【Citation】

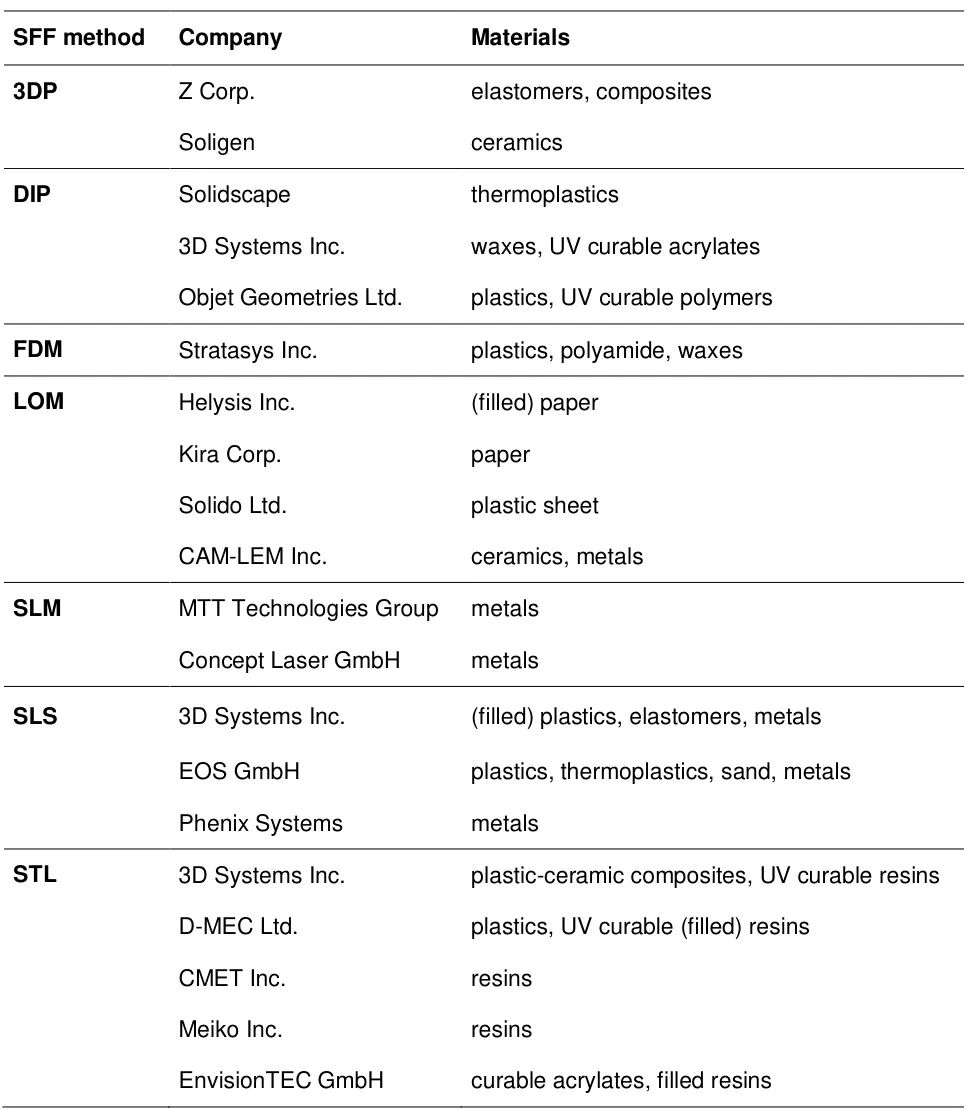

The global additive manufacturing sector exhibits a parallel development of multiple technological routes. German companies (such as EOS and SLM Solutions) dominate the industrial-grade market with multi-laser metal printing technology, while American firms (3D Systems and Stratasys) excel in non-metal printing and medical applications.

Technologies such as Electron Beam Melting (Arcam), Binder Jetting (ExOne), and Photopolymerization (EnvisionTEC) have established differentiated advantages in aerospace, casting, and biomedical fields, respectively. Industry consolidation is accelerating, with companies like GE and Nikon strengthening their full industry chain layout through acquisitions, while micro-nano manufacturing (3D-Micromac) and bioprinting (RegenHU) are emerging as high-growth sectors.

Future trends focus on multi-laser collaboration, AI process optimization, and green manufacturing, driving large-scale applications in high-value sectors such as aerospace and healthcare.

1. 3D-Micromac AG (Germany)

- Industry Position: A hidden champion in the global semiconductor laser processing equipment sector, particularly holding a significant share in the laser scribing machine market (with a compound annual growth rate of 12% from 2019 to 2024).

- Product Advantages:

- Micro-Nano Manufacturing Technology: LIFT (Laser-Induced Forward Transfer) technology enables the lossless transfer of micron-level chips with a precision of ±1μm, supporting MicroLED mass production.

- Silicon Carbide Wafer Cutting: Clean Scribe technology achieves particle-free cutting, improving efficiency by 15 times compared to traditional methods, applied in the power semiconductor production line for new energy vehicles.

2. 3D Systems Inc. (USA)

- Industry Position: A leader in non-metal 3D printing globally, with a market share of 10% in 2021, strengthened metal printing capabilities after acquiring Phoenix Systems.

- Product Advantages:

- Multi-Technology Integration: Comprehensive coverage of the entire technology chain including SLA (Stereolithography), SLS (Selective Laser Sintering), and SLM (Selective Laser Melting), offering personalized cranial implant solutions in the medical field.

- Regenerative Medicine Layout: Developed live cell printing technology through the acquisition of Titan Additive and Kumovis, applied in organ-on-chip research.

3. Arcam AB (Sweden, under GE Additive)

- Industry Position: A global leader in Electron Beam Melting (EBM) technology, with over 300 systems installed worldwide, holding approximately 2% market share in orthopedic implants.

- Product Advantages:

- Vacuum Environment Printing: Eliminates residual stress, suitable for titanium alloy aerospace turbine blades and porous bone implants (with porosity controllable to 70%).

- Powder Recovery Rate: Exceeds 95%, reducing the overall cost of metal printing by 50%.

4. CONCEPT Laser GmbH (Germany, under 3D Systems)

- Industry Position: A pioneer in metal laser melting technology, becoming a core supplier of aerospace engine components after being acquired by GE.

- Product Advantages:

- Random Exposure Strategy: LaserCUSING technology reduces thermal stress, supporting deformation-free printing of large components (up to 800mm) such as Airbus A350 engine brackets.

- Real-Time Monitoring System: QMmeltpool module ensures a qualification rate of over 99.5% for aerospace components.

5. EOS GmbH (Germany)

- Industry Position: Holds over 30% of the global metal 3D printing market share, collaborating with Siemens to create an Industry 4.0 digital process chain.

- Product Advantages:

- Multi-Laser Collaboration: The M400-4 device is equipped with four 400W lasers, achieving a build rate of 100cm³/h for mass production of nickel-based high-temperature alloy components.

- Material Innovation: EOS NickelAlloy IN718 has fatigue strength reaching 120% of traditional castings, applied in spacecraft fuel nozzles.

6. ExOne GmbH (Germany, under Desktop Metal)

- Industry Position: Among the top three in binder jetting technology globally, with over 200 foundries using its equipment, reducing BMW engine sand mold production cycles by 70%.

- Product Advantages:

- Large-Size Sand Molds: The S-Max Flex system supports 4m³ sand mold printing, reducing costs by 40% compared to traditional methods.

- Metal Indirect Printing: Achieves the manufacturing of complex structures in stainless steel and tungsten alloy through debinding and sintering processes.

7. Fraunhofer Society (Germany)

- Industry Position: The largest applied research institution in Europe, the FutureAM program aims to increase the speed of metal additive manufacturing processes by tenfold.

- Technological Breakthroughs:

- Digital Twin Process Chain: Achieves full process optimization from design to post-processing, collaborating with Fiat to develop a 3D-printed brake caliper that reduces weight by 36%.

8. SLM Solutions GmbH (Germany, under Nikon)

- Industry Position: A benchmark in multi-laser metal printing technology, the NXG XII 600E device is equipped with 12 lasers, achieving a build rate of 1000cm³/h.

- Application Case: Collaborated with Orbex to print rocket engines, achieving a weight reduction of 30% and a 20% increase in efficiency.

9. Stratasys Inc. (USA)

- Industry Position: A global leader in FDM technology, holding a 27.2% market share in non-metal printers in 2017, with over 55,000 units installed.

- Product Matrix:

- PolyJet Technology: Supports simultaneous multi-material printing, used for medical anatomical models (with a precision of up to 16μm).

- SAF Technology: High-speed production of consumer product packaging prototypes, with over 200 material combinations.

10. voxeljet AG (Germany)

- Industry Position: A leader in large-scale sand printing, the VX4000 device printed a 1.5m engine sand core for BMW, reducing costs by 50%.

- Technological Upgrade: The VJET X system has increased printing speed by tenfold, with a single build sand mold weight of up to 8 tons.

11. Key Analysis of Other Companies

| Company Name | Industry Position and Product Advantages |

|---|---|

| EnvisionTEC GmbH | Leading in photopolymerization technology, holding a 20% market share in dental models, supporting live cell encapsulation in bioprinting. |

| Optomec Inc. | Aerosol jet printing technology used for electronic circuit manufacturing, collaborating with Lockheed Martin to produce military sensors. |

| Materialise NV | A leader in medical 3D printing software, the Mimics platform supports personalized surgical planning, serving over 1,000 hospitals worldwide. |

| CMET Inc. (Japan) | Specialized in photopolymerization equipment, developing ceramic-resin composite materials for precision casting molds. |

| MicroFabrica Inc. | Unique micro-nano 3D printing technology, with a minimum feature size of 5μm, applied in MEMS sensor manufacturing. |

| RegenHU Ltd. (Switzerland) | An innovator in bioprinting, supporting collagen/hydrogel printing for skin tissue engineering. |

| Kira Corporation | Representative of LOM (Laminated Object Manufacturing) technology, with paper model costs reduced to 1/10 of traditional methods. |

| CAM-LEM Inc. | Specialized in ceramic/metal lamination technology for high-temperature components in aerospace. |

| Solidscape Inc. | A benchmark in high-precision wax model printing, with a surface roughness of Ra<1μm, serving jewelry lost-wax casting. |

| The Ennex™ | An industrial-grade customized printing service provider, focusing on complex structural components for aerospace. |

| D-MEC Ltd. (Japan) | A supplier of photopolymerization equipment, developing high-temperature resin materials for automotive lamp prototype production. |

| Mcor Technologies | A pioneer in full-color paper 3D printing, holding over 40% market share in the education sector. |

| Cubic Technologies | A supplier of materials for sand printing, with binder formulations compatible with ExOne/voxeljet equipment. |

Technological Routes and Market Landscape

- Metal Printing: EOS/SLM Solutions/Concept Laser occupy 70% of the market share, with multi-laser collaboration and AI process optimization becoming competitive focal points.

- Non-Metal Printing: Stratasys/3D Systems lead, with bioprinting and multi-material integration driving growth in the medical field.

- Emerging Technologies: Binder jetting (ExOne/Desktop Metal) and micro-nano printing (3D-Micromac) are growing the fastest, with a projected CAGR of 18% from 2024 to 2030.

Industry Merger and Acquisition Dynamics

| Acquirer | Acquiree | Technology Integration Direction |

|---|---|---|

| GE Additive | Arcam/Concept Laser | Building a complete metal printing industry chain |

| 3D Systems | Phoenix Systems | Strengthening metal printing capabilities |

| Desktop Metal | ExOne | Accelerating the commercialization of binder jetting technology |

| Nikon | SLM Solutions | Layout for multi-laser large-scale production |

Data Source: Compiled from global market reports (QYResearch, CITIC Construction Investment Securities, etc.) and technical literature, data updated to Q1 2024.