline in revenue from the robot and functional kit business, Yunjike Technology’s overall revenue fell nearly 10% year-on-year; that year, it added 3,431 direct sales corporate clients, a 21.5% increase compared to the previous year’s 2,825 clients.This performance is directly related to the continuous decrease in the price of Yunjike Technology’s robots. The prospectus shows that the average selling price of its Gege and RUN series robots was 26,800 yuan and 23,200 yuan in 2022, dropping to 24,900 yuan and 20,600 yuan in 2023, and further down to 20,900 yuan and 13,100 yuan in 2024.

Yunjike Technology’s revenue composition. (Image/compiled by China News Weekly from the prospectus)However, based on the three-year performance disclosed by Yunjike Technology, its revenue growth has not been stable. In 2023, due to a decline in revenue from the robot and functional kit business, Yunjike Technology’s overall revenue fell nearly 10% year-on-year; that year, it added 3,431 direct sales corporate clients, a 21.5% increase compared to the previous year’s 2,825 clients.This performance is directly related to the continuous decrease in the price of Yunjike Technology’s robots. The prospectus shows that the average selling price of its Gege and RUN series robots was 26,800 yuan and 23,200 yuan in 2022, dropping to 24,900 yuan and 20,600 yuan in 2023, and further down to 20,900 yuan and 13,100 yuan in 2024. (Image/screenshot from the prospectus)A hotel robot dealer told China News Weekly that since 2022, the domestic hotel robot market has seen a decline in heat, with many brands already entering. To seize the market, price wars have intensified.After years of development, Yunjike Technology’s revenue still largely comes from the hotel scene. The prospectus shows that from 2022 to 2024, the hotel scene contributed 70.1%, 95.1%, and 83.0% of Yunjike Technology’s revenue, while revenue from commercial buildings, medical institutions, factories, and other scenes is relatively small and unstable.

(Image/screenshot from the prospectus)A hotel robot dealer told China News Weekly that since 2022, the domestic hotel robot market has seen a decline in heat, with many brands already entering. To seize the market, price wars have intensified.After years of development, Yunjike Technology’s revenue still largely comes from the hotel scene. The prospectus shows that from 2022 to 2024, the hotel scene contributed 70.1%, 95.1%, and 83.0% of Yunjike Technology’s revenue, while revenue from commercial buildings, medical institutions, factories, and other scenes is relatively small and unstable.

Yunjike Technology’s revenue by scene. (Image/screenshot from the prospectus)

Yunjike Technology’s revenue by scene. (Image/screenshot from the prospectus)

“Yunjike Technology’s core advantage lies in its deep understanding of the hotel scene and system integration capabilities, providing not only robot products but also comprehensive hotel AIoT solutions. At the same time, Yunjike’s products are mature, and its service network is complete, giving it significant advantages in large-scale delivery and after-sales support.”Li Junlan, IDC’s research manager in China, told China News Weekly, “However, against the backdrop of increasingly similar functions and intensifying price competition, Yunjike Technology also faces challenges such as product and business concentration.”In other words, Yunjike Technology faces the problem of dependency on a single scene, with other scenes not yet able to constitute growth points for its performance.Moreover, the market capacity itself is not ideal. According to a Frost & Sullivan report, the market size of the robot service intelligent agents in the hotel scene in China grew from 500 million yuan in 2019 to 1.1 billion yuan in 2023, and is expected to reach 3.6 billion yuan by 2028. Given that the top five participants, including Yunjike Technology, have a combined market share of 27.6%, the intensity of competition in this market is evident.Some hotel robot practitioners pointed out that this puts considerable pressure on the continuous growth of enterprises while also hindering their profitability.Yunjike Technology has indeed not been able to escape the quagmire of losses. From 2022 to 2024, its total revenue was 551 million yuan, but its net loss reached 815 million yuan. Yunjike Technology’s revenue and net loss. (Image/compiled by China News Weekly from the prospectus)Although net losses are gradually narrowing, Yunjike Technology, which has not received any financing since 2021, may find it difficult to alleviate its financial pressure in the short term.According to the prospectus, by the end of last year, Yunjike Technology had about 100 million yuan in cash and cash equivalents, while its current liabilities exceeded 2 billion yuan. Among these, the redemption liabilities triggered by the listing agreement accounted for 1.87 billion yuan. This means that if Yunjike Technology’s listing application is withdrawn or rejected, or if it fails to successfully list within 18 months of its initial application to the Hong Kong Stock Exchange, it will face substantial debt repayment.In 2022, Yunjike Technology sought guidance from CITIC Securities to list on the Shanghai Stock Exchange’s Sci-Tech Innovation Board, but by March of this year, the listing guidance agreement was terminated. It is evident that this application to the Hong Kong Stock Exchange carries significant pressure for Yunjike Technology.

Yunjike Technology’s revenue and net loss. (Image/compiled by China News Weekly from the prospectus)Although net losses are gradually narrowing, Yunjike Technology, which has not received any financing since 2021, may find it difficult to alleviate its financial pressure in the short term.According to the prospectus, by the end of last year, Yunjike Technology had about 100 million yuan in cash and cash equivalents, while its current liabilities exceeded 2 billion yuan. Among these, the redemption liabilities triggered by the listing agreement accounted for 1.87 billion yuan. This means that if Yunjike Technology’s listing application is withdrawn or rejected, or if it fails to successfully list within 18 months of its initial application to the Hong Kong Stock Exchange, it will face substantial debt repayment.In 2022, Yunjike Technology sought guidance from CITIC Securities to list on the Shanghai Stock Exchange’s Sci-Tech Innovation Board, but by March of this year, the listing guidance agreement was terminated. It is evident that this application to the Hong Kong Stock Exchange carries significant pressure for Yunjike Technology. The common dilemma of lossesIt is worth mentioning that the above challenges are not unique to Yunjike Technology but are common to the entire commercial service robot industry.Commercial service robots refer to robots that provide various services to humans in non-manufacturing fields, mainly including food delivery robots, hotel robots, commercial cleaning robots, and guiding robots.During the years when Yunjike Technology’s financing was hot, the entire commercial service robot market was in an investment frenzy, peaking in 2021.According to a report by Yiou Intelligence, in 2021, there were 115 related financing events in the service robot sector, with a total financing amount exceeding 44 billion yuan. Companies like Pudu Technology, Qianlang Intelligent, and Gaoxian Robotics received investments in the 10 billion yuan range that year. However, from January to November of the following year, there were only 11 related financing events, less than the amount in one quarter of the previous year.It was during this year of lacking capital infusion that Yunjike Technology, Qianlang Intelligent, Pudu Technology, and other commercial service robot companies were reported to have large-scale layoffs. A letter from the management of Orion Star (a company founded by Fu Sheng that provides delivery and other service robots) poured cold water on the industry, pointing out that there are industry “anomalies” such as using capital to simply expand product lines, sales teams, engaging in price wars, and using aggressive sales strategies to boost apparent sales figures.

The common dilemma of lossesIt is worth mentioning that the above challenges are not unique to Yunjike Technology but are common to the entire commercial service robot industry.Commercial service robots refer to robots that provide various services to humans in non-manufacturing fields, mainly including food delivery robots, hotel robots, commercial cleaning robots, and guiding robots.During the years when Yunjike Technology’s financing was hot, the entire commercial service robot market was in an investment frenzy, peaking in 2021.According to a report by Yiou Intelligence, in 2021, there were 115 related financing events in the service robot sector, with a total financing amount exceeding 44 billion yuan. Companies like Pudu Technology, Qianlang Intelligent, and Gaoxian Robotics received investments in the 10 billion yuan range that year. However, from January to November of the following year, there were only 11 related financing events, less than the amount in one quarter of the previous year.It was during this year of lacking capital infusion that Yunjike Technology, Qianlang Intelligent, Pudu Technology, and other commercial service robot companies were reported to have large-scale layoffs. A letter from the management of Orion Star (a company founded by Fu Sheng that provides delivery and other service robots) poured cold water on the industry, pointing out that there are industry “anomalies” such as using capital to simply expand product lines, sales teams, engaging in price wars, and using aggressive sales strategies to boost apparent sales figures.

(Image/unsplash)

After a period of calm, the fact that commercial service robots are still unable to make a profit has become the most concerning issue in the market, with previous praise turning into pessimism. As a result, returning to the essence of business and seeking profitability has become the primary task for players, especially leading companies in the industry.However, to this day, losses remain a common dilemma in the industry.“The robot industry is a typical representative of advanced technology, involving core components such as motors, drivers, visual sensors, as well as autonomous navigation technology and AI large models that bring intelligent improvements. The progress of these technologies requires long-term investment and continuous R&D. At the same time, companies need to continuously validate the market to ensure the effectiveness and stability of products in real scenarios,” Li Junlan believes that the current losses caused by high investment will lead to technological breakthroughs and product maturity, which will ultimately be the competitive advantage of enterprises in the future.However, a financial expert who wished to remain anonymous believes that the technological threshold for commercial service robots is not high, and while products in various sectors continue to iterate, there is significant homogenization, and the level of intelligence is still insufficient to meet the complex demands of more intricate scenarios.

(Image/unsplash)

“For hotel robots, if the function is merely to deliver items, the cost savings and efficiency improvements are relatively limited.” This individual stated that in this case, the competition of burning money for market share is hard to avoid, and losses are inevitable.According to a manager of a chain hotel, when they initially purchased robots, they considered the potential savings in labor costs, but in practice, it did not meet expectations. “Although using robots for delivery can free up some time and energy for the front desk, adding one robot does not reduce my staffing levels.”From this perspective, if more industries are to pay for commercial service robots, companies like Yunjike Technology still have a long way to go in refining technology, product functions, and exploring application scenarios.

1. “Over 500 million in financing in half a year, Tencent invests, over 10,000 hotels are using this robot, why is it so popular?”, August 23, 2021, China Entrepreneur

2. “Commercial service robots collectively ‘slim down’, who will be the ‘first to profit’?”, July 10, 2022, China Business Report

After reading, please click 【View】👇

After reading, please click 【View】👇