Based on publicly disclosed data from Anji Technology (688019), Shanghai Xinyang (300236), Jingrui Electric Materials (300655), Jianghua Micro (603078), Glinda (603931), and Feikai Materials (300398), the following statistics summarize the main product information and other data of these six companies.

Company Overview

Company Introduction

The earliest listed company is Shanghai Xinyang, which has been listed for over 13 years. The latest listed company is Glinda, which has been listed for 4 years.

Company Performance in Q3 2024

Compared to Q3 2023, Anji Technology, Shanghai Xinyang, Jingrui Electric Materials, Jianghua Micro, and Feikai Materials have seen an increase in total revenue, with Anji Technology experiencing the fastest growth. However, Glinda’s total revenue has decreased to some extent, with Glinda showing the fastest decline. Anji Technology, Shanghai Xinyang, and Feikai Materials have seen an increase in net profit excluding non-recurring items, with Shanghai Xinyang showing the fastest growth. Conversely, Jingrui Electric Materials, Jianghua Micro, and Glinda have experienced a decline in net profit excluding non-recurring items, with Jingrui Electric Materials showing the fastest decline.

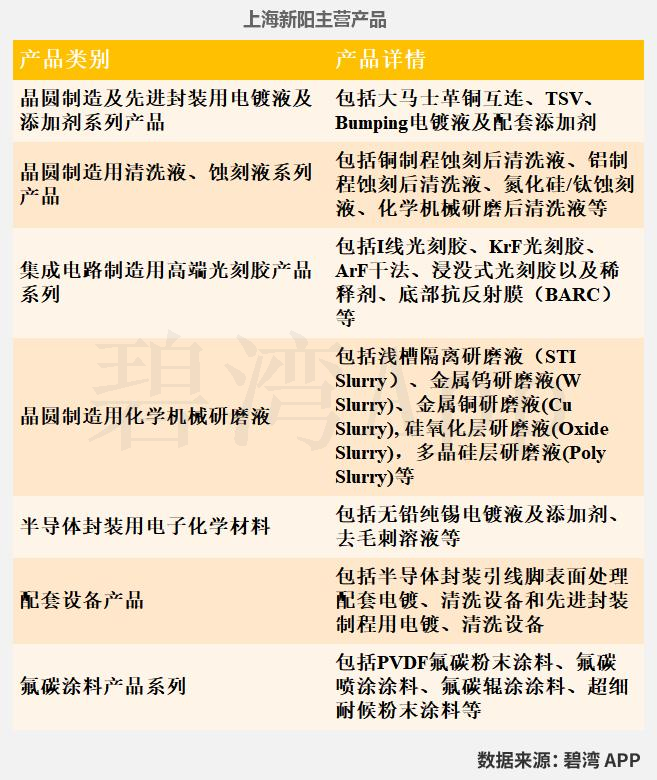

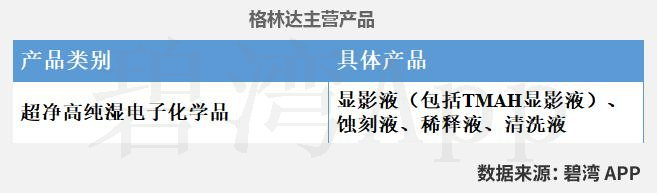

Main Products

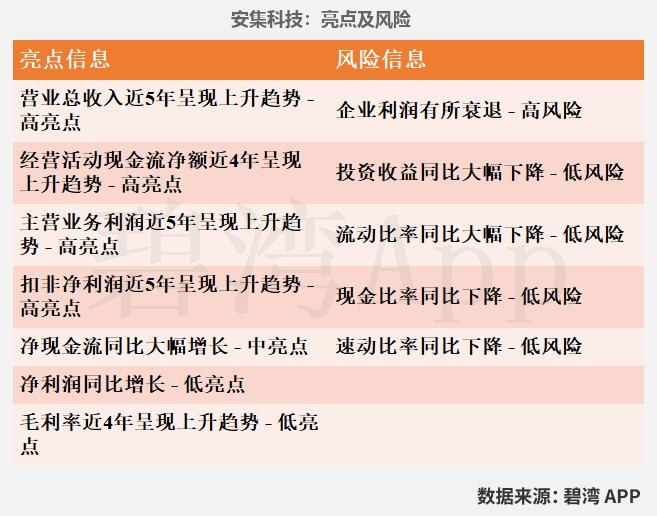

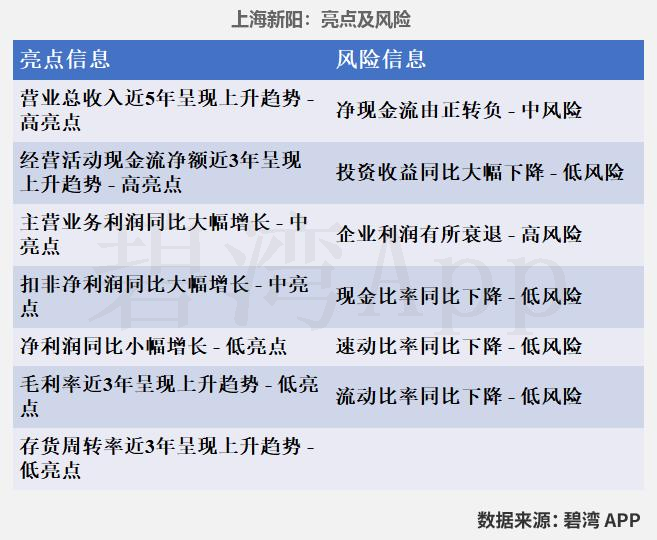

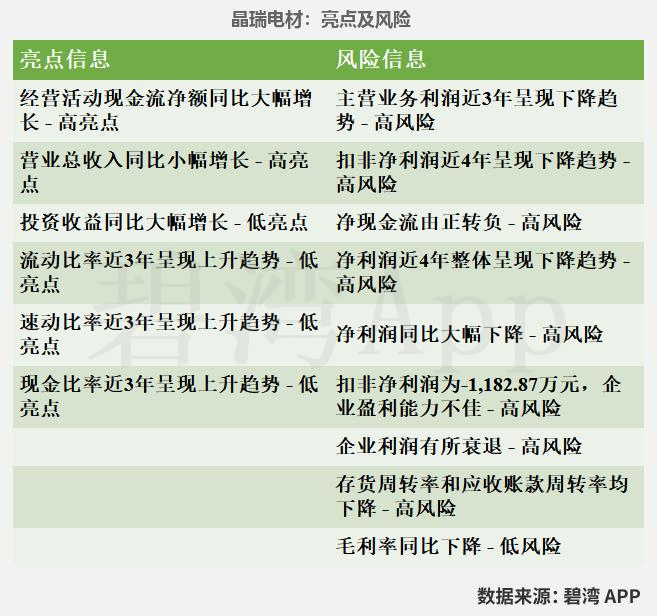

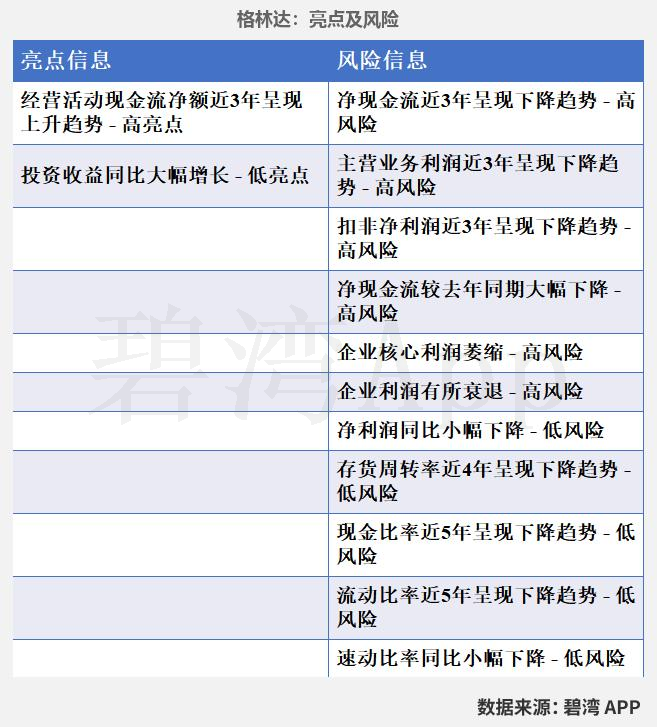

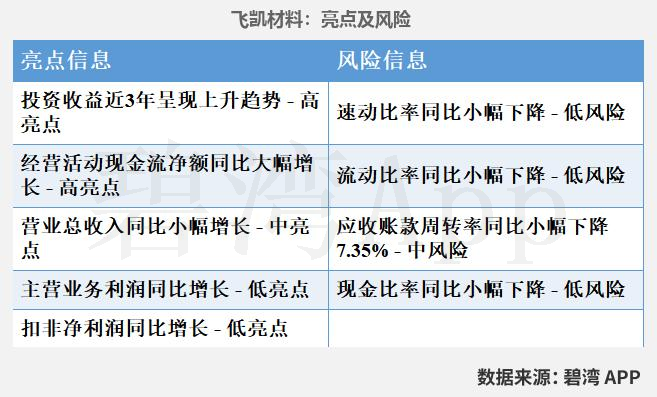

Highlights and Risks for Q3 2024

Revenue Structure

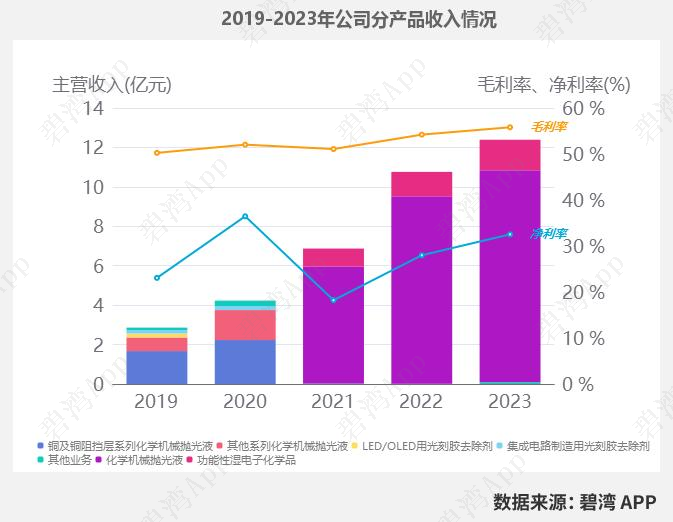

Anji Technology Revenue Situation

In 2023, the company’s main business is integrated circuits, with chemical mechanical polishing liquid being the largest source of revenue, accounting for 86.81%.

Shanghai Xinyang Revenue Situation

In 2023, the company’s main business is in the semiconductor industry, accounting for as much as 63.36%, with main products including electronic chemicals and coatings, where electronic chemicals account for 58.47% and coatings account for 36.64%.

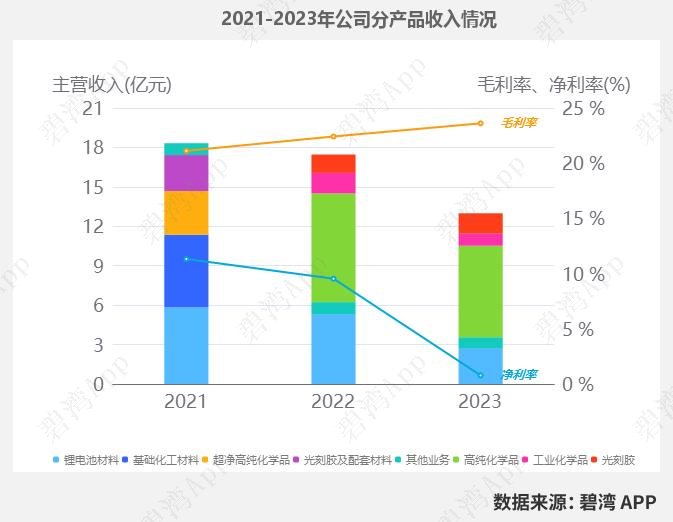

Jingrui Electric Materials Revenue Situation

In 2023, the company mainly engages in the semiconductor industry, other industries, and the new energy industry, with main products including high-purity chemicals, lithium battery materials, and photoresists, where high-purity chemicals account for 53.56%, lithium battery materials account for 21.10%, and photoresists account for 11.96%.

Jianghua Micro Revenue Situation

In 2023, the company mainly engages in semiconductors, display panels, and solar cells, with main products including ultra-pure high-purity reagents and photoresist supporting reagents, where ultra-pure high-purity reagents account for 64.68% and photoresist supporting reagents account for 31.94%.

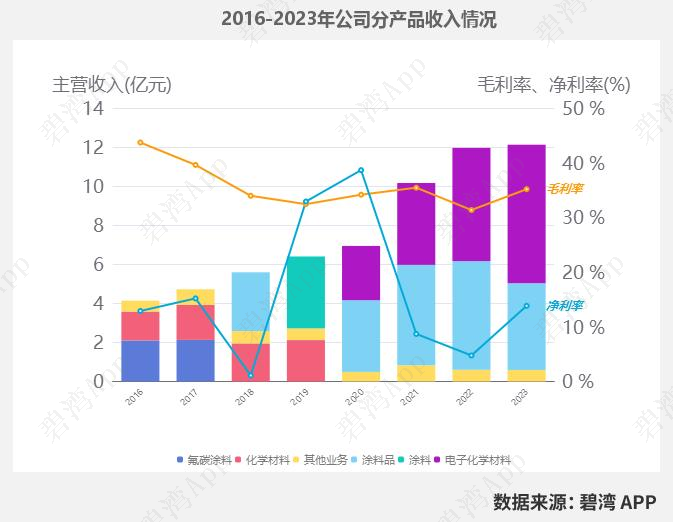

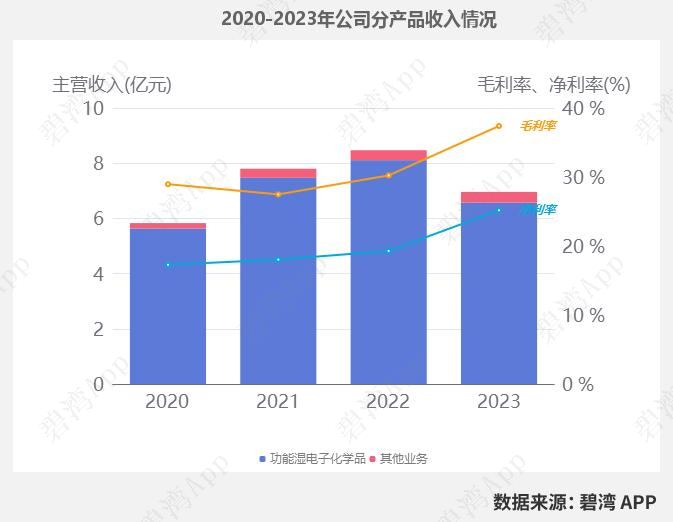

Glinda Revenue Situation

In 2023, the company’s main business is in display panels (OLED-LCD), accounting for as much as 80.48%, with functional wet electronic chemicals being the largest source of revenue, accounting for 94.44%.

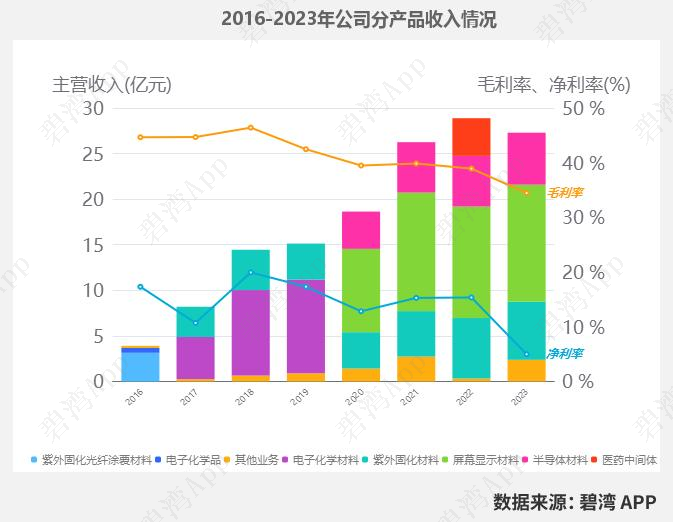

Feikai Materials Revenue Situation

In 2023, the company’s main business is manufacturing, with main products including display materials, UV curing materials, and semiconductor materials, where display materials account for 47.02%, UV curing materials account for 23.39%, and semiconductor materials account for 20.89%.

Disclaimer:All information above is based on publicly available market data, generated through data processing technology and artificial intelligence algorithms. Biwan will strive but cannot guarantee absolute accuracy and reliability, and will not be liable for any losses or damages arising from any inaccuracies or omissions. All data information is for reference only and does not constitute any investment advice, nor does it represent Biwan’s views. Investors act on this at their own risk.

For more analysis reports on listed companies, please click the link below to useBiwan Researchmini program.  END

END

If you like the article, please like, share, bookmark, and follow

If you like the article, please like, share, bookmark, and follow

Click belowRead the original text, for more

Click belowRead the original text, for more