Remember to star the public account ⭐️ to receive notifications promptly.

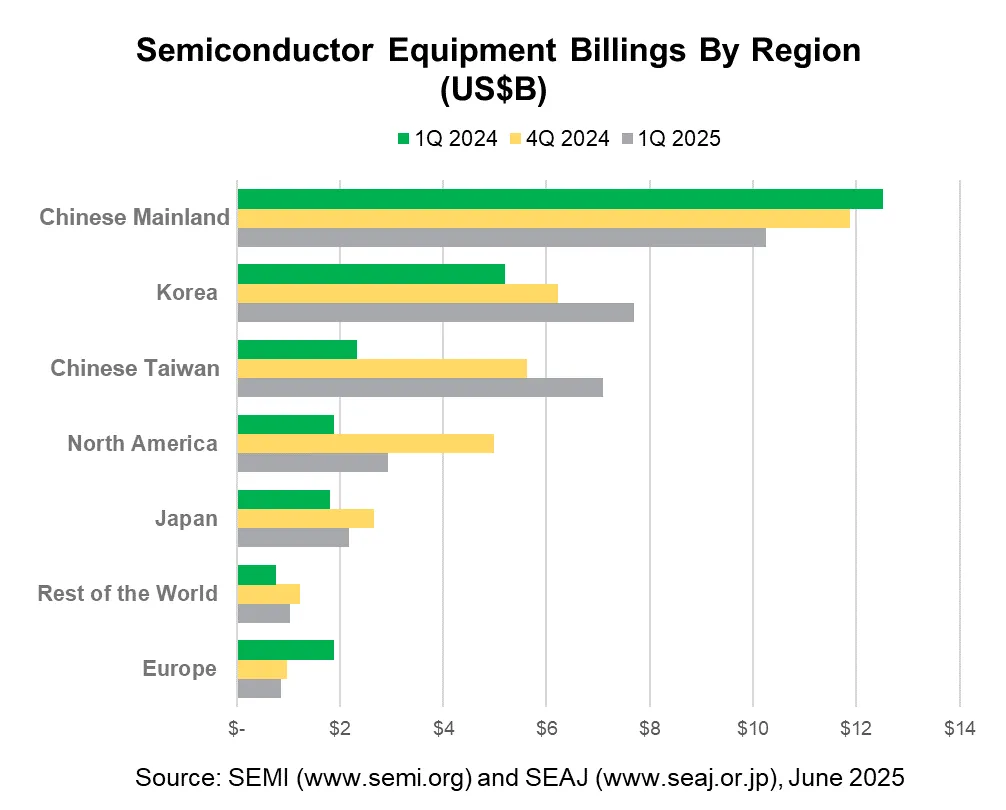

Recently, SEMI pointed out in its latest “Global Semiconductor Equipment Market Report” that the global semiconductor equipment shipment value in the first quarter of 2025 is expected to grow by 21% year-on-year, reaching $32.05 billion. According to typical seasonal patterns, the shipment value in the first quarter of 2025 is expected to decline by 5% quarter-on-quarter.

From the specific data of various regions:

-

Mainland China: In Q1 2025, revenue is expected to be $10.26 billion, still the largest single market globally, but down 14% quarter-on-quarter and 18% year-on-year, showing a “double decline”;

-

South Korea: In Q1 2025, revenue is expected to be $7.69 billion, up 24% quarter-on-quarter and 48% year-on-year, showing strong growth;

-

Taiwan: In Q1 2025, revenue is expected to be $7.09 billion, up 26% quarter-on-quarter and a staggering 203% year-on-year, leading the global growth rate;

-

North America: In Q1 2025, revenue is expected to be $2.93 billion, down 41% quarter-on-quarter and up 55% year-on-year;

-

Japan: In Q1 2025, revenue is expected to be $1.03 billion, down 18% quarter-on-quarter and up 20% year-on-year;

-

Europe: In Q1 2025, revenue is expected to be $870 million, down 11% quarter-on-quarter and down 54% year-on-year, showing the largest decline.

From the changes in regional sales, the data shows a stark contrast.

In Q1 2025, the sales in the Mainland China market fell sharply by 18% year-on-year, dropping to $10.26 billion. Nevertheless, the Mainland China market has maintained its position as the largest chip equipment market globally for the eighth consecutive quarter. However, with significant increases in semiconductor equipment investments in Taiwan and South Korea, the proportion of Mainland China’s overall semiconductor equipment sales has shrunk from 47% in the same period last year to 32%.

Meanwhile, the North American and Japanese equipment markets have shown “pulse-like” fluctuations, while the European market continues to decline, with severe hollowing-out issues in the industry.

Regarding the current state of the equipment market, SEMI President and CEO Ajit Manocha stated: “The global semiconductor equipment market has made a solid start in Q1 2025, reflecting proactive investments in future chip manufacturing capacity across regions. Despite uncertainties posed by geopolitical issues, tariff fluctuations, and export controls, the industry still demonstrates resilience, driven by the ongoing AI boom that continues to push wafer fab expansions and equipment sales.”

Behind these data and viewpoints may hint at subtle changes in the global equipment market landscape and the semiconductor industry.

What signals does the semiconductor equipment market release?

Triple Logic Boosts South Korea’s Equipment Market Growth

In Q1 2025, South Korea’s semiconductor equipment market performed outstandingly, with sales surging 48% year-on-year to $7.69 billion, surpassing Taiwan for two consecutive quarters to become the world’s second-largest market. This growth is driven by the recovery of memory chips, capacity expansions by major manufacturers, and policy support.

From the perspective of the industry cycle, memory chips have exited the downturn since the second half of 2023, with the AI wave and terminal demand recovery accelerating the rebound and prices recovering. Samsung, SK Hynix, and others have initiated a “capacity replenishment” cycle, coupled with advanced DRAM process expansions, HBM capacity explosions, and 3D NAND stacking upgrades, driving a surge in equipment orders in South Korea.

ASML’s financial report shows that the South Korean market contributed 40% of its revenue in Q1 2025, surpassing China for the first time to become its largest customer, with 23 units of High-NA EUV lithography machines delivered in a single quarter, accounting for 58% of global shipments. Applied Materials and Lam Research also achieved high growth in orders due to procurement from South Korean memory customers, with Morgan Stanley noting that local South Korean equipment manufacturers (such as SEMES) are expected to see revenue growth of over 600% year-on-year in 2024, continuing the upward trend in Q1 2025.

On the policy front, the South Korean government has launched the “K-Semiconductor Strategy,” providing a 30% tax credit (for SMEs), priority land supply, and a 15% subsidy on industrial electricity prices, with over $5 billion in subsidies for Samsung and SK Hynix in 2025. The “K-Semiconductor Strategy Roadmap” clearly states that “the global market share of memory chips should remain at 70% by 2030,” forcing companies to accelerate technology iterations and capacity expansions.

The triple logic supporting South Korea’s high equipment growth includes:

-

Cycle: Memory transitions from “inventory reduction” to “capacity replenishment,” with price and profit recovery driving expansions;

-

Enterprise level: Samsung and SK Hynix create equipment demand through product upgrades and HBM expansions;

-

Ecological level: Policy subsidies and technical adaptations from equipment manufacturers like ASML and Applied Materials create synergistic effects.

Regarding the high growth of South Korea’s semiconductor equipment in Q1 2025, I believe it fundamentally stems from the release of three dividends: “memory cycle recovery + technology iteration + policy support.” Given that the equipment procurement cycle for memory expansions lasts 6-12 months, the high growth of the South Korean equipment market is expected to continue into the second half of 2025.

Surging 203%, Taiwan’s Equipment Growth Rate Leads

In Q1 2025, Taiwan’s semiconductor equipment market size surged 203% year-on-year, reaching $7.09 billion.

This rapid growth is the result of multiple factors, including capacity expansions by leading manufacturers, explosive growth in advanced packaging, and the Matthew effect of industrial clusters.

In the foundry sector, TSMC and UMC’s expansion plans have significantly boosted equipment demand. TSMC continues to advance research and production of advanced processes, with its 3nm capacity rising to 100,000 wafers per month in Q1 2025, a 25% increase from the second half of 2024, meeting the demand for advanced chips like Apple’s A18 and NVIDIA’s B100; simultaneously, it has launched a 2nm pilot production line at the Baoshan plant in Hsinchu, planning a monthly capacity of 3,000-3,500 wafers. To support the 2nm research and pilot production, TSMC allocated 70% of its capital expenditure in 2025 to advanced processes, acquiring six EUV lithography machines from ASML in Q1 2025, including two High-NA EUV machines for 2nm pilot production, with a single purchase price of approximately $350-380 million.

UMC focuses on mature and specialty processes to fill the “mid-to-low-end” equipment gap. In Q1 2025, it initiated the “Hsinchu 28nm capacity doubling plan” to meet the demand for automotive chips from Tesla and BYD, increasing capital expenditure by 50% to $5 billion, with 60% allocated for equipment procurement. UMC’s 65% of capacity is concentrated in 28nm and 40nm mature processes, requiring over 300 units of equipment per production line, driving a 35% growth in mid-to-low-end equipment demand. Additionally, UMC is ramping up its silicon carbide power device processes, procuring related specialty process equipment in Q1 2025, contributing to a 15% growth in the equipment market.

Advanced packaging has become the “second pole” of equipment growth in Taiwan. TSMC’s CoWoS packaging technology is used for NVIDIA’s H100/H200 and AMD’s MI300 AI chips, with tight capacity utilization in Q1 2025, forcing it to initiate capacity expansions at the Tainan packaging plant, planning to increase CoWoS capacity from 35,000 wafers/month in 2024 to 65,000-75,000 wafers/month in 2025. UMC is also laying out fan-out packaging (FOWLP) for IoT chips, forming a dual-track driving pattern of “high-end packaging + mid-to-low-end packaging” with TSMC, significantly boosting the demand for related packaging equipment and driving the development of the industry.

The Matthew effect of Taiwan’s semiconductor industry cluster is significant, with the entire industry chain from design, manufacturing to packaging, equipment, and materials collaborating, allowing for globally leading efficiency in equipment delivery, debugging, and iteration, further amplifying the growth potential of equipment. TSMC and UMC cover “high-end logic + mature processes + advanced packaging,” combined with the world’s densest semiconductor ecosystem, continuously reinforcing Taiwan’s position as a global semiconductor equipment demand hub, with the Matthew effect further consolidating under this trend.

North American Equipment Market: “Pulse-like Expansion” and “Overdraft Effect”

The North American equipment market saw sales surge 55% in Q1, reaching $2.93 billion, but declined 41% quarter-on-quarter. This data may confirm that Intel’s “pulse-like” expansion characteristics directly impact the rhythm of the North American equipment market.

In Q4 2024, due to the risk of trial production for the 18A process, there was concentrated procurement of key equipment such as EUV lithography machines and high-precision etching machines, coupled with the first $1.5 billion subsidy from the CHIPS Act, with 70% of capital expenditure in a single quarter allocated for equipment procurement, pushing the North American equipment market to a historical peak.

However, this concentrated procurement created a base “overdraft effect,” leading to a shift in equipment procurement in Q1 2025 towards “quality demand” in the pre-mass production verification phase, compounded by the Chinese New Year holiday causing reduced deliveries in the Asian supply chain, resulting in a 41% quarter-on-quarter decline in the North American market. However, on a year-on-year basis, the 18A process, as the world’s first node integrating RibbonFET and PowerVia technologies, has driven high-end equipment procurement with a unit price exceeding $150 million for high-NA EUV lithography machines, along with an 80% year-on-year increase in demand for Foveros 3D packaging equipment, and a 70% year-on-year increase in equipment procurement for factories in Arizona under the goal of localizing production in the U.S., collectively supporting a 55% year-on-year growth in the North American market.

The pulse-like expansion has a “double-edged sword” effect on the North American semiconductor equipment market: the procurement peak in Q4 2024 led to a quarter-on-quarter adjustment in Q1 2025, but the year-on-year growth of 55% indicates that the market is still in the IDM 2.0 upward cycle. In the long term, with Intel’s 18A process expected to enter mass production in the second half of 2025 and continued subsidies from the CHIPS Act, the market is expected to rebound by over 25% quarter-on-quarter in Q2, with an annual growth rate of over 30%.

However, the risk lies in whether Intel’s 18A process can achieve the target yield of 85%, or if delays in equipment procurement will exacerbate fluctuations. This “pulse-like” growth results from a combination of technological breakthroughs, policy drives, and mismatches in procurement cycles, with long-term competitiveness relying on the mass production of 18A and the synergy of the local supply chain.

Japanese Equipment Market: “Year-on-Year High Growth, Quarter-on-Quarter Adjustment” Trend

The Japanese semiconductor equipment market has shown a “year-on-year high growth, quarter-on-quarter adjustment” trend.

In Q1 2025, the Japanese equipment market grew by 20% year-on-year, mainly due to local policies and capacity expansions. The Japanese government has provided substantial subsidies to Rapidus, promoting its 2nm chip pilot production line to start in April 2025, driving local equipment demand. TSMC’s Kumamoto plant (12-28nm) entered the equipment installation phase in Q1 2025, procuring cutting equipment from Disco and coating equipment from SCREEN, significantly increasing related orders year-on-year.

However, the quarter-on-quarter decline of 18% is due to seasonal fluctuations and supply chain adjustments. In Q4 2024, global equipment sales reached a historical high, and Japanese companies concentrated on delivering equipment to match customer trial production cycles, such as Tokyo Electron’s revenue growth in Q4, but a quarter-on-quarter decline in Q1 2025 reflects the cyclical nature of order deliveries. In Q1 2025, the Asian supply chain was affected by the Chinese New Year holiday, leading to reduced equipment delivery volumes. Meanwhile, Chinese wafer fabs prioritized inventory digestion, resulting in a decrease in chip inventory turnover days and weakened equipment procurement willingness.

From industry perspectives and third-party corroboration, the year-on-year growth of the Japanese equipment market benefits from its global competitiveness in mature process equipment and advanced packaging materials, while the quarter-on-quarter decline is influenced by seasonal and supply chain factors.

Brokerage reports indicate that Japanese equipment manufacturers have advantages in AI-driven HBM and advanced packaging fields, but shortages of PSPI materials may impact long-term orders, and it is expected that in Q2 2025, as TSMC’s CoWoS capacity is released, Japanese equipment demand may rebound quarter-on-quarter.

Plummeting 54%, Europe’s Semiconductor Industry Hollowing Out Intensifies

In stark contrast to the aforementioned regions, the European semiconductor equipment market is expected to decline by 54% year-on-year and 11% quarter-on-quarter in Q1 2025, totaling only $870 million.

Specifically, the current state of the European equipment market can be attributed to ineffective policy implementation, reduced capital expenditure, and global competitive pressure.

The EU’s “Chips Act” funding accounts for only 10% of the planned budget, with significant projects like Intel’s factory in Germany delayed, leading to a sharp reduction in corporate capital expenditure, and STMicroelectronics’ equipment procurement has significantly decreased. The expansion of capacity in Asia has siphoned demand, with Taiwan and South Korea’s equipment markets growing by 203% and 48% year-on-year, respectively, causing Europe’s share to shrink to 2.7%. Seasonal fluctuations combined with inventory adjustments have led to European automotive and industrial chip inventory turnover days exceeding 167 days, resulting in low equipment procurement willingness.

The lack of local expansion has exacerbated supply chain risks. Europe lacks large semiconductor manufacturing enterprises with global competitiveness, and the local market demand is relatively limited. Although Europe has certain technological advantages in specific fields, such as automotive semiconductors and compound semiconductors, the overall industry scale is small, making it difficult to match the procurement demand for semiconductor equipment with other major regions. Additionally, most memory and logic chips heavily rely on overseas imports, further increasing procurement costs.

The trend of industrial hollowing out is evident, with Europe lacking 3nm/2nm production lines, and the capacity share of logic chips below 14nm being less than 5%, with equipment R&D investment lower than that of Asia and North America, and the market share of etching and thin film deposition equipment being less than 10%. The weak collaboration between design and manufacturing, with companies like NXP relying on TSMC for foundry services, results in local wafer fabs operating at only 75% capacity utilization, with a localization rate of 45% for materials and 60% of equipment subsystems relying on Japanese and American sources.

This decline has triggered a chain reaction in the global supply chain: delays in European automotive electronics orders affect Asian foundries, shortages of industrial chips impact global smart manufacturing, and rising equipment import costs exacerbate supply chain resilience risks. If the implementation of the “Chips Act” continues to lag, the technological gap and ecological disconnection will continue to weaken Europe’s semiconductor competitiveness, further amplifying the vulnerabilities in the global industrial chain.

Moreover, the restructuring of the global semiconductor industry supply chain and geopolitical factors have also adversely affected the European semiconductor equipment market, leading to a significant decline in its equipment market.

In summary, the decline of the European equipment market is a comprehensive result of policy stagnation, demand disconnection, and ecological disconnection, with the sharp drop in Q1 2025 reflecting a systemic failure of its semiconductor industry in global competition.

It is worth noting that the trend of hollowing out in the European semiconductor industry has become irreversible. If large-scale expansions are not initiated in the second half of 2025, its equipment market share will further shrink.

Mainland China’s Equipment Market Experiences “Double Decline,” but Future Looks Promising!

In Q1 2025, Mainland China’s revenue is expected to be $10.26 billion, still the largest single market globally, but down 14% quarter-on-quarter and 18% year-on-year, showing a “double decline” trend.

The reasons behind this performance are complex. On one hand, the inventory built up from previous large-scale equipment procurement requires time to digest, leading to a slowdown in market demand in the short term.

From 2020 to 2023, Mainland China experienced a wave of wafer fab construction, and by 2024, the mature processes were nearing saturation, with the capacity utilization rate of 28nm and above mature processes declining, leading to high chip inventory levels, forcing wafer fabs to pause new production line constructions and reduce equipment procurement. In terms of advanced processes, due to U.S. equipment restrictions, the capacity ramp-up speed has significantly slowed, with equipment investment shifting from “incremental expansion” to “stock maintenance,” resulting in a substantial decline in investment and a continuous downturn in the equipment market.

On the other hand, adjustments in the global semiconductor industry supply chain and uncertainties in the external environment have also impacted Mainland China’s equipment market. The U.S. has implemented export controls on semiconductor equipment, leading to a sharp reduction in ASML’s shipments of EUV lithography machines to China, which basically came to a halt in Q1 2025, and companies like Applied Materials and Lam Research have also seen a significant decline in sales of etching and thin film deposition equipment for processes below 14nm in Mainland China. The U.S. has also requested Japan and the Netherlands to impose similar restrictions, resulting in reduced supply from non-U.S. equipment manufacturers. In terms of technological ecosystem blockades, the U.S. has tightened the authorization of advanced process EDA tools, requiring equipment manufacturers to disclose segments of the supply chain with “U.S. technology content ≥10%”, causing many foreign equipment manufacturers to hesitate in supplying to Mainland China. Under these sanctions, the import value of semiconductor equipment in Mainland China has significantly declined.

Additionally, in Q4 2024, global equipment sales reached a historical high, and Japanese and other companies concentrated on delivering equipment to match customer trial production cycles, leading to a high base. In Q1 2025, the Asian supply chain was affected by the Chinese New Year holiday, resulting in reduced equipment delivery volumes. Furthermore, Chinese wafer fabs prioritized inventory digestion, leading to a decrease in chip inventory turnover days and weakened equipment procurement willingness.

In summary, U.S. technological restrictions have directly impacted advanced process investments, while domestic capacity cycle adjustments have led to an oversupply of mature process capacity, compressing overall demand. The combination of these two factors has resulted in a decline in sales and market share of Mainland China’s semiconductor equipment market in Q1 2025.

Challenges and Opportunities for Domestic Semiconductor Equipment

Recently, a team of authors including Ye Tianchun, Zhu Yu, Zhang Guoming, Du Xiaoli, Lei Zhenlin, and Yuan Pengpeng published an article titled “Challenges and Opportunities for Semiconductor Equipment Facing the 14th Five-Year Plan” in the journal of the Chinese Academy of Sciences, stating: “Facing the 14th Five-Year Plan, China’s semiconductor equipment industry faces dual challenges of technological blockade and supply chain decoupling, requiring a shift from ‘catching up and replacing’ to ‘path innovation’ to break the dependence on the international technology system.”

Currently, the global semiconductor equipment market is characterized by highly globalized product division and monopolistic competition for single products, with over 80% of the market share held by U.S., Japanese, and European manufacturers. Northern Huachuang is the only Chinese company among the top 10 equipment manufacturers globally, ranking 6th in 2024. China’s semiconductor equipment has developed from nearly zero in 2008 to a total sales of 85.3 billion yuan in 2024, with some front-end manufacturing 12-inch high-end equipment entering the market in batches, but the high-end field is still dominated by foreign manufacturers, with U.S., Japanese, and Dutch leading companies holding over 70% market share in China.

2024 Global Semiconductor Equipment Manufacturer Market Size Ranking Top 10

Data Source: CINNO • IC Research

Semiconductor manufacturing is divided into front-end and back-end processes, with front-end including about 190 types of subdivided equipment across nine categories such as lithography; each process upgrade requires an additional 10%-20% of equipment; back-end includes thinning, testing, and other equipment. As chip technology evolves, the requirements for equipment continue to increase, and the industry is also exploring new technological paths such as three-dimensional structures, photonic chips, and advanced packaging technologies.

Integrated Circuit Logic Device Technology Roadmap

(Image Source: Chinese Academy of Sciences Journal)

China’s semiconductor equipment development faces two core issues: first, the upstream component supply chain is “choked.” Semiconductor equipment relies on tens of thousands of precision components, and the domestic component industry started late, making it difficult to meet the equipment and wafer manufacturing needs in terms of core technologies and manufacturing processes. Second, the “involution” dilemma caused by low-level repetition. “Domestic replacement” has evolved into “replacing domestic,” with fierce competition in mid-to-low-end products, a large influx of new entities, horizontal expansion of enterprises, and homogeneous competition, leading to resource misallocation and hindering technological breakthroughs towards mid-to-high-end. Externally, due to U.S. restrictions on processes below 14nm, and internally, due to the listing dividends and local support attracting a large amount of capital into the market disorderly, exacerbating the involution phenomenon.

Main Domestic Semiconductor Equipment Enterprises

(Image Source: Chinese Academy of Sciences Journal)

In the past, China’s semiconductor industry integrated into the international cycle, developing through “catching up” and “replacement” strategies, but this also formed a dependence on external paths. In the context of de-globalization, the original development foundation has been lost, and a new model must be established to take the initiative. Facing the 14th Five-Year Plan, China should seize the opportunity of technological transformation, carry out transformative innovation, reshape the semiconductor industrial system and ecology, and semiconductor equipment should play a supporting and leading role in the development of the “Chinese characteristic Moore’s Law,” addressing supply chain and involution issues, achieving a leap from self-controllability to self-reliance and strength.

In summary, the long-term strategic direction of self-controllability in Mainland China’s semiconductor industry will not change. With continuous investment and breakthroughs in technology research and development by domestic enterprises, as well as strong support from national policies, the future demand for semiconductor equipment still has significant growth potential.

As domestic wafer manufacturing and equipment manufacturers have stated:

SMIC’s CEO candidly stated in the 2024 earnings call: “Delays in advanced equipment supply and the digestion of mature capacity have forced us to adjust the pace of capital expenditure, but we remain optimistic about breakthroughs in the local supply chain in the long term.”

The chairman of Northern Huachuang emphasized: “U.S. restrictions have accelerated the replacement of domestic equipment, with equipment for 28nm and below already achieving batch delivery, but 7nm and below still require time; this is a ‘protracted war.'”

Yin Zhiyao, chairman and general manager of Zhongwei Company, previously stated, “In the past twenty years, our progress towards self-controllability has been generally smooth, with the self-controllability rate of major components reaching over 90%, and we expect to reach 100% by the end of Q3 2024.”

Yin Zhiyao also discussed the challenges in front-end equipment: “Apart from lithography machines, electron beam measurement and ion implantation equipment are two relatively urgent bottlenecks that need to be broken through.”

Industry analysts have pointed out that if the U.S. continues to tighten controls, investments in advanced process equipment in Mainland China may drop another 30% in 2025-2026. In the short term, equipment investment will still face pressure in 2025-2026, but if demand for automotive electronics and AI terminals recovers, it may drive equipment investment to bottom out and rebound.

In the long term, if domestic equipment manufacturers achieve technological breakthroughs in etching machines, lithography machines, and other fields, coupled with the development of emerging fields such as third-generation semiconductors and advanced packaging, it is expected to open a “new growth cycle driven by self-reliance.” Currently, domestic equipment manufacturers have a replacement rate of over 40% in mature processes, which has somewhat hedged against market downturn risks, and they are continuously making breakthroughs in advanced equipment, with new progress expected in the future. “Domestic replacement” and “opportunities in emerging fields” bring hope for the industry to break through.

Short-term Adjustment or Cycle Shift?

In Q1 2025, the global semiconductor equipment market’s total revenue is expected to be $32.05 billion, down 5% quarter-on-quarter but up 21% year-on-year, showing characteristics of “annual growth but quarterly fluctuations.” This data indicates that despite quarterly adjustments, the overall annual trend is upward, reflecting the strong resilience and potential vitality of the semiconductor industry.

Looking at future changes in the chip market, a structural differentiation and cyclical upturn coexist.

In the advanced process and memory sectors, equipment investment is transforming into capacity explosions. From 2024 to Q1 2025, equipment investments by companies like TSMC, Samsung, Intel, and SK Hynix in advanced processes and memory capacity expansions have driven a 21% year-on-year increase in global equipment spending in Q1 2025. It is expected that from the second half of 2025 to 2026, capacity will gradually be released, with global wafer fab capacity expected to increase by 7% quarter-on-quarter, with advanced nodes below 5nm accounting for an increasing share. However, in the mature process sector, there are challenges in supply-demand rebalancing. Although Mainland China continues to expand mature process capacity, with new capacity accounting for 35% of global incremental growth in 2025, globally, mature process capacity is nearing saturation, as evidenced by high inventory levels of automotive chips in Europe, which may lead to price pressures on chips after Q3 2025.

High-end chips will maintain a tight supply-demand balance and price resilience due to strong demand driven by AI. The HBM market is rapidly growing, with significant price premiums, and companies like TSMC are improving yield rates in advanced process technologies, supporting mass production of high-end chips. However, ASML’s EUV lithography machine capacity is limited, and HBM capacity is concentrated in South Korea, creating bottlenecks in high-end chip supply. In contrast, mid-to-low-end chips are facing continuous price declines due to oversupply in mature process capacity and weak demand in consumer electronics. Global capacity for 28nm and above is increasing, but declining shipments of smartphones and PCs are leading to price drops, and capital expenditure growth rates for foundries like UMC are slowing. In the memory chip sector, DRAM is benefiting from HBM demand growth, while NAND is affected by inventory levels in consumer electronics, leading to differentiated performance.

Regarding whether the current industry is experiencing a “short-term adjustment” or a “cycle shift,” I believe the industry is in a recovery mid-term, and the Q1 adjustment is a result of seasonal fluctuations, inventory adjustments, and geopolitical disturbances, rather than a cycle shift. From a seasonal and inventory perspective, the global equipment sales in Q1 2025 decreased by 5% quarter-on-quarter, with weak demand in Europe and Japan. Geopolitically, unstable tariff policies have led to increased supply chain costs, resulting in a quarter-on-quarter decline in equipment procurement amounts in Chinese wafer fabs.

However, from the second half of 2025 to 2026, the industry is expected to welcome a cycle shift and enter an expansion phase. Demand for logic chips driven by AI servers and autonomous driving will increase, leading to a significant rise in HBM shipments, while global wafer fab capacity utilization rates will recover, and prices for advanced process chips will remain high, with mature process prices stabilizing. SEMI predicts that global front-end facility equipment spending is expected to reach $110 billion in 2025, a slight increase of 2% compared to 2024, marking the sixth consecutive year of positive growth. Spending in 2026 is expected to grow by 18% year-on-year, reaching $130 billion.

Final Thoughts

In summary, while the global semiconductor equipment market experienced a quarterly adjustment in Q1 2025, year-on-year growth and industry dynamics confirm an upward cycle trend.

The industry is currently in a recovery mid-term, with quarterly fluctuations stemming from seasonal, inventory, and geopolitical factors, rather than a cycle shift. The future chip market will continue to exhibit a structural differentiation pattern, with high-end demand remaining strong while mid-to-low-end segments face pressure. As capacity is released and demand rebounds, the industry will enter an expansion phase in the second half of 2025. Despite uncertainties posed by geopolitical factors, the semiconductor industry continues to forge ahead with its strong resilience and innovative capabilities. Domestic chip companies need to seize structural opportunities in high-end manufacturing and domestic replacement while remaining vigilant against external risks that may impact the industry in the short term.

*Disclaimer: This article is original by the author. The content reflects the author’s personal views, and Semiconductor Industry Observation reprints it solely to convey a different perspective, not representing its endorsement or support of the views expressed. If there are any objections, please feel free to contact Semiconductor Industry Observation.

END

This is the 4066th issue shared by “Semiconductor Industry Observation”. Welcome to follow us.

Recommended Reading

★A Chip That Changed the World

★U.S. Secretary of Commerce: Huawei’s Chips Are Not That Advanced

★“ASML’s New Lithography Machine Is Too Expensive!”

★The Quiet Rise of NVIDIA’s New Competitors

★Chip Prices Plummeting, All Blame Trump

★New Solutions to Replace EUV Lithography Announced!

★Semiconductor Equipment Giants, Salaries Soar by 40%

★Foreign Media: The U.S. Will Propose Banning Software and Hardware Made in China for Cars

Star the public account ⭐️ to receive notifications promptly, and avoid losing track of the small account.

Please like

Please share

Please recommend