In the past two months, major manufacturers have successively released their most significant hardware products for this year. So, which smart hardware category saw the fastest sales growth last quarter? It is neither smartphones nor laptops and tablets, but smart speakers. Recently, the consumer technology market research firm Strategy Analytics released the “Global Smart Speaker Market Report for Q3 2018,” which shows that global smart speaker shipments in Q3 increased by 197% year-on-year, reaching 22.7 million units, setting a new historical high.

In the past two months, major manufacturers have successively released their most significant hardware products for this year. So, which smart hardware category saw the fastest sales growth last quarter? It is neither smartphones nor laptops and tablets, but smart speakers. Recently, the consumer technology market research firm Strategy Analytics released the “Global Smart Speaker Market Report for Q3 2018,” which shows that global smart speaker shipments in Q3 increased by 197% year-on-year, reaching 22.7 million units, setting a new historical high. This also means that global smart speaker sales are expected to exceed 100 million units this year. The vice president of Strategy Analytics stated that the speed at which the smart speaker market has reached this milestone is faster than any other consumer electronics product launched in the past decade.

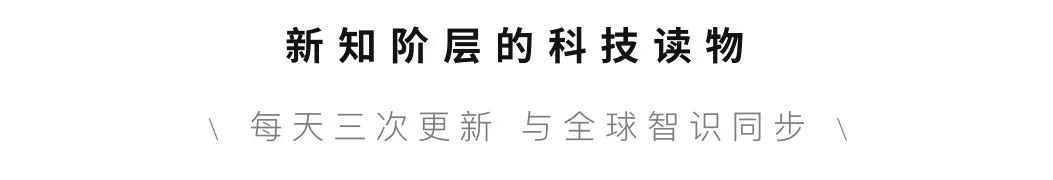

This also means that global smart speaker sales are expected to exceed 100 million units this year. The vice president of Strategy Analytics stated that the speed at which the smart speaker market has reached this milestone is faster than any other consumer electronics product launched in the past decade. The rapid growth of the smart speaker market is largely attributed to Chinese manufacturers. The report indicates that China has become the second-largest smart speaker market in the world, second only to the United States. Although Amazon still holds the largest market share, it has been halved from 64.8% a year ago to 31.6%. In addition to competitors like Google entering the smart speaker market, Chinese companies such as Alibaba, Baidu, and Xiaomi have also captured a significant share of the market. According to the report, Google follows closely behind Amazon with a 22.7% market share, while Alibaba ranks third with a market share of 9.5%, a staggering year-on-year increase of 1692%. Both Baidu and Xiaomi hold 8.4% market share, with Xiaomi also achieving an impressive year-on-year growth of 1800%. Due to the promising prospects of smart voice interaction, major internet technology companies have launched their own smart speakers after Amazon, including Google Home, Microsoft’s Invoke, Alibaba’s Tmall Genie, Xiaomi’s Xiao Ai, JD’s Ding Dong, Baidu’s Xiaodu, and Tencent’s Ting Ting…

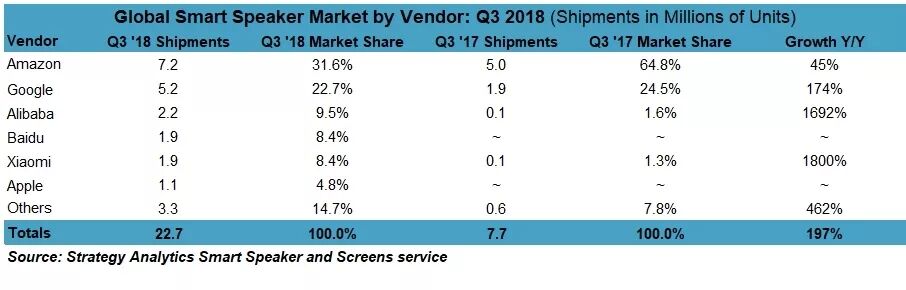

The rapid growth of the smart speaker market is largely attributed to Chinese manufacturers. The report indicates that China has become the second-largest smart speaker market in the world, second only to the United States. Although Amazon still holds the largest market share, it has been halved from 64.8% a year ago to 31.6%. In addition to competitors like Google entering the smart speaker market, Chinese companies such as Alibaba, Baidu, and Xiaomi have also captured a significant share of the market. According to the report, Google follows closely behind Amazon with a 22.7% market share, while Alibaba ranks third with a market share of 9.5%, a staggering year-on-year increase of 1692%. Both Baidu and Xiaomi hold 8.4% market share, with Xiaomi also achieving an impressive year-on-year growth of 1800%. Due to the promising prospects of smart voice interaction, major internet technology companies have launched their own smart speakers after Amazon, including Google Home, Microsoft’s Invoke, Alibaba’s Tmall Genie, Xiaomi’s Xiao Ai, JD’s Ding Dong, Baidu’s Xiaodu, and Tencent’s Ting Ting… ▲ From left to right: Tencent Ting Ting, Raven H, Tmall Genie X1The smart speaker market is bustling, but the penetration rate of smart speakers in China is still relatively low. GfK’s national retail monitoring data shows that last year, the sales of smart speakers in China were 1.65 million units, with a market size of only 310 million yuan. However, the growth rate of smart speakers is astonishing. Last quarter alone, Tmall Genie sold 2.2 million units, and GfK predicts that smart speaker sales in 2018 will reach 9 million units, with the market size increasing to 1.8 billion yuan, compared to just 60,000 units and 20 million yuan in 2016.

▲ From left to right: Tencent Ting Ting, Raven H, Tmall Genie X1The smart speaker market is bustling, but the penetration rate of smart speakers in China is still relatively low. GfK’s national retail monitoring data shows that last year, the sales of smart speakers in China were 1.65 million units, with a market size of only 310 million yuan. However, the growth rate of smart speakers is astonishing. Last quarter alone, Tmall Genie sold 2.2 million units, and GfK predicts that smart speaker sales in 2018 will reach 9 million units, with the market size increasing to 1.8 billion yuan, compared to just 60,000 units and 20 million yuan in 2016. In the Chinese market, Alibaba’s Tmall Genie and Xiaomi’s Xiao Ai have consistently held over half of the market share. Last quarter, Baidu’s Xiaodu smart speaker, priced at 89 yuan, successfully entered the market with sales reaching 1.9 million units, making it one of the top four smart speakers globally. As analyzed by Strategy Analytics, the main driving force behind the growth of Chinese smart speaker manufacturers like Alibaba and Xiaomi is the low prices and significant discounts. However, these large companies’ low-price strategies have made it difficult for smaller manufacturers to compete. High-end smart speakers have even less market presence in the context of China’s underdeveloped smart home market. For instance, the high-end smart speaker brand Raven, which was acquired by Baidu for 90 million yuan, began developing new products like Raven H, but due to internal concerns about sales, the final production volume was reduced from the planned 50,000-100,000 units to less than 10,000 units.

In the Chinese market, Alibaba’s Tmall Genie and Xiaomi’s Xiao Ai have consistently held over half of the market share. Last quarter, Baidu’s Xiaodu smart speaker, priced at 89 yuan, successfully entered the market with sales reaching 1.9 million units, making it one of the top four smart speakers globally. As analyzed by Strategy Analytics, the main driving force behind the growth of Chinese smart speaker manufacturers like Alibaba and Xiaomi is the low prices and significant discounts. However, these large companies’ low-price strategies have made it difficult for smaller manufacturers to compete. High-end smart speakers have even less market presence in the context of China’s underdeveloped smart home market. For instance, the high-end smart speaker brand Raven, which was acquired by Baidu for 90 million yuan, began developing new products like Raven H, but due to internal concerns about sales, the final production volume was reduced from the planned 50,000-100,000 units to less than 10,000 units. ▲ Raven H. Another reason for the rapid growth of the Chinese smart speaker market is the lack of competition with the two major players, Amazon and Google. The complexity of Chinese natural language processing hinders the development of foreign smart speaker brands in China. For example, Apple’s HomePod supports English, and among the major American tech giants, only Siri supports Chinese. Even domestic smart speakers struggle with understanding Chinese semantics.

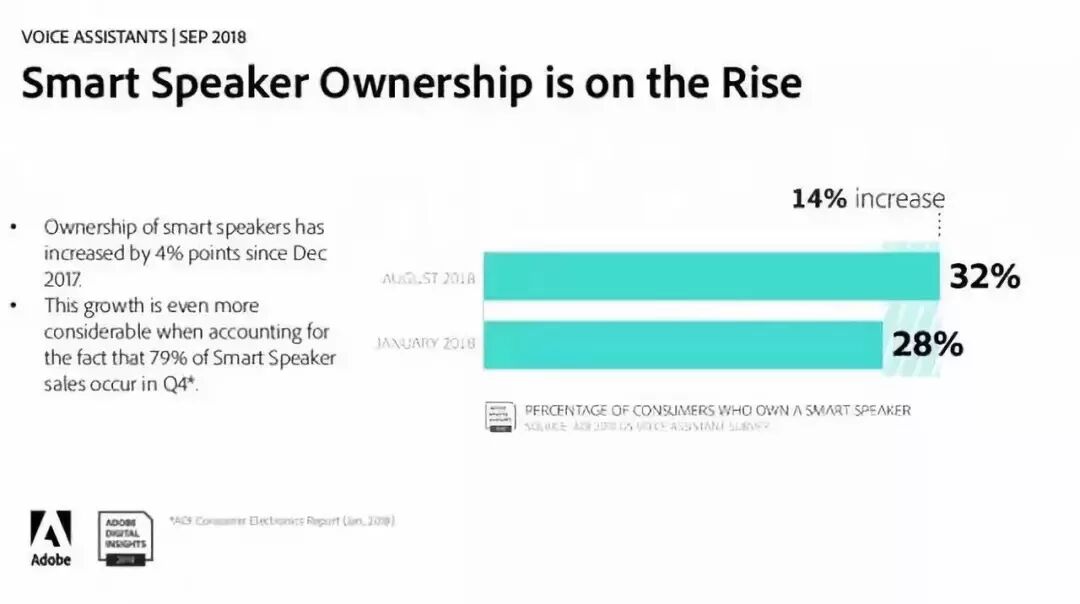

▲ Raven H. Another reason for the rapid growth of the Chinese smart speaker market is the lack of competition with the two major players, Amazon and Google. The complexity of Chinese natural language processing hinders the development of foreign smart speaker brands in China. For example, Apple’s HomePod supports English, and among the major American tech giants, only Siri supports Chinese. Even domestic smart speakers struggle with understanding Chinese semantics. In contrast, the smart speaker market in the United States is much more mature. First, the penetration rate of smart homes in the U.S. has reached 5.8%, the highest in the world, allowing smart speakers to serve as the entry point for smart home scenarios. A recent survey report from Adobe Analytics shows that smart speakers like Amazon Echo, Google Home, and Apple HomePod have now entered 32% of American households, and this number is expected to approach 50% by the end of this year.

In contrast, the smart speaker market in the United States is much more mature. First, the penetration rate of smart homes in the U.S. has reached 5.8%, the highest in the world, allowing smart speakers to serve as the entry point for smart home scenarios. A recent survey report from Adobe Analytics shows that smart speakers like Amazon Echo, Google Home, and Apple HomePod have now entered 32% of American households, and this number is expected to approach 50% by the end of this year. Another survey from consulting firm Accenture shows that 66% of users of smart speakers like Amazon Echo and Google Home have significantly reduced their mobile phone usage, indicating the promising application prospects of smart speakers in home environments.

Another survey from consulting firm Accenture shows that 66% of users of smart speakers like Amazon Echo and Google Home have significantly reduced their mobile phone usage, indicating the promising application prospects of smart speakers in home environments. Steve Wozniak, co-founder of Apple, has stated that smart voice interaction will become the next important platform in computing, with voice control and artificial intelligence achieving seamless integration between the real world and the internet. Looking at the current situation, this future seems still far off. Smart speakers in China are still in their infancy, and to realize the scenarios described by Steve Wozniak, smart speaker manufacturers need to establish a new ecosystem. Simply integrating Siri into a speaker is far from sufficient.

Steve Wozniak, co-founder of Apple, has stated that smart voice interaction will become the next important platform in computing, with voice control and artificial intelligence achieving seamless integration between the real world and the internet. Looking at the current situation, this future seems still far off. Smart speakers in China are still in their infancy, and to realize the scenarios described by Steve Wozniak, smart speaker manufacturers need to establish a new ecosystem. Simply integrating Siri into a speaker is far from sufficient.

Is the Wireless Reverse Charging on Huawei Mate 20 Pro Really Practical?

Is the Wireless Reverse Charging on Huawei Mate 20 Pro Really Practical?

WeChat Major Update

You Can Soon Find It Hard to Locate iFanr…

Come andStar / Pin “iFanr”

⭐ Don’t Miss Great Content in the Information Flood ⭐