Recently, ARM, a subsidiary of Japan’s SoftBank, and the Tsinghua Unigroup Innovation Fund signed a memorandum of cooperation in Beijing to establish a joint venture in Shenzhen. In the future, this joint venture will be developed into an important domestic integrated circuit core intellectual property development and service platform, controlled by Chinese stakeholders.

Many netizens have expressed concerns about the joint venture with ARM. Indeed, China has suffered many losses in joint ventures with foreign companies, with numerous lessons learned. Often, the market has been given away, while core technologies remain in the hands of foreign companies, and a significant portion of profits is siphoned off. However, in the current environment in China, this joint venture should be viewed dialectically, as it presents both positive aspects and potential negative impacts.

The Purpose of the ARM Joint Venture is to Expand into the Chinese Market

In recent years, the progress of China’s independent CPU technology—although there are gaps in industrialization and software support—has reached a point where it can completely replace foreign chips in embedded applications in terms of chip performance. Coupled with the immense attractiveness of the Chinese market, ARM’s joint venture in China is driven by profit motives.

As growth in PCs, smartphones, and tablets has reached a bottleneck, and with the advent of the 5G era of connectivity, the Internet of Things (IoT) is seen as the next big opportunity.

In the IoT era, devices such as smartphones, computers, televisions, air conditioners, refrigerators, microwaves, water heaters, washing machines, cars, rice cookers, security monitoring equipment, electric meters, water meters, and home routers will all be connected to the internet. Before we leave work, we can remotely control our home appliances via our smartphones or computers, setting the air conditioning temperature, heating the water heater, or warming food in the rice cooker or microwave. We could even download our favorite movies using the router. Once self-driving cars are sufficiently mature, we could ride one home, greatly enhancing convenience in our lives.

In addition to making life more convenient, connecting factories through the internet can help eliminate information asymmetry and improve industrial production efficiency. With advancements in artificial intelligence and robotics, future factories will develop towards informatization and intelligence. Moreover, idle production capacity during off-peak seasons can be offered as contract manufacturing services online, providing customized services to startups and maximizing production efficiency.

To achieve the “connectivity of all things” in consumer electronics and the informatization transformation of traditional industries, various chips such as Wi-Fi chips, RF chips, and CPUs/MCUs are essential. Considering the vast global population and China’s large traditional manufacturing sector, this represents an exceptionally large market, which is why international giants like Intel, ARM, and Qualcomm are all investing in the IoT space.

China is not only the largest electronic consumer market globally but also produces most of the world’s computers, smartphones, and televisions. It has a significant number of influential PC, smartphone, and white goods manufacturers, as well as a group of ODM manufacturers represented by Foxconn, along with a very complete downstream industrial chain. This necessitates chip companies to establish joint ventures in China, whether to be close to the downstream industrial chain or the end consumer market.

The Joint Venture is Not ‘Inviting the Wolf into the House’

This joint venture project has positive aspects for industrial development—Chinese capital and companies can participate more deeply in ARM’s industrial ecosystem, allowing more profits to remain in the country. If there is a company that, while technically constrained to some extent, possesses strong revenue-generating and profit capabilities, and is controlled by Chinese stakeholders, this would be beneficial for strengthening China’s IC design industry, boosting local economic development, and providing high-paying job opportunities. If the joint venture’s business can be promoted, it could cultivate a large number of applied technical talents, expanding the talent pool.

ARM has over 100 partners in China, including Huawei HiSilicon (Kirin), Spreadtrum, Datang Microelectronics, Xiaomi’s Pinecone, ZTE Microelectronics, Allwinner, Rockchip, and companies like Huawei, Feiteng, and Huaxintong that have purchased ARM instruction set licenses to develop server CPUs.

Therefore, viewing this joint venture as ‘inviting the wolf into the house’ is inappropriate, as although ARM has not previously established a joint venture in mainland China, its chips have already deeply penetrated our lives with the support of numerous domestic ARM ecosystem IC design manufacturers.

In this context, domestic ARM ecosystem IC design companies do not have the capability to develop a technology system that can compete with the AA system or the Wintel system on their own. In the long run, continuing to purchase ARM technology licenses commercially is inevitable. Thus, rather than purchasing IP licenses from Japan’s ARM, it would be better to buy IP licenses from the domestic joint venture, allowing more profits to belong to the joint venture and remain in the country. In short, the positive aspect of the joint venture is to keep more profits domestically and strengthen the domestic IC design industry while cultivating a batch of applied technical talents.

Joint Ventures May Also Have Negative Impacts

The biggest negative factor of the joint venture is that it may confuse the goals of achieving security and controllability with strengthening the industry. For instance, many joint ventures repackage foreign chips and promote them as self-controllable. This joint venture may also have the potential to repackage ARM-designed IP as ‘self-controllable’ IP.

Secondly, whether the joint venture’s design team can develop its own capabilities and independently develop chips without relying on foreign technical support is highly debatable.

Currently, the national definition of self-controllability is very vague, and there is no unified standard. Companies like Loongson and Shenwei, which have truly achieved core IP self-mastery, fall under the self-controllable category. However, some manufacturers that purchase ARM’s IP for integration also promote their products as independently developed and self-controllable, and their complete products have already been applied in special fields. There are also companies that purchased IBM’s Power8, rebranded it, and promoted it as self-controllable, even attempting to penetrate the party, government, and military markets.

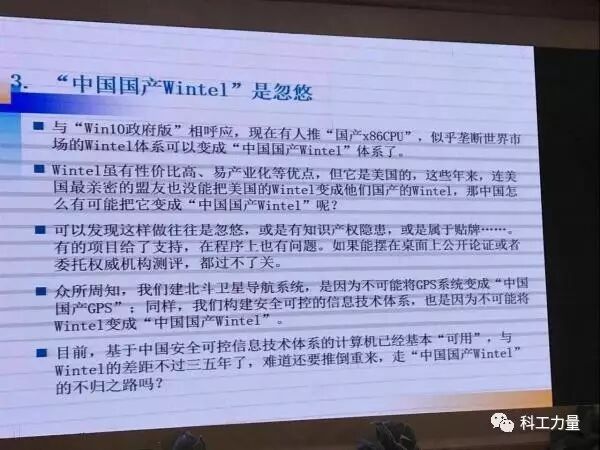

Even more alarming is that, in response to the government version of WIN10, some are starting to promote ‘domestic X86 CPUs’, transforming the globally monopolized Wintel into ‘Chinese domestic Wintel’, and this rhetoric has gained some traction. A certain joint venture has acquired the design/layout from Centaur in Texas, USA, reprocessed it at TSMC, and then rebranded it as a major technological achievement of the national ’12th Five-Year Plan’ core high-tech project, which is now being applied in government confidential computers in bulk…

In this broader context, it is easy to question whether, under the Chinese government’s requirements for self-controllability in key areas, ARM can meet these requirements. Thus, establishing a joint venture to repackage ARM-designed IP as ‘self-controllable’ IP seems plausible.

Additionally, there is the question of whether technical capabilities can be developed. Recently, the ‘EternalBlue’ exploit swept the globe, prompting discussions among netizens about whether Linux is more secure than Windows. However, the reality is that there is only relative security, not absolute security—Linux also has many vulnerabilities, such as the Dirty COW vulnerability exposed last October. Achieving true information security hinges on one’s technical capabilities; if there is a significant gap in capabilities compared to foreign giants, even if all code is written by domestic engineers, it cannot withstand attacks from state-level adversaries.

Similarly, a key point for the joint venture is whether it can cultivate a technical team capable of independently developing chips without relying on foreign technical support. However, the likelihood of achieving this is quite low.

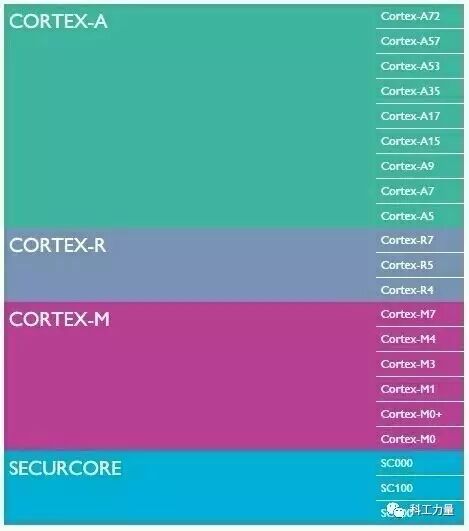

ARM’s product line is very comprehensive, including system IP, physical IP, GPUs, video decoding, displays, and more. The Cortex-A series targets open systems; the Cortex-R series targets embedded systems; the Cortex-M series targets various microcontrollers; and the SC series targets secure markets such as payments, e-government, and SIM cards.

It is precisely because of this comprehensive product line that ARM can directly use suitable IP to address various application scenarios in the IoT. Therefore, there is no need to reinvent the wheel; existing ARM IP can be utilized. However, without practical experience, it is impossible to develop one’s capabilities. Moreover, the technical challenges of digesting and absorbing technology are quite high. First, a team with rich experience and combat capability is needed, but such teams are very scarce domestically. Relying solely on a few veterans, a couple of foreign experts, and a batch of newly recruited students will result in limited combat effectiveness.

Even if one obtains the unaltered source code, fully understanding it is very difficult, and design documentation is essential, ideally with a mentor to guide the process. However, whether for economic interests or due to Japanese concerns about technology leakage, ARM has no motivation to cultivate a competitor in China. Furthermore, although Chinese stakeholders hold the majority, the decision-making power will likely still rest with ARM, which could resemble the situation with Microsoft’s joint venture for the WIN10 government version. In summary, the talent cultivated by this joint venture is likely to be oriented towards how to use ARM’s IP rather than how to independently design IP. Whether it can develop its own capabilities remains a contentious issue.

Conclusion

In fact, this joint venture will not significantly impact independent CPUs like Loongson and Shenwei, as companies like Intel, AMD, IBM, and VIA have already established joint ventures or technical collaborations in China. In this situation, adding another ARM is inconsequential. Moreover, ARM has already entered China alongside domestic ARM ecosystem IC design companies, and prior to establishing this joint venture, independent CPUs have already competed with ARM in the party, government, and military markets.

Additionally, the IoT market is vast, and neither Intel nor ARM has the capacity to monopolize it. Furthermore, the ecological requirements for IoT are not as stringent as for desktops; as long as independent CPUs find their niche and delve into their specific markets, they can achieve success and establish their own stronghold.

Editing and Layout: Liu Xiang

This article is original content from the “Science and Technology Power” public account

Reproduction and use are prohibited without written permission

For reproduction authorization, please contact