Recommendation | Bian Zhihan Opinion | Bao ZhipingEditor | Huang Zhaolong

Source | Zhong’en’s Previous Online Training Class on “Business Analysis Meetings”

Improving management capabilities is a crucial support for enterprises to capture future “organizational dividends”. To cope with the uncertainties of the external environment, it is essential to have certainty in internal management actions, among which business analysis meetings serve as a vital management tool.

Conducting effective business analysis meetings is a fundamental skill that every enterprise must master. Each business analysis meeting is an opportunity for enterprises to enhance and solidify their operational capabilities, improve operational efficiency, and management effectiveness.

However, many enterprises struggle to conduct effective business analysis meetings, or even fail to hold them altogether. How can we conduct high-quality business analysis meetings? Firstly, we need to address six core pain points!

The Six Core Pain Points of Business Analysis Meetings

01 Incorrect Meeting Positioning

Positioning determines the outcome; if the positioning is unclear or incorrect, the meeting will undoubtedly fail to achieve the desired results.

Many enterprises have mischaracterized business analysis meetings as work reporting meetings, simply going through the motions. Alternatively, they turn into complaint sessions or credit-seeking meetings, where various processes are reported without consistent granularity. The meeting atmosphere is either overly harmonious, lacking intensity, or dominated by the boss’s monologue, leading to a “whipping session” where the reporter feels anxious.

Such meetings significantly lower employee morale. After the meeting, employees not only remain uncertain about their tasks but also fear making mistakes, leading to inaction. These negative impacts stem from incorrect meeting positioning.

02 Chaotic Meeting Arrangements

Chaotic meeting arrangements manifest in two main aspects. Firstly, the reporting theme remains the same every month, presented in a flat manner without addressing the main contradictions, with departments taking turns to report. The business analysis report is lengthy and filled with information, yet fails to highlight the key issues, merely “going through the motions”.

Secondly, the reporting schedule is uncertain. Meetings are often postponed or canceled due to executives’ schedules, leading to a diminishing importance of business analysis meetings within the company. Additionally, irrelevant personnel attend, wasting time.

03 Inadequate Gap Analysis

Business analysis reports consist solely of financial data, lacking multi-dimensional gap analysis and failing to establish a multi-tiered internal management reporting system, making it impossible to identify root causes.

The report content aims for comprehensiveness, addressing all six operational elements from opportunities to returns, but it is challenging to grasp the key points. Because information must be distilled through multi-dimensional comparisons to yield insights; however, many remain at the data level.

04 Absence of Annual Forecast Data and Analysis

Many enterprises only provide short-term forecasts, such as for one to three months, lacking a comprehensive assessment of annual goal achievement.

Secondly, there is a lack of analysis regarding the gap between forecasts and targets, and how to bridge that gap, along with a lack of opportunity point lists. It is normal for there to be gaps between forecasts and targets; the goal of annual budgeting is not to achieve 100% accuracy but to refine our understanding, documenting assumptions to see how deviations impact us.

05 Failure to Expose Problems, Lacking Root Cause Analysis and Opportunity Points

Analysis is superficial, failing to reach the root causes of problems, making it impossible to identify core operational issues. Alternatively, business units may prefer to report only good news while concealing issues, covering them up. Business analysis is a collaborative process; it is suggested to have checks and balances from multiple forces; if there is only one voice, what we hear is merely deception.

Secondly, there is no opportunity point list for achieving targets; the overall process lacks strategies, action plans, and resource allocation. Business analysis must align with the realization of annual operational goals; if there are gaps in targets, they must be identified in the business analysis meeting, and an opportunity point list with corresponding action plans must be established.

06 No Action Measures Aligned with Goals

Only overall strategies exist, lacking specific action plans and typical initiatives. Many enterprises, after holding meetings and analyzing problems, fail to derive corrective actions. Assistance and suggestions are often glossed over without detailed discussion and collaboration during the meeting, lacking practical implementation. After going through numerous efforts, the final step lacks action measures, which is quite regrettable.

How to Conduct Effective Business Analysis Meetings?

Business analysis meetings summarize and analyze the company’s operational results and existing issues, conducting year-on-year comparisons, budget benchmarking, and best practice analysis to pragmatically guide the management team in calculating the “operational account” and clearly understanding the operational status.

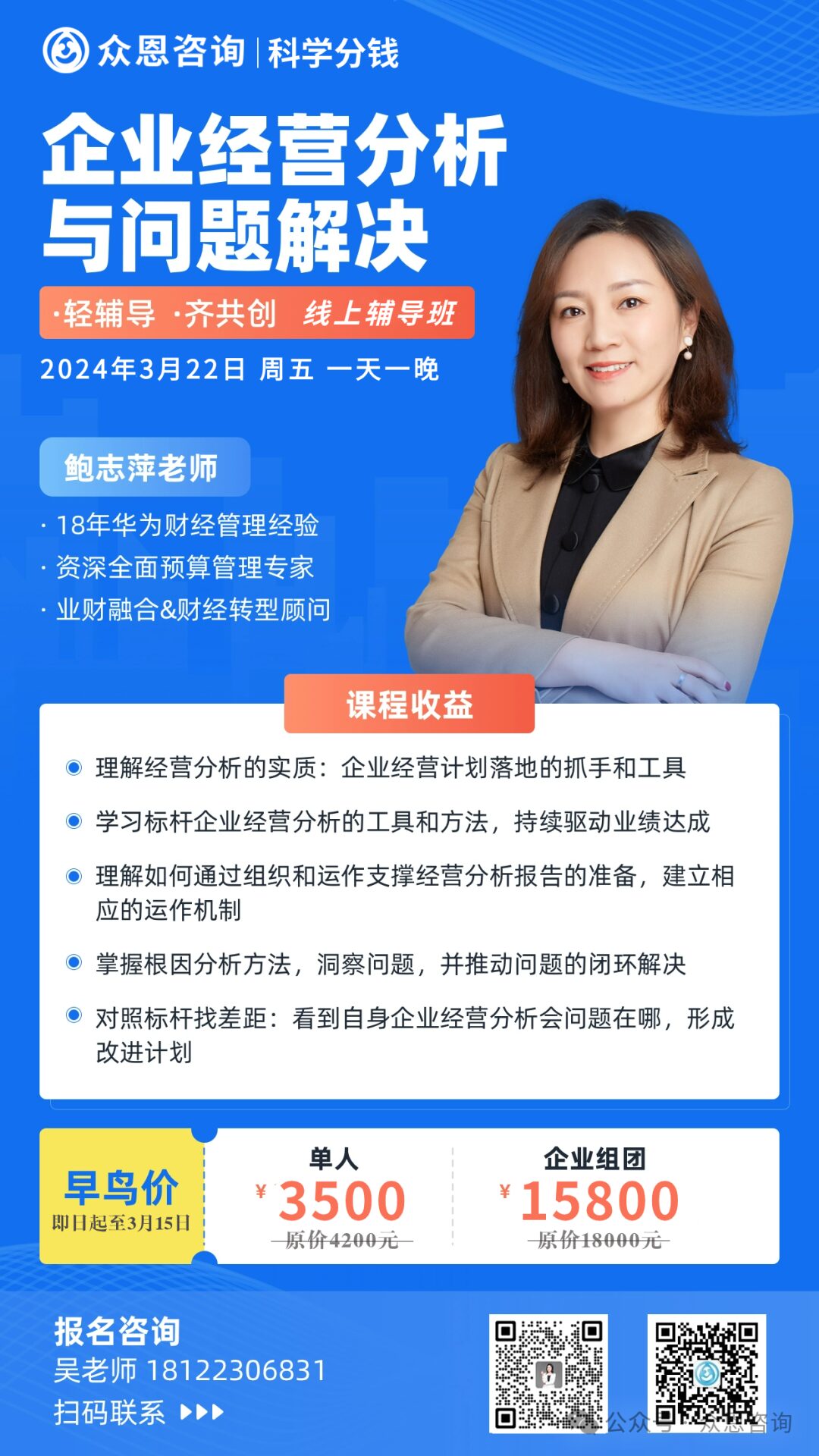

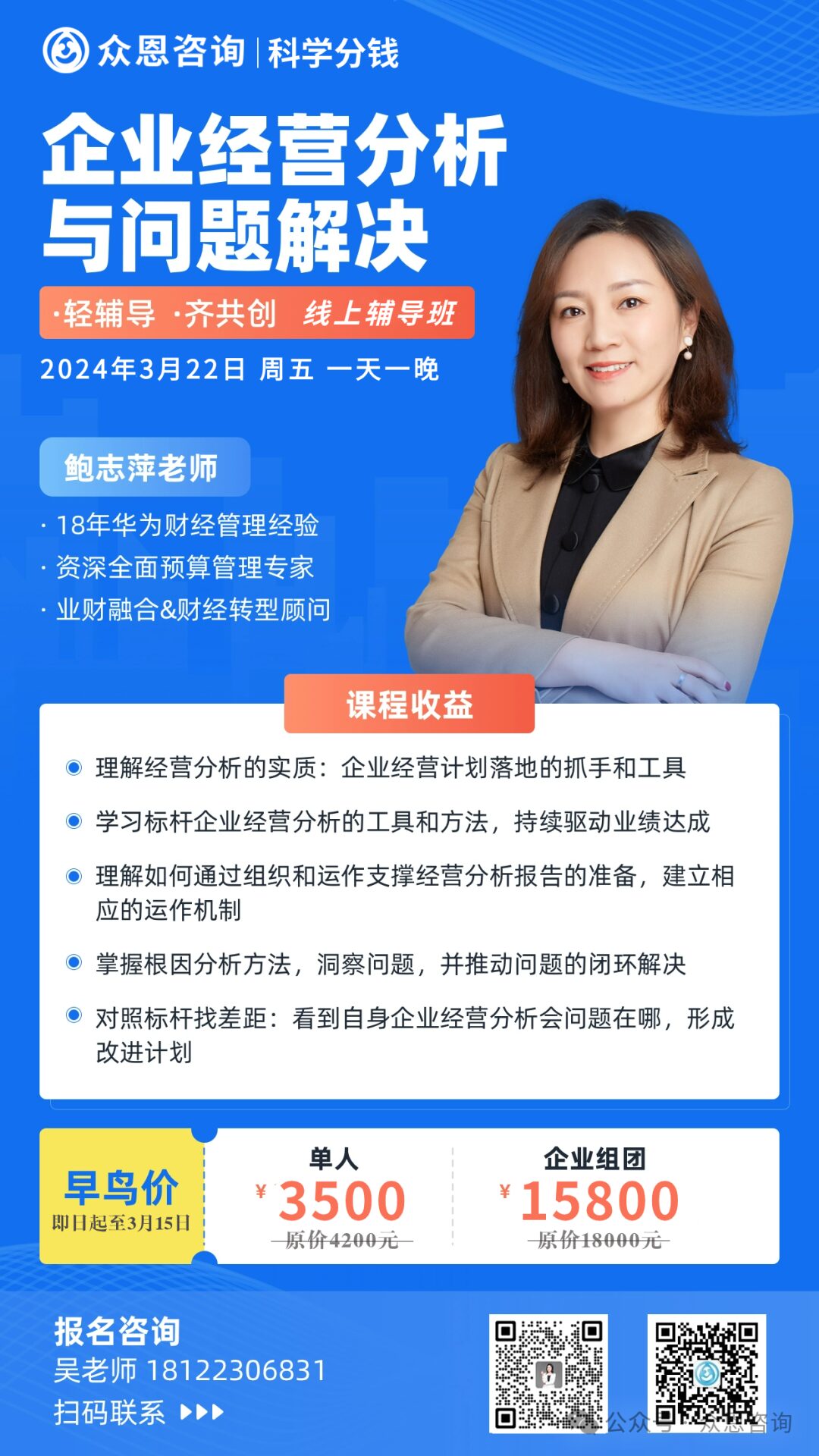

On March 22, 2024, Zhong’en will launch“Corporate Business Analysis and Problem Solving” online training class, one day and one night, assisting enterprises in understanding the essence of business analysis, learning tools and methods from benchmark companies, welcome to inquire and register to secure valuable spots!

Zhong’en focuses on stimulating organizational vitality and driving organizational effectiveness, sharing actionable management concepts, methods, and tools from industry leaders like Huawei, helping growth-oriented enterprises achieve growth and win battles. If you have any confusion in this area, feel free to engage in discussions.